What will the new pension depend on?

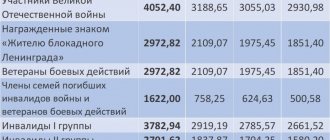

From now on, social benefits for pensioners will be calculated not in rubles, but in conventional units - points, which will depend on many individual factors:

- the salary of the future pensioner. Points are accrued only for that part of the income from which the employer pays insurance premiums, i.e. salary “in an envelope” will not be taken into account when calculating pensions;

- duration of insurance work experience. A simple arithmetic relationship will apply here: the longer the working period, the more points the pensioner will receive;

- citizen's age. If you retire later than the legal age, the individual coefficient will increase and the benefit amount will be higher.

Separately, non-insurance periods will be taken into account during which citizens served in the army due to conscription, service in internal affairs bodies, leave to care for a child under 1.5 years old, a disabled child or a disabled citizen over 80 years of age. The final amount of accrued points will be converted into rubles based on the coefficient established by the law “On Insurance Pensions”.

In 2021, pensions will be calculated not in rubles, but in special points

As of January 1, 2015, the “cost” of a pension point was fixed in the amount of 64.1 rubles. Separately, the law provides for annual indexation of the IPC (individual pension coefficient) depending on the income received by the Pension Fund in the previous calendar year.

Latest news on pension indexation in 2021

Recalculation of pensions in 2021 in Russia for current pensioners will be made at the level of four percent. In other words, an indexation (or increase) of 4% is expected. Residents of Moscow are entitled to an additional allowance. Sobyanin intends to continue to implement additional indexation of payments within the framework of social security. "Five-Year Plans" Based on his words, such an increase will become more significant for citizens of retirement age.

Most likely, indexing will take place in one stage. However, this information is not yet accurate because the debate on this issue is still ongoing. Of course, from the point of view of an ordinary pensioner, it is better to index pensions once, but at the level of annual inflation. But we all understand that this is impossible to do in the conditions of the economic crisis, which means we need to look for other options. Thus, “connecting” the second indexing will help to even out the situation a little. But it’s too early to talk about the second stage of indexing - we will find out about its connection, if it happens, based on the results of the first half of 2016.

Just recently we learned that the Ministry of Labor wants to waive monthly insurance payments for pensioners who continue to work after reaching retirement age. A corresponding bill has even been prepared, but they want to introduce it only in a year – in 2017, so it’s too early to worry. Besides, no one knows whether he will be approved by those at the top or not.

As you can see, there are quite a lot of changes. And this is taking into account the fact that we did not cover everything in our article.

By the way, interesting information has appeared on the innovations in collecting fines. Based on the updated Code of Administrative Offences, small administrative fines will soon be levied in a “simplified” manner: they will begin to be written off from pension accounts. How do you feel about such innovations?

Pension structure

The 2021 pension reform establishes a certain composition of the labor pension. It will be formed from the insurance and savings parts.

- The insurance part of the pension will be calculated based on actual payments made. When calculating the insurance component, work experience is taken into account, which must be at least 15 years. Only citizens who registered for work on January 1, 2015 will be able to evaluate their insurance pension in a “pure” form. For other pension recipients, its size will be recalculated in accordance with the new requirements. If, as a result of recalculation, the pension decreases, then the citizen has the right to choose a more profitable option for himself.

- The funded component of the pension will be calculated as a result of dividing all pension contributions made by the statistical unit specified in the Federal Law.

Video: pension increases in 2021

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2021.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training