Features of pension recalculation after 40 years of work experience

A citizen of the country can apply for an increase in pension payments after receiving 40 years of service. In government agencies, re-registration occurs without problems, but a number of conditions must be met.

Accrual occurs according to the formula. Capital indicators, the number of months for which the calculation is taken, and the entered volume rate are taken into account. Pension Fund employees calculate the amount of additional payment for each specific case separately.

Recalculation of a woman’s pension for 40 years of service in 2021: where to apply, what documents are needed

After the reform, in order for a worker to retire, he needs to fulfill one of three requirements: for men to reach 60 years old, for women - 55; accumulate 13.6 pension points, this is the minimum amount for 2021; achieve the minimum insurance period of 9 years. Pension contributions, for which points are calculated, are sent to the fund directly by the employer. Thus, there are several key factors that influence pension calculations:

Insurance payment is a completely different matter - it can already be influenced by third-party factors. The pension of a person working for more than nine years will consist of a fixed payment of 4982.9 rubles and an individual pension coefficient multiplied by the number of points earned over a lifetime. The IPC is constantly indexed, taking into account the growth of inflation and, at the time of 2021, is 87 rubles 24 kopecks.

What is included in the experience?

The total work experience is calculated depending on the specific specialization. But you don’t have to work continuously for 40 years. The law provides that certain life periods may also be included in the amount.

The following must be taken into account:

- maternity leave;

- service in the Russian army.

Women count on maternity leave, which can be a maximum of five years, but not more than one and a half years per child.

Military service is taken into account entirely by both sexes. Time spent studying in educational institutions, including the military department of state higher educational institutions, is not taken into account. Important! Military personnel who serve under a contract are provided with bonuses depending on their length of service. For example, if the service time was more than 25 years, then this is 40 percent.

List of benefits for pensioners of St. Petersburg and rules for their registration

If the work experience is 50 years, then what benefits will be provided to pensioners? Federal law No. 400 defines the specifics and conditions for providing benefits to pensioners with significant work savings. The project is dated 2013. It determines bonuses for work experience of 30, 35, 40 and 50 years. In addition to pension supplements, which are prescribed in accordance with Bill No. 400 throughout the entire Russian Federation, there are also regional benefits. They are prescribed to pensioners for a period of work of 40 years or more. This may be a fixed material allowance and benefits on utility bills. On a note! The most famous regional benefit, which is assigned to pensioners of one of the constituent entities of the Federation after 40 years of work, has become the “Luzhkov” benefit. The amount of the bonus for pensioners with 50 years of experience We have already spoken above about the possibility of receiving material benefits for pensioners based on the period worked.

Allowances for length of service

The funded pension payment is fixed across the country. In 2021, it is set by the Pension Fund in the amount of 4,805 rubles. This is a minimum amount, but often retired Russians receive a lot of money. The fact is that allowances are made depending on years of experience. They are equal to the sum of points earned, and the parameter is multiplied by the cost of one point. The cost is not a fixed value; it is changed by the citizen of the country independently. It is calculated depending on what payments a person makes to the government agency. The more he pays, the more his point becomes worth. Consequently, the size of the pension payment increases.

Points are awarded in the following quantities:

- 1 coefficient if a woman’s work experience reaches 30 years, and a man’s work experience reaches 35 years;

- 5 coefficients if a woman has worked for 40 years and a man has worked for 45 years.

The Government of the Russian Federation has set the size of one point at 98.86. According to the state program developed until 2025, the size of the point will increase annually. There is no exact data on the increase, since the amount is affected by the level of inflation in the country.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Those citizens who have 50 years of continuous work experience at the enterprise receive additional payments. The amount is fixed, paid in addition to the main one. That is, points are not recalculated. In [year] the amount of this payment will be 1063 rubles per month.

Conditions for supplementing pensions for long service

In addition to the increase in the amount of old-age payments associated with indexation and recalculation of insurance contributions made by the employer for working pensioners, they are entitled to a bonus for the length of years worked. Of course, if there is such a thing.

In 2021, the length of service upon which the pension for the elderly is increased is 40 years or more. However, there are a number of requirements, without which a working pensioner, of course, can count on recalculation of benefits, but only on a general basis. In this case, the increase will not be related in any way to the length of years worked.

But in order to gain the right to recalculate a pension upon reaching 40 years of service, you will need to meet a number of conditions, the main one of which is considered to be the title of Veteran of Labor. In this case, the person receives the right to a mandatory supplement to the accrued old-age benefit.

It is worth clarifying that fixing the status of Labor Veteran is also carried out only if one of the following requirements is met (Law No. 5-FZ, paragraph 7):

- the citizen has any medals, orders and other insignia of the USSR or the Russian Federation - diplomas, commendations, titles;

- a person started working before reaching the age of majority during the Great Patriotic War, subject to a fixed length of service of 40 years for men and 35 years for women;

- a citizen is awarded insignia for labor merits in any field of the economy with a duration of service of at least 15 years, subject to a total length of service of at least 25 years for men and 20 years for women.

Veterans of labor with a total work experience of 35-40 years, in addition to a pension supplement, are entitled to a number of various benefits. To receive the full scope of preferences, you must officially register your status in the territorial office of the social protection authorities.

In addition, there are a number of additional allowances, which can be received in the following cases:

- if the man’s total experience exceeds 35 years;

- For women, an additional payment is provided for 30 years of experience or more.

In these cases, pensioners are awarded 1 additional pension coefficient.

Bonus 5 points will be awarded if:

- the woman has worked for at least 40 years;

- the man has 45 years of experience or more.

If the total professional experience exceeds 50 years, we can talk about a fixed increase in the pension benefit. The amount is just over 1 thousand rubles.

Where can I apply for additional payments?

Recalculation of the amount of payments upon reaching forty years of service occurs automatically. A person does not need to contact the authorities. But there are situations, especially when it comes to small towns or cities with a large number of pensioners, when recalculation does not occur. Therefore, you need to apply yourself.

If the recalculation does not occur and the Russian receives the same amount, then he should immediately contact the authorities and demand an explanation of the situation. The social protection authorities are dealing with the issue.

What will you need?

Please note that in 90 percent of cases there is no need to apply for recalculation. The process happens automatically. But if for some reason this does not happen, then contact the government agency. To re-register a pension if you have reached 50 years of service, you must apply yourself - there is no automatic calculation.

The pensioner is not required to take any action other than telling the authority employee what question he is asking about and presenting the necessary package of documentation. Copies remain with the public protection authorities.

Required documents

You will need to present the following documents:

- passport;

- pensioner's ID;

- work book;

- documents confirming pension insurance.

Attention! If you do not have a work book, you will need to present a certificate from the company, which states the hours of work. If there are no supporting documents, then employees will not be able to complete the registration.

Step by Step Actions

After presenting the package of papers, all that remains is to wait. As a rule, payments are transferred in the next pension. If the accruals should have been much earlier than the circulation period, then a person can receive the maximum only in the last six months. That is, if you forgot to apply, and payments based on length of service could have been given for more than 6 months, then after applying you will receive only the last 6.

Those who keep savings in a bank account additionally provide its number.

St. Petersburg law on housing and communal services compensation for persons with 40 years of experience

To receive payment, a pensioner in St. Petersburg applies to (hereinafter referred to as the Department) (hereinafter referred to as the Administration) at the place of registration with the appropriate application and a set of necessary documents. Dear visitor, please

2155317.ru

- compensation for the rehabilitation process or expensive treatment.

- A document that can confirm pensioner status.

- Certificate of ownership of residential premises (if you have personal housing).

- Documents that confirm payment of utility bills for the previous month.

- Document on the size of the occupied area.

- Details of the account created with the bank to receive cash payments.

- Passport.

- Papers about earnings for the last three months.

- the basis that gives the right to benefits;

- how the beneficiary wants to apply for it: through social security (administration), MFC or electronic resource;

- where the social benefit should be sent (name of the bank with personal account number or post office).

Procedure for submitting documents for conferment of the title Veteran of Labor 1. Persons applying for the title Veteran of Labor submit an application, a copy of an identity document, and documents confirming the grounds for its conferment to the social protection authority at the place of residence, in accordance with the requirements of this articles. 2. The basis for conferring the title Veteran of Labor to persons specified in paragraphs two to four of Article 1 of this Law of St. Petersburg are documents confirming: 1) awarding orders or medals, or conferring honorary titles of the USSR, RSFSR or Russian Federation, or awarding departmental insignia in labor 2) the length of service required to assign an old-age labor pension (25 years for men, 20 years for women) or a long-service pension. 3.

List of benefits for pensioners of St. Petersburg and rules for their registration

Residents of retirement age in the Northern capital are entitled to benefits for housing and communal services. This is a standard set of compensations and subsidies, which is guaranteed by the state and is aimed at ensuring comfortable living for elderly people.

- a correctly drawn up application for a one-time benefit;

- original and copy of passport;

- original and copy of pension insurance certificate;

- a certificate received along with the badge “Resident of besieged Leningrad”;

- if necessary, additional papers.

What does forty years of service give to those who have already retired?

Recalculation is required, but there are conditions for it to begin. Pensioners have the right to apply for it:

- whose age has reached 80 years;

- with a disability.

Those who have worked in the North of the country should take other criteria into account. 50% of the established norm is added after 20 years of experience for women and 25 for men. Disabled people of the third group cannot receive a double bonus.

Decree on benefits if the experience is 50 years

In order to assign a labor pension, it is necessary to take into account the work experience of the future pensioner. According to Article 30 of Federal Law 173-FZ, the minimum work experience for a woman is 20 years, and for a man - twenty-five years.

Recalculation of pension after 40 years of work experience

I am a working pensioner (pension since 2011). This year my work experience reached 40 years. All the years she worked in St. Petersburg. Question: can I be classified as a Veteran of Labor under current laws and am I entitled to receive benefits for utility bills?

For non-working pensioners, pension payments are the only way to survive, so an increase in pension for length of service is a hot topic of the day. It is no secret that Russians have to live in difficult economic conditions, when inflation outstrips the growth of pensions and other social benefits. Therefore, the increase announced by the Russian government in 2021 will help many survive, and it is also a good incentive to receive a “net” salary without envelopes.

You might be interested ==> Statistics of dysfunctional families in the Russian Federation

According to the legislation of the Russian Federation, citizens have the right to obtain the status of a labor veteran if they have sufficient length of service to retire and receive social benefits. Additionally, it is extremely important to have titles and awards.

Benefits for 40 years of work experience

The pension supplement for 40 and 45 years of service for women and men is 5 bonus coefficients. For this period, 1 such point equals 78.58 rubles. The country's authorities state that this amount will continue to grow due to the degree of inflation, so in the future the amount of payments should increase.

There will be another indexation of Russians' pensions. At the beginning of 2021, pensioners' pensions will be indexed by 6.3%. Even taking into account the expected inflation (up to 4%) in the country, non-working pensioners will receive an increase in payments.

- having a working experience of 35 years (women) or 40 years (men), while the start of work must occur during the Second World War;

- sufficient work experience to retire and the availability of awards and incentives for valiant work.

What additional payment can you expect for 40 years of experience in Russia?

But the state has introduced a phased transition for women as well; it will take place from 2021 to 2034. For retirement, women have less work experience than men. 20 years of experience will be enough to obtain the required coefficient for calculating pensions of 0.55.

In addition to additional monthly payments, it provides the opportunity to enjoy certain benefits. Currently, the determination of the right to a pension, its assignment and payment are carried out in accordance with the provisions of Law No. 400-FZ “On Insurance Pensions”, which has been in force since the beginning of 2020.

The new regional law covers everyone who was registered in the region before January 2008. According to some estimates, more than 72 thousand people will be able to count on this title. All of them will receive a monthly cash payment of 550 rubles. True, the mechanism for processing the necessary documents to obtain the coveted title by regional authorities has not yet been developed.

Woman with more than 40 years of experience awards no benefits St. Petersburg 2020

“The bill is important and fair, since now people will not have to run around the social security authorities and look for formal reasons for assigning them the title “Veteran of Labor,” the Commission on Social Issues of the St. Petersburg Parliament explained to Komsomolskaya Pravda. “After all, the work of, for example, a nurse is no less important than that of representatives of other professions, who more often receive certificates and awards.

2) citizens who are recipients of an old-age labor pension or a long-service pension and have reached retirement age, living alone or living in a family consisting only of pensioners who are not provided with social support measures for paying for living quarters and utilities

What periods of employment give the right to preferential exit?

When calculating any type of length of service, you should take into account the relevant periods that are taken into account when calculating it. This is especially relevant in light of ongoing reforms and changes.

Thus, for the insurance period, the periods of transfer of insurance contributions to the Pension Fund are taken into account. In addition, there are also non-insurance periods when the employee did not actually work. Their list is closed and is contained in Article 12 of the above-mentioned law on insurance pensions. For example, these include time spent caring for children up to 1.5 years old, military service (under certain conditions), etc.

To calculate the length of service that gives the right to receive a pension early according to the new rules, only 2 periods are taken into account:

- carrying out labor activities directly (insurance period);

- periods of temporary incapacity for work due to health reasons (in other words, being on sick leave).

Attention! Those periods that the law classifies as non-insurance, but taken into account when calculating the length of service for a pension on a general basis, are not considered when calculating the length of service for receiving the benefits discussed in the article.

Governing Law

The right of citizens who have a long work history to retire early is enshrined in federal legislation. So, part 1.2 of Art. 8 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” states that men have the right to retire 2 years earlier if they have a total output of 42 years, but not earlier than 60 years.

This norm was introduced relatively recently, at the end of 2018, and its implementation in practice started in the new year, 2021. Federal legislation applies throughout the country. Regional authorities cannot adopt acts that contradict it.

Based on this, the law establishes that men, having reached the age of sixty, have the right to count on early financial support when they reach 42 years of age . No other conditions are provided.

40 years of experience, what are the benefits in St. Petersburg?

Accordingly, until this point, pension provision could only be provided by the state of origin. In the question you did not indicate whether the pension was assigned in Kyrgyzstan. If a pension has been assigned, then it is advisable to contact the pension authority at your place of residence on the territory of the Russian Federation with a request to provide you with possible assistance in resolving your issue regarding the payment of a pension for the past period by the authorized body of the country of origin.

Where exactly you should apply directly depends on the type of benefit you receive. For example, in 2021, in order to initiate the recalculation of pensions for length of service, Russian citizens are forced to contact the local branch of the Pension Fund.

Early retirement

For a long time, a certain age was established in Russia when citizens who worked during their lifetime had the right to retire. Before the start of the corresponding reform, it was 55 years old (female) and 60 years old (male).

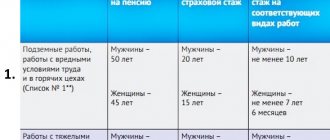

At the same time, certain categories of workers had the right to end their working career before the generally established age. In particular, this concerned workers who were employed in industries with difficult and hazardous working conditions, doctors, teachers and some other employed citizens.

After the start of the above-mentioned reform, which involves a significant increase in the age when citizens will be able to apply to the pension fund for the assignment of financial support, the right to early retirement for beneficiaries remains, but with some changes.

In addition, the list of these beneficiaries has expanded; now workers who have an impressive amount of work experience can also apply for early retirement benefits. In this case, the sphere of employment of these persons and whether they have financial benefits does not matter.

Also noteworthy is the deadline for early exit. Thus, men who have worked for a long time have the right to retire 2 years earlier than their peers who do not have the right to do so.

However, with all this, not all citizens will be able to take advantage of the benefit in its entirety. Thus, the pension reform currently being carried out in Russia does not imply the immediate achievement of its goals, but a certain transition period when the age will increase smoothly. It is 5 years for both men and women.

Accordingly, after the end of the pension reform, male beneficiaries will be able to retire 24 months earlier - at 63 years old.

Calculating benefits during the transition period is somewhat more complicated. Thus, it has been established that, taking into account the preference under consideration, the lower limit of the retirement age for a man cannot be less than 60 years.

In this regard, in 2021, citizens who have worked for a long time have the right to go on vacation only six months earlier. In 2021 it’s already one and a half. And starting from 2022, citizens will be able to take advantage of the preference in full, namely, start receiving material funds for pensions 2 years earlier.

40 years of experience What are the benefits in St. Petersburg

Popular articles Labor veteran benefits in St. Petersburg Along with the capital of our state, St. Petersburg is a city of federal significance…. Benefits for residents of besieged Leningrad Under the siege of Leningrad we mean a special category of citizens who have the right... Benefits for pensioners in St. Petersburg List of benefits for pensioners in St. Petersburg: for transport tax, for housing and communal services...

- labor veterans and other persons equated to them, numbering 28,918 people, received benefits in the amount of 526.20 rubles in 2010.

- pensioners who, having worked in Leningrad or St. Petersburg, received 20 years of work experience and 40 years of total (40 for women and 45 years for men) experience;

- pensioners who do not belong to the category of beneficiaries.

10 Jun 2021 lawurist7 757

Share this post

- Related Posts

- Who Should Communicate to Individual Housing Data for Large Families in 2021

- Benefits for gas payments in a private house for pensioners

- Benefits for labor veterans in Tyumen

- What was the Indexation of Pensions in 2021?