Where can a pensioner get a 2nd personal income tax certificate?

Documents can be issued on behalf of the same organization. Credit institutions, after identifying this fact, will refuse to issue a loan to the client. The certificate may be issued on behalf of a non-existent institution. It is important to check the existence of the organization using special services.

Purchasing a false document may result in liability under the Criminal Code of the Russian Federation. After all, the actions will be classified as a crime related to the production or sale of counterfeit documents. The disposition and sanction are prescribed in Article 237 of the Criminal Code of the Russian Federation.

Despite the existing responsibility, it is difficult to identify this fact. After all, tax authorities should not provide information about citizens’ debts to commercial structures. Therefore, it is possible to determine a fake only in court proceedings.

Video

There can be many situations that require proof of income. But where can I get a 2-NDFL certificate for a person who has problems with a “white” salary or generally receives only benefits. Documentedly, this form contains information about the income of citizens in the amount of taxes paid to them and the source of the main profit of each person who applied.

This certificate is a guarantee of salary stability or the availability of a permanent source of money. Having such confirmation, people can apply for certain social benefits and easy access to loans and credits.

Is it possible to do without a certificate?

Before figuring out where to get a certificate of income, you need to consider who needs it and why, since a pensioner, a member of a large family, as well as an individual entrepreneur may need the document for completely different reasons.

There are a number of situations when the provision of a document is mandatory:

- Obtaining a loan or mortgage.

- Registration of social benefits.

- Submitting an application for payment of social subsidies or benefits.

- Applying for a visa to travel abroad.

- When considering certain cases in court.

You can do without a certificate when receiving some credit programs, in the form of small loans, for which only a passport is required.

Why does the Pension Fund need a certificate?

It would seem that the pension fund can receive all the necessary information about the presence or absence of earnings from the pensioner based on insurance contributions.

Accordingly, if they exist, it means the citizen is still working; otherwise, the person is only dependent on ensuring his own pension payments.

In fact, the situation is somewhat more complicated. Accordingly, upon receiving a request from a government agency, citizens will have to go to the employment center to obtain the necessary extract.

Is the demand legal?

Unfortunately, such demands from government agencies are completely legal. The situation is regulated by Federal Law No. 27 “on individual (personalized) accounting in the compulsory pension insurance system.”

How to contact the Pension Fund? Answer in video:

According to this law, representatives of government agencies have every right to make demands on citizens to provide certain documentation to enter or correct existing data.

In this case, the question concerns not only statements about the absence of a permanent place of work from pensioners. The Pension Fund has the right to request any extracts they need. It is worth noting that if the requirement is refused or ignored, the citizen may be fined.

Control over the income of pensioners

In this simple way, the pension fund under the leadership of the government is going to introduce total control over the income of pensioners and, as a result, in case of violation, deprive citizens of the required additional payments.

To better understand the situation, let's give an example. If a person has requested and provided to the Pension Fund a certificate from the employment center stating that he is not working, but in fact is receiving additional income unofficially, the government agency has every right to sue the pensioner in order to reimburse the overpaid funds.

A new mockery of pensioners is certificates of absence from work. Photo: ua.today

And the most offensive thing is that we are not talking about some underground ways of earning money. After all, in fact, citizens may lose additional pension supplements only for trading in the harvest from their own land plot during the season.

The fact that older citizens are trying to somehow earn extra money on the side not from a good life interests no one. Just like the fact that a citizen needs not only to pay for housing and communal services and eat something, but also to repay, for example, an existing loan.

Where to get a certificate 2 personal income tax for a military pensioner

It is important to note the last name, first name, patronymic, taxpayer identification number, passport information, the person’s status as a taxpayer, citizenship and residential address.

- The full amount of income received during the reporting period is entered. All funds subject to 13% tax are indicated.

- It is necessary to note the tax deductions that the payer received for the reporting period.

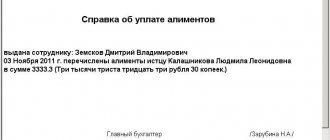

Certificate 2-NDFL is a document reflecting a person’s income.

The document is issued by the employer for whom the person works under a contract.

How is a fake certificate recognized?

When resorting to unconventional methods of obtaining documents, it is worth considering that financial institutions verify the authenticity of the submitted documents. This process includes a whole range of activities:

- Visual assessment of the submitted certificate. It must comply with the approved form and completely contain the required information.

- Institutions that received the certificate call back the place where it was issued to make sure that the extract is real and the information provided is official.

- All specified information is checked against several databases, access to which is available only to government and competent institutions.

- The audit can also be carried out through a pension fund.

- Some organizations for which a package of documents is being prepared practice counter-inspections.

If a document does not pass verification and the fact of falsification is confirmed, it can be regarded as:

The following measures can be applied to all participants:

- Blacklisting of the applicant and the organization that issued the false certificate.

- Criminal prosecution.

In the event that fraud is proven, the following applies to the guilty person:

- Administrative penalty in the form of a fine.

- Disciplinary work.

- Arrest.

- Imprisonment for up to 4 years.

How to get an income certificate for a pensioner

The execution of the document depends on the status of the pensioner:

- not working;

- working;

- military;

- IP;

- self-employed.

Note! Depending on the type of activity of the pensioner and the purposes for which information about income is needed, different forms are issued to him - certificate 2 of personal income tax, about earnings, about average income, or a document in free form.

For a non-working pensioner

A citizen who has reached retirement age and left work has the following sources of assets:

- pension;

- various benefits;

- remunerations and fees under contract agreements or without documentation of activities;

- rent;

- dividends from bank accounts, shares in legal entities, etc.;

- profit from savings on interest and securities transactions;

- and other income in accordance with Articles 208 and 209 of the Tax Code of the Russian Federation.

As you can see, the absence of an official job does not mean that a pensioner is deprived of additional income. But, as a rule, a “non-working pensioner” means a person receiving an old-age pension, long service pension, etc.

Attention! A non-working pensioner receives a certificate of income from the Pension Fund.

If a citizen made contributions to non-state institutions and thus created a savings reserve for himself, then a certificate must be obtained from this organization.

To obtain a certificate of income for a non-working pensioner, you need to contact the Pension Fund:

- with a personal visit to a department or MFC;

- Through your online personal account, the service fills out an application to the Pension Fund for the provision of a certificate of income, pension amount, personal account statement, etc.

Important! When visiting a Pension Fund office in person, have your SNILS passport with you, and pension certificates have lost their significance since 2015.

You need to fill out an application in any form with the following details:

| To whom | You can simply name the branch of the Fund. If you know the boss's name, please include it. |

| From whom | Your full name, insurance certificate number (SNILS), contact phone number. |

| Text of the statement | “Please provide...” |

| Date and signature | On the day of submission |

We recommend additional reading: Filling out 3 personal income tax declarations for individual entrepreneurs: simplified tax system, UTII, OSNO and zero

The operator at the window will accept the application, register it and inform you of the date the response will be ready. On the specified day, collect the result by presenting your passport. Most likely, the certificate will be given to you on the spot.

Important! To obtain a certificate when visiting the Pension Fund of the Russian Federation, you do not need to make an appointment in advance and participate in the electronic queue.

The applicant can prepare a pension certificate in the branches independently in the self-service area. The completed certificate not only performs an informational function, but is also an analogue of a pension certificate - present it in public transport and in other places where you need to confirm your pensioner status.

Here is a sample pension certificate:

You can also send a request through the State Services portal and the Pension Fund website.

Through MFC

Since 2021, “My Documents” offices will issue a certificate of the amount of pension benefits online - show your passport and receive the certificate on the spot, you do not need to order it in advance and come on the appointed day to receive the result.

At your request, MFC staff will contact the Pension Fund database and complete the document within a few minutes. All that is required of you is to sign the electronic application, consent to the processing of personal data, and receipt.

Note! Not all MFCs interact with the Pension Fund. If you do not want to waste time, call the department before your visit and find out if you can get the service you are interested in.

On the government services website

If you have an active profile registered on the ESIA portal, you can submit an application to receive information about your pension through a special online service. The easiest way for citizens to do this is through the mobile version of the portal, as it is more compact and easier to use.

Instructions for submitting an application:

- Sign in to the app or website.

- Open the service catalog. Select a category or department - “Pension, benefits and benefits” or “PFR”. You can also enter keywords into the search bar, for example, “certificate of pension amount.”

- In the subsections, select a specific service – “Issue of information about assigned pensions”. You will be taken to a page with information.

- Most regions do not provide the service online and ask you to contact the Pension Fund or MFC, but if an electronic service is available in your region, then click the “Get service” button, fill out a short application and wait for the result.

On a note! Through “State Services” you can order an extract on the status of your personal account, as well as brief information about the assigned pension.

Also, owners of personal accounts on the PFR website can pre-order a pension certificate (and other documents) and pick up the finished form in the branch hall from the administrator.

Working pensioner

Pensioners who are officially employed, in addition to the listed income of the unemployed, receive wages from the employer, including bonuses, allowances, vacation pay, and sick leave. To confirm their assets, for example, to enter into an agreement with a bank, they need to submit a certificate of pensioner’s income from the Pension Fund, as well as Form 2 of personal income tax from their place of work.

2 Personal income tax is a strict reporting form established by the Federal Tax Service of Russia to reflect the taxable income of employees. As a general rule, it is formed based on the results of the calendar year, but the employee has the right to request a document before the end of the year with data for the last quarter or month.

Today there are 2 forms 2 of personal income tax - for the inspection and for employees. The second option will be given to you in the accounting department when you apply.

Note! In accordance with Article 62 of the Labor Code of the Russian Federation, the employer is obliged to issue a certificate, like any other documents related to work, within 3 days after your written request.

Users of the taxpayer’s personal account can view their certificates for the past year online, since the employer submits them to the Federal Tax Service for all official personnel.

To the military

Persons who are paid a military pension can obtain a certificate of income from the military registration and enlistment office:

- Write an application in free form, indicating the military ID number among the standard information.

- Submit it to your commissariat.

- Pick up your results on the appointed date.

For an entrepreneur

If an individual entrepreneur is required to confirm his financial condition, he draws up a certificate of the pensioner’s income, and also prepares documents on business profits:

- tax return accepted by the Federal Tax Service - fill out the report and put an acceptance mark on it at the inspection; if you submitted an electronic form, print it from your personal account;

- book of income and expenses - all entrepreneurs are required to keep such a journal;

- statement of account;

- cash register - individual entrepreneurs engaged in retail are required to conduct all transactions through cash registers;

- a certificate of income generated by an entrepreneur for himself - you can take 2 personal income taxes as a basis and draw up your own form by analogy.

Self-employed

Citizens who have registered as payers of professional income tax (self-employed) can easily generate income documents in the “My Tax” application. The finished file simply needs to be printed or sent to the required department in electronic form.

Where can I get a 2nd personal income tax certificate for a pensioner?

If the response must be sent by mail, then the address to which it should be delivered is also indicated. You can submit an application:

- by sending it by registered mail, enclosing an inventory;

- by fax;

- independently to an authorized person;

- sending via the Internet.

The certificate cannot be issued longer than three days from the moment the application was registered.

The document will be sent by registered mail to the address specified in the application.

When ordering a certificate, consider the time it will take for the letter to arrive.

Certificate 2-NDFL is the employer’s reporting on the amount of tax paid on the employee’s income. In other words, this certificate reflects the level of income of an individual.

A person asks the question of where to get a 2-NDFL certificate when he needs to confirm the amount of his own income.

This may be a requirement of the bank when considering an application for a loan, the procedure for obtaining a visa, or provision to social authorities for the provision of state support to certain categories of citizens. Information contained in the certificate: - employer data - name, details, etc.; — personal data of the employee; — total amount of income; — a list of tax deductions indicated by codes.

You can obtain a 2-NDFL certificate directly from an accountant at your place of work.

Where to get a certificate 2 personal income tax for a pensioner

Despite the existing responsibility, it is difficult to identify this fact.

After all, tax authorities should not provide information about citizens’ debts to commercial structures. Therefore, it is possible to determine a fake only in court proceedings. This often happens during the consideration of cases of failure to repay a citizen’s debt to a credit institution. Obtaining a 2-NDFL certificate is not considered a bureaucratic delay. It is important to remember that the document is necessary in various situations. If it is available, a citizen will be able to get a loan much faster, confirming his solvency.

Non-working persons are not simply provided with a certificate.

Where to get a 2nd personal income tax certificate for a non-working pensioner

No later than five days after receipt of the application, the necessary certificate will be issued and sent to the address specified in the application.

It is best to send an application for an income certificate by email or registered mail. The further the military unit is located from Moscow, the longer it will take to wait for a response from the clearinghouse.

A pensioner receiving a pension from a non-state fund and paying taxes to the budget of the Russian Federation can request a Form 2 personal income tax certificate from the relevant department of the fund. The application can be sent to the fund either electronically or in paper form.

For a pensioner receiving a state pension, Form 2 of personal income tax is not provided.

Buy or wait?

The current legislation clearly states that you can only obtain a certificate from a tax agent. Using other resources, the client can buy an income certificate, which contains similar information, but is not an established sample. Therefore, those who do not have the opportunity to obtain a supporting document are asked whether it is possible to make a 2-NDFL certificate to order.

Help can be obtained:

- With an employer who acts as a tax agent.

- On the State Services portal.

- On official Internet sites that offer such services.

The average price for a certificate that will be ready within one day is 4 thousand rubles. Some companies offer to purchase a certificate with confirmation. This means that the company that issued the documents acts as a guarantor of the accuracy of the information, and if necessary, confirm the information, confirm it to the responsible person (bank, MFO or MFC).

You can obtain a legal certificate from those companies that officially have access to reliable databases and are authorized to carry out their information activities. Purchasing a certificate with a knowingly inflated amount that does not correspond to reality is considered falsification and may be considered a fake.

The average time to receive a certificate does not exceed 3 days. But some employers may delay the request at their discretion.

If a person needs to get a certificate of income, he should use the classic method - contacting the accounting department at work. In the event that an enterprise or company is liquidated - to the tax authority.