Now the pension fund provides a new service - confirmation of pre-retirement status. Or confirmation that there is no such status. The certificate is issued in a minute via the Internet. It will help you get paid days off for examinations, increased unemployment benefits and property tax breaks. That's the main thing.

Ekaterina Miroshkina economist

Read until you retire

A pre-retiree is someone who has five years or less left until retirement. Pre-retirees have benefits such as exemption from property taxes, two days off for medical examinations, a mandatory share of inheritance, early retirement and increased unemployment benefits. If the benefit depends only from pre-retirement status, you need to confirm it. What do you need for this? You need help, of course. For this purpose, the pension gods have created a service on the website pfrf.ru. A valid government services account is required. All.

Who are pre-retirees?

Pre-pensioners are people who have five years left until they reach the age that will give them the right to an old-age insurance pension, including an early one. Such people were placed in a separate category due to the increase in the retirement age from 2021. Now women cannot retire at 55, and men at 60, but the state wants to support them. Therefore, pre-retirement workers are given special benefits, are paid increased unemployment benefits and can be granted an early retirement pension upon dismissal. To take advantage of pre-retirement benefits to save money and protect your rights, you must confirm your pre-retirement status. And not in words, but in an official document. Pre-pensioners are also called those who received the right to benefits according to the old rules - from 55 or 60 years of age. That is, if the retirement age had not been raised, the woman would have retired at 55, and now she will retire later, but will not pay tax now. For such benefits, it is enough to confirm your age; no other conditions are important. These are two different categories. For example, a woman will only have the right to an obligatory share in the inheritance at the age of 55, because it depends specifically on age. And another woman will be able to receive increased unemployment benefits as a pre-retirement worker from the age of 54, because she was fired five years before retirement.

What benefits do pre-retirees have?

Several years before retirement, you can enjoy the following rights and benefits:

Tax benefits are not provided based on age, but with the following condition: if the right to a pension has arisen according to the old rules. But for this, a woman must be 55 years old, and a man must be 60. It’s just that for taxes, experience and points will also be taken into account in the right to a pension, but for inheritance and alimony they are not needed.

When do you need to confirm your pre-retirement status?

This status must be confirmed in cases where the benefit depends specifically on it - that is, the law about the benefit says that it is due to citizens of pre-retirement age. Or is there some other connection to the old age pension. Some people get on the list of pre-retirement people at 51 years old, some at 57 years old, and some only at 60 years old and even later. Then, for a benefit, benefit or medical examination, you need to bring a document that says that this woman or this man is about to retire. Confirmation is issued by the pension fund. Everything has already been calculated there. Here is a complete list of cases when it is worth getting a certificate: You are undergoing a medical examination and are asked to take two days off from work. Pre-retirees can do this every year, they must be paid for this time. You have registered with the employment service and expect to receive increased benefits within 12 months. You do not need to confirm your status for early retirement. You want to receive property and land tax benefits, although you do not yet have the right to a pension. You were fired because of your age five years before retirement, and you want to punish the employer. It is strange that the pension fund does not provide certificates on precisely this basis - under Article 144.1 of the Criminal Code. You will have to confirm your status, but it is not clear what certificate to take. You want to check if such a status already exists. Just like that, for myself.

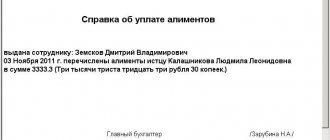

How to get a salary certificate for a pension fund

A certificate for the Pension Fund is obtained from the accounting department of the organization in which the future pensioner worked. In small firms, you need to verbally ask the chief accountant to draw up a document. In some organizations, the preparation of such paper is directly carried out by the manager.

Why do you need a certificate?

Attention! Typically, a salary certificate is Form 2-NDFL, but to submit it to the Pension Fund, it is not necessary to draw up the paper in accordance with all the rules. The document contains a list of information required to be reflected:

To receive the document, you must go in person with the documents, as a rule, to the accounting department of the enterprise, and after the certificate you must transfer it to the Pension Fund. If the document fully reflects all the information, then specialists will accept it within the prescribed time frame. And, on the contrary, if there are inaccuracies, then the document must be reissued and entered later.

How to confirm pre-retirement status?

The pension fund has all the information about people of pre-retirement age. To obtain a certificate, you need to submit a request: in person at any branch of the Pension Fund of Russia, regardless of your place of residence; in any MFC; via the Internet at pfrf.ru. If you submit your request in person, you only need your passport. They cannot require any documents about length of service, earnings or insurance contributions. The employee is only required to verify his identity. If you are required to provide any certificates or sent to another department, this is a violation of the regulations. If you come with a passport and they refuse to issue you a certificate, this is also a violation. Complain right away: for starters, to the management of the presumptuous employee. He does not have the authority to send you somewhere and demand additional documents. There is only one reason for refusing a certificate: if you came without a passport or it is expired. If you submit documents online, you do not need a passport. Your identity will be confirmed by a simple electronic signature - in other words, the login and password for your account on public services. This is the simplest and most convenient option, and it really works.

How to get an income certificate for a pensioner

The place where the document is received depends on the category of the payment recipient:

- A non-working pensioner due to age, disability or loss of a survivor.

- A working recipient of a pension in the same areas.

- Military pensioner.

- An individual entrepreneur engaged in business during a well-deserved retirement.

Regardless of the type of security and availability of work, a pensioner may have other sources of money:

- Payment for rental housing. The reference is documentation for the tax office.

- Profit from the sale of real estate. Similar to the previous point.

- Dividends on shares and other securities. Confirmation will be a bank account statement confirming the transfer of funds.

- Receipts from non-state pension funds. The income report is issued by the NPF itself.

For a non-working pensioner

The pension amount certificate is issued by the Pension Fund. An application for the preparation of this paper can be submitted in person, with the help of a trusted person, through online services, etc. Depending on the chosen option, the place where the document is received changes.

In person

Receipt procedure:

- Write an application and prepare a package of documents.

- Submit them to the Territorial Branch of the Russian Pension Fund.

- Wait for the request to be reviewed (this takes 2 business days) and receive a completed certificate from the Pension Fund.

Required package:

- Passport.

- A copy of the pension certificate (if it has not expired).

- Certificate with insurance number of an individual personal account (SNILS).

Through MFC

Getting it step by step:

- Contact the Multifunctional Center with a package of documents (the contents are in the previous paragraph). In the application, indicate a convenient way to inform about readiness, for example, by telephone.

- Wait for the message. Printed information about a pensioner’s income will be ready in 5 working days. When the extract arrives at the MFC address, employees will contact the applicant and inform him about it.

- Present your passport and receive a certificate.

On the State Services website

The service can only be used by registered citizens (the easiest way to do this is through the MFC). Receipt procedure:

- Log in to the government services website using your username and password, confirm your identity via SMS message.

- Go to the “Pensions” section and click on the “Get statement of amount” link.

- Fill out the fields in the window that opens, and also enter a convenient pickup location.

- Wait for your application to be reviewed (this may take up to 5 days). The pensioner will be informed about the readiness of the paper by phone or email.

- Obtain information about income from the territorial branch of the Pension Fund or a multifunctional center (depending on what is specified in the application).

- Worcestershire sauce - composition and use in cooking, step-by-step recipes for cooking at home

- How to choose a blender for your home, and which brand

- Import contacts from iPhone to Android

Working pensioner

These citizens have at least two sources of funds – pension transfers and wages. Each type of profit requires a separate document. Then the numbers are summed up. In some cases (for example, when applying for a subsidy), providing only one certificate is considered an attempt to reduce income. Such an offense entails a fine.

Salary certificate

Receiving algorithm:

- Contact your local accountant. Sometimes a passport is needed (for example, if the organization is large). In all cases, an application is not required, and issuing information about the amount of income is the responsibility of the employer.

- Wait for the result. The accounting department has 3 days to prepare a printed 2-NDFL certificate.

- Receive the printed document there.

The income certificate of a retired employee is valid for 30 days; in addition to the date, it contains:

- Cash receipts of a citizen for a certain period.

- Withheld personal income tax.

- Tax deductions (if any).

Certificate of pension

The registration procedure depends on the type of accrual:

- A pensioner due to age, disability or loss of a breadwinner can obtain a certificate through government services, the MFC, or the Pension Fund.

- A military retiree must contact the commissariat.

To the military:

- Write an application to the city or district military commissariat through which the pension is calculated. In addition to standard information (last name, first name, patronymic, date of birth, etc.), indicate the military ID number.

- Submit your application.

- Please wait for it to be reviewed.

- Go to the military registration and enlistment office to receive the document.

For an entrepreneur

The procedure for obtaining information about the income of a pensioner engaged in business depends on the taxation system he uses:

- General . Prepare another (third) copy of the declaration.

- Simplified . Similar to the previous one. Additionally, the entrepreneur can use a certified copy of the income and expense ledger.

- A single tax on imputed income . An alternative to a certificate for a businessman would be bank statements about the receipt of money into the account. You can maintain a cash book and provide a copy of it.

Obtaining information about income for individual entrepreneurs with a general taxation system:

- Prepare 3 copies of the 3-NDFL declaration (take a sample form from the tax office or download it from the Federal Tax Service website).

- Collect a package of documents.

- Submit them to the tax office at your place of registration. Please ensure that all copies are marked with acceptance.

- Use one of the remaining declarations as a document confirming your income. When considering a loan application, banks require data for the last 6 months. Instead of a single annual report, an individual entrepreneur can prepare separate information by quarter.

The package of documents that an entrepreneur needs to submit to the tax office along with the 3-NDFL declaration includes:

- Passport of a Russian citizen (presented in person).

- Individual taxpayer number.

- Certificate of assignment of the status of an individual entrepreneur.

How to get help online?

Anyone at any age can request information from the register of pre-retirement people. The certificate will indicate whether you belong to this category or not. Here are instructions on how to do everything on the Pension Fund website: Go to your personal account in the pension fund: es.pfrf.ru. Confirm your identity using a government account and select the desired service. Indicate why the certificate is needed and where to send it.

class=”aligncenter” width=”782″ height=”214″[/img]You need to correctly specify the purpose of the request. This is not a formality. For the employer, you may be about to retire, but for the tax authorities, you are not yet. Only the pension fund can sort it out.

The help will instantly appear in your request history. It can be downloaded, printed or sent as a file.

It took exactly a minute to receive such a certificate via the Internet.

The tax certificate will indicate a different basis. You can request several such certificates, receive them at least every day, or take them separately for the tax office, employment service and employer. Everywhere different rules of law will be indicated, but the answer always comes instantly.

What is an income certificate

This is a financial statement showing the amount of cash received by a specific individual. It could be an extract from the Russian Pension Fund, a tax return, a bank report, etc. The main information contained in this paper is the amount of a citizen’s income for a specified interval (month, quarter or year). Additionally, information on personal income tax deductions may be indicated.

- Vegetable stew with chicken

- DIY crafts from vegetables and fruits for an exhibition at school

- Signs and symptoms of coronavirus in children