Can an employee of pre-retirement age be fired?

According to Art. 144.1 of the Criminal Code of the Russian Federation, it is impossible to dismiss an employee because he has reached pre-retirement age. However, a pre-retirement employee may be pressured and persuaded to write a letter of resignation of his own free will. In this case, the citizen will be able to go to court, present evidence that the application was written “under pressure”, and the real reason for the dismissal was his age. In this case, the employer will face a fine or mandatory work in accordance with the Criminal Code of the Russian Federation.

However, the law does not in any way limit the dismissal of a pre-retirement employee in the following cases:

- Due to the expiration of a fixed-term employment contract;

- By agreement of the parties;

- Due to the liquidation of the organization or change of owner;

- Due to inconsistency with the position;

- Due to failure to fulfill job duties, theft of property, absenteeism, and so on.

Naturally, the reasons for dismissal of a pre-retirement employee must also be documented. For example, the employee’s absenteeism, the results of the certification he failed must be documented, explanatory notes from the employee must be presented, orders on disciplinary sanctions must be drawn up, etc. Only in this case, questions about the validity of the dismissal will not arise, for example, if the employee contacts the labor inspectorate.

Photo pixabay.com

Expert opinions

According to international consulting, surveys conducted in July 2021 showed:

- 32% of Russian companies are ready to employ highly qualified pre-retirees;

- 29% of employers will agree to hire older people without qualifications for ordinary positions;

- 32% of respondents are not ready to provide jobs to people 5 years before retirement.

Rice. 4. How many workers will have to accept low-paying jobs?

According to the Ministry of Economic Development, the number of people in the preferential category by 2024 will be about 2 million people. And analysts from the Moody's rating agency suggest that by 2036 the number of working-age Russians will increase by 12 million people.

Experts cannot predict which category of the population the possible shortage of jobs will be distributed among: pre-retirement people or young professionals. But in order to employ such a number of Russians, it will be necessary not only to come up with effective incentives for business, but also to create new jobs.

No 1 Average Yes

Save and share information on social networks:

Discussions are closed for this page

We recommend reading

- Early retirement for the Far North

- Benefits for pensioners in Bashkiria

- Municipal long-service pension

- Which card can you receive a pension on?

- The report on pre-retirees was canceled

- Registration of a pension through the MFC

- List of benefits for pre-retirees

- Increase in old age pensions in 2021

Retraining people of pre-retirement age

For the retraining and retraining of people of pre-retirement age, the Ministry of Labor has already developed a draft program for advanced training. According to this program, pre-retirees will be able to receive additional professional education in accordance with the skills and competencies that are in demand at the present time.

Training will take place according to the following scheme:

- Retraining will be carried out on the basis of the employment service (SZN) for an average of 3 months, off-the-job

- During your studies, scholarships will be paid in the amount of the minimum salary in the region

According to the Ministry of Labor program, vocational training for pre-retirees will allow:

- Work with new equipment, technologies, software

- Receive a qualification rank, class, category in accordance with the citizen’s profession without changing his level of education

According to the Ministry of Labor, about 75 thousand pre-retirement workers will be retrained in Russia annually, for which 5 billion rubles will be allocated. annually.

Experts from the Ministry of Labor and Social Protection determined the average cost of a training course at 29.9 thousand rubles, but for pre-retirees such advanced training courses will be provided free of charge (that is, at the expense of funds allocated from the federal budget).

Retraining for pre-retirees

To retrain and improve the skills of people of pre-retirement age, the Ministry of Labor has developed a program for the implementation of which it is planned to allocate 5 billion rubles annually. As part of the activities of this program, it is planned to organize vocational training, which will allow pre-retirement people to acquire new skills, develop competencies, and be in demand in the labor market.

The training will be aimed at acquiring the following professional skills:

- obtaining qualification categories, classes, categories by profession (without changing the level of education);

- skills to work with specific equipment, programs, technologies, etc.

The program does not provide training for a completely new profession, but is aimed only at professional growth of competencies within the framework of an existing specialty, acquiring new skills that will be necessary in work (for example, teaching skills, mentoring, working with reporting programs, etc.)

The Ministry of Labor estimates the cost of one training course at 29.9 thousand rubles, but for citizens of pre-retirement age such training will be paid for from the budget (that is, it will be free). Retraining will take place within 3 months, with a break from the main job. During the training period, a stipend will be paid in the amount of the regional minimum wage.

According to the plan of the Ministry of Labor, 75 thousand people will be trained annually under the program, and by 2024 the number of citizens who will improve their skills as a result of these activities will exceed 450 thousand people.

Pre-retirement age - how many years?

- Old age insurance pensions, including early ones:

- Pensions of state and municipal employees.

- Social (for disabled citizens).

The changes provided for by law will be implemented from January 1, 2019, with a transition period during which the retirement age will be gradually changed until the value established by law is reached. However, for civil servants, adjustments will be introduced a year later - from 2021, since for them this process has already been going on for several years - from January 1, 2021, in accordance with a similar law No. 143-FZ of May 23, 2016 (i.e., civil servants in The schedule for changing the retirement age adopted in 2021 will be amended by the new law starting in 2020).

In addition, the adopted law of October 3, 2018 No. 350-FZne provides for an increase in the retirement age for certain categories of citizens:

- Those employed in jobs with difficult and harmful working conditions, namely:

- employees in whose favor the employer pays insurance premiums at the appropriate rates, which were determined as a result of a special assessment of working conditions;

- civil aviation pilots, aircraft maintenance engineers and technicians;

- flight test personnel involved in testing aircraft and other equipment;

- workers of locomotive crews, workers organizing transportation and ensuring traffic safety on railway transport and in the metro;

- drivers of construction, road, loading and unloading equipment;

- tractor drivers working in agriculture and other fields;

- workers in logging, timber rafting, as well as those involved in servicing machinery and equipment;

- truck drivers in mines, quarries, shafts, etc.;

- in underground or open-pit mining, in mine rescue units, in the extraction of shale, coal, ore and other minerals;

- in the construction of mines and mines;

- in geological exploration, search, topographic teams and expeditions, in survey and other work;

- in the sea and river fleet, in the fishing industry;

- drivers of passenger transport on regular city routes (buses, trolleybuses, trams);

- lifeguards in emergency services;

- working with convicts in organizations executing criminal sentences in the form of imprisonment;

- women working in the textile industry with heavy loads in high-intensity conditions and others.

- Citizens who are entitled to a pension for health reasons or social reasons:

- one of the parents or guardians of disabled people since childhood, who raised them until they reach 8 years of age;

- visually impaired people of group 1;

- disabled people due to military trauma;

- women who have given birth to 5 or more children and raised them until they reach 8 years of age;

- women who have given birth to 2 or more children and have established work experience in the Far North and equivalent areas, and others.

- Persons who suffered as a result of man-made or radiation disasters (at the Chernobyl nuclear power plant, the Mayak chemical plant, the Semipalatinsk test site, etc.).

A complete detailed list of persons who will not be affected by the Government's planned increase in the retirement age from 2019 is provided in

relevant document

(PDF file format), prepared by specialists of the Pension Fund of the Russian Federation.

Please note that the pre-retirement age is set 5 years before the retirement of each individual person, which depends on his date of birth. Many websites, including the Pension Fund website, have tables with incorrect data and tables

For example, it is indicated that women in 1968

The answer from the PFR online consultant on this issue is below. We reported an error in the tables on the official website of the Pension Fund of Russia, it will be corrected in the near future.

Response from the Pension Fund of Russia online consultant on the issue of establishing “pre-retirement” status.

Let's start with the fact that the need for such a reform has been brewing for a long time, however, the initiative of the head of the Government Dmitry Medvedev to increase the retirement age initially assumed a categorical increase in the age limit. In particular, it was decided that men would be able to work until 65 years of age, and women until 63. However, subsequently the President, by personal order, made a number of mitigating adjustments.

These adjustments resulted in the lowering of the age limit for women to 60 years, while for men everything remained unchanged. However, the reform itself will be implemented gradually, and a grace period of 10 years is provided for a smooth transition to the new system.

Attention! The principle of consistently increasing the age of pensioners will continue until 2028

Benefits for people of pre-retirement age

In order to mitigate the negative consequences of the pension reform, various benefits for pre-retirees, as well as measures of additional support and protection, were proposed. They were developed by State Duma deputies from the United Russia faction and Russian President Vladimir Putin.

The list of benefits may be supplemented in the future, since a working group continues to operate in the State Duma, which is engaged in the analysis and processing of information and proposals received from citizens, public organizations, ministries and departments.

To support citizens of pre-retirement age, the following decisions have already been made:

- On October 14, 2021, a law on criminal liability of an employer for dismissal or refusal to hire citizens of pre-retirement age came into force. In addition, various options are being considered to encourage employers to hire pre-retirees and retain them in their jobs.

- To undergo a medical examination, pre-retirees will be able to take 2 working days annually while maintaining their wages. The law providing for such a change also comes into force on January 1, 2019.

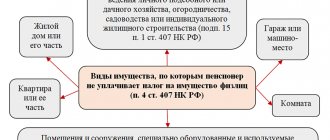

- From 2021, various tax benefits will be provided upon reaching the retirement age established by the old legislation: according to generally established standards - for persons who have reached 55/60 years of age, and if a citizen has the right to become a pensioner early, then upon reaching the age of acquisition of such a right according to the norms of the old legislation. In fact, such tax benefits will also be provided for pre-retirees

Upon reaching retirement age under the old law (55 and 60 years), Russians will have the right to receive such types of tax benefits as exemption from property tax (house, apartment, garage, etc.), partial exemption from land tax ( deduction for 6 acres of land).

In the regions, upon reaching the specified age, various additional local benefits will be provided (for travel, payment of utilities, etc.), the right to which previously extended only to those with pensioner status.

- A special program has been developed for the retraining of pre-retirees and advanced training, which will allow a citizen to be in demand in the labor market before reaching the new retirement age (which, we recall, in the coming years will increase, respectively, to 60 years for women and 65 years for men)

- Starting from 2021, a funded pension can be received upon reaching the ages of 55 and 60, and not after retirement, as provided for in the old legislation.

Innovations for people of pre-retirement age

What age is considered pre-retirement?

Legislators have changed the concept of “pre-retirement age”. In 2018 and earlier, it was believed that it begins 2 years before the retirement age, including when a pension is assigned early. In 2021 and beyond, the pre-retirement age will begin 5 years before reaching retirement age, including in case of early retirement (new edition of clause 2 of article 5 of the Law on Employment). Let us remind you that from next year the retirement age for women will generally be 60 years, and for men - 65 years.

Thus, as a general rule, women who will turn 55 years old and men who will turn 60 years old will be considered persons of pre-retirement age.

Information about pre-retirement age

There are other innovations as well. Thus, from 2021, the Pension Fund will provide free information on classifying a person as a citizen of pre-retirement age. You will need to apply for this information to the Pension Fund of the Russian Federation at your place of residence or work. The Fund is obliged to send information in the form specified by the citizen: by mail, electronically, for example, through a portal of state and municipal services or through the personal account of the insured person, or in another way (clause 12 of Article 10 of Law No. 350-FZ) .

Unemployment benefits for people of pre-retirement age

Starting from 2021, citizens of pre-retirement age will be assigned unemployment benefits according to special rules. For those who were dismissed for any reason (with some exceptions, which will be discussed below) during the 12 months preceding the start of unemployment, the benefit payment period should not exceed 12 months for a total of 18 months.

Important! If a person’s insurance experience is at least 20 years (for women) or 25 years (for men), then the benefit payment period will be increased by two weeks for each year of work exceeding the specified length of service. In this case, the final period for calculating unemployment benefits cannot be more than 24 months in total for 36 months. The amount of benefits for people of pre-retirement age depends on how long the person worked during the 12 months preceding the start of unemployment

Those who worked for at least 26 weeks during this period will be able to receive the following benefit amounts: in the first 3 months in the amount of 75% of the average monthly earnings accrued over the last 3 months at the last place of work, in the next 4 months - in the amount of 60% of the specified earnings , then - in the amount of 45% of the specified earnings. In this case, the amount of the benefit cannot be higher than the maximum amount and lower than the minimum amount, increased by the regional coefficient. Those persons of pre-retirement age who worked less than 26 weeks before the onset of unemployment will be able to receive benefits in the amount of the minimum amount

The amount of benefit for people approaching retirement age depends on how long the person worked during the 12 months preceding the start of unemployment. Those who worked for at least 26 weeks during this period will be able to receive the following benefit amounts: in the first 3 months in the amount of 75% of the average monthly earnings accrued over the last 3 months at the last place of work, in the next 4 months - in the amount of 60% of the specified earnings , then - in the amount of 45% of the specified earnings. In this case, the amount of the benefit cannot be higher than the maximum amount and lower than the minimum amount, increased by the regional coefficient. Those persons of pre-retirement age who worked less than 26 weeks before the onset of unemployment will be able to receive benefits in the amount of the minimum amount.

The maximum and minimum amounts of unemployment benefits for persons of pre-retirement age will be approved annually by the Government of the Russian Federation. According to Resolution No. 1375, the maximum benefit for 2021 for this category of unemployed will be 11,280 rubles. per month, and the minimum amount is 1,500 rubles. per month. These rules will not apply to persons of pre-retirement age in the following cases: a citizen seeks to get a job after more than a year's break; the citizen was fired for violating labor discipline or other guilty actions; a citizen sent by the employment service for training was expelled for guilty actions. For these categories of people of pre-retirement age, unemployment benefits will be paid according to the general rules that we described above (new Article 34.2 of the Law on Employment).

When you need status confirmation

First of all, this is beneficial to the citizen, because after this he will be able to count on legal preferences from the state and local authorities.

In practice, confirmation is needed when:

1) Obtaining a discounted travel pass. It is provided by a transport company that issues regular, student, children's and other passes for public transport (buses, trolleybuses, etc.).

2) To the employer - to take legal 2 days off for medical examination, to be protected from unfair dismissal, etc.

3) Apply for utility, tax and other benefits . If they were not provided automatically after the person reached the specified age.

4) Receiving an inheritance - when the citizen was not indicated in the text of the deceased’s will.

The reasons that require documentary confirmation of status are different; sometimes employees of the Pension Fund or MFC, where a person receives a certificate, can clarify why it is needed.

More than a million pre-retirement pensioners have confirmed their status for 2019, and all of them are entitled to benefits. Like people who have 5 years or less left until retirement.

First of all, this is a special protection at the legislative level from dismissal, which is dictated by only one factor - age. This directly violates Article 3 of the Labor Code of the Russian Federation.

increased unemployment benefits should be available

Some pre-retirees are also entitled to early retirement.

Social benefits and payments for pre-retirees

The main type of benefits that pre-retirees are most interested in are social benefits. Their provision is regulated by the laws of local authorities. Therefore, depending on the place of residence of the pre-retirement person, the list of payments and benefits will differ.

In addition, it is necessary to pay attention to the conditions for the provision of pre-retirement benefits and payments. Local laws may specify the age for receiving such support as 55 and 60 years, or within 5 years before retirement

To find out what benefits and payments are due as a pre-retirement person, you need to contact the social security department at your place of residence or the MFC.

It can be:

- benefits for home gasification, major repairs, housing and communal services;

- free dental prosthetics;

- travel by public transport;

- free telephony;

- visit to the bathhouse;

- monthly/quarterly payments and much more.

Benefits for pre-retirees in Moscow

Moscow City Law No. 19 of September 26, 2018 came into force in 2021. It established benefits and payments for Muscovites of pre-retirement age. The following support measures are provided for them:

- For women over 55 and men over 60:

- free travel on public transport, including the metro;

- free travel on railway transport on the Moscow Central Circle and outside it in suburban traffic;

- free production and repair of dentures (with the exception of expenses for paying the cost of precious metals and metal-ceramics);

- free sanatorium-resort treatment for unemployed citizens with medical indications, reimbursement of expenses for railway travel to the sanatorium and back;

- assistance with relocation as part of renovation for pre-retirement people living alone.

- For Labor Veterans and Military Veterans aged 55/60 years:

- discount on utility bills and housing in the amount of 50%;

- monthly compensation for telephone services (250 rubles);

- monthly city payment of 1 thousand rubles, if annual income is less than 1.8 million rubles.

Muscovites who have reached the age of 50 can receive targeted social assistance in the form of an electronic certificate. It can be used to purchase food, equipment, clothing, and so on.

Forms of state support in 2021

Support measures for pre-retirees are established at two levels of government:

- at the federal level , that is, they are established immediately for the entire Russian Federation;

- regionally , that is, they are installed in each specific region depending on what capabilities a particular region has.

Federal benefits

Federal benefits for pre-retirees include:

- the opportunity to receive an additional two days of paid annual leave in order to undergo a medical examination;

- receiving increased unemployment benefits in case of job loss and registration with the territorial employment service;

- if the employment authorities do not have vacancies in the profile of a person’s previous job that can provide him with a decent standard of living, then an early retirement mechanism can be used upon the recommendation of the employment authorities and an individual decision of the Pension Fund;

- a ban on terminating an employment contract with an employee with pre-retirement status at the initiative of the employer - except for cases where such termination occurs due to the liquidation of the employing company;

- exemption from taxes on existing real estate;

- reducing the volume of land for which land tax must be paid by six hundred square meters (that is, an area equal to six hundred square meters is subtracted from the available area of land subject to taxation, and a tax is charged on the remaining difference);

- allocation of a mandatory share in the inherited property even in the case of a will in which the person was not included as one of the heirs;

- the possibility of receiving alimony from close relatives - but only if the court makes a positive decision on this issue.

Are you about to retire?

Yes Not anymore - I’m a pensioner Not yet

Regional benefits

Regional benefits include:

- the possibility of free or discounted travel on public transport. The only exception is taxi services, for which you will have to pay anyway, since taxis are not public transport;

- the possibility of using dental services either completely free of charge, or with additional discounts in the form of payment for part of the work by the state represented by the subject of the federation where such a benefit is provided;

- provision of sanatorium-resort treatment and payment of travel to such a sanatorium and back to the place of permanent residence;

- free provision of medications that a person needs to maintain his health in proper condition;

- the possibility of free training in terms of professional retraining so that a person can continue his working activity;

- providing benefits for paying for utilities, for example, subsidies for paying contributions for major repairs;

- the possibility of receiving a discount or complete exemption from payment of transport tax;

- subsidy for communications and information costs (for example, to reimburse half of the monthly subscription fee for television);

- provision of targeted assistance if a person with pre-retirement status is below the poverty line after losing his job.

What should be the algorithm for an employee’s actions in the event of a delay in payment of wages, and what liability does the employer face?

Read

What is wage indexation, how often is it carried out and what legal norms are it regulated by?

More details

Rules for drawing up an application for a salary increase and options for justifying the stated requirement

Look

Benefits for pre-retirees

For persons who have reached pre-retirement age, various benefits will be provided, as well as various measures to support and protect their labor rights. Most of the benefits for pre-retirees were adopted on the basis of proposals from President V. Putin and State Duma deputies from the United Russia faction, and over time, the list of benefits can be further expanded.

Among the benefits already enshrined in legislation for people of pre-retirement age, the following can be distinguished:

- An amendment to the Criminal Code of the Russian Federation was adopted, on the basis of which an employer who fired a pre-retirement employee... The same punishment will be applied for refusal to hire due to old age. The law providing for such a change has already entered into force.

- The Ministry of Labor proposed, which will allow pre-retirement people to gain new skills, improve their qualifications and remain in demand in the labor market.

- To undergo a medical examination, pre-retirees will be given 2 working days with continued pay. This benefit will be available from 2021.

- Payments of a funded pension can now be issued upon reaching retirement age in accordance with the old legislation (according to generally established standards - at 55 and 60 years).

- For people of pre-retirement age, the maximum unemployment benefit will be increased - from 4,900 to 11,280 rubles.

- From 2021, Russians will have the right to tax benefits when they reach 55/60 years of age or the age of early retirement (for example, for long service - medical workers, teachers, etc.) according to old standards. Therefore, pre-retirees will also be able to take advantage of such benefits.

Among the tax benefits provided for by federal laws, we can highlight exemption from land tax (for 6 acres of land), exemption from property tax (for one object of each type of property - apartment, house, room, garage, etc.) and other. In addition, in a number of regions (for example,) a decision has already been made to maintain local benefits for pre-retirees - providing free travel, exemption from payment of transport tax, benefits for payment of housing and communal services, etc.

Benefits for citizens of pre-retirement age in Moscow

In order to support people of pre-retirement age, Moscow City Law No. 19 of September 26, 2018 was adopted, which established benefits for pre-retirement people living in the capital. Such measures will apply to citizens who have reached retirement age according to the old legislation (women over 55 years of age and men over 60 years of age), who already have the insurance period necessary to assign an old-age insurance pension.

From January 1, 2021, pre-retirees who are residents of Moscow will have the right to:

- free travel on public transport (including the metro), on suburban rail transport;

- free production and repair of dentures;

- free vouchers for sanatorium-resort treatment through social services. protection (if there are medical indications);

- free medical examination;

- targeted assistance to citizens in difficult life situations (in the form of cash payments, assistance with food, equipment, etc.).

For residents of Moscow who have the title “Veteran of Labor” or “Veteran of Military Service”, benefits will be provided for payment of housing and communal services (in the form of a 50% discount), compensation for payment of telephone services, 1000 rubles will be paid monthly. , if the citizen’s income per year is no more than 1.8 million rubles.

Photo pixabay.com

Regional benefits

The authorities of all regions of the Russian Federation have officially stated: all benefits available to pensioners apply to pre-retirement people (55 years old for women, 60 years old for men):

1. Reduced/free travel – public city/suburban transport, sometimes intercity. Except private taxis.

2. Transport tax – benefits are established separately by region. Usually this is a 50% reduction in taxation for cars with a 100-150 hp engine. power.

3. Social norms regarding utility bills - relevant for PPs who live with elderly (70-80 years old) relatives.

4. Labor veterans – PPs may have this status.

5. Dental prosthetics and other services. For example, installing a telephone, installing cable television.

Citizens apply for most benefits through social security by submitting applications there. Or visiting the MFC.

A passport is enough to confirm your PP status. The pension fund itself will transfer the necessary information about the citizen.

At what age does a citizen receive pre-retirement status?

A citizen of pre-retirement age is a person who will have the right to receive an old-age insurance pension within the next 5 years. Previously (until January 1, 2021), a pre-retirement citizen was considered a citizen who would leave his job and retire in 2 years. But in connection with the pension reform, the situation has changed - today, pre-retirement status can be obtained by a man aged 60 years and a woman aged 55 years (those who have 5 years left before retirement). During these five years (until retirement at 65 and 60 years old, respectively), the status is assigned to its owner.

Such changes are connected with the fact that the consequence of the pension reform was a gradual increase in the retirement age. This is stated in the text of Article 8 of the Federal Law of December 28, 2013 No. 400-FZ. Every year, starting from 2020, 1 year will be added to the age at which you can start receiving a pension. This will continue until retirement age reaches:

- at 60 years old - for women;

- at 65 years old - for men.

You can determine in what year a citizen will have the opportunity to quit his job and live off the state pension provision using the following table (information taken from Appendix 1 to Federal Law No. 166-FZ of December 15, 2001):

| Year of retirement | Retirement age | |

| Women | Men | |

| 31.12.2018 | Vzh (the age of a woman at which she could retire as of December 31, 2018) | Vm (the age of a man at which he could retire as of December 31, 2018) |

| 2020 | Vzh+1 | Vzh+1 |

| 2020 | Vzh+2 | Vzh+2 |

| 2021 | Vzh+3 | Vzh+3 |

| 2022 | Vzh+4 | Vzh+4 |

| 2023 | Vzh+5 | Vzh+5 |

What age is considered pre-retirement (table by year of birth)

As noted earlier, the age at which a citizen will be considered pre-retirement will change annually during the transition period (from 2021 to 2023). Therefore, for Russians of different years of birth, the pre-retirement age will be different, which means they will begin to enjoy the benefits provided at different times.

- Women born 1964-1966 and men born 1959-1961. It will be possible to take advantage of the benefits provided for pre-retirees from January 1, 2021 , since they have less than 5 years left before retirement.

- Women born in 1967 and men born in 1962 will be considered pre-retirees only in 2021 , since for them the new law establishes retirement in 2026.

You can determine the pre-retirement age depending on the citizen’s year of birth using the table below:

| For women | For men | From what year will it be possible to take advantage of benefits for pre-retirees? | ||||

| GR | PV | PPV | GR | PV | PPV | |

| 1964 | 55,5 | 50,5 | 1959 | 60,5 | 55,5 | 2019 |

| 1965 | 56,5 | 51,5 | 1960 | 61,5 | 56,5 | |

| 1966 | 58 | 53 | 1961 | 63 | 58 | |

| 1967 | 59 | 54 | 1962 | 64 | 59 | 2021 |

| 1968 | 60 | 55 | 1963 | 65 | 60 | 2023 |

| 1969, etc. | 1964, etc. | 2024, etc. | ||||

Abbreviations used in the table: GR - year of birth; PV—retirement age in years; PPV - pre-retirement age in years.

The final pre-retirement age values will be fixed for women born in 1968 and younger, and men born in 1963. They will be considered pre-retirement 5 years before reaching the generally established retirement age, i.e. at 55 years for women and 60 for men.

Amounts of benefits in Moscow and regions

Before the coronavirus pandemic, the maximum amount of unemployment payments for pre-retirees was higher than for younger people: 11,280 rubles. against 8 thousand. Now the limit for all ages is the same, equal to the minimum wage (minimum wage) - 12,130 rubles. This norm is enshrined in government decree No. 485 of April 12, 2020.

The specific amount of the benefit depends on the length of service of the unemployed and the salary at the last place of work. Conditions for pre-retirees: first 3 months. – 75% of salary, 4 subsequent ones – 60%, then – 45%. The period for receiving benefits is 1-2 years.

Payment limits vary by region:

- Moscow. An amount for loss of work during the coronavirus period is added to the base rate by decree of the city mayor. The maximum benefit is increased to 20 thousand rubles for the period from April 1 to September 30, 2020. To take advantage of the benefit, you need 2 months of work in the current year. Those who lost their jobs not due to the pandemic are not entitled to a bonus

- Moscow region. A similar surcharge, but in a smaller amount - 3 thousand rubles. Taking this into account, the maximum benefit amount is 15 thousand.

- Vorkuta. The base rate is multiplied by the regional coefficient, which for this city is 1.6. The maximum will be: 12130 * 1.6 = 19.4 thousand rubles.

- Yamalo-Nenets Autonomous Okrug. The calculation is similar, but increases the climate coefficient - 1.5. The maximum amount to be paid is 18.2 thousand.

- Central Russia. There are no allowances here, the maximum benefit is 12,130 rubles. But, as in all regions, from April 1 to June 30, 2021, one of the parents who lost their job will receive an additional 3 thousand for each child