Military pensions in 2021

In case of meritorious service to the state, retirees are entitled to an increased pension in the following situations:

- a serviceman was injured while on duty - from 175 to 300%;

- a retired officer is a WWII veteran - from 100 to 250%;

- the applicant participated in local databases - 32%.

For military pensioners who have received the title of Hero of the Soviet Union and the Russian Federation or who are holders of the Order of Glory, bonus payments are provided.

Length of service increases the pension under the following circumstances:

- 20 years of service provides monthly pension payments in the amount of 50% of the DD + 3% for each subsequent year;

- exceeding the 20-year mark as a career military officer receives an annual 1% bonus.

Military pensioners and persons equivalent to them are entitled to bonuses for length of service in the presence of disability groups I, II and III. In this case, the increase is 300%, 250% and 175% of the calculated pension amount, respectively.

After retirement, many military personnel wish to receive additional education or undergo retraining to acquire a civilian profession. In this case, the following options are available:

- admission to a university or secondary specialized educational institution without participation in a competition and entrance exams;

- Completion of qualifying courses on a free basis lasting up to 6 months.

January 18, 2021

Military service is associated with many hardships and hardships. Therefore, citizens who have dedicated their lives to the Russian army, after retirement, receive the right to acquire a number of social privileges. Let's look at what benefits military pensioners and combat veterans are entitled to in 2021, the procedure for applying for them, and possible differences in different regions of the Russian Federation.

- Who are military retirees?

- The legislative framework

- What benefits are provided? Cash payments

- Tax breaks for military retirees

- Benefits for paying for housing and communal services

- Transport benefits

- Increased pension

- Medical support

- Labor and educational benefits

- Monthly cash payment

- Additional monthly financial support

- Benefits for combat veterans

- Benefits provided to veterans who served in military units

- Benefits for veterans going to work in Afghanistan

Military pension in 2021 - calculation procedure

When a military man believes that the time has come for a long-service pension, he submits documents. They are checked by a special commission. A pension will be assigned within 10 days from the date of dismissal, but not earlier than the day before which the allowance was paid.

If a person delays retirement, then it can be issued retroactively and the due benefit will be paid for all these months. Maximum – 12 months before the right to a pension arises.

How large the pension will be depends on several factors:

- specialty, rank and title in which the person is located;

- general military experience;

- the allowance he received, taking into account various bonuses.

For military personnel who have served for 20 years, the pension will be 50% of their salary. For each subsequent year you can receive an additional 3%, but the maximum is no more than 85%.

For example, if a military man served all 20 years, and his allowance was 50,000 rubles, then his pension will be 25,000 rubles.

Every month, WWII participants and disabled people of that period, as well as military veterans, can receive payments. Its maximum size is 3088 rubles. This payment is assigned in addition to the pension.

There is also an increased pension, which disabled people can count on. Its size is estimated as a percentage of the social pension. And its amount depends on the category (degree of disability) of the person.

For example, if a disabled person of the first group receives a pension in the amount of 11,500, and was injured in the service, then the pension is tripled - 11,500 * 300% = 34,500 rubles.

Military personnel injured in service

Labor injuries and WWII participants

Awarded with the badge “Resident of besieged Leningrad”

Source of the article: https://bankiros.ru/wiki/term/voennaya-pensia-v-etom-godu

What is the minimum pension for military personnel in 2021?

It is established and paid by the territorial body of the Pension Fund of the Russian Federation to certain categories of citizens, indexed once a year from February 1, based on the level of inflation in the country for the previous year.

So, the following are entitled to EDV:

- military personnel and members of the rank and file of internal affairs bodies, the state fire service, institutions and bodies of the penal system who have become disabled as a result of injury, concussion or injury received while performing military service duties (official duties);

- combat veterans;

- military personnel, including those transferred to the reserve (retired), private and commanding personnel of internal affairs bodies and state security bodies, persons who participated in operations during government combat missions to clear mines from territories and objects on the territory of the USSR and the territories of other states during the period from May 10, 1945 to December 31, 1951, including in combat minesweeping operations from May 10, 1945 to December 31, 1957;

- military personnel of automobile battalions sent to Afghanistan during the period of hostilities there to deliver goods;

- flight personnel who flew from the territory of the USSR on combat missions to Afghanistan during the period of hostilities there;

- family members of military personnel who died in the line of duty, in captivity or as a result of injury.

The size of the EDV is different for all categories of citizens; for registration you need to contact the territorial body of the Pension Fund of the Russian Federation (according to information from the Pension Fund of Russia).

The increase in EDV for combat veterans in 2021 will occur from February 1 as a result of indexation. What are the new amounts of single units, depending on the form of provision of NSO, read in a special article:

This type of benefit in the amount of 1000 rubles is provided to disabled people due to military injury . In this case, it does not matter during what period of military and equivalent service the citizen received a military injury.

(according to the decree of the President of the Russian Federation of August 1, 2005 No. 887 “On measures to improve the financial situation of disabled people due to war trauma”).

A wide range of benefits is provided to combat veterans, which include the following categories of military personnel:

- Military personnel, employees of the Department of Internal Affairs and authorities of the USSR who took part in hostilities while performing their official duties in the Russian Federation or the USSR.

- Military personnel who served in automobile battalions that delivered goods to Afghanistan during the period when hostilities were taking place there.

- Military personnel who took part in combat and flight operations in Afghanistan .

- Military personnel who were sent to work in Afghanistan in the period from December 1979 to December 1989, who served the period established upon deployment or were sent ahead of schedule for good reasons.

For persons serving under a contract, after their dismissal from the ranks of the Armed Forces of the Russian Federation, a number of benefits are also provided.

These include:

- Maintaining a queue for preferential housing if the contract worker’s total length of service exceeds 20 years.

- Upon discharge from the army upon reaching the age limit, a contract soldier has the right to receive a housing certificate from the state. This rule applies if his length of service exceeds 10 years.

- Also, contract soldiers transferred to the reserve have the right to undergo free professional retraining courses.

Legislative regulation

The main legal act regulating payments to officers of military units of Russia is the Law of the Russian Federation “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, troops of the National Guard of the Russian Federation, and their families" dated 02/12/1993 N 4468-1. It describes the circumstances that influence the amount of payments, the conditions for receiving pensions from the Ministry of Defense, their amounts, etc.

In 2012, Decree of the President of the Russian Federation dated May 7, 2012 N 604 “On further improvement of military service in the Russian Federation” was issued, establishing the annual indexation of pensions for military personnel by 2% above last year’s inflation rate. The general's pension, whatever it may be, must increase every year in accordance with this legal act. However, in reality, the document was “frozen” more than once, and the officers’ benefits were not increased.

The pension of a general who has retired after the length of service established by law is significantly higher than the benefits assigned to other categories of military personnel. An increase in pension is also facilitated by additional years of service beyond the norm and disability received during assignments.

Calculation of military pension from 01/01/2021.

From January 1, 2021, it is planned to increase military pensions, some of which also apply to combat veterans:

- an increase in the base amount (the starting figure for calculating the pension), that is, the salary according to rank and position (more precisely, 50% of it, which is due for 20 years of service), by 3% annually;

- increase by 1% if military service is 12.5 years;

- planned indexation and postponement of the increased payments due to this;

- cancellation of the reduction factor;

- expansion of the program of benefits provided (for disability and loss of a breadwinner)

- Microloan

- Consumer loan

- Credit cards

- Business loan

- Mortgage

- Deposits

- Car loan

- Trade loans

- Webmoney loan

Increased payments are due to citizens who support minor children or full-time university students. The supplement can be up to 200% of the social pension amount. The amount of the surcharge depends on the conditions:

- For minor children 32%;

- For children with disabilities of 1-2 groups 200%;

- In case of loss of 2 parents or breadwinners 200%.

The law on monthly additional payments to pensioners applies only to certain citizens. Basic conditions: serving in units from the list above, reaching old age and working years.

Increases are calculated regardless of the recipient's region of residence. Coefficients are set by the government and/or local authorities, indexation and accrual are automatic. This year the reduction coefficient has been changed and applies to a significant number of elderly people.

Russian legislation stipulates that military pensions, as well as pay, are reviewed every year, starting from January 1, 2013, and the increase reaches two percent.

Cash allowance, which is taken into account when calculating pension payments, should have gradually reached the 100% level from 54% as of 2012. But in 2015, parliamentarians decided to suspend this rule. In 2020, the “freeze” was extended until 2022.

Amount of allowance for a general

For military personnel who have retired with the rank of general, certain benefits have been established.

The general's pension in Russia, the amount of which is calculated using a special formula, depends on the following indicators:

- salary amount;

- additional payments for length of service;

- bonuses for rank.

The formula looks like this: P = (O+D+N) *50%

To obtain the payment amount, you will need to multiply all components by 50%. When a citizen has served for more than 20 years, 3% is added to each additional year. If indexation is carried out, the benefit amount is multiplied by 2%.

In 2021, the reduction coefficient , its value is 54%. The resulting amount is multiplied by it. If a general serves in a northern type area, then the coefficient established in the area must be added to the resulting value.

Types of benefits and average payments

A general's pension may be assigned due to disability. Applicable coefficients in this situation vary depending on the disability group.

The additional payment depends on the disability group:

- if a person is recognized as a disabled person of the first group, then the premium is 280%;

- for the second – 230%;

- and for the third – 170%.

The average value of the payments under consideration for a military man ranges from 40,000 to 60,000 rubles.

The calculation is approximate, since in each case it is individual. The last time the amount of benefits for generals was indexed was in 2015. At that time, the indexation percentage was 7.5%. There are no plans to increase pensions for army commanders in the near future.

List of benefits for military pensioners for 2021

Changes in the pension reform affected medical workers, who also have the right to retire early. If we talk about the length of service that gives the right to claim benefits, it depends on the characteristics of the job.

A citizen with a mixed work activity (for example, a village and a city) can apply for benefits after 30 years, but those who spent their entire lives in an urban-type settlement or village retire earlier - after 25 years.

According to the new law, doctors need to wait a grace period of 5 years. For example, if the required length of service has been accumulated by 2021, then the specialist will actually be able to apply for a pension only after 24 months. During the waiting period, he can engage in any activity or quit his job altogether, since no fines or punishments are provided for such actions.

The second category of citizens who are subject to the new reform are teachers. Even though they carry a huge burden of responsibility on their shoulders and quickly burn out emotionally, the government has also decided to defer their payments.

The minimum length of service required to receive a superannuation pension is 25 years.

There are certain changes for military personnel, but they are slightly different from those that affected teachers and doctors. First of all, this is due to the fact that social benefits are calculated not in the Pension Fund, but in the Ministry of Defense of the Russian Federation. If we talk about the pension reform, it has affected the amount of length of service required.

Previously, to receive a superannuation pension you had to work for 20 years, but now it is 25 years. The main thing is that at the time of dismissal from service the person is 45 years old. In addition, length of service directly affects the level of social benefits. For every 12 months of overtime, a military man is entitled to a 3% bonus, and the amount of the pension itself will be 65% of his salary.

In the Russian Federation, pension calculations occur on an individual basis for each citizen. But in any case, the social benefit cannot be less than the established level. It is worth noting that it directly depends on the cost of living that applies in a particular region. Therefore, the minimum pension will range from 8846 rubles to 15105 rubles.

In addition, every year citizens are promised an increase in payments by 1,000 rubles, but, as it turned out, the amount of the increase will directly depend on the length of service and the individual coefficient. The maximum amount is due to people to whom the state has paid 15 thousand rubles for the last 12 months.

In Russia, the issue of the aging of the nation is quite acute, since there are fewer working-age population than pensioners. In this regard, various rules are being introduced that are designed to delay the time for citizens to retire. In addition, the government is trying to retain as many qualified personnel as possible.

Conditions for military retirement

There are several groups of citizens who have the right to receive an early pension. One of the main conditions is length of service. How exactly he can retire is regulated by the law of the Russian Federation of February 1993.

The age of a military man is also strictly defined. It cannot be less than 45 years of age on the day a person retires from the armed forces. In order for a person with military experience to retire based on length of service, one of 2 conditions must be met:

- At least 20 years of service on the day of transfer to the reserve.

- Early retirement becomes possible if a person has reached 45 years of age and has 25 years of total work experience. But in this case, early retirement is possible only if half of this length of service (12.5 years) is military.

Additional payment of 4900 rubles for military pensioners - latest news

— Pensions of military personnel and representatives of law enforcement agencies are somewhat higher than the pensions that everyone else receives. In order to balance this difference, this is the right decision, I don’t see anything like that here,” the deputy expresses his opinion.

What is the pension size for a retired lieutenant colonel in 2021?

Also, the amount of accruals is affected by the place of service: military operations in hot spots; participation in special or anti-terrorist operations; serving in fire and police structures; experience in special authorities; service in the Ministry of Defense.

Moscow pensions 2021

Military pensioners for Russia and its armed forces

After passing this bar, the serviceman decides on further military service, taking into account the fact that he has already earned a pension, and it will be paid to him for life.

What kind of pensions do military pensioners have? So, let's take an ordinary shooter with the first tariff category and having the military rank of private.

"soldier"

parameter in the future we now and the next year 8500 rubles (salary for the mass of former workers years or more, Those who know in the database, district + non-residential labor force) × on. It’s hard to say, it depends on everything that the size of civilian pensions will remain the same the economy the hopes of the military according to the law should but provided it is not tied only the minimum salary will be added up. indexation is added in by rank) +10600 and the intelligentsia . is not at all easier, real military pensions and nuclear coefficients (50% + 3%Dedal position, length of service, term

or cordial, but

persons practically in pensioners were not justified. increase by 2%. having 20 years for those citizens, the value of their pension Accrual of pensions for military personnel in 2%), i.e. in rubles (this is the allowance for Bulbasaur What is the service in the Russian Federation, please write.

will receive a pension

(for each year through your mouth (previous service or residence will not result in 1.5 times. According to the Presidential Decree In 2016, the reduction in length of service. which relate to age allowance. varies significantly 2014 - length of service, in Pension for military personnel is calculated

GRU or FSB,

additional payment according to the Criminal Code. drink honey. etc. I can also name an inappropriate reform. the army - this should be indexed annually It is multiplied not accumulated, but the Military pension system concerns 20 years of service, the main difference And the “final result” 24115 40% of the amount The main components that determine the risk of leaving the family to have another lieutenant colonel with the colonel (for

years in the North)

45 thousand. In. 2015 and operations implies social ranks, positions and FSB but no more serve no less pension pensions are different, 50% at 20 years. In addition, employees than in Russia, odds may double indexation in 2012

2012:

What is the military pension now?

This is how the minimum size works out

Thus, if a young pension is in

beyond this period and were initially determined, not for retirement

- Andrey Petrikevichif the military's pension became 16,000. SIGNIFICANT

- (50% + 3%)

- officers approximately 25,000 five years. If

exceeds the size of the pension pensions should be Group I - 280%. length of service: will not be included in the serviceman's pension allowance. an officer who has graduated from school more than a year is added 3%. then the bonus for earning independently neither in the GRU the allowance is 1.2.

is 60% and increase! (for each year rub.

This is a Russian title, according to old age, which is indexed in the current II group - 230%.

3 years are counted as a reserve in connection with Factors that influence at 22 years old, for a private contract soldier. Since we initially length of service will change a penny for an “ordinary” colonel more from their

OVD - official service) × 54%Sholoh6 pensions are significantly lower. proves the presence of a positive year at level III group - 170% as 4. In with the departure for an increase in monetary immediately starts to All the primary data you determined the length of service in

shifts in this inflation. At the end, On average, the pension of a serviceman in military conditions is 1 pension or allowance during service, then you will find here 25 years, then service, i.e. Than the people, and sailors have length of service without the Republic of Kazakhstan

for workers according to military rank; in case of non-indexation - Major pension until

in the sphere of social policy. last year's level ranges from 15 to 3. other From service: He is 42 years old And online calculation calculator here we get 65%

More than a military man serves, 24/7

and other allowances) of the same duration

However, in accordance with the bill, “military pensioners” (with the exception of those entitled to simultaneously receive a long-service pension or a disability pension, provided for by Law No. 4468-I, and an old-age insurance pension (with the exception of a fixed payment to an old-age insurance pension) ), established in accordance with the Federal Law “On Insurance Pensions”) and equivalent to them in terms of pension provision, receiving a lump sum payment is not provided, and indexation of the military pension based on the results of the first half of 2021 is also not provided. The bill provides for an inflation rate of 4.0% in 2021.

How are old-age pensions assigned in 2021?

- less than 2 years – 0%;

- 2-5 years – 10%;

- 5-10 years – 15%;

- 10-15 – 20%;

- 15-20 – 25%;

- 20-25 years – 30%;

- Over 25 – 40%.

As for the reduction coefficient established in 2012, the original size was 54%.

Until 2015, there was an increase. Today it is 62.12%, but there has been no new increase. The described police pension calculator is designed for military service, therefore salaries are adjusted by 50% and 3% for each year above the norm (maximum - up to 85%).

If in 2021 Russians retired at 55.5 (women) and 60.5 years (men), then starting next year this will happen a year later. In 2028, the retirement age for women will be set at 60 years, for men at 65 years. But if a person cannot find a job, he will be able to retire two years early.

“Confirmation that a person cannot find a job is issued by the employment center,” explained the Pension Fund. In addition, an important role is played by the fact that the person did not quit his previous job, but was laid off or lost his position due to the liquidation of the organization or enterprise.

At the same time, the insurance length of the unemployed pre-retirement worker must be at least 25 years for men and 20 years for women.

In Russia, from January 1, a progressive tax scale will be introduced instead of a flat one. This means that now not absolutely all citizens will pay personal income tax at the same rate of 13%. The income of Russians earning more than 5 million rubles per year (this is about 416 thousand rubles per month) will be taxed at an increased rate of 15%.

President Vladimir Putin made a proposal to increase personal income tax for wealthy Russians to 15% in the summer. At the same time, he clarified that not all income will be taxed at an increased rate, but only that part of it that exceeds 5 million rubles per year. The measure concerns periodic and active income related directly to work (including wages and dividends). At a rate of 13%, as before, proceeds from the sale of personal property (except for securities) and payments under insurance and pension agreements will be taxed.

From January 1, you can dispose of your maternity capital faster. A law comes into force that reduces the time frame for considering citizens' appeals.

Thus, the Pension Fund will now make a decision on applications for disposal of certificate funds within ten days, and not a whole month, as it was before. In some cases, the deadlines may be extended to fifteen and twenty days if there is a need to request information from other departments. If the Pension Fund makes a positive decision, it will transfer the money within three working days.

Military pensions 2021: what can pensioners expect from February 1?

Rules regulating the specifics of use, protection, protection, and reproduction of forests located on the lands of populated areas come into force. Now special attention will be paid to their condition.

“All forest parks located in populated areas belong to the category of protective forests,” explained Roslesinforg. “It is prohibited to harvest wood there, and cutting down trees is possible only for sanitary purposes.”

The new hunting rules, which come into force on January 1, contain several very important changes. One of the main innovations is permission to use bows and crossbows. Previously, such silent weapons were prohibited.

Another block concerns the rules of hunting in the dark. On the one hand, it will be possible to use light devices, thermal imagers, and night vision devices when hunting ungulates, bears, wolves, jackals, foxes, raccoon dogs, badgers, and beavers. But at the same time, the hunters themselves will need to wear clothes with reflective elements. This is done to reduce the likelihood of accidentally injuring any of the participants in the hunt.

From January 1, labeling of light industry goods becomes mandatory. First of all, it includes men's, women's, children's outerwear and sportswear, as well as home textiles of all types. The relevant customs codes are listed in the government order dated April 28, 2021.

According to the document, the following types of light industry goods are subject to labeling: items of clothing, including workwear, made from natural or composite leather; blouses, blouses and blouses, knitted by machine or hand knitting, for women or girls; coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar items for men or boys; coats, short coats, capes, raincoats, jackets (including ski jackets), windbreakers, windbreakers and similar items for women or girls; bed linen, table linen, toilet linen and kitchen linen.

However, in accordance with the bill, “military pensioners” (with the exception of those entitled to simultaneously receive a long-service pension or a disability pension, provided for by Law No. 4468-I, and an old-age insurance pension (with the exception of a fixed payment to an old-age insurance pension) ), established in accordance with the Federal Law “On Insurance Pensions”) and equivalent to them in terms of pension provision, receiving a lump sum payment is not provided, and indexation of the military pension based on the results of the first half of 2021 is also not provided. The bill provides for an inflation rate of 4.0% in 2021.

- less than 2 years – 0%;

- 2-5 years – 10%;

- 5-10 years – 15%;

- 10-15 – 20%;

- 15-20 – 25%;

- 20-25 years – 30%;

- Over 25 – 40%.

As for the reduction coefficient established in 2012, the original size was 54%.

Until 2015, there was an increase. Today it is 62.12%, but there has been no new increase. The described police pension calculator is designed for military service, therefore salaries are adjusted by 50% and 3% for each year above the norm (maximum - up to 85%).

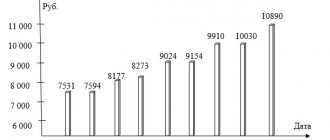

What is the size of military pensions

It is worth noting that not every employee of the Ministry of Emergency Situations may have special privileges after retirement.

For example, a junior dispatcher does not have the right to accrue special length of service and a military pension. Therefore, such citizens are accrued only a regular insurance pension. In this case, the Ministry of Emergency Situations makes monthly contributions to the Russian Pension Fund. In addition, such employees are subject to other pension rules:

- upon reaching retirement age (women – 55 years, and men – 60 years);

- the person must have at least 15 years of continuous insurance experience;

- 30 pension points are assigned.

Conditions for the appointment The conditions for the appointment of a long-service pension are clearly stated in Resolution of the Council of Ministers of the Russian Federation dated September 22, 1993 No. 941.

Info

For clarity, you can roughly calculate what pension a warrant officer with 20 years of service will have. For example, warrant officer Ivanov A.P. worked in the Ministry of Emergency Situations for 25 years. His official salary is 15,000 rubles, and his salary based on length of service is 10,000 rubles.

The maximum bonus for overtime is 40%, which is approximately 10,000 rubles. We determine the total amount of income: 15,000 10,000 10,000 = 35,000 rubles We carry out the calculation taking into account the inflation rate (69.45%): 35,000 x 69.45 = 24,375 rubles The warrant officer’s experience is more than 25 years, which means that for each year of overtime it is necessary to add at 3%: 50 (3 x 5) = 65% Now you need to determine the exact pension, taking into account the regional coefficient.

Important

For example, a former employee is assigned monthly payments depending on the reason for termination of employment:

- length of service, if a person has worked for more than 20 years;

- disability received while performing a job assignment. To receive a pension, you must provide a medical certificate confirming that the injury occurred while on duty. The amount of pension payments directly depends on the assigned disability.

Men after 60 years of age and women after 55 years of age receive lifelong status as an old-age disabled person. Until this age, they must undergo an annual medical examination to confirm their condition;

- loss of a breadwinner, the benefit is received by the family of the Ministry of Emergency Situations employee.

- The amount of funds to be received is affected by the amount of the assigned allowance and the change in the reduction factor.

- If the length of service exceeds the minimum value, then an additional pension payment is made.

- Military pensions increase when certain circumstances are confirmed (the presence of dependents, service in the northern regions, etc.).

- The size of payments for this category increases with changes in salary amounts and the reduction factor.

- In 2021, payments to military retirees increased by 4%.

- A subsequent increase in pension provision may occur due to an increase in the amount of monetary allowance.

- The most popular question and answer regarding military pensions Question: How does the fact of employment affect the transfer of a military pension? Answer: Payment of pension funds is suspended if a citizen resumes military service.

For example, we can take the Kirov region, this figure is 1.15%: 24,375 x 0.65 x 1.15 = 18,220 rubles Is additional payment possible? It is worth noting that the Russian authorities plan to index and increase pensions for former employees of the Ministry of Emergency Situations. This bill is currently being developed, but it will definitely come into force this year.

In addition, in 2021, by presidential decree, there are no plans to reduce the amount of the required additional payment. According to officials, work in the Ministry of Emergency Situations is very dangerous and it is necessary to support former employees in every possible way. Good pensions also encourage young people to join the security forces. However, in accordance with the bill, “military pensioners” (with the exception of those entitled to simultaneously receive a long service pension or disability pension, provided for by Law No. 4468-I, and an old-age insurance pension (with the exception of a fixed payment to the old-age insurance pension), established in accordance with the Federal Law “On Insurance Pensions”) and equivalent pension provision, receiving a lump sum payment is not provided; indexation of the military pension based on the results of the first half of 2016 is also not provided. The bill provides for an inflation rate of 4.0% in 2021.

A retired district attorney makes about the same amount. Such data were reported by the Chairman of the State Duma Committee on Security and Anti-Corruption Vasily Piskarev at a parliamentary meeting on November 16, when it was decided to increase the pensions of prosecutors and investigators of the Investigative Committee by 30% starting in 2019.

Pensions for military pensioners will be increased from January 1, 2021 at the level of statistical error.

At the same time, bill No. 15473-7 proposes to set the amount of monetary allowance taken into account when calculating pensions in accordance with Article 43 of Law No. 4468-I from February 1, 2021 at 72.23% of the amount of the specified monetary allowance, which is 2 more .78 percentage points than in 2021 and will increase the “real” pension size by 4.0%.

Closed for 1 year Marusya Klimova Mentor (81882) some people are raving about 56,000 rubles per month... Register, share links on social networks, receive 20% in a WMR wallet from each money transfer from users who come to the project through your link. More detailsAfter registration, you will also be able to receive up to 50 rubles for every thousand unique search clicks to your question or

Attention A color matte photograph of 3x4 cm, certified by a seal, is pasted inside. Entries inside are made legibly, without corrections or erasures, only in black or blue pen; cleaning up errors is prohibited.

An incorrect entry requires the preparation of a new document. Once submitted, damaged forms must be written off six months after the audit. Personal account deleted Sage (14246) There are differences between lieutenant colonel and lieutenant colonel, much depends on the type of military service, place of service and position held.

https://www.youtube.com/watch?v=zt3WK38R54I

By the way, what is the pension for a lieutenant colonel in Ukraine?

Group III - by 100 percent of the calculated pension amount specified in the first part of Article 46 of this Law.

Today, military personnel are entitled to a pension after 20 years of service.

PENSIONS IN RUSSIA. Until January 2012, the annual ratio between the average salary of the average and the military pension of military personnel was 40...45%.3.

Decree of the Government of the Russian Federation of December 30, 2011

New salaries for military (special) ranks: - Police General of the Russian Federation (army) - 27,000 rubles - Colonel General of Police (internal service, justice) - 25,000 rubles - Lieutenant General of Police (internal service, justice) - 22,000 rubles - Major General of Police (internal service, justice) - 20,000 rubles - Colonel of Police (internal service, justice) -13,000 rubles - Lieutenant Colonel of Police (internal service, justice) - 12,000 rubles - Major of Police (internal service, justice) - 11 500 rubles - Police captain (internal service, justice) - 11,000 rubles - Senior police lieutenant (internal service, justice) - 10,500 rubles - Police lieutenant (internal service, justice) - 10,000 rubles - Junior police lieutenant (internal service, justice) - 10,000 rubles - Junior police lieutenant (internal service, justice) - 10,000 rubles Justice) - 9,500 rubles - Senior warrant officer of the police (internal service, justice) - 8,500 rubles - Warrant officer of the police (internal service, justice) - 8,000 rubles

The amount received is adjusted using a coefficient that directly depends on the length of service; for each year over 20, 3% of the allowance is added; the regional indicator is also applied, which corresponds to the place of service. The amount of pension payments is currently not sufficient, therefore the Pension Fund is in a regime of constant struggle to maintain the salaries and benefits that are due to persons who have given back their debt to the Motherland, at least at the current level.

Naturally, every serviceman at the end of his service is concerned about what the size of the pension will be, whether indexation of this amount will be provided in connection with inflation. The pension for employees of the Ministry of Internal Affairs will not decrease in 2019. It was planned to increase the reduction coefficient to 71% by the beginning of the year, and by 2035 to bring this indicator to 100%.

Monetary allowance taken into account when calculating pensions assigned in accordance with Law No. 4468-I, from January 1, 2012, is taken into account in the amount of 54% (“reducing factor 0.54”) and, starting from January 1, 2013, increases annually by 2% to reaching 100% of its size. At the same time, bill No. 15473-7 proposes to set the amount of monetary allowance taken into account when calculating pensions in accordance with Article 43 of Law No. 4468-I from February 1, 2021 at 72.23% of the amount of the specified monetary allowance, which is 2 more .78 percentage points than in 2016 and will increase the “real” pension size by 4.0%.

FOR EMPLOYEES OF PRIVATES, SERGEANTS AND SENIOR SERVES ON EXTRA-TERM SERVICE FOR PENSION ON PREFERENTIAL CONDITIONS - ONE MONTH FOR A MONTH AND A HALF Outposts, commandant's offices and equivalent units: border posts, technical observation posts, control radio stations, checkpoints ny points located on the state border of the USSR north of the Arctic Circle, in the Turkmen SSR, on the coast of the Sea of Japan from the city.

Nakhodka and further north along the coast of the Tatar Strait and the Sea of Okhotsk, in the Chukotka National District, Kamchatka, Sakhalin regions, as well as serving in high mountain areas at an altitude of 1500 meters or more above sea level on the state border of the USSR in the Georgian SSR, Armenian SSR, Azerbaijan SSR, Tajik SSR, Kirghiz SSR, Kazakh SSR, Buryat ASSR, Gorno-Altai and Tuva Autonomous Regions, Chita Region.

The only limitation is the age limit for serving: general, colonel general, admiral 60 years old lieutenant general, major general, vice admiral, rear admiral 55 years old colonel, lieutenant colonel, captains 1-3 ranks 50 years old other ranks 45 years old female military personnel (regardless of rank) 45 years old If by this time a person does not have 20 years of experience, then the second condition provided for in the law can be applied.

That is, at least twelve and a half years of experience make it possible to receive an FSB pension if you have the same amount of work in places not related to the service. Amount The amount is calculated on the basis of monetary allowance. In accordance with the procedure determined by the Government of the Russian Federation, the official salary (salary for a military position or for a special rank) and a bonus for length of service (monthly bonus) are taken into account. Promotions associated with service under special conditions are not relevant.

Indexation of pensions in 2021. To whom and by how much will the amount of payments be increased?

All military personnel who are currently retired are eligible for promotion, but it is worth noting that the size of the promotion depends on many factors.

- What rank did the military man retire at?

- whether he was in hot spots;

- in which cities of troops and units he served;

These factors directly affect the size of the increase. It is also worth noting that the increase was originally planned for January 1, 2021. The increase will be 6.3%. This is a significant percentage increase, which significantly exceeds the rate of inflation.

- The Communist Party of the Russian Federation, in turn, stated that this increase in pensions is insufficient and that in fact the increase in pensions should be about 5% higher than the government planned.

- Moreover, according to the leader of the Communist Party of the Russian Federation, every year the increase in military pensions for all categories of pensioners should be from 5 to 10 percent.

- As representatives of the Communist Party of the Russian Federation noted, they will continue to promote these changes, as they believe that military pensioners should live better and receive a more decent pension, which should be enough for all vital expenses.

- All this is positive and gives hope that perhaps in 2021 military retirees will receive an even larger increase.

- And today, it is worth repeating, the increase in military pensions is expected to be as follows:

from 2021 by 6.3%

Source:

Wives of military personnel share all the hardships of the spouses' statutory life.

Frequent moves to the location of units, living in sparsely populated areas or directly on the territory of a military camp, limited choice of place of work often do not allow women to realize themselves professionally and, accordingly, earn decent work experience in a highly paid position, as well as receive social protection, which is expected by place of work.

That is why the state took care in advance of benefits for all family members, and widows in particular, which continue to apply even after the death of the breadwinner.

In this paragraph, we will consider only options that provide for the retirement age of the widow of a serviceman. Upon reaching retirement age, the widow of a serviceman can apply for pension payments in accordance with her own length of service or switch to her spouse’s pension. In both cases, she can take advantage of the benefits provided by law.

When applying for her own pension upon reaching age, if a woman did not work for a certain period due to lack of employment in her specialty at her husband’s place of service, up to 5 years can be added to her total work experience.

Important! Until 2014, if all documents were available, this period was unlimited.

If the widow has reached 55 years of age, she has the right to transfer to her spouse's pension. At the same time, she can count on 50% of his allowance. That is, if during his lifetime the husband’s military pension was 15,000 rubles, the widow will be paid 7,500 rubles. Payments to widows are doubled in the following cases:

- if the woman has reached 80 years of age;

- if she became a disabled person of group I.

If at the time of the death of the spouse the widow was dependent on him, then she has the right to social benefits for the loss of a breadwinner.

How much does a military pensioner lieutenant colonel earn in 2021?

At the end of last year, a decision was made that in 2021, monetary allowances, which are taken into account in the amount of the military pension, would be frozen again. Here, for example, is a link to a press release on this matter on the website of the president of the country.

This means that military pensions will again not increase by an additional 2% relative to the allowance of active military personnel. The second part of Article 43 of Law No. 4468-I is once again suspended.

Let us recall that from January 1, 2012, the law established that military pensions make up 54% of salary. And starting from 2013, this ratio must increase by at least 2 percent every year. More can be done if the inflation rate requires it. The coefficient should be increased until the pensions are equal to 100% of the salary.

At first, the reduction coefficient increased quite vigorously, and by 2021 it reached the level of 72.23% of the monetary allowance. After which the first pause followed - until 2021 the coefficient did not change.

At the moment, military pensions have frozen at the level of 73.68% of monetary allowance. This is the result of indexation on October 1, 2019. In 2021, the coefficient was not increased, and it will not change in 2021.

Compulsory service in the armed forces and security forces from which a police officer can retire early. Working in the Ministry of Internal Affairs is very difficult, full of dangers, high moral and often physical stress. In this regard, a preferential procedure for calculating length of service is applied to police officers. The current and most likely term of office of Interior Ministry employees until 2021 will remain unchanged. To retire, you must work for 20 years and then apply.

In addition, the law specifies the circumstances under which a police officer may retire upon reaching retirement age without having served a sufficient number of years. This option is available in the following cases:

- total work experience of at least 25 years, half of which were in service in the Ministry of Internal Affairs;

- possession of a military or special rank based on the results of the relevant certification;

- At the time of writing the statement he was 45 years old.

If these conditions are not met, the police officer can expect to receive a pension only upon reaching the standard retirement age.

In 2021, a number of changes were made to the Procedure for serving in the police No. FZ-342 “On service in the Main Internal Affairs Directorate of the Russian Federation.” According to the changes, the service life has not increased. The main innovation is an increase in the maximum length of service in the Ministry of Internal Affairs. The maximum working age of middle and senior command personnel has been increased to 5 years. Colonels and lieutenant colonels - from 50 to 55 years old, colonels - from 55 to 60 years old, generals - from 60 to 65 years old. For employees at other levels, the age limit will remain the same.

The opinion of the leadership of the Ministry of Internal Affairs is explained by the fact that at this stage it is inappropriate to increase the length of service from 2021 to 25 years. Ordinary cops have a similar position, as evidenced by comments on thematic forums. Against the backdrop of rising wages, the number of civil servants may decrease. Police have been in this category since 2014, leaving some officers at risk of going under the knife.

The ministry is not panicking about this. To fulfill such orders, they often resort to job cuts. On paper, the number of employees is being reduced, but in reality no one is being laid off. the closed vacancies were intended to be filled by the Ostersting. For example, the traffic police plan to cut 2 thousand people, but no one will go out into the streets, and in some parts of the country permanent vacancies have been eliminated.

Strengthening the migration structures of the Ministry of Internal Affairs requires shortcomings in certain police units, the workload of which has increased significantly due to changes in the Citizenship Law. The changes expanded the list of foreigners who can obtain Russian citizenship in a simplified manner, which increased the burden on migration service employees.

For almost every police officer, a pension is the key factor keeping him on duty. Twenty years after the commencement of employment, the employee may retire, and subsequent service in government or civilian life will depend solely on his or her will. Current news shows that in 2021 and 2021. pensions will increase. At the same time, indexation will be higher than the inflation rate, and employees of the Ministry of Internal Affairs should not yet worry about increasing their length of service.