Paying for such an expensive tax as land tax can make life very difficult for an elderly person, because he lives only on his pension. And as we all know, it does not amount to fabulous money. Also, based on previous laws and regulations, benefits regarding land tax applied exclusively to a certain list of people.

These included war veterans, Chernobyl plant workers and disabled people. All others were not provided with such benefits. But from the beginning of 2021, the state decided to make some amendments to this resolution, and now pensioners are also provided with land tax benefits. We will tell you exactly what documents are needed and where to apply in this article.

Land tax benefits for pensioners in 2021

According to the 2021 bill, it was established that land tax benefits are provided only to the following persons:

- WWII veterans.

- Heroes of the USSR.

- Disabled people of all three groups.

- Workers of the Chernobyl station.

But from 2021, some changes come into force, according to which now every pensioner has the right to receive this type of discount. Also, previously payments provided the opportunity to pay tax at a discount of 10,000 rubles. But now it has been replaced by a reduction in the size of the plot by 6 acres. That is, now the territory of your plot according to the cadastre is reduced by 6 acres, and the remaining part is paid for.

General federal benefit: for what area of land do pensioners do not pay land tax

In connection with changes made to the legislation regarding land tax benefits provided to certain persons, now instead of providing a discount payment for this tax in the amount of 10,000 rubles, it was decided to change it to reduce the paid area of land according to the cadastre.

Good to know. It is also worth noting that the adopted changes in this system also apply to 2021.

Additional tax benefits for land

There are also additional benefits for retirees that few people know about, but also have legal enforcement.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

But there is one caveat - this is that these types of payments are provided at the local regional level. This means that they will not apply to the entire territory of the country, but only to certain parts of it.

These may include:

- Benefits for war veterans.

- Disabled people of 1st, 2nd or 3rd degree and others.

General rules of taxation and benefits

A key feature of land tax is that it falls within the competence of local authorities. This means that the Tax Code of the Russian Federation establishes only general rules for taxation and the provision of benefits. Specific conditions for the exemption of citizens from payments to the budget will be determined by municipalities through the annual publication of local regulations.

From 2021, only one land tax benefit is available at the federal level. A pensioner who owns a plot of land will be exempt from payments only for 6 acres. In practice, this benefit is implemented as follows:

- exemption from payments applies only to land owners, so tenants must transfer payments according to the terms of the contracts;

- the right to the benefit arises immediately after retirement, and remains provided that the pensioner does not go to work;

- Only an area of 6 acres is exempt from tax. If the plot exceeds this size, land tax will be charged on the entire area over 6 acres according to the general rules.

The provision of this benefit is automatic if the citizen confirms his pensioner status. To do this, you only need to contact the Federal Tax Service once with a pension certificate or other relevant document. For subsequent provision of benefits, you do not need to re-submit your pension certificate.

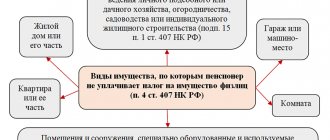

Military pensioners are completely exempt from paying property and land taxes. To confirm their right to the benefit, they only need to present a document confirming their retirement from the law enforcement agencies. The benefit will apply to 1 plot of land owned by a military pensioner.

The list of municipal benefits will depend on the provisions of local regulations. They can be provided in the following areas:

- introduction of reduced coefficients or complete exemption for payments for certain categories of land - for example, a benefit can be introduced for SNT plots or for personal subsidiary plots;

- the benefit can only be provided to citizens who have confirmed their status as low-income. Such a check will be carried out by social protection authorities and the relevant certificate will be issued;

- the benefit may be provided for the first few years after the purchase of land from the municipal fund (for example, when purchasing a plot for the construction of private housing);

- Tax exemptions may be provided for certain preferential statuses (for example, disabled people, labor or military veterans).

If local authorities decide to provide benefits, they will act along with the federal rule on tax exemption for plots of 6 acres.

It must be taken into account that local authorities are obliged to make an annual decision on land tax in their territory. Therefore, the conditions for providing benefits may also change annually. Relevant changes in legislation can be clarified directly with the Federal Tax Service or on the tax service website, or through the local administration.

Amnesty for tax debts

This law was adopted in the shortest possible time, the adoption of which took only a few weeks. According to him, all debtors should be forgiven and they will no longer have debts.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

It was adopted in 2021, and also applies to existing debts for payment of not only tax, but also land, transport and property taxes for 2015.

How can a pensioner apply for a land tax benefit?

There is only one way to apply for a tax benefit on a pensioner’s land in the amount of 6 acres, which are not taxed: the owner of the land, before November 1 of the year in which he wants to receive this deduction, submits a notification to the Federal Tax Service Inspectorate indicating the land plot whose base he wants to reduce.

The purpose of the notification is that thanks to it, the payer himself chooses for which object the tax will be reduced. After all, the deduction is provided only for one plot of all that is owned by a citizen. If you do not submit a notification, the Federal Tax Service will still provide a deduction, but will independently select the object based on the principle of the largest base.

Example 1

Pensioner Mikhail Medvedev inherited 2 plots of land - 6 acres and 10 acres. He did not submit a notification for the deduction in a timely manner, and the tax office itself calculated the land tax, applying the deduction to land of 10 acres. And this plot is in the use of the tenant, who himself pays the tax on it. If Medvedev had handed in the notice, he could have reduced his expenses by choosing a plot of 6 acres, because then his base would have become zero, which means the tax would be zero.

Example 2

Lvov Alexey has 2 plots - 15 and 20 acres. He leased the largest of them by concluding a written agreement. According to the transaction, the tenant agreed to pay land tax. Lvov never submitted a notification about the selection of an object, but now he filled out the form and submitted it to the Federal Tax Service, choosing the first object. The tax office reduced its base by 6 acres of cadastral value. If Lvov had not done this, he would have had to pay from 15 acres, and the tenant from 14.

What documents does a pensioner need to apply for land benefits at the tax office?

Since the deduction is not conditional on anything, in order to receive a land tax benefit, pensioners do not need to collect any documents from outside.

It is enough for him to attach to the notice:

- copy of passport;

- a copy of the pensioner's certificate.

You must take the originals of these documents with you. Just in case, you can also take documents for the land. A sample application for a land tax benefit for pensioners in the form of a notification about the selection of a land plot for using the deduction looks like this:

Applications for land tax benefits for pensioners can be found here .

Important!

Fill it out with dark paste, block letters and strictly according to your passport and land documents.

Immediately after submitting the notification, the tax will be recalculated, and by December 1 the payer will pay other amounts. After November 1, you can no longer change the object of deduction; you will have to wait for the next calendar year, i.e., on the first working day of the next year you can submit a notification for deduction.

Documents for applying for land tax benefits for pensioners

In order to successfully apply for and receive a land tax benefit for pensioners, you must prepare and submit to the Federal Tax Service a package of documents, which includes:

- Passport of a citizen of the Russian Federation, namely, printed copies of each page where there are marks.

- A corresponding application for providing land tax benefits to pensioners in the required form.

- Documents confirming the fact of ownership of the land plot.

- Pension certificate of a citizen of the Russian Federation.

In the event that the benefit is issued not by the pensioner himself, but by his relative or other authorized representative, then a power of attorney must be presented. In 2021, a similar procedure can be completed online, which will save a lot of time.

Concept of land tax

What is this land tax, and what is it paid for? Where do the funds go? How is it used?

Based on the Tax Code of the Russian Federation, land tax is a local tax, calculated on the basis of the cadastral value of a plot of land, paid by individuals or legal entities that own, use and dispose of a land plot as:

- Property;

- Perpetual possession;

- Perpetual inheritable use.

Land tax funds go to budgets of different levels:

- 50% - the territorial entity where it was collected;

- 20% – higher local budget (for example, region)

- 30% - federal.

The purpose of using these funds has also been established. They are intended to cover the costs of:

- land management;

- cadastre maintenance;

- monitoring the condition and development of new land plots, including agricultural ones;

- compensation, in accordance with the procedure established by law, for the expenses of landowners, if it was independently spent on the above purposes.

So, this tax is designed to keep the lands fertile, healthy, and expand the land fund. But this does not mean that it should place an unbearable burden on the land user.

After all, there are categories of owners and owners who cannot fully pay such expenses. For this reason, federal and regional benefits for paying land tax have been established.

Interesting information: Documents required for tax deduction

How to apply for benefits

You will have to confirm your right to a discount yourself by personally submitting a written notification of the required form to the Federal Tax Service office at your place of residence or registration of the land plot, or by sending an electronic application to the organization’s website. You need to act in the following sequence:

- If you own two plots or one with an area of over 600 m2, select the territory for which the discount will be issued.

- Collect documents justifying the preference.

- Fill out the notification, indicating the details of official documents proving the right to the benefit or attaching them to the application form.

- Submit the collected documentation to the tax service before November 1 of the current year. If you need to receive a discount for 2021, then information must be submitted before July 1, 2018.

- Caesar with salmon - how to cook at home using step-by-step recipes with photos

- Unusual signs of heart failure that are important to pay attention to in time

- Vitamin deficiency: 8 signals that our body gives

List of required documents

The list of required documentation to justify an individual’s right to preference is established by municipal authorities. The standard list of official papers provided to the Federal Tax Service looks like this:

- passport or other taxpayer identification card;

- pensioner's certificate;

- data confirming ownership of the territory;

- a correctly completed discount notification form.

Calculation of land tax

When calculating land tax, you need to take into account a number of simple rules:

- The Federal Tax Service collects data on the tax base for each citizen independently and issues receipts based on the information they have. If they are not relevant, it is better for the payer to take care of it himself and inform the service.

- Preferences are provided only for one taxable object. That is, if a pensioner owns 2 or more plots, then the discount will affect only one of them, at his choice. He must inform about his decision when drawing up the application. But he may not do this. In this case, the Federal Tax Service explains in a letter dated January 17, 2018 No. BS-4-21 / [email protected] that the benefit will be provided at the choice of the Federal Tax Service for an object with a higher tax payment, believing this to be in the interest of the payer.

- The applicant must apply for the benefit himself, but may not do so if he has previously applied for benefits on property tax, land tax, etc. He will still enjoy the privilege. Such clarifications are provided by the Federal Tax Service in the above letter.

- The tax is charged for a full month of use. For the first and last month of ownership, it is accrued as full only if the right arose before the 15th day of the month and ceased after it.

- Starting from 2021, the tax on inherited land will be calculated from the date of opening of the inheritance.

- The tax payment deadline is December 1st of the next year.

- A plot of land for individual housing construction is taxed with a coefficient of 2 if real estate has been built and registered on it within 10 years. The coefficient is applied before registration of housing.

- A building plot is taxed with a coefficient of 4 3 years after the object should have been built. The coefficient will be canceled after the object is registered.

Example of calculating land tax

The calculation formula is simple:

N=KS × % rate × Kv.

KS – cadastral value of the site;

Kv – ownership coefficient.

Let's look at an example.

The plot of pensioner Petrov is 7 acres. Of these, 6 acres are subject to federal benefits, leaving 1 hundred square meters in the tax base. The cadastral value of the remaining hundred square meters is 100 thousand rubles. In the region where Petrov lives, the tax rate is 0.3%

The pensioner also enjoys a local discount of 50%. Petrov owned the plot for a year, so the coefficient does not apply.

Interesting information: How to apply for and receive a tax deduction for children

So, we get:

100.000 × 0.3 = 30.000

After which we will apply a regional discount of 50%. There will be 15,000 rubles left, which Petrov must pay.

Local benefits

As for “local” benefits for pensioners, you need to find out about them in local governments, because laws at the non-federal level are different everywhere. For example, in Moscow there are no land tax benefits for people of retirement age.

In the Moscow region, in different cities, single pensioners may have benefits, or those who do not have a source of income, or if the area of the plot does not exceed a certain value.

In St. Petersburg and the Leningrad region, pensioners can count on no tax or a 50% reduction if the land area does not exceed 25 acres.