Registration of land tax benefits: procedure, documents

How to apply for a pensioner

Documents for registration (pensioners)

How to apply for large families

Results

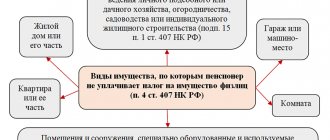

Land tax is regulated by Chapter 31 of the Tax Code of Russia, as well as the local legislation of each municipality. The benefits provided for by the Tax Code of the Russian Federation may increase in each district or city and have different sizes. However, at the federal level, preferences are established for pensioners, citizens with limited mobility and large families - the most socially vulnerable class of the population. How to get benefits quickly and easily?

If you have questions or need help, please call Free Federal Legal Advice.

- The call throughout Russia is free 8 800 350-94-43

Registration of land tax benefits: procedure, documents

The following are required to pay this tax:

The benefit is closely related to the tax base. And the tax base depends on the cadastral value of the property. The owner is not able to calculate the cadastral value on his own - it is calculated by cadastral engineers who have membership in the self-regulatory organization of cadastral engineers, according to the methods of Rosreestr.

All information about the cadastral value and other characteristics of land plots is located in Rosreestr - in the Unified State Register of Real Estate.

If you want to find out the cadastral value of your property and other data recorded in the register, you can:

- get free reference information on the Rosreestr website;

- order an extract - on the Rosreestr website or at the MFC; it requires payment (250-400 rubles).

To do this, you need to know at least one of the site descriptions:

- number - cadastral, inventory, conditional;

- address;

- license number.

So, according to the general rule of Article 390 of the Tax Code of the Russian Federation, the tax base is the cadastral value. But Article 391 of the Tax Code of the Russian Federation states that the base of 600 square meters is not counted for a number of persons, incl. in paragraph 8 of paragraph 5 of the article - pensioners.

If you have questions or need help, please call Free Federal Legal Advice.

How can a pensioner apply for a land tax benefit?

There is only one way to apply for a tax benefit on a pensioner’s land in the amount of 6 acres, which are not taxed: the owner of the land, before November 1 of the year in which he wants to receive this deduction, submits a notification to the Federal Tax Service Inspectorate indicating the land plot whose base he wants to reduce.

The purpose of the notification is that thanks to it, the payer himself chooses for which object the tax will be reduced. After all, the deduction is provided only for one plot of all that is owned by a citizen. If you do not submit a notification, the Federal Tax Service will still provide a deduction, but will independently select the object based on the principle of the largest base.

Example 1

Pensioner Mikhail Medvedev inherited 2 plots of land - 6 acres and 10 acres. He did not submit a notification for the deduction in a timely manner, and the tax office itself calculated the land tax, applying the deduction to land of 10 acres. And this plot is in the use of the tenant, who himself pays the tax on it. If Medvedev had handed in the notice, he could have reduced his expenses by choosing a plot of 6 acres, because then his base would have become zero, which means the tax would be zero.

Example 2

Lvov Alexey has 2 plots - 15 and 20 acres. He leased the largest of them by concluding a written agreement. According to the transaction, the tenant agreed to pay land tax. Lvov never submitted a notification about the selection of an object, but now he filled out the form and submitted it to the Federal Tax Service, choosing the first object. The tax office reduced its base by 6 acres of cadastral value. If Lvov had not done this, he would have had to pay from 15 acres, and the tenant from 14.

What documents does a pensioner need to apply for land benefits at the tax office?

Since the deduction is not conditional on anything, in order to receive a land tax benefit, pensioners do not need to collect any documents from outside.

It is enough for him to attach to the notice:

- copy of passport;

- a copy of the pensioner's certificate.

You must take the originals of these documents with you. Just in case, you can also take documents for the land. A sample application for a land tax benefit for pensioners in the form of a notification about the selection of a land plot for using the deduction looks like this:

Applications for land tax benefits for pensioners can be found here .

Important!

Fill it out with dark paste, block letters and strictly according to your passport and land documents.

Immediately after submitting the notification, the tax will be recalculated, and by December 1 the payer will pay other amounts. After November 1, you can no longer change the object of deduction; you will have to wait for the next calendar year, i.e., on the first working day of the next year you can submit a notification for deduction.

How to apply for a land tax benefit for a large family

In addition to the deduction under Article 396 of the Tax Code of the Russian Federation, such a benefit is provided as exemption from paying the fiscal payment for land in full. However, this article does not list all categories of beneficiaries, but only those established at the federal level. Of the individuals, there are only indigenous residents of Siberia, the Far North and the East in relation to the lands that are their cultural heritage and source of life and craft.

But at the local level, each municipality passes its own law, according to which it can expand the circle of those exempted or at least reduce the tax for them.

You can find the law of the local government of your territory on the Internet or visit the Federal Tax Service and find out there which categories of citizens are entitled to exemption. You can also see the preferences you are entitled to on the Federal Tax Service website.

For example, according to the Moscow Law on Land Tax No. 74 of November 24, 2004 under Article 3.1, some citizens are exempt from paying part of 1,000,000 rubles of the taxable base, incl. one of the parents or adoptive parents in a large family.

Each region independently determines which family is considered to have many children. In regions of Russia where the birth rate is high, families with 4 or more children acquire this status, while in other regions, as a rule, 3 children are enough to be classified as having many children.

Another example - in accordance with the Decision of the City Duma of Rostov-on-Don No. 38 dated August 23, 2005 in paragraph 3.2.6 of section 3, families with more than 3 minor children are completely exempt from paying this payment in relation to plots received under special regional program. The Decision also completely exempts pensioners from taxation in relation to 1 property, taking into account the federal deduction.

Documents for land tax benefits for families with many children:

- passport;

- certificate or certificate of status of a large family - issued by Social Security;

- statement.

Who has the right to use land tax benefits?

Land tax benefits available to the population are divided into three groups, including the following:

- complete removal of obligations to pay land tax;

- providing a deduction in the amount of 10 thousand rubles, which reduces the tax base for calculating the amount of tax;

- additional benefits that are established locally by representatives of municipal authorities in relation to a specific region.

Deposit "MEGA Online" Moscow Credit Bank, Person. No. 1978

up to 7.7%

per annum

from 1 thousand

up to 1100 days

Make a contribution

Let's consider which categories of citizens can take advantage of one or another benefit specified in the law.

Those who are officially exempt from paying land taxes include individuals and entire communities of small-numbered peoples in remote areas of the country (North, Siberia, Far East) if the use of land is conditioned by maintaining a traditional way of life for their culture and the way of running a personal household. The relevant article of the law deals with land plots that are located in the specified areas and are owned.

A reduction of the taxable amount by 10 thousand rubles is provided for each taxpayer who can confirm his belonging to one of the following categories of citizens:

- awarded the title of Hero of the Soviet Union or the Russian Federation, as well as the Order of Glory;

- people with disabilities of groups 1 and 2, disabled children;

- veterans and disabled veterans of military operations, including WWII;

- persons injured due to the accident at the Chernobyl nuclear power plant, during testing of nuclear weapons and others.

Deposit "Honey" Asian-Pacific Bank, Person. No. 1810

up to 7.04%

per annum

from 10 thousand

up to 1098 days

Make a contribution

As for who can receive benefits for paying this tax in a specific region of interest, such information can either be obtained directly from a representative of the tax office, or found on a specially designed electronic resource, which is listed among the electronic services available to visitors of the official website of the Federal Tax Service Services of the Russian Federation. Thus, if land tax benefits for veterans in the form of a deduction are due in any case, then in relation to, for example, pensioners, one should refer directly to local regulations.

applications for land tax benefits

The application form for land tax benefits for pensioners, large families and other persons is uniform. It can be downloaded from here .

Unlike a notification for a deduction, if you do not submit an application, the tax office will not automatically take it into account and will continue to charge tax.

The Federal Tax Service of Russia recommends submitting an application before May 1 of the year in which the right to a preference arose, so that the Federal Tax Service has time to take it into account when calculating payments. But even if you receive a notice without taking into account the exemption, you do not need to worry - visit your tax office and show documents confirming your right to exemption.

Important!

As soon as you lose the status for which you received the benefit, the Federal Tax Service will recalculate the payment starting from the next month taking into account the loss of the right.

An example of such a loss is that one out of 3 children became an adult.

Application for benefits

An application for a transport or land tax benefit must be filled out in the prescribed form.

There is only one for both taxes, and you will find it in the order of the Federal Tax Service dated July 25, 2021 No. ММВ-7-21/377. If you are claiming a transport tax benefit, you will fill out a cover page and section 5. For a land tax benefit, you will fill out a cover page and section 6.

If you have benefits for both taxes, then fill out the title page and both sections.

The benefit can be in the form of a complete exemption from paying tax, a reduction in the amount of tax or a reduction in the rate. Thus, for transport tax (field 5.5), these are codes 20210, 20220, 20230, respectively. They are provided on the basis of Part 3 of Article 356 of the Tax Code of the Russian Federation and are given in Appendix No. 1 to the said order.

There are more benefits for land (the code is entered in field 6.3). In addition to the similar ones established by paragraph 2 of Article 387 of the Tax Code of the Russian Federation (codes 30022400, 30022200, 30022500), there is also a tax deduction, a benefit in the form of a share of the land tax-free area of a land plot, as well as a number of benefits that are provided to individual organizations on the basis of Article 395 of the Tax Code RF. These are institutions of the penal system, foundations, organizations of the disabled, folk crafts, SEZ residents and others.

Since benefits are provided by regional authorities, the application must provide information about the law and fill out:

- fields 5.6 - 5.6.3 for transport tax;

- fields 6.4 - 6.4.3 for land.

In fields 5.6.3 of the application for a transport tax benefit and 6.4.3 for a land tax benefit, you must indicate the so-called “structural units”. This is an article, part, clause, subclause, paragraph or other elements of a regional law establishing a benefit. The order in which you fill out the application describes how to fill out these fields.

There are four familiarization spaces for each structural unit. The field is filled in from left to right. If the attribute has less than four characters, the empty spaces to the left of the value will be filled with zeros. For example, if the corresponding tax benefit in the form of a tax-free amount is established by Article 2, paragraph 3, subparagraph “a” of the regulatory legal act of the representative body of the municipality, then the submitted line indicates 000200000003000a00000000.

Results

- All pensioners have their cadastral value reduced in the tax base by 6 acres . To do this, the pensioner does not need to do anything, but he can choose which section to receive a deduction for, if he has several of them. For this purpose, a special notice is given.

- , there are practically no land tax benefits for individuals

- Most local authorities exempt pensioners, large families, low-income citizens, disabled people, etc. from paying land tax in full or in the amount of 1,000,000.

What categories of citizens are entitled to land tax benefits?

The issue of providing citizens with benefits is decided by the municipality, but not only. They are also given by the federal government. All national exemptions are listed in the Tax Code.

The existing bifurcation is undoubtedly useful. After all, the more benefits, the better for the final recipient. Often the categories of citizens receiving tax privileges overlap at both levels. We are talking about federal beneficiaries, which include:

- awarded the Order of Glory and Heroes of Labor;

- veterans of the war of 1941–1945 and participants in other military conflicts;

- Heroes of Russia and the Soviet Union;

- liquidators of the disaster at the Chernobyl nuclear power plant;

- people exposed to radiation;

- citizens with 1st or 2nd group disability, disabled since childhood or raising disabled children;

- families considered to be large.

Pensioners are ordinary citizens and do not have outstanding merits or physical defects that entail incapacity, but old age leaves its mark. Health declines, multiple diseases appear. And hard work throughout their lives deserves respect, which is why they are also given benefits when paying land taxes.