Features of calculating property tax

According to the Tax Code of the Russian Federation, official owners of property are required to pay the tax of the same name. It is calculated once a year. Payment is made upon notification sent by the Federal Tax Service in the form of a registered letter, no later than December 1. Payments are made for the previous period, i.e. Taxpayers will receive a receipt for 2018 in 2021.

Property subject to taxation includes:

- Apartments.

- Private houses.

- Garages.

- Country houses.

- Other buildings.

Tax is calculated automatically. This means that a citizen does not need to personally contact the tax service. Payments are accrued from the first day of registration of ownership. The data necessary for the calculation is transferred to the Federal Tax Service from Rosreestr.

Deliberate refusal to pay can lead to the accrual of fines, further appeal by the Federal Tax Service to court, and seizure of property and bank accounts.

Only a limited number of citizens belonging to the preferential category will be able to avoid paying tax legally. The actual amount to be paid depends on the cadastral price of the property and the regional rate. The tax may be reduced by the amount of the tax deduction. The cadastral value is determined on the basis of the estimated data indicated at the time of registration of ownership. All information about the property is located in a single database of Rosreestr.

What are the property tax benefits for military pensioners?

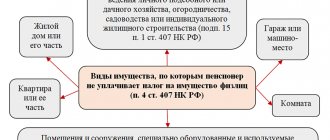

For citizens who served in the armed forces and retired, property tax is calculated based on the cadastral value. At the same time, preferential conditions apply to some of the real estate. Former military personnel can receive tax breaks on the following types of property:

- apartment;

- house;

- room;

- garage;

- Construction in progress;

- real estate complexes;

- individual structures and buildings.

- How to get rid of fungus

- How not to pay in a cafe if you don't like the food

- 10 Best Ways to Get Rid of Neck Fat

When calculating property tax benefits for military pensioners, it is important to take into account the following subtleties:

- There is a complete exemption from payment for one of the owned objects, at the choice of the taxpayer. Important conditions - the area of the property does not exceed 50 m², the cost is 300 million rubles.

- There is a statute of limitations on benefits. A pensioner’s legal right can be restored within three years.

According to the Tax Code of the Russian Federation, the following are subject to mandatory taxation:

- premises used for business activities;

- buildings costing more than 300 million rubles and having an area of more than 50 m²;

- all real estate owned by a military pensioner, except for one type that received tax breaks.

Conditions for obtaining tax benefits for military personnel

Military personnel are among the citizens who are required to pay property taxes. However, the government has introduced special benefits for them.

Preferences apply to:

- Active military personnel (conscripts, contract soldiers).

- Retired military personnel.

Property tax benefits for military pensioners in 2021 are provided for at least 20 years of service. If the length of service is less than the specified norm, the right to use the benefit is canceled.

The timing of the provision of property benefits for conscripted soldiers is equal to the total duration of service. As soon as the citizen returns home, all benefits are removed from him. Contractors can use the benefit until the end of the contract and after its extension.

Legislative regulation

The main legislative document regulating the right of pensioners to property tax benefits is Article 407 of the Tax Code of the Russian Federation. It explains who is eligible to receive these benefits, what specific types of property are eligible for the benefit, and other specifics.

The Federal Law “On Veterans” No. 5-FZ should also be considered. Articles 8 and 13 of this law discuss social measures to support veterans - benefits, material support, allowances, and so on.

Property tax benefits for military pensioners are also regulated by such regulatory documents as the Constitution of the Russian Federation, Decrees and Orders of the President and the Ministry of Defense.

The amount of property tax relief for military personnel

Active military personnel and military retirees have the right to receive 100% benefits for property taxes. However, there is a small caveat here: this right only applies to one piece of property. This means that if a military person owns two apartments or two garages, the benefit will only apply to one of them; you will still have to pay for the second.

Example. Citizen Litvinov worked in a military unit for more than 25 years, after which he retired. He owns two apartments, a country house and a garage. Litvinov is completely exempt from paying property taxes on a garage, a country house and one apartment. For the second apartment he will have to pay tax calculated according to standard rules.

Only military personnel can take advantage of the benefit; it does not apply to his children and wife. If a citizen did not take advantage of the right to receive benefits in previous periods and paid the property tax in full, he can request a refund of funds to his current account by writing a corresponding application to the Federal Tax Service. It should be taken into account that the statute of limitations for granting property benefits is three years.

Conditions for providing tax benefits

Any military retiree can take advantage of the tax benefits. The exercise of this right is permitted after assignment of the appropriate status. Its assignment is subject to availability:

- Total service experience of at least 25 years.

- Continuous work experience in a specific military department for at least 20 years.

When providing benefits, it does not matter whether the military pensioner retired early or due to old age. The main thing is to have the necessary experience.

Tax benefits are provided to pensioners working in the following structures:

- National Guard;

- Ministry of Internal Affairs;

- Executive authorities;

- Fire Service;

- Other law enforcement agencies.

Registration of the status of a military pensioner is carried out in a subordinate structure. One of the regulations governing its provision is Federal Law No. 76-FZ dated May 27, 1998 (as amended on December 30, 2012) “On the status of military personnel.” It is pointless for a former employee to contact the Pension Fund. The exception is receiving insurance payments or old-age pensions. However, as a rule, they are rarely combined with a military pension.

Registration of property tax benefits for the military

Property tax benefits are not provided automatically. A serviceman or military pensioner will have to contact the Federal Tax Service in person. This is the only way to exercise your legal right. An application for preference is filled out at the tax service.

The following package of documents is attached to it:

- Copies of the passport of a citizen of the Russian Federation and TIN.

- Copies of documents certifying ownership of property.

- Extract from Rosreestr.

- Pensioner's certificate.

It is possible that it is necessary to provide an additional list of documents confirming military service. You must submit your documents before November 1st. This will avoid tax accrual for the previous period. If the serviceman did not manage to submit the documentation on time, he has the right to request a recalculation and withdrawal of the accrued tax amount legally.

Transport tax benefits

The amount of the transport tax benefit depends on the region of residence. As a rule, military retirees are given a 100% discount on one car. At the same time, the regional government has the right to put forward an age requirement for applying for benefits (for example, 60 years for men). You can find out the exact conditions by contacting the territorial branch of the Federal Tax Service or from the information on the website of the regional tax service.

When providing benefits, the power of the car plays an important role. Most regions set the conversion limit at 100-150 horsepower. In case of owning several vehicles, the owner will be given a benefit for only one. Which one, the pensioner has the right to choose independently, taking into account the size of the benefit received.

Example. Vlasov Yuri Petrovich is the owner of two cars. The annual transport tax for the first is 500 rubles, for the second – 188 rubles. The citizen took advantage of his right to a 100% benefit by choosing the first car, since the cost of payments for it is more expensive.

The Federal Tax Service is in charge of issuing benefits. The pensioner will need to visit the organization in person, providing:

- Completed preference application form.

- Passport.

- Military pensioner certificate.

- TIN.

- Technical passport for the vehicle.

Federal Tax Service employees will check the documents for authenticity. After which, the application will be sent for consideration. If the answer is positive, tax accrual will stop from the date of application. However, you will still have to pay for the previous period.

Providing a property deduction

If a military person owns several real estate properties of the same type, a 100% benefit is issued for one of them, and a property deduction is possible for the second. It is also a kind of preference aimed at reducing the tax base, in particular the cadastral value.

For military personnel the following is provided:

- Reducing the area of the apartment by 20 square meters. m.

- Reducing the area of a private house by 50 square meters. m.

- Reducing the area of the room by 10 square meters. m.

The value of the property influences the deduction. If it exceeds 300 million rubles, the right to the benefit is canceled. The owner will have to pay all funds due to the state.

Tax breaks for military retirees

Many regions practice providing property deductions. The purpose of their implementation is to reduce the total amount of tax payments. So, when calculating the tax for a military pensioner, the following will be deducted from the total square footage of real estate:

- 20 sq.m. – for apartments;

- 50 sq. m. - for private houses;

- 10 sq. m. – for dorm rooms.

The benefit is provided to a pensioner on an application basis. To receive it, a citizen will need to visit the Federal Tax Service and submit a standard package of documents.

If the land is leased, the right to receive benefits is abolished. If there are two plots, to apply for a discount, the pensioner will need to choose one of them.

When does the property tax benefit begin to apply?

In fact, the benefit begins to apply from the moment the right to it arises, i.e. retirement, contract or conscription. If the deduction begins in the middle of the period, the military personnel will still have to pay part of the tax.

Example. Citizen Sidorenko began military service in September 2021. He owns a two-room apartment, for which he made annual tax payments. Sidorenko took advantage of the right to the benefit, but he will have to pay tax calculated before the month of September.

Thus, the tax will still be accrued until the right to grant a preference is obtained.

Property tax.

Preferential property taxes for military pensioners are established at the regional level.

This category is exempt from paying the fee only for one property. In this case, the maximum area and cost of the premises are established for which you will not have to pay tax.

If a pensioner owns several real estate properties, then he is exempt from the fee for the one for which the maximum amount is charged. A citizen has the right to independently choose for which property the tax is not paid.

He must write a statement about this to the Federal Tax Service before November 1 of the calendar year. Otherwise, the tax will be calculated automatically.

Applications submitted after this date will be considered for government fees for the following calendar year.

Property tax benefits: for families with many children, pensioners, application.

Preferences for land tax

All plots of land owned by Russian citizens are subject to taxation. Previously, pensioners - former military personnel, military veterans, Heroes of the USSR and the Russian Federation had the right to a deduction of 10 thousand rubles. from the total tax amount. Since January 2019, a federal benefit has been adopted for all retired Russian citizens. There are features of its calculation:

- if there are several areas, the relaxation applies to one;

- the benefit is extended to an area of 6 acres;

- for a plot of smaller size, no tax is paid;

- for a larger area, the calculation is performed by subtracting 6 acres from it.

- Beet caviar - step-by-step recipes for cooking from boiled or raw vegetables with photos

- Watermelon rind jam

- 4 changes in laws for homeowners

Since land tax deductions go to the regional budget, local authorities have the right to introduce adjustments to benefits. Pensioners may be exempt from payment in whole or in part. Military personnel on well-deserved retirement should contact their local office of the Federal Tax Service (FTS) to find out more details. For example, the financial burden has been reduced for pensioners in the following regions:

| Benefit | Features of establishing | |

| Kursk region | 50% | The size of the area is not specified |

| Rostov region | 100% | |

| Saint Petersburg | Plot up to 25 hectares | |

| Samara | Land area 6 acres and garage 25 m² |

How to get benefits

The right to receive a benefit in the amount of 100% of the tax amount must be independently confirmed by the military personnel with the relevant documents. In particular, in order to be exempt from paying property tax, a person who is entitled to receive the corresponding benefit must contact the Federal Tax Service at their place of residence and submit an appropriate written application.

How to write an application ? Simple enough. As a rule, in the Federal Tax Service department you can get the appropriate application form, in which you will need to indicate the passport details, full name, date of birth of the applicant, details of the document under which this benefit should be provided, the type of property, and the period for granting the benefit.

Along with the application, a document is submitted that confirms its official status, for example, a military unit certificate or a certificate issued by a military commissariat, military unit or specialized educational institution.

Members of the family of a deceased soldier will need a pension certificate with the appropriate label “widow of a deceased soldier” to receive the appropriate benefit. It should be ensured that this crust is properly certified with the signature of the head of the organization and a seal.

If the family members of the deceased are not pensioners, then they will have to bring a certificate of death to the tax authority instead of a certificate. In addition, citizens must bring their passport with them to apply.

Citizens with 20 years of service or more who resigned for health reasons must also provide a certificate of disability.

At the same time, the Federal Tax Service of the Russian Federation recommends sending applications for benefits before May 1, so that tax notices are generated taking into account the benefits provided. It should be noted that applicants for benefits can submit such an application without leaving home through their personal account on the official website of the Federal Tax Service of the Russian Federation.