- home

- Reference

- Military pension

All military personnel of the Russian Federation are subject to the laws of the country, therefore they must pay alimony to support minor children after a divorce. Alimony is calculated from any type of military income, including pensions. Former spouses can conclude a peace agreement with each other with a fixed amount of alimony and have it certified by a notary.

If the debtor refuses financial responsibility, then the monthly collection of alimony can be ordered by a court decision and will be withheld automatically. This article examines in detail the question of how alimony is paid from the pension of a former military man and how to arrange it.

Withholding alimony from a military man's pension - is it possible or not?

After a divorce in a family in which there are minor children, one of the spouses takes them into care, and the other undertakes to help financially. In case of a peaceful agreement between the parents, the agreement can be concluded in the presence of a notary. From the moment the papers are signed by both parties, the alimony agreement becomes legally binding.

Attention! If one of the parents with whom the children remain cannot agree on alimony in this way, then he has the right to file a claim with the court. As a result of the court proceedings, part of the defaulter's income will be automatically withheld and then transferred to dependents.

Military personnel receive alimony from such sources of income as:

- monetary allowance;

- salary;

- allowances and bonuses;

- severance benefits;

- military pensions.

Alimony from a former serviceman's pension is paid in the same manner as for other citizens of the Russian Federation , since pension benefits are one of the possible types of income.

A military serviceman's disability pension is not a reason to relieve responsibility for withholding alimony.

Features of a military pension

The “military serviceman” status is granted to employees of the RF Armed Forces, customs, Ministry of Internal Affairs, FSB, Civil Defense, etc.

Military personnel have the legal right to retire early. In fact, they can become pensioners at the age of 35. Preferential length of service includes the years during which the service took place:

- in high mountain areas;

- in conditions of testing nuclear weapons;

- when eliminating the consequences of an emergency;

- with participation in hostilities.

A pension is also awarded as a result of becoming disabled. However, with this type of benefit the obligation to provide financial support for children is not canceled, because disability is not a reason to refuse to pay alimony.

You should know! Military retirees can be employed in any civilian position. In such cases, alimony is withheld from pensions and earnings.

From what part of the pension is alimony paid?

If a peace agreement was not concluded between the parties after the divorce, then the court will impose a mandatory recovery from the income (pension) of the alimony in the amount of:

- 25% for one child;

- 33% for two;

- 50% for three or more.

Alimony will be withheld from all sources of income even if the former military personnel is officially employed. The amount of financial support cannot be less than 30% of the subsistence level of a minor citizen of the Russian Federation.

In the case of a peaceful agreement, the alimony provider can, at his own discretion, increase financial assistance, as well as additionally help the child by buying clothes, toys, paying for education and other needs.

Income of military personnel from which alimony is withheld

The Russian Family Code in Article 82 determines that the types of income from which the accounting department should deduct alimony payments to be collected from minor children must be determined by regulations of the Government of the Russian Federation.

Currently in force is Decree of the Russian Government of 1996 N 841 “On the List of types of wages and other income from which alimony for minor children is withheld.” The specified List determines that alimony payments should be withheld from the military personnel's allowance (maintenance).

Further, in the Government Resolution there is a breakdown of the types of income received by different categories of military personnel of the Russian Federation and citizens equated to them. In particular, alimony is withheld:

- for military citizens - from the amount of the salary assigned by military position and the salary assigned by military rank, as well as from the amount of monthly or other payments for monetary allowance, provided that these payments are constant;

- for employees serving in the police department, in the fire service, in the authorities that control the circulation of narcotic drugs, and for employees of the Russian customs system - from the amount of the salary assigned to a regular position or assigned to a special rank, as well as from all percentage additional payments for length of service, academic title or degree and other permanent monetary payments;

- for military personnel and persons who served in the internal affairs department, fire service - from the amount of one-time and monthly benefits and other amounts paid upon dismissal from service.

The collection of alimony payments from military personnel sometimes raises certain questions and disagreements. This mainly concerns additional payments received by military personnel.

For example, when they are paid monetary compensation in exchange for food rations, accounting departments often ask whether to withhold alimony from this amount. In this case, it is worth following judicial practice, in particular, the decision of the Supreme Court of August 2005, which explains that payments of compensation to military personnel in exchange for food rations are permanent, and, therefore, alimony from these monetary amounts of compensation must necessarily be withheld.

Who is entitled to payments?

Child support is levied not only to provide for a minor child, but also for an incapacitated parent . According to Article 87 of the RF IC, children over 18 years of age who are able-bodied citizens are responsible for financially helping their parents if they are in need and are not able to work.

This is possible if the parent is disabled or retired and needs constant care. In this case, he can sue the child, which will oblige him to pay financial assistance for the maintenance of the plaintiff.

Attention! The defendant retains the right to file a counterclaim with his own objections, invite witnesses to testify and claim a reduction or exemption from alimony.

Procedure for issuing alimony

At the request of the parent in whose favor the deduction was made, alimony amounts can be received either at the cash desk of the relevant institution where the military serviceman who is obligated to make alimony payments works, or transferred to a bank account, or sent by the accounting department by postal order. However, it must be taken into account that many military units operate in closed areas, so receiving withheld alimony payments from the company’s cash desk is not always possible.

To determine the procedure for receiving alimony payments, the parent-collector must submit to the accounting department of the military unit (or other institution where the military serviceman paying the alimony works) a corresponding application about where he will receive withheld alimony in the future. This application indicates the bank details or postal address of the alimony claimant.

All financial costs associated with bank or postal transfer of alimony payments are also deducted from the income of the military personnel paying alimony.

There are cases when the address of the recipient of alimony payments is unknown to the accounting department and the payer himself. In this situation, the employing institution must still withhold alimony, notify the bailiff about the current situation and transfer the withheld amounts to the deposit account of the court located at the location of the employing institution.

Termination of alimony obligations for military personnel

If alimony payments are made by agreement of the child’s parents, the serviceman is exempt from further alimony payments if:

- one of the parties has died (either the serviceman himself or the child in whose favor payments were made);

- the alimony agreement concluded by the parents has expired;

- there are grounds for termination of payments that are expressly provided for in the agreement itself (for example, a condition is stipulated that payments will stop when the child graduates from college).

Payments of alimony payments collected from a military serviceman in court must stop in the event of:

- the child of a military serviceman reaches the age of majority;

- children of a military serviceman acquire full legal capacity until adulthood;

- adoption of a child of a military man, for whose maintenance alimony payments were withheld, by another person;

- recognition by the courts of restoration of working capacity or lack of need for assistance from the citizen receiving alimony;

- the entry of a disabled ex-spouse who is the recipient of alimony payments into a new marriage;

- death of the recipient of alimony payments, or the death of a military serviceman obligated to pay alimony.

This is interesting: Labor Pensions 2021: A) By Age B) By Length of Service

In what cases is it possible to reduce the size?

According to the court ruling, the amount of alimony is fixed. But this amount may change due to various reasons. Accordingly, both former spouses can file a claim to review the amount of alimony.

A reduction in the amount of alimony may occur if the payer’s financial situation or health deteriorates, which affects his ability to work. The appearance of children from a new marriage may also be a reason for filing an application to review the amount of alimony . The court deals with each specific case on an individual basis.

Amount of alimony by court decision

The amount of the defendant’s monthly payments is directly dependent on:

- the amount of pension benefits;

- the presence of other sources of income for the serviceman;

- stability of receiving funds.

If these factors change for a retiree, the amount of alimony payments may become higher or lower.

The number of children for whose maintenance a military pensioner is obliged to contribute also has a significant impact on the amount of alimony. For one minor child, he must pay 25% of his pension and other income, for two – 33% , for three or more – 50% .

Alimony can be collected both as a percentage and as a fixed equivalent, which is tied to the level of the subsistence minimum established in the region of residence of the family.

The court's decision on the amount of alimony payments may not be final. If the recipient or payer needs to change the amount of payments, they have the right to file a claim.

For example, a military pensioner whose income has decreased may ask the court to reduce the amount of alimony. He also has the right to review the amount of payments if the second parent with whom the children live has improved their financial situation. To increase the amount of alimony, the supporter of minor children, on the contrary, is required to prove a decrease in his income level or an increase in the military pension of his ex-spouse.

For your information! An essential condition for changing the amount of alimony is a change in the marital status of the payer. If he has children from his next marriage, he has the right to demand a reduction in the amount of alimony payments.

The same applies to situations where military pensioners take care of relatives who have lost the opportunity to work or have become incapacitated. If the payer increases the number of dependents, the amount of alimony may decrease, since the total amount of payments should not exceed 50%.

How are payments withheld?

A voluntary agreement between spouses makes it possible to independently determine the amount and timing of financial assistance. But the amount of alimony should not infringe on the interests of the child. Former military personnel can pay alimony in person against a signature. Another option is to apply to the relevant authorities to have money withheld from each pension.

If the former spouses do not come to a consensus on alimony, then the parent in whose care the minor child remains has the right to go to court to demand that the amount of assistance be established and oblige the debtor to pay it. The procedure for considering a case for former military personnel is the same as for other citizens.

If the alimony provider ignores payments, he will be held administratively liable. According to the legislation, the debtor may be subject to a penalty in the amount of 0.1% for each day of delay in financial assistance or the right to drive a car may be limited.

Grounds for collection

Family law names two cases of collecting alimony payments from Russian citizens for dependent minor children if these children continue to live with one parent (or with both parents):

- From one parent to support children (child) after the dissolution of the marriage;

- From a parent who refuses to support his children, even if the parents do not divorce (Article 80 of the Family Code).

Alimony from military personnel, as from other categories of payers, is withheld monthly . The basis for such withholding of alimony payments is a writ of execution or a parental agreement. In the first case, a corresponding court decision is required, obliging the serviceman to pay alimony in a certain amount, in the second - a written agreement of the parents, preferably certified by a notary. In the case of notarization, such an agreement acquires the legal force of a writ of execution.

How to apply for deduction from a military pension

Before filing a claim with the Magistrates' Court, the applicant must collect all documents justifying the need to pay alimony. Since the plaintiff is faced with the task of guardianship of a minor child, this must be confirmed by a certificate from the social protection authorities. You can also pick up the document at the employment center.

After the court makes a decision and issues a writ of execution, a copy of the document is sent to the Pension Fund, which makes monthly payments to the debtor. A note is made in the administrative body and in the future part of the funds will be withheld from the alimony provider’s pension with their further transfer to the account of the plaintiff (child’s guardian).

If the military man is still in the service, then the corresponding document can be sent by registered mail to the military unit.

Important! Applicants often have to monitor the work of bailiffs to the best of their ability. Only by taking active steps can you speed up the start of alimony payments.

List of documents

The plaintiff must draw up an application for financial support from a relative.

The package of documents must include copies of the following documents:

- marriage certificates;

- divorce certificates;

- child's birth certificate;

- applicant’s passport (sheets with registration and marriage registration);

- defendant's passport;

- documents confirming the solvency of the plaintiff and defendant;

- a document indicating the place of residence of the alimony holder;

- certificate from the child’s place of study.

It would also be useful to supplement the package of papers with receipts related to the maintenance of a minor child.

Where to contact

The applicant applying for alimony must take the application to the Magistrates' Court. The official body is selected according to the place of registration of the plaintiff. If possible, the debtor should be informed about the place and time of the court hearing.

This can be done by calling the military unit with a request to provide information about the place of residence of the former military man. Or contact his place of work if the former employee is employed. trial may be delayed if the defendant is not present. In most cases, the court issues an order and obliges the debtors to pay the relief.

The procedure for collecting alimony from military pensioners

Alimony refers to compulsory payments from one person. The funds have a designated purpose; they are transferred to provide for and support a child or disabled relative. The Family Code of the Russian Federation defines two ways of collecting alimony:

- Voluntary. The parties (payer and recipient) sign a settlement agreement, which indicates how much and in what order payments will be made. The document must be certified by a notary. Since this agreement is a voluntary decision, a citizen who is not legally obligated to do so can perform the functions of the payer. There are often situations when children left without parents are paid alimony by their adult able-bodied relatives.

- Forced. If parents cannot agree on child support payments or one of them deliberately refuses to transfer money to the child, the issue is resolved in court. The recipient files a statement of claim in which he sets out the requirements against the defendant. Experts recommend contacting a professional lawyer for family disputes, whose services will help improve the success of the case in court. He will collect the necessary documents, draw up and file a petition to recover from the defendant the plaintiff’s attorney’s fees.

If the child’s parent does not communicate and hides himself and his income from the recipient of alimony, then the latter must submit a petition for the forced issuance of a certificate of pension accruals for the military personnel.

It is important to know! If the child’s birth certificate does not contain information about the father, then the procedure for collecting child support becomes more complicated. In such cases, the court decides to establish the paternity of the person whom the child’s mother forces to transfer funds for his maintenance. The defendant is ordered to undergo mandatory genetic testing.

Clause 3 of Government Resolution No. 841 of July 18, 1996 states that deductions are made from all types of income that military personnel receive permanently.

Alimony is collected according to the standard procedure. To receive payments from wages, a writ of execution is submitted to the accounting department of the military unit. If payments will be withheld from a pension, the document is submitted to the Pension Fund at the payer’s place of residence.

The law establishes 3 methods for calculating alimony in the form of a percentage of monthly income, a fixed amount, or a combined payment.

Most often, parents transfer money to support their children as a percentage of their earnings or pension. The obligation to pay alimony in a fixed amount is imposed by the court if the payer does not have a stable income or receives money in foreign currency. A combined system is established if calculating the amount of alimony as a percentage of income is not possible.

General provisions

Alimony is a monthly payment made by a parent who has left the family in favor of a child. These funds must be used exclusively to provide for the benefits of the minor. Most often, they are deducted as a percentage from the income of a particular citizen. Is alimony taken from a military personnel's pension? First of all, it is necessary to identify citizens who belong to this category:

- persons serving in the ranks of the Russian Army;

- employees of departments supervising drug trafficking;

- prosecutors;

- customs officers;

- employees of the Ministry of Internal Affairs.

Even if a citizen is a pensioner, the law does not relieve him of his obligations to provide for his children. For this reason, the need to pay alimony remains with the military personnel even after retirement. Alimony payments can be collected in one of two ways:

- By agreement of the parties. In this case, a child support agreement is concluded between the mother and father of the child, which spells out the main nuances regarding the amount and procedure for payments. This contract comes into force after appropriate notarization, without which it is considered legally void.

- Based on the writ of execution. If the former spouses cannot reach a consensus, then the only way out of the situation will be legal proceedings. With the appropriate court decision, the defendant will be charged a certain amount of alimony payments on a monthly basis, after which the case is transferred to the bailiffs' executive service. This organization monitors compliance with the sentence, and if the father evades his obligations, funds may be forcibly withheld from him.

Case studies

Judicial practice is extensive and varied, including the collection of money from pensioners. One example:

“The woman went to court on the issue of collecting alimony from her ex-husband in a fixed amount - 6,500 rubles for each child (13,000 in total). The court granted the request. The man filed an appeal, which was also granted. As the appellate court noted, the ex-husband has a 2nd group disability, and the pension is his only income, so there is no point in collecting a fixed amount (besides, 13,000 rubles is more than the man’s income). The Court of Appeal ordered alimony in the amount of 1/3 of income.”

If we sum up all the practice, we can draw the following conclusions:

- Payments in a fixed amount are assigned only when the defendant has unaccounted income, and the plaintiff manages to prove this.

- Amount of payments = minimum cost of living for 1 child in this area. More is usually not prescribed, less is only for good reasons.

- The absence of a living wage after deducting alimony is a very serious argument in favor of reducing the latter.

- It is almost impossible to cancel the penalty for payments in case of debt.

- Courts take into account not only the income of the pensioner, but also the income of the plaintiff. If the ex-wife, with whom the child remains, earns 5 times more than the disabled retired husband, then the chances of monthly payments to a minor child tend to zero (but there is a chance of alimony for the ex-husband, albeit small).

Features of legislation

According to the legislation regulating enforcement proceedings, there is a ban on the deduction of alimony from accruals that:

- received by the alimony provider as compensation for harm to his health;

- received by the alimony worker in connection with work that led to radiation exposure.

Speaking about the second type of payments, alimony may be withheld from them if the harm to health is insignificant.

Also a controversial issue regarding alimony payments from a pension is the disability accrual of the alimony provider. When the court sets the amount of child support, special attention will be paid to the health of the debtor; if it is considered satisfactory, he will pay alimony, but in a smaller amount.

Important! Money credited to the account of participants in military operations is not included in the proceeds from which alimony payments can be collected. The court will also not write off special pensions that some military personnel may receive to support the child.

Recovery from disability pension

According to the legislation of the Russian Federation, even if the father of the child is needy, low-income or disabled, his obligations regarding alimony are not relieved. The father is obliged to support his child and the state does not take into account the citizen’s disability group. So, if the payer receives only a pension and has no other sources of income, then 25% of the pension amount will be collected for alimony payments. The share of the penalty varies depending on the number of children. The table below shows the amount of child support depending on the number of children.

We recommend reading

Alimony in a fixed amount and how to convert it to interest

| Amount of children | Amount of alimony |

| 1 child | 25% of pension and other income |

| 2 children | 33% of pension and other income |

| ≥ 3 children | 50% of pension and other income |

The amount of alimony can be appealed in court, so during the trial the amount increases or decreases. If information comes to light that the payer is hiding income and not paying benefits to the child, the bailiff has the right to collect the debt from the time the application was submitted. Alimony can be reduced if the court takes into account the additional expenses of the spouse with a disability, which are caused by the costs of medications, treatment, transportation, etc. The maximum amount of alimony withholding from a pension is 50%, depending on the number of children. In some cases, the amount of alimony may be increased by the court to 70%, for example, for the treatment of serious illnesses in children. Delay in alimony leads to a penalty for the debt and the number of days of non-payment (see → penalty for late alimony).

What does the UK say about alimony?

Article 80 of the Family Code obliges all parents to provide for their children who are under eighteen years of age.

In the event of a divorce, the former spouses can independently decide what the amount of alimony should be and in what form it will be paid. If you cannot reach an agreement, you can resort to the help of the court. The court will not only force the ex-spouse to provide money for child support, but will also determine the amount of this assistance. There is no single amount required to be paid per child. The amount of alimony directly depends on the income of a particular person. So, for one child, 25 percent of income is taken, for two - 33. For three or more children, half of the income is withheld. If a person has arrears in paying alimony or has caused harm to the health or property of the second spouse, up to 70% is taken from his income. The amount of payments may be increased if the child needs additional funds - for example, to treat a serious illness.

If, during a divorce, children are “divided” between parents, one of whom is less wealthy, then the second parent is also required to pay a certain amount every month. If a child is in an orphanage or adopted, according to Article 84 of the RF IC, parents are still required to pay child support to his guardian or adoptive parents.

Collection procedure

There are 2 options : when the mother and child collect alimony from pension payments, and when the father independently submits documents for payment.

In the first case, the woman needs to submit a written court decision or agreement on the payment of alimony either to the pension fund or to the bailiffs.

It is important to know! Important information about compulsory pension insurance

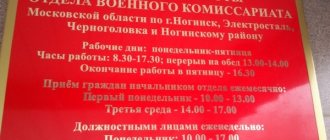

This is what the document looks like

First, it is better to go to the pension fund, because this structure will resolve the issue quickly. After receiving and checking the documents (you will have to wait about a month), the pension fund will make a decision, and if it is positive, alimony from the pension will be collected even before the money is transferred to the father. Actually, the option in which the father submits documents on his own looks the same: you need to submit documents to the pension fund, and the money will be transferred to the mother’s current account automatically.

You need to contact the bailiffs in one of two cases: if there is a debt; if the court ordered payment of a fixed amount.

The first case occurs when the father hid the existence of his pension, and eventually it became known. His income was recalculated and he was ordered to pay everything he owed. Since in case of debt the court acts quite harshly (70% of the debtor’s income per month is taken away for repayment), some men hide their income or refuse to pay. In this case, the bailiffs take over the case: the father will face arrests of accounts and property, a ban on traveling abroad and other troubles.

The assignment of a fixed amount of alimony is also associated with deception. For example, according to documents, a 50-year-old serviceman receives: 10,000 rubles for length of service, 20,000 rubles for salary for an office job. Payment to a minor child – 7,500 rubles. But the mother knows that the ex-husband receives half of his salary “in an envelope”; his real income is 50,000 rubles. Consequently, he does not pay an additional 5,000 rubles. If she manages to prove the presence of unaccounted income in court, the man will be required to pay 12,500 rubles a month, fixed. And the bailiffs will monitor this.

Note : when the case is transferred to the bailiffs, the process of collecting debts/fixed amounts usually lasts for 2-3 months.

In what cases do payments stop?

There are several situations when a person’s obligation to pay alimony ceases. They are spelled out in Art. 120 IC RF.

Here are the most common reasons for termination of legal relations :

- death of the child or child support payer;

- adoption of a son (daughter) by a third party;

- the child reaches adulthood.

Child support transfers also end when children receive full legal capacity before they officially reach adulthood. This happens after marriage or after receiving emancipation status through the courts.

To free himself from alimony obligations, the payer can file a corresponding claim in court. The resulting decision is passed on to the bailiffs. Based on it, they close the enforcement proceedings.

If the money was paid under an agreement certified by a notary, the obligations terminate upon the expiration of its validity. The above also applies to cases of death of one of the parties to the agreement.

Reducing alimony

to reduce monthly payments from income only through the court , and for this you need good reasons. Most often this concerns alimony payments from a disability pension - the latter is usually received due to incapacity for work, and a person who cannot work finds himself in an extremely unpleasant financial situation.

To reduce alimony, you need to prepare a package of documents confirming serious financial problems: a certificate of income, monthly expenses for medicines and treatment in general, a “fat” with the amount of expenses for utilities, and so on.

If the documents show that there are much more expenses than income, alimony may be reduced or even canceled.

The second scenario in which the amount of payments may be reduced is the subsistence level threshold . Any person must have money to survive; if alimony “eats away” the money without which a person cannot feed himself, payments will be reviewed and reduced.

The third option is that the payer has his own family with a child. Usually these cases are the most difficult, the judge has to find a balance between the two families. If the plaintiff proves that monthly payments to the first child interfere with the normal provision of the second child, the amount may be reduced. But how much it will be reduced is a difficult question.

How to apply for alimony for a pensioner?

What will you need?

- A court decision or agreement to pay alimony.

- If there is data on unaccounted income, documents confirming it.

Step by Step Actions

- Collect documents.

- Open a current account to which money will be received.

- Contact the court (at the pensioner’s place of residence), the pension fund or the bailiffs.

- Wait for a decision (for the court or the fund).

- If there are no problems, wait for the money. If the pensioner refuses to pay, the court does not satisfy the requirements, or the pension fund has not resolved the issue within 3 months, it goes back to court.

It is important to know! Dismissal of a pensioner due to staff reduction

The procedure for collecting alimony payments from a military serviceman’s pension after a court decision

| Collection options. | Required documents. | Step-by-step instruction. | Sample documents. | Price. | Deadlines. |

| Through the FSSP. | ·The claimant's application to initiate proceedings. ·Performance list. | 1. Receive the writ of execution. 2.Send the documents to the FSSP unit at the defendant’s place of residence. 3.Wait for the execution of the court decision and, if necessary, assist the bailiffs. | Application to initiate enforcement proceedings based on a court decision. | No cost required. | ·30 days – time for appeal. ·3 days from the date the claimant submits documents to the FSSP - to initiate enforcement proceedings. ·5 days from the date the debtor receives the order to open a case by the bailiffs - for voluntary compliance with the requirements. ·Next, the FSSP employee sends a request to the Pension Fund about the need to withhold alimony from the serviceman’s pension. The first payments are received on the next day the funds are credited. |

| Through the Pension Fund. | · Application for deduction of alimony from a military personnel pension. ·Writ of execution/voluntary agreement. | 1. Take a writ of execution from the court. 2. Transfer the papers to the Pension Fund branch where the debtor receives payments. 3.Wait for accrual. | Application for deduction of alimony from income. | A month from the date of the decision is given to the debtor to file a complaint. The nearest day of pension payment - from this date alimony payments begin to be withheld. | |

| By court order. | ·Application for withholding payments/initiating enforcement proceedings. ·Court order. | 1. Request an order from the court. 2.Send documents to the Pension Fund or the FSSP. 3.Wait until alimony from the serviceman’s pension is calculated. | Application to initiate enforcement proceedings based on a court order. | The timing depends on the chosen method of executing the order: through bailiffs or directly to the Pension Fund. They correspond to the above values. The only difference is that you have 10 days from the date of the decision to appeal the decision. |