Are construction foremen and foremen entitled to a preferential pension?

There is a special list that indicates the positions of those construction workers who are entitled to benefits ahead of schedule.

The special list includes ordinary workers, as well as people engaged in professional activities in the following areas:

- stonemasons;

- bitumen workers;

- asphalt pavers;

- sandblasters;

- insulators;

- roofers;

- electricians;

- stonemasons.

- installer of steel and reinforced concrete structures

Some professional activities must take place under certain conditions: Roofers must carry out their work processes on roll roofing or roofing of piece materials, using primer and mastic. Insulators must work on thermal or waterproofing.

Electricians must install overhead power lines; the work process must be carried out at a height of more than 5 m at a voltage of more than 35 kV.

This is not the entire list ; foremen, construction foremen, experts and management personnel can also count on early retirement. A separate category includes professions that are directly related to underground work, namely the construction and reconstruction of subways.

If we are talking about craftsmen, then only those who have “master of construction and installation work” indicated in their work book in the position section will be able to receive incentive payments. If the personnel officer at one time is about, then you need to get a certificate confirming the position you need.

To count the experience, the personnel officer must indicate the installation or construction field of activity in the work book. If the worker indicated that he worked simply as a foreman, then representatives of the fund must issue a certificate, relying on the collected package of documents. This is necessary to confirm the presence of work activity for a certain period.

There is no difference in which organization the labor activity was carried out. The main thing is that it is an enterprise that carries out the entire range of construction work. And if the name of the organization does not reflect the type of its activities, then you can familiarize yourself with the statutory acts, which indicate the purpose of the organization.

Attention! If the worker worked part-time and in total did not work more than 80% of the allotted time, then this period of working time will not be included in the length of service.

If an employee has been awarded the title of Honorary Builder of the Russian Federation, this does not mean that he will receive benefits in addition to the required payments. The final decision does not depend on any regalia, unless it is prescribed at the legislative level of the Russian Federation. But an honored builder has the opportunity to receive the title of Veteran of Labor, and Veterans, in turn, have a number of advantages and benefits that are provided by the state or regions.

New procedure for assigning early pensions in 2021-2021 under new conditions

- Every year this standard will be increased by 1 year until the final value is fixed in 2023 ( 5 years ).

- In 2021 and 2021, preferential conditions for retirement will apply - payments will be processed six months ahead of schedule . This means that in 2021, receiving a pension will be delayed only by 6 months, and in 2021 by a year and a half.

The right to early retirement in the Far North from 2021

The corresponding table of output by year of birth for northerners is presented below. In comparison with the original version of the bill, this table has been adjusted to take into account the presidential amendments, which were adopted by the State Duma in the third (final) reading on September 27, 2021.

It should be noted that the increase in the working period will not affect workers in the Far North and equivalent areas if they work in difficult or harmful conditions (for example, workers in ferrous and non-ferrous metallurgy, miners, railway workers, etc.). No changes are planned for them by the adopted law.

Thus, starting in 2023 , a new regulatory deadline for obtaining a preferential pension will be established for all medical and teaching workers - 5 years after receiving the required number of years of special experience.

Raising the retirement age for residents of the Far North

Note: the table was compiled taking into account the final law, which takes into account the amendment of the President of the Russian Federation V. Putin, according to which in the first 2 years of the new pension law it will be possible to issue a pension 6 months earlier than the stipulated period.

We recommend reading: How Long After Submitting an Application They Provide Housing to Large Families in Sosnovy Bor Leningrad Region

At the same time, when making a reasoned decision to change the amount of amounts collected to reimburse the costs of paying for the services of a representative, the court does not have the right to reduce it arbitrarily, especially if the other party does not object and does not provide evidence of the excessiveness of the costs collected from it.

It is still used today in accordance with the decree of the Government of the Russian Federation dated July 18, 2021. The list includes both blue-collar professions and positions of managers and specialists. Preferential working specialties, in particular, include: - asphalt concrete workers; — brigade masons; - stonemasons; — roofers for roll roofing and roofing made of piece materials, engaged in work using mastics and primers; — drivers of asphalt concrete pavers, etc.

Preferential pension for foremen and foremen during construction

The workplace certification card for working conditions contains only information about whether the employee whose workplace is certified has compensation in the form of the right to early assignment of an old-age pension in accordance with pension legislation. The results of certification of an employee’s workplace cannot have legal significance for the early assignment of an old-age labor pension to him if the pension legislation provides for this employee the right to this pension without additional justification.

According to List No. 2, early pension is due to men at the age of 55 (insurance experience - 25 years, work experience as a "harmful" person - 12.5 years), and women - at 50 years of age (insurance experience - 20 years, experience as a "harmful" person - 10 years).

What laws regulate early retirement for construction workers?

The end of the labor activity of men and women working in construction enterprises is determined by the Federal Law “On Labor Pensions of the Russian Federation” No. 21, Art. 1 dated 12/17/2001.

The procedure for issuing payments to professional builders is regulated by Government Law No. 10 of January 26, 1991.

It states that employees of enterprises where construction work, alterations, reconstruction or restoration of premises and other structures are carried out can retire earlier than the generally established period for all citizens of the Russian Federation.

In 2021, the State Duma of the Russian Federation adopted a bill on pension reforms, but the innovations did not affect this category of persons. There is no age increase for construction workers.

Reference! The fact of issuing benefits for payments is in no way affected by the category of the organization and the type of work performed.

Foreman Retires 2021

Workers in many industries expected to receive preferential pensions in 2021. The latest news about pension reform suggests their abolition next year. In this article we will cover in detail an issue that is important for future retirees.

Preferential pension for builders, foremen, foremen 2021

Initially, it was proposed to increase the retirement age to 63 years for women and 65 years for men, but Vladimir Putin introduced his own amendments to the document, suggesting more lenient conditions and, first of all, increasing the retirement age for women by only 5 years.

According to the legal position of the Constitutional Court of the Russian Federation, set out in Resolution No. 382-O-O of July 17, 2021, the court is obliged to recover the costs of paying for the services of a representative incurred by the person in whose favor the judicial act was adopted from another person participating in the case, within reasonable limits, is one of the legal methods provided for by law, aimed against unreasonably inflating the amount of payment for the services of a representative and thereby implementing the requirement of Article 17 part 3 of the Constitution of the Russian Federation, according to which the exercise of human and civil rights and freedoms should not violate the rights and freedoms of others persons..

Pension legislation provides for the assignment of pensions to certain categories of citizens earlier than the generally established retirement age. One of these categories are workers of construction organizations. It does not matter which organizations carry out the specified work.

Preferential pension for foremen and foremen during construction

The main document confirming the periods of work under an employment contract before registering a citizen as an insured person in the compulsory pension insurance system is a work book of the established form. In cases where the work book does not contain all the necessary information that determines the right to preferential pension provision, the enterprise administration issues a clarifying certificate with reference to documents for the corresponding period of work of a particular employee.

Women with at least 37 years of experience and men with at least 42 years of experience will be able to retire two years earlier than the generally established retirement age. At the same time, women will be able to retire no earlier than 55 years of age, and men – no earlier than 60 years of age. Thus, in order to achieve early retirement, you need to start working at the age of 18 and have continuous official employment.

We recommend reading: Voluntary decision-making

At what age do foremen retire?

Installation and construction workers can apply for preferential deductions 5 years before the official generally established age. Women can retire from work at 50, and men at 55.

An important principle when applying for early preferential pension payments is the total length of service, the duration of which must be no less than 20-25 years. Sick leave, labor leave, or vacation taken at the expense of the employee are not considered time worked.

It turns out that if a worker has worked in the construction industry all his life, then he has every right to complete his work activity, having worked only half of the full term, taking into account the insurance period. That is, a woman can work for 10 years, and a male foreman can work for 12.5.

If the work experience is incomplete, but not less than 50%, preferential payments will be issued with a reduction in the generally accepted retirement age by one year for every full 2.5 years of work for the male population and for every full 2 years of work for the female population.

If a worker in the construction and installation industry worked outside of Russia, the years worked are included in the length of service in those cases provided for by legislation or international treaties of the Russian Federation. Also, length of service can be counted if payments were made to the Pension Fund of the Russian Federation on time.

Labor activities carried out abroad must be officially entered into the work book . If the time worked is not counted towards the length of service, then there must be a justified official refusal from the Russian Pension Fund. Based on the refusal, you can file a lawsuit or appeal the refusal in court so that the time worked is still included in the total length of service.

Attention! If an application for accrual of payments is submitted after the specified period, then accruals will begin only from the moment of submission. Recalculation is not provided.

Lawyer for preferential retirement in Yekaterinburg

Every person who has worked at state-owned enterprises for a period established by legal norms and has reached a certain age has the right to receive monetary compensation. Financial assistance is calculated according to the average salary that was paid over any five years of work. The legislation of the country provides for cases when a person can take a holiday, honestly deserved, earlier than the established period.

Our pension lawyer is ready to advise not only on appealing the decision of the pension fund regarding the refusal to grant a pension, but will also tell you what pension supplements are possible for labor veterans, and how to solve other problems related to the granting of a pension.

How to apply for a preferential pension

To apply for benefits, those who want to complete their work will need to contact the personnel officer of the organization where he worked all this time. It is necessary to request information from the personnel officer about the date of the last special assessment of working conditions.

If suddenly the certification was not carried out, then you need to find out about the one that was carried out the last time. The working conditions assessment is valid for 5 years. Having received the results, you need to contact the Pension Fund branch that is closest to your place of residence.

There are several options for contacting the Pension Fund:

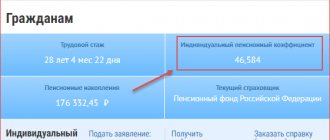

- Go to the official website of the Russian Pension Fund and log into your personal account. If this does not work, then you need to check whether you have previously registered on the government services portal. If you have not registered, then you should register.

- You must send an application to the bank where the current account is opened.

- Contact a branch of the Russian Pension Fund to receive a written response.

- Applications are considered no longer than 10 days.

Early pension payments will be issued to workers who work not only on new construction, but also on reconstructed and restoration sites and other buildings.

Work experience to receive a preferential pension

The main factor giving a foreman or construction foreman the right to early retirement is the presence of the required work experience. Only pure work experience is taken into account when calculating a pension. Time spent on sick leave, on regular vacation, or on vacation at your own expense is not taken into account.

The reduction in the pension threshold in this case occurs according to the following scheme:

- For men : 1 year for every 2.5 years of work in the construction industry.

- For women : for 1 year, for every 2 years spent working in construction.

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below: