Why the pension system was reformed

Pension contributions received by Russian citizens who have reached a certain age by law are allocated from the federal budget. The distribution of pensions by person, calculation of length of service, and recording of data is carried out by the Pension Fund of Russia. Funds for these purposes are collected from tax contributions from the country's working population.

Everyone who officially works in any position in a private or public institution pays a pension contribution every month from the payroll, which is an investment in his future pension and a means of maintaining officially registered pensioners of the present.

Due to the increase in average life expectancy in the Russian Federation, it is predicted that the number of pensioners in the state will increase. Given the low level of demographics and the declining number of working-age population, the sources for forming a fund for pension payments will not be enough.

The bill was developed in 2021 and presented to the State Duma by D. A. Medvedev. The main postulates of the reform for June 2021 were as follows:

- raising the retirement age from 55 to 63 for women and from 60 to 65 for the male working population;

- preferential conditions for official pension registration for certain categories of citizens (medical specialists, teachers, law enforcement officers, etc.);

- other age thresholds for residents living in the Far North.

The main parameter for calculating pension benefits for the civilian population, law enforcement officers, and military personnel is the length of service or length of service of civilians. By 2028, men will be able to obtain pensioner status at the age of 65, and by 2034, at the age of 63, women will also be able to do this. Innovations are planned to be introduced gradually.

Interesting! As a compensation measure, the Government approved the opportunity to retire 2 years earlier if a woman’s total work experience exceeds 40 years, and a man’s 45. Thus, if a citizen of the Russian Federation began working at the age of 19-20, after the age of 60 she can register herself pensioner.

A military serviceman, an employee of the National Guard, a certified employee of the Federal Penitentiary Service, a police officer has the right to an official pension after 20 years of service in the ranks of the Russian army. At the same time, he has a choice - to continue his professional activities or retire to the reserve. Only in case of dismissal will the state transfer pension payments accrued from the state treasury.

Military personnel receiving a long-service pension

According to the head of the Ministry of Finance of the Russian Federation, Anton Siluanov, due to the difficult demographic, economic, and political situation in the country, the pension conditions of military personnel must be transformed. The politician stated this at a press conference. Funding for most social programs is being reduced, and staffing is being cut in many government areas. Therefore, it is necessary to reform the military sphere as well.

The official said that the following proposals are already being considered in joint work by the Ministry of Finance and the Ministry of Defense:

- on increasing the length of service from 20 to 25;

- on providing monetary benefits to military personnel forced to end their careers earlier than the deadline established by law;

- on maintaining old settings until January 1, 2023;

- on adjusting the age for military retirement.

Deputy Prime Minister of the Russian Federation T. Golikova stated that in 2021 everything will remain as before, there will be no changes for security forces in the issue of formations and registration of pension benefits.

The conditions under which a law enforcement officer can retire are currently spelled out in the regulatory document “On the Status of Military Personnel.” In accordance with the legislative act, a military man can become a pensioner after serving at least 20 full years from the date of his registration in the ranks of the army, the National Guard or another law enforcement unit.

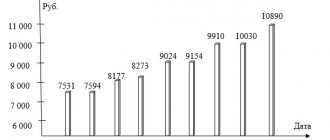

Indexation of military pensions in 2018

In connection with the planned indexation, which was carried out at the beginning of 2018, experts note that in October there will be an increase in social support by one thousand rubles. We also made additional payments to military pensioners who are working or have disabilities.

We also recommend the article: Salaries of public sector employees in 2021

Indexation was shifted from the previously planned dates, as the timing of increasing wages for working military personnel was changed. Based on the budget recalculations, we concluded that there will be no second indexation this year. This is due to the fact that the limits for 2021 have been exhausted. The new government program establishes that the indexation of payments to military pensioners will be 4% and will last for 3 years.

Deputy Minister of Defense Tatyana Shevtsova said that cash payments to military personnel and military pensions will be indexed at the beginning of January 2021, October 2019-2020.

When will the reduction factor be cancelled?

Previously, the State Duma had already tried to cancel the reduction factor for military pensioners. This bill was proposed by the Communist Party faction, but was subsequently rejected.

At the moment, the current increase in the coefficient is frozen for the entire period of 2021. The news is not very promising, since the chances of the coefficient being canceled are very small. The maximum that military pensioners can count on in the coming years is an increase in the size of pensions by 2021 at the expense of funds from the Pension Fund.

New bill to raise the retirement age

In connection with the increasing number of military pensioners, widespread layoffs, and decreased funding for the military-defense complex, the Ministry of Finance had to develop reform changes that would make it possible to predict financial stability in the country and ensure sources of budget replenishment.

Experts from the financial institution analyzed the staffing situation in the defense complex and outlined the following steps:

- the amount of pension benefits should directly depend on the number of years spent in service;

- the concept of length of service has been replaced by the term social package;

- pension money allowance will range from 65% to 95% of a military man’s earnings;

- each subsequent period of payments to the pensioner will be indexed with an increase of 3%;

- the transition to the new system is planned over 5 years and will come into force on January 1, 2023;

- introduction of financial incentive bonuses for persons who have served more than 25 years, amounting to 25% of earnings;

- military personnel retiring on the grounds of being medically unfit will receive special benefits. To do this, the pensioner must undergo an IHC and receive an official decree of absolute unfitness. Partial suitability after passing the commission is not the basis for obtaining the status of a military pensioner.

Important! The social package introduced by the upcoming military pension reform will provide monetary benefits to security forces who were forced to end their service before the legal retirement deadline (due to injuries, illness, or family circumstances).

In 2021, according to the latest news, the bill on adjusting the length of service of military personnel for a 25-year pension has not come into force. It is being developed by the Ministry of Finance together with the Ministry of Defense. A phased implementation was expected from 2021.

| Annual trend | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 and beyond |

| Length of service upon achievement of which a military pension is granted, years | 21 | 22 | 23 | 24 | 25 | 25 |

At the moment, military personnel can also apply for pension benefits upon reaching 20 full years of service or upon reaching the age of 45 years and preferential length of service in the ranks of the Russian army of at least 50% of the total military service.

According to the note to the new document on changes to the military pension reform, the duration of implementation will be 5 years. Until 2023, certified law enforcement officers will be able to become pensioners with 20 years of service. With the onset of January 1, a serviceman will be able to retire with pension benefits only after 25 years of continuous service.

An ambiguous situation arises with military personnel of the CIS countries, who can receive a military pension in 2023 with 20 years of service if they move to the Russian Federation. This right will not be extended to Russian citizens serving under contract in defense and law enforcement agencies.

How does retirement work?

The amount of pension benefits when registering status depends on the title received. In all structures - the Federal Penitentiary Service, the National Guard, the Ministry of Internal Affairs, the Russian Army, there are structural gradations according to which a specialist’s career is built.

Important! The age limit for military personnel serving under contract was raised in 2014 from 45 to 50 years.

At the moment, the amount of monthly pension benefits for Russians who have reached the rank of major ranges from 15 to 17 thousand rubles. Pensioners in the rank of private to sergeant receive 11 thousand rubles. The transition to new calculations of pension contributions and conditions for registration of military pensioners was planned in 2 stages. The reform was to begin in 2013 and benefits were to be paid to security forces personnel in 2021 in order to smoothly implement the reform. After analyzing the financial capabilities of the state treasury, these plans were rejected.

According to the law that came into force in 1990, the following can apply for military pensions:

- officers;

- long-term military personnel;

- military leadership;

- certified employees of the Ministry of Internal Affairs;

- FSIN employees;

- National Guard members.

For 2021, the length of service for assigning a pension to the listed categories in the event of their dismissal is 20. Law enforcement officers who continue to serve beyond the minimum length of service receive monetary compensation equal to 25% of their pension pay.

A paradoxical situation may arise in which former military personnel of the countries participating in this Agreement, having military service of 20 to 25 years, when moving to permanent residence in the Russian Federation, will have the right to a pension for long service, and citizens of the Russian Federation with the same length of service - No.

Legislative regulation of military pensions for military personnel

These payments are made not through the Russian Pension Fund (PFR), as for civilians, but from the budget of the Russian Ministry of Defense. The main provisions are determined by Law No. 4468-1 “On pensions for persons who served in military service” dated February 12, 1993.

There are pensions:

- For length of service . The most common type of government support for the military. To be appointed, a citizen must meet legal requirements - serve in the ranks of the Armed Forces of the Russian Federation (AF) for at least 20 years or have established reasons for resigning.

- For disability . It is prescribed to persons who have received limited capabilities due to injury or illness received while serving in the RF Armed Forces.

- For loss of a breadwinner . Recipients of this type of pension are members of the family of a deceased military man.

How are they calculated?

Pension benefits for military personnel are calculated taking into account length of service, rank and the amount of cash allowance (SDS) that the citizen had in the service.

For example, for those transferred to the reserve:

| Length of service | Pension calculation formula | Pension ceiling |

| More than 20 years | 50% of SSD + 1% for each year of service over 20 years | 85% of SSD |

| Less than 20, but more than 12.5 years, with a total experience of 25 years | 50% of SSD + 1% for each year of service over 25 years |

Officers' salaries are indexed to combat inflation - this is also reflected in the amount of pensions.

The law also introduced additional payments to the state support of retired military personnel. For example, if a citizen has dependents, the total payment will be increased by 32–100% (if there are three or more of them).

- How long do cats live at home - maximum and average lifespan

- Fortune telling by candles

- Erection pills

The remaining two types of pensions have the following features:

- For disability . Depends on the assigned category and the reasons for the disability. For example, persons who became disabled group I during hostilities receive a pension - 85% of the allowance.

- For loss of a breadwinner . The amount of payments is regulated by the cause of death of the serviceman. The maximum amount is due to dependents of those killed in service - 50% of the amount of monetary allowance.

How are they different from civilians?

According to current legislation, a military pension is awarded to persons:

- Those with at least 20 years of service in the Armed Forces or equivalent structures. These are the Federal Penitentiary Service, the Ministry of Internal Affairs of the Russian Federation and other law enforcement agencies.

- Dismissed from the ranks of the RF Armed Forces upon reaching the age limit.

- Those who retired due to health reasons or due to organizational and structural changes, and have reached 45 years of age. In this case, a total of 25 years of experience is required, of which at least half is service in the army, navy or law enforcement agencies.

In addition to the existing military state support, a citizen, having retired, according to the law, can then accumulate insurance experience. Then he becomes entitled to a second pension - according to age.

Changes in 2021

The upcoming reform project considers the following options:

- Replacement of state benefits for length of service with a one-time social package. Its size will be comparable to pension payments for several years. According to the developers of the reform, these funds are considered not as compensation for canceled payments, but as assistance when leaving military service and looking for further work. At the same time, retirees receive the right to free retraining in a new specialty and assistance in finding employment.

- The definition of pension is not based on length of service, but upon reaching a specific age (as for civilians).

- Increasing the length of service to obtain the right to a pension from 20 to 25 years with a change in the payment structure. Their maximum amount will be 95% of the salary (persons with 35 years of service experience can receive it).

These changes are currently under development. The first three proposed options are radical, and the last one acts as a gentle alternative, so it is preferable for future retirees.

In order for the reform of military pensions to take place, it is necessary to prepare a bill, consider it by the Duma and adopt the corresponding normative act. This takes from six months to a year and a half, so the earliest date for introducing new rules for state support for retired military personnel is 2020. It is also possible that the corresponding bill will not be prepared or rejected, and the payment system will remain the same.

- 10 weight loss myths you believe

- 7 steps to help you get a good night's sleep

- Increasing the retirement age in Russia from 2021 - new terms for men and women

Two pensions for military personnel

According to Russian law, a military serviceman who retires from service after reaching 20 years of service has the right to receive one of the types of pensions - military or disability. It is also possible for a law enforcement officer to continue working at any enterprise, subject to official employment.

Thus, a serviceman has the right to 2 types of pension:

- military service, which he can apply for after 20 years of service and official dismissal;

- state (insurance), issued on the basis of length of service when working in civilian positions and professions.

A military pensioner will be able to apply for an insurance state pension after he has officially worked for 8 to 15 years. Depending on what year it is on the calendar. The government plans to raise the lower limit for receiving pension benefits by 2024 to 15 full years.

For those who have work experience, the period of work officially confirmed in civilian positions must be at least 9 years. If a serviceman reaches the required insurance pension age, in order to receive a military pension benefit, he must serve in the force for at least 12.5 years.

Second pension

Pension changes will also soon occur for military personnel. So, from January 1, 2021, their second pension will be indexed in the same way as for civilians. Legislators are also planning an annual increase in basic pension contributions for military personnel. But the second pension will not be available to every military man, but only to that group of people who meet the conditions of the program.

The key feature of the second pension is the following: military personnel can retire earlier than other persons in accordance with Labor Law. But the majority of citizens who received military pension contributions do not leave service or switch to civilian life.

In theory, a military pensioner, while continuing to work, must make contributions to the Russian Pension Fund. But in practice, this activity is carried out for him by the employer. This means that the citizen becomes part of the OPS system. If a person takes part in pension insurance, then he can try a second pension according to the special conditions specified in Federal Law No. 400.

We also recommend the article: Social pensions in 2021

In order for this payment to be legally processed, it is necessary to send a number of documents to the district pension fund. The procedure for obtaining a second pension from the military is almost no different from obtaining a regular one. Interesting points are revealed in the process of its calculation.

Receipt procedure

Before starting the procedure for collecting documents for applying for a second pension, the serviceman must find out whether he can become a participant in the program. If he meets the specified conditions, then the next step will be to go to the regional pension fund at the place of registration. The assignment of pensions for military personnel is not carried out by Pension Fund employees. The system for assigning a pension will begin to operate only after submitting an application for its receipt. You can do this in the following ways:

- Through the Pension Fund by personal visit.

- Appeal to the specified bodies of a third party representing the interests of the pensioner (possible only with a power of attorney).

- Personal contact with the HR department at work (this option excludes communication with Pension Fund employees when submitting an application).

- Sending all necessary documents to the specified authority by mail.

- Help from the multifunctional center (here they will provide information assistance, explain the procedure for completing and submitting documents, help collect documentation, and check its compliance with the samples).

Based on the package of documents for the insurance pension applicant, the subsequent issuance of such a payment or refusal of it will be decided. The list of required documents is as follows:

- Passport of a citizen of the Russian Federation or other identification document.

- SNILS.

- Certificate confirming receipt of a military pension.

- Employment history.

- A document indicating work experience.

- Certificate of income for the last 5 years.

- Information confirming the presence of dependents (if any).

This list of documents is not closed. So it can be supplemented with a number of other documents, for example, certificates of incapacity for work, other documents confirming government benefits, etc.

After all the specified documents have been verified, the pension will be accrued to the citizen in any way convenient for him. In the future, the method of receiving funds can be changed; to do this, you need to submit an application to the Pension Fund authorities.

What a military man must comply with to receive a long-service pension

According to the legislation of the Russian Federation for 2021, a military serviceman or a certified employee of the Ministry of Internal Affairs or the penal service, upon reaching 20 full years of service, can apply for a pension allowance. For example, if a man began serving under contract in the army at the age of 21, already at the age of 41 he will be a pensioner.

Currently, the main conditions for calculating length of service are:

- a full time period of 20 years, which is counted from the date of execution of the contract document;

- performing duties, including working on an irregular schedule, business trips to different regions.

Interesting! In 2015, during a discussion of military pension reform, a proposal was put forward to immediately increase the length of service to 30 years. The proposed application was rejected by a vote of parliamentarians.

The amount of pension benefits depends on the total length of service in the ranks of the Russian Army, the rank received, and the fact of participation in armed conflicts or hostilities. After serving for 2 decades in the law enforcement agencies, upon dismissal, pension benefits will be 50% of earnings. Every year, with continued service, the amount of payment will increase by 1%. Pension subsidies and settlements are handled by the authority that was last in the service record of the serviceman.

What are the retirement criteria for the military?

The criteria for assigning pension payments depend on the rank at the time of dismissal and the maximum position held. The size of the pension depends on the salary, which is set in proportion to the earnings of the top manager of the department. This applies to military prosecutors, judges, and military investigators. For security departments of various directions, the amounts have been increased by 20%. Salary does not depend on the rank of this category.

The department from which a law enforcement officer formalizes his dismissal upon reaching the length of service established by law is responsible for calculating pension benefits. Experts calculate pensions in the following ways:

- 50% of average earnings in service at the time of dismissal + 3% of earnings during the period that the employee served in excess of length of service x number of years in excess of the minimum length of service. The maximum possible pension payment can reach 85% of wages;

- 50% of the salary at the last place of service + (experience in civilian activity (from 8 to 15 years) + length of service in the service (at least 12.5 years)) x 1% of earnings in excess of 20 years.

According to the law, the minimum military pension cannot be lower than the minimum amount of social payment approved at the level of the Government of the Russian Federation.

Will the changes affect working military pensioners?

There is no exact answer to this question now, since there has been no information about planned changes. In 2021, working pensioners of the Armed Forces of the Russian Federation will simultaneously receive wages and pension payments. However, Prime Minister Dmitry Medvedev proposes to cancel payments to working pensioners, since the state budget will not be able to pay benefits to those receiving income.

It is possible that working retired military personnel will soon face a difficult choice - to live on a pension or on a salary.

There is no need to expect an increase in pensions for working military personnel.

We also recommend the article: Indexation of pensions in 2021

Calculator for calculating pensions based on mixed experience

Pension experience for military personnel is calculated based on the sum of the entire duration of a military career. The beginning of service is the day the contract is signed or entered in the work book.

When making calculations, periods are included in the overall time period and the following factors are taken into account:

- annual periodic vacations;

- periods when the military man issued sick leave;

- maternity leave;

- study time during advanced training or receiving specialized education;

- type of experience (military only or mixed);

- reasons for the dismissal procedure (own desire, reaching the age limit, court decision, etc.);

- the presence of a regional and district coefficient;

- paid bonuses (for achievements, for participation in conflicts, hostilities, for awards, etc.).

Important! Changes are expected in articles 13 and 14 of the approved bill of 1993 “On pensions for military personnel,” which applies to police officers, contract military personnel, employees of the Federal Penitentiary Service, drug control agencies, and National Guard troops. Document number 4468-1

The listed periods are included in the pension period in connection with the transfer of tax contributions at this time. It is possible to calculate your military career length and retirement time using special programs and automatic calculators. The total length of service of a serviceman can be mixed and consist of the addition of military service and work experience in civilian positions.

For example:

Captain Ivanov served for 24.5 years; he has no work experience in a civilian position. His pension calculation is as follows = 50% of salary at the time of dismissal + 3% x 4 years worked beyond the length of service. In total, his pension benefit will be 62% of his salary.

Major Ivanov served for 13 years, and has 15 years of work experience in a civilian position. Pension calculation = 50% of salary at the time of dismissal + 1% of earnings x (13 + 15-25) = 54%. Ivanov’s pension will be 54% of the average annual income during his service.