In the event of the loss of a loved one, those who were in his care suffer.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

As a rule, this applies to minor children. Also, the financial situation may worsen for the relatives and spouse living with him.

Therefore, it is worth finding out what kind of survivor’s benefit for a child and other family members is assigned by the Pension Fund and what its amount is in 2020.

Legislation

A survivor's pension is a monthly payment to the disabled dependents of a deceased citizen.

The procedure for assigning compensation is regulated by:

- Law of December 28, 2013 No. 400-FZ on insurance pensions;

- Law of December 15, 2001 No. 166-FZ on state pensions;

- Law of February 12, 1993 No. 4468-1 on pensions for military personnel and members of their families.

Under what conditions is it appointed?

What are the conditions?

As already mentioned, some of the most important are residence in the Russian Federation and loss of ability to work.

But the legislation is not limited to these requirements.

- Another thing is the breadwinner’s lack of insurance coverage. Payment will be denied if the deceased family member took an official job for at least one day.

- The pension is also paid if the death was a consequence of a criminal act.

But you should not count on payment if the crime that led to death was committed by the applicant for benefits.

Survivor pensions can be granted indefinitely. Or generally for the entire time until working capacity is restored. Or received.

How much is this assistance paid?

The exact numbers depend on which category of citizen is making the payment.

- A little more than 10 thousand rubles are given to those who have lost both parents at once.

- Those who had one breadwinner can count on five thousand.

Some regions introduce their own coefficient, which may increase the amount of benefits.

In what order is it assigned?

Where should I contact?

You need to collect a package of documents and then contact the appropriate authorities. Using the most convenient method available for contact.

- You can personally apply at your place of residence, to one of the territorial branches of the Pension Fund.

- Or visit the official website to submit an application using it.

- Or use the multifunctional center.

If the interests of the child are represented by any institution where he lives or is being raised, then the documents are submitted to the address of the institution.

Social pensions begin to be transferred on the first day of the same month when the application was submitted. Even if registration took place in the middle of the month.

The main thing is not before the right to obtain assistance has arisen. But direct payment will be made only on the first day of the next month following the date of application.

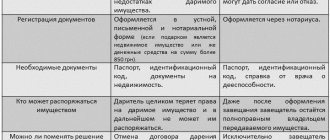

What documents are needed for registration?

What is the required package of documents?

The main and additional lists include the following items:

- Statement of desire to receive assistance.

- Passport. If the child is under 14 years old, then a birth certificate is given, as well as an identity card of the person who is the legal representative.

- Death certificate of one breadwinner or both parents.

- Birth certificate in form 25 from the registry office. This is necessary if additional evidence is required that the mother was single.

- A court decision establishing family ties or other evidence that the deceased was a relative of the child.

- A certificate from the institute or any other institution where the victim is studying full-time.

- Residence permit or registration certificate.

Who should

Citizens who cannot support themselves for various reasons need financial support.

Close relatives have the right to count on financial support:

- child, brother, sister, grandson up to 18 years of age (with full-time education - up to 23 years of age);

- disabled child;

- mother, father, grandparents aged 60 years - men and 55 years old - women, or with disabilities;

- or spouses

- mother, father and spouse who have lost their ability to work and who have no means of subsistence;

- close relatives, if they do not work, are raising children, brothers, sisters or grandchildren of the deceased under fourteen years of age and are entitled to an insurance pension;

- all of the listed categories, if the breadwinner died during military service.

The deceased did not have to live with a dependent.

It is enough that the named citizens were in his employ.

Social security pension type: what is it?

What is state social security?

Social security plays a major role in the life of the state. After all, it depends on the economic situation that develops in the country.

And it affects the social well-being of citizens receiving assistance. Any citizen has the right to receive such support in the following cases:

- Loss of the only source of income and assistance.

- Disability.

- Diseases.

Social pension provision is financial support for citizens who, for one reason or another, have lost their legal capacity, permanently or temporarily.

Size in 2020

The amount of insurance payment is influenced by the insurance period and the individual pension coefficient.

If at the time of death the person was not officially employed and did not have time to accumulate the required length of service and points, then a social pension is assigned.

The amount of compensation to the relatives of a serviceman is determined on the basis of the monetary allowance of the deceased.

The fixed part of the insurance pension from the beginning of February 2020 is 2,498 rubles. The rest is calculated taking into account the cost of the IPC. To find out what benefit will be assigned to the recipient, you should consult with Pension Fund specialists.

Social benefits are approved in a fixed form and from April 1, 2020 amount to 5,034.25 rubles, if one parent is lost, 10,068.53 rubles. – in the event of the death of two or a single mother.

The amount of compensation for family members of military personnel is 7,830 rubles. in case of death from a disease and 10,472 rubles if a citizen died due to injury.

In all regions, state support must correspond to the minimum pension.

Each region has its own minimum subsistence level. So, in Moscow it is 16,160 rubles, in the Sverdlovsk region – 8,726 rubles.

The amount of payment may vary depending on different circumstances.

For example, the number of dependents, insurance savings, etc. Therefore, in each case it is necessary to clarify how much they pay in the event of the loss of a breadwinner.

Types and amounts of survivor's pension

There are three main types of survivor's pensions: social, insurance and state. Payments for them may differ slightly (sometimes quite significantly), so it makes sense to talk about each type of security separately.

State and military

The state pension is the amount that is assigned to dependents whose breadwinners had special services to the Motherland, were astronauts, heroes of war and labor, liquidators of man-made or radiation disasters. It is not at all easy to calculate what the size of the child’s state pension for the loss of a breadwinner may be for the children of these categories of citizens, since the amounts can differ significantly, depending on the circumstances. Benefits to the family of a military personnel can also be classified as such payments. There is no single algorithm here, but some rules are still followed when calculating.

- If the death of the breadwinner occurred while serving, then children, parents or other relatives will receive 200% of the monthly allowance. When there were no wages, then two hundred percent of the social norm accepted at that time will be charged.

- If the breadwinner dies from an illness acquired at work or service, the amount will be 150%.

- When the entire family lives or lived in the Far North, or in regions equivalent to it, then any benefit will be automatically multiplied by the regional coefficient.

- Children who have lost both breadwinners receive 250% of their allowance.

- Other family members, except children, can only count on 125% of the breadwinner’s salary.

- Family members of astronauts receive exactly forty percent of the breadwinner's salary after his death.

There is material on the website about how to arrange support for the widow of a serviceman, everyone can read it. According to the law, the size of a serviceman's survivor's pension, like any other, must be indexed annually from April 1st. The minimum payment amount for 2020 is 7,830 rubles 78 kopecks.

Unlike labor pensions, which directly depend on length of service and IPC points, the state type of payments has a firm and clear framework. It will be calculated depending on the base rates that were accepted at the time of calculation, on the status of the deceased or missing person, as well as the reasons for his disappearance or premature death.

Even with such a fairly significant amount of benefits, for family members of those who are entitled to state payments, there are also northern allowances. That is, if you live in difficult climatic conditions, all amounts will be automatically multiplied by regional coefficients, and when leaving, they can be withdrawn. For registration, additional certificates confirming the right to receive this type of payment will be required.

Labor (insurance)

If at the time of death, the breadwinner had a certain work experience, then all his dependents, by law, can be assigned and paid an insurance-type pension. Such a payment is compensatory, that is, it compensates for a lost source of income for disabled persons. The subtleties and nuances of assigning such a pension are regulated by articles of the Federal Law of the Russian Federation numbered 166 and 400, which it would not hurt to read separately. Material support is assigned to all persons, without exception, who can prove their right to it, at the same time. That is, money will be paid for all children, spouse, grandparents, regardless of each other.

Such a benefit can be assigned not only to one child or parent, but to everyone who is entitled to it. There is already an article on our website in more detail about applying for a survivor’s pension; it would not hurt to read it if a similar situation arises.

Correct calculations

The size of the insurance pension for the loss of a breadwinner depends entirely on how much money he managed to accumulate in his account in the Pension Fund of the Russian Federation, since this is precisely what will be used to “dance” when assigning payments. It won’t be difficult to calculate; you’ll just have to take into account the individual points (IPC) of the breadwinner, as well as their cost at the time of submitting documents for registration. The calculation formula used by experts looks quite simple.

SPspk = IPC x SPK + FV

Decoding abbreviations

SPspk – the final amount of the insurance pension in the event of the loss of a breadwinner.

IPC – individually collected points.

SPK is the price (cost) of one such point, according to the government decision. For 2020, it was exactly 81 rubles and 49 kopecks.

FV is a fixed additional amount, which also changes annually, taking into account indexation for inflation. Now, starting from February 2020, the PV is 4982 rubles and 90 kopecks.

The calculation option given above implies that the breadwinner at the time of death or disappearance did not receive a pension himself, but was working fruitfully. If he was a pensioner, then a different calculation formula can be used:

SPspk = IPC / CHI x SPK

Where:

NHI is the final number of dependents who claim insurance-type benefits for the loss of a breadwinner.

When it comes to a deceased single mother, the size of the labor pension for a child for the loss of a breadwinner can be immediately multiplied by two, since the payment is made in double amount (200%). If you have “northern” experience, a regional coefficient is also calculated, by which the fixed payment is additionally multiplied.

Calculation example

To clearly show how a pension is calculated and what it consists of, let’s analyze an example:

Anton Ivanovich worked in the police for 30 years. He retired as the head of the police department with the rank of “Colonel”. Anton Ivanovich died from an accident not related to work. After death, he left behind a wife who did not work anywhere and two minor children.

To calculate the social pension we take:

the salary according to the position is 17,500 rubles;

the bonus according to the rank of “Colonel” is 14,000 rubles

The percentage increase for 30 years is 40% and is calculated as: (official salary + salary for a special rank) * 30%. We calculate the allowance: (17500 + 14000) * 40% = 12600 rubles;

The amount of cash allowance for calculating benefits from 2020 is 72.23%. There were no changes in 2020, so the interest rate remained at the same level.

Anton Ivanovich died accidentally, not at work, so his family members will receive benefits in the amount of 40% of their salary.

The formula for calculating financial assistance for each family member today:

(17500+14000+12600) * 72.23% * 40% = 12741 ruble

As a result, each family member will receive 12,741 rubles, and the total amount will be 38,224 rubles.

Social pension

If the actual breadwinner has never worked anywhere, for example, he himself was disabled, his children, parents and other dependent relatives should not be disadvantaged and left without a means of support after his death. Children under eighteen years of age who do not work anywhere and full-time students until they reach twenty-three years of age can receive benefits.

Payments are due to disabled parents, grandparents, uncles and aunts if their return has reached a certain milestone.

- For all dependents who have lost one breadwinner since February 2018, a benefit in the amount of 5,240 rubles and 25 kopecks is assigned.

- If children lose both breadwinners, or for children of a single mother, the amount of payments will be more than doubled and will amount to 11,068 rubles and 50 kopecks.

There is the concept of a social old-age pension, the size of which will depend on many factors. It will be assigned to those relatives of the deceased who have already reached a certain age themselves, but do not have their own experience, as well as special services to the Motherland.

For social benefits for the loss of a breadwinner, a regional coefficient is also applicable, by which the amount of the payment is multiplied, but only under the condition of living in the Far North and similar territories. If a person leaves there, then all increasing indices will be removed, but upon return, they will be added again.

Types of pensions

In Russia, the following system of federal support in case of loss of a breadwinner is in effect:

- insurance;

- social;

- state (military).

Insurance

Most citizens are assigned an insurance benefit, since the employer pays contributions to the Pension Fund for them and for the deceased breadwinner.

In this case, the period for which insurance transfers were made and the number of pension points are taken into account.

Minor children do not have to prove their dependency.

Other relatives provide a special certificate or prove this circumstance through the court.

The benefit is not awarded if the recipient committed a crime against the deceased that resulted in death. In this case, he can only count on a social pension.

Relatives of retirement age and lifelong disabled people receive payments indefinitely.

For the remaining categories, upon reaching adulthood or becoming able to work, accruals cease to be made.

Conditions of appointment

The right to compensation arises after the death of the breadwinner or his recognition as missing.

The legislator establishes the conditions for assigning a payment to the recipient:

- presence of disability received in childhood;

- age of children under 18 years of age (if enrolled in full-time studies - up to 23 years of age);

- the person is raising a fourteen-year-old child, sister, brother, and grandchildren of the deceased;

- approaching retirement age.

The benefit is assigned to each of the family members who have lost their ability to work, if the deceased breadwinner had several dependents.

If grandparents have able-bodied children, and a brother, sister and grandson have able-bodied parents, then they are not granted a pension. The responsibility for maintenance lies with relatives.

Adoptive parents and adopted children, stepfather and stepmother, stepson and stepdaughter have the same rights as blood relatives.

If compensation was paid to a spouse who remarried, the money will be transferred regardless of the occurrence of this circumstance.

Payment terms

You can apply for payment immediately after the death of a citizen.

The benefit is accrued monthly from the date of registration of the application with the Pension Fund.

The amount of transfers depends on the moment of application:

- if less than 12 months have passed, then the money will be paid for all missed months;

- missed more than a year - only the last 12 months will be reimbursed.

If not all documents are submitted when submitting an application, they must be submitted within three months.

In this case, payment will be assigned from the moment of initial submission of papers.

Social

If the deceased breadwinner does not have an insurance record or died due to the unlawful actions of one of the dependents, then the recipients are assigned a social pension.

Children under 18 years of age can apply for benefits (in the case of full-time education - up to 23 years of age).

Children of military personnel

The child, brother, sister and grandson of a deceased serviceman, as well as other close relatives and the widow receive a state pension.

By call

If the deceased served in conscription and died during it or died within three months from the date of dismissal, then relatives can receive child benefits.

Compensation is also awarded in the event of death after three months, if it occurred due to concussion, injury, injury or illness that the citizen received while in the army.

The right to benefits arises for citizens who:

- have not reached the age of majority (when studying full-time after 18 years to 23 years);

- first registered as disabled in childhood;

- raise children, sisters, brothers, grandchildren of the deceased who are under 14 years of age.

Also, government assistance is due if the recipients are a mother, father, or grandparent of retirement age.

Financial support is provided to the wife of a deceased serviceman.

Children are entitled to compensation until they reach working age. If they have a disability, they will receive the payment indefinitely.

By contract

If the deceased served under a contract, then his relatives also have the right to receive benefits.

Similar subsidies are awarded to children of employees of the Ministry of Internal Affairs, drug control, fire service, and the penitentiary system.

Money is transferred if:

- the employee died while performing his duties;

- a citizen died in captivity;

- the fact of disappearance during hostilities has been established;

- death occurred within those months after leaving the army or later due to military injuries and mutilations;

- The military man died after retiring.

The recipients are the same categories of persons as in the previous case.

If the children of a deceased breadwinner are adopted, they lose the right to maintenance.

About the features of calculations in different situations

How is social pension calculated?

The procedure for calculating payments for the loss of a breadwinner remains the same.

The difference arises in the calculation procedure itself for different cases and in some registration conditions. After all, different categories of citizens may have different rights.

For example, if two children are left without a breadwinner, then a pension is assigned to each of them.

If the death of the breadwinner occurred when the child was 18 years of age or older, then financial assistance is not provided.

An exception is made only for those who are enrolled as full-time students at a university.

How to apply for survivor benefits for a child

To assign a pension, you need to contact the Pension Fund.

Methods for submitting documents:

- contact PFR specialists directly;

- send a letter by mail;

- through the MFC;

- use the State Services portal or the fund’s Internet resource.

What documents are needed

You will need to fill out an application according to the sample proposed by the fund’s employees.

Additionally provided:

- passport;

- pension certificate (SNILS);

- document on the death of the breadwinner;

- papers confirming relationship;

- information about the length of service of the deceased.

In some cases, to apply for a benefit, you will need to confirm that the recipient is a full-time student, raised by a single mother, has a disability, etc.

Is it possible to make an additional payment?

This is only permissible if, after all the calculations, it is discovered that the amount of compensation does not even reach the subsistence level. But at the same time, any type of pension is officially indexed every year.

An additional payment is also calculated if the pension has already been calculated, but the cost of living itself has changed.

The amount of additions is regulated in each region separately. These are the so-called social supplements to the standard type of security.

To receive an increase, you must contact the same authority where the initial application was made.

What benefits are there for children?

In addition to the survivor benefit, some individuals receive additional preferences for children.

Disabled children of deceased military personnel have the following benefits:

- free medicines;

- medical assistance;

- a trip to a sanatorium;

- reimbursement of expenses for travel to the place of treatment.

How much is the funeral benefit for a military pensioner in 2020?

What documents are needed to receive funeral benefits for a pensioner? Find out here. Orphans are provided with:

- free education at universities;

- medicines and medical care;

- housing from a specialized fund;

- unemployment benefits for six months from the date of graduation;

- legal assistance.

How to get

For some categories of persons, individual conditions apply when assigning state support.

For students

Students have the right to apply for support if:

- are a child, brother, sister or grandchild of a deceased breadwinner;

- they are under 23 years of age;

- enrolled full-time;

- are not documented under an employment contract.

Only relatives of military personnel can combine work and study.

Other persons, if employed, lose the right to compensation.

If a woman gets married

In cases where the recipient gets married, he retains the pension if:

- has not reached the age of majority;

- full-time student until age 23;

- was the spouse of the deceased breadwinner.

Exceptions include situations where marriages are entered into by widows of military personnel.

After receiving the certificate, they lose the right to a pension.

If parents are divorced

The law establishes that parents are obliged to provide for their children regardless of the presence or absence of an official marriage.

The child does not need to confirm the fact of dependency. Therefore, if the mother and father are divorced, he is entitled to a pension on a general basis.

Insurance part and accounting rules

If a labor pension has already been issued for the deceased, then the relatives are given a payment in proportion to the insurance portion. The basic or fixed part does not take part in the calculations.

A double amount of the subsidy is registered for the child if a single mother dies.

The calculation rules are similar to the standard ones.

In the event of a violent death or a crime committed by relatives, an insurance pension is simply not awarded.

Deadlines for consideration of applications to the Pension Fund of Russia

It takes no more than ten days to review documents at the Pension Fund of Russia

In the standard case, it takes no more than ten days to review documents.

Only after this the amount of compensation and those persons who will count on it are determined. Coordination is carried out only once. But the duration may vary: Until the age of 18.

- Until the age of 23.

- Until the disability certificate ceases to be valid.

- For life if a relative has retired.

The pension stops accruing after the age of 18, if after school the student continued his studies, but did not immediately enter a university.

The process resumes only after the relevant certificate from the educational institution has been submitted.

Assignment of social pensions for the purpose of replacement

There are situations when people can officially count on insurance assistance, but do not meet certain criteria for its transfer.

The state does not refuse help at all, so it assigns a social version of it, with a smaller size. This happens in two situations:

- If the relatives themselves committed actions that led to the death of the breadwinner.

- When a serviceman died, but the cause was the commission of a crime by himself.

Terms of termination

Benefit payment is terminated in the following situations:

- completion of studies at a university;

- expulsion from an educational organization under 23 years of age;

- transfer to evening or correspondence courses;

- execution of an employment contract;

- registration at the labor exchange;

- assignment of another type of pension benefit;

- the presence of circumstances that impede state provision;

- refusal of compensation.

Last news

The Russian government indexed all social benefits from February 1 and April 1, 2020.

The fixed amount of the insurance pension increased to RUB 2,498.66.

Social compensations have increased:

- from RUB 5,034.25 up to RUB 7,386.35 if the child has lost one of the parents;

- from 10,068.50 rub. up to RUB 10,472.23 in the event of the death of both parents.

Family members of military personnel received an increase of 372.03 rubles, compensation is 10,068.50 rubles.

- If a military man died outside of service, then relatives will receive 279.40 rubles. more, or RUB 7,551.38.

- On the contrary, pension payments to employees of the Ministry of Internal Affairs were reduced by 3.7%

What determines the amount of unemployment benefits in 2020? What is the size of the lump sum benefit for the birth of a child in 2020? Find out here.

How to calculate maternity benefits? Read on.

Thus, the survivor's benefit is paid by the Pension Fund. Financing is provided from different sources depending on the type and basis of payment.

Procedure for calculating payments

For the current 2020, the size of the fixed part of this benefit is 2491.45 rubles.

This amount is subject to mandatory payment to each disabled family member who has the right to do so.

If a child has lost two breadwinners, he will be assigned 4,982.90 rubles.

If citizens live in the territories of the Far North, as well as in other territories that, due to natural conditions, are equivalent to them, then this amount is subject to increase by the corresponding coefficient established individually for a given region.

It is important to know how the survivor's pension is calculated . The fixed size depends on:

- independent pension coefficient;

- tariff for the individual number that was established on the day the pension payment was assigned.

If a deceased citizen, before his death, had a pension established on the basis of his disability or age, then the amount of his compensation will be calculated in a different way.

It will depend on:

- individual coefficient;

- the number of incapacitated dependents supported by a given citizen;

- tariff for an individual number at the time of applying for benefits.

It is important to know that if children remain after the death of a mother recognized as single, the amount of payments will be doubled.

In addition to the fixed part, you are entitled to receive an additional payment, which depends directly on the length of service and deductions made by the person. They determine his individual pension coefficient.

In fact, for a citizen who did not have time to apply for his earned pension, his dependents receive it.

In addition, relatives of government employees receive a fixed payment in the amount of 5,034 rubles. And for relatives of those who were military personnel or were employees of the Ministry of Internal Affairs, a payment of 7,830 rubles is due.

But if this employee died directly in the service, he is entitled to 10,440 rubles.

Social Security

In other cases, when remaining dependents cannot count on receiving insurance payments, they will only be able to receive social security.

Such cases include:

- situations where the deceased citizen did not officially work for a single day;

- children who are recognized as orphans.

The size of the social benefit is set at 5,240 rubles this year if only one breadwinner died. If a citizen has lost two breadwinners, then this amount will be doubled and amount to 10,481 rubles.