Investing in real estate registered in the name of a child is a worthy investment in his future, protected by law. How you can draw up an agreement for a minor, who should sign it, when he will be able to dispose of real estate, whether it is possible to receive personal income tax from a purchased apartment in what order, is described in detail in this material.

Is it possible to register an apartment for a minor?

The law allows property to be registered for persons under 18 years of age on the initiative and with the consent of their legal representatives. Transactions are completed by parents. After reaching 14 years of age, a citizen has the right to sign documents on his own and express his intention to complete or refuse to complete any transaction.

The transfer of rights to an apartment to children is carried out at any age up to 18 years of age in the presence of a conclusion from the guardianship and trusteeship authorities, which is presented when registering the transaction in Rosreestr and is an integral document. If you have problems obtaining a document, ask lawyers how to purchase it.

Is it possible to purchase an apartment if maternity capital has been issued to a minor child, and how are his rights protected? The purchase of real estate is possible in the name of parents or children, both under a purchase and sale agreement with direct payment, and with the provision of maternity capital.

When making payments from state subsidies, when purchasing real estate for the family’s own needs, parents or legal representatives provide a notarized obligation to allocate a share in the property for the child after he reaches the age of 18.

The legitimacy of the transaction when using maternity capital funds is confirmed by the Pension Fund of Russia.

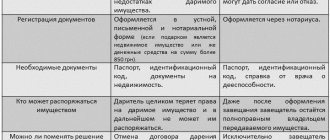

What is a gift transaction and how to conduct it correctly

The law does not prohibit the donation of an apartment, its share or a residential building in favor of a child under 18 years of age, provided that the transaction is properly executed.

According to the Family Code, donation is impossible if:

- In the text of the agreement there is a note that the child will be able to inherit only when the current owner dies. This is already a sign of a will;

- there are other conditions, for example, it is required to transfer something in return for the gift;

- when the second spouse, who is the owner of the apartment, did not give his consent to the transaction. It is mandatory to provide consent in writing, after which the document is certified by a notary.

It is advisable to contact a notary office. The specialist will help you settle all the formalities, prepare the text of the deed of gift, check it and certify it.

The deed of gift is drawn up in writing; three copies are required. All documents must be signed on behalf of the minor by a parent or authorized guardian. A child aged 14-18 years has every reason to sign himself, provided that his parents have given written consent to this.

Please note that in 2020, a visit to a notary and the costs of certification of a deed of gift are unnecessary. If the object of the transaction is a share of an apartment, a visit to a notary is required.

Additionally required documents:

- Identification card of parents or guardians, as well as the baby's birth certificate.

- Proving the fact of ownership of the premises (extract from the Unified State Register of Real Estate). The cadastral passport and technical plan are optional documents, but a lawyer can request them for verification.

- Consent of the other half to the donation if the object was purchased by a couple during marriage. Notarized.

- Original marriage certificate. If lost, it can be easily restored at the territorial registry office.

The agreement is submitted for registration in Rosreestr along with a receipt for payment of the state fee.

How can a notary help?

Some of the documents that are provided when registering the property rights of minors, also at the disposal of real estate belonging to them, are subject to mandatory notarization.

In addition, it is recommended to sign the agreement in the presence of a lawyer, which serves as an additional legal guarantee of the legitimacy of the transaction.

The notary checks the legal capacity of persons representing the interests of minors, documents of title for housing, and analyzes the legal consequences of concluding such agreements.

It is almost impossible to challenge a transaction concluded in the presence of a notary. This feature provides additional protection for the rights of the child and a significant reduction in the risks of canceling such an agreement. To determine all the nuances of the transaction and pitfalls, we recommend that you seek advice from the specialists of our website and you can ask your question.

The advantage of executing a transaction in the presence of a notary is that they provide legal advice on the question of whether it is legally possible to formalize and on the basis of what documents the transfer of rights to an apartment to children when concluding a specific agreement, taking into account the current legal situation.

What options are there?

In practice, the question often arises: if I want to register my apartment for minor children under eighteen years of age, how best can I transfer the property and what documents are needed for this?

Registration of the transfer of rights is possible in several options, even if the recipient of the property is a young child:

- conclusion of a purchase and sale agreement,

- signing a deed of gift,

- inheritance by will or by force of law,

- making a barter transaction,

- privatization with the mandatory allocation of a share in the apartment,

- refusal of a share in favor of a minor by parents or other persons registered in the living space.

A child enters into an inheritance if at the time of the opening of the inheritance, that is, the death of the testator, he was in the womb by virtue of Article 1166 of the Civil Code of the Russian Federation.

When state or municipal housing is privatized, the child retains the right to re-participate in the procedure for allocating property into private ownership.

This is an exceptional opportunity provided for by the Federal Law “On Privatization” No. 26 of 08/11/1994. They do not have the right to renounce their share even if they reach the age of limited legal capacity - 14 or 16 years old, since such a possibility is not provided for by law.

They are included in the privatization agreement forcibly. It is not allowed to deregister a child before privatization of previously occupied housing in violation of the rights of a minor. Guardianship and trusteeship authorities monitor the observance of children's rights.

In this case, the person transferring the rights to the apartment to a minor can be anyone who is the full owner of the property, not necessarily a relative.

If an apartment is registered under an agreement and children are listed as the owners, then a certificate or extract from Rosreestr on assigned property rights is issued for the corresponding share or the entire housing.

How does the state protect children from property loss?

The law is strong, but it's law. It covers every step. The state protects children in the maximum possible ways. Privatization guarantees the impossibility of depriving a child of property rights.

If minors who have not reached the age of majority at the time of privatization of housing are registered in the apartment, they still retain the right to part of the square meters, even if they are already the owners of other real estate.

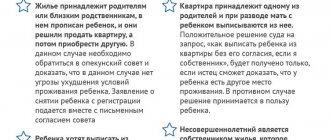

Adults do not have the right to worsen the living situation of children . This means that you can sell an apartment owned by a child if you purchase more spacious and comfortable housing.

Legislation of the Russian Federation

Russian regulations do not establish restrictions on the transfer of real estate to minors from the very moment of their birth. The main reason for registering property in the child’s name is to provide him with living space. However, a citizen can independently dispose of an apartment or other object only after reaching 18 years of age.

The personal property of children recorded in their name is not included in jointly acquired property, on the basis of Articles 34-35 of the RF IC and has a different status.

During a divorce, parents cannot divide it among themselves, but they have the right to use any means to improve the child’s living conditions: by providing more space, moving to the city center, an area with developed infrastructure, near a school, etc.

According to the law, all minors are divided into two categories:

- those who have reached 14 years of age (Article 28 of the Civil Code of the Russian Federation),

- aged from 14 to 18 years (Article 26 of the Civil Code of the Russian Federation).

Children over 14 years of age are recognized as having limited legal capacity. They are believed to be able to understand the consequences of their legal actions and make their own decisions.

The right of any citizen from the moment of birth to own real estate is stated in Article 35 of the Constitution of the Russian Federation and Article 17 of the Civil Code of the Russian Federation.

Transfer through privatization

The concept of privatization was introduced in 1994. As part of the process, citizens registered on the territory of municipal apartments have the right to become their full owner once in their life free of charge. Everyone registered, including minors, receives the right to claim a share of the privatized object. Thus, citizens have the opportunity to quickly and at minimal cost solve their housing problems.

The procedure for changing the owner within the framework of privatization:

- Prepare a package of documents for participation in the procedure.

- Both parents or their representatives renounce their right in writing, thereby the child receives 100% of the entire living space.

- The certificates are submitted to the municipality for verification and consideration.

If a positive decision is made, privatization is carried out in the name of the child.

How is the property of a minor disposed of?

Transactions with real estate registered in the name of children can be carried out by parents or legal representatives appointed by decision of the guardianship and trusteeship authorities (or by a court decision).

When selling an apartment or other real estate, if the owner is a minor, it is mandatory to provide another living space with characteristics no worse than the sold property, which is documented.

Registration of housing or other real estate for a minor is carried out with the written consent of the parents and in the presence of a positive conclusion of guardianship and trusteeship, even if the child puts his signature on the documents when he reaches the age of 14.

It is possible to register an apartment for a minor child only if the requirements of Article 131 of the Civil Code of the Russian Federation and Federal Law No. 218 on registration of rights to real estate are compulsorily observed. The procedure is practically no different from that provided for adult citizens. The difference is noted regarding the package of documents.

Additionally, you must provide the following to the Rosreestr authorities:

- birth certificate in original and copies, civil passport for children over 14 years old,

- conclusion of the guardianship and trusteeship authority on the possibility of completing a transaction on such conditions,

- notarized consent of parents or legal representatives to sign the agreement,

- passports of parents or other legal representatives, court decision on the appointment of a guardian or trustee.

If the apartment is under mortgage

Here the situation becomes somewhat more complicated, since three parties take part in the transaction - parents, child and bank. The bank is reluctant to enter into transactions involving a minor because:

- If the property has to be seized for non-payment of the mortgage, the minor cannot be evicted - this is prohibited by law.

- The sale of such property and any other legal transactions will be carried out only with the permission of the guardianship and trusteeship authority - it monitors compliance with the rights of the child.

- It will be much more difficult for the bank to sell the mortgaged apartment - this requires permission from the guardianship and trusteeship authority, and it is difficult to obtain.

Actually, the parents themselves will also not be able to carry out a legal transaction with such an apartment without the permission of the guardianship and trusteeship authority.

Features when designing

When a child receives property, a conclusion from the guardianship and trusteeship authorities is not required, however, the consent of the legal representatives will still have to be verified. This is due to the need to bear the costs of maintaining real estate, ensuring payment of taxes, and disposing of property in the future.

Gift deed for an apartment

A child can make a donation after reaching the age of 14, if there is a written consent signed by him personally. He must be present at the conclusion of the contract and its registration in Rosreestr upon presentation of an identity card. He signs the application on the form for registering the transfer of rights with his own hand.

When concluding a gift agreement, ownership rights to an apartment are transferred to a minor in the same manner as when concluding a transaction in favor of an adult citizen. An agreement is concluded, which is signed by the donor and the recipient.

It is possible to make transactions to transfer property to other persons owned by a child until he reaches 14 years of age with his consent. Until this moment, donating real estate even with the will of parents or legal representatives is prohibited by law.

When registering a deed of gift in the name of a minor, in contrast to the consequences when purchasing real estate, income tax is not paid only in cases where the transfer of ownership takes place from close relatives, including parents, grandparents, full and half brothers and sisters. The list of such persons is established by the Family Code of the Russian Federation.

Why buy an apartment for a child?

One of the most popular reasons is to provide the child with their own housing . Parents think about this event in advance, preparing their child for a carefree life in the future.

Another reason why parents buy real estate for children is to prevent the emergence of controversial issues in the event of a divorce between father and mother.

When legal proceedings begin over the division of common property, the children’s property is not included in the division. And housing is not shared between former spouses.

And the rarest reason for registering an apartment for a child is to exclude claims to the property of third-party enterprises . For example, if financial obligations to creditors are not fulfilled.