Maternity capital funds can be used to purchase housing only if the children and each parent are allocated shares in the property rights. Since it is not always possible to immediately determine the size of shares for all family members when purchasing real estate, the Pension Fund (PF) allocates maternity capital funds after the parents provide an obligation to allocate shares.

This document is a guarantee that the purchaser of the home undertakes to allocate shares in the property to family members within 6 months after registering the property rights in Rosreestr.

When the moment of fulfillment of the obligation arrives, parents must allocate shares in the apartment to their children by submitting a corresponding agreement to the registration authority. Such a document is drawn up by a notary, but in some cases it can be drawn up without his participation.

An alternative way to allocate shares to all family members when purchasing a home using capital funds is a gift agreement.

Legislation allows you to use targeted maternity capital funds for the purchase of housing only under the condition that it will be registered as the property of all family members (including children born after the certificate is issued).

Housing can be recognized as common property only after the following circumstances occur:

1) Registration of property rights

— if real estate is acquired under an agreement of shared participation in construction, then ownership rights arise after the house is put into operation. When constructing a residential building - after registration of ownership of the finished building.

2) Removal of collateral by the bank

- if the apartment is purchased with a mortgage.

To issue funds for these needs, the Pension Fund requires parents to provide a notarial agreement, under the terms of which the owner will have to allocate shares of the property within 6 months after the right to dispose of the property.

It is possible to avoid fulfilling the requirement to allocate shares on the basis of an agreement. This can be done in case of purchasing finished housing under a purchase and sale agreement. Upon concluding this transaction, the seller has the right to transfer the property immediately into common ownership, indicating in the agreement the shares of all members of the buyer’s family.

To complete such a transaction, a purchase and sale agreement is concluded with the seller, in which it is necessary to indicate that part of the funds will be transferred to his account from maternity capital funds.

After completing the transaction, the parents contact the Pension Fund and submit an application for an order - to transfer funds to the seller’s account. Their application is reviewed for about 1 month, after which the funds are transferred to the seller within 10 working days. After full payment of the contract, the parties need to contact Rosreestr with an application to remove the encumbrance on the property (since until this moment the property is pledged to the seller).

To whom should the shares be allocated?

A maternity certificate, which is allocated by the state and issued by the Pension Fund of the Russian Federation, is a means of material support for families in which a second or subsequent (if MS was not received after the birth of the second) child was born. In essence, this is money allocated to support the whole family, so each family member, when purchasing or improving housing with the help of MS funds, has the right to a part of this living space.

If an apartment or house is registered as the property of both spouses, then they are required to draw up an agreement on the allocation of children's shares in the residential premises. Moreover, this rule applies not only to those children who were already born at the time of receiving MS funds, but also to all others born before the agreement was drawn up. In addition to their own children, spouses are required to draw up agreements on determining the children’s shares for all minors adopted by that time.

In cases where a residential property is registered in the name of only one of the spouses, the second also has the right to allocate his share. The specific size of the allocated part of the residential premises is determined in the agreement on the allocation of shares.

But this category does not include minors under guardianship, as well as their parents and other blood relatives of the recipient of maternity capital.

For example, the spouses Nina and Oleg Romanov had a second child together, so Nina was able to provide her with MS. The couple decided to improve their living conditions and built an extension to the house they had previously purchased. Since the house was previously registered only in Oleg’s name, the question arose about allocating shares for two children and Nina Romanova.

While the documents for the extension were being processed, a tragedy occurred in the family, Oleg’s older brother and his wife died, the couple was left with a minor son, whom Oleg and Nina decided to adopt. Thus, the agreement on the allocation of shares had to be drawn up in the name of Nina Romanova, who has two children together and a nephew, Oleg, adopted by the couple.

In cases where the maternal certificate is used to purchase housing with a mortgage, when building a private house, or to participate in shared construction, in order to allocate MC funds, the spouses will have to submit to the Pension Fund an obligation to allocate children's shares after the encumbrance on the residential premises is lifted.

The obligation and the agreement on the allocation of shares are similar, but not identical. The obligation is essentially a promise to allocate shares after the opportunity to do so arises, and in the agreement the owner realizes the intention and obligation of the parents to allocate parts of the joint residential premises to the ownership of their minor children.

On the basis of an obligation, registration of property rights is impossible, and the agreement is precisely the basis for such registration with the bodies of Rosreestr.

Determining the size of shares

The share can vary from 1/100 to ¼ (that is, it is distributed equally among everyone - two parents and two children). There is no clear regulated size of shares. Part of the housing can be allocated by agreement.

According to Art. 60 of the RF IC, children do not claim the share of their parents, and parents do not claim the share of their children. Therefore, shares must be no less than the size of maternity capital. Those. the certificate is divided in half between two children and the share of the amount of the purchased apartment is determined.

The period for allocating shares should not exceed 6 months, but there are cases when this is impossible:

- the apartment was purchased with a mortgage and the parents continue to pay it off;

- housing is purchased using a housing loan for one owner;

- parents purchased an apartment under DDU;

- maternity capital funds are used for construction;

- the object was built later than January 2007 and is already registered in the name of one or both parents.

Important! It is mandatory to allocate a share according to the law when using maternity capital in order to improve living conditions. In the worst case, if the share is not registered, then the Pension Fund has the right to request a refund of the funds under the certificate.

What share should be allocated to children?

There is no clear indication in any regulatory documents of exactly what share of residential premises should be allocated to minor children when purchasing an apartment or house using MS. However, allocating part of an apartment with an area smaller than the standard is permissible only as a last resort, when the house or apartment is small and several shares need to be allocated. Typically, shares are allocated that are equal in area to the standards existing in a given region (from 6 to 18 square meters per allocated share).

In cases where residential premises are purchased using MS funds, without attracting additional money, the shares of all family members are distributed equally. But, if, in addition to MS funds, the money of the parents or one of them was used to purchase or improve the property, an uneven allocation of shares is allowed, for example, as a percentage in proportion to the funds invested in the purchase of housing.

For example, the Kirillov family lived in a two-room apartment, purchased by the husband before marriage. After the birth of their second child, the couple decided to sell this apartment and, adding MS funds, buy a three-room apartment.

The apartment was sold for one and a half million rubles, a new one was bought for two million. The shares were distributed as follows: 3/4 of the living space was allocated to the spouse, since he invested personal funds in the purchase of a new apartment, proceeds from the sale of the old one, and one quarter of the property was divided into three shares between the wife and two minor children - 1/ each 12 parts each.

Is it necessary to allocate a share to a child when buying an apartment?

When purchasing a new apartment, the issue of allocating children's shares remains at the discretion of the parents. Some people register ownership of residential premises for one family member, while others allocate part of the property to everyone: parents and all children. But there are some situations when allocating a child’s share in the purchase is mandatory:

- According to Federal Law No. 256 of December 29, 2006, when purchasing residential premises on a mortgage using MS funds , after the encumbrance on housing is removed, parents are obliged to allocate shares to each of their children. But first, the parents pay off the mortgage loan, and only then allocate part of the living space to the minors.

- When selling an old apartment in which children were co-owners , the allocation of an equal share in the new apartment is also mandatory. Before the purchase and sale transaction of the old apartment, parents must formalize an obligation to allocate children's shares in the new residential premises, otherwise the PLO will not allow the sale. If they somehow circumvent this ban and do not allocate children's shares in the new housing, the transaction may be declared invalid.

- When privatizing municipal apartments, the allocation of children's shares is also mandatory.

For example, the Novoseltsev couple with two children lived in a municipal three-room apartment under a social tenancy agreement. They decided to privatize the apartment and started paperwork. In order not to collect unnecessary paperwork, they initially decided to privatize the living space only for the husband; the wife signed a waiver of privatization in favor of her husband.

But the municipality refused to privatize Novoseltsev, since in addition to him and his wife, two minors were registered in the residential premises, and Novoseltsev was obliged to allocate their parts to each of them. He had to re-collect all the documents and submit an application for privatization on behalf of three people - father and children.

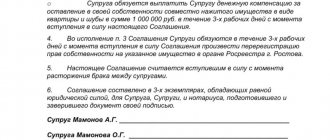

How to correctly draw up an agreement on determining the size of shares in maternity capital

Some parents ask the question: why allocate children’s shares at all, since the living space will go to the children anyway after the death of the parents?

That’s all true, but if the children’s shares are allocated, then in this case, in addition to the parents, the children’s property is also protected by the state in the person of the guardianship and trusteeship authorities. Without their permission, no one will be able to sell such a living space or exchange it for a smaller one, that is, the PLO will not allow the living conditions of minor children to worsen. Thus, by drawing up an agreement, parents insure their children against deterioration of their living conditions in the future.

Since 2020, such an agreement requires mandatory certification of the document by a notary office. Thus, parents are obliged to visit a notary, pay for his services, draw up the document in accordance with all the rules and receive it in their hands already signed and certified by a notary seal.

The law does not stipulate that spouses are required to draw up a document in a notary’s office; they can do it themselves, however, they must follow the rules for drawing up an agreement in any case. If the document is drawn up with violations, or if all the necessary data is not indicated, the notary will not certify the agreement.

So, the document should contain the following information:

- personal data of parents, numbers of their passports or other documents proving their identity;

- information about the persons in whose favor the agreement is drawn up and to whom shares of the residential premises are transferred into ownership (natural or adopted children, second spouse);

- date of document preparation;

- place of its preparation and certification;

- full name;

- information about the residential property in which children's shares are allocated, the address of the residential premises;

- a brief description of the apartment or house (size, number of floors, number of residential and non-residential premises);

- on what basis the right of ownership arose (purchase, construction, equity participation, mortgage loan, etc.);

- information about MS;

- references to regulations, namely: Art. 244, 245, 254 of the Civil Code of the Russian Federation, provisions of Federal Law No. 256;

- the size of all allocated shares;

- a record of the number of copies of the agreement;

- signatures of all parties, with parents signing as one of the parties to the agreement, also certifying the signature of those minors who have already reached the age of 14 years;

- a record that the agreement was drawn up in the presence of a notary, verified by him and is legal;

- stamp of a notary office.

Features of drawing up an agreement

Drawing up an agreement on the allocation of children's shares when purchasing residential premises using MS has a number of features:

- The document is strictly in writing and must be certified by a notary office.

- The number of copies must be equal to the number of parties to the agreement, plus one copy. For example, if shares are allocated to both parents and three children, then it will be necessary to issue six copies of the document: to each of the participants, plus one copy, which will be transferred to Rosreestr for permanent storage.

- All signatories, with the exception of children under 14 years of age, must provide personal signatures. Parents sign for children under this age.

- The document must not infringe upon the rights of any of the parties.

- No coercion is allowed to draw up a document, or to any part of it: spouses must make a decision consciously and voluntarily.

Allocate to child

Each spouse and their children must own a certain part of the apartment. The right of children to a share in real estate is enshrined in law.

The fulfillment of legal requirements is monitored by the Guardianship and Trusteeship Authorities (TCA). The owners will have to agree on the procedure for allocating the share with this authority.

The procedure remains virtually unchanged:

- Determine the terms of division of the apartment and draw up an agreement.

- Collect the necessary documents.

- Submit them to Rosreestr and OOiP.

- Wait for the decision of Rosreestr and the guardianship authorities, and then go through state registration of the rights of each owner.

At the end they must obtain permission from the POiP. An important condition: the minor child’s share in the new premises must be no less than what he had in his previous place of residence.

All the best goes to children!

When filing a divorce and allocating shares, the one who will raise the child has the right to most of the apartment.

In a mortgaged apartment

Housing purchased with a mortgage can be divided by concluding an additional agreement with the bank. It specifies the conditions for the allocation of shares from the main agreement. As a result, the borrowers' loan debt is distributed strictly in proportion to the size of the parts of the apartment that they own.

Before making the allocation, written consent must be obtained from the bank. The main requirement is that each shareholder must confirm his financial solvency and ability to pay the loan taken out.

Accordingly, to allocate a share to a child in a mortgaged apartment ; first you will need to close the mortgage. And if the law requires the allocation of a share to a minor (if, for example, part of the mortgage is paid off with maternal capital), then a notarial obligation is made that after the closure of the mortgage, the corresponding share in the apartment will be allocated to the child.

By maternity capital

Before transferring maternity capital funds to the seller’s account, the Pension Fund will request a certified document confirming the fulfillment of obligations to the buyer. This measure guarantees that the current owner of the property will transfer the apartment to the acquirer into common ownership in the next six months. Next, the shares are allocated by general agreement by signing the appropriate agreement.

A distinctive feature is the time it takes to complete the entire procedure. The Pension Fund requests a lot of documents and takes quite a long time to approve them. It may take up to two months before the deal goes through, and you can start registering the rights with Rosreestr.

Sample agreement on the allocation of shares to children under maternity capital 2020

Sample agreement on determining children's shares in maternity capital

The text of the document must contain the following points:

- The date the agreement was drawn up in the format “hh. mm. yyyy."

- Place of compilation (populated area).

- Full name of the parents, their passport details, as well as a record of who they are related to the children (father, mother, adoptive parent).

- Location of the residential premises in which children's shares are allocated (address, building, apartment, floor).

- Data on the current ownership of residential premises (joint, common share).

- Date and method of emergence of ownership of housing (purchase and sale agreement, mortgage loan, DDU, etc.).

- Information about MS (when and by whom it was issued, in what amount).

- What share of the apartment or house is transferred to which family member.

- Number of copies.

- Signatures of the parties.

Where to begin

It is necessary to distinguish between procedures such as division of real estate and allocation of shares:

- If co-owners share common property, then the apartment ceases to be joint property. Everyone gets their own separate part.

- When allocating shares, certain parts of the apartment are assigned to specific persons. Real estate still remains common (the main provisions are described in Article 282 of the Civil Code).

Plus, there are two forms of ownership:

- Shared – everyone has the right to a certain part of the property. Since the shares have already been allocated, the owners just have to fence off their part.

- Joint - there is a common right of ownership of the property without the allocation of a specific share. Therefore, to allocate, you must first determine the size of the parts of each resident.

The owners have the right to independently divide the living space into parts. If the size of the share has not been specified, then the property is divided into equal parts between all co-owners. Let's give an example: if in an apartment of 90 sq.m. If three people live, then each person’s share is 30 sq.m. If there are disagreements, the division of housing is carried out in court.

The parties can also arrange a division of bills for payment for housing and communal services and other services. But you need to remember - if there is a debt for a period of more than three months, they may turn off hot water, electricity, etc.

"Do not wait.

The time will never be right." - Napoleon Hill. When co-owners agree to divide an apartment, they act as follows:

- An agreement on the allocation of shares is prepared, detailing all the terms of the transaction.

- Design the highlighted parts properly. For example, if this requires redevelopment or other construction work, they obtain consent from the BTI and register the result.

- They decide on the financial side of dividing the apartment: if someone has a smaller share than others, then the co-owners pay him extra, and if his share is larger than the others, he pays compensation.

- The parties register the agreement and their rights in Rosreestr.

The additional payment does not have to be in cash. The parties can determine what type of compensation suits them. The main thing is to clearly state this in the main agreement.

Registration cost

Of course, you will have to pay a certain amount to determine children's shares in residential premises. In many ways, registration costs will depend on the cadastral value of the apartment or house. This is due to the fact that the residential premises for which the agreement is drawn up can be assessed, and transactions with such objects, in accordance with paragraphs. 5 tbsp. 333.24 of the Tax Code of the Russian Federation, are subject to a duty of 0.5% of the cadastral value of housing. But, in accordance with the same tax code, the amount of state duty cannot be lower than 300 and higher than 20,000 rubles.

For example, if children's shares are allocated in a residential building with a cadastral value of 2 million rubles, then the amount of the state duty will be 2,000,000 * 0.5% = 10,000 rubles. In this case, we did not go beyond the minimum and maximum limits of the state duty.

If the cost of the apartment is, for example, 5 million rubles, then the estimated amount of the state duty will be 5,000,000 * 0.5% = 25,000 rubles, but the law specifies the maximum upper limit of the state duty, above which its size cannot rise (20,000 rubles), so the payment will be reduced to exactly this amount.

If the parents decide to resort to the help of a notary when drawing up the text of the agreement, then they will also have to pay at the notary office for the work of the employee in drawing up the document. Depending on the region, the cost of this service will vary from 1 to 5 thousand rubles.

Some costs will also have to be incurred when registering the agreement with Rosreestr. In the Russian Federation, there is a single tariff for determining shares in residential premises; it is 2,000 rubles.

Drawing up any legal document requires at least minimal knowledge of the basics of jurisprudence and the rules for drawing up such papers. Any wrong word or definition, and the text of the document takes on a completely different meaning, in some cases the exact opposite of what was originally required.

Therefore, in order to avoid mistakes and not to rewrite the document several times, it is advisable to seek help from an experienced lawyer. He will not only help you draw up a competent document, but will also undertake legal support of the entire transaction, collect the necessary documents, and, if necessary, represent your interests in any government agency.

You can also seek help from the lawyers of our website, who will advise you on the issue of interest, tell you where to start, what documents will be needed in your particular case, and help in resolving other important issues. You can contact our employees by calling the indicated numbers or by contacting the duty lawyer online.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

What does a document on privatization of an apartment look like?

As of [current_date format='Y'], as the main document...

How to evict your ex-wife from an apartment

Not all families live happily ever after; many get divorced. Behind…

Privatization of an apartment through the MFC

Privatization of an apartment is a complex and lengthy process, but for many...

Privatization of a garden plot

A garden plot of land, provided that a house is located on it, can...

1

Certificate of non-participation in privatization

The certificate of non-participation in privatization has now been replaced by an extract...

What does a privatized apartment mean?

Almost immediately after the collapse of the USSR, the era of privatization of state and...