Everything about taxes and insurance premiums for the self-employed in 2021: what is the NAP, who can apply it and under what conditions. Online consultation with a specialist.

Let's understand the provisions of the law: the tax for the self-employed exempts from the need to pay personal income tax on income that is taxed under the new special NAP regime; individuals must pay personal income tax on the remaining income. In the special NAP mode, you also do not need to pay mandatory insurance premiums. Individuals and individual entrepreneurs can switch to the new tax regime for the self-employed online. Read about all this in more detail below.

What is professional income tax (PIT)?

Professional income tax (PIT) is a new special tax regime for self-employed citizens, which could be applied in pilot regions from 2021. The Law on Self-Employed and the NAP are designed to bring millions of self-employed citizens with unofficial income out of the “shadow”.

Individuals and individual entrepreneurs who switch to a new special tax regime (self-employed) will receive the right to pay only tax at a preferential rate on income from self-employment. When receiving income from an individual, the tax rate is 4%, from an individual entrepreneur or legal entity - 6%.

The use of NAP allows self-employed individuals and individual entrepreneurs to legally conduct business and receive additional income from part-time jobs without the risk of being held accountable for illegal business activities.

It is this information that is important to know for Russians searching the Internet for information on the queries “self-employed citizen taxes”, “tax on self-employed citizens of the Russian Federation” or “what self-employed tax”.

Pension for NAP payers

A professional income tax payer is an individual who is not legally required to pay pension contributions. Thus, the insurance period for the self-employed according to Law No. 422 is not formed by default. If a person during the period of working activity is only a payer of NAP, then he can only count on a minimum, “social” pension. A citizen becomes entitled to it 5 years later than the normal retirement age. That is, no earlier than 70 years (in the regions of the Far North and equivalent territories - 65 years). The amount of such a pension corresponds to the minimum subsistence level for a pensioner (about one and a half to two times less than a regular pension).

At the same time, insurance premiums for self-employed citizens can be paid voluntarily. NDP payers have the right to enter into a private agreement with the Pension Fund of the Russian Federation - and transfer contributions there in the amount established by the relevant agreement.

In the most general case, it is assumed that such contributions will be paid under an agreement providing for the transfer to the Pension Fund of the amount for the formation of:

- 1 year of experience;

- 2 points for pension.

In 2021, the corresponding amount is just over 59,000 rubles.

Note that to obtain the right to a pension from the usual retirement age of 65 years (still less, since the pension reform has not yet been completed), you need 15 years of experience and at least 30 points. It is easy to calculate that in order to receive a pension, the NPA payer must pay under the agreement with the Pension Fund on current conditions 15 times.

If 15 years of experience and 30 points are not formed, the self-employed can only count on a “social” pension.

If a self-employed person cannot pay contributions in the amount established by default (this is several tens of thousands of rubles per year), then he has the right to agree with the Pension Fund that he will transfer a partial amount of contributions there: in this case, the person’s pension rights are calculated “proportionally” » the full amount of contributions. And then the formation of the required length of service - if we are talking about applying the agreement with the Pension Fund in its pure form - will take more than 15 years.

Please note that the contributions calculated under the individual’s agreement with the Pension Fund of the Russian Federation differ in size from the fixed contributions of the individual entrepreneur, who pays them for himself (and which are obligatory for him). Accordingly, the pension rights of the NPA payer, who voluntarily transfers contributions to the Pension Fund of the Russian Federation, will be different from those established for individual entrepreneurs (we will consider them further). That is, the length of service and pension points for NPAs and individual entrepreneurs will differ.

Of course, a self-employed person paying NPA can also enter into an agreement with any non-state pension fund for the formation of a private pension. Its value will be determined strictly by the content of such an agreement.

A completely workable option for the self-employed is to open an account in a reliable bank and save capital for your old age. By the time you reach normal retirement age—or, alternatively, the one established by law—a tidy sum may have accumulated in this account. At the expense of it (or at the expense of interest from it), a self-employed person who decides to take a well-deserved rest may well reach the “social” pension - to which he will not lose the right.

A combination of different pension formation scenarios is possible. For example, you can first save for old age in a bank account, and then “purchase”, if necessary, experience and points from the Pension Fund.

Who has the right to apply the special regime for the self-employed?

Taxation of the self-employed and tax on professional income for the self-employed today interests many citizens of the Russian Federation. However, the experimental special NAP regime can be used not only by Russian individuals and individual entrepreneurs, but also by foreign citizens from the EAEU countries.

Citizens of Russia

Any citizen of the Russian Federation can switch to the new special tax regime, provided that he does not employ hired employees for his activities under employment contracts and does not engage in the resale of goods, does not sell excisable goods or those goods that are subject to mandatory labeling.

The full list of activities for which the self-employed are prohibited from using the new special regime is indicated in Articles 4, 6 of Law No. 422-FZ of November 27, 2018. Portal experts discussed in detail who is not entitled to apply the special tax regime of NAP in the article at the link.

Individual entrepreneurs

Individual entrepreneurs can also change the tax regime and pay NAP. It is important to remember that combining this tax with other special tax regimes is prohibited even for different types of activities (clause 7, part 2, article 4 of Law No. 422-FZ of November 27, 2018). So, for example, you cannot rent out housing as a self-employed citizen and at the same time operate as an individual entrepreneur on a simplified basis.

An individual entrepreneur, within 1 month after registration as a self-employed citizen, is obliged to refuse to apply other special tax regimes. Otherwise, the registration of an individual entrepreneur as a self-employed citizen will be canceled (Part 5 of Article 15 of Law No. 422-FZ of November 27, 2018).

Foreign citizens

Foreigners can also apply the special NPD tax regime, but only citizens of the countries of the Eurasian Economic Union (EAEU), i.e. those with citizenship of Belarus, Armenia, Kyrgyzstan or Kazakhstan. Citizens of EAEU countries can register as a self-employed citizen through the “My Tax” mobile application or the personal account of a self-employed person.

Citizens of states that are not members of the EAEU cannot apply the special tax regime of the NAP.

Amount of pension contributions for the self-employed

The rules for interaction between the self-employed and the Pension Fund are defined in Art. 29 of the Law “On Compulsory Pension Insurance”. There are two directions in which contributions can go - the insurance and funded parts of the pension. Regarding insurance payments, the conditions are somewhat different for different categories of self-employed. And in terms of savings, they are the same for everyone.

Self-employed tax payments are in no way related to pension contributions . They do not decrease by the amount of expenses, as happens with individual entrepreneurs. And insurance premiums do not depend on the amount of income. That is, no one will control how much of the proceeds goes to future pensions.

Mandatory pension insurance

The calculation period for contributions to compulsory pension insurance is a calendar year. For this period, the maximum and minimum possible amounts are established, and credit is taken based on length of service and pension points. If a person applied to the fund not from the beginning of the year, a proportional calculation is made for the number of months and days remaining until December 31.

The exact amount of contributions remains at the discretion of the payers themselves. It can be round or with pennies, a multiple of the established minimum or not. Restrictions exist only on payments per year.

To understand the entire system, we can single out a conventional unit of account - about 30 thousand rubles. per year (or 2,500 per month), which approximately corresponds to the minimum contribution. For this, the insured receives 1 year of service and 1 pension point. And after retirement, he will have the right to minimum insurance payments. If you pay less, both indicators decrease proportionally. With a larger contribution amount, additional points are awarded, but the length of service does not increase. This unit is convenient to use for calculations, for example, how much is missing to calculate an insurance pension. This will make it easier to plan payments.

If Russians are ready to save for old age themselves, then these amounts are comparable to those with which the Pension Fund operates

Minimum and maximum contributions

There are two categories of self-employed, and the rules for them are different:

- Payers of professional income tax (PIT). They only have a maximum contribution limit. In fact, you can pay as much as your capabilities allow and common sense dictates.

- Nannies, tutors, nurses, house helpers who do not pay taxes. In this case, there is a minimum and maximum limit.

Maximum contribution rates are tied to the minimum wage approved at the federal level. That is, you will only be able to find out the exact figure for the current year. In 2021 it is 11,280 rubles.

The minimum amount of contributions is calculated as follows: minimum wage x insurance premium rate (22%) x 12 months. This is 29,779.2 rubles. in 2019. That is, approximately the amount that we took as a conventional unit. The maximum size is 8 times the minimum - RUB 238,233.6. for 2021.

Video: how a self-employed person can earn money for retirement - commentary from the Pension Fund of Russia

Funded pension

The savings system works as an investment that generates income. And all the risks and benefits are associated with this. The rules for the formation of a funded pension are described in laws 56-FZ of April 30, 2008 and 424-FZ of December 28, 2013.

Contributions to the funded part of the pension are not converted into points, but are calculated in monetary terms. To place funds, you can choose one of the funds or a management company, and then change your decision. Children and grandchildren will inherit the money if the payer himself did not have time to use it.

The Pension Fund offers self-employed people to make contributions on a voluntary basis and participate in the state co-financing program. There are no restrictions on the amount of contributions. But there is an essential condition: if an amount from 2,000 to 12,000 rubles is received in a year, it is doubled at the expense of the state. And their consultants are happy to talk about the rules of operation of non-state funds.

How does a future pension depend on the amount of contributions?

We can speak very conditionally about the return on pension contributions. A pension is a long-term project, and legislation changes frequently. And this is the main problem of calculations. Another difficulty is the many variables that depend on the decisions of the authorities and the state of the economy.

The insurance part of the pension is calculated using a special formula. What the payer himself can control here is the length of service and pension points (officially this is called the IPC - individual pension coefficient). To calculate, the total number of points must be multiplied by the cost of one point at the time of applying for a pension. The latest indicator is officially approved for each year. For now, the figures are available until 2024. Therefore, the amount received will be relevant if you retire in the near future. That is, you cannot calculate from contributions what your pension will be in 10 or 20 years. You can only understand the pattern - more or less than others.

The pension consists of several parts, which are calculated differently

An important point is the right to receive an insurance pension. It occurs if a person has the minimum required experience and number of points. And here it is worth deciding whether it makes sense to apply for payments. It is possible that a person has not worked for a long time or has worked without official registration. Previously, there were no deductions, and for years of self-employment it was impossible to pay large contributions. If you don’t reach the minimum, it’s better to forget about deductions - the money will be lost. In another situation, it would be wiser to spend money on contributions in order to cross the minimum threshold.

It’s not so simple with savings either. For example, due to the crisis, it was decided to freeze funds in the Pension Fund, in other words, to transfer them to the insurance part. In fact, this is the collapse of the system. In such realities, it’s time to think about whether it’s worth the risk. After all, it’s your money, not your employer’s.

Table: indicators by year for calculating pensions

| Year of retirement | Minimum IPC amount to receive a pension | Minimum insurance period for retirement | Cost of IPC in rubles |

| 2019 | 16,2 | 10 years | 87,24 |

| 2020 | 18,6 | 11 years | 93 |

| 2021 | 21 | 12 years | 98,86 |

| 2022 | 23,4 | 13 years | 104,69 |

| 2023 | 25,8 | 14 years | 110,55 |

| 2024 | 28,2 | 15 years | 116,63 |

| 2025 and beyond | 30 | 15 years |

Examples of calculations

Let's calculate the minimum you need to pay to qualify for an insurance pension. If a self-employed person has not made contributions before and will not retire soon, he will need 15 years of experience and 30 pension points. To do this, you need to pay contributions for 30 years at the minimum rate or 15 at the double rate.

Let's consider a situation where a person previously worked under an employment contract and deductions came from the employer. And then I decided to go self-employed. Let’s say the salary was small, during employment, 10 years of experience and 10 points were accumulated. This is not enough for an insurance pension. Therefore, a person is faced with the task of “earning” five years of experience and accumulating 20 points. There are options here: pay contributions for 5 years at the minimum rate x 4 (approximately 120 thousand per year), 10 years at a double rate, or 20 years at the minimum. If the salary was high before, the starting conditions may be different - for example, 10 years of experience 30 points. Then the task is simplified - it’s 5 years of payments at the minimum rate. Everything else will go towards increasing benefits.

As a rule, employees have higher pensions than the self-employed. This happens because the average annual payment to the Pension Fund for an employee in the region is 92.8 thousand rubles, and for the self-employed population - 44 thousand rubles. in year. Hence the difference in pension amounts.

Elena Andrusenko, head of the department for organizing the assignment and payment of pensions, Branch of the Pension Fund of the Russian Federation in the Khabarovsk Territory

https://www.consultant-dv.ru/periodika/gazeta-vernoe-reshenie/vypusk-10–20–10–17/kak-samozanyatym-grazhdanam-zarabotat-dostoynuyu-pensiyu/

Now let’s determine the increase in pension from contributions for a specific year. For example, a person pays the maximum rate (RUB 238,233.6 in 2021), he will receive 8 points for this. Then everything will depend on when he retires. The additional payment in 2021 will be: 8 x 93 = 697.92 per month. In 2024 it will be 8 x 116.63 = 933 rubles.

Video: negative opinion about pensions for the self-employed

How to determine the optimal contribution amount

It would be wisest to seek advice from the Pension Fund. Before that, solve a few problems:

- Find out the current amount of pension capital. This information can be obtained in person at the fund at the place of registration or remotely by ordering a certificate of personal account status through your personal account or the State Services portal.

- Make an approximate calculation of your future pension using a calculator.

- Decide on your wishes for retirement - whether it will be the legal minimum, the optimal middle or the highest possible payments.

- Select the principle of pension formation (insurance, funded).

- Calculate the amount that can be allocated for contributions per year.

The answer will depend on the balance of priorities and capabilities. Knowing the initial data, the fund's employees will suggest possible options and help with advice. But the decision remains with the person himself.

Conditions for applying the special NPD regime

To apply the experimental special regime, several conditions must be met, in particular, there are restrictions on the region of the Russian Federation, income limits, types of activities and a ban on hiring employees working under an employment contract. This is why Russians so persistently search for information on the Internet using the queries “self-employed citizens types of activities tax”, “self-employed maximum income” or “tax on self-employed”.

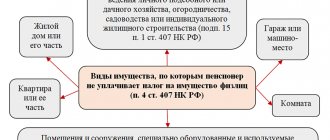

Personal income tax, VAT and insurance premiums

Are you looking for up-to-date information on the topics “what taxes do self-employed people pay”, “self-employed people taxes” or “self-employed Tax Code”? This is understandable, since the NAP exempts from personal income tax income that is taxed under this special tax regime, but individuals must pay personal income tax on other income. Under the special regime, self-employed citizens also do not need to pay mandatory insurance premiums.

What are the benefits of the special regime for the self-employed?

The special NAP tax regime was created specifically to bring millions of Russians with unofficial income out of the “shadow”, and therefore is maximally beneficial for self-employed citizens.

Taxes and fees

Self-employed citizens are exempt from the obligation to pay insurance premiums. At the same time, the NPT rate is lower than the personal income tax - when receiving income from an individual, the tax rate is 4%, from an individual entrepreneur or legal entity - 6%. If you have no income, you do not need to pay tax. How to pay tax as a self-employed person using the My Tax app for self-employed people? Accounting for tax rates and calculation of the tax amount payable is carried out automatically by the My Tax application.

Reports and cash register

Self-employed citizens do not need to submit any declarations or reports. To make payments to clients, you do not need to buy an online cash register - a receipt is automatically generated in the My Tax application.

Contributions of self-employed people to the Social Insurance Fund

A self-employed person can pay insurance contributions, like pension contributions, on a voluntary basis. But only if he operates as an individual entrepreneur under the NAP (self-employed tax) regime.

Another useful article: Analysis of the law on self-employed: everything you wanted to know

A self-employed individual entrepreneur can pay insurance premiums for himself when submitting an appropriate application to the Social Insurance Fund. It is better to do this before December 31, 2020: in this case, individual entrepreneurs on NAP would have the opportunity to receive money for sick leave and some payments for children from the beginning of 2021.

Now, having submitted an application for voluntary transfer of contributions, individual entrepreneurs will receive the right to payments from the Social Insurance Fund only from 2022, not earlier. The amount of insurance premiums in 2021 was 4,221.24 rubles.

They won’t pay me sick leave, but I can save money on premiums...

That is, a minimum set of options is available to the self-employed, but for services beyond compulsory health insurance you will still have to pay out of your own pocket. No one will pay sick leave or maternity leave for self-employed individuals.

Those self-employed people who are individuals and not individual entrepreneurs cannot voluntarily act as insurers in an agreement with the Social Insurance Fund; they are only entitled to health insurance under compulsory medical insurance policies.

So, the only mandatory contributions of self-employed people are their tax contributions. They amount to 4-6% of the income received or slightly less, taking into account the application of tax deductions.

Another useful article: Is it worth becoming self-employed: the pros and cons of self-employment

Self-employed people can make pension contributions to accumulate work experience when submitting an application for a voluntary transfer of funds to the Pension Fund, in which case they will be credited with years and points in proportion to the amounts contributed.

But only individual entrepreneurs in self-employment mode can transfer money upon application to the social insurance fund; for other self-employed people this opportunity is not provided for by law. This deprives self-employed non-individuals of the right to receive payments during a period of temporary disability (due to illness or maternity leave).

(Visited 1,448 times, 2 visits today)

Self-employed in the Russian Federation

Self-employedv.rf is an information portal for self-employed people. Relevant and interesting information, answers to important questions and solutions to non-standard problems of the self-employed.

What are the penalties for self-employed people?

For violation of the procedure or deadlines for transmitting information about settlements to the tax office, a fine of 20% of the settlement amount is established for the self-employed. In case of repeated violation within six months, the fine will be 100% of the settlement amount. However, the minimum size of the sanction is not limited. Thus, if you do not provide information on a 200-ruble settlement, then a fine of 20% of the settlement amount will be 40 rubles (provided that this is not a repeated violation within six months).

Contributions to the Pension Fund

Self-employed people can make all other contributions if they wish. For example, if a self-employed person needs to accumulate years of experience or points, he can contact the Pension Fund with an application for voluntary payment of pension contributions to the fund.

Another useful article: Tax deduction for the self-employed

You can submit an application:

- in writing to the Pension Fund office at your place of residence;

- in electronic form through your personal account on the website of the Pension Fund or the Federal Tax Service of the Russian Federation;

- through the “My Tax” mobile application.

After submitting the application, the self-employed will need to transfer pension contributions towards the insurance pension. At the same time, the minimum amount of transfers is not limited, and the maximum in 2020 is 256,185.6 rubles.

However, it is worth considering that if the total amount of contributions for the past year is less than 32,023.2 rubles, then the year will not be counted in full, but in proportion to the money contributed and the time during which the self-employed person was in a voluntary relationship with the Pension Fund.

In other words, if the application was submitted not at the end of the previous year, but, say, in February or March of this year, then the required minimum for depositing money will be less, since it will no longer be possible to count the full year under these conditions.

We receive a pension, and you still have to save and save :)

How to become a self-employed citizen?

There are three ways to switch to the new tax regime for the self-employed. Register online using your passport through the “My Tax” mobile application, through the taxpayer’s personal account on the website of the Federal Tax Service of Russia or through an authorized bank.

Read the review article by portal experts about self-employment and the features of doing business as a self-employed person at the link.

Authors: Tatyana Knyazeva, Alexander Grishchenko Photo: vetkit, Dmyrto_Z, Professor25 / Depositphotos; NjoyHarmony, StartupStockPhotos, edar, Snatali / Pixabay