Supplement to pension

The legislation of the Russian Federation states that the payment of cash benefits, especially upon reaching retirement age, cannot be less than the minimum subsistence level. If the assigned pension is less than the approved figure, citizens can count on a social supplement upon presentation of the appropriate application and the necessary package of documents.

After approval, benefits will be assigned from the first day of the month following receipt of the application.

An additional payment to the survivor's pension for minors is assigned and paid automatically, without filing an application.

From what funds is the social supplement paid, including for the loss of a breadwinner?

- From the federal budget - assigned by the Territorial Department of the Pension Fund of Russia, provided that the pension amount does not reach the official subsistence minimum established by the state.

- From the regional budget - considered and assigned by the regional social protection body, provided that the pension amount is less than the regional subsistence level, but more than established by the state.

The cost of living on the territory of the Russian Federation in 2018 for minor citizens will be 9,756 rubles, for pensioners – 8,178 rubles.

Recalculation of survivor's pension

By April 1, 2021, the survivor pension will be recalculated, taking into account growing inflation and based on the level of the cost of living.

How will the amounts of pension payments change?

One of the biggest tragedies in life is the death of a loved one. It seems even more unfair when young people, full of strength and potential, die. Such death, as a rule, happens suddenly, unexpectedly for relatives and friends of the deceased.

Tragic events associated with the loss of a loved one can be aggravated in many ways if the deceased was the sole breadwinner for his family. In this case, its members find themselves in an extremely difficult and socially dangerous situation due to the lack of sources of livelihood.

However, the current Russian legislation in this case establishes that persons who were dependent on the sole deceased breadwinner have the right to receive special material payments - pensions. Its size, calculation procedure and grounds for appointment largely depend on the nature of the deceased’s work activity. These and some other features of survivor benefits payments will be discussed further.

How to apply for survivor benefits?

To begin the registration procedure, you need to submit an application to the social protection authorities at your place of residence.

The following must be submitted along with it:

- passport of a citizen of the Russian Federation;

- for a dependent under 14 years of age - birth certificate;

- documents confirming family ties;

- evidence that the breadwinner has died or gone missing;

- documents confirming dependency;

- a certificate of the average salary received by the breadwinner for the last five years;

- certificate of insurance experience of the breadwinner;

- a document confirming the work experience of the breadwinner (work book - for civilians, military ID - for military personnel).

In some cases, the authorities involved in assigning payments may require additional documentation. In the case of a minor dependent whose interests are represented by a guardian, the presence of documents confirming this is required. For persons over eighteen years of age applying for a survivor's pension, a certificate will be required confirming that the person sought is undergoing full-time training.

An application for a survivor's pension submitted to government agencies is considered within ten days. If a positive decision is made, accrual will be carried out from the moment the necessary documentation is submitted. This payment is assigned once, but there are exceptions. They include persons under twenty-three years of age, as well as disabled people.

What laws govern the assignment of survivor benefits?

The legislation of the Russian Federation establishes a unified list of grounds for calculating this type of payments, and also regulates their purpose, as well as their termination.

When studying this issue, first of all, one should rely on the provisions of the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Security in the Russian Federation.” It contains the basic concepts and principles of material support for various categories of citizens entitled to state support.

Among other things, the norms of this federal law establish the procedure for assigning a state pension for the loss of a breadwinner.

No less important is the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”. In particular, Article 10 of this regulatory document determines the conditions for the appointment of an insurance pension paid to citizens in the event of the loss of a breadwinner.

Conditions for assigning an insurance pension in case of loss of a breadwinner

The following have the right to an insurance pension in the event of the loss of a breadwinner:

- disabled family members of the deceased breadwinner who were dependent on him (with the exception of persons who committed a criminal offense that resulted in the death of the breadwinner and was established in court);

- one of the parents, spouse or other family member specified in clause 2, part 2, art. 10 Federal Law dated December 28, 2013 N 400-FZ “On insurance pensions” (regardless of whether or not they were dependent on the deceased breadwinner).

The family of an unknown breadwinner is equated to the family of a deceased breadwinner if the unknown absence of the breadwinner is certified in the prescribed manner (namely by the court, Article 42 of the Civil Code of the Russian Federation).

Thus, in order to assign an insurance pension in the event of the loss of a breadwinner, the following conditions must be met:

- the deceased breadwinner has an insurance period (at least one day);

- the death of the breadwinner is not associated with the commission by a disabled family member of an intentional criminal act that resulted in the death of the breadwinner and was established in court.

Subject of the pension legal relationship in the event of the loss of a breadwinner:

- the family as a whole, but first the right to it of each family member individually is determined.

The concept of “disability” covers such diverse phenomena as:

- disability, i.e. disability of one of three degrees;

- inability to work due to the need to care for children under 14 years of age;

- presumption of incapacity for work by age - up to 18 years of age (students up to 23 years of age) and after men reach 60 years of age, women 55 years of age.

Grounds for receiving benefits

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

Russian pension legislation distinguishes three forms of survivors' pensions, the procedure for assigning them has its own specifics. Let's look at it in more detail.

- Insurance pension. It can be claimed by persons who were supported by a citizen who had insurance experience, that is, officially carried out labor activities with contributions transferred to the state pension fund for him. It should be noted that the work experience of the deceased in this case is not a fundamental condition for the assignment of benefits, but directly affects its size.

- Social pension. This type of pension is paid to the dependents of the deceased, if the latter had no insurance experience at all, that is, he never worked within the framework of labor legislation. When determining the type of appointment, only the periods of transfer of insurance premiums are taken into account. If the deceased breadwinner worked “unofficially,” this does not give the right to receive an insurance pension, the amount of which is higher than that of a social pension.

- State pension. Persons who were dependent on a deceased serviceman (or an employee of another structure equivalent to the army) can apply for it. It is calculated in a special manner, and payments are made from the federal budget.

The basis for assigning any type of pension provision from the above is the fact of the death of the breadwinner and being dependent on him.

Such dependents must include relatives of the deceased. This circumstance largely specifies the circle of possible recipients of the benefit in question.

Who should

So, relatives of the deceased breadwinner who were on his full financial support and do not have employment opportunities or other ways to obtain money for subsistence can apply for cash payments:

- children under the age of majority;

- adult children who are studying full-time primary, secondary and higher vocational education programs, under the age of 23;

- other minor relatives (brothers, sisters, grandchildren);

- parents, spouses if they do not have the opportunity to receive a permanent income, as well as those with a disability group;

- Grandmothers and grandfathers.

In addition, the right to receive financial payments can be exercised by persons who actually care for the minor child of a deceased citizen until he turns 14 years old. An important condition for this is the absence of an official place of work and, as a consequence, other income, in addition to this type of financial assistance.

Categories of disabled citizens

The legislation of the Russian Federation defines the following categories of citizens who, after the death of their breadwinner, have the right to receive financial benefits:

- Minor children, as well as disabled children, for whom the deceased was the father/mother, grandmother/grandfather, brother/sister. If a minor’s father or mother has died, survivor benefits for the child will be provided even if there is only one able-bodied parent.

If a citizen does not undergo full-time study at a vocational school or university, payments will be provided until the age of 18, but if the child is a full-time student, the benefit will be transferred until the age of 23.

- Wife/husband, mother/father, grandfather/grandmother of the deceased, provided that they have reached retirement age or are officially recognized as disabled.

- Wife/husband, father/mother who have lost their main source of income and acquired the status of disabled.

- Relatives of the deceased who are raising his child, provided that he is under 8 years old.

Please note: citizens who, through their intentional actions, provoked the death of the breadwinner are deprived of the opportunity to receive survivor benefits. Mandatory condition: this fact must be proven in court.

How to make a payment

The survivor's pension is not established automatically only upon the fact of his death. To apply for benefits, a citizen who has the right to do so should contact the appropriate institution with an application.

Thus, for recipients of an insurance or social pension, such an institution is the state pension fund, since it is from its funds that it will be paid.

There is a separate treatment procedure for dependents of a deceased serviceman. They must submit an application to the department in which the deceased carried out official activities.

For example, if the deceased was a police officer, then you should apply for the appointment of security to the Ministry of Internal Affairs. The pension for this category of persons will be paid from the federal budget.

Citizens must attach the following documents and their copies to the corresponding application in the established form:

- identification document;

- death certificate of a citizen;

- documents confirming relationship;

- work book of the deceased;

- documents confirming the fact of being a dependent (for example, a certificate of family composition).

This list is basic; employees of the Pension Fund or other government agency may request other documents if necessary.

You can apply for payments at any time, starting from the date of death of the breadwinner.

You can apply for benefits either personally or through a representative. In the latter case, the authorized person must have a duly executed written power of attorney.

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

In addition, it is possible to apply for a pension through multifunctional centers, as well as submit documents online through the State Services portal.

Subtleties of registration for a child

Due to obvious features, a young child cannot independently apply for survivor benefits. In this case, all the necessary procedures are carried out for him by his legal representative. This can be either the child's parent or his guardian .

In this case, an appeal to government authorities occurs on the same grounds and in the same manner as when an application is submitted by an adult citizen.

Separately, mention should be made of the peculiarities of receiving funds by an adult citizen who is a student of an educational institution. In this case, he independently provides a certificate issued at the place of study.

If a student is expelled before he reaches the age of 23 or switches to distance learning, the payment of the pension is terminated.

How is it calculated?

The survivor's pension in 2021 is accrued to the local post office, which is located at the place of residence or to the balance of organizations involved in organizing the delivery of pension payments to your home. In the case of mail, delivery of benefits to the apartment is carried out on the basis of a schedule according to which an individual date of receipt is assigned, while payments can be transferred within the delivery period.

It can be transferred to a bank account or a card issued to it for the convenience of withdrawing funds. The pension is delivered on the day the funds are received, transferred by the territorial representative office of the pension fund. Money is available for daily withdrawal, but after it is credited. Financial receipts coming to a pensioner’s account at a credit institution are not subject to a commission fee.

The choice of the method of calculating benefits or changing it is carried out by notifying the Pension Fund (PFR) using two methods:

- by writing a request to the territorial body of the Pension Fund that assigned the pension and filling out a form to choose the method of calculating funds;

- electronic notification sent through your personal account on the pension fund website.

If the recipient of the pension is a minor child, then the pension under 18 years of age can be transferred both to his personal bank account, registered by an official representative (adoptive parent or trustee), and to the balance of the guardian’s card. Upon reaching 14 years of age, he has the right to independently receive the established pension at the post office or to a bank account.

- Causes of pain in the left lower abdomen in men and women

- Potatoes with mushrooms in the oven: recipes with photos

- Pork knuckle baked in the oven

Additional payments up to the cost of living

This type of compensation is provided to pensioners who are disabled and whose total financial support is below the level of the subsistence level (SMP) or (SMG) - a citizen and the average salary in the region of residence. There are two types of surcharges:

- federal surcharge. It is accrued by local branches of the pension fund when the amount of total material support is below the subsistence level, which is established in the region and does not reach the PMP (the subsistence level of a pensioner) in the country.

- regional. Accrued by a representative of the social protection committee with a slight increase in the PMP in a constituent entity of Russia compared to the same indicator for the country, but in total lower than the regional PMP.

For the working-age population who is eligible to receive benefits, adjustments to additional payments are made based on the average salary.

Payment amount and calculation procedure

The amount of pension provision depends directly on its type, since separate calculation methods are provided for each of them. Let's take a closer look.

Insurance pension

The amount of material support in this case is not the same for all its recipients. It directly depends on the volume of accumulated pension rights of the deceased citizen.

Thus, a survivor's pension consists of two parts - a fixed payment and the insurance part itself . If, for example, a minor has lost one breadwinner, then he is entitled to 50% of the fixed payment, and if both, then 100%. The payment amount in 2021 is 5334.19 rubles.

The insurance part depends on the accumulated points and their value. In 2019, the cost of 1 point is 87.24 rubles.

Example of calculation per child

Let's simulate a situation where in a complete family a child lost his father, who was officially employed. Accordingly, over the entire period of his working life he accumulated 40 pension points. The calculation procedure will be as follows:

Thus, the amount of the pension paid to the child will be 6159 rubles 19 kopecks.

Social pension

The size of the social pension for the loss of a breadwinner is uniform and is set at 5034.25 rubles. This amount doubles if both breadwinners die.

State (military) pension

In this case, the form of military service and the circumstances of death play a role.

Thus, dependents of conscripts have the right to receive benefits in the amount of 200% of the social pension if death occurred from a military injury, and 150% if the soldier died from a disease.

Accordingly, dependents of contract servicemen receive an amount equal to 50% of his salary in his last position in circumstances of death related to injury, and at least 40% of the salary if the military man died of illness.

Structure, calculation and amount of payments

The relevance of insurance pensions in the event of the loss of a breadwinner is ensured by the state. That is, every year all payments are necessarily indexed in due time, like any other security from the state.

Correct calculation

To make it clear how the benefit is calculated, it would not hurt to take a closer look at the structure of the survivor's insurance pension. The amount of payments can be determined using two basic formulas. Experts usually choose the more appropriate one, depending on whether the person was a real pensioner at the time of death or continued to work. The security will be assigned not to just one of the possible candidates, but to everyone who has the right to it, without limitation on the number of persons.

For deceased pensioners

SPspk = IPK x SPK

Let's decipher the abbreviations

SPspk - the final amount of the insurance pension in the event of the loss of a breadwinner to be paid.

IPC – personal (individual) pension points accumulated by the deceased breadwinner during his working life.

SPK – the cost (real price) of one point at the time of death of the breadwinner and paperwork. For 2021, the amount was 78 rubles 58 kopecks.

For the dead workers

SPspk = IPKu / KN x SPK

Let's decipher the abbreviations

SPspk - the final amount of payment for the loss of a breadwinner.

IPKu – pension points (coefficients) of a deceased person, collected at the time of death.

KN – the number of dependents (those in need) who require material support.

SPK is the price of one pension coefficient.

Recalculation

This procedure can only be carried out if the insurance premiums of the deceased breadwinner were not fully taken into account during registration. Moreover, such an action will be carried out only once, on the first of August of the year, which follows when the person who was considered the main breadwinner died.

SP2 = SP1 + (IPK / K / KN x SPK)

Let's decipher the abbreviations

SP2 – the amount of payments that will be obtained after recalculation.

SP1 – the amount of security paid as of July of the year in which the recalculation is made.

IPC – pension points collected by the deceased.

K is the direct ratio of the deceased’s insurance experience at the time of his death to 180 months.

KN - the number of dependents who should receive benefits. It is also calculated at the time until July of the year in which the recalculation is made.

SPK – The price of one pension point, relevant at the time of recalculation.

Features and nuances

It is imperative to take into account the individual characteristics of each specific case, because the size of the final payments (survivor's insurance pension) will directly depend on them.

- The insurance pension for children who have become orphans (lost their father and mother) implies that the pension points (IPC) of both parents will be summed up.

- Payments for those who have lost their only breadwinner - a single mother can count on her IPC being multiplied by two.

- The size of the points can be calculated taking into account the increasing coefficient.

Similar coefficients, as in the last paragraph, can be used only in two cases. Firstly, if the deceased person had not previously written an application for an insurance pension and did not receive it, and secondly, if he deliberately refused it, which happens much less often.

Minimum size

According to the legislation of our country, the minimum amount of insurance pensions, as well as payments for the loss of a breadwinner, can be varied and vary from region to region. However, it cannot in any way be less than the minimum subsistence level established by the state, which can also vary significantly in different regions. If the final benefit amount is below this level, then a social supplement will be assigned, which is non-applicant, that is, it will be added automatically.

- The minimum as of April 1, 2021 in the country was exactly 4959 rubles 85 kopecks, with the loss of one breadwinner.

- The minimum security for the loss of both earners was 9919 rubles 70 kopecks.

As already mentioned, in the event of a complete lack of work (insurance) experience for the deceased, all dependents may be assigned social benefits in the same amounts as indicated above.

Conclusion: suspension of payments

If desired, an approximate calculation of the insurance pension in the event of the loss of a breadwinner will not be so difficult, but still these figures are only an approximate amount, nothing more. You should not be surprised if the benefits calculated by the experts of the Pension Fund of the Russian Federation differ slightly in one direction or another. But in addition to the appointment, upon the occurrence of certain conditions, a termination of payment may be issued.

- If the child is eighteen years old, and a certificate of enrollment in an educational institution for in-patient study is not provided to the Pension Fund of the Russian Federation or the social security service, then payment of benefits will not be made. If such a paper is issued, then payment will last up to 23 years.

- When a disabled citizen, after coming of age, decided to enroll in an educational institution, but for some time could not provide a certificate of enrollment (the period of admission and passing exams, for example), then the payment may be withdrawn or suspended. After enrollment in a university, it can be restored, or it can be assigned again.

- If, after the death of the spouse, the widow receiving payments remarries or gets a job, then she will not be paid a pension.

- When a student transfers to part-time study and/or is employed, the payment will be completely stopped.

- When the disability of the dependent of the deceased, according to the decision of the ITU commission, is completely removed, the benefit will stop being paid.

If any of the situations listed above occurs, the recipient of a pension for the loss of his breadwinner is obliged to inform the Pension Fund of the Russian Federation as soon as possible about a change in his status. If a person hides such facts, then an overpayment may occur. When the real situation is clarified, it will definitely be exacted, either voluntarily or in court. So it’s better not to hide such nuances from the state, so as not to rack your brains about how to pay off your debts.

When benefits stop being paid

The survivor's pension ceases to be paid when the grounds for its assignment in terms of the citizen's incapacity for work cease.

This, among other things, could be:

- reaching adulthood;

- termination of education or reaching the age of 23 years (for full-time students);

- removal of disability group;

- employment;

- receiving other social benefits.

The survivor's pension is an important support measure for citizens who have lost loved ones and are left without a source of livelihood. There are three types of this form of pension provision, depending on the length of service and the nature of the work activity of the deceased, the amounts of payments for which vary significantly.

Benefit for caring for a child under 14 years of age in case of loss of a breadwinner

- education in universities at the expense of budgetary funds;

- free medicines and medical care;

- housing from a specialized fund;

- unemployment benefits for 6 months from the date of graduation, but subject to registration with the Labor Exchange and job search;

- free legal assistance in case of violation of the rights of an orphan.

We recommend reading: Apartment inherited by will, taxes

That is, he does all the work that his relative cannot do due to illness or infirmity; Fulfills spiritual wishes - conducts conversations, listens, gives advice, etc. The size of the survivor's pension was indexed on 04/01/2018.

Useful video

For changes in survivor benefits in 2021, watch the video:

A survivor's pension is provided to every child whose parents or other persons in whose care he was have died. Such payments continue up to 18 years, and in some cases for life, and are regulated by Article 10 of Federal Law No. 400-FZ “On Insurance Pensions”.

There are three types of survivor pension for children:

- insurance;

- social;

- state

The size of monthly payments, terms of assignment and categories of recipients depend on the type.

- Until what age are pensions paid?

- Insurance pension

- Indexation procedure and amount of insurance pensions

- How to apply

- Example: payment deadline

- Example: if husband and wife are divorced

- What documents are needed

- An example of calculating an insurance pension

- Example: calculating pensions for two children

- Example: for orphans

- Social pension for a child for the loss of a breadwinner

- How much will social pensions increase from April 1, 2021?

- List of documents for obtaining a social pension

- State survivor's pension

- Registration procedure

- Amount of state pensions

- Survivor's pension under the Ministry of Internal Affairs

- Amounts of benefits for the loss of a breadwinner through the Ministry of Internal Affairs

- An example of calculating a pension through the Ministry of Internal Affairs

- Special cases

What is the loss of a breadwinner?

At the state level, it has been established that the loss of a breadwinner is considered to be the death or absence of a person providing for disabled citizens who are part of the family. In order to confirm the absence of a breadwinner, it is necessary to prepare the appropriate documents. In the event that citizens of the Russian Federation, for certain reasons, cannot provide documentation stating that there is no loss of a breadwinner, confirmation of this fact occurs in accordance with the civil code of the country. The survivor's pension, in turn, is paid if a certain citizen dies or disappears. It is financial assistance that is paid every month. A prerequisite for receipt is confirmation of the fact of incapacity for work of those dependents whom a previously identified person provided for. Unfortunately, the pension amount set by the government cannot fully compensate for the amount the breadwinner previously earned.

Insurance pension

The main condition for assigning a survivor's insurance pension to children is an official work experience of at least 6 months.

If the child was dependent on other close relatives, he was also entitled to state support. Breadwinners are recognized as: brothers and sisters, grandparents.

An insurance pension is not assigned to persons if it is proven in court that the death of the breadwinner was their fault; they are assigned a social pension.

Indexation procedure and amount of insurance pensions

Payments are calculated using the formula:

- IPC - individual pension coefficient (pension point). It depends on the insurance period and income of the taxpayer. If a child’s two parents have died at once, then the IPC of both of them is added up during the calculation. If the child was raised by a single mother, then the coefficient doubles. If at the time of death the breadwinner was receiving a disability or old-age pension, then when calculating the pension, the IPC is divided by the number of disabled relatives who were dependent on the deceased.

- SPK is the cost of one pension point as of the day from which the insurance pension is assigned. In 2021, the SPK is set at 87.24 rubles .

- FV - fixed payment. The size of the fixed payment is set by the state and indexed annually. In 2021 it is 2667 rubles. Children who have lost both parents receive a fixed part of the pension in double size - 5334 rubles.

Indexation of insurance pensions for the loss of a breadwinner took place on January 1, 2021 in accordance with Law No. 350-FZ “On amendments to certain legislative acts of the Russian Federation on the assignment and payment of pensions.” The indexation coefficient is equal to the actual inflation recorded in the country at the end of last year and this year it amounted to 7.05%.

How to apply

To apply for a survivor's insurance pension, you need to contact the Pension Fund branch at your place of residence or a multifunctional center. The interests of minors can be represented by a legal representative or guardianship officials.

The application is submitted personally by the dependent of the deceased, electronically on the Pension Fund website, or by mail. In the latter case, the date of application is determined by the postmark.

There is no statute of limitations for assigning an insurance pension; you can apply for it even several years after the occurrence of the insured event.

If the application was submitted within a year after the loss of the breadwinner, then the pension is assigned from the date indicated on the death certificate. If more than a year has passed since his death, then the payment is assigned for the 12 calendar months preceding the day of application.

Example: payment deadline

Oksana's dad died on December 20, 2021. Oksana’s mother went to the Pension Fund on March 1, 2021.

Oksana will receive payment for 10 days of December, January and February. Starting from March, the girl’s pension will be paid monthly.

Example: if husband and wife are divorced

Vova’s mom and dad were divorced and did not keep in touch with each other. The father died on July 13, 2012, when the boy was 2 years old. Mom found out about this only in February 2021. Immediately after this, she contacted the Pension Fund to apply for benefits.

Vova will receive monthly pension payments from the date of application. Additionally, he will be paid the amount for the 12 calendar months preceding the date when the boy’s mother wrote an application for a survivor’s pension for her child.

The processing time for applications is 10 working days.

This type of state support also applies to children who are Russian citizens and do not live in the country. To process payments, they need to contact the Pension Fund of Russia, at the address, Moscow, st. Shabolovka, 4.

What documents are needed

The standard package of documents includes:

- statement;

- identification document: passport or birth certificate;

- documents confirming relationship with the deceased;

- documents confirming the insurance experience of the deceased;

- certificate of education for persons studying full-time at universities;

- certificate of disability for children with disabilities.

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

When making payments, adults representing the interests of the child must present documents proving their identity and degree of relationship.

An example of calculating an insurance pension

In the family, father Denis was a driver, and mother Oksana was a salesman. Together they raised two children - Seryozha and Sveta.

Example: calculating pensions for two children

Trouble happened - in March 2021, dad died in an accident and mom began to apply for a survivor's pension for Sveta and Seryozha.

Since dad was officially employed, the pension for each of the two children is calculated as follows:

At the time of Denis’ death, the IPC was equal to 117.4, the SPK was 78.58 rubles, and the fixed payment amount was 2,402.56 rubles.

We get: 117.4:2 × 78.58 + 2402.56 = 7015.21 rubles for each child.

Example: for orphans

After a family tragedy, my mother fell ill and died a year later. The grandmother of Sveta and Serezha applied to the Pension Fund to arrange another pension for her grandchildren.

The new pension is calculated for each child as follows:

(Mom’s IPC + Dad’s IPC): 2 × SPK + FV × 2

At the time of her death, she had an insurance score of 98.3.

We get: (117.4 + 98.3) : 2 × 78.58 + 2402.56 × 2 = 13279.97 rubles for each child.

Assignment and payment of a survivor's pension

The establishment of insurance pensions and the payment of insurance pensions, including the organization of their delivery, are carried out by the body providing pensions in accordance with the Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation”, at the place of residence of the person applying for insurance pension.

Citizens can apply for the establishment, payment and delivery of an insurance pension directly to the body providing pensions, or to the multifunctional center for the provision of state and municipal services at their place of residence if there is a connection between the body providing pensions and the multifunctional center for the provision of state and municipal services, an agreement on interaction has been concluded and the submission of these applications is provided for by the list of state and municipal services provided in the multifunctional center established by the agreement.

The Government of the Russian Federation determines (Article 21 of the Federal Law):

- list of documents required to establish an insurance pension, establish and recalculate the amount of a fixed payment to an insurance pension (taking into account the increase in the fixed payment to an insurance pension),

- rules for applying for the specified pension, a fixed payment to the insurance pension (taking into account the increase in the fixed payment to the insurance pension), including employers,

- rules for assigning (establishing) and recalculating the amount of insurance pensions, including for persons who do not have a permanent place of residence on the territory of the Russian Federation,

- rules for transferring from one type of pension to another, conducting checks of documents necessary to establish the specified pensions and payments,

- rules for paying an insurance pension, a fixed payment to an insurance pension (taking into account the increase in the fixed payment to an insurance pension), monitoring their payment, checking the documents necessary for their payment,

- rules for maintaining pension documentation, as well as storage periods for payment files and documents on the payment and delivery of insurance pensions, including in electronic form.

Social pension for a child for the loss of a breadwinner

If the deceased did not officially work and there was no income to the Pension Fund on his behalf, the children are assigned a social pension. This type of payment is also due if the death occurred due to the fault of family members of the deceased.

A prerequisite for granting a social pension is the child’s permanent residence in Russia.

The size of the social pension for the loss of a breadwinner in Russia for 2019 was 5,034 rubles.

To apply for a social pension, dependents of the deceased apply to the branch of the Pension Fund of Russia or to the multifunctional center at their place of residence. You can submit an electronic application on the Pension Fund website or send documents by mail. The day of application is determined by the date the letter was sent.

When determining a pension, the period during which the child will receive monthly pension payments is immediately established. The pension is assigned from the beginning of the calendar month in which the application for its assignment was received, but not earlier than the day of death of the breadwinner.

If, upon reaching 18 years of age, a person who has lost a breadwinner is studying full-time at a university, an additional application to the Pension Fund will be required.

How much will social pensions increase from April 1, 2021?

An increase in social pensions for children who have lost their breadwinner is also carried out annually on April 1 within the framework of Law No. 166-FZ “On State Pension Provision in the Russian Federation”. The coefficient of increase in social pensions, as well as insurance ones, is tied to the level of inflation in the country. In 2021, it is expected to be 2.4%.

List of documents for obtaining a social pension

- application for a pension;

- identification document (passport or birth certificate);

- if the child does not yet have a passport, a document confirming citizenship and place of residence is required;

- death certificate of the breadwinner.

A certificate from the place of study, a certificate of disability, and a certificate stating that the child was raised by a single mother may be required.

Representatives of the child must present a passport, a certificate of authority to defend the interests of the child, which is issued by the guardianship and trusteeship authorities.

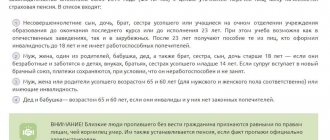

The circle of persons provided with a survivor's pension

The following are recognized as disabled family members of the deceased breadwinner:

- children, brothers, sisters and grandchildren of the deceased breadwinner who have not reached the age of 18, as well as full-time students in educational institutions of all types and types, regardless of their organizational and legal form, until they complete such training, but no longer than until they reach the age 23 years of age, or over this age if they became disabled before reaching the age of 18 years.

- one of the parents or spouse or grandfather, grandmother of the deceased breadwinner, regardless of age and ability to work, as well as a brother, sister or child of the deceased breadwinner who has reached the age of 18, if they are caring for children, brothers, sisters or grandchildren of the deceased breadwinner who have not reached 14 years old and entitled to a labor pension in the event of the loss of a breadwinner, and do not work;

- parents and spouse of the deceased breadwinner, if they have reached the ages of 60 and 55 years (men and women, respectively) or are disabled;

- grandfather and grandmother of the deceased breadwinner, if they have reached the ages of 60 and 55 years (men and women, respectively) or are disabled, in the absence of persons who, in accordance with the legislation of the Russian Federation, are obliged to support them.

More details (clause 2 of article 10 of the Federal Law)

- children, brothers, sisters and grandchildren of the deceased breadwinner who have not reached the age of 18, as well as children, brothers, sisters and grandchildren of the deceased breadwinner studying full-time in basic educational programs in organizations engaged in educational activities, including foreign organizations located outside the territory of the Russian Federation, if the referral for training was made in accordance with international treaties of the Russian Federation, until they complete such training, but not longer than until they reach the age of 23 years or children, brothers, sisters and grandchildren of the deceased breadwinner are older than this age if they became disabled before reaching the age of 18. In this case, brothers, sisters and grandchildren of the deceased breadwinner are recognized as disabled family members, provided that they do not have able-bodied parents;

- one of the parents or spouse or grandfather, grandmother of the deceased breadwinner, regardless of age and ability to work, as well as a brother, sister or child of the deceased breadwinner who has reached the age of 18, if they are caring for children, brothers, sisters or grandchildren of the deceased breadwinner who have not reached 14 years old and entitled to an insurance pension in the event of the loss of a breadwinner in accordance with paragraph 1 of this part, and do not work;

- parents and spouse of the deceased breadwinner, if they have reached the ages of 60 and 55 years (men and women, respectively) or are disabled;

- grandfather and grandmother of the deceased breadwinner, if they have reached the ages of 60 and 55 years (men and women, respectively) or are disabled, in the absence of persons who, in accordance with the legislation of the Russian Federation, are obliged to support them.

It is important to note that brothers, sisters and grandchildren of a deceased breadwinner acquire the right to a pension only if they do not have able-bodied parents obligated by law to support them. According to the Family Code of the Russian Federation, deprivation of parental rights, as well as serving a sentence in prison, does not relieve parents of the obligation to support their children.

Family members of the deceased are considered dependent on him if they were fully supported by him or received assistance from him, which was their constant and main source of livelihood. The assessment of the amount of actual assistance of the deceased breadwinner is carried out by the territorial bodies of the Pension Fund of the Russian Federation on the basis of available documents (for example, certificates from housing authorities or local self-government bodies about cohabitation, certificates of income of family members, receipts for postal orders, etc.). In the absence of documents, the fact of dependency can be established by the court.

The duration of dependence, as a rule, does not matter (an exception is provided for stepfather and stepmother).

Dependency of children (including adopted children) is assumed and does not require proof. For example, for pension provision, it does not matter the fact that the father lived separately from the children and did not actually provide them with any assistance, that the child was born after the death of the father, or that the child’s mother died during childbirth, etc. But children declared fully capable must confirm fact of dependency.

Adoptive parents have the right to an insurance pension in the event of the loss of a breadwinner on an equal basis with their parents, and adopted children - on an equal basis with their own children. Minor children entitled to an insurance pension in the event of the loss of a breadwinner retain this right upon adoption.

The stepfather and stepmother have the right to an insurance pension in the event of the loss of a breadwinner on the same basis as the father and mother, provided that they raised and supported the deceased stepson or stepdaughter for at least 5 years. A stepson and stepdaughter have the right to an insurance pension in the event of the loss of a breadwinner on the same basis as their own children, if they were raised and supported by a deceased stepfather or stepmother, which is confirmed in the manner determined by the Government of the Russian Federation.

Disability must occur before the death of the breadwinner, or before the court declares him dead or missing.

The type and type of educational institution in which dependents are studying is determined on the basis of its Charter. Legal significance is attached not to the type or type of educational institution, but to the form of education, because according to Art. 10 Federal Law dated December 28, 2013 N 400-FZ “On insurance pensions”, the circle of disabled family members includes only full-time students. Receiving education through part-time or part-time education does not give the right to a pension, even if the student does not actually work. Cadets of higher educational institutions of the Ministry of Internal Affairs of the Russian Federation and the Ministry of Defense of the Russian Federation are not considered students, since they are military personnel.

Establishment of the degree of relationship is carried out according to the norms of family law. Adopted children, as well as stepsons and stepdaughters, have the right to a pension on an equal basis with their own children.

Dependency of children of deceased parents is assumed and does not require proof, with the exception of these children declared fully capable in accordance with the legislation of the Russian Federation or who have reached the age of 18 years.

Disabled parents and the spouse of the deceased breadwinner, who were not dependent on him, have the right to an insurance pension in the event of the loss of a breadwinner if, regardless of the time that has passed since his death, they have lost their source of livelihood.

Family members of the deceased breadwinner, for whom his help was a constant and main source of livelihood, but who themselves received some kind of pension, have the right to switch to a labor pension in the event of the loss of a breadwinner.

Cases of establishing a social pension in the event of the loss of a breadwinner in accordance with the Federal Law of December 15, 2001 N 166-FZ “On State Pension Provision in the Russian Federation”:

- In the event that the deceased insured person has no insurance experience at all.

- In case of disabled members of the family of the deceased breadwinner committing a criminal act that entailed the death of the breadwinner and was established in court. It is difficult to agree with the position of the legislator, who believes that this norm is due to the insurance nature of the pension system. It can hardly be considered fair for the occurrence of adverse property consequences for persons who did not commit guilty actions. In addition, if the deceased breadwinner worked and contributions were paid for him, which serve as the basis for calculating the insurance pension, then it is not clear why the legislator deprived his dependents of the right to an insurance pension, the financial means for the payment of which had already been generated.

State survivor's pension

Conditions for granting children a state pension: if their deceased breadwinners were military personnel, astronauts, or if they suffered as a result of man-made or radiation disasters.

These payments are due to children under 18 years of age. The period of pension payments is set to 23 years if the child is a full-time student at a university. Persons undergoing training in another country within the framework of international treaties can receive a state survivor's pension for up to 25 years.

Registration procedure

The procedure for applying for a state pension is similar to applying for a social pension. The difference is that you need to provide additional documents.

If the breadwinner was a military personnel, documents are needed confirming the fact and cause of death, as well as certifying that the death occurred due to an illness, injury or disability received during service.

A special list of documents is needed if the deceased was an astronaut.

Sometimes some of the necessary papers are already in the Pension Fund of the Russian Federation.

Amount of state pensions

The size of the fixed part of state pensions for children whose parents were in the military depends on the cause of death of the breadwinner.

- 50% of the social pension is received by relatives of military personnel, one of whose parents died due to a disease received during military service;

- Parents receive 200% of the social pension if the death of the breadwinner was due to a military injury;

- 250% of the social pension is due to children who have lost both parents and children of a deceased single mother.

The increase in state pensions for children who have lost their breadwinner is carried out in the same manner as for social payments.

The size of the survivor's pension in 2021

The compensation payment is formed based on the type of benefit and is paid according to certain time intervals. These periods are also characterized by changes in the amount of financial assistance. It can either decrease or increase by a certain percentage level, which depends on the economic situation in the country and a number of other factors.

| Type of pension accrual | Current pension amount | Benefit increase |

| Survivor's Insurance Benefit | The size depends on the length of service of the deceased breadwinner and a number of other factors. However, a fixed payment of 2279 rubles is always added to it. 41 kopecks | From February 1, 2021, the benefit amount will be 2498.66 kopecks. |

| Social benefits for the loss of a breadwinner | Until April 1, 2021 it is 5034 rubles. 25 kopecks. When a child is raised by a single mother or both deceased parents, the amount paid doubles: 10,068 rubles. 50 kopecks | From April 1, 2021 – 7586.35 rub. If you lose your mother or both parents at once, the pension benefit will be 10,472.24 rubles. |

| State benefit in case of loss of a military personnel |

1.5 times higher than the social pension, that is, it is 150% of it - 7551 rubles. 38 kopecks. |

|

| Survivor's pension under the Ministry of Internal Affairs | The amounts of benefits intended to be paid to family members of police officers are similar to the amounts accrued upon the loss of a serviceman. Until April 1, 2021, they amount to 10068.50 and 7551.38 rubles. |

|

Survivor's pension under the Ministry of Internal Affairs

These payments are due to children whose deceased parents served in: the Ministry of Internal Affairs, the Ministry of Emergency Situations, the penal service, the drug control service, the National Guard of the Russian Federation, and also if they served under contract as sailors, soldiers, sergeants and foremen or conscription as officers, midshipmen and warrant officers.

A pension through the Ministry of Internal Affairs is paid to the relatives of the deceased in cases where the employee died:

- during the period of service;

- within three months after dismissal;

- due to contusions, injuries, wounds or illnesses received during service, regardless of how much time has passed since dismissal.

Amounts of benefits for the loss of a breadwinner through the Ministry of Internal Affairs

Expert opinion

Kozlov Andrey Kirillovich

Lawyer with 10 years of experience. Specialization: criminal law. More than 3 years of experience in developing legal documentation.

The calculation of this type of pension depends on the amount of monetary allowance that the deceased received during his service. Contentment consists of three parts:

- salary for a special rank;

- official salary;

- bonuses for length of service.

To calculate the pension under the Ministry of Internal Affairs, a coefficient of 72.23% is applied to the amount of monetary allowance.

Children receive 50% of the allowance if:

- the cause of death of the breadwinner was a war injury;

- a deceased serviceman became disabled during his lifetime due to a military injury;

- the children of the deceased are raised by a single mother;

- the children were left orphans.

Children receive 40% of the monetary allowance if the breadwinner died as a result of an illness, injury or injury received during service.

An example of calculating a pension through the Ministry of Internal Affairs

In the Shcherbakov family, dad Sergei Ivanovich was a senior investigator with the rank of major. He died in an accident after serving for 8 years.

Let's calculate the size of the pension for Maria, the daughter of Sergei Ivanovich.

Long service bonus 20% to the sum of the official salary and salary by rank (11500+15500) × 0.2 = 5400

Since the breadwinner died due to an accident, the pension for his daughter will be 40% of 23,402.52 rubles, that is, 9,361,008 rubles.

Who can apply for benefits?

In most cases, a survivor's pension is assigned to a minor child whose age is less than 18 years. However, there are exceptions. If this citizen is a full-time student, for example, at an institute, he is entitled to a payment until he is 23 years old. True, there are some deviations from the standard rules here too.

Situations arise when a student takes an academic leave while studying at a university. In this case, the recipient of the survivor's pension continues to receive the required benefit from the state. If such a citizen leaves the university of his own free will or is expelled for poor academic performance, he will be denied a pension.

If there are several children in a family, each child has the right to apply for a survivor's pension. The benefit amount is divided proportionally to the number of children. The state must also ensure that the amount of assistance is not lower than the subsistence level in the region. Note that this indicator differs depending on the subject of the Russian Federation. Therefore, it is impossible to give an exact minimum wage.

Special cases

- A survivor's pension can be applied for regardless of whether the child was dependent on the breadwinner, or whether the breadwinner lived separately and did not support the child financially.

- When applying for a survivor's pension, adopted children have equal rights with their natural children.

- If the mother of a child receiving a survivor's pension decides to officially get married, the child will continue to receive monthly payments. The right to payments remains even after adoption.

- The marriage of a person who receives a pension is not grounds for its cancellation. Even if after the wedding a woman takes her husband’s surname.

- Children who are entitled to a survivor's pension should not be officially employed. If a child is a full-time student at a university and works part-time, he is deprived of the right to receive a pension. The exception is the children of law enforcement officers.

Who is entitled to a survivor's pension and what is its amount? What documents are needed and how to apply for a survivor's pension? Up to what age are benefits paid and how is it calculated? We will answer these and other questions in this issue.

A survivor's pension is a monthly payment from the state to families in which the person providing for this same family has died. It applies to all dependents of the deceased. Not only children, but also other relatives are considered dependents. A survivor's pension can be social, state or insurance.

In the article we will figure out how much is paid and to whom, how to apply for a pension and who, in principle, can claim these payments.

Who can receive survivor benefits?

Depending on the circumstances that arise for a particular person, the age limits of persons applying for financial assistance in the event of the loss of a breadwinner are determined.

The categories are as follows:

- Disabled persons under the age of eighteen who have received incapacity for work.

- Persons from eighteen to twenty-three years of age studying full-time.

- Relatives who have reached the age of majority and are caring for dependents under fourteen years of age. In this case, the status of a benefit for caring for a dependent person who has lost a breadwinner is obtained. Guardians may be unemployed and must be registered with the Employment Center and also receive appropriate benefits.

- Close relatives who are pensioners due to advancing age or loss of ability to work.

When claiming survivor benefits, it is not necessary to have a blood relationship with the breadwinner. Payment of social benefits is intended, for example, for adopted children, but strictly in the presence of correctly completed documentation.

Often, benefits continue to be paid even if the circumstances necessary for their accrual change. Widows who have remarried after losing their main breadwinner, as well as persons under eighteen years of age who have gained legal capacity, such as having their own financial income or starting their own family, may qualify for continued social material support.

What is a survivor's pension?

The concept of survivor's pension includes many nuances, only there are several types of pensions (insurance, social, military), so first let's understand the basic terms.

The breadwinner is legally considered an able-bodied family member who provides for his relatives.

Dependents are considered to be relatives of the deceased who require financial support by law: either from the insurance pension of the deceased or from public funds. Dependents include disabled parents of the deceased (pensioners and disabled people), children under 18 years of age, and a non-working spouse.

Depending on whether the breadwinner worked or not, whether he was military or civilian, an appropriate pension will be assigned to his relatives. The pension is state support, its task is to help relatives left without a breadwinner.

The family consists of four people: father, mother and two children. The father (breadwinner) dies in an accident, the mother is left alone with the children (dependents, but with nuances).

According to the law, if the mother was fully supported by her husband, that is, she did not work anywhere, then she has the right to apply for a survivor’s pension for herself and her children. But if she worked and is working, then she is not considered a dependent and only children can receive a pension.

If the children are under 14 years old, then the pension will still need to be applied for in the name of the mother as the legal representative; upon reaching the age of 14 years, the child has the right to receive payments himself.

If a woman worked during her husband’s lifetime and, say, for some time after his death, but then quit or was fired, she is not entitled to a survivor’s pension, since she is not considered a dependent. She had to be disabled at the time of her husband's death and be his dependent.

Survivor's pensions are regulated by the following laws:

What is a survivor's pension?

This is the amount of money paid to relatives and family members who are left in a difficult financial situation or have completely lost their source of livelihood due to the death of the head of the family. It is established by the state and directly depends on the type of activity a person does during his lifetime. The following survivor benefits are available:

- insurance. Dependents and pensioners who were supported by the deceased may apply for an insurance pension if he had a minimum work experience. Except for persons who have committed unlawful actions, after which the breadwinner is declared dead, if their presence is confirmed by police officers and presented to the court with the appropriate evidence base;

- state Payments are made to disabled citizens (family members) of military personnel, deceased astronauts, participants in active military operations on a local or global scale, people who suffered as a result of man-made, radiation disasters or became disabled as a result of accidents;

- social. A social pension is provided to the families of the deceased if he did not have insurance coverage. It can be accrued if the purposeful and unlawful acts of third parties led to the moment of death, and in the conditions of death the elements of a crime were revealed, but only after confirmation of this fact by the investigative authorities and the court.

Features of accrual

Each benefit: insurance, state or social, intended for payment to the population, depending on the type, has its own conditions and calculation characteristics. The insurance pension is calculated every month and is aimed at supporting disabled citizens who have lost their only source of livelihood. It is paid according to two other indicators:

- by old age. Accrued to men and women upon reaching retirement age - 60 and 55 years. In this case, the individual coefficient and the total length of service before retirement are taken into account;

- for disability: carried out after passing an examination in medical and social institutions of Moscow or another locality. The benefit is awarded to persons with I, II and III disability groups.

The survivor's pension for minors in 2021 is calculated based on insurance premiums transferred on behalf of the deceased, as well as the amount of accumulated labor points. If both parents are lost, these figures are summed up and the compensation payment is doubled. Orphans are sent to an orphanage or under the guardianship of official representatives while maintaining benefits.

Insurance-type compensation benefits paid by the state have the following distinctive features:

- are part of the state's social policy;

- provide the minimum amounts necessary to meet the basic needs of those in need;

- extended if one of the parents, after the death of the other, enters into a new marriage;

- automatically accrued to children under the age of majority.

Social pension is paid on a monthly basis to those in need. It is accrued exclusively for the period of incapacity, after which it ceases to be allocated:

- is formed and determined based on the state and framework of the state budget;

- is not subject to contributions to the pension fund account.

Citizens entitled to receive a pension

Depending on the type of survivor's pension, the following categories and types of persons applying for such a pension are usually distinguished.

- Persons entitled to social pension due to loss of a breadwinner.

- Disabled family members of the deceased breadwinner - the insured, who were his financial dependents, are entitled to a full insurance pension for the loss of a breadwinner.

Note. Other family members include the persons specified in paragraph 2, part 2, article 10 of Law No. 400-FZ.

Pension amount, indexation

It should be noted that this criterion is conditioned by:

- the group to which the recipient is assigned;

- the actual cause of death;

- type of benefit provided.

Social type of pension:

| Type of pension | Until April 2021 | From April 2021 |

| Recipients who have lost 1 breadwinner | 5606.17 rub. | RUB 5,751.93 |

| For those who have lost both breadwinners Children who have lost a single mother Children whose parents are unknown | RUB 11,212.36 | RUB 11,503.88 |

Indexation of this type of pension will occur in January next year. The amount of security will increase by 6.3%

Watch until the end! — How much will pensions increase in 2021, latest news

State type of pension for disabled military family members:

| What was the cause of death | Collateral amount |

| Consequences of war trauma | 200% of the social pension |

| Illness acquired during years of service | 150% of the social pension |

State type of pension, the recipients of which are disabled family members of citizens affected by various man-made disasters:

| Recipient category | Collateral amount |

| Children who have lost a single mother, or who have completely lost both parents | 250% of the social pension |

| Other disabled family members of the breadwinner | 125% of the social pension |

In order to find out exactly what increase will be from April next year, you need to multiply its current size by 1.026.

What needs to be done to receive a pension?

To apply for a survivor's pension, you need to collect several important documents:

- Passport of a citizen of the Russian Federation.

- Supporting death certificate of the breadwinner.

- Work record book of the deceased.

- Certificate of income of the breadwinner from work for the last months.

Together with the application for benefits, the collected package of documents is submitted to the local branch of the Pension Fund.

Let us remind you that from January 1, it will be possible to receive a survivor’s pension only on a bank card with the Russian payment system “MIR”.

State pension

The state survivor's pension is awarded:

- In the event of his passing away.

- When the breadwinner goes missing. To confirm this status, you will need to contact the police and file a missing persons report. After 1 year, if the person is not found, then pension payments are assigned to the children of the missing person.

- When a person is declared dead and a death certificate is issued.

Payment is calculated in the form of a social or labor pension. Their differences are as follows:

- A labor pension can be issued if the deceased was an insured person.

- A social pension is assigned if a citizen committed suicide or died as a result of an intentional criminal act. These facts will need to be proven and recognized in court.

Any type of payments and benefits can be assigned only if it is confirmed that the breadwinner has died and the person is a minor or incompetent. You can take advantage of the benefits only when preparing documents, since they are of a declarative nature.

Minimum survivor's pension: amount

The payment amount from 02/01/2020 to the end of 2021 is 2457 rubles. The benefit is issued in a situation where the deceased was a military serviceman or served in the police department, a firefighter, a participant in emergency situations, liquidated disasters, or an employee of the penal system when he served in the Federal Tax Service. Funds are transferred to the account until the child turns 18 years old.

On a note!

Moreover, in case of disability, age does not matter.

Also, money is transferred until the age of 23, when persons dependent on the deceased study full-time.

It is worth deciding what the social pension is from 04/01/2020 to the end of 2021. It is equal to 5653.72 rubles when a dependent lost his mother or father. 11,307.47 rubles when both parents died, or they were unknown, or if they were raised only by a single mother.

In some regions of the Russian Federation there are regional coefficients, they can increase the payment. In addition, the amount may change when indexing occurs.

In general, the size of the pension payment is influenced by the cause of death, insurance or social security, service status and more.

The size of the survivor's pension from 2021 by region

If you take the specific size in Tatarstan and Moscow, it will be different. Since a specific region may have its own coefficient. For example, in the Perm Territory, the amount in 2021 was 10,057.43 rubles, it all depends on the region.

There are some peculiarities in the calculation. In the situation of the loss of a breadwinner who paid military debt to his homeland, the benefit is calculated as a percentage of the amount of social pension remuneration.

On a note!

200% died in the war. 150% - death from disease as a result of military service.

When the breadwinner is included in the category of those who died from disasters (radiation, for example), his relatives (when actual dependency is confirmed) are given an increase in pension benefits: 250% for the children of a single parent or completely orphaned and 125% for the rest.

When the deceased worked in the space field, the amount of payment to his dependents is 40% of the deceased's salary. The volume will be adjusted to reflect the area ratio if the applicant lives in a difficult climate.

When the deceased breadwinner worked for the law enforcement agencies, to calculate payments, it is necessary to apply not to the pension fund, but to the Ministry of Internal Affairs fund.

On a note!

Length of service and the cause of death are important in the calculations: 50% of the salary is death from injury in service, 40% from illness.

They are also calculated using various methods. So, when the amount of pension benefits is below the subsistence level in a constituent entity of the Russian Federation, a social increase is accrued. In general, it is better not to rely on your own. Experts who can competently and legally apply calculation algorithms will always help.

How much will survivor pensions increase?

Many people are interested in what exactly and by how much survivor benefits have increased.

Insurance pensions for the loss of a survivor include a fixed part and an individual one. Fixed in 2021 is ½ of the full amount (5334), it is equal to 2667 rubles. For minors who have lost a parent, a 100% payment is established; residents of the RKS receive a pension, taking into account regional benefits. The individual part is calculated by the number and value of points. This year 1 point = 87 rubles. The insurance pension is changed annually on January 1 of the current year. This year the increase was 7%. You can find out how much the survivor's pension will increase for a particular person by applying these data.

The increase in social payments in the Russian Federation from April 1, 2021 increased the average pension to 9 thousand rubles. Total costs in the country amounted to over 7 billion rubles. until the end of the year. The indexation coefficient is 1.02 points. It is calculated as the ratio of the cost of living for a pensioner in 2021 to the same indicator for 2021. The percentage increase was 2 points. In monetary terms, the increase will range from 300 to 600 rubles in different regions. So they have different living wages. For those whose payments do not reach the subsistence level, a special additional payment will be established through federal subsidies. Social payments to children for the loss of a breadwinner are equal to 5 thousand rubles. upon the loss of one parent and 10 thousand rubles. orphans.

Government aid has also increased by 2% since April this year. The amount of monthly compensation if a conscript's breadwinner dies will be 10,500 rubles if he died from an injury while serving. If the cause of death was illness, the pension will be lower - almost 8 thousand rubles. State pensions are usually calculated as a percentage of social benefits.

Will survivor pensions increase from 2021: latest news

Recent changes to the Russian Federation Law have also affected survivors' pensions. This year there are 3 types of payments that fall under this definition. Citizens who meet the requirements set forth in the country’s legislation can apply for payments. The size of the pension depends on certain points:

- The person claiming payment. A disabled dependent who is subject to restrictions, or a family member who has lost a breadwinner (the list has restrictions).

- A close relative who is not working and is caring for children or relatives of the deceased breadwinner can also receive money.

- The work experience of the deceased, for which the amount is calculated for each month. Based on his presence, absence, type of activity, relatives, on the basis of certain conditions, a pension is paid, which can be state, insurance or social.

- Subject of the federation where the family lives. The amount may be higher if there is a coefficient from the region (in RKS or equivalent climatic conditions). Also, the pension is higher in the capital of Russia, where prices are the highest. The amount in the regions and Moscow changes every year, depending on the indexation carried out.

In 2021, changes took place in the Law of the Russian Federation - the age indicator for retirement has increased. The period for assigning pension payments has also been changed. If you write an application more than 12 months late, a person will receive money not from the moment the breadwinner died, but a year from the date of application to the Pension Fund. In this case, any funds, except for insurance pension benefits, will be transferred from the beginning of the month of circulation.

On a note!

Updates and amendments make it difficult to independently calculate the amount of payments in 2021. It is better to contact a professional who will carry out the calculations and explain all the intricacies of receiving money.

Indexation of survivor's pension in 2021

In the coming year, pension benefits for the loss of a breadwinner were indexed. The size of the increase and the period of increase will be different, depending on what pension is determined. There are 3 types:

- Insurance. It is prescribed to those whose breadwinner has an insurance record, namely, has officially worked for at least a day. It was increased in January of this year.

- Social. Prescribed to those whose breadwinner did not have work experience, or to children whose father and mother are unknown.

- State. Assigned to disabled relatives of deceased military personnel or people affected by disasters.

On a note!

Social and state pensions will be increased in April 2021.

The pension increase will be carried out in parallel with the increase in pension insurance in January 2021. According to the law, in the next 2 years, 6.3% will be added to the pension.

In rubles, the increase depends on the benefits received. The amount of the pension this year will be calculated according to the following method: StrP = IPC × SPK + FV. It deciphers like this:

- StrP - the amount of insurance pension compensation;

- IPC - the number of pension coefficients that have accumulated in the personal account of the deceased;

- SPK - the price of one pension coefficient (in 2021, this is 98.86 rubles);

- FV is a fixed amount of increase (this year it is 3022.24 rubles).

You need to know that the fixed fee for this year is 6044.48 rubles. (Part 8 of Article 10 of Federal Law-350). However, for the transfer of survivor's pension accrual, it is 50% of this amount. Namely - 3022.24 rubles. (Part 2 of Article 16 FZ-400).

On a note!

There is also a more accessible way to calculate the size of the pension after the increase this year. To do this, multiply the existing value by 1.063. This will get the size taking into account indexing.