You will find the latest news about increasing the survivor's pension, what is the minimum amount and who is entitled to receive these cash payments in this review of the ProfiKomment magazine.

Who is entitled to a survivor's pension: types and where to apply?

Before we get into the details, let's take a look at what a survivor's pension is and who it's available to.

A survivor's pension is a special type of pension payments that are available to disabled citizens of the Russian Federation who have lost their breadwinner, as well as to certain categories of able-bodied citizens who are family members of the deceased.

There are 3 types of survivor's pension:

- Insurance (labor);

- Social;

- State.

Below we talk in detail about each type of pension.

Who is entitled to receive a survivor's pension?

Since it follows from the definition of this pension payment that it is assigned to disabled persons, we can conclude that only children can receive this pension. However, this is not the case.

The full list of persons who are eligible to receive a survivor's pension varies depending on the type of pension. The largest list of persons is available to state and insurance pensions for the loss of a breadwinner - we will talk about this below, but here we can clarify that these pension funds can be claimed not only by the minor children of the deceased breadwinner, but also by his spouse, parents, brothers and sisters, as well as guardians and other members of his family.

If we talk about a social pension for the loss of a breadwinner, then it can only be assigned to the children of the deceased, but the rest of his family members cannot apply for this type of pension.

Where to apply and where to apply for a survivor's pension

Since the state is responsible for this type of pension provision, to apply for a survivor’s pension you need to contact the local branch of the Pension Fund at the recipient’s place of stay or residence.

Previously, it was difficult to obtain this pension if a person did not have permanent registration - harsh Pension Fund employees could refuse such an applicant. But today, it seems, the state has managed to cope with this problem, and even if a family does not have a permanent residence permit (for example, they live in a rented apartment), then it is enough for them to provide a Certificate of Registration at the place of residence.

An example of registration at the place of residence, according to which you can receive a pension without registration

When does the survivor's pension come in?

Payment frequency is once a month. You can receive it at the bank's cash desk or on a plastic card on the day when the funds arrive from the local branch of the Russian Pension Fund, as well as at any time after this date. You can check the deadline for transferring pensions at your Pension Fund branch.

You can receive your pension at the post office or with home delivery. In the latter case, the postman will deliver the money in accordance with the established schedule.

A citizen has the right to receive payment through a specialized organization that delivers it. A list of such organizations is presented on the Pension Fund website.

Documents for applying for a survivor's pension

Despite the apparent complexity, in order to apply for a survivor's pension, you need to collect a not so large package of documents. It is necessary to immediately make a reservation that depending on the type of pension, the list of documents may vary, so we decided to collect here all types of documents and indicate in brackets for what type of pension they will be needed, if this requires additional clarification.

Full list of documents for assigning a survivor's pension:

- Passport (for citizens of the Russian Federation);

- Residence permit (for foreigners and stateless persons);

- Certificate of registration at the place of residence (in the absence of permanent registration in the passport);

- SNILS of the deceased and all family members, as well as the person who will receive the pension;

- Death certificate (breadwinner);

- A court decision to recognize a citizen as missing or to declare him dead (if the fact of the person’s death is established in court);

- The work record book of the deceased and other documents confirming the work experience of the deceased (military ID, employment contracts, extracts from orders, personal accounts, salary slips, certificates from the employment service);

- Birth certificate;

- Marriage certificate (if there is an official marital relationship with the deceased);

- Divorce certificate (if available);

- Certificate of adoption (for deceased adoptive parents);

- Certificate of change of last name, first name or patronymic (if available);

- Certificates from the registry office confirming family relationships (for brothers, sisters and other family members, if necessary);

- Certificate of income (to confirm the fact of dependence of able-bodied family members)

- Court decision to confirm family relations (if such a decision exists);

- Documents confirming the fact that able-bodied family members are dependent on the deceased;

- A certificate from the educational institution stating that the person is studying full-time (for students);

- Certificate of a guardian, trustee, adoptive parent or certificate of adoption, or a decision of the guardianship and trusteeship authorities (for cases where the disabled person has an adoptive parent or a guardian or trustee has been appointed over the disabled person).

IMPORTANT! It is worth mentioning the fact that most of the information about the income of the deceased and the insurance premiums transferred for him, if he was officially employed in a Russian organization, is stored in the PFR Personalized Accounting database. Therefore, if the deceased’s work book is missing (lost) and if it is impossible to provide it, employees of the Pension Fund are required to apply for a survivor’s pension even without this document.

How is the survivor's pension calculated?

To apply for a pension in the event of the loss of a supporting head of the family, you must submit an application to the Pension Fund. It is the PF that keeps records of cases on such issues. The application must be accompanied by a package of documents provided for by Order of the Ministry of Labor No. 958n. Documents include:

- Identification documents of the deceased and the applicants;

- Death document;

- Documents evidencing relationship;

- SNILS of the deceased;

- Documents about periods of employment, for example, a work book;

- Document on the age of the breadwinner;

- Document on the coefficient.

As a general rule, the Pension Fund independently requests missing papers from outside organizations, but for quick processing, the applicant has the right to apply for them personally. After submitting a complete package of papers, within 10 days a decision is made on the payment of the pension and its amount is established.

The entry of a dependent into a new marital relationship is not an obstacle to the further accrual of a pension. The basis is only the restoration of the working capacity of the remaining husband or wife. The pension is credited to the card or delivered by mail every month.

Who is entitled to a one-time payment of 5,000 towards the survivor's pension?

In the new year, a payment of 5 thousand rubles is provided. Citizens who are pensioners, disabled people, or those who have experienced the loss of their main supporter can apply for it. The payment is one-time in nature. Thus, the state is called upon to support financially citizens who find themselves in difficult life circumstances and are left without help. For these purposes, the procedure for assigning payments is established by law.

Social pension for the loss of a survivor

The simplest pension case in our review is the Social Security survivor pension. Who is entitled to receive a social pension in the event of the loss of a breadwinner:

- Minor children under 18 years of age who have lost 1 or both parents;

- Children of a deceased single mother;

- Adult children in full-time education aged 18 to 23 years, deprived of 1 or both parents.

Important! It is noteworthy that the social pension for the loss of a breadwinner can be assigned indefinitely - for cases where the child has become an adult, but remains disabled.

One of the common cases in legal practice for children who have lost a parent who did not work is what will be the survivor’s pension if he did not work? If the parent did not work anywhere, then in the event of his death, a social pension is assigned to the children for the loss of a breadwinner.

The total size of the social pension for the loss of a breadwinner cannot be less than the subsistence level for a given category of citizens (children or adults, depending on their age) in a given region.

By the way, you might be interested in:

- child benefits increased this year;

- From January 1, 2021, new child benefits will be introduced.

Who is entitled to a survivor's pension?

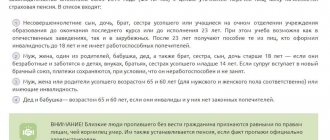

The list of persons and other factors related to the payment of pensions are determined by federal pension legislation. Each category of dependents has its own conditions for receiving. The pension is assigned:

- children under 18 years of age (full-time students up to 23 years of age) - regardless of any circumstances;

- sisters, brothers, grandchildren under 18 years of age (full-time students under 23 years of age) - if they do not have able-bodied parents;

- father or mother, brother or sister, spouse, grandmother or grandfather - regardless of any circumstances, provided that they do not work and are raising minor (under 14 years old) sisters, brothers, grandchildren or children of the deceased;

- father or mother, grandmother or grandfather, spouse - provided that they have become disabled or have reached the generally established retirement age.

An applicant for a pension must be disabled (this category also includes persons caring for a person with a disability), he must not have other able-bodied breadwinners (this requirement does not apply to children), and he must not be the cause of the death of the breadwinner.

In this case, the adopted children of the deceased have the same rights to receive a pension as his natural children.

Labor or survivor's pension

An insurance pension for the loss of a breadwinner is assigned to disabled family members of a deceased citizen who has officially worked for at least 1 day, that is, has a certain insurance period in the pension insurance system of the Pension Fund of the Russian Federation.

In simple words, a labor pension for the loss of a breadwinner is pension savings that a citizen did not receive due to his death and which the state, represented by the Pension Fund, carefully pays for him to members of his family who need a breadwinner due to their disability. This social measure to protect disabled persons is one of the most important state responsibilities to citizens, since it prevents family members from losing income even after the death of one or both parents.

Who is entitled to a survivor's insurance pension and at what age:

- Minor children, including adopted children, brothers, sisters, grandchildren and granddaughters - under the age of 18;

- To the father, mother, husband, wife, grandfather or grandmother of the deceased breadwinner, if they do not work anywhere and are busy caring for the children, brothers, sisters, grandchildren of the deceased under 14 years of age - at any age;

- Mother, wife or grandmother of the deceased breadwinner - over 55 years of age;

- To the father, husband or grandfather of the deceased breadwinner - over 60 years of age;

- Adult children, including adopted children, brothers, sisters, grandchildren and granddaughters, if they are receiving full-time education at an educational institution - aged 18 to 23 years;

- Adult brothers, sisters, children of the deceased breadwinner, if they are caring for the children, brothers, sisters, grandchildren of the deceased under 14 years of age and do not officially work anywhere - at any age;

- Grandfather or grandmother of a deceased breadwinner who has a disability but has no one to support them - at any age;

- Adult brothers, sisters, children, grandchildren of the deceased breadwinner, if they received disability before the age of 18 - at any age;

- Parents and spouse of the deceased breadwinner who have a disability group - at any age.

Attention! The total amount of the insurance pension for the loss of a breadwinner this year cannot be less than the subsistence level for this category of citizens (children or adults, depending on their age) in a particular region. If the calculated insurance pension for the loss of a breadwinner is below the subsistence level, FSD (federal social supplement) or RSD (regional social supplement) is added to it so that the total pension reaches the subsistence level.

Amount of fixed payment to the survivor's insurance pension

From January 1, 2021, the amount of a fixed payment to the insurance pension in the event of the loss of a breadwinner is 3 thousand 22 rubles 24 kopecks for each disabled family member, which is 50% of 6044 rubles 48 kopecks.

How is the survivor's pension calculated?

Formulas for calculating the amount of insurance payments depend on whether the person was retired at the time of his death or not.

In the first case, the numerical indicator will be equal to the product of the pension coefficient and the tariff applied at the time the benefit is assigned; in the second case, the value will depend on the individual personal coefficient of the deceased, its currency equivalent and the number of people dependent on the deceased.

Thus, for each of the minor children, the amount of the insurance pension is calculated according to the formula:

SPspk = IPC (individual personal coefficient) × SPK (the cost of the personal coefficient at the time of pension assignment.

In addition, the insurance pension also includes a fixed payment - an additional benefit established in a fixed amount.

Pension legislation also provides for increasing coefficients for children:

- If you lose 2 parents, the pension doubles.

- If the breadwinner was a single mother, the individual coefficient and the fixed payment are doubled.

State survivor's pension

A special type of pension that is paid to disabled family members of the deceased:

- Conscripted soldier;

- A former conscript who died within 3 months after being discharged from service;

- A former conscript soldier who died after discharge at any time from an injury or illness received during service;

- Astronaut;

- A citizen who received the disease during a radiation or man-made disaster.

The most common cases of receiving a state survivor's pension are:

- survivor's pension for the liquidator of the Chernobyl nuclear power plant (Chernobyl nuclear power plant);

- serviceman's survivor's pension;

- survivor's pension for the wife of a military man;

- survivor's pension for a minor sister of a serviceman.

Attention! The total amount of the state survivor's pension this year cannot be less than the subsistence level for this category of citizens (children or adults, depending on their age). If the calculated insurance pension for the loss of a breadwinner is below the subsistence level, the FSD (federal social supplement) is added to it so that the total pension reaches the subsistence level.

Table 1. Amount of state survivor's pension

| Recipient category | Pension amount |

| Family members of an astronaut who died in the line of duty | 40% of the deceased cosmonaut's allowance |

| Children of a citizen who died after contracting a disease during a radiation or man-made disaster, having lost both parents | 250% of the social pension |

| Family members of a citizen who died after contracting a disease during a radiation or man-made disaster | 125% of the social pension |

| Family members of a serviceman who died from an illness acquired in military service | 150% of the social pension |

| Family members of a serviceman who died as a result of a military injury | 200% of the social pension |

Types of survivors' pensions

The survivor pension in 2021 has the following types:

- insurance;

- social;

- state

Insurance compensation is provided if the person has no work experience. Its period is not important. State payments are made to the relatives of a military man or to the widow of Chernobyl victims. This category includes victims of a radiation disaster. Social assistance is established if the citizen did not have a job.

Survivor's pension for two children

No less tragic is the case when the breadwinner dies, and his family is left with two children. It’s an unfortunate situation, but, alas, it’s not uncommon – the reason for this is the increasing number of fatal road accidents in recent years. It happens that the breadwinner, often a man, dies in service due to difficult conditions or force majeure.

In any case, the mother is left alone with two children in her arms. Such families are entitled to a survivor's pension for both children, that is, pension payments are transferred to each child separately if he meets the criteria listed above (age, disability). And depending on the place of work of the deceased breadwinner, either a state, insurance, or social pension can be paid for his two children.

What is a survivor's pension?

A payment such as a survivor's pension is actually the labor pension accruals of the deceased, who is survived by relatives. According to the law, these payments cannot be transferred in a will, however, provided that the citizen still has wards requiring maintenance, the state undertakes to pay the required funds to them.

The grounds for paying this pension accrual to relatives may be:

- death of the breadwinner;

- official recognition of a given citizen as missing.

However, only one document can form the basis for receiving benefits - a death certificate. However, if a loved one has disappeared and the deadline for recognizing him as missing by law has been met, relatives can do the following:

- file a lawsuit to establish the missing person’s mentioned status;

- on the basis of a positive court decision, obtain a death certificate from the registry office.

Only subject to official confirmation of both statuses of the breadwinner, his relatives can apply for benefits.

A survivor's pension is a source of material income, the only one that remains with the dependents of a deceased person

Survivor's pension for the wife of the deceased

, a survivor’s pension can be assigned (in a more precise legislative formulation, this also applies to the husband of the deceased, but such cases are quite rare, so here we will only examine cases with the wives of deceased breadwinners) .

In what cases is a survivor's pension awarded to a wife:

- She must be officially registered as married to her deceased spouse;

- She must have no other income, that is, she must not work.

When the wife of the deceased is entitled to a survivor's pension:

- If she is busy caring for minor children, brothers, sisters, grandchildren of the deceased before he turns 14 years of age

- If she has a disability group;

- If she is over 55 years old and she has no one who must support her by law.

In other words, a survivor's pension for a spouse who does not work and has no other means of subsistence is a kind of dependent support. In some cases, the wife of the deceased needs to prove the fact that she was dependent on the deceased, and here any documents that need to be provided in court will come to the rescue.

IMPORTANT! It is worth noting here that a survivor’s pension can be assigned to the former wife of the deceased, even if she subsequently remarried, that is, entered into a new marriage, but only if at the time of death she was still married to the deceased.

Survivor's pension for the wife of a military man

The wife of a deceased conscript soldier is awarded a state survivor's pension. The Law on Pensions explicitly states that the recipients of the state survivor's pension are widows of the deceased who were dependents.

If the wife of a deceased breadwinner-military enters into a new marriage, the state pension in the event of the loss of a breadwinner is not preserved. However, this clause is canceled if the wife is entitled to an insurance pension for the loss of a breadwinner.

Survivor's pension for the wife of the deceased in 2021

In what cases is a spouse granted a survivor's pension? Let's consider all the conditions for receiving:

- officially registered marriage with a deceased spouse;

- lack of other income;

- caring for minor children, brothers, sisters, and grandchildren of the deceased;

- presence of a disability group;

- age up to 55 years;

- the absence of loved ones who are legally obliged to support her.

A survivor's pension can be assigned to a widow even if she is married, if at the time of the loss of her husband she was married to him.

Note! The wife of a deceased conscript soldier has the right to claim a state survivor's pension.

However, if the widow remarries, the state pension is withdrawn, while the insurance pension remains.

Survivor's pension if you work officially

An interesting situation arises for some potential survivors' pension recipients. Is it possible to work and receive a survivor's pension?

The answer to this question will depend, first of all, on the category of the pension recipient, as well as on the type of pension provision.

If a mother receives a pension for the loss of her breadwinner-husband for her children, then she can calmly work and even get married again. Payments for children have continued and will continue to be provided. After all, the final recipient is not the wife of the deceased, but his children.

If the recipient of the survivor's pension is the wife of the deceased breadwinner, who has proven to the Pension Fund of the Russian Federation that she was his dependent, then such a person cannot work, otherwise, if you work, you have no right to receive a survivor's pension.

You cannot work and receive a survivor's pension - this contradicts the essence of this pension payment, which is due to persons who do not have any other income.

Survivor's insurance pension

It is accrued and paid if the deceased (missing) breadwinner has a work experience of at least 6 months. In this case, the following rule is observed: the longer the length of service, the greater the pension.

The payment consists of two parts: fixed and cumulative. For 2021, the fixed part of the survivor's pension is set at 3,022.24 rubles.

As for the savings part, it is calculated using the following formula:

LF = IPC x SPK, where

- NC

– funded part of pension; - IPC

– individual pension coefficient, formed depending on the length of service available; - SPK

is the cost of a pension point, which for 2021 is set at 98.86 rubles.

If pension recipients are children, they may be given additional payments if they have a disability, as well as if the deceased (missing) parent was the child’s only parent.

Survivor's pension after 18 years of age

A fairly common situation: the breadwinner died, but he was left with adult family members. This begs a natural question: until how many years is the survivor’s pension paid?

To answer this question most fully, you must first find out the category of the recipient and the type of pension.

For example, a student is paid a survivor's pension until the age of 23, if he does not have a disability, does not work and studies full-time.

When does the survivor's pension stop?

If a student receives additional education, works, or is over 23 years old, survivors' pension payments to that person automatically stop. Thus, if a child works, he is not entitled to a survivor’s pension. But all full-time students are entitled to a survivor's pension until their 23rd birthday.

Who is entitled to a survivor's pension over 23 years of age?

However, not all persons who reach the age of 23 stop receiving this benefit. Those over 23 years of age are entitled to receive a survivor's pension:

- Disabled people who were dependent on the deceased;

- Father, mother, husband, wife, grandfather or grandmother, brother, sister, children, grandchildren of the deceased breadwinner, if they do not work anywhere and are busy caring for the children, brothers, sisters, grandchildren of the deceased under 14 years of age;

- The mother, wife or grandmother of the deceased breadwinner, if they are over 55 years old and they do not have anyone who is obliged to care for them according to the law of the Russian Federation;

- The father, husband or grandfather of the deceased breadwinner, if they are over 60 years old and they do not have anyone who is obliged to look after them according to the law of the Russian Federation.

Until what age is a survivor's pension paid?

Children are paid this pension benefit until they are 18 years old.

But if they study at a university as a full-time student, then social benefits continue until the end of their studies (up to 23 years of age).

Important! If a student begins to officially work with a work book, then pension payments will stop . Part-time work without making entries in the work book will not affect pension payments.

For a disabled person, payments will continue until his disability is removed . Persons caring for a minor will receive a pension until the child reaches 14 years of age.

The size of the survivor's pension in 2018

The compensation payment is formed based on the type of benefit and is paid according to certain time intervals. These periods are also characterized by changes in the amount of financial assistance. It can either decrease or increase by a certain percentage level, which depends on the economic situation in the country and a number of other factors.

| Type of pension accrual | Current pension amount | Benefit increase |

| Survivor's Insurance Benefit | The size depends on the length of service of the deceased breadwinner and a number of other factors. However, a fixed payment of 2279 rubles is always added to it. 41 kopecks | From February 1, 2021, the benefit amount will be 2498.66 kopecks. |

| Social benefits for the loss of a breadwinner | Until April 1, 2021 it is 5034 rubles. 25 kopecks. When a child is raised by a single mother or both deceased parents, the amount paid doubles: 10,068 rubles. 50 kopecks | From April 1, 2021 – 7586.35 rub. If you lose your mother or both parents at once, the pension benefit will be 10,472.24 rubles. |

| State benefit in case of loss of a military personnel |

1.5 times higher than the social pension, that is, it is 150% of it - 7551 rubles. 38 kopecks. |

|

| Survivor's pension under the Ministry of Internal Affairs | The amounts of benefits intended to be paid to family members of police officers are similar to the amounts accrued upon the loss of a serviceman. Until April 1, 2021, they amount to 10068.50 and 7551.38 rubles. |

|

Who receives a survivor's pension?

Family members of a deceased pensioner are entitled to receive a survivor's pension. Not everyone can receive a social pension. This list includes:

- Children for whom either one or both parents have died; as well as children whose single mother died. 2. Children must be of minor age, except for those who are enrolled in full-time studies at a university. In this case, the child must be no more than 23 years old.

Apart from this category of dependents, no one else has the right to receive pension payments for the loss of a breadwinner. If a citizen who receives this type of pension begins to carry out his activities, this does not have any effect on payments. Only a citizen of the Russian Federation can apply for a survivor's pension.

Military survivor pension in 2018 - size and latest changes

The pension for the loss of a military breadwinner is based on a basic payment of 4 thousand 959.85 rubles. Each family member who, according to the law, has the right to receive benefits in connection with the loss of a relative liable for military service, can count on one-time funds:

- 200% of the basic payment in rubles if a person died in the performance of official duties;

- 150% of the basic payment if the military man died while not on duty.

Each dependent of a contract military man, in the event of the death of a soldier, can claim by law for:

- Registration and issuance of an increase of 40% of the deceased’s due funds in rubles, if the death of a person occurred while performing official functions;

- An increase of 30% in monetary support if he died not while on duty.

Labor pension in case of loss of a breadwinner

The same categories of persons listed above have the right to a labor pension in the event of the loss of a breadwinner. The difference between a labor and a social pension increase in rubles lies in its calculation when issued on the basis of the work experience of a deceased relative. The amount of such benefit may be higher than the social pension payment. Missing people must be recognized as such by a court decision.

In the event of a difficult financial situation, citizens of the Russian Federation have the opportunity to seek help from the appropriate authorities. This process can also be implemented in the situation of the loss of a relative who was the only source of income in the family.

Survivor's pension in 2021

Preferential consultant › Pensioners › Survivor pension in 2021

A survivor's pension is assigned to disabled citizens of the Russian Federation who are left without the care of one or both parents, as well as to children whose parents are unknown (for example, if they were left without the care of their mother in a medical institution). Recipients of such payments are minor children or students under the age of 23. The social pension is paid if the parent did not have a period of payment of contributions at all. An insurance pension is assigned if the parent has worked for at least one day.

The size of the social pension in the event of the loss of a breadwinner is determined for each category of recipients. Every year, from April 1, these amounts are indexed in accordance with changes in the social minimum for pensioners. For example, in 2021, social pensions were indexed by 3.4%.

According to the law, the amount of payment cannot be less than the social minimum pensioner (SMP). Thus, persons who received a smaller pension will be provided with an additional social subsidy PSM. Recipients of such a pension can officially work or engage in any activity for which they pay OFE insurance contributions - pension payments will not be interrupted.

Who is entitled to a survivor's pension?

In accordance with Article 18 of Law No. 166-FZ of December 15, 2001. “On state pension provision in the Russian Federation”, a social pension in the event of the loss of a breadwinner is assigned to a child:

Attention, if you have any questions, you can ask them to a lawyer on social issues by calling 8 804 333 16 88 or ask your question in a chat to the lawyer on duty. Calls are accepted 24 hours a day. The call is free! Call and solve your problem!

- who have lost their parents;

- both parents;

- single mother;

- whose parents are unknown.

The size of the pension in this case is determined depending on which of the above categories the recipient belongs to.

According to the law, only disabled citizens, i.e. Children under the age of 18 and full-time students up to 23 years old receive a social pension in the event of the loss of a breadwinner. Payments are canceled if the child is expelled from school, transferred to part-time study, or drafted into the army (which must be notified to the Pension Fund).

Amount of social family pension in 2021

The amount of benefits for children who have lost one or both parents is established by Article 18 of Law No. 166-FZ. They are provided in a fixed amount depending on the category of the recipient, the amount of which is assessed annually.

The 2021 indexation took place on April 1, as a result of which pensions increased by 3.4%. The amount of the survivor's pension after taking into account valorization is as follows:

- 11593.58 RUB. — For people who have lost both parents, single mothers and in cases where the parents are unknown.

- RUB 5,796.78 - for those who have lost one of their parents.

If a territorial coefficient is established in the recipient’s region of residence, it will be applied to the established pension amount. This increase will be fixed for the entire period of residence in this region and will be removed if the child moves to another region where there are no coefficients.

Minimum amount and social benefit

If the amount of the assigned social pension in the event of the loss of a breadwinner is lower than the regional minimum social contribution for pensioners, then an additional social payment in PMS will be assigned to the pension. This norm is established by law in Article 12.1 of Law No. 178-FZ of July 17, 1999. “On state social assistance.” That is, de facto, the amount of the payment will be the social minimum (the table for 2021 by region is given in the article).

Children receiving a survivor's pension before the age of 18 are entitled to a social security supplement from the date the pension is awarded.

Appointment to a survivor's pension

The social pension is assigned in a declarative manner after the right to such payments arises. To do this, children who have lost one or both parents must contact the territorial office of the Pension Fund at their place of residence. This can be done in several ways:

- submit an application in person to the Pension Fund;

- send an application by mail;

- contact the MFC;

- Submit your application electronically through the official website of the Pension Fund of Russia or through the Unified Portal of State and Municipal Services.

The date of filing an application for a pension is considered to be the date of receipt of the application at the Pension Fund or MFC along with the necessary documents, and if the application is sent by mail, the date of the postmark of the communication organization at the place of sending.

In the case of minors, an application for a social pension is submitted to the Pension Fund by their legal representative: a parent, adoptive parent or guardian (trustee) with documents confirming the right to represent the interests of the child.

Documents required to process a pension application

To receive a social insurance pension, you must submit the following documents:

- passport or other identification document, as well as a document confirming the rights of a representative (parent, adoptive parent, guardian, trustee);

- Death certificate of the parent(s), court order declaring the breadwinner dead or missing;

- documents confirming that the single mother was a breadwinner (a birth certificate, in which the child’s father should not be indicated, or a certificate from the registry office stating that the father was indicated according to the mother);

- documents confirming the degree of relationship with the deceased (birth or adoption certificate, court decision to establish paternity, certificate from the registry office or other body, other documents containing such information);

If a student-child receives a pension, then documents from the university confirming full-time study are also required. If parents are divorced, then a student over 18 years of age must prove that he was dependent on his parents for the last 3 months.

Payment procedure and terms

The insurance pension is assigned from the 1st day of the month in which the application was submitted to the pension institution, but not earlier than the date of acquisition of the right to benefits. This type of benefit is established for the entire period of incapacity of the benefit recipient, i.e. until the child reaches 18 years of age or until the child reaches 23 years of age if he is a full-time student.

The pension is paid for the current month at the location:

- at the child’s place of residence;

- at the place of residence of the legal representative (guardian, trustee);

- at the location of the educational institution in the case of orphans and children left without parental care.

The pensioner chooses the method of receiving the pension and the organization of delivery of the pension (home, by mail, to a bank or other organization) by submitting an application to the Pension Department.

Attention, legal advice is available to you

If you have any questions, you can ask a social issues lawyer by phone:

8

You can also ask your question in the chat to the lawyer on duty. Calls are accepted 24 hours a day. The call is free! Call and solve your problem right now!