Types of survivors' pensions

The specific type of pension is determined by many circumstances:

- Insurance is assigned to dependents (minor children, widow-widower, mother and father), if the deceased has managed to accumulate a minimum insurance period in the Pension Fund. It will not be assigned to those whose criminal actions resulted in the death of the breadwinner. This benefit is maintained for the ex-wives of the deceased who remarried.

- State assistance is provided to relatives of those who are unable to work, those who died while performing duties as employees of the military, law enforcement, or space departments or victims of disasters and accidents, for example, widows of Chernobyl victims.

- A social pension for the loss of a breadwinner is given to relatives of a deceased person with little work experience who are unable to work.

Survivor's pension: size and latest changes in payments

Depending on the type of survivor benefits, the amount will be different, so to correctly consider the amount of benefits, you need to look at each type separately:

- The insurance pension is basically completely dependent on the former work of the breadwinner, namely on the accumulated experience. The amount of service will be proportional to the future pension. But it is worth noting that you should definitely add a fixed rate to this amount, namely 2279.47 rubles. Immediately after the increase in 2021, the size of the minimum survivor pension began to be 2402.56 rubles.

- Social pension – 5034.25 rubles;

- If a child is raised by a single mother or when both parents die, the pension is doubled. This will be 11068.53 rubles;

- Loss of a breadwinner through the Ministry of Internal Affairs. Such a pension is intended if the breadwinner died as a result of an injury in war, or also retired or became disabled due to an injury received in war. Also, payments are assigned according to this standard if both parents have died and when the children were raised by a single mother. The amount of payments is 10,177.61 rubles;

- The ATS pension should not exceed 150% of the social pension if the person died due to a disease acquired during service. The amount of payments with increased payments is 7633.31 rubles.

Interesting fact! It is worth noting that in addition to increasing payments this year, in 2021 it is planned to introduce a new type of benefit and benefits for the loss of a breadwinner for children whose parents were never known. Benefits for foundling children will be approximately 10,068.53 rubles. The bill on these survivor pensions in 2021 comes into effect immediately from the New Year. Payments will be accrued to the child from the date of birth.

Who is eligible to receive it?

The list of potential pensioners is determined by law. These people must meet certain conditions of appointment: degree of relationship, age, ability to work, etc. All such things are prescribed in the Federal Law on this issue.

If the payment has stopped coming, there may be conditions under which it is cancelled.

Who is entitled to

Survivor benefits are available only to disabled citizens.

Recipients of the state (if the deceased was a military serviceman or astronaut) or insurance pension are:

- Children, sisters, brothers and grandchildren of the deceased, if they are under 18 years of age or have not reached 23 years of age and are studying full-time in educational institutions, or have been assigned a disability before the age of 18. Please note that brothers, sisters and grandchildren can count on pension payments if they do not have able-bodied parents.

- A grandmother who has reached 55 years of age, or has a disability if there is no one to support her.

- A grandfather who has reached the age of 60, or is disabled if there is no one to support him.

- Mother or spouse who has reached the age of 55 or has a disability.

- The spouse, one of the parents, sister, brother, grandfather, grandmother of the deceased, regardless of age and employment, if they are caring for children and sisters under 14 years of age, but entitled to receive a survivor's insurance pension , brothers, grandchildren of the deceased.

- Father or spouse who has reached 60 years of age or is disabled.

In addition, a disabled mother, father, or spouse has the right to apply for an insurance pension if they have lost their source of income. The appointment is made regardless of whether they were dependent on the deceased or not.

If the deceased was a military serviceman, his widow can apply for a state one, but subject to two conditions: she is 55 years old and has not remarried.

If the breadwinner died during compulsory military service or died after dismissal due to a military injury, pension benefits are assigned to his mother after 50 years of age and to his father over 55 years of age.

- Sildenafil C3

- Chinese style eggplant

- Top up MTS from a bank card via the Internet, terminal, ussd request or Autopayment service

The state pension, if the breadwinner was a Chernobyl survivor, is assigned:

- A grandmother who has reached the age of 55 or is disabled if there is no one to support her.

- A grandfather who has reached the age of 60 or is disabled if there is no one to support him.

- Children under 18 or 25 years of age if they are studying full-time.

- To a husband or wife, regardless of employment and age, if they are raising a deceased child under 14 years of age.

- Husband reaching 55 years of age or disabled.

- Wife over 50 years old or disabled.

- Disabled parents.

Social pension and survivor benefits are assigned only to the children of the deceased until they reach the age of majority or 23 years old if they are full-time students.

The survivor's benefit, which is paid through the internal affairs bodies, is:

- Parent, guardian, adoptive parent, trustee for the maintenance of a minor child.

- A guardian or trustee for the maintenance of a child over 18 years of age, if the latter became disabled before reaching the age of majority and the court limited his legal capacity or declared him incompetent.

- An adult child if he was assigned a disability before the age of 18 or if he is a student or full-time student until he graduates or reaches 23 years of age while continuing his education.

Please note that survivors' pensions are granted for life or for a specified period. The grounds for termination of payments may include:

- the child reaches adulthood;

- the child reaches the age of 14, if the money was accrued to the citizen who provided care;

- deprivation of parental rights;

- death of the recipient.

Will the survivor's pension be increased in 2021?

The surcharge is tied to the base amounts, its amount is fixed until the size of the base changes. Since it is aimed at satisfying minimal human needs, its size is extremely small. In 2021, according to the news, there was an increase in all types of benefits, except social benefits.

How much will the payments increase?

The insurance pension for the loss of a breadwinner was increased by the state in January 2021 by 7% points, in material terms this is about one thousand rubles. Its basic part is 5334 rubles. Indexation of pensions from May 1, 2021 applies only to those who are on well-deserved retirement; recalculation for the loss of a breadwinner was not made, since there was no reason.

Survivor's pension: marriage and divorce of parents

If a person is a minor, then while studying at a university, survivor benefits continue to be paid to him, even if the person enters into a marriage relationship. This does not change anything in the status, and payments continue in the same amount.

Amounts of benefits for the birth of a child

Divorce of parents also does not affect child benefit payments. Indeed, according to the law, a parent must provide for his child in any case, even if the spouses have been divorced for a long time.

Thus, you should not delay in applying for a survivor’s pension. After all, if a person falls into the required category, then soon he may already receive benefits.

The size of the survivor's pension in 2021

The basic component of social pension is 5034 rubles, for orphans - 10000 rubles.

State support for dependents who are under 18, whose parents died in a man-made accident (or if he was supported by a single mother) is 12,500 rubles in 2021, for other relatives 6,200 rubles.

The fixed premium for the insurance part is 5334 rubles.

When determining the amount of payments for loss of family support, not only basic amounts and coefficients are taken into account, but also individual indicators. Pension points and insurance contributions transferred to the Pension Fund of the Russian Federation are influenced. Pension Fund employees have their own scheme. With which they calculate the individual amount of cash payments:

Last but not least, the place of residence of the pensioner is important. In large cities and the capital, this type of benefit will be an order of magnitude higher than the size of the survivor's pension in the country. This is due to different levels of income in the regions and the size of the regional subsistence level.

For pensioners living in climatically difficult zones (Far North, etc.), a regional coefficient will be added to the payments due. Moreover, if they want to move to another region on a permanent basis, the regional coefficient will no longer be taken into account when calculating their payment.

How is survivor benefit calculated?

Each benefit: insurance, state or social, intended for payment to the population, depending on the type, has its own conditions and calculation characteristics.

The insurance pension is calculated every month and is aimed at supporting disabled citizens who have lost their only source of livelihood. It is paid according to two other indicators:

1. Due to old age.

Accrued to men and women upon reaching retirement age - 60 and 55 years. In this case, the individual coefficient and the total length of service before retirement are taken into account.

2. For disability: carried out after passing an examination in medical and social institutions in Moscow or another locality. The benefit is awarded to persons with I, II and III disability groups.

The survivor's pension for minors in 2021 is calculated based on insurance premiums transferred on behalf of the deceased, as well as the amount of accumulated labor points. If both parents are lost, these figures are summed up and the compensation payment is doubled. Orphans are sent to an orphanage or under the guardianship of official representatives while maintaining benefits.

Insurance-type compensation benefits paid by the state have the following distinctive features: they are part of the state’s social policy; provide the minimum amounts necessary to meet the basic needs of those in need; extended if one of the parents, after the death of the other, enters into a new marriage; automatically accrued to children under the age of majority. Social pension is paid on a monthly basis to those in need. It is accrued exclusively for the period of incapacity, after which it ceases to be allocated: it is formed and determined based on the state and scope of the state budget; is not subject to contributions to the pension fund account.

Conditions for receiving pensions due to the loss of a breadwinner in 2021

If a person has lost a family member who supported him, according to the current legislation regarding such compensation to relatives, he may qualify for assistance from the state. To complete it, you first need to collect all the required documents.

The assignment of support payments can be approved if one of the following documents is required:

- Death certificates of a person who provided for the family

- A decision made by a court to recognize such a person as missing.

Additionally, a person applying for pensioner status must provide documents confirming the fact of his inability to work and being dependent on the deceased. Also, this person must be a permanent resident of Russia.

Registration for a child

The survivor's pension in 2021 for minor children is calculated by including the insurance premiums paid by the deceased parent and his insurance points. If an orphan has lost both parents, then the indicators are summed up. According to Russian law, complete orphans must be either in an orphanage or with guardians, but their benefits will be retained. At the same time, stepchildren also apply for benefits if their adoptive father has been caring for them for more than 5 years.

Registration if parents are divorced

It does not matter whether the parents were married at the time of the death of one of them, divorced or in a civil marriage. A child under 18 years of age will automatically be recognized as a dependent; the second parent only needs to submit an application to the local branch of the responsible authority and attach the necessary documents.

What matters here is the fact of paternity and maintenance of the child by the deceased parent, and not the relationship of the former spouses. The child’s second parent will not be able to obtain pensioner status, even if he was actually a dependent; this benefit is assigned only to official widows/widowers.

Amounts of survivor benefits in 2021.

The amount of the benefit due is established by regional legislation, therefore in each region its amount is different, but it is always no less than the minimum subsistence level defined in the region.

The size of the survivor's pension in 2021 is determined based on the type of benefit and is paid according to certain time intervals. These periods are also characterized by changes in the amount of financial assistance. It can either decrease or increase by a certain percentage level, which depends on the economic situation in the country and a number of other factors.

The type of pension accrual, the current size of the pension, the increase in benefits and the survivor's insurance benefit depend on the length of service of the deceased breadwinner and a number of other factors. However, a fixed payment of 2279 rubles is always added to it. 41 kopecks.

From February 1, 2021, the benefit amount will be 2498.66 kopecks.

The social benefit for the loss of a breadwinner until April 1, 2021 is 5,034 rubles. 25 kopecks.

When a child is raised by a single mother or both deceased parents, the amount paid doubles: 10,068 rubles. 50 kopecks, and from April 1, 2021 it will be 7586.35 rubles.

If you lose your mother or both parents at once, the pension benefit will be 10,472.24 rubles.

State benefit for the loss of a military personnel in the event of the death of a person serving in the army due to injuries and injuries.

The benefit amount until April 1, 2021 is double the social pension or 200% of it - 10,068 rubles. 50 kopecks; when a person serving in the army dies due to illness.

The amount until April 1, 2021 is 1.5 times higher than the social pension, that is, it is 150% of it - 7551 rubles. 38 kopecks.

From April 1, 2021 it will be 10440.53 rubles.

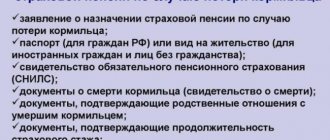

Documents for registration

For appointment you will need:

- Personal Statement

- Passport

- Certificate of death of the miner or his missing person

Depending on the specific situation, the Pension Fund employee may request other certificates, so it is better to first clarify by phone the full list of documents, as well as information on where and how to obtain them.

To receive a social pension, similar documents are required, except for a work book and salary certificate.

To receive a state award, you will need more certificates. Thus, relatives of the deceased from military structures additionally need to submit:

- Certificate indicating the cause of death

- Proof that the widow has not remarried

What documents are required to receive survivor benefits?

To apply for the benefit you will need the following documents:

- Documents proving the identity of each member of the family who has lost their breadwinner;

- Official certificate of loss of the deceased;

- Work record book of the breadwinner;

- Certificate from the place of employment about the income of the breadwinner for the last 2 months.

These documents are submitted to the branch of the Pension Fund of the Russian Federation together as an appendix to the corresponding application.

Until what age is it paid?

Survivor benefits are tied to the dependent's age and ability to work. Age limits are:

- For minor dependents, the pension is assigned until they reach the age of 18, and is automatically withdrawn after 18 years.

- They will receive benefits into their cash accounts until the age of 23 if they are studying full-time at a university.

- At the age of 16 - cancellation of payments to children who have entered into an official employment contract or early marriage;

- After reaching the age of majority, the pension continues to go to family members for the period of officially confirmed incapacity for work.

- A disabled mother and father, the legal wife of the deceased or husband, as well as family members who are disabled from childhood, will be paid a pension throughout their lives.

That is, the law establishes that pensions can be received by citizens who officially do not have the opportunity to ensure their own existence.

If you are studying full-time

Until what age is a survivor's pension paid to a student? Dependents who are studying full-time in Russia or abroad are paid until the end of their studies. If a student changes institutions, but the form of study remains the same, the benefit will continue to be paid.

After turning 23 years old, the payment stops, regardless of continuing education. An exception is the case when a student becomes disabled before reaching the age of 18. Money will be transferred to his account until the end of his life or until his disabled status is removed.

Who is the survivor benefit intended for?

A survivor's pension is paid if other family members cannot provide for themselves. Such persons include: disabled people with disabilities, pensioners when they were supported by a younger family member, minors (survivor's benefit for a child is provided to the eldest child under 18 years old), adults (persons from 18 to 23 years old, full-time students in higher and secondary educational institutions until the very end of their studies), other relatives of the deceased (who took custody of a child under 8 years of age).

Family members for whom a survivor's pension is issued can receive it until the moment when an able-bodied member appears in the family who has taken on the role of supporting dependents.

The new breadwinner of the family can become one in the following cases provided by law:

- when the dependent has reached the age of majority;

- when an adult dependent graduated from a university or was expelled;

- if the pension was received by a relative of the deceased who was dependent on a child under 8 years of age and the child has reached this age.

FAQ

The loss of loved ones is always difficult to experience, but if at the same time the question of one’s own financial support arises, the situation becomes critical. Therefore, it is very important to receive clear and understandable questions to all questions of interest to the future pensioner regarding the conditions and procedure for assigning payments. And there are usually enough of them, since in this case legal regulation does not always give unambiguous answers.

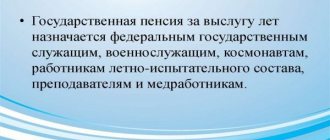

Payments in the event of the death of a military personnel or police officer

A separate case is state support for family members of a military man or an employee of the Ministry of Internal Affairs. Conditions for its purpose and dimensions:

- If a man dies from injuries incompatible with life while serving in the army, his relatives will be paid a double standard social benefit. The amount of the survivor's pension in 2021 in this case will be 10,800 rubles.

- If a military contractor is sick due to illness, the payment will be less, its amount is 7900 rubles.

Is it possible to receive 2 types of pensions?

Currently it is allowed to receive only one type of security. If several options are suitable at the same time, the recipient can choose the most profitable option. But some categories: relatives of fallen military personnel, astronauts, victims of man-made disasters - are entitled to several pensions at the same time.

What date does it arrive?

State and social maintenance are assigned to the applicant if a positive decision is made from the 1st day of the month in which he applied.

If the future pensioner applies within a year from the date of death of the caregiver, insurance money will be paid from the date of his death. If the applicant applied a year later, they will appoint a year earlier than the day of application. For example, a citizen died on 04/07/2019. If you apply for help within a year, it will be assigned from April 7, 2021. If the pensioner submits an application on April 10, 2021, it will be paid from April 10, 2021, and will arrive on time.

Is it possible to work officially?

State, insurance and social survivor's pensions are a measure of support for people who cannot work and whose support depended on the income of a deceased family member. This is not a one-time payment, but a monthly one, designed to maintain a minimum standard of living for the dependent. If the recipient was able to find official work, the basis for payment of benefits disappears. At the same time, it is the responsibility of the recipient to inform the Pension Fund that there are no longer grounds for payment. The department will still find out that the dependent is officially working, which means it will have the right to hold him accountable and recover the illegally paid amount.

Who gets survivor benefits?

Let's take a closer look at the circle of people who are entitled to survivor benefits in 2021.

The following persons have the right to receive insurance benefits for the loss of a breadwinner in 2018:

1. Children.

1.1. A minor child of the deceased, his brother, sister or grandson who has not reached 18 years of age;

1.2. Adult children. If they study in educational institutions, subject to full-time training in university departments. Payment stops upon reaching age 23. Over 18 years of age if they received a disability before reaching adulthood;

2. Senior members of the deceased's family.

2.1. Mother and father upon reaching 55 (60) years of age or having a disability.

2.2. Grandparents under the same conditions, in the absence of other persons who are entrusted with the responsibility for their care and maintenance.

3. Guardians or other official representatives are on an equal basis with parents, and adopted children are on an equal basis with natural children.

4. The right to receive a state and social pension for the loss of a breadwinner in 2021 belongs to: the older and younger generations of children under conditions similar to those for receiving insurance benefits.

5. Widows of military personnel who died while performing military duty as part of conscription due to military injuries. If they have reached the age of 55 and have not married.

6. One of the older generation (grandparents), brothers, sisters, involved in the process of caring for persons who have not reached 14 years of age. In this case, length of service is not taken into account; mother and father upon reaching 50 and 55 years of age. If the son died during conscription service or died after its completion due to injuries received while in the unit. Family members of citizens who suffered or died from the consequences of the Chernobyl accident: parents, regardless of whether they were dependent on the child during life; spouse (wife, husband) caring for a child under 14 years of age, regardless of length of service and employment. He may be provided with benefits until he reaches 50 (55) years of age, regardless of the time that has passed since the death of the citizen and the status of a dependent.

Grounds for recalculating payments

Issues of assignment, accrual and procedure for recalculating pensions are regulated by law. The main acts are:

- Federal Law No. 400-FZ (December 28, 2013) “On insurance pensions”;

- Federal Law No. 166-FZ (12/15/2001) “On state pension provision in the Russian Federation.”

Recalculation may be carried out in connection with changes in legislation or for other reasons, if there is documentary justification. Adjustment of the size of a social or state pension occurs only on the condition that minor children receive it. This option is only possible upon the death of the second parent.

- What happens to a loan if the bank’s license is revoked

- How to stop nosebleeds

- 3 organs need to be checked for those who have had COVID-19

Increase in fixed part

Recalculation of insurance pension benefits is carried out only after the death of the second parent, when the child becomes an orphan. The increase occurs only upon application. In a non-declaration procedure, not a recalculation is carried out, but an indexation of the fixed payment.

Recalculation of the insurance part

The increase in the insurance part of the pension is made taking into account the change in the value of the individual pension coefficient (IPC) of the deceased for the year preceding the assignment of the pension, and is a one-time increase. For recalculation the formula is used:

SPPK = USPPK + (IPK / K / KNCh x SPC), where:

- SPPK – the amount of insurance pension for the loss of a breadwinner;

- USPPK - the established amount of insurance pension for the loss of a breadwinner;

- IPC – the number of points determined based on the amount of insurance contributions to the Pension Fund of the Russian Federation, which were not taken into account as of the day of the citizen’s death;

- K – coefficient of the ratio of the standard duration of the breadwinner’s insurance period, calculated in months, to 180 months;

- KNC – the number of disabled family members as of August 1 of the year in which the recalculation is made;

- SPB – the value of the pension point established on the day of recalculation.