The influence of military service on work experience

The term “work experience” (TS) is used to indicate the length of work of individual citizens.

It includes not only the time when a citizen was actually at work, but also periods when he was forced to leave his workplace for certain reasons. For example, due to military service. The concept of “work experience” was applied in Law No. 173-FZ. Before the changes in 2002, the pension (the fact of its provision and the amount) depended precisely on this indicator. Subsequently, the size of pension payments began to be determined by the insurance period (SS) - the period during which a person was insured in accordance with the established pension insurance regime.

Article 11 of the same legislative act indicates that service time is included specifically in the SS.

The time of military service will be taken into account in the length of service, as established by Law No. 173-FZ of December 17, 2001. Also, according to the provisions of Federal Law No. 400-FZ, it will affect the size of the CC.

The procedure for enrolling military service in the length of service

Article 1 of Law No. 4468-1 establishes that persons undergoing military service and entitled to include this period in their length of service include:

- warrant officers and officers;

- midshipmen;

- privates and sailors who are contract soldiers.

The time spent in the army will be taken into account when calculating disability payments and some types of length of service only if before and after it the citizen was officially listed as working.

General provisions for enrollment of work experience

A person undergoing military service, on the basis of Art. 2 of the Federal Law “On Military Duty...” can choose to serve under a contract or by conscription. Conscription for all Russian men over 18 years of age is mandatory, is not paid and is not considered from a work perspective. Contract workers choose service based on their own motivations, but this always involves concluding a contract, receiving a salary and a host of other privileges.

Important! There is an immutable rule for conscripts - if before serving in the army they did not make contributions to the Pension Fund of the Russian Federation, then the period of service will not be counted towards their length of service. In order for a man to have conscription service included in his total length of service, he must work before that time and pay contributions to the Pension Fund (FSS).

The work can be short-term, lasting a few months, but it must be official and with a “white” salary. An exception is made only for young people drafted into the Russian army, navy, border troops and serving in the internal troops.

According to the law of the Russian Federation No. 4468-1 , a person who has completed military service is considered:

- employees of the army and navy with the rank of officer;

- ensign, midshipman;

- contract soldier (sailors and soldiers).

All of them are entitled to a military pension, which is calculated not according to standard civil laws, but according to length of service. The length of service is taken into account for other categories of military conscripts, for whom the general principle of calculating pensions and calculating length of service applies.

The state has not forgotten about the wives of officers, who accompany their spouses to any point where they are based in their line of service. In garrisons, especially distant ones, the problem of employment is acute for women. Even with all the desire, there are not enough jobs for everyone and accrual of length of service by the time of retirement is minimal or non-existent.

Types of length of service and principles for including military service in each of them

Military service is taken into account when calculating the total amount of most types of service:

Labor/general

Used when making calculations related to determining the size of the pension.

Previously (before 1993), length of service was decisive in determining the size of the pension. Inclusion of military service in this indicator is based on its actual duration. For some groups of citizens, the calendar length of service may be increased:

- doubled for conscripts (included in civil service and labor experience, and also taken into account when assessing the right to a pension);

- three times for those who took part in hostilities (taken into account when assessing the right to a pension).

Also, this type of length of service is used to determine the right to a pension that was earned before 2002 and early establishment of a pension.

Insurance

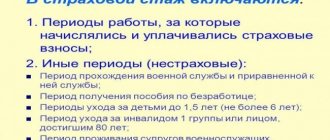

It is decisive for determining the possibility of calculating a pension, and also regulates the percentage of sickness benefits accrued. In this category, military service is accepted as a non-insurance period and is important when calculating:

- pensions (provided that the beginning and end of military activity is directly adjacent to the working periods);

- sick leave.

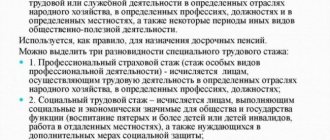

Preferential

Provides the opportunity for early retirement.

Obtaining preferential length of service for a military serviceman is possible only if his position is listed in Law No. 76-FZ (clause 3), which contains a list approved by the Government of the Russian Federation.

The principle of calculating the length of service of those who served in the army

As a general rule, service in the Armed Forces and structures equivalent to them is counted on the basis that 1 day of being there is equivalent to 1 day of work. In other words, it is taken into account depending on its duration in calendar days. However, there are exceptions. Thus, for conscripted military personnel, 1 day in the army or navy is equivalent to 2 days.

Example 1

The contract soldier served for less than 3 years, after which he left the army, subsequently working in civilian positions. Thus, he did not earn the right to a military pension, and the entire period of his stay in the army is equated to ordinary work. Accordingly, during the period he was in the army, he accumulated 3 years of work experience.

Example 2

A conscript soldier served the statutory period of 1 year and after demobilization worked in civilian life. Taking into account the increasing coefficient, the period of work experience accumulated during service is 2 years.

When applying for a pension, PFR specialists may request documents confirming that the citizen is in the army. These include:

- military ID;

- work book with a record of its owner being in the army;

- certificate from the military commissariat;

- certificates from military units and other places of service.

Insurance part: calculation features

The insurance period is more important, determining both the right to retire and its size.

For conscripted military personnel, being in the army is included in the insurance period only if, before this time or immediately after it, he had an official job (or was engaged in entrepreneurial activity) and contributions were made to the Pension Fund for him.

Important! The duration and nature of the work activity in this case does not matter at all; it is only important that it coincides in time with the period of being in the army.

If this condition is met, for each year that a citizen serves in the military, he is awarded 1.8 pension points.

For contract soldiers (including officers) who cannot qualify for a long-service pension, military service is included in the insurance period.

As for military pensioners who are going to apply for a second “civilian” pension, the time spent in the army, taken into account when calculating length of service, cannot be included in the insurance period.

Preferential length of service: nuances

As a rule, preferential service requires early retirement due to difficult and harmful working conditions. Staying in the army may be included in this period, provided that the citizen worked in hazardous work before being in the army or immediately after discharge and returning to civilian life. However, this applies to those workers who worked under special working conditions before January 1, 1992.

As for the special experience of health care and education workers, only compulsory military service before October 1, 1993 is included in it.

The situation is different during the period of contract service. It can be counted as special service provided that 1/3 of its citizen was in the army, and 2/3 worked in relevant positions in healthcare and educational institutions.

Military service in most cases is still of great importance for the formation of various types of length of service and, as a result, affects the size of future pension benefits, which, undoubtedly, is one of the incentives for completing it.

How does the length of military service affect seniority?

In general, military service is included in the length of service in a 1:1 ratio (a year of service equals a year of experience). This also applies to those cases when a person decides to devote his entire life to the army. If he serves under a military contract, then he actually receives official employment.

Moreover, it provides an opportunity for early retirement. To do this, you must voluntarily serve a certain number of years. Today, this period is 20 years and upon completion, a citizen can become a full pensioner. This initiative receives significant support from the state in the form of increased pension payments.

How military service affects the calculation of sick leave (SL) and the calculation of pensions

Not immediately, but at a certain point, the military becomes interested in the question of whether military service is included in the insurance period for sick leave. This provision is provided for by law. Since the person worked and made contributions to the Pension Fund.

Related article: Confirmation and calculation of insurance experience

In addition, the following periods are included in the insurance period:

- stay on sick leave;

- military leave to care for a child up to 18 months;

- caring for disabled or elderly people over 80 years of age;

- temporary unemployment of one of the family members when transferred to a remote area or to another state;

- stay in places of deprivation of liberty with subsequent rehabilitation;

- protection of a diplomatic mission by the husband when the wife was deprived of the opportunity to work;

- studying at an academy or taking advanced training courses.

The insurance period for sick leave includes the labor activity in which the citizen was engaged, provided that the interval between types of activity did not exceed 12 months. In this case, the average salary for the last 2 years and a reduction factor determined by length of service in calendar terms are taken into account. So, for up to 5 years of service, 60% of the amount is paid, up to 8 years - 80%, then - in full.

Example:

Citizen A spent 9 days on sick leave. At the same time, over the last 24 months he was paid 1,200,000 rubles, which is 1,643 rubles per day and 14,794 rubles for the period of incapacity. Considering that A served for 7 years, then K 0.8 is applied, and the entire payment will be 11,855 rubles.

Note! A certificate of incapacity for work is subject to tax collection. As a result, citizen A will receive compensation in the amount of 10,296 rubles.

Accounting for military service when calculating pensions using a point system

This system, used to assign pension payments, was approved in 2015.

The exact amount of payments is determined by the pension coefficient, which is calculated individually for each citizen. The higher it is, the more money a citizen will receive while on a well-deserved rest. As a general rule, points are added when the employer makes pension contributions. 1.8 points are awarded per year. Military years are counted in a similar manner, although no payments are made during this time.

Necessary documents for including military years in the length of service

To confirm the fact of being in the army for a certain period and accruing the corresponding length of service, a citizen of the Russian Federation will need to provide:

- Military ID. Read more about how to get a military ID here.

- Certificates issued by a military medical institution.

Experience is awarded not only for service, but also for time spent in military educational institutions.

In this case, the pension applicant can provide a diploma indicating that such a fact actually occurred. Read more about whether studying at universities is included in your work experience here. A citizen returning from the army must bring a certificate of demobilization to the personnel department of the organization in which he previously worked. Based on this paper, a record is made in his work book about how long the person spent in military service.

The following is a record indicating the fact that the employee has returned to perform his duties or indicating his dismissal.

If previously (before the army) a man did not work, then he must get a job and present the new employer with a clean work record book and one of the documents confirming the fact of military service.

Drawing conclusions

Insurance (work) experience affects a person’s pension and sick leave payments. In essence, the state provides minimum payments, and a person must earn a larger amount himself in the form of insurance contributions.

Military service can be included in the length of service (insurance), but is actually considered a non-insurance period (without deductions) if there was no actual work activity during the service.

The concept of preferential (work) length of service as applied to people who have devoted themselves to military affairs. For them, the length of service is counted as length of service, and the military can retire based on length of service. The concept of a “military pension” is present here, and when it is accrued, a man can continue to work and in the future apply for a “second”, civil pension.

Important! Despite the fact that military service is considered a non-insurance period and without paying contributions to the Social Insurance Fund and the Pension Fund, it is still counted towards the length of service and will be taken into account in the future when calculating a pension, but for this you need to provide a military ID. The exception is “rural experience,” when a village resident goes to serve in other regions of the Russian Federation.

What else do you need to know about including years of military service in your length of service?

Key points related to the calculation of seniority for military personnel:

- In the vast majority of cases, length of service correlates with regular work experience as one to one (1 day of service equals 1 day of length of service). However, there will be no entries about him in the work book.

- In order for work experience before and after service to be considered continuous, a citizen must return to work within a year from the date of demobilization.

- When calculating length of service, military service is understood as both conscription and contract (Article 2 of Law No. 53-FZ).

The length of service is maintained even if the service is interrupted several times, and this is important because it allows you to receive the maximum compensation provided by the state.

Military service does not become a reason for interrupting your work experience. The calendar length of time spent in the army is taken into account in almost all types of service. It can also become a condition sufficient for early retirement.

Peculiarities of calculating the insurance period of a military personnel

If before 2002 the basis for calculating social benefits was the length of service, that is, the sum of entries in the work book, now the calculation is based on the amount and duration of insurance contributions. This is due to the fact that the well-being of citizens and their secure old age depend on the payment of taxes to the state budget by employers.

Military service in the Soviet Army and law enforcement agencies that arose after the collapse of the USSR is considered labor activity, regardless of the name of the country in which it was carried out. This decision was made to prevent infringement of the rights of military personnel who performed their military duty in various conditions.

At the same time, all the features that are characteristic of all categories of citizens are taken into account, but in accordance with the legal status that they had during the period of service. Thus, the insurance experience of military personnel includes:

- emergency service;

- by contract;

- length of service of career military personnel.

Related article: The concept of special insurance experience

Without knowing whether military service is included in the insurance experience and how it is calculated, you can suffer serious material losses on social benefits.

Meanwhile, this indicator is the basis:

- for calculating pensions;

- to pay for sick leave;

- for the purpose of disability benefits.

Important! To assign an old-age pension, it includes not only military and work experience, but also takes into account intervals, including the time of forced unemployment.