Is study included in the total length of service? According to current legislation, no. If the training took place before 2002, yes, because this was established by the law in force before 2002.

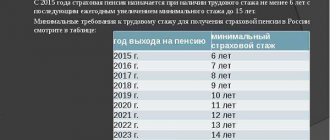

The insurance period (production) is the time when pension contributions were made for a citizen. Its main significance is that it influences the formation of pension contributions (currently the minimum for assigning a pension is 15 years).

Pension legislation is constantly changing, but a new law cannot worsen a citizen’s situation. According to the previous law, the time of study was taken into account when assigning pension benefits, but according to the current law, it is not. Therefore, whether studying at an institute is included in the length of service depends on the period during which it occurred.

Is study included in the total work experience?

Until 1992, pensions were assigned on the basis of Resolution of the Council of Ministers of the USSR No. 590 of 08/03/1972, from 1992 to 2002 - according to the law on pensions No. 340-I of November 20, 1990. In accordance with these legislative acts, years of study are included in the total work experience if a citizen received education in higher and secondary specialized educational institutions.

Since 2002, Federal Law No. 173 of December 17, 2001 on pensions has been enacted in Russia. In accordance with Art. 10-11 of this law, the period of study is not taken into account when assigning a pension. The very concept of “work experience” has been replaced by “insurance”.

In 2015, the legislation changed again. Federal Law No. 400 came into force, adopted on December 28, 2013 and still in force to this day. He increased the number of periods counted in labor output, but the period of education was not included in it.

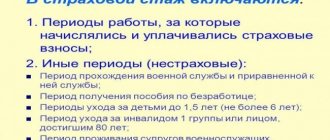

In accordance with Art. 11 of the new 400-FZ, insurance coverage includes the following periods:

- military service;

- receiving unemployment or disability benefits;

- caring for a young child under one and a half years old;

- caring for a disabled person, an elderly citizen over 80 years old, a disabled child;

- unjustified detention;

- living together with a military spouse (or military spouse) in an area where there was no opportunity to carry out work activities;

- living with a spouse abroad.

According to the law, it turns out, and this is indicated in paragraph 8 of Art. 13 400-FZ, that study is included in the length of service for a pension if it was carried out before 2002. This term refers to the acquisition of knowledge in secondary and higher educational institutions.

Studying at an institute or university while working while calculating a pension

Many students are interested in the question: are the years spent studying at a university included in their work experience? The same question is asked by employees of enterprises who, at the request of the employer, undergo training. Let's figure out how the time when a person receives education affects his work experience in 2018-2019.

Types of work experience

Work experience is the time during which a citizen officially worked at any enterprise or performed socially useful work defined by law. This length of service is recorded in a document called a work book. If the book is lost, evidence that the person actually worked can be provided by certificates stating that he was paid a salary.

Until 2002, the concept of “total length of service” existed. These are all temporary periods when the employee was officially employed. Then such periods included the time of receiving education at a university or in special educational institutions. It is important that studies at a university take place full-time. The work record book indicated the years in which the person was trained.

In 2002, the government approved the Federal Law “On Labor Pensions in the Russian Federation”. According to this law, the concept of “total length of service” was replaced by the concept of “insurance period”.

The new definition more accurately reflects the essence: the insurance period is the time period during which the employee made official contributions to the Pension Fund of the Russian Federation.

During the Soviet Union, such deductions were called state insurance contributions.

Important! It does not take into account whether there were breaks between employment: “continuous experience” has been abolished.

Sometimes in special documentation there may be other concepts of length of service that affect the calculation of various accruals:

- Public service experience – work in government organizations

- Continuous service is a concept eliminated on January 1, 2007. It is not taken into account when calculating accruals for pensions and sick leave. It may turn out to be significant only when compared with the insurance experience after a year of reform (if the continuous experience exceeds the insurance period, the pension will be calculated based specifically on the continuous one)

- Special insurance experience is a job that gives the citizens employed in it the right to early retirement

Studentship and experience

The years that a person devotes to learning his chosen profession while studying at a college, school, or university are quite long time periods associated with future employment directly or indirectly. Will they be included in the insurance period? We reason logically and without contradicting the law.

The time of study in any educational institution is not mentioned in Art. 12 Federal Law No. 400 “On Insurance Pensions” dated January 1, 2015. A student citizen does not make pension contributions, and this is the main argument for a negative answer.

The only exception

The law will include university studies in the insurance period only in two cases:

- The educational institution is under the jurisdiction of the Russian Ministry of Defense

- The university prepares future law enforcement officers (Ministry of Internal Affairs department)

Students of these universities are equated to military conscripts, and this activity, as Article 10 of the Federal Law “On Pensions in the Russian Federation” says, is included in the length of service.

If the employee studied during the USSR

For a large number of people preparing to receive a pension, their education ended before 1991, when the concept of general work experience was in force, which included their stay in educational institutions.

However, Art. 10 Federal Law of December 17, 2001 excludes this time from the length of service, even if such a citizen’s pension was accrued before the reform.

Part-time work while studying

While studying, a student can officially find a job:

- By concluding an employment contract for a “fixed-term” employee (for example, during the holiday months)

- Performing home work under an employment contract

- Having chosen remote cooperation, formalized

Since, while working, he will also make pension contributions, accordingly, these periods will count towards his length of service.

A student has the right to start saving for retirement

According to the laws of the Russian Federation, having received a passport at the age of 14, a student can officially find a job. Working at such a young age, a citizen of the Russian Federation is already accumulating funds in his account for a future pension, increasing his insurance period.

Study while working - but what about the experience?

It is not uncommon for working citizens to undergo on-the-job training. Naturally, studying employees have a question: how does the time spent on studying compare with their work experience, since they are not working during this time?

Art. 173 of the Labor Code of the Russian Federation guarantees employees sent for training by the employer or enrolled independently, additional study leaves, for which payment continues to be in the amount of average earnings.

Since wages have been maintained, required Pension Fund contributions are also made on time. Thus, the educational leave on which the employee goes, like all types of paid leaves, will be counted towards the insurance period.

Study and special work experience

When a person works in difficult conditions and/or in harsh territories, such as the Far North, his work experience is calculated according to a special, preferential scheme - with a special coefficient. Therefore, the employee gets the opportunity to take a well-deserved rest before the usual deadline.

When else, while studying, can you not lose experience?

In the life of employees, there are moments of varying duration when they do not actually perform their job function, but their service is not interrupted. Naturally, the length of service will continue to increase if during such a special period the person is also studying.

According to the law, the insurance period continues to run if the employee is employed:

- Military service or cooperation with the Ministry of Internal Affairs

- Improvement of health (with official certificate of incapacity for work)

- Your baby up to 1.5 years of age

- Looking after a disabled person of group 1 (including a child), an elderly relative (after 80 years)

- Being on the way for employment in another area, if the referral was received from the employment service

- Public works

- After serving the sentence

- Proof of the unfoundedness of criminal prosecution

Important! The listed periods are included in the insurance period if before these events or immediately after them the person was employed and made contributions to the Pension Fund of the Russian Federation.

Is studying at an institute included in the length of service for calculating a pension - laws and regulations

Russian legislation quite strictly regulates the issue of pension provision for citizens, since it is one of the most important components of the social policy of the Russian Federation.

In turn, the length of service for calculating a pension is the main criterion according to which citizens of the Russian Federation and foreigners who have the right to an insurance pension can apply for its assignment.

In pension legislation, the concept of “work experience” in Russia was abolished for all citizens after 2002 and replaced by insurance experience, but among the population most often an equal sign is put between these different concepts.

The direct legal regulation of how the length of service for receiving a pension is calculated is provided by the provisions of the following legal documents and acts:

- Federal Law No. 167 dated December 15, 2001. This federal-level law establishes the general principles of the pension mechanism used in the Russian Federation, considers the main types of existing pensions and the criteria for their assignment

Source: https://soczaschitnik.ru/trudovoj-stazh-pri-uchebe-i-raschet-pensii/

When will training time be counted?

University, technical school, and graduate school are taken into account when assigning a pension; college is included in the length of service for a pension, but not school years; studying at a comprehensive school has never been included in the calculation. And they count only when completing training before 2002.

The exception is cases when the student carried out labor activities in his free time from classes.

According to Soviet legislation, vocational education was equal to these types of education, so the answer to the question of whether courses are included in the pension experience is positive if they were completed before 2002 and related to vocational training (advanced training, etc.).

All about whether studying at a technical school is included in the length of service for calculating a pension

- service in the army, the Ministry of Internal Affairs and other government agencies;

- looking after a disabled person: a child or an adult, if he is assigned to group 1;

- caring for an elderly person over 80 years of age;

- sick leave;

- child care up to 1.5 years (up to 6 years in total);

- receiving unemployment benefits;

- performing public works on a paid basis;

- stay in places of deprivation of liberty subject to further rehabilitation;

- living in a marriage with a military man in settlements where there were no employment opportunities (up to 5 years);

- living abroad with a spouse who is an employee of diplomatic departments (up to 5 years).

We recommend reading: Renovation News in Lefortovo

Until 2001, the accrual procedure was different, and the length of service was called labor experience. Nowadays the name “insurance period” is relevant and the main emphasis is on the periods when contributions were actually transferred, and not on years of service. But in order to earn a pension, you will have to work a certain minimum number of years.

The training took place at a departmental university

In accordance with Law No. 4468-1 of February 12, 1993 and Government Decree No. 941 of September 22, 1993, training is included in the length of service for receiving a pension in the internal affairs bodies within 5 years. This rule applies to employees who entered the service before 01/01/2012, subject to graduation from an educational institution (Part 2, Article 17, Article 22 of the Federal Law of November 30, 2011 No. 342-FZ “On service in the internal affairs bodies of the Russian Federation and making amendments to certain legislative acts of the Russian Federation", clause 2 of article 35 of the Federal Law of March 28, 1998 No. 53-FZ "On military duty and military service", order of the Minister of Defense of the Russian Federation of April 7, 2015 No. 185).

Based on 342-FZ dated November 30. 2011, 53-FZ dated 03/28/1998, order of the Ministry of Defense of the Russian Federation No. 185 dated 04/07/2015, enrollment in universities of the Ministry of Internal Affairs or the Ministry of Defense is actually entry into service with the signing of contracts.

Does work experience include time spent studying at a university?

During the entire working life, a person sometimes has a need to use funds due to disability. As you age, you need a pension.

Legal relations in this area are based on the concept of seniority . It consists of the time of all work activities, documented. All the nuances of relationships in this area are prescribed in legislation.

The length of service records the applicant’s credentials and the size of the pension. The main confirmation of activity is considered to be a work book , since information about the person, responsibilities, and incentives is entered into it. The length of service is considered for the payment of a future pension.

What is included in the total work experience?

The phrase “total length of service” is popular in everyday life, but it is not included in the law. Previously, it meant the total time period during which a person performed work.

This provides the right to various guarantees and pension calculations. Therefore, it is important to apply for a job officially , with all the necessary documents. With age and disability, a person will be entitled to the necessary benefits.

After recent reform, the “total length of service” began to be called “insurance length of service” . Then an improved insurance system for employed citizens appeared.

insurance amounts for employees . All time periods and money add up, and with the arrival of retirement age, pension payments occur.

The following periods are counted:

- Army;

- Caring for a baby up to one and a half years old;

- Temporary disability;

- Caring for a disabled person, a person over 80 years old;

- Unemployment leave;

- Detention.

In what cases should study be included in the work experience?

According to current legislation, periods of study are not included in the length of service and do not provide any additional pension points. However, if you wish, you can still include your studies in your work experience.

More on the topic Bolshoi Pension Fund: official website of the NPF, personal account, profitability statistics, reviews

The number of years of service currently affects the size of the pension. The assessment of pension rights formed by a citizen before 2002 depends on the length of service.

As we wrote in the article on calculating pensions, for periods since 2002, the amount of the pension depends only on the insurance contributions transferred to the Pension Fund.

For previous years (up to 2001), the assessment of pension rights can be carried out in two ways. In particular, the estimated pension amount as of December 31, 2001 is calculated in two ways:

- the ratio of the average salary of an employee to the national average in the same period (no more than 1.2) is multiplied by the length of service coefficient and by 1,671 rubles;

- The average employee salary is multiplied by the length of service coefficient. This option has a limit on the total amount of 555.96 rubles

After calculating the pension for each option, the option that gives the largest amount is selected.

| Option 1 (clause 3 of Article 30 of Federal Law-173) | Option 2 (clause 4 of Article 30 of Federal Law-173) |

The principle of calculating the length of service coefficient:

| |

What counts towards experience:

| What counts towards experience:

|

This is the problem with the advisability of including study in the length of service for calculating a pension: in order for study to be taken into account as length of service, the pension as of December 31, 2001 must be calculated only through the second option, and this is unprofitable for most pensioners. Here the main role is played by the limitation of the maximum amount of the pension calculated in this way - 555.96 rubles.

For example, when calculating a pension according to the first option, if the employee had a salary close to the national average, the amount will be equal to 919.05 rubles, which is much higher than 555.96 rubles - the limit under the second option.

Mathematically, it can be calculated that it is advisable to include studies in the length of service only for those whose salary in the Soviet years and in the 90s was at 60% or below the national average, and the total length of service (as of December 31, 2001) will be more than 20 years for women and 25 years for men.

For example, if a person’s salary certificate shows the average earnings for 60 months as 90 rubles, and the average salary in the country in the same period was equal to 130 rubles, then it is already beneficial not to include studies (the ratio with the average will be at 70%) .

More on the topic Pension increase from January 1, 2021 and by how much, latest news, indexation for non-working pensioners (infographics)

When establishing an insurance pension, Pension Fund employees are required to calculate both options and then choose the most profitable one (that is, with a larger amount). If you have doubts about the correctness of the calculation, you can request official clarification.

How to correctly calculate the total length of service?

Calculating work experience is simple. It is necessary to calculate the number of years recorded in the work book.

When there is no official work, no contributions are made . That is why the state calls on citizens to take care of their future. Pension reforms and systems that have their own characteristics are constantly emerging.

To calculate your length of service and pension amount, you should visit the accounting department of your place of work . They must provide a document confirming insurance transfers.

Is studying at a university (USSR period) included in the total length of service for calculating a pension?

In Resolution No. 2-P (2004)

) The Constitutional Court of the Russian Federation established that the norms of Law No. 173-FZ “On Labor Pensions in the Russian Federation” do not worsen the situation of persons insured in the compulsory pension insurance system, since this law also provides (except for those established by this new law) the procedure for calculating length of service and the procedure for establishing pension rights that were valid until 2002. and were applied in the corresponding law No. 340-1, repealed in 2002.

: PFR News In September 2021 In Lipetsk

In accordance with Federal Laws dated December 17, 2001 No. 173-FZ and December 28, 2013 No. 400-FZ (names below), study is not included in the length of service (insurance period) for calculating a pension -

What else may be included in the total work experience?

To calculate the pension the following is taken into account:

- Temporary disability;

- The period of unemployment, if the citizen is registered at the labor exchange;

- Time for a government employee to move to another settlement;

- Detention;

- Being with a spouse who served in military service under a contract for no more than 5 years;

- Living abroad with a spouse who is a citizen of a Russian institution;

- Staying under occupation during the Second World War;

- Life in Leningrad during the siege.

Does student time count towards work experience?

The latest pension instructions require that the time of production or other type of activity in the Russian Federation, only provided by insurance contributions, be counted into the insurance period.

Consequently: a full-time student is busy working under a contract, deductions go to the Pension Fund, and the time of his study, which coincides with work, is included in the minimum labor requirement for a pension. The Russian labor law allows a person to start working at the age of fourteen; therefore, a teenager’s work is also subject to inclusion in the insurance period.

Receiving vocational education at a school, college, or university (which does not provide insurance contributions to the Pension Fund) is not included in the length of service. This is stated in Articles 10–11 of Federal Law No. 173. But there is an opportunity to earn the period necessary for a future pension: during vacation time under the contract; through freelancing or remote work, but always with contributions to the Pension Fund.

The situation is different for those who received a pension before 2002 (before the pension rules were changed), at that time studying at a university was included in their work experience. In the regulatory documents of the Ministry of Labor dated 17.10.

2003 No. 70 talks about the right to apply Soviet-era pension laws if studies took place during that period. Previous pension circulars dictated that education should be included in the length of service without work.

That is, the period of studenthood (full-time work) is included in the length of service according to the court, if you can use the legislation of the Soviet era.

Modern legislation allows the inclusion of full-time study time in length of service (medical or pedagogical) if:

- the beginning of studies was preceded by work in the specialty being acquired;

- the period of study was before October 1, 1992, when Law No. 400-FZ and Council of Ministers Resolution No. 590, paragraph 109 regulated the inclusion in the work experience of receiving education in universities, colleges, party, Soviet party schools, trade union schools, and workers' faculties; in graduate school, doctoral studies and clinical residency;

- a student of a higher, secondary (school) or secondary specialized educational institution is officially registered at work and insurance contributions are received by the Pension Fund of Russia;

- Pension contributions for the entire period of study are transferred independently upon a citizen’s application to the Pension Fund and a specially drawn up agreement containing the calculated contribution amount;

- the student officially works at the enterprise during the internship. From the time of dismissal, the calculation of the insurance period also stops.

Are the years of study at a vocational school included in the total length of service when granting an old-age pension?

From 01/01/2002 The Federal Law “On Labor Pensions in the Russian Federation” came into force, according to which periods of work and (or) other activities that were performed on the territory of the Russian Federation by persons specified in part one of Article 3 of this Federal Law are included in the insurance period, provided that During these periods, insurance contributions were paid to the Pension Fund of the Russian Federation.

Hello. Please tell me how the law on adding the period of study at a technical school to the total length of service for the purpose of granting an old-age pension is interpreted today? As far as I know, years of study are added to work experience. but in reality, in the Pension Department, some get an increase and some don’t. But it can’t be that the law says: Act at the discretion of the employees of the Pension Fund Department?

Is studying at a vocational school included in the work experience and where is it noted?

Whether studying at a vocational school is included in the length of work experience is not a rhetorical question, since the length of work experience directly affects benefits and the calculation of pensions. In connection with regular changes in labor legislation, one can often hear an ambiguous and pressing question: whether study at a vocational school or university is included in the work experience . In the Soviet edition of the Labor Code, the answer was clear: all periods of training were included in the total length of service and did not interrupt it. However, today such a characteristic of length of service as continuity no longer applies; there are only insurance periods. So how do HR officers now calculate experience?

- Military service;

- sick leave (including maternity leave);

- caring for a baby up to one and a half years old;

- care for disabled people 1 gr.;

- living with a wife or a military husband if there is no work in the town (no longer than 5 years);

- staying abroad with your wife or husband as a consul, ambassador, or diplomatic representative (also no longer than 5 years);

- registration at the labor exchange;

- looking after an 80-year-old retiree or older;

- illegal imprisonment (confirmed by a decision or determination of a judge).

Is vocational school included in the pension experience?

When studying the question of whether vocational school is included in the length of service for a pension, one should consider the Federal Law on Pensions in Russia. It states that studying at universities, institutes and education courses “does not affect the accumulation of total work experience.” That is, the short answer is “no,” but in fact, exceptions are possible, and in the article we will look at them in more detail.

According to Law 173 on pension savings (and it controls this issue), in order to receive a pension in old age, you must have five years of work experience or more. The official length of service is “insurance”. Previously, when asked whether vocational school is included in the pension experience, one could answer “yes”, because the studies counted. But today, vocational school is considered only with the following options:

We recommend reading: Kyiv Donation by a Non-Resident

Total work experience

Lyudmila, Since 01/01/2002 The Federal Law “On Labor Pensions in the Russian Federation” came into force, according to which periods of work and (or) other activities that were performed on the territory of the Russian Federation by persons specified in part one of Article 3 of this Federal Law are included in the insurance period, provided that During these periods, insurance contributions were paid to the Pension Fund of the Russian Federation. Article 11 of the said Federal Law provides for other periods that are counted towards the insurance period. The list of these periods is exhaustive and is not subject to broad interpretation. Thus, it follows from this legal norm that the period of study at an educational institution is not counted towards the insurance period.

1) the period of military service, as well as other service equivalent to it, provided for by the Law of the Russian Federation of February 12, 1993 N 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, and control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families”;

25 Jan 2021 etolaw 372

Share this post

- Related Posts

- Bailiffs took the car from the yard, what should I do?

- How much does it cost labor veterans to travel by bus for a month in Mariinsk?

- Statement of claim for the recovery of alimony for the second child in marriage sample

- What Documents Are Needed to Apply for a Survivor's Pension?

Is studying at a vocational school included in work experience for calculating a pension?

This allows for a more individualized and fair application of the pension formula. The pension can be divided into two independent parts: funded and insurance. The second is mandatory for all citizens of the Russian Federation, but its amount is calculated privately and takes into account the period during which contributions were made to the Pension Fund.

Is maternity leave and studying at a vocational school in the 80s included in the calculation of a pension? Tell me, is maternity leave and studying at a vocational school in the 80s included in the calculation of a pension? I would like to provide an answer to similar questions published on these sites: www.sknews.ru/consult/31143-vopros-otvet.html General means the total duration of labor and other socially useful activities until January 1, 2002.

25 Jan 2021 etolaw 3015

Share this post

- Related Posts

- Tula for a low-income family

- Formulas for calculating one for hot water in Kursk 2021

- Young family project Yaroslavl results for 2021

- Subsidies for the construction of houses for large families in 2021 in Bashkiria