Home / Alimony / Alimony from sick leave

The child's needs do not decrease just because the parents cannot satisfy them. Even such a valid reason as illness cannot be a basis for non-payment of alimony.

What to do in this case:

- if a parent deliberately does not pay child support, “hiding behind” sick leave;

- if the alimony payer is in a hospital bed for serious medical reasons;

- if the payer is caring for a sick family member.

Is alimony taken from sick leave and what needs to be done for this?

Is alimony withheld from sick leave?

Yes! The alimony payer is not exempt from paying alimony due to temporary disability (illness). Alimony is calculated from the corresponding “sickness” payment.

During the period of temporary disability, the employee receives income corresponding to his salary and length of service. To receive sick pay, he must provide a certificate of temporary incapacity for work - an official document from a medical institution.

This payment is subject to personal income tax (NDFL), since it is a temporary replacement for wages.

Government Decree No. 841 of July 18, 1996 contains a complete list of income from which alimony can be collected. And payment for a certificate of incapacity for work is included in this list. Therefore, alimony is paid from this payment.

How are payments calculated?

The Family Code of the Russian Federation determines what percentage of earnings is supposed to be deducted in favor of minor children. When calculating alimony, the amount of monthly income after taxes is taken into account (for employees - 13%) . Of this amount, a quarter, one third or one second is taken for the maintenance of children.

Table: minimum amount of alimony payments

| Number of minor children | Percentage deducted for alimony |

| 1 child | 25% |

| 2 children | 33% |

| 3 children | 50% |

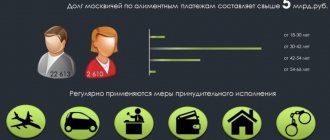

Bailiffs have the right to seek payment of alimony

How to calculate the amount withheld (example)

The amount for sick leave is 9,735 rubles for 15 days of illness. It is subject to income tax of 13% (i.e. 1265.55 rubles). The amount from which alimony will be paid will be 8469.45 rubles. We remember that 25% of this income is required to support one minor child. Consequently, 2117.36 rubles will be used to pay alimony. As a result, the employee will receive 6352.09 rubles. after all deductions.

The court may decide to collect alimony in a fixed amount, which must be paid every month, regardless of the income and employment of the alimony.

Of course, the illustrated calculation of alimony is valid only if the alimony recipient is officially employed.

Video: in what cases is alimony paid in a fixed amount and how can you apply for it?

Innovations in calculations

In 2016–2017, changes in legislation did not affect the method of calculating alimony on sick leave. And yet their final size may change due to a review of the very nature of hospital compensation. Currently, compensation is calculated based on the employee’s length of service. The longer the experience, the higher the amount of deductions will be:

- if the length of service is less than 5.5 years, then the amount of payments will be 60% of the calculated benefit;

- with experience from 5.5 to 8.5 years - 80%;

- when the experience is more than 8.5 years - 100%.

Conditions for withholding alimony on sick leave

The only “BUT!” Deductions from sick leave can be made only on the basis of an executive document . In this case it could be:

- alimony agreement drawn up in writing and certified by a notary;

- writ of execution issued on the basis of a court decision;

- court order.

No other document, for example, a statement from the employee himself or a letter from a bailiff, can be the basis for withholding alimony from a sick leave certificate.

Thus, parents are required to pay child support from hospital payments. But for the process of retaining them to be legal, an executive document is required.

The procedure for working with a writ of execution or other writ of execution

The actions of the employer upon receipt of a writ of execution or other document for the collection of alimony are determined by law. When a writ of execution arrives at the enterprise where the payer works, the document is registered in a journal specially designed for this purpose. It states:

- date of receipt of the document and its number;

- data of the executive body carrying out the collection;

- details of the alimony payer;

- amount of payments and method of calculation.

After registration, the document is transferred for execution to the accounting department of the enterprise. Within three days after registration, it is necessary to inform the bailiffs about the fact of receipt of the document for execution. Withholding of alimony must be carried out regularly according to the schedule specified in the sheet. An exception to the violation of the terms of alimony deductions may be the long-term stay of the payer on sick leave.

Expert commentary

Kamensky Yuri

Lawyer

In case of dismissal of the payer from the organization, the administration is obliged to notify bailiffs about this.

How to get alimony?

Draw up an alimony agreement

One of the executive documents that gives the right to collect alimony on sick leave is an agreement on payment of alimony. This agreement should provide for the obligation to pay alimony even in case of incapacity and the ability to withhold alimony from sick pay.

File a lawsuit

If there is no alimony agreement and it is not possible to conclude one, it is necessary to apply to the court with an application to collect alimony from sick leave through a claim or writ proceeding.

Since the payment of alimony from sick leave is provided for by law, the court, as a rule, makes a positive decision. A negative decision can be made in exceptional cases, for example, if the payer has absolutely no means of subsistence.

A court decision and a writ of execution or court order issued on its basis are the legal basis for withholding alimony from the “sick leave” payment.

Indexation of alimony

Alimony payments in most cases are long-term in nature. Therefore, the economic situation affects the rise in prices and the level of consumption of the population. The possibility of indexation of alimony payments collected in a fixed amount from the debtor’s income (or by agreement) is provided for in Article 117 of the RF IC.

In 2020, adjustments to the amount of alimony due to inflation are made simultaneously with an increase in the minimum level of income necessary to maintain the health and social development of a child (the subsistence level). The minimum level of consumption for the population is confirmed by a regulatory government act, taking into account regional characteristics. The increase in the amount of alimony payments subject to collection is calculated as part of enforcement proceedings. In accordance with the new law on indexation of alimony, signed by the President of the Russian Federation V.V. Putin, bailiffs were able to quickly collect alimony payments from debtors, taking into account the volume of indexation in the economy.

Indexed alimony is paid only if a court decision is made on payments in a fixed amount. When paying salary in shares, indexing of alimony payments is not provided for by law.

Thus, indexation of alimony payments is a government measure to protect these funds from depreciation.

Procedure for withholding alimony from sick leave

The writ of execution (any - alimony agreement, writ of execution, court order) should be submitted to the payer’s place of work. This can be done either by the recipient or payer of alimony, or by bailiffs.

If enforcement proceedings are initiated by bailiffs, they establish the payer’s place of work, the amount of his salary and other income. Along with the writ of execution, a covering letter is sent with a precise indication of the income from which deductions must be made.

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

An accountant who has received a writ of execution for the collection of alimony from sick leave first calculates the amount of the sick leave payment due to the employee. This is done on the basis of the law and the charter of the enterprise, the submitted certificate of incapacity for work and data on the employee’s salary. Taxes are withheld from the amount of sick leave (13%). And then - alimony is withheld: in the manner and amount provided for by the writ of execution. The alimony payment is transferred to the recipient according to the details specified in the document, while the costs for bank transfers also fall on the payer. After collecting the alimony payment, the employee receives the remaining amount of sick leave. Calculation example:

Valery works at a company and pays child support for two children. Soon he takes sick leave and writes a statement for 7 days.

- Accounting considers his daily income to be 1,500 rubles.

- Paid sick leave will cost the company 1,500 rubles x 7 days = 10,500 rubles.

- Tax deductions (personal income tax) will be 10,500 rubles x 13% = 1,365 rubles. Total “net” - 9,135 rubles.

- Payments for alimony from sick leave: 9,135 rubles x 33% = 3,014 rubles.

This is exactly how much child support for 2 children will be withheld from sick leave for a period of 7 days. The accounting department will hand over to Valery the remaining 7,486 rubles.

It should be noted that the collection of alimony on sick leave can be carried out not only at the payer’s place of work, but also at his place of residence. As a last resort - at the location of the property - if arrears arise in alimony payments and there is a basis for holding the debtor accountable.

We recommend reading “Is alimony calculated from vacation pay”, “Alimony from bonuses”, as well as “Alimony from severance pay upon dismissal”.

Basic moments:

- Sick leave does not exempt you from paying child support.

- The basis is a child support agreement, a writ of execution or a judge’s order.

- Payments are made in the same amounts, for example - 25% for one child, 33% for two, etc.

- Calculations are made taking into account the charter of the enterprise.

- First of all, 13-personal income tax is withheld from sick leave, and the rest goes to pay alimony.

- The funds are transferred by the accounting department at the payer’s place of work.

The law does not include temporary disability as a basis for non-payment of alimony. If an employee takes out sick leave, child support is also withheld from him. However, many people forget about an important nuance. Namely, the presence of a writ of execution. There is no need to sit and wait for the accounting department to transfer alimony. What if there is no writ of execution at your place of work? Then the child will not receive any money. To prevent this from happening, it is necessary to calculate alimony from sick leave and take care of providing documents. If you have difficulties with this, contact our lawyers. They will help you understand the laws and avoid mistakes.

Video instruction “How to fill out a sick leave certificate correctly”:

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 6 ratings, average: 5.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612

How is the amount of alimony determined?

The amount of child support awarded to a child depends on many factors. It is calculated individually. The amount of payments is determined in accordance with the following rules:

- It must be at least 0.25 of the employee’s average monthly income. An employee's income includes benefits, basic salary, and sick leave benefits.

- Sometimes the amount of alimony is set in a fixed form. For example, it is 10,000 rubles. In this case, the amount of alimony will be the same regardless of the amount of income. Part of it is formed from the basic salary, part from temporary disability benefits (if any).

- Other deductions may be made from the employee's income. For example, a person has a debt to a bank. If there is a corresponding resolution, the debt is collected from the employee’s salary. However, payments to the child are a priority. They are held first.

The amount of alimony may be determined based on a certain percentage. It depends on the number of children:

- One – 25%.

- Two – 30%.

- Three or more – 50%.

IMPORTANT! If a person is recognized as a persistent defaulter, he has a large alimony debt, the amount of deductions can reach 70%.

Example of alimony calculation

Ivan Sidorov is obliged to pay alimony for three children in the amount of 50%. His salary is 20,000 rubles. The employee went on sick leave from March 1 to March 15. During this period, he will receive an allowance of 10,000 rubles. The accountant carries out calculations in accordance with the following algorithm:

- Taxes amounting to 13% are deducted from the benefit. In this case, they will be 1,300 rubles. Tax is deducted from the benefit: 10,000 – 1,300 = 8,700 rubles.

- Child support is calculated. Their size will be 4,350 rubles.

The total amount of alimony for March will be 8,700 rubles.

Documents for an accountant

In order to correctly process alimony, it is necessary to provide information about the amount of monetary compensation to the accounting department. For this you will need the following documents:

charter of the company in which the payer works;- order from the management of the enterprise;

- certificate of incapacity for work from the worker;

- an extract on the basis of which the average salary for the last two years of the employee’s work is calculated.

Based on all this, the accountant will have to calculate the amount of sick leave. The required amount of funds for the child will be deducted from the resulting amount. In this case, the requirements that are specified in the writ of execution are taken into account.

If a certain amount of interest is deducted from an employee’s salary in favor of alimony, the same will happen with sick leave payments. As a rule, if in a family:

- One child, then 25% is deducted from the salary.

- If there are 2 children – 33%.

- If an employee has three children, then half of the salary will be deducted in their favor.

If a certain amount is deducted from the payer’s salary every month, then the calculation of hospital payments will occur in a different way. Alimony will be deducted at the end of the month from the general salary. In this case, the employee’s sick leave no longer affects the amount of alimony.

How is collection carried out?

In order for alimony to be deducted from the payer while he is on sick leave, the child’s representative must send an application to the accounting department and begin forced deduction of alimony.

The application can be submitted at the payer’s place of work or submitted to the bailiffs. In the latter case, it is necessary to take into account the principle of territoriality. This is stated in Article 33 of the Federal Law “On Enforcement Proceedings”.

When the amount of alimony is more than 25 thousand rubles, then the filing of an application and a writ of execution at the payer’s place of work is carried out with the initiation of enforcement proceedings. If the amount is less than 25 thousand rubles, then you can do without it, according to paragraph 1 of Article 9 of the Federal Law “On Enforcement Proceedings”.

After the application and the necessary list of documents are submitted, the deduction of alimony will occur according to the following scheme:

- First of all, enforcement proceedings are initiated, and then the bailiff issues a ruling that will be sent to both parties.

- The next step is to establish the debtor’s place of work. The bailiff must send the necessary documents to the administration of the enterprise: a writ of execution, as well as a resolution to foreclose on the payer’s income.

- After the documents are received by the company’s accounting department, the accountant will have to determine the amount of the payer’s income and also subtract from the resulting amount the required amount of funds for alimony.

- When the accountant receives a certificate of incapacity for work from the employee, he will be required to deduct the amount from the sick leave benefit in accordance with the writ of execution.

Attention! The amount a parent must pay their child is determined only after all taxes have been deducted from the debtor's sick leave benefits.

After the employee receives sick pay, within 3 days the accountant will be required to withhold the required amount from them and transfer it to the recipient’s account, which is indicated in the application in accordance with Art. 109 SK.