Home / Alimony / Is alimony deducted from financial assistance?

In addition to wages and bonuses, from which alimony for minor children is undoubtedly deducted, there are many other sources of income. More than 20 years ago, namely on July 18, 1996, Government Decree No. 841 was issued, the provisions of which are still relevant. This Resolution approved a complete list of income from which deductions are expected, as well as income from which it is prohibited to withhold alimony.

In addition, the current Federal Law “On Enforcement Proceedings” also contains a list of income from which funds are not withheld.

This article is devoted to the issue of withholding alimony from amounts of material support - on what basis and in what order are funds withheld from it.

How is child support paid?

If the parents of the children fail to reach an agreement on the substance, then alimony must be collected in court from the parent who refuses to voluntarily support his children.

In case of judicial collection, alimony can be withheld in two ways:

- In the form of a fixed amount paid monthly;

- In the form of a percentage (share) of all types of parent’s earnings.

In cases of shared collection, alimony will be deducted from the official income of the parent or, if it is collected in a fixed amount, will be paid to him voluntarily. Also, a fixed amount can be withheld by the employer from wages and other due payments.

Alimony payments and their forms

Usually this refers to money that must be paid to people in need, either voluntarily or based on a court decision.

The main regulatory act that regulates their calculation and payment is the Family Code of the Russian Federation. By virtue of its provisions, maintenance funds are collected (section 5 of the RF IC):

- judicially;

- voluntarily, when the parties have entered into an agreement, which is certified by a notary. A notarized agreement has the force of a writ of execution (Article 100 of the RF IC).

How are the types of income for which alimony is taken regulated?

Before answering the question of how you can withhold part of the paid financial assistance in favor of alimony, you need to understand what legal acts regulate the admissibility of collecting alimony payments from one or another type of financial assistance. Such acts are:

- Government Decree No. 841 of June 18, 1996, which contains information about all types of wages and other income, including received financial assistance, from which alimony can be withheld for the maintenance of minor children. This document was adopted back in 1996, however, after quite a lot of time, it still has not lost its relevance.

- Federal Law “On Enforcement Proceedings”. This regulatory legal act also reflects the types of income from which alimony payments can be calculated, as well as income from the amount of which any deduction is prohibited by law.

Note: The legislation on enforcement proceedings also establishes what property can be seized to pay off a debt (including alimony).

Find out more about what income is and is not subject to alimony.

Procedure and rules of retention

The procedure for collecting part of the transferred income is standard. There are 2 reasons for retention:

- voluntary agreement between parents (you can read about it here);

- a judicial act adopted at the request of the other parent (detailed information on the forced collection of alimony is posted here).

The document for holding the deduction can be presented either by the other parent or by the bailiff.

To ensure compliance with the terms of the writ of execution, and also not to withhold excess funds, you must follow the algorithm outlined below.

- First, it is necessary to establish the reason why the debtor is being paid assistance.

- The next step will be to clarify the intended purpose of the amount issued or transferred.

- Next, it is necessary to determine the existence of a legislative prohibition on withholding (clause 2 of Resolution No. 841 and Article 101 of the Law “On Enforcement Proceedings”).

- At the last stage, it is worth studying the executive document itself. Namely, compliance with the requirements for its execution (the court decision must enter into force, and the voluntary agreement must have an certifying signature of a notary). Next, the recovery parameters are specified (interest and its amount or a fixed payment).

Is alimony deducted from financial assistance?

The procedure for withholding alimony is based on the principle of the impossibility of unlawful enrichment of the party receiving alimony in the event that such payments may worsen the financial situation of the alimony payer.

Current legislation allows deduction only from a certain list of types of material assistance, namely from assistance that does not have a social purpose.

Thus, if the payments provided should be used to eliminate the consequences caused by emergency events such as a fire, earthquake, death of a close relative, or are intended to provide the necessary care for a seriously ill person, then the funds allocated for these purposes are not subject to withholding alimony payments.

If the specified assistance is targeted in nature and allocated to cover specific expenses, then such monetary payments should go precisely to their designated purposes. In this case, the legislator also prohibits retention. For example:

- financial assistance provided to meet the needs of a newborn child should be spent exclusively on providing such a child with all the necessary things such as clothing, baby food, etc.

- Financial assistance for the treatment or burial of a relative is similarly targeted.

A more detailed list of types of financial assistance from which alimony is not deducted is disclosed in paragraph “L” of Article 2 of the previously mentioned Government Resolution No. 841.

Payments allocated for a person's vacation are those that the recipient has the right to dispose of at his own discretion, and therefore there are no restrictions on the collection of alimony payments from vacation.

The principle of withholding funds for dependents from financial support

Other types of financial assistance are subject to alimony payments. They are included in income. Deductions are made in the same way as wages. If a citizen pays 25% of his salary, then the same amount will be deducted from financial support.

Initially, income tax deductions must be made from the income amount. Financial support for minors and disabled relatives is withheld from the remaining amount.

In accordance with the law, after payment is calculated, alimony is transferred to the recipient’s account within 3 days. Since material support that does not have a specific purpose is accrued together with wages, deductions will be made along with the main amount of alimony.

Important! Financial support for the maintenance of a minor or disabled relative is not subject to income tax. The entire accrued amount is transferred to the recipient in full.

Material assistance in difficult situations (fire, death of relatives)

Money accrued to the alimony payer as assistance in critical situations, such as the death of a close relative, fire, etc. are of a direct social nature, since these payments are intended to financially support a person during one of the most difficult periods of his life. These targeted funds are aimed specifically at solving socially important problems of a person, and therefore alimony is not withheld from them.

Situations similar to those mentioned above may also include:

- Financial assistance in connection with a natural disaster;

- Funds paid in connection with an injury or injury;

- Payments taken by the payer to repay material damage, for example, associated with theft of property;

- Compensations related to moral damage.

The procedure for withholding alimony payments from financial assistance

If financial assistance relates to the income of the alimony provider, the deduction of alimony obligations occurs according to the general procedure, as with other types of income.

The withholding procedure depends on the basis on which the payment of funds is made:

- on the basis of a child support agreement between the child’s parents;

- based on a decision made by the court.

In the first case, parents independently agree on the amount, frequency, and method of paying child support payments.

In the second case, alimony is paid monthly in a fixed amount by court decision. If the employee works officially, the deduction of alimony from financial assistance is carried out by the organization’s accountant on the basis of a writ of execution.

Maternity assistance during vacation

The case of payment of compensation when an employee goes on vacation does not have any social basis. This payment serves only the purpose of making the vacation more comfortable for its recipient. Thus, deduction of alimony from such payments is not prohibited.

However, it should be understood that according to the labor legislation of the Russian Federation, vacation pay must be paid no later than three days before the alimony payer goes on vacation. If the payment was made later, then it will be necessary to clarify the question of the real purpose of such assistance.

Retention amount

When determining the amount of withholding, it is necessary to calculate the income of the alimony obligee, taking into account the financial assistance determined by the order of the employer, indicating the legal grounds for payments.

The next stage is the taxation process in accordance with the chosen system (STS, personal income tax, others).

The amount of alimony is determined by two methods:

- a fixed amount of money;

- percentage (part) of the payer’s total income:

- 25% for 1st child;

- 33% — 2;

- 50% - 3 or more.

The maximum allowable amount of alimony is 70%.

Example

Fedorov F.F. is obligated to provide child support for two minor children. From July 14, the citizen was provided with part of the annual basic leave and the following payments were accrued:

- vacation pay - 12,500 Russian rubles;

- salary for the number of days before rest - 10,000 Russian rubles;

- one-time financial assistance for vacation, provided for by the local act at the place of employment - 6,000 Russian rubles.

All money was credited on July 12. The total amount of income is 28,500 Russian rubles. Withholding of alimony is assigned in the amount of 1/3 of earnings.

Calculation sequence:

- Taxation: 28500*13%=3705 Russian rubles.

- For issue: 28500-3705=24795RUR.

- Withholding in favor of alimony: 24795*33%=8182.35 Russian rubles.

Note: financial assistance for vacation does not belong to the list of payments from which collection is unlawful.

Material assistance for funerals

The amount of money paid in connection with the death of a close relative is not part of the official income from which alimony obligations are fulfilled.

The legislator determines the prohibition on collection from the following amounts:

- money given to newlyweds at a wedding;

- workers' refurbishment compensation;

- business trips;

- compensation for medical nutrition.

For treatment

Basically, financial assistance for health and rehabilitation procedures aimed at improving health status is identified with earnings (aimed at improving the employee’s standard of living) and precedes the retention of the established amount of alimony obligations.

Financial support can be targeted - providing treatment due to an injury sustained at work during working hours.

The process of proving the need to resolve a specific serious case is mandatory for refusing to withhold alimony from this amount.

The FSSP's attempt to obtain financial support provided for in the above situation is illegal. The actions of the bailiffs are subject to appeal.

At the birth of a child

A one-time benefit expected at the birth of a child is not subject to withholding of alimony. The purpose of the payment is to meet the needs of the minor. The amount is not subject to tax or other monetary obligations.

Otherwise, the state rights of the mother and child are considered violated.

For vacation

In this case, there are no serious goals of influencing the social status of the recipient. The payment is intended to increase the level of comfort during your vacation.

Withholding financial support in favor of a minor dependent from financial assistance for vacation is a legal procedure.

For military/government employees

| Official wording of financial support | Hold |

| Supplement to salary (rate), length of service, bonus, additional payment and compensation | Yes |

| housing benefits, payments to veterans, “lifting” | No |

Difficult financial condition (unemployed)

In this case, financial assistance is of a one-time social nature.

The amount and procedure for payments for working citizens is determined by the governing body at the place of employment, for the unemployed - by the state.

There is no deduction for alimony.

Financial assistance for treatment

As a rule, funds provided for health improvement are equated to those intended to improve a person’s quality of life, since they are mainly allocated for the completion of health procedures for such a person in specialized sanatoriums. In this case, alimony may be withheld from the amount provided.

However, there are situations when the employer provides financial assistance not just for health improvement or rehabilitation. Thus, if the alimony payer received a serious injury at work, and a specific amount of financial assistance was allocated for his treatment, aimed specifically at such recovery procedures, then it would be unlawful to withhold alimony from such payments.

Financial aid concept

Financial assistance is understood as a one-time gratuitous payment from the employer or from the state. The support measure is not of a production nature. It has nothing to do with a citizen’s successes/failures in the workplace. The law does not oblige the employer to pay money as financial assistance. Support is provided at the initiative of the employer.

The payment of financial assistance cannot be affected by:

- performance by the recipient of official duties;

- results of the organization's activities;

- compliance with labor discipline rules.

The law establishes a list of grounds that affect the possibility of receiving financial assistance:

- health improvement;

- marriage;

- funeral of a relative;

- birth of a child;

- holiday;

- emergency (fire, flood);

- difficult life situation;

- presence of minor children;

- any other situations at the discretion of the employer.

Important! Funds are transferred to the employee’s account, together with wages. The law does not provide for the need to return funds to the payer.

Help at the birth of a child

Money intended to improve the quality of life of a child does not count as income from which child support payments can be recovered. The fact is that such payments in the literal sense do not bring any benefit to the general family budget, since the state allocates a specific amount of money for certain purposes, namely, to meet the needs of the newborn.

This also includes:

- Incentive payment in connection with the birth of a child;

- A one-time payment for a child from social security or an employer.

Any attempts to foreclose on financial assistance in favor of alimony at the birth of a child will entail an actual deterioration in the child’s living conditions, and such actions are prohibited by current legislation.

If the bailiff demands withholding of alimony from any of the types of financial aid prohibited from withholding, then you can safely file a complaint against the official.

Problems and nuances

The process of withholding alimony from financial assistance has its own characteristics and in practice is often accompanied by violations of the payer’s rights. The most common problems to consider are:

- For the maintenance of a child from the first marriage, alimony is not deducted from the financial assistance assigned to the family of the alimony provider in connection with the birth of a child from the second marriage. Regardless of how many official relationships the payer had and still has, when children appear, it is strictly prohibited to write off funds from such financial support.

- In order to return funds unlawfully withheld from financial assistance as alimony, you must contact the accounting department that calculated the write-off. It is necessary to indicate the violation both verbally and in writing. Accountants must return the withheld amount to the payer back in any convenient way.

- In case of dismissal, the employee is paid compensation for unused vacation and is assigned additional funds. Child support is also deducted from such financial assistance.

- Alimony is assigned only after income tax in the amount of 13% is withheld from the salary.

Attention

: Alimony is the most important form of support for minor children, which has enormous social significance. In the event that the court or the parties (parents of the offspring) have established a percentage option for collecting obligations, it is necessary to know the list of income from which shares of funds for the children are taken away. Financial support can be assigned to an employee in completely different situations, so the question often arises as to whether alimony is withheld from such payments. This article contains answers to many questions that recipients and payers of alimony may have.

Comments Showing 0 of 0

How alimony is withheld from financial assistance: terms of transfer, before and after taxes

If the financial assistance provided to the alimony payer does not have a social purpose and is considered to improve the general financial condition of the debtor, then according to Art. 99 of the Federal Law “On Enforcement Proceedings”, alimony is withheld from these payments in accordance with the general procedure. As in the case of wages, only after personal income tax has been withheld, and only then is interest paid from the remaining amount, which goes towards repaying alimony payments.

Also, according to the regulations of the RF IC, namely Art. 109, alimony must be accrued to the recipient of such payments no later than three days from the moment the alimony payer receives wages or other income, including material assistance.

Important! Personal income tax is not withheld from the final amount of alimony. This rule is provided for in paragraph 5 of Art. 217 Tax Code of the Russian Federation.

In addition, according to the mentioned Art. 217 of the Tax Code of the Russian Federation, there are many types of material assistance that are not subject to taxes at all. These include:

- Compensations made on a one-time basis to family members of a deceased employee;

- Payments provided in connection with a natural disaster or other emergency situations;

- Compensation provided to victims of terrorist attacks;

- Funds intended for persons who are members of public organizations of disabled people;

- Monthly benefits that are issued at the birth of a child (first and second), etc.

When are payments from financial support not withheld?

Within the meaning of clause “l”, part 2 of Government Decree No. 841 and part 1 of Art. 101 of the Federal Law “On Enforcement Proceedings”, alimony is never deducted from payments of financial assistance intended to solve difficult life situations. These may include:

- Humanitarian support for citizens.

- Travel allowances paid in accordance with labor laws.

- Compensation for transfer to work in another location.

- Payment in connection with the death of a relative.

- Payment in case of registration of marriage relations.

- Additional payment due to the birth of a baby.

- Funds intended for a person affected by a disaster or emergency.

- Reimbursement of expenses for treatment and rehabilitation.

Alimony is not withdrawn from the above payments of material assistance due to the fact that the purpose of such maintenance is to satisfy the necessary needs of the citizen. In some life situations, additional expenses may be required, so financial support is provided.

Example of calculating alimony with financial assistance

Ivanov A., in connection with his departure on regular leave from July 15, received the following payments at his main place of work:

- Vacation pay in the amount of 16,000 rubles;

- Salary from July 1 to July 14 in the amount of 14,000 rubles;

- A one-time payment for vacation, provided for by internal regulations and called “material assistance for vacation in the amount of 10,000 rubles.

All of these funds were credited to him on July 13 shortly before he left for vacation. The amount of all funds received was 40,000 rubles. For the child, ¼ of all types of earnings is withheld from Ivanov.

Thus, the total amount of alimony payable will be:

- We subtract personal income tax: 40,000 rubles – 13% = 34,800 rubles;

- We calculate alimony: 34800 * 25% (1/4) = 8700 rubles.

Please note that in this case, there is no need to separately calculate alimony from financial assistance. The employer's accounting department itself will calculate them at the same time as deducting mandatory payments from vacation pay and wages.

If the payer pays child support in a fixed amount, then the amount of financial assistance will not matter at all - the required amount will be withheld either from vacation pay, or from the balance of wages for the month, or from financial assistance. Typically, accounting tries to evenly distribute the burden of alimony in a fixed amount across the payer’s income.

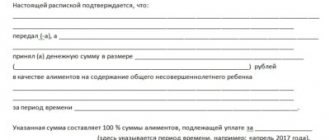

Cost and terms

If the parties decided to peacefully conclude an agreement on the withholding of alimony obligations from financial assistance, then in accordance with clause 9 of Art. 333.24 of the Tax Code of the Russian Federation, you must pay 250 rubles for certification of a document by a notary. Moreover, if the project was drawn up not by the parties, but by a notary, the specialist may increase the cost of services. 250 rubles only includes certification of the completed agreement. Regarding deadlines, no rules have been established at the legislative level. In practice, everything depends on the workload of the specialist; on average, the procedure for concluding an agreement on alimony with financial assistance takes no more than 2 days.

For your information

In a situation where citizens have not agreed peacefully to provide for their offspring and they have to go to court, it is necessary to take into account the provisions of Art. 333.36 Tax Code of the Russian Federation. Item 2, part 1, art. 333.36 of the Tax Code of the Russian Federation indicates that for applications related to the collection of alimony, the plaintiff is exempt from paying money. The financial burden falls on the defendant after the case is decided. According to the rules of clause 14, part 1, art. 333.19 of the Tax Code of the Russian Federation, the amount of the duty in this situation will be 150 rubles. The time frame for consideration of a case on the collection of alimony from financial assistance is reflected in Art. 154 of the Code of Civil Procedure of the Russian Federation, this is 2 months. In complex cases, the duration of the trial may increase by 1 month, which means a total of 3 months.

Collection procedure

If material assistance can be equated to regular income, then alimony is withheld from its amount (what percentage of income is alimony?). How does this happen? It all depends on what document the deductions are based on. If a child support agreement is concluded between the parties, then everything happens like this :

- The employee receives assistance.

- Personal income tax is withheld from its amount.

- The remaining funds are issued in person or transferred to a card.

- The alimony provider allocates the required amount from the money received and transfers it to the recipient in the manner specified in the agreement.

If the agreements contained in the alimony agreement are not observed, or alimony is collected on the basis of a judicial act, then the procedure for withholding funds is as follows.

- The organization's accounting department deducts personal income tax from the assistance amount.

- Alimony is calculated from the balance.

- The funds are transferred to the recipient of the funds (how is alimony transferred?).

If additional expenses occur, they are covered by the employee . Thus, alimony can be collected from financial assistance, but not from any type of payment. In each specific situation, it is necessary to correctly determine whether the assistance is simply income or is of a targeted social nature.

If you find an error, please select a piece of text and press Ctrl+Enter.

From a legal point of view

Difficulties in determining the legality of the collection begin when the payment to the parent occurs outside the “employee’s labor income” item. According to labor legislation (Article 57), a contract with an employee implies the possibility of including additional clauses that provide the person with more favorable conditions. This measure is also provided for in Art. 41 Labor Code of the Russian Federation.

The process of determining whether a withholding is necessary should be based on:

- the grounds on which the cash flow was organized in favor of the employee of the enterprise;

- the method of securing this norm (based on an individual contract, collective agreement, norms adopted at the local level).

The law presupposes the right to receive not only wages and related additional payments, but also various types of financial assistance. When determining the obligatory nature of deductions in favor of the child from financial assistance funds, one should refer to subparagraph “l”, paragraph 2 of the general List of Income for the collection of alimony. You can find out in more detail the eligibility of deduction from PP No. 841 dated July 15, 1996, where clause 2 indicates the types of income registered as material support for the employee.

In order to understand whether the retention is legal, you should find out whether there is a targeted focus of financial assistance to solve specific problems of the employee in certain life circumstances. If there is no intended purpose, funds for the child will be withheld.

Income exempt from alimony fees

The main types are:

- At the birth of a child . Everything is obvious. The money is allocated to support the young parent so that he can buy some necessary things for the newborn. There is a social character. There is also a specific goal.

- For treatment . In this case, we are talking not just about restoring the body, improving the general condition of the body, but, for example, about rehabilitation in connection with an injury or occupational disease.

- When an employee goes on vacation . Again, we can talk about targeted social benefits if leave is provided not on a general basis, but in connection with a specific life situation: for example, to care for a child.

- On the occasion of the death of a relative . This happens to everyone in life, sooner or later. A good employer is one who is ready to support an employee in such a difficult life situation. Naturally, alimony is not taken from this payment.

The list can be supplemented with the following types of financial assistance:

- due to an emergency;

- on the occasion of marriage;

- when moving to another area;

- in connection with the detection of crimes.

Each specific case must be considered separately to determine whether alimony can be withheld or not. The criteria, we repeat, are indicated: social character, a specific goal.

On the pages of our website you will find other materials on alimony. From them you will learn how to calculate payments, what the maximum and minimum amount of maintenance may be, as well as how to file a claim to reduce or increase the amount of alimony.