The timing of the transfer of alimony from the payer’s work is a pressing issue, because when raising a child, a parent must calculate the possibility of meeting the current needs of the minor. The law establishes deadlines for the provision of alimony. If they are not observed, the responsible accounting employee may incur administrative penalties. If the transfer deadline has expired, you must contact your employer to clarify the situation. If you refuse to understand the reasons for the delay, the FSSP will deal with the issue of meeting the deadlines.

In what cases does an employer pay child support?

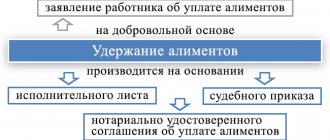

Alimony payments in favor of a minor can be paid by agreement of the parties or by force. In each case, the recipient is left with a writ of execution in the form of a notarized agreement, an order for alimony, or a writ of execution issued on the basis of a court decision. The recipient may act at his own discretion:

- Leave the IL with yourself, having agreed with the payer to transfer the money in person or transfer it to the card. The employer remains uninvolved.

- Submit the document to the FSSP. The bailiff will monitor compliance with the transfer deadline if the payer often changes jobs or has unofficial income.

- Transfer the IL to the organization where the alimony provider works. In this case, it is necessary to submit an application for the need to make deductions, written to the director. From the moment the documents are accepted, responsibility for the timely transfer of funds rests with the accounting department.

The payer himself can initiate deductions from wages. This way he won’t have to bear responsibility for incorrect calculations and worry about missing the payment deadline.

Until what period must the employer pay child support?

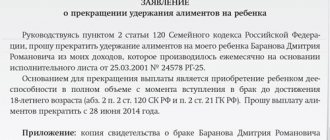

The legislation establishes the grounds for an employer to terminate child support payments from an employee.

These include:

- The child reaches the age of majority (except for cases in which the child is recognized as fully capable before reaching the age of eighteen, as well as cases in which the child is recognized as incapacitated due to disability after reaching the age of eighteen);

- When changing jobs or dismissing an employee at his own request;

- If the claimant filed an application to terminate the relevant payments at his own request;

- Receipt by the employer of a bailiff's order to terminate the withholding and transfer of alimony payments due to the cancellation or termination of the proceedings.

Alimony from advance payment

Enterprises pay wages in parts - in the form of an advance and the main amount of earnings. This is not a whim, but a duty assigned to organizations by Art. 136 of the Labor Code of the Russian Federation, according to which the employer must pay wages at least 2 times a month . Then the question arises: should I expect alimony when paying an advance? It all depends on the accounting policy of the enterprise.

Articles on the topic (click to view)

- Assignment of the right to claim under alimony obligations is possible

- Formula for calculating penalties and fines for alimony: sample

- What are the consequences of not paying child support in 2020?

- Criminal liability for non-payment of alimony under Art. 157 of the Criminal Code of the Russian Federation

- Is alimony from financial assistance withheld for vacation?

- Find out the debt by name from the bailiffs for alimony

- Reducing alimony debt over the past period

In theory, an accountant can make deductions twice a month, but in practice this is difficult. The reason is the need for a preliminary deduction of personal income tax from earnings in the amount of 13%. According to Art. 223 of the Tax Code of the Russian Federation (clause 2), the date of receipt of income is considered to be the last day of the month for which earnings were accrued to him. Personal income tax calculations are made from the final amount, therefore it is more convenient to calculate the amount of alimony when paying the basic amount of wages.

If the amount of alimony is higher than part of the salary (for example, if it is necessary to pay off a debt), you will have to make deductions twice a month. The recipient will receive deductions from the advance payment and the remaining part of the salary.

Both options are considered the norm and do not go beyond the law.

Receiving alimony from a parent's unofficial salary

Often, the enterprise or the employees themselves, avoiding tax burdens, try to hide the real amount of wages. As a result, children who are paid child support receive much less than the amount due to them. For example, the official salary of an employee is 10 thousand rubles. , alimony (25%) - 2.5 thousand rubles. >; “in an envelope” the employee receives another 35 thousand rubles. , and his minor descendant receives less than 8,750 rubles .

This situation is unfair. The way out of the situation is to agree with your spouse on the payment of funds for the children in a fixed amount of money without reference to salary or to defend your position in court. An experienced lawyer will tell you how to increase the amount of alimony in court.

The first step is to collect evidence that the spouse's actual income is much higher than reported. This could be receipts for the purchase of expensive material assets, an extract from Rosreestr about purchased real estate, or witness testimony. By a court decision, the spouse may be required to pay an amount that is a multiple of the minimum subsistence level in the region of residence.

An effective method of dealing with dishonest employers is to file a complaint with the labor inspectorate at the place of work of the alimony provider, the tax office, or the prosecutor's office in the relevant region of residence.

The complaint is drawn up according to the general rules for writing applications to government agencies and must contain the name of the organization, details of the applicant, a statement of the essence of the problem, date and signature. Upon receipt of information, the authorities conduct an inspection of the enterprise to determine the legality of its activities.

Alimony from advance

Often, an employee of an enterprise receives payments twice a month, for example, on the 15th - an advance, and on the 30th-31st - the main part of the salary. Since these payments are one salary, divided into 2 parts, the relevant question is: how long will alimony be received from the advance payment? You should refer to the legislation:

- According to paragraph 1 of Art. 99 of Law No. 299-FZ of October 2, 2007 “On Enforcement Proceedings,” the employer must make deductions from the amount remaining after taxes are withheld.

- According to paragraph 2 of Art. 223 of the Tax Code of the Russian Federation, the date of payment is the last day of the month when income was accrued, and tax is withheld from this amount.

The advance is not the final salary.

This is only part of the amount of full income for the period worked, which will be finally determined on the last day of the month, therefore, personal income tax is calculated once a month from the full salary, which means that alimony payments from the advance should not be received within 3 days from the date of its receiving. Most often, alimony is paid at the end of the month, but sometimes the employee is charged 70% of the income to cover the previously incurred debt. Then the second part of the salary (excluding the advance) may not be enough to cover the debt, and the accountant’s task is to calculate alimony from both the advance and the remaining part of the salary, taking into account personal income tax.

The decision on how many times to make transfers for alimony depends on the employer. If the amount of payments is large, deductions are made twice a month, however, failure to receive payment within 3 days from the date the spouse receives the advance payment does not constitute a violation of the provisions on the timing of alimony payments.

The absence of collections from the advance does not mean that the recipient will receive less payments for the child at the end of the month, but only means that the required deductions were not divided into 2 parts.

From sick leave

Illness is not an absolute reason for non-payment of alimony. An employee of an enterprise receives “sick leave”, from the amount of which funds for the child are calculated.

The date of payment of alimony depends on the date of payment of sick leave, which is determined as follows (Article 15 of Law No. 255-FZ of December 29, 2006):

- after providing sick leave, the employer assigns payment within 10 days ;

- benefits are paid on the next payday.

This is important to know: Objection to a claim for the collection of alimony in a fixed amount

Alimony from sick leave will be transferred within 3 days from the date of issuance of the salary in which it was included.

Frequency of payments

Depending on the status of the payer and his employer, the frequency of alimony payments may differ. Often during the month an employee receives additional payments to his salary, for example:

- bonuses;

- incentive amounts;

- vacation pay>;

- material aid;

- disability benefits (sick leave);

- other payments from which alimony is collected in accordance with current legislation.

Thus, the recipient can count on additional payments during the current month.

In other cases, the frequency of receipts in favor of the claimant depends on the procedure established by the court or by a notarial agreement. It is important to determine this procedure at the stage of concluding a written contract in order to avoid possible consequences.

The greatest difficulty is presented by situations when the payer receives unaccounted income, for example, official earnings and additional amounts in an envelope. In practice, it is almost impossible to prove this fact, because in such a scheme not only the alimony payer is interested, but also his employer, who will deny everything on occasion.

If the amount of maintenance is critically small, the only way out is to file a lawsuit to change the procedure for collecting alimony. In the document to demand the recovery of maintenance in a fixed sum of money. By law, the solid value is determined in accordance with the minimum values established in a particular region of the country. Information about the cost of living or wages is often used.

In most cases, the frequency of payments is determined at least once a month.

What date is alimony paid?

The law does not link the receipt of payments to a specific date of the month. You need to wait for alimony within 3 days after your spouse receives income.

When counting the 3-day period before receiving alimony from salary, only working days are taken into account. If the final day for receiving payments falls on a weekend, for example, Saturday, then the period is automatically extended until the first working day, that is, until Monday.

Alimony when paying wages unofficially

To avoid paying taxes, some employers pay part of their income “in an envelope.” It is impossible to understand how much the employee received, and it is impossible to calculate alimony from such income. There is no need to talk about the timing of payment of alimony from the “gray” salary, but to restore justice you can:

- Contact the labor inspectorate with a complaint. This will be a reason to carry out an inspection at the enterprise, however, in the absence of evidence, it can only worsen the relationship with the payer.

- File a claim for alimony to be established in a fixed amount or in mixed payments: partly from the salary, and partly in a fixed amount on the card. The spouse may be against this turn of events and will begin to underestimate income. But do not forget about the recipient’s right to demand evidence through the court, thanks to which it is possible to prove the acquisition of property, the appearance of funds in bank accounts and obtain other evidence of receiving third-party income.

How does foreclosure of a debtor's wages occur?

After the initiation of proceedings, the bailiff sends the necessary requests to various bodies and organizations, including the Federal Tax Service, the Pension Fund of the Russian Federation, in order to determine the payer’s place of work. After receiving information on the relevant requests, the bailiff sends a copy of the writ of execution to the organization in which the alimony payer works.

Based on this document, the employer is obliged to withhold the amount specified in it from wages, as well as from other income, including vacation pay, bonuses, and so on. Please note that alimony can be set either as a percentage of earnings or as a fixed amount.

When establishing alimony as a percentage of the payer’s earnings or other income, the courts, under normal conditions, are guided by the following limits established by the RF IC:

- For one child – ¼ of the income;

- If two children – 1/3 of the income;

- For three or more children – ½ part of the income.

If alimony was established as a percentage of earnings, then the employer is obliged to independently calculate the amounts payable to the recipient. The calculation is made from the payer’s net income, that is, after deducting all necessary taxes.

The withheld amounts are subject to payment to the recipient of alimony in cash from the organization's cash desk, or transfer to a bank account according to the details specified by the recipient.

Responsibility of the organization for untimely transfer of alimony

Delayed child support is not the norm. Frequent causes of violations are the inattentiveness of an accounting employee, untimely payment of labor to employees of the enterprise. If there are no funds in the account, you must:

- Contact the head of the enterprise with a written request. The submitted document should be registered with the secretary in the incoming correspondence journal. Keep the second copy for yourself with a note from the secretary that the letter has been “received”; also ask for the number indicated in the journal and the date of receipt. The waiting period for a response from the manager is 30 days . Subsequently, this letter can be used as evidence of evasion by the company’s employees from fulfilling obligations.

- Contact the FSSP with a statement about violation of the deadlines for transferring alimony. The bailiff will conduct an inspection and find out the reasons for non-compliance with the instructions of the IL. As a result, a fine may be imposed on the person responsible for non-payment.

According to Art. 113 of Law No. 229-FZ “On Enforcement Proceedings”, in case of violation of the payment procedure specified in the executive document, the perpetrator must be held accountable.

The amount of the fine, in accordance with paragraph 3 of Art. 17.14 Code of Administrative Offences, will be:

- for citizens - 2-5 thousand rubles. ;

- for officials - 15-20 thousand rubles. ;

In addition, the recipient has the right to recover from the culprit a penalty for overdue days in the amount of 0.1% of the debt amount for each overdue day (Article 115 of the RF IC).

The employer and accounting employees are interested in meeting deadlines, otherwise they face fines and inspections by government agencies.

You need to know the deadline for receiving alimony, otherwise it is impossible to track when payments are delayed. When transferring an executive to an enterprise, timely transfers are the responsibility of the administration.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

What to do if the transfer deadlines are violated?

Recipients of alimony often turn to lawyers with the question: when should alimony payments be received? Why are transfer deadlines violated?

It happens that the employer of the alimony payer commits gross violations of the law and delays the payment of wages and transfers of alimony - for several days or even several weeks.

In this case, the recipient of alimony must act as follows:

- Submit a written request to the head of the enterprise, institution or organization where the alimony payer works - asking for clarification regarding the reasons for the delay in payments. The request must be recorded in the incoming correspondence ledger. A written response to the request must be provided within a reasonable time (30 days - in accordance with the Federal Law “On the procedure for considering appeals from citizens of the Russian Federation”). No answer is also an answer.

- Submit an application to the FSSP regarding violation of the terms of fulfillment of the alimony obligation. FSSP officials will conduct an inspection of the employer, establish the reason for the delays and bring to administrative responsibility those responsible for violating the payment deadline. An accountant or the head of an enterprise, organization, or institution may be fined for failure to comply with a decision of a judicial authority.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 1 ratings, average: 5.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612

Alimony payment period

Making child support payments is the main responsibility of a parent living separately from their own child. The basis for payment of alimony is an agreement or a writ of execution. Alimony payment terms

by agreement or order are regulated by the current norms of family law. At the same time, there are often situations when the alimony obligee independently transfers the writ of execution to the employer’s organization, which is obliged to pay the funds no later than three days after the calculation of wages.

What are the deadlines for paying alimony?

It should be noted that alimony is not always established only through the court. Parents have the opportunity to establish the procedure for calculating and the deadline for paying alimony under a notarial agreement.

This will be discussed in more detail below. Alimony obligations can be imposed on a person using a writ of execution, a notarial agreement or a court order. What is each of these methods?

The most common recovery is based on a writ of execution. The process begins with the plaintiff filing a lawsuit to collect child support from the other parent, who will be considered the defendant in this case. After the parties present their evidence, involve witnesses and speak at the hearing, the court will make its decision.

If it satisfies the plaintiff’s demands, then he will be given a writ of execution.

Procedure for claiming alimony obligations

According to the current legislation of Russia, the mother and father of a minor, regardless of whether they are officially married or not, are obliged to provide financial support to the child. Absolutely all expenses incurred by the child must be equally divided between both parents.

There are two ways to recover funds for the maintenance of a minor:

- on the basis of a voluntary agreement between the parties, certified by an accredited notary officer;

- on the basis of a court order or other writ of execution.

Parents have the right to independently decide on the payment mechanism. If the father refuses to pay the money voluntarily, then the child’s mother has the right to go to court and oblige him to transfer the amount approved by law to a card or current account.

Important! When claiming alimony obligations in court, the amount of financial assistance will be calculated based on the income of the payer. If the latter does not have an official income or receives a salary in foreign currency, then the court will order alimony to be paid in a fixed amount.

Legislative mechanisms for calculating the amount of obligations

The fifth section of the FR IC describes two methods for calculating the amount of alimony payments paid in favor of a child:

- percentage;

- in a fixed amount.

This is important to know: Application for recalculation of alimony debt: sample

Payments calculated under the first mechanism will depend on the number of minor children the payer has:

- If there is only one child, you will have to transfer 25% of the income to the mother’s account.

- If there are two children, the amount of obligations will increase to 33% of wages or other source of funds.

- If the payer has three or more children, he will have to give them exactly half of the salary.

Important! If the payer has serious financial difficulties, then he has the right to apply for a reduction in the amount of deductions. At the same time, in order for the court to satisfy the requirements, the alimony obligee must provide evidence of the impossibility of paying the alimony prescribed by law.

Methods of transferring money from payer to recipient

During the court hearing, not only the issue of the amount of alimony is resolved, but also the method of payment. Today, there are three main mechanisms for transferring funds:

- cash, in person;

- transfer of alimony to the current account or plastic card number specified in the writ of execution;

- transfer of funds using the postal service.

Important! When using the last listed mechanism, the period for transferring alimony

will be from one to three working days.

Transfer of alimony by an enterprise: grounds

Documentary evidence of the right to alimony is:

- Agreement between the parties on the amount and frequency of payments. To transfer amounts from a current account, it must be drawn up or certified by a notary.

- Court order - issued by a magistrate to consider a claim without summoning the parties, if all the necessary documents are attached and there is no doubt about the legality of the claim for alimony.

- A writ of execution is issued by a city or district court when payments are requested in a fixed amount, the plaintiff does not agree with the previously valid agreement, and the coordinates of the alimony payer are unknown.

Attention: the listed documents are sufficient for the accounting department to calculate alimony and transfer it as intended.

Late payments are punishable: Art. 17.14 FZ-195 2001 (Administrative Code) establishes liability in the form of a fine for officials of 15–20, legal entities – 50–100 thousand rubles.

Term for collecting alimony

In general, child support obligations are paid until the child reaches the age of majority. However, there are certain cases in which the maintenance time will be increased. These include:

- lack of ability to work in an adult child;

- disability of 2 or 1 degree;

- studying at a higher educational institution.

If the payment of alimony is carried out on the basis of a voluntary agreement between the parents, then the timing of termination of assistance can be indicated directly in the document.

When does a mother have the right to request payment of child support?

Payment of obligations begins from the day of application to the court or drawing up an agreement. Therefore, the timing of consideration of the claim does not play any role.

If the payment of alimony is carried out by the organization in which the alimony obligee is employed, then, according to the law, deductions must come to the recipient’s account no later than three days from the date of payment of the salary. If the third day falls on a weekend, the payment deadline is postponed to the beginning of the next week. For example, if the payer’s salary was accrued on Thursday, then the accounting department undertakes to pay alimony by Tuesday of the next week.

Important! If an organization does not make timely payments, it faces a fine of 0.5% of the amount specified in the writ of execution.

Stages of transferring alimony payments

The transfer of alimony is carried out on the basis of a writ of execution issued by the court, or a settlement agreement concluded between the parties.

The document indicates the method of receiving money (for example, to a bank account), the periods of transfer.

Responsibility for retention lies with the employer.

The procedure for collecting alimony from an employee consists of five stages:

- receipt by the accounting department of a writ of execution from the claimant, a specialist from the Federal Bailiff Service;

- calculating employee wages;

- recovery of personal income tax from the accrued amount;

- calculation of alimony from the remaining amount;

- transfer of alimony payments to the recipient.

Each of these stages must follow strictly the previous one. Otherwise, the accruals will be incorrect.

Collection of alimony obligations for the past period of time

Family law allows you to collect alimony payments from the obligated person for the past period. The maximum period for which a parent has the right to collect child support is three years.

It is possible to request financial assistance if:

- the mother has not previously applied to the court to collect obligations;

- the writ of execution was not submitted to the bailiff service.

Important! Collection of funds for the previous period is possible only if the parent supporting the child manages to convince the judge of the advisability of such requirements. As evidence in court, you should present checks, receipts and other papers confirming too much spending on the child in the past.

Legal basis

A system of legal acts consisting of international and Russian norms is aimed at ensuring the rights of children.

The period for payment of child support is described in many legislative acts.

List of regulatory documents:

- Constitution of the Russian Federation;

- Federal Law-124 1998 on guarantees for children in Russia;

- Family Code (SC);

- Civil (Civil Code) and Civil Procedure (CCP), Criminal (Criminal Code);

- standards of the Federal Bailiff Service (FSSP) - FZ-229 2007 and FZ-118 1997;

- other departmental orders and instructions.

The implementation of children's rights is carried out by agreement between parents or through an appeal to the court to collect alimony.

Art. 81 of the IC provides for the collection of amounts by court order or decision.

As a result: how long is alimony paid?

Payment of obligations is carried out in the manner established by the executive document or agreement. If there is an agreement, parents have the right to independently agree on the frequency and amount of contributions. If the obligations are levied on the basis of a court decision, then payments are made monthly throughout the entire period until the child comes of age. Often, the payer delegates the responsibility of transferring alimony funds to the employing company. In this case, the transfer period will be no more than three days from the date of accrual of the alimony worker’s salary.

Transfers upon dismissal

Many alimony recipients are sometimes very concerned about this issue. However, the dismissal of a debtor from work is not a reason for delaying payments under an existing decision of the justice authorities.

Therefore, in such a situation, the accounting department withholds alimony from the final earnings of the payer and transfers them to the claimant. The deadline in this case is the same - within three days. After the dismissal of the alimony payer, the accounting department is obliged to notify the bailiffs and the recipient of these funds. The writ of execution can be transferred to the new place of work of the debtor or sent to bailiffs. The organization must complete this action within three days after the termination of the employment relationship with the debtor. You also need to know about this.

Deadline for alimony payments under a writ of execution

Collection of alimony in court is carried out if it is impossible to reach an agreement between the parties, but an attempt to agree on payments voluntarily on the part of the plaintiff is not a prerequisite.

At the end of the proceedings, the plaintiff is given a writ of execution, which is presented at the defendant’s place of employment or to the territorial division of the FSSP.

If the payer does not work, but is registered as unemployment, the IL is submitted to the Employment Center. When a person liable for alimony receives benefits or a pension from the state, the documents are submitted to the Pension Fund. The responsibility for transferring alimony rests with the accountants of the above organizations.

When transferring the IL to the FSSP, the responsible bailiff draws up a resolution to initiate enforcement proceedings within 3 days from the date of receipt of the documents. No later than 1 business day following the day the decision was made, a copy of it is sent to the parties to the proceeding - the recoverer and the payer.

The person obligated to pay alimony is given 5 days from the date of initiation of the individual entrepreneur to voluntarily repay the debt, otherwise an enforcement fee of 7% of the amount of the debt is collected.

This is important to know: Statement of claim for the recovery of alimony for the maintenance of a parent: sample

The bailiff has the right to send a resolution to withhold alimony from the salary at the payer’s place of work, in other cases - to the Employment Center or the Pension Fund of the Russian Federation.

Terms of deduction of alimony

According to Art. 109 of the RF IC, the administration of the enterprise where the debtor works is obliged to withhold alimony from the payer every month and transfer it to the recipient no later than within 3 days from the date of payment of wages or other types of income received by the payer at the place of work.

Algorithm for calculating alimony

The implementation of collections consists of several stages.

Step 1. Receipt of a writ of execution by the parent supporting the child

If this is an agreement, it is concluded jointly with the second spouse in the presence of the child (when he reaches 10 years old) and a notary. A court order can be obtained in court independently, and a court decision can be obtained after a court hearing that took place as a result of filing a claim for the collection of alimony. With the received document you can contact the bailiff service.

The writ of execution contains the following information:

- the amount of alimony payments;

- the procedure for making deductions;

- recipient details.

Step 2. Sending the writ of execution to the payer’s enterprise

To transfer the sheet, you can contact the bailiff or present the document to the payer’s place of work in person. You should also submit an application containing information about the details of the recipient bank and post office number.

Sample application to an enterprise for the transfer of alimony:

Download a sample application

The alimony provider can work not one, but several jobs. Then the recipient will have to take the appropriate number of copies of the executive documents and send them to each place of work.

Step 3. Receipt of the writ of execution by the responsible person

The document is transferred to the accounting department for storage to the responsible person, who monitors its execution.

If alimony does not arrive within the period prescribed by law due to the loss of a writ of execution or a court order, the responsible official may be fined 2,500 rubles. (Article 431 of the Code of Civil Procedure of the Russian Federation).

Step 4. Calculation of alimony

To start making payments, you do not need to wait for an order from the head of the enterprise or other administrative document. A writ of execution or a court order is a sufficient basis for starting deductions.

The calculation is based on the amount of accrued wages minus personal income tax. If an employee has drawn up an application for a tax deduction, personal income tax is calculated in accordance with Article 218 of the Tax Code of the Russian Federation, taking into account benefits.

Alimony is withheld from the date specified in the writ of execution. If the writ of execution arrived after wages were accrued, the debt is paid in the next period, but deductions should not exceed 70% of the monthly salary. The balance of the debt is carried over to the next month.

Step 5. Transfer of alimony from salary

After the salary has been accrued, personal income tax deductions have been made and the amount of alimony has been calculated, they must be transferred to the recipient without exceeding a period of 3 working days.

The recipient can receive money at the payer's cash desk, to a bank account, by contacting the post office and receiving the transfer.

Duration of alimony payments according to agreement

An agreement to pay child support is an acceptable solution for both parents: they independently determine the amount, procedure and timing of transferring funds to the child. Only a notarized document has legal force; without a notary’s signature it is considered invalid.

The agreement may establish the following payment terms:

- Monthly on certain dates.

- Quarterly. The amount is indicated for 3 months.

- Every six months. Payments for 6 months are taken into account.

- Annually. Child support payments are taken into account per year.

- One time. For the calculation, the maximum possible amount is used for the period from the moment the agreement is concluded until the child reaches adulthood.

It is allowed to provide property as alimony. Its cost should be approximately equal to the amount of payments for a certain period specified in the agreement.

Accruals begin from the moment the agreement comes into force - this nuance is specified in the document. Most often, he begins to act immediately after assurance. Termination of alimony obligations is possible at the initiative of the recipient, upon the death of the payer or child, reaching adulthood or emancipation before the age of 18.

The procedure for collecting alimony from working and non-working fathers

We invite you to understand everything in detail, get answers to your pressing questions and understand that not everything is as scary and confusing as it looks at first glance. You just need to know the relevant laws that are relevant both in 2020 and in 2020.

Decree of the Government of the Russian Federation of 1996 No. 841 regulates the list of income from which alimony must be collected, and the procedure for calculating and the process of withholding children's money is established by the IC of the Russian Federation. The income “basket” from which alimony is taken includes: salary, vacation pay, pensions, various dividends of other origin.

At the same time, children's money should not be paid from income called: payments upon dismissal, reduction of staff and liquidation of an organization. Money for child support can be calculated in two ways:

- In a fixed amount of money (by peaceful agreement of the parties).

- In a share of the payer’s income (according to the court).

Withholding alimony has a number of restrictions. Here is a table of percentage deductions for alimony (Article 81 of the RF IC ):

| №/№ | Number of children | Amount of deductions |

| 1 | Only child | 25% from pension |

| 2 | Two minors | 33% from pension |

| 3 | Three or more minors | 50% from pension |

A fixed sum of money, as opposed to interest deductions, is prescribed in a peace agreement on a voluntary basis. In addition, establishing a fixed amount of children's money occurs in the following situations:

- When the payer does not have a permanent job and income.

- When the income is foreign currency or the income is in kind.

First, the necessary taxes are withdrawn from the payer’s salary, and then only alimony ( Government Order No. 841 ): for this reason, alimony is not the income of the recipient and is not required to pay tax duty.

Often, the father who pays alimony shows irresponsibility, refusing to work, and he has no official income. In such a situation, the law may impose punishment in the form of seizure of the debtor's property and its forced sale by court decision.

The most extreme measure in relation to persistent defaulters is a decision on criminal punishment, but this measure cannot help the minor in any way.

Waiting for the first alimony payment

Every recipient of money is interested in the question of when exactly do child support payments begin? Alimony money should be accrued from the moment you apply to the judicial authority, but, in reality, the receipt of the money supply may be delayed. Reasons for late payment for the maintenance of a minor:

- sluggishness of the BSC. The bailiffs are very busy with work. If, within 14 days from the date of submitting the writ of execution to the bailiff service, the recipient was unable to receive a document on the opening of enforcement proceedings, he should go to court and file a claim for the inaction of the bailiffs;

- the payer has no official income. In this case, only after the bailiffs discover the debtor’s money or property can one count on alimony;

- wages are delayed. When an employer delays wages, the alimony worker may even be exempt from paying the penalty. After all, the fact of non-payment was provoked by third parties.

Payment terms when drawing up a voluntary agreement

Former spouses, having agreed to pay child support voluntarily, have the right to independently determine the date from which the money will be paid. The law does not establish any special restrictions on this.

You should know! In order for the alimony agreement to gain legal force, you must visit a notary: without his certification, this document is just a piece of paper. The agreement is drawn up in writing. In this case, you need to go to the notary with a draft document in hand (the cost of this service is about 2,500 rubles ).

The payer has the following rights:

- make a one-time payment of money in an amount not lower than that required by law;

- transfer real estate to the child to pay off the child support obligation;

- make monthly transfers in a fixed amount of money; or shares of earnings that are specified in the peace treaty.

From when should alimony be calculated according to the agreement? According to the peace agreement, they must be accrued as soon as the notary certifies the document.

From what date is alimony calculated when going to court?

As a general rule, the judge will order child support for the benefit of the recipient and the minor starting from the moment the claim is filed.

Note! The judge orders the transfer of children's money not from the moment the court decision enters into force, but immediately from the moment the court office receives a claim demanding forced deduction of alimony money.

If, during the court hearing, the plaintiff is able to prove the fact that the payer deliberately evaded the obligation to support the child, then he will have the right to raise the issue of collecting money for the previous three years. In this case, it does not matter whether it is a fixed amount or interest payments.

Note! To determine from what date alimony will be calculated, it is not at all necessary to know the date of divorce: the mother has the legal right to apply to the court for child support both a week and several years after breaking up with the child’s father. Simply, only money for the past three years will be withheld.

From what date is alimony calculated if there is a writ of execution?

If the court renders a verdict to collect alimony from the payer, but the citizen does not make payments for the maintenance of the minor, then the alimony debt can be collected immediately for the entire period of non-payment of the debt, without taking into account the period of three years.

The procedure and terms for transferring alimony by the employer

When receiving IL, the employer or accountant must be guided by the following algorithm:

- Determine the number of days to withhold for an incomplete period from the date specified in the IL until the receipt of wages. Personal income tax, pension and medical contributions are deducted in advance.

- Calculate wages several days before the date established by the company’s internal documentation. Payments are made every 15 days, but alimony is calculated once a month from the total amount, consisting of advance payment and salary.

- Calculate alimony as a percentage of earnings or as a fixed amount.

- Pay wages and transfer alimony to the recipient using his details within 3 days after payment of wages to the payer.

Popular questions about the collection of alimony for previous years - lawyers answer

Highly qualified lawyers answer questions:

Question: During the divorce, my husband promised to help his 8-year-old son, I did not apply for alimony. The ex-husband periodically helped with very small amounts. This year, my 14-year-old son was diagnosed with blood cancer. Since he requires funds for treatment, I am considering the possibility of collecting money from his father for treatment. Is it possible to apply for alimony for the past period, taking into account our situation, if the three-year period has already passed?

Answer: You can file an application with the court to collect alimony for the past period of 3 years. That is, child support will be calculated from the age of 11. You can demand from your ex-spouse a share of your earnings or a flat sum of money.

In addition, child support may be increased since additional money will be required for your son's treatment.

Question: When divorcing my ex-husband, there was a verbal agreement that he would help his daughter - it was he who asked not to file for alimony. Indeed, throughout the year we regularly received money transfers from him for the child. Then he stopped making payments, left his previous place of residence and left in an unknown direction. I have information that he got married. 2 years and 10 months have passed since the divorce. Can I file for collection of alimony for the past period from my ex-husband if I do not know his whereabouts?

Answer: Yes, you can collect alimony in court for 3 years before filing the application. Even if you do not know the whereabouts of your ex-spouse, you still have the right to collect child support.

The search for this citizen will be carried out by the FSSP of your region.

Question: During the divorce, I did not apply for alimony - my husband promised to help our two common children. As a result, I received payments twice, then I found out that my ex-husband moved permanently to another country - Italy. Can I collect alimony for the past period (exactly 2 years have passed since the divorce) if my ex-husband lives abroad?

Answer: Yes, you can collect alimony from a Russian or foreign citizen, but only if the relationship between him and the children is proven. Child support for the past period can be collected 3 years before the moment you file an application with the court.

For a new, current period, alimony may also be awarded in a percentage, share or fixed amount.

Question: My husband left the family 3 years ago. All this time we lived with our son (now 7 years old), without any support from him. The husband went somewhere to work, changed addresses, and lived with other women. All this time I tried to somehow contact him to talk about his help for my son, but to no avail. The divorce took place recently, without his presence. Can I collect alimony from my now ex-husband for the past period, if for almost these three years he actually remained my husband according to documents?

Answer: You can recover alimony from your ex-spouse for the past period - regardless of whether you were married to a citizen or not. The calculation will be made for 3 years - from the child’s 4th birthday, if you go to court now.

Divorce also does not affect the assignment of alimony.

Still have questions? Just call us:

What to do if child support payments are delayed?

The first step in case of delay in alimony is to submit a written application addressed to the manager with a demand for payment of the penalty and the possibility of going to court or to the bailiffs. The deadline for submitting a response is also indicated.

If there is no response or systematic delays, it is recommended to immediately contact the bailiff leading the individual entrepreneur, since it is he who is responsible for collecting alimony. If the IL was provided by the claimant at the payer’s place of work independently, without the participation of the FSSP, enforcement proceedings are initiated.

The bailiff must take the following measures:

- send a resolution to withhold alimony from wages;

- If the alimony-paying person works unofficially, a search is made for his property and bank accounts.

If a large debt is accumulated, equal to the value of real estate or a car, the property may be seized for sale on electronic platforms in order to pay off alimony debt.

What to do if the salary is “gray”?

Where to go if there is a long delay in child support?

Delay in alimony payments for a long time is the basis for recognizing the debtor as a willful defaulter and bringing him to justice under Art. 5.35 Code of Administrative Offenses of the Russian Federation. For this purpose, the recipient can contact the bailiff leading the individual entrepreneur by submitting a corresponding application.

If the payment terms are repeatedly violated, the alimony obligee is brought to criminal liability under Art. 157 of the Criminal Code of the Russian Federation. The initiative can come from the claimant or the bailiff:

- Documents are drawn up to initiate criminal proceedings.

- The case materials are transferred to the FSSP investigator.

- The investigator submits documents to the court.

Income that cannot be levied

The process of collecting alimony is regulated by the Federal Law “On Enforcement Proceedings,” which defines the types of income that cannot be collected. These include:

- funds to compensate for damages associated with the death of the breadwinner;

- funds for compensation for injuries related to the performance of work duties;

- state compensation for citizens caring for disabled persons;

- compensatory government payments for reimbursement of purchased medications, transport tickets, etc.;

- alimony payments;

- labor compensation payments;

- insurance compensation;

- pensions paid in connection with the loss of a breadwinner;

- child benefits;

- maternal capital;

- state financial assistance;

- compensation payments related to the purchase of sanitary resort vouchers;

- compensation for travel to the place of sanitary and resort treatment;

- benefits assigned for the burial of relatives.

Practical examples

For a detailed analysis of the features of calculating the timing of alimony payments, it is enough to familiarize yourself with the examples:

Deadlines for alimony payments from vacation pay

The alimony payer goes on vacation from May 10. According to the Labor Code of the Russian Federation, vacation pay must be paid 3 days before the start of the vacation, i.e. no later than May 8.

Terms of alimony payments upon dismissal of an employee

The man wrote a letter of resignation on October 15, and was assigned two weeks of work. By law, the day of dismissal is considered the last working day, i.e. October 29, full payment is made. Upon termination of the employment contract, the employee is paid wages and compensation for unused vacation. Alimony is calculated from the total amount after the transfer of state contributions.

Limitation on the amount of deductions from wages

Financial deductions made from wages cannot be dimensionless, which is due to the need to have funds to provide for the employee himself. For this purpose, the law sets a limit on the amount of deductions from wages.

The general rule is to limit penalties to 20 percent of the accrued amount, in some cases this level increases to half the amount of earnings.

These restrictions do not apply to earnings received while serving correctional labor, deductions related to alimony payments, compensation for damage caused by a crime, compensation for damage caused by the death of the breadwinner. In this case, the total amount of deductions increases to 70%.

Violations

The law establishes a maximum period for payment of alimony. The transfer of funds for the maintenance of a minor child of an employee of the organization must be made by the employer no later than three days after payment of earnings to the debtor. If the alimony was not transferred to the collector within the specified period of time, then he has the right to turn to the bailiff for help. In turn, the latter conducts an inspection and finds out the reasons for the delay in transfers.

As a rule, alimony is transferred to the recipient on the day the salary is paid. Sometimes the next day. Therefore, if the debtor himself (the alimony payer) decided to transfer money to his child himself, then he must also meet the three-day deadline specified in the law. But most often the accounting department transfers funds according to the writ of execution. It's much more reliable this way.

However, penalties are charged for late alimony payments. Therefore, if the funds were not deposited by the payer into the creditor’s account on time, the fine here will be 0.5% per day of the amount.

When should I expect alimony collected voluntarily?

The settlement agreement between the spouses is also an executive document on the basis of which amounts for child support are collected. How long to wait for the first alimony in this case should be indicated in the text of the contract certified by a notary.

The parties can set any period, but their agreement should not violate current legislation and infringe on the rights of a minor child. If parents want to change the provisions of the child support agreement, they also do this with the help of a lawyer, after which all changes are certified by a notary. In case of disputes, the parties go to court on a general basis.

Difficulties

Very often, heads of organizations and accounting departments encounter various difficulties when calculating and withholding alimony. This is primarily due to the fact that salaries are transferred to employees twice a month.

Thus, many managers and accountants have a logical question: “How much should transfers be made for the support of an employee’s children as ordered by a judicial authority?”

So, in this case you need to follow the norms of the current law. First of all, the management of the organization must comply with the deadlines for payment of child support according to executive documents. Therefore, the collector must transfer the required amount within three days after the payment of wages to the debtor himself. This must be done from the income that closes the current month. But the entire amount earned by the parent obligated to pay child support is taken into account.

Interesting

In most cases, the issue of financial support for a child is of concern only to the parent with whom he lives.

In addition, many fathers, after divorcing their wives, categorically refuse to fulfill their legal obligations and do not pay alimony to their children at all. There are certain advantages here too. After all, a parent who did not provide financial assistance to his child before he came of age will not be able to demand alimony from him in the future in old age or in case of loss of ability to work. This is the law.

Nevertheless, in most cases, the period for paying child support in Russia is still limited to the child’s coming of age. Then the adult citizen himself will be able to demand from the parent who did not provide him with financial assistance in childhood a full refund of unpaid funds for the last three years.

Important to know: alimony payments begin to accrue from the moment the claim is filed.

According to Article 107 of the Family Code, the start date for calculating alimony is the date the court receives the statement of claim. This means that no matter how long the trial itself takes, if the court makes a positive decision for the recipient of alimony, the money will be collected from the payer starting from that date.

Moreover, according to the same article, if the recipient of alimony manages to prove in court the fact that he tried to collect child support before filing documents with the court, then alimony can be calculated for the past period, but not more than for three years preceding moment of submission.

Time frame for consideration of the case after filing an application for alimony

In cases established by the Code of Civil Procedure, citizens have the right to have their case considered in simplified (mandatory) proceedings. In writ proceedings, the judge independently makes a decision, without holding a court hearing. The parties to the case are not invited by the judge and are not heard.

When making a decision, the judge is guided only by the arguments of the claimant, set out by him in the application. The judge's decision is formalized in the form of a court order, which must be issued no later than 5 days from the date the court receives the corresponding application from the claimant.

After the court issues an order, a copy of this document is sent to the alimony payer (debtor). The debtor has the right to express his objection to it within ten days. The objection must be made in writing to the magistrate who made the order.

If the alimony payer sends an objection to the court, the order will be canceled, regardless of what arguments were given by the debtor in this document. In this case, the claimant has the right to prepare and file a statement of claim with further consideration of the case in court in general (claim) proceedings.