There are several ways to fulfill alimony obligations, but not all of them are universal. Personal transfer allows you to save on bank services, but hostile relations between former spouses will become an obstacle. An additional inconvenience is the preparation of receipts. Transferring alimony payments to a bank account is also not always suitable. Branches of a financial organization are not present in all localities. Many payers send alimony payments by postal order to avoid these inconveniences.

Pros and cons of the method

The obvious advantage of this method is its accessibility to all citizens. To make a postal transfer, you do not need to have a bank account or card - the transfer is made on the basis of the recipient’s passport data.

It is convenient to receive alimony through Russian mail in the following cases:

- There is no bank branch in the payer's locality.

- There is no bank branch in the recipient's locality.

- One of the parties does not actually have the opportunity to open an account or card, or receive electronic payment (using Qiwi wallets, Yandex money, and so on).

When paying, a receipt will be issued indicating the recipient.

The payer receives a document confirming the fact of payment, which is also a definite plus.

However, this method also has a number of disadvantages:

- A fairly high commission is paid for transferring alimony through Russian Post.

- There are usually quite long queues at post offices.

- Long transfer period (compared to bank transfer).

Main nuances

Transferring alimony payments via mail has some features:

- It is important to fill out the receipt correctly and indicate the type of payment and period.

- A commission is charged for the transfer, which must be provided for by the payer, which means the costs will increase.

- The transfer period can be up to eight days. In addition, the notice may be delivered to the recipient a little later.

- It is important to keep all receipts in case litigation arises.

- If the agreement specifies exactly this method of payment, then to change it it is necessary to draw up a new agreement.

All these points must be taken into account to avoid problems in the future.

Regularity of payments

The regularity of payments depends on the terms of the agreement. The court decision always indicates a periodicity of one month.

You can pay via mail with any regularity, depending on the obligation. For example, once a month, quarter or year.

Russian Post allows you to make payments at any frequency. You need to focus on the agreement or court decision, as well as the agreement between the parties if alimony is paid orally.

Type of payments

The post office can provide several transfer options:

- Payment and receipt of cash through the post office cash desk.

- Payment is made through a bank account, and receipt is in cash.

- Payment is made in cash, and the money is transferred to the recipient's account.

You can also make addressed or addressless payments through Russian Post.

With a targeted payment, the recipient's place of residence is indicated; with an addressless payment, accordingly, not. In some cases, a party does not want to tell the payer their place of residence for certain reasons, so using addressless payment seems to be the most convenient.

Russian Post can also provide an urgent transfer service. If urgent, the funds will arrive much faster, but the commission will be slightly higher.

What papers are required?

To send alimony by postal transfer, you must provide the following documents:

- Sender's passport.

- Recipient's passport details.

- A duly certified payment document.

If the transfer is executed not by the payer, but by another person, then it is necessary to have an appropriate power of attorney, certified by a notary.

In the application for transfer, you will need to indicate the details of a court decision, court order, agreement or writ of execution, so it is worth taking a copy of the document (or a copy of it) to avoid mistakes.

In what cases is alimony paid through Russian mail?

Maintenance obligations may arise:

- On a voluntary basis. This means that the parties enter into an oral or written agreement (simple or notarized), in which the amount of payments, the method of transfer and other conditions are established by mutual agreement.

- On a forced basis. that is, payments are assigned on the basis of a court decision and are executed according to a writ of execution sent to the bailiffs. It is in the executive document that all the conditions for transferring money are prescribed.

You might be interested:

How is alimony paid from bonuses, from travel expenses, from vacation pay, from financial assistance, and also how to correctly calculate alimony from wages?

IMPORTANT. The process of paying money is undertaken either by the payer himself or by the employing organization.

The frequency of payments is set voluntarily or through the court, and can be different, for example, every month or quarter.

Methods of transferring money:

- personally from hand to hand (do not forget to take a receipt for receipt of alimony>);

- payment transfer via Russian Post;

- payment transfer through a banking organization.

Transferring alimony payments via mail is possible in all three of the above methods.

But still a large number of citizens receive alimony by mail and this is due to the following:

- location of the recipient or payer in a remote area to which there is no banking system or it is difficult to access. And there are post offices in almost all localities.

- making translations the old fashioned way, out of habit. This is not an unimportant factor, especially for older people who often do not trust plastic cards.

Is it possible to pay child support by mail?

There are several ways to pay for the maintenance of a minor child. They can be sent from the payer to the recipient using one of the available methods:

- postal transfer;

- personally from hand to hand;

- to a bank account or card.

The choice of method is entirely the right of the payer and is determined by convenience and availability in specific circumstances. However, there are also several methods for determining the optimal method of transferring alimony:

- voluntarily. In this case, the payer himself decides how exactly to transfer funds;

- forcibly. This method is usually used if the court makes a decision to pay alimony payments.

That is why it is possible to transfer alimony payments by mail. If this method is preferred by the payer or indicated by a court decision, this is the method that will be used in the standard case.

Who can pay and receive child support via mail?

To make and receive transfers, you must be an adult citizen who has received a passport.

If the recipient is a child, then his rights are represented by a legal representative on his own behalf and, accordingly, on the basis of his passport.

- a parent obliged to support his minor child, or an adult disabled child (disabled children)>;

- children if their parents are disabled and need help;

- spouse, if the spouse is pregnant or raising a common child under 3 years of age (the same in case of divorce), or if the second spouse is incapacitated, or capable, but caring for a disabled child.

It follows that the recipient can be:

- child;

- spouse;

- parent;

- other relatives (if they have no other relatives obligated to provide for them, and they at one time conscientiously raised (maintained) the payer for at least 5 years).

How to pay child support via mail

- minor children from parents

- disabled adult children from parents

- ex-wife from ex-husband during pregnancy, if pregnancy occurs before divorce

- ex-spouse caring for a common child under 3 years of age, or a disabled child under 18 years of age, or an adult disabled child

- disabled parents from able-bodied children in need of financial assistance

- by court decision - one of the former spouses who has become disabled and needs financial assistance from the other former spouse

Rules and procedure for paying alimony by postal order

Alimony must be withheld from all income the employee receives each month. They must be transferred to their destination no later than 3 days after payment of wages. The organization's costs for transferring alimony (bank commission, cost of postage) are also deducted from the employee's salary.

Deadlines for receiving money

The timing of receiving money depends on how to transfer alimony via mail:

- within one hour;

- during two days;

- within a few minutes (instant transfers through the Western Union system).

- name of the republic, point and post office - upon receipt in the “post restante” mode;

- name of the republic, point, department and post office box details (number) - upon receipt through a mailbox;

- name of the republic, locality, house and apartment numbers, streets - upon receipt at the place of residence.

When alimony payments are delivered by postal order to the recipient's office , a notice will be sent to the recipient's mailbox - this is free.

But almost always such notifications arrive late or may get lost.

REFERENCE. If the transfer is made through the Western Union system, then the tracking number must be indicated in the payment document; it can only be used through the Western Union website.

Received funds are stored in the department for one month .

After the month, the payment is sent back to the sender.

The sender himself, due to circumstances, can extend the storage period of the transfer by writing a corresponding statement.

How to confirm payment of alimony via mail

Confirmation of the transfer is issued at the post office to the client.

In case of controversial issues, you need to rely on it.

At the post office you can find a transfer by the name of the recipient or the sender.

But if the document is lost and the translation is never received, and the employees refuse any help, you must first contact the management orally or immediately write a complaint.

If this does not help, go to court to protect your rights.

Writ of execution postal fee

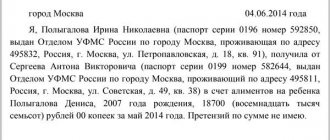

Sample of filling out a postal order for alimony

If alimony is paid on the basis of a voluntary alimony agreement, the documents are filled out in the same way, except that instead of the details of the court decision, the details of the alimony agreement (date of conclusion and registration number supplied by the notary).

- How to transfer child support via mail

- How to send child support via mail

- How to transfer alimony payments via mail

Perhaps the most important step in the sending process is filling out the postal order form.

Transfers from card to card by Russian Post

The main disadvantages of postal transfers:

- high fees for providing services;

- routine process (going to the post office, waiting in line, filling out a special form, etc.).

In order to save time and money, it is possible to use the service of banking organizations - transfer from card to card.

It is possible to transfer money from card to card in the following ways, through:

- bank employee in person;

- specialized terminal (ATM);

- online bank application;

- virtual payment systems (virtual wallets);

- Russian Post online program.

- Russian Post has posted a service on its website that allows you to transfer funds from card to card without leaving your home. The commission for such a service is from 65 rubles.

A payment document in the form of:

- printed paper receipt;

- online check.

For online transfers, there is a special window “Purpose of payment” , in which you can indicate that the payments relate to alimony .

If the money has not been received on the card, you need to promptly contact the sending bank.

You can contact the branch in person, or by calling the operator’s toll-free number.

Deadlines for transferring alimony

Of course, the payer, as well as the recipient himself, is interested in the question of how much alimony is by postal order?

The period for receiving alimony depends on the selected money transfer service, the amount, distance and whether the branch is equipped with electronic services. The translation can take several hours or several days (up to 8 business days).

The main methods of transfer indicating the deadline:

- Tariff plan “Fast and Furious” – receiving money is available within an hour;

- Transfer from the card to the recipient's post office - the next day;

- There are other ways to transfer alimony from electronic accounts, foreign banks via Russian mail to the recipient's address. Check with your post office.

How to send alimony by postal order from an organization

The organization withholds alimony based on:

- notarized voluntary agreement;

- or a written statement from the employee;

- or on the basis of a writ of execution.

Regardless of the basis document, the company must calculate the amount of withholding and send it in the manner specified in the documents .

This must be done within 3 days from the date of payment.

A transfer on behalf of an organization is similar to a transfer from an individual:

- tariffs remain the same;

- it is necessary to indicate the name and address of the organization in the sender column;

- indicate the passport details of the employee authorized to act on behalf of the legal entity;

- in the “Additional” , indicate that the purpose of the payment is alimony payments for a certain period for a specific employee .

Regardless of the distance between the alimony payer and the recipient, you can always find a convenient method of transfers.

The main thing is to study in detail the market of offered translation services and choose the most convenient one.

Deadlines for transferring funds

Rules for paying targeted payments by mail When making a voluntary transfer, you should clarify the transfer directly with the sender of the money (child's parent), who can write a statement of claim to the department with a copy of the receipt attached.

The obligation to pay child support for minor children is established for parents living separately from them. In this case, divorce of the spouses is not required. The obligation arises on the basis of a writ of execution (WOR) received in court, or under an alimony agreement concluded with a notary.

Transfers from a bank card with cash receipt

It often happens that the recipient does not have a card or refuses to issue one.

In this case, the alimony payer can make a transfer from his card to a certain bank branch , and the other party can receive it in cash.

Depending on the selected bank:

- delivery time - from a few minutes to 3 days;

- cost of the service - from 1 to 5%, paid by the debtor;

- it is necessary to indicate the full name, telephone number of the payer, recipient;

- receiving cash at specific points of issue upon presentation of a passport and departure number;

- There is a daily limit.

Russian Post also provides a similar service:

- transfer only in rubles;

- minimum 100 rubles, maximum 15 thousand rubles;

- only from Mastercard and Maestro cards;

- within 2-8 days;

- commission 1.5%, minimum 30 rubles;

- Home delivery is possible (4.5%, minimum 90 rubles).

Confirmation of the transfer is a payment receipt or online document.

If you have a problem getting money, you need to seek help in person or by calling the hotline.

What to consider when receiving benefits on the card

The method of transferring alimony support is established in accordance with the wishes of its recipient. The method chosen by the recipient must be indicated in the writ of execution or in the agreement on payment of alimony.

If the recipient has expressed a desire to receive alimony on a bank card, then in addition to having an open account, the following conditions must be taken into account:

- With the mutual consent of the parties and when signing an additional agreement on the payment of monetary assistance for the maintenance of a young child (Article 99 of the RF IC), the document must indicate:

- the selected method of transferring money (to a bank card);

- requisites;

- the amount of payment and its frequency.

The payer independently transfers money without additional statements from either party.

- If the debtor is officially employed:

- the recipient of the funds will be required to submit an application indicating the payment card details;

- the debtor's employing organization, within 3 days after payment of wages: will independently calculate the amount of withholding (Article 109 of the RF IC);

- will transfer according to the details specified in the application.

- If the payer does not have official employment, the application to transfer money to the card is submitted to the bailiffs.

At the request of the bailiffs, alimony may be transferred to:

- card (at the recipient's choice);

- deposit account of the bailiff division.

In the latter case, the amount is transferred to the applicant within up to 5 working days (Article 110 of Federal Law No. 229, 10/02/2007).

Important! The costs of transferring funds to the card are not taken into account in the amount of the benefit and must be paid by the payer (Article 109 of the RF IC). Download for viewing and printing:

Federal Law of October 2, 2007 N 229-FZ (as amended on December 28, 2016) “On Enforcement Proceedings”

Family Code of the Russian Federation No. 223 Federal Law ed. 12/30/1995

Basic Rules

A postal transfer allows a parent, even if he is far from his child, to systematically transfer funds for his maintenance. In this case, it is necessary to follow a number of rules when translating:

- It is necessary to make payments systematically and in accordance with the terms of a voluntary agreement or writ of execution: 1 time per month;

- quarter;

- half a year/year.

- It is necessary to indicate information about the purpose of payment in the appropriate column of the form. Enter that the funds are transferred to as an alimony payment.

Transfer of funds must be made within 3 days after receipt of income (salary). If alimony is determined by a court decision, more information must be provided on the postal order form. The following information must be provided:

- The period for which alimony payments are made;

- The amount of income received for the period under review;

- Number of days worked for a given period;

- The amount of the payer's income tax;

- Amount of alimony;

- Information about the total amount of alimony debt, indicating the remaining amount (if debt arises).

Debt in alimony situations is often formed due to the lack of payments during a certain period or the low income of the payer. Indicating the number of days worked and the amount of income allows you to detail information about the income received and the capabilities of the payer, thereby avoiding further litigation.

A parent making child support payments under a voluntary agreement must also protect himself from possible misunderstandings and provide detailed information about it when making a transfer. So in the postal transfer form you must indicate the following information:

- About the recipient of funds and their purpose;

- About the amount of transferred funds;

- Address details and postal code of the recipient.

How to prove the fact of transfer?

Child support payments can be made at any post office. The most important thing is that all the conditions specified in the executive document are met. The amount must clearly correspond to the established amount (how to determine the amount of alimony?).

If money is transferred by the alimony payer on the basis of a court decision, then all important information must be entered when sending it. A correctly and completely filled out form may in the future become proof of the completed postal item.

The form contains the following information:

- the amount is indicated in numbers and words;

- Full name of the alimony recipient;

- postal code and address of the recipient of the money;

- Full name of the alimony payer in the “sender” column;

- sender's address indicating postal code;

- purpose of payment - alimony for a specific period;

- sender's passport details;

- citizenship of the alimony payer;

- personal signature.

By the tribunal's decision

If the payer transfers alimony on the basis of a court decision, then when making the payment it is necessary to indicate:

By voluntary agreement

If a voluntary alimony agreement is concluded between the parties, and a postal transfer is chosen as an option for transferring funds, then the only difference in filling out the form will be the column on the writ of execution. It is necessary to indicate the details of the alimony agreement: the date of signing the agreement, the registration number assigned by the notary.

Cost of postal transfer of alimony and commission

Postal transfer, which has recently become especially popular again, allows you to transfer funds to a bank card in the amount of up to 15 thousand rubles. inclusive. Funds will be credited within 5 days. This is a very convenient way if there are no banks, ATMs or terminals at the place of departure.

The commission fee or cost of services directly depends on the amount transferred. Thus, postal fees are calculated as a percentage and are:

- 40 rub. for carrying out a transfer operation and 5% of the transferred amount, but not more than 1000 rubles;

- 50 rub. for the transfer and 4% of the amount if it is 5 thousand rubles;

- 150 rub. for the transfer and 2% of the amount if the transferred amount is in the range from 5 to 20 thousand rubles;

- The cost of services when transferring amounts in the range from 20 thousand to 50 thousand rubles. will be 250 rubles. for processing the transfer and 1.5% of the amount sent by transfer.

The cost of postage is paid by the payer. You must retain shipping receipts as proof of the transfer.

Transferring funds through Russian Post branches allows you to transfer up to 15,000 rubles. from hard-to-reach places: rural villages and small towns.

How many days from the date of deduction does it take for alimony to arrive in the mail?

This document also specifies the details for the money transfer.

03 Options for transferring money - to a card or through bailiffs? The question of how exactly the alimony provider should transfer funds is not spelled out in the executive documents.

The choice is given to both parties, because the main thing is that the money is transferred on time and in full. The transfer option can be changed at any time by agreement of the parties. The alimony payer has the following options:

- transfer money monthly to the specified bank account;

- transfer the amount to the baby’s card;

- make payments through bailiffs;

- The most common method is monthly salary transfers.

When withholding money, the employer is obliged to ensure that the payment is made correctly, as well as to transfer funds from the organization’s current account to the recipient’s account on time.

How long should I wait for the first alimony payments?

Important By law, a woman has the right to receive alimony from her ex-husband until their common child turns three years old. After all, it is during this period of time that the baby really needs the care and care of his mother.

In this case, the period for paying alimony after salary is also three days, it is counted from the moment when the debtor (father of the family) received his earnings.

Conclusion Once again, it is necessary to say that an enterprise needs to comply with the terms of payment of alimony only in cases where the accounting department has a document confirming the decision of the justice authority (writ of execution, court order), as well as an agreement on the payment of funds for child support, certified by a notary .

In another situation, an employee of an enterprise and his ex-wife have the right to independently set the date when the latter will transfer money to her to provide for their joint child.

Attention This method is based on Article No. 99 of the Family Legislation of Russia, which states that an alimony payment agreement can be concluded between the alimony payer and the recipient, which is further equated to a writ of execution. Such an agreement specifically specifies the time of payment, place and form of payment. The peculiarity of this agreement is that parents can change the terms of the agreement by mutual consent.

- 2. Payment according to the writ of execution. Involves a court decision for the father or mother. As a result of the court verdict, an enforcement order is issued, which indicates information about the meaning of the court decision, the payer himself and the amount of payments.

- According to the executive document, funds are withheld from the monthly earnings of the alimony worker. All costs associated with the transfer of money are covered by the payer.

Deadline for transferring alimony - how much to pay and how often to do it?

But how long can alimony payments be in this case? Here, the former spouses can agree that one of the parents, who will not live with the child, is obliged to help the latter financially until he graduates from a university or college.

Although the cases are different. For example, some parents believe that after reaching adulthood, a child should provide for himself.

If you quit What should an employer do if an employee who is obligated to pay alimony suddenly decides to leave the organization? Everything is quite simple here. The employee must notify the manager of his decision in advance.

This is done two weeks before the date of expected dismissal. On the last day of official activity, the subordinate (debtor) receives a salary from which funds are withheld; they will be transferred to the claimant for child support.

Payment of alimony via mail

There are certain advantages here too. After all, a parent who did not provide financial assistance to his child before he came of age will not be able to demand alimony from him in the future in old age or in case of loss of ability to work. This is the law. Nevertheless, in most cases, the period for paying child support in Russia is still limited to the child’s coming of age.

Then the adult citizen himself will be able to demand from the parent who did not provide him with financial assistance in childhood a full refund of unpaid funds for the last three years. Violations The law establishes a maximum period for payment of alimony.

The transfer of funds for the maintenance of a minor child of an employee of the organization must be made by the employer no later than three days after payment of earnings to the debtor.

Deadlines for transferring alimony payments by the accounting department

The main types of alimony deductions are as follows:

- fixed monthly payment amount. This form is used in cases where the payer does not have a stable income and his income is seasonal;

- amount in shares relative to the salary or other type of income of one of the parents;

- fixed amount in one payment. This type is used in cases where the defendant wants to fully pay the debt for a period before the age of 18;

- payment in material assets: real estate, car, other valuables;

- funds paid periodically in the established (agreed) manner;

- other methods determined by the decision of both parties.

The procedure for paying alimony is determined in two main ways:

- 1. Payment according to a bilateral agreement of the parties.

On average, alimony lasts from several hours to several days. The maximum period is 8 working days. Russian Post offers several options for money transfers.

The speed of transferring funds from the sender to the recipient depends on the service chosen by the sender.

For example: The Forsazh service is one of the most popular ways to urgently transfer cash between citizens throughout Russia. Its main advantage is the high speed of delivery of postal orders.

You can receive money at any post office in Russia - just a few minutes after sending (no more than 1 hour - up to 100 thousand rubles, up to 2 days - over).

The recipient is notified of the receipt of funds at his place of residence. New service - transfer of funds from the sender’s bank card (Mastercard or Maestro), receipt of cash at the post office.

Registration and payment of alimony 10/07/2017 7.8 thousand 5.2 thousand 4 min. It is important for parents who pay child support from their own funds to adhere to the requirements of the law.

- 1. Who is obliged to pay alimony and what amounts?

- 2. What types of payments are there?

- 3. Options for transferring money - to a card or through bailiffs?

- 4. Is it possible to transfer alimony to a child and not to an ex-wife?

- 5. Terms for transferring funds – how many days after salary?

- 6.

Nuances The timing of child support payments should be taken into account by the head of the organization in which the debtor (one of the parents) works only if there is a specific decision of the judicial authority. For example:

- performance list;

- court order;

- agreement (agreement) on the payment of alimony, certified by a notary.

Only if the accounting department of the enterprise has one of the specified documents, transfers should be monthly.

As a general rule, alimony is paid by parents only until the children reach adulthood. Difficulties Very often, heads of organizations and accounting departments encounter various difficulties when calculating and withholding alimony.

This is primarily due to the fact that salaries are transferred to employees twice a month.

The procedure and standard for filling out the paper of a postal transfer How to adequately register the recipient's details Transfer of cash capital by card number Currency “CyberMoney” (to neighboring countries, the Baltics and foreign countries) Foreign currency “CyberMoney” (in the Russian Federation) Contributions/Deposits (opening and service) Reception payments for interconnection services, Web and TV Accepting payments at self-service terminals Currency from a card for cash payment Prototype of a completed postal form for the federal customer CJSC Bank Russian Etalon (then Bank). Postal transfer of alimony For postal transfer of alimony, interest is taken by the post office and this should not be reflected in the amount of alimony. It should not decrease and it is taken from the husband, we had this at work (I work as an accountant). If anyone is not satisfied with this, we simply do it.

They're making a fool of you. According to the executive, 25% is withheld from him. They should be given to you. And the shipping costs are my husband's problem.

In this case, the payment amount and the amount of postage are entered into the cash register. All expenses are borne by the debtor-payer. Tariffs for postal services in 2018 are a fixed amount for the postal transfer service and a percentage of the payment amount.

Moreover, the amount of the fee varies depending on the size of the payment:

- when paying less than 1000 rubles - 80 rubles + 5% of the amount;

- when paying from 1000 to 5000 rubles - 90 rubles + 4% of the amount;

- when paying from 5,000 to 20,000 rubles - 190 rubles + 2% of the amount;

- over 20,000 rubles - 290 rubles + 1.5% of the amount.

Note! The amount of postage is paid in addition to the amount of the alimony payment! How much does alimony cost by postal order cost? The time frame for sending/receiving a money transfer depends on factors such as the type of postal service, amount, distance, and whether post offices are equipped with electronic systems.

In both the first and second cases, to receive money you will need to provide an identification document (passport). There are also urgent and non-urgent postal orders.

The expedited payment service is available at almost all post offices in the country. If the recipient of alimony is located within the country, he will be able to receive the money within a few hours after sending.

Sample of filling out a postal order for alimony Perhaps the most important step in the sending process is filling out the postal order form. Important: the form should be filled out legibly to avoid errors or misunderstandings when sending or receiving it, in order to deliver funds to the recipient in a timely manner.

Correct and complete completion of the form is also important in order to provide evidence of fulfillment of one’s obligations in the event of disputes.

Source: https://pbcns.ru/skolko-dnej-s-momenta-otchisleniya-idut-do-pochty-alimenty/

Documents for registration

Payment via mail is made based on the submitted package of documents.

The current Family Code of Russia provides for the withholding of money from a parent who does not live with the children after a divorce. This obligation extends to children under the age of majority (18 years). But if the child is studying at a university hospital, then the duration of payments can be extended until he reaches 23 years of age.

The amounts of alimony penalties are as follows:

- for one child – 25% of the parent’s total income;

- for two children – 33%;

- if there are three or more children – 50% of the parent’s total income.

Article 116 of the Family Code does not allow the recovery of paid alimony.

Procedure in case of non-receipt of transfer

Sometimes situations arise when the money transfer was not completed. If such a situation arises, it is necessary to contact the payer’s place of work and confirm the fact of transfer of alimony (if payment is made by voluntary agreement). If the decision to pay alimony was made in court, then the recipient of the alimony must contact the bailiffs. The bailiff checks the organization's transfer of part of the wages for alimony.

If the transfer was not delivered due to the fault of third parties: postal employees, an enterprise accountant, etc., then they can be held accountable under Article 315 of the Criminal Code of the Russian Federation, accusing them of obstructing the execution of a court decision.

Postage

Alimony must be received at the frequency specified in the agreement or IL: monthly, quarterly, etc. For example, if the IL indicates that payments are made on the 8th of each month, then the funds must be transferred before this time.

The sender is required to compensate the amount of the transfer, the commission and the losses incurred by him - a penalty. If the post office refuses to return the money or cannot find the payment, a complaint is filed with a higher division of the Federal State Unitary Enterprise or the Ministry of Telecom and Mass Communications.

Legal difficulties when paying alimony by mail

When transferring funds via postal transfer, difficulties sometimes arise. When transferring funds via mail and without indicating that this transfer was made as a transfer for alimony, difficulties may arise in recognizing it as a fact of payment of alimony. In this case, the court considers such a transfer as voluntary and free assistance to the child, and this is only a fact confirming the parent’s participation in his upbringing.

Funds transferred by postal order and directly in the name of the child will not be considered alimony. These transfers are considered as a gift to the child. Therefore, it is necessary to indicate the purpose of the payment and keep all payment receipts, otherwise the bailiff may charge the payer with debt.

Registration of transfer of alimony through accounting

If the spouses were able to agree with each other on the payment of alimony without bringing the matter to court, then all they have to do is confirm the terms of their agreement with a notary. When peace negotiations do not lead to anything, the potential recipient of child support brings an application to the court. If the defendant agrees to pay alimony under the specified conditions, the court will issue an order. If there are serious disagreements between the former spouses, the single parent will be forced to file a statement of claim in court, after which the verdict will be a writ of execution. In order for an employer to begin transferring alimony, he must provide documents confirming the legal basis for the payments. Such papers include notarized agreements between spouses, court orders and writs of execution.

All these documents must indicate the conditions for the transfer of alimony, as well as the details for their transfer (mailing address of the defendant or bank account). The claimant must himself send the original papers to the organization where the future payer works. If the alimony worker works at several enterprises at once, then it is necessary to deliver documents to each of them. Duplicates, photocopies and scanned electronic versions are not accepted.

Agreements on the payment of alimony, writs of execution and court orders are documents of strict accountability. Therefore, the employer appoints a responsible accounting employee to record, store and process them. These papers are handed over against signature and are stored not in a general pile of documents, but in specially designated places: safes or metal locked cabinets.

If documents on the assignment of alimony are lost, the responsible person may be punished with a fine of up to 2,500 rubles.

The entire procedure for withholding and paying alimony is specified in the Family Code of the Russian Federation. Upon receipt of writs of execution, orders and agreements, the accountant is obliged to record their appearance in the reporting journal. Then the responsible employee determines from what date the funds must be withheld. The date must be indicated on the documents received. Sometimes the papers arrive much later than the start date of collection stated in them. In this case, the accountant is obliged to borrow the debt for the previous days or months from the employee of the enterprise. If all the necessary documents arrive on time, then the accounting department begins to calculate payments for child support from the employee’s next salary according to the specified percentage or a fixed amount after deducting personal income tax. Alimony is not paid in advance, so the recipient can expect it no earlier than the day the former spouse “pays”, but no later than three days after this event.

According to the law, alimony cannot amount to more than 50% of a citizen’s income. If, in addition to the basic monthly contribution, a child support debt is withheld, then the total amount of payments should not exceed 70% of the salary. Before making payments, the accounting department checks whether these conditions are met.

Postings for the transfer of alimony reflect quantitative changes in the payer’s salary and are usually characterized by the debit and credit of the accounting item. So, the debit part will always have account No. 76, and the credit part will depend on the method of paying alimony. That is, account No. 50 is a cash payment, No. 51 is for payment by bank transfer, No. 71 is for a postal transfer. And the posting of alimony through the eyes of an accountant always looks like this: Dt 76 Kt 50 (51, 71).

When transferring alimony, the organization does not undertake additional expenses associated with the delivery of funds to the recipient. That is, the costs for bank commissions and postal transfers are paid by the employee.

Also, payers often have a reasonable question: is it necessary to pay alimony from the refund of tax deductions? For example, if an employee gets sick, studies or buys a home, he can get some of the funds back by filing an application with the tax office. In fact, these payments are not listed in the list of income from which alimony is collected. Therefore, the payer can be calm in the event of receiving a tax refund.

See also:

Alimony: how to index the amount of child support

Alternative ways to pay child support

In addition to postal transfers, alimony payers can use other methods of transferring funds:

- To the recipient's bank account (on a plastic card) . To transfer funds using this method, the recipient must submit an application to the accounting department at the payer’s place of work to select the appropriate method of receiving alimony, indicating his bank details. In this case, alimony payments are transferred to the recipient's bank account within three days from the date of payment of wages to the payer; the transfer can be made directly from the current account of the employing organization. The application can also be sent by registered mail with acknowledgment of delivery to the accounting department, to further confirm the legality of the application for alimony payments.

- To the child's bank account . Transfer of alimony to the account of a minor child is carried out within 50% of the total amount.

Funds are transferred to the child’s account in the following cases:

- Inadequate fulfillment by the mother or father of the child who receives alimony of their responsibility to rationally spend alimony payments for the maintenance, education and upbringing of the child, responsibilities to maintain a level of sufficient financial support for the child for his full development (food, clothing, toys, sports equipment).

- Opening a separate bank account in the name of the child to transfer funds in addition to or in addition to the established amount of payments.

- Mutual agreement between the child’s parents to open a personal account.

Payment methods

The divorce is completed, the amount of alimony is determined, all that remains is to clarify where and how to transfer it. The ideal option is to conclude an agreement between the mother and father. In this case, the father pays child support in cash through a receipt. But very often this method of payment is impossible, since for former spouses the divorce process is a serious stress.

The alimony payer, in order to avoid questions from regulatory authorities, must follow a certain procedure for transferring the payment. Alimony payments are recognized as absolutely legal in the following cases:

- accrual of payment via postal transfer (mail);

- the employer deducts from the employee (the alimony payer) the required amount from the salary and assigns it to the recipient;

- transfer of alimony to the claimant’s savings book or to a card, for example, of Sberbank;

- payment and transfer of alimony through the bailiff service.

Let's look at each method in a little more detail.

Calculation of alimony payments via mail

Funds can be transferred via mail to the recipient's account monthly or even quarterly. The regularity of money transfers via mail depends on a court order or a voluntary agreement certified by a notary. Help may contain the following options:

- once a year;

- once a month;

- quarterly;

- once every six months.

The amount of alimony payments and terms are specified in the writ of execution or voluntary agreement.

Certificate of transfer of payment by court decision

When making a transfer via mail, with special attention, you need to fill out the “For written message” column, which is located on the back of the postal transfer coupon. In this column you must correctly indicate:

- month for which alimony was paid;

- the number of days worked by the alimony payer;

- salary size;

- withheld personal income tax;

- alimony deductions;

- if the alimony payer has a debt, its amount must be indicated.

Certificate of payment transfer by mail - sample

When transferring money via mail, the certificate must indicate the following points:

- recipient details;

- FULL NAME;

- amount of money transfer.

Money via mail can be transferred both to the recipient’s address and to his bank account. To avoid controversial issues, it is necessary to save all payment documents (receipts) confirming that the payment has been transferred. To make a transfer via mail, a passport is required.

Calculation of payment through accounting

An employee who pays alimony has the right to contact the accounting department of his company with a statement. It should indicate the recipient's account to which transfers will be made.

A photocopy of the writ of execution or voluntary agreement must be attached to the application. The sample (you can download it below) will help you write the application correctly and quickly complete the assignment of money.

In addition, the ex-wife can independently submit an application for the method of receiving and transferring alimony. She should also contact the accounting department of the company where her ex-husband works and provide an application with her details for transferring alimony.

In this case, the deadline for paying alimony is three days from the date of payment of wages to the alimony payer. The former spouse can submit the application in person or by registered mail. Payment of alimony can be calculated through the company's current account.

Calculation of alimony to a savings book or bank account

Money can be transferred to a savings book or bank account (plastic card) independently by the alimony payer or by the company in which he is an employee. When sending money yourself, you must keep receipts indicating that the payment has been transferred. This will provide the alimony payer with security in the event of litigation and misunderstandings.

Calculation of alimony to a child's account

Transfer of payment to the account of a minor child is possible in the amount of no more than 50% of the amount of alimony. Money is transferred to the child’s account in the following cases:

- By mutual agreement of the mother and father of the child.

- If the parent receiving child support does not reasonably spend the bulk of the transferred money. In this case, a court decision is required confirming that the child support money is not spent on the child. The assignment of alimony involves spending money on the maintenance of the child. The child support payer can ask the parent living with the child where he spends the child support money.

- At his own request, the alimony payer can open an account for the child, where he will pay money in any amount in addition to the established alimony.

Alimony is paid no later than on the third day from the date of salary payment.

Payment of alimony through the bailiff service

If the alimony payer evades the transfer of alimony, then the help of bailiffs is needed. The application is submitted to the Federal Bailiff Service. Within 24 hours, bailiffs initiate or reasonably refuse enforcement proceedings. After this, copies of the document are sent to the claimant, the debtor and the court. In addition to information about the debt, the resolution contains information about criminal liability and coercive measures for evading the payment of alimony.

After this, a summons is sent to the defaulter, and if he does not repay the debt within 24 hours, he is recognized as having failed to comply with the requirement, after which fines are imposed. The debtor is obliged to provide reliable information to the bailiffs about his financial situation, availability of property, and income.

If the debtor refuses to transfer alimony, the bailiffs have the right to use coercive measures. These include:

- ban on traveling abroad;

- seizure of property;

- criminal liability;

- administrative and legal responsibility.

If within three days the whereabouts of the payer are not identified, the bailiffs put him on the wanted list, which is carried out by law enforcement agencies.

Alimony from vacation pay and other types of income

Alimony from vacation pay is mandatory, since it represents a kind of salary.

In addition, alimony can be collected not only from vacation pay, but also from other sources of income. These include:

- salary;

- cash bonuses;

- income from your own business;

- premiums for harmfulness;

- payments to employees of medical institutions;

- rewards;

- pension;

- awards for professional merit;

- rental income from real estate;

- scholarship.

Alimony is calculated within certain periods. If the money does not reach the recipient on time, a fine may be imposed on the company and the employee (alimony payer). Transfer of funds from vacation pay is accrued within 3 days from the date of payment of funds.

Documents for transferring alimony to the recipient's bank account

The recipient of alimony sends a package of documents to the employing organization or other legal entity paying the payer a stipend, salary or pension. These include a writ of execution - a court order, an agreement to pay documents, a writ of execution, as well as a statement indicating the following information:

- Last name, first name, patronymic of the alimony recipient.

- Details of the document that identifies the recipient (passport).

- Details of the bank account to which funds should be transferred or the address for transfers.

When opening a bank account for the transfer of alimony, the card holder is issued a separate bank card.

If alimony is issued in cash to the recipient's representative by proxy or to the recipient himself from the cash desk of the organization in which the alimony payer works, then the cashier must record the date, number and place of issue of the passport or other document presented by the recipient and identifying him, and the place of registration.

How does the accounting department pay child support?

Withholding child support must have a legal basis. That is, a potential payer cannot come to the accounting department and say: “I want you to transfer a quarter of my salary to my ex-wife/husband.” For the process to proceed, you need an agreement certified by a notary, a court order or a writ of execution. Of course, the first option is more preferable, because litigation is not very pleasant and lasts quite a long time. However, the accounting department doesn’t care, and this service will accept any document confirming the legal grounds for deduction of alimony in favor of the former spouse. Let's look at the features of this operation through the eyes of an accountant:

- From what payments are deductions made? Contributions in favor of the child are transferred not only from the basic salary. The Government of the Russian Federation has decided to pay alimony from many types of citizen’s income. So the payer will not be able to cheat on the premium. What can I say, even remuneration in kind is subject to mandatory division. Alimony is withheld from wages at the main place of work and from any additional earnings, as well as from most payments provided for by the legislation of the Russian Federation. This includes compensation for meals, income from rental property, income from copyrights, and dividends. In general, a single parent will be forced to share almost all income imaginable with their children. This is not true in all cases, since often after deducting taxes and alimony the payer is left with a very modest amount. But you can’t argue with the law, and you have to get out of it like crazy until your son turns 18.

- Payment terms. Since alimony is directly related to the payer’s income, the date of their transfer usually coincides with the arrival of fixed assets to his account. That is, on the day of the alimony provider’s salary, funds for the maintenance of the child are received by the recipient, a maximum of three days later. Usually, accountants monitor the timely payment of alimony, since they are the ones who face punishment for late payments. How many times a month are funds collected for the maintenance of a minor child? After all, according to the law, salaries are paid in installments twice a month, that is, workers receive an advance and the bulk of the funds. Most often, alimony is paid once a month, deducted from the total amount of income, but there are exceptions. It is clear that the first option is more convenient for accountants, but sometimes a single parent requires double payment. By the way, you can receive alimony in three ways: by mail, at the cash desk of the organization where the payer works, and by bank transfer using the account number. Needless to say, the last method is the most convenient and popular. In one moment, the funds appear on your bank card, and you don’t need to go anywhere to get your legitimate money.

- Personal income tax and alimony. Is alimony transferred by the accounting department before personal income tax is deducted or after? This issue justifiably worries payers, because funds for child support are most often paid as a percentage of income. And before deducting personal income tax, the figure would have looked much more impressive. However, the amount of child benefits is calculated after taxes are paid, from the “net” salary. If the employee is entitled to benefits and personal income tax is not withheld from him, then alimony is calculated from total income without tax deduction.

- What income cannot be withheld? Are there any funds that will go to the child support provider’s account in pure form, and they do not need to be shared with the children? Yes, there are some. This may include payments on the occasion of the birth of another child, marriage registration, compensation in connection with the death of close relatives, business trips, therapeutic and preventive nutrition, moving to a remote area, and wear and tear of working tools. Also, alimony is not charged for financial assistance in the event of a serious illness or work injury. The survivor's pension remains entirely with the recipient. If an employer reimburses an employee for the cost of trips to a sanatorium, then it is also impossible to collect funds for child support from these payments.

See also:

Alimony or benefits for a single mother: what to prefer and how to get it?

Child support is paid until the child reaches 18 years of age. The procedure for their payments does not change if the employee continues to work in the same organization. If the payer has changed his place of work, then the recipient of alimony must forward all the necessary documents (agreement, writ of execution, court order) to the accounting department of this enterprise.