A pension in Germany for immigrants is of interest to many people who choose this country for permanent residence and plan to meet their old age here.

Today the population of Germany is almost 83 million people. Of these, 10.1 million residents (12%) are foreigners.

Despite the fact that in Germany people retire at 67, every fifth resident is a pensioner. Experts predict that with a constant increase in the number of pensioners, by 2035 the figure could increase by 5–7 million. But even immigrants will not be able to improve the balance between working-age citizens and pensioners.

We must pay tribute to the German government, which constantly takes care of older citizens. The country regularly reviews social packages and various payments for vulnerable groups of the population. This allows us to provide them with a decent life. Especially now, when the pandemic has added difficulties.

Pension in Germany for migrants: applicants

The country's legislation and the Pension Fund have designated categories of citizens who are entitled to receive pensions.

Their list includes the following persons:

- persons upon reaching retirement age;

- employees who have not reached retirement age but have paid contributions for 45 years;

- people of any age who have lost their ability to work as a result of an injury at work or an occupational disease;

- dependent persons who have lost their breadwinner, including widows;

- people who worked in enterprises with hazardous conditions; for them the retirement period is 60 years;

- women born before 1952 who are eligible to retire at age 60;

- citizens with less than 5 years of work experience and receiving special social benefits.

The category of citizens eligible to receive a German pension also includes persons with official employment for at least 5 years. They receive a salary, from which contributions are made to the German pension fund.

Let's talk about numbers...

There is a twofold image of German pensioners on the pages of the media. Some believe that Germans bask in luxury in their old age, others argue that most of them live below the poverty line.

The average pension for a person with 45 years of service is considered to be 1,250 euros. In comparison, the cost of living is 700 euros. Even a native German finds it difficult to reach the maximum length of service, as evidenced by the following statistics:

- Less than 1% receive more than 2 thousand euros.

- 72% of pensioners receive up to 1 thousand euros.

- A third of pensioners have a pension of less than 500 euros.

On July 1, 2021, the authorities made a record increase over the past 23 years. An increase of 4.25% is planned for Western residents, and 5.95% for Eastern residents.

The lowest income is received by those who have not completed 5 years of minimum experience. The state pays an additional social benefit of 350 euros (Grundsicherung) to poor pensioners. The state also pays for housing, utilities and health insurance.

Let's estimate the basic consumption basket of a German pensioner:

- renting an apartment (2-room) – 500 euros;

- medical insurance – 160 euros;

- beef meat – 12 euros;

- bread – 2 euros;

- milk – 1.4 euros.

It turns out that if during his working life a person has not taken care of private savings for old age, he will have to live very modestly...

Pension in Germany for immigrants. What is the minimum pension and what does it depend on?

In Germany, the standard basic pension is 1,250 euros. But people with more than 45 years of work experience and a monthly salary of at least 3,900 euros can receive it. Citizens without 5 years of work experience who received a small salary can count on financial assistance from the state (Grundsicherung).

As a rule, the German Pension Fund sends notifications to people who have worked for 5 years. They are informed that their minimum pension will be 380 euros, regardless of the nationality of the citizens. Additional factors may affect the size. Also, the size of the pension benefit depends on the total income received. But if it is below the subsistence level, in the amount of 789 euros, then the pensioner can exercise the right and apply to the social security office to receive state assistance.

For this category of people, minimum payments are provided:

- 404 euros – to single parents;

- 364 euros per person – for low-income families;

- 324 euros – adults living together.

In addition, the above-mentioned persons may receive partial compensation for apartment rent, utility costs, and the purchase of medicines or food.

Details

When people become pensioners

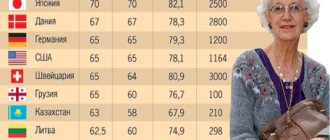

In Germany there are two definitions of the "normal" and actual age for retirement. In accordance with this, we highlight:

— The “normal” age for retirement for men is sixty-five years, in fact – sixty-one and a half years.

- for women - the “normal” retirement age for women is sixty-five years, in fact - sixty and a half years.

The issue of age-based retirement has been troubling the government for a long time. The plan is to rise to sixty-eight for both sexes. According to statistics, the German population is aging rapidly compared to citizens of other EU countries.

Are there any charges in Germany in 2021 and what is their size?

Yes, German charges exist:

- according to age;

- social plan - for disability;

- by dependency.

There are also state and funded pensions.

The size of the German pension salary depends on the salary received at the place of employment and the number of accumulated pension points. Conventionally, there is no concept of “minimum pension” on German territory.

Provided that a person who has the right to regularly reside on German territory reaches retirement age, but he was unable to earn a pension above the subsistence level, then he is assigned an old-age social benefit. Its value in 2021 is three hundred seventy-four euros.

What is the average pension

According to official data, the average pension in Germany is one thousand two hundred and fifty euros. The relevance of the figure does not affect everyone. Some retirees can count on receiving corporate savings or from private Pension Funds. Widowers can apply for a double pension.

Main types of pension accruals. German citizens who have worked on German territory for more than five years are eligible to receive subsidies from the government. Obtaining is simple - you need to make monthly contributions to the Pension Fund of at least nineteen and a half percent of your own salary. This contribution is relevant for the employer and his employee.

The amount of contributions to the Pension Fund per person - nine point seventy-five hundredths - is expressed as a percentage.

Deductions for disabled people in Germany

In accordance with the current legislation, the bulk of benefits and rights for persons with disabilities are controlled by regulations and the legislative framework.

Persons who have disabilities and have reached 65 years of age can qualify for basic security in old age, with a supplement of 17%. The amount of deductions for people with disabilities is five hundred forty-five euros.

Features of pension calculation

For pension accruals in Germany, the following formula is used:

Rente = EP × ZF × RAF × aRW

Let's take a closer look at what the formula consists of:

- Rente - the amount of the pension, which is calculated by multiplying the coefficients earned by a person over the entire period of work;

- EP – the sum of accumulated pension points, which depend on the difference between the pensioner’s salary and the average in the country;

- ZF – size of the output coefficient; in case of retirement on time, this coefficient is 1; if a person retired earlier or later, then the decrease or increase in the indicator occurs proportionally;

- RAF is an indicator that combines different calculations: old age coefficient - 1, disability coefficient - 0.5, coefficient for a widow or dependent - 0.5;

- aRW – pension point price, indicated in euros; it is calculated taking into account the general economic situation in the country, the amount of contributions, and the demographic situation.

Pension system in Germany

The pension system in Germany in the form in which it exists today is an already established, established institution. Its structure is somewhat more complex than in Russia, however, at the same time, it is not as complicated as in our country.

So, the pension system in Germany consists of 3 steps. Let's look at them in more detail.

State pension insurance (gesetzliche Altersversorgung)

It is the basic form of material support in the country. In accordance with federal legislation, special contributions are paid for the purposes of state pension insurance for each employee. They go to the local equivalent of the state pension fund - Deutsche Rentenversicherung.

However, unlike Russia, contributions are paid equally by both the employee and the employer . Pension insurance rates are not constant and are approved by a special government commission for certain periods. So, in 2018-2019. The contribution rate was 18.6% of the employee’s salary.

Attention! At the federal level, a moratorium has been approved on increasing the rate of contributions for state pension insurance by more than 20% of the salary of a particular employee.

Industrial pension provision (betriebliche Altersversorgung).

In Germany, this form of support is understood, first of all, as the formation of pensions for government employees.

These include:

- civil servants;

- police officers;

- judges;

- medical workers;

- teachers.

Traditionally, representatives of these professions have a slightly larger amount of material support, since their pensions are formed in a special manner.

In addition, large employers also create a separate pension for their employees. Typically, betriebliche Altersversorgung is part of corporate programs to attract and retain the most qualified employees.

Important! In Germany, the position of trade unions is traditionally strong. It is their representatives who control accruals for industrial pensions.

Private pension provision (private Altersversorgung)

Today, there are dozens of private pension companies operating in Germany, the analogues of which, to a certain extent, are domestic non-state pension funds. German citizens with sufficient income make contributions to these companies in order to receive a private pension in old age.

At the same time, citizens have the right to independently manage these funds, including using them before retirement age.

It is also useful to read: Pension and retirement age in Sweden

For more information about the pension system in Germany, watch the video:

Pension taxes

Please note that in Germany the income-generating part of the pension is subject to taxation. All German pensions have a non-income part, which is paid from contributions already made, and an income part, which is formed from interest on previously contributed funds, attracted contributions from other persons, and is also taxed.

When calculating the tax, the date of retirement is taken as the basis.

For example, a person acquired pensioner status before 2005 or directly in 2005. He must pay half the current tax rate on the part of the pension that exceeds the Grundfreibetrag (tax-free minimum - 9,000 euros per year for singles and 18,000 euros for a family). As a reminder, in 2021 the average rate of tax-free pensions was 22% of pensions. After increasing the size of pension payments from July 1, 2021, the ranks of pensioners who will have to pay income tax will increase to 50 thousand people.

German pensioners can exchange their driver's license for a travel pass

Pensioners in Ludwigsburg can receive a pass worth 560 euros per year free of charge in exchange for their driving license.

(03/29/2019) The 400 euros that pensioner Schneiders manage to save go towards visiting cafes and restaurants, gifts for children and grandchildren. “In other words, they don’t stay with us, but are spent under another expense item. And I’ll tell you a little later about what we want to spend the saved money on,” Ute promises with a smile.

Holidays mainly in Germany

The German word Urlaub, that is, vacation, is also used by pensioners in Germany; it means recreation outside the home - trips and travel. That’s why Ute says: “On vacation we mostly travel around Germany for a few days. Recently we spent three days in a picturesque place in the Sauerldand. We will go there again in September. There is an old castle in the mountains that has been converted into a hotel, so we wanted to feel like a count and countess for a couple of days,” she laughs.

The retired couple mainly spends on vacation the money that Ralph earns in a year - 5,400 euros. Next year they are going on a cruise along the Danube - from the German city of Passau to Budapest. “Of course, this pleasure is not cheap - a week-long cruise for two will cost us 3,200 euros, but this also includes two nights in a hotel in Passau on the way there and back, train tickets and insurance for all eventualities - we are not young anymore, God knows what could happen to us. It’s always safer to drive with insurance,” emphasizes pensioner Ute.

This is what the Cologne Schneider family of pensioners spends their pension on with the part-time job of husband Ralf. Uta complains that the kiosk next to her house closed a year ago; she also worked there part-time, but for free. Although no - for a few hours of work she could take a pack of cigarettes, drink tea and coffee for free and communicate with clients. This was quite enough for her - better than sitting at home, she believes.

“And now only Ralph is busy with work, and I’m idle all day long,” the pensioner shrugs. Ute, as she admits, is increasingly drawn to nature. “We’re going to leave town,” she says goodbye. — Mostly students live in our house - noisy, restless, but we want peace and quiet. We saved up money to move, now all that’s left is to find an affordable apartment in one of the small towns near Cologne.” Pensioners dream of a terrace or a small garden and a dog from a shelter: “We don’t want to get a puppy, what if he outlives us and is left without an owner. We don’t wish such a fate for him.”

See also:

Such a different old age

On the way to increasing pensions

As of July 1, 2019, an official increase in pension payments was recorded in Germany, thanks to the decision taken by the government. After the increase, the pension of persons living in the western regions of the country increased by 3.18%, in the east - by 3.91%. That is, when calculating a pension of 1000 euros, the “Western” allowances amounted to 31.80 euros, and the “eastern” ones – 39.10 euros. The government now aims to equalize pensions between residents of the east and west by the end of 2024. At the moment, the size of the “eastern pension” is 96.5% of the “western pension”.