January 28, 2021

Employees of the Armed Forces of the Russian Federation, the Ministry of Internal Affairs, the Federal Penitentiary Service and other government departments have the right to retire earlier than civilians. But their pension is paid with a reduction factor , that is, it is incomplete. Why is this happening and are they planning to cancel this coefficient in 2021?

Reduction factor for military pensioners in 2021

In 2021, the reduction factor for military pensioners is 0.7368 . That is, former employees of the armed forces of the Russian Federation, the Ministry of Internal Affairs, the National Guard and other law enforcement agencies receive only part of the pension. When calculating and calculating the monthly benefit, only 73.68% of the total amount due is taken into account.

This coefficient applies from 10/01/2019. For the entire 2020, it was “frozen” at 0.7368, then the moratorium was extended for 2021. That is, consideration of the initiative to cancel the reduction coefficient will take place no earlier than 01/01/2022.

Will there be an increase in pensions for military pensioners in 2020 from January 1

Some sources on the Internet report that military pensions will increase from January 1, 2021. This is incorrect information! An increase for military personnel and law enforcement officers is planned only for October 1 - by exactly 3%. There will be no increases in military pensions in January.

However, we note that the increase from January 1, 2021 will affect military pensioners receiving a second civil pension . From January 1, the indexation of insurance pensions will take place, so military personnel who have received old-age insurance coverage for their civilian experience will also be eligible for this increase.

- The increase will be made by indexing the value of the pension point, taking into account which the insurance pension is calculated. From January 1, 2021, the point price will increase from 87.24 to 93 rubles, which corresponds to indexation by 6.6%.

- To calculate how the size of the second pension for military personnel and security forces will increase in 2021, you need to multiply the amount received in 2019 by 1.066. For example, if the amount of the old-age insurance payment was 5,000 rubles, from January 1 the payment will increase to 5,000 × 1.066 = 5,330 rubles.

Note that the increase in the size of the civil pension from January 1, 2020 is only available to non-working military pensioners. If a citizen continues to work, the 6.6% indexation will not affect him.

Law on reduction coefficient in 2021

On September 30, 2020, the Government prepared a bill to extend the “freeze” of the reduction coefficient for the next year 2021. The legislative initiative was submitted for discussion to the State Duma. In November, it was already approved in the third reading, and on December 8, 2020, the bill was signed by the President. This means that in 2021, military retirees can expect to receive only part of their pension again, namely 73.68% percent of it. No. 397-FZ dated 12/08/2020.

The explanatory note to the bill states that against the backdrop of a “freezing” of the reduction coefficient, a gradual increase in military pensions is planned in 2021. This will happen due to the indexation of salaries by position and rank . The increase will be 3.7%, which corresponds to the inflation rate that was officially recorded last year 2021.

Bill in 2021

For the 2nd reading of the legislative draft, which took place on November 20, 2018, adjustments were prepared and approved, which were made by presidential decree. On November 22, 2018, the State Duma adopted an adjusted bill.

According to this bill, the indicator 0.7223 will be used to calculate military pensions only until 10/01/2019. From this date the indicator will increase to 0.7368. Consequently, pension provision will be calculated as 73.68 percent of salary.

From 10/01/2019, pension benefits will increase due to a modified reduction factor. In addition, pensions for former military personnel, police officers, employees of the Ministry of Emergency Situations, the National Guard, and the Federal Penitentiary Service will be increased through indexation by 6.3 percent.

Graph of coefficient changes in previous years

The procedure for applying the payment of partial pensions to military pensioners has been applied since 01.01. 2012. During this period, only half of the pension was paid - the reduction factor was set at 0.54. This was stated in paragraph 2 of Art. 43 of Law No. 4468-1. It was planned that each year the figure would increase by 2% until it reached 100%.

The actual change in the reduction factor is presented in the table below:

| Period | Reduction factor value |

| From 01/01/2015 | 0,6212 |

| From 10/01/2015 | 0,6678 |

| From 02/01/2016 | 0,6975 |

| From 02/01/2017 | 0,7223 |

| From 10/01/2019 to present | 0,7368 |

The last increase in the indicator was carried out in October 2019, after which it was “frozen” until 2021.

We have already written about what awaits military pensioners in 2021: indexation and reduction coefficient

Latest news from the Duma

On September 30, 2021, the draft law “On the federal budget for 2021 and for the planning period of 2021 and 2022” was published. According to the project, budget funds in 2021 will be allocated only for one type of increase in military pensions - by indexing the pay of military personnel from October 1 by 3%. Similar increases are planned for 2021 and 2022 from October 1, but by 4%. The project did not provide for any other expenses - neither for additional indexation, nor for adjusting the reduction factor for military pensioners.

Let us note that the bill has not yet passed a single reading in the State Duma, so it is too early to draw final conclusions. True, he has already received the Conclusion of the State Duma Committee on Defense, which does not agree with the proposed increase scheme. If any specific changes are made regarding military pensions in 2020, this article will be updated with the latest information and news.

Among the bills currently under consideration in the State Duma, one can note project No. 583048-7, concerning the pension provision of military personnel and law enforcement officers. In it, deputies of the State Duma of the Russian Federation from the Communist Party faction propose to speed up the topic of increasing the reduction coefficient :

- from 01/01/2019, set it at 0.77, that is, take into account 77% of the monetary allowance;

- from 2021, increase by 5 percent annually: that is, in 2021 - up to 82%, in 2021 - 87%, in 2022 - 92%, in 2023 - 97% and from 2024 completely cancel the reduction factor and take into account 100% of the monetary allowances.

This project has not been considered for quite some time and, obviously, will soon be rejected, since according to the text of the document it should have come into force on January 1, 2021. In addition, the Government plans to “freeze” the value of the reduction coefficient of 0.7368 until 2021.

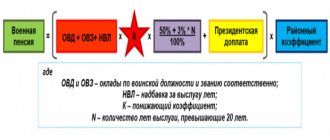

Calculation of military pensions

Each military personnel receives a salary, the amount of which depends on rank and position . This amount includes salary and various monthly bonuses and payments. Based on these values, the future pension of the serviceman is calculated.

When calculating a military pension, the following indicators are taken into account:

- salary for the position held by the serviceman before retiring;

- salary according to the rank that the serviceman had before entering his well-deserved retirement;

- bonuses that are paid every month while the service is in progress;

- the number of years of “overtime” in excess of the minimum length of service that a serviceman needs to retire;

- reduction factor established at the federal level;

- reduction coefficient, which is established at the federal level by region;

- percentage of salary - this indicator depends on the basis on which the military pensioner retired.

Conditions for granting pensions to military personnel:

- for length of service of at least 20 years - payments are assigned if the former military man served in the department for a certain time period;

- reach 45 years of age , have a total work experience of at least 25 years, of which at least 12.5 years are military service; in this case, the person must resign upon reaching the age limit for service, for health reasons or in connection with organizational and staffing measures

- disability - assigned if a serviceman became disabled during service or within 3 months after dismissal;

- loss of a breadwinner - assigned to the relatives of a deceased serviceman. Paid while family members are considered disabled.

If a military pensioner retires on the basis of disability or loss of a breadwinner, his immediate family and dependent relatives will also receive payments. Depending on the basis for retirement, a coefficient is used in calculating payments. Its minimum value is 50% of the salary for position and rank, the maximum is 85%.

In addition, a serviceman has the right to a second civilian pension:

A second pension through the Pension Fund of Russia can be assigned to a military pensioner if the following conditions are simultaneously met:

- Age. Reaching the generally established age - 65 years for men, 60 years for women (age is determined taking into account the gradual increase in the retirement age). Thus, in 2021, women born in the second half of 1964 and men born in the second half of 1959 will reach retirement age. Certain categories of military pensioners are assigned an old-age insurance pension before reaching the generally established retirement age, subject to the conditions for early assignment. For example, in the case of working in the North, working in difficult conditions, etc.

- Experience. The presence of the required insurance experience, which is not taken into account when assigning a pension through the law enforcement department (in other words, length of service in civilian life). In 2021 it is 11 years and will increase by 1 year annually to 15 years in 2024.

- Odds. The presence of a minimum amount of individual pension coefficients - for 2021 it is set at 18.6 and will increase annually to 30 in 2025.

How PC affects the size of military pensions

Many people mistakenly believe that retired military personnel demand that their pension benefits be returned to them in the amount of 100% of their salary. This is far from the truth. To understand what kind of increase we are talking about, it is necessary to understand how pension payments for this category of pensioners are calculated.

Indeed, the basis for the calculation is the DDV, including for military rank and position at the time of dismissal.

But, regardless of the type of experience, only 50% of the salary is taken into account. Subsequently, the following is added for each year of overtime after receiving the right to receive a long-service pension:

- 3% – if you have 20 years of military service;

- 1% – over 25 years of mixed experience, including 12.5 years of specialized experience.

In any case, the prescribed singing cannot exceed 85% of the DDV.

It turns out that the accrued security can range from 50 to 85% of the allowance. It is to this amount that the reduction factor is applied, which from October 1, 2021 will be 0.7368.

Rice. 3. Increases for security forces have little impact on the growth of pensions

Example. The average salary of a lieutenant in the position of platoon commander under the Ministry of Defense - this is what the DDV in the Armed Forces is taken as the average - at the beginning of 2021 was 68.8 thousand rubles. If you have 20 years of service, a retiree with this salary will be assigned the following security:

68,800 * 50% = 34,400 rub.

But at the beginning of the year, the rule for applying the PC was in force in the amount of 0.7223. That is, the following will be paid monthly:

34,400 * 0.7223 = 24,847 rubles.

For reference! According to a report from the military laboratory of the Gaidar Institute, the average pension in the Armed Forces is 24,600 rubles.

By lowering PC to 0.7368, the payout will increase:

34,400 * 0.7368 = 25,346 rubles.

That is, the increase will be:

(25 346 – 24 847) / 24 847 * 100 = 2%,

or 498.8 rub. in absolute terms.

If we take into account that in October 2021 the salaries of military personnel will also be indexed by 4.3%, the calculation of pension benefits will take the following form:

68,800 * 1.043 * 0.5 * 0.7368 = 26,435.79 rubles.

This is exactly the kind of growth in pensions for military personnel due to the reduction of PC and indexation of the additional income that is planned on average by the Ministry of Defense.

As you can see, even after all the increases, the pension amount for a retired lieutenant will be:

26,435.49 / 71,758.4 = 36.84% of the DDV.

Before the October increase, this figure was 36.11%.

Of course, in each specific case the numbers will be different, but the general picture looks like retirees receive pension payments in the amount of 36-62% of their salary, taking into account the PC.

For comparison! With a salary of 50,000 rubles. and 25 years of service, the old-age insurance pension will be 16,713.32 rubles.

Calculation of military pensions until the end of the freeze

The reduction factor negatively affects payments to military pensioners. They receive only part of the pension they deserve. Therefore, indexation of salary is important! By 2035, it is planned to increase the pay of active military personnel to 100%.

When calculating the pension, the following formula is used:

P=((OKD+OKZ)*0.5+(OKD+OKZ)*0.03*T)*k,

where OKD is salary according to position, OKZ is salary according to rank, T is the period of overtime in excess of the minimum period required to assign a pension to a military personnel, k is the reduction factor.

For clarity, it is necessary to give an example of a calculation: A serviceman holds the rank of colonel in the position of deputy unit. His salary by position is 22 thousand rubles, and by rank - 18 thousand rubles. He is about to retire after 27 years of service. This is 7 years more than the minimum established. He is assigned a pension of 50%, with 3% added for each year of service. As a result of his retirement, he will receive ((22000+18000)*0.5+(22000+18000)*0.03*7)*0.7368=20,925.12 rubles the colonel will receive monthly.

If the reduction factor had not been applied (absent at all or equal to 100%), the former colonel would have received a pension in the amount of 28,400 rubles, which is almost 7.5 thousand rubles more than the current one. This formula, together with the coefficient, will be applied for another whole year - until the end of 2021.

How does PC affect military pensions?

The use of a reduction factor led to budget savings - almost 3 trillion rubles remained at the disposal of the state. But military pensioners still do not receive their full pension, which causes dissatisfaction.

Initially, the reduction factor was set at 54%, and every year it was supposed to increase by 2%. In 2021 it was supposed to be 70%, but in fact it was 73.68%. Developments are ahead of schedule.

According to the Presidential Decree, the pay of military personnel should increase by 5% every year, but in fact - by 3%. That is, military pensioners do not receive another 2% of their due payments.

Taking into account the current “freeze”, former military personnel will lose another 5% of their monthly contributions for each “frozen” year. But the probability of achieving the plan to achieve a coefficient of 100% by 2035 is quite high. But the “freeze” should be lifted next year. Otherwise, military retirees will continue to lose their money. The pensions of ordinary military personnel and non-commissioned officers are already almost equal to the insurance pensions of civilians.

In the period from 2012 to 2021, the growth dynamics of military pensions was 2.5 times, but the overall lack of indexation was 20%. That is, over these 7 years, former military personnel received almost 1/5 of their pensions. If the freeze is not lifted, military retirees will be on a par with civilian employees. This significantly reduces the state's social responsibility in relation to the military sector.

State Duma Defense Committee on military pensions from 2020

On October 9, 2021, the State Duma Committee on Defense prepared an opinion on the draft law on the federal budget for 2021. In conclusion, the Committee criticized the proposed indexation scheme for military pensions in 2021 and pointed out the following facts:

- The analysis shows that military pensions are growing at a lower rate than insurance ones. For example, in 2021, insurance payments increased by 7.05%, and for military personnel by only 6.3%. In 2021, the indexation for “civilians” will be 6.6%, and for the military only 3%.

- The reduction factor in 2021 was increased not by 2%, as provided, but only by 1.45% (to 73.68%). And in connection with the introduced bill No. 802513-7, this value is planned to be extended into 2021. Accordingly, the procedure established by law is being violated, according to which this coefficient must increase by 2% annually .

- The scheme for increasing military pensions for 2021 does not provide for an increase of 2% above inflation, as required by Presidential Decree No. 604. To comply with the provisions of this Decree, an increase of 5% , not 3.

To eliminate discrimination against military pensioners, the State Duma Defense Committee recommended the following:

- Increase from January 1, 2021 the value of the reduction coefficient by 2%, that is, to 75.16%;

- Index the amount of military pay and, as a consequence, military pensions by 3%;

- Allocate an additional 16.79 billion rubles for these purposes in 2020.

In addition, the Committee indicated that they would prepare amendments to the bill, which recommend an increase according to the above scheme. Whether the indexing order will be changed will become known in the coming months.