How is pension calculated for former military personnel?

According to Art. 43 of the legislative act of February 12, 1993 number 4468, the amount of payments to former army employees and their relatives is determined by taking into account monetary allowances. In addition, the size of the pension depends on:

- salary;

- ranks;

- length of service;

- indexing.

Pension coverage for army employees is divided into 4 types:

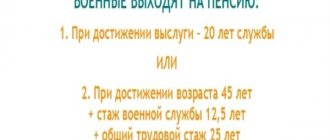

- For 20 years of service.

- For 12.5 years of service, with the recipient’s total experience of at least 25 years.

- For the loss of a breadwinner for disabled relatives: sons/daughters; mother/father with a disability or retired; a wife who is caring for a child under fourteen years of age.

- Due to disability that occurred during military service or due to illness during this period.

Salary is the salary of an army employee, including salary and allowances. According to Art. 2 of the legislative act of November 7, 2011 number 306, military personnel receive bonuses for:

- Federal Law on the financial liability of military personnel as amended in 2020

- Federal Law on Martial Law as amended in 2021

- Federal Law on conscription and military service as amended in 2020

- Dismissal from military service: procedure, early dismissal, report

- Evasion of conscription for military service: article of the Criminal Code of the Russian Federation, liability

- Federal Law 51 on military duty as amended in 2021

- Dismissal due to conscription into the army

- rank - 5-30 percent;

- access to classified information – up to 65 percent;

- service under special conditions; performing tasks that are dangerous to life and health; achievements in service – up to 100 percent;

- conscientious performance of official duty - up to 300 percent of the annual salary.

Calculation algorithm

The initial value is taken as the salary of a military personnel. Then a bonus for the rank is added to it, the resulting result is multiplied by the bonus for length of service. The result obtained is added to the sum of the salary and bonus for the rank. This forms the basis for calculating pension benefits.

The base is multiplied by an adjustment factor (depending on length of service) and a reduction factor. The product is then multiplied by the district index. The result obtained will indicate the size of the military pension.

When will the reduction factor for military pensioners be cancelled?

Thus, the reduction coefficient in 2021 will be equal to 0.7368 , that is, when calculating pensions, only 73.68% of the monetary allowance of citizens who served in military or equivalent service will be taken into account. A bill establishing such a PC value was prepared by the Government, submitted to the State Duma for consideration and has already been approved in the third reading .

Given the freeze, military personnel will lose 5% of their monthly pension contributions. Military pensions for privates and sergeants are almost closer to civilian insurance ones. However, there is still a high probability that the reduction factor will increase to 100% before 2035 if the freeze is not extended.

In 2021, there are no plans to cancel the use of the reduction factor when calculating pensions for military pensioners. On the contrary, the Government plans to “freeze” the value of 0.7368 for the entire 2021. Taking into account this value of the PC, the federal budget for 2021 has already been formed, a bill on which has also been submitted to the State Duma.

- official salary;

- salary according to rank;

- monthly allowances;

- years of service beyond the minimum length of service;

- reduction factor;

- regional coefficient;

- interest on salary depending on the basis of retirement.

The initial value is taken as the salary of a military personnel. Then a bonus for the rank is added to it, the resulting result is multiplied by the bonus for length of service. The result obtained is added to the sum of the salary and bonus for the rank. This forms the basis for calculating pension benefits.

Bill in 2021

For the 2nd reading of the legislative draft, which took place on November 20, 2018, adjustments were prepared and approved, which were made by presidential decree. On November 22, 2018, the State Duma adopted an adjusted bill.

According to this bill, the indicator 0.7223 will be used to calculate military pensions only until 10/01/2019. From this date the indicator will increase to 0.7368. Consequently, pension provision will be calculated as 73.68 percent of salary.

From 10/01/2019, pension benefits will increase due to a modified reduction factor. In addition, pensions for former military personnel, police officers, employees of the Ministry of Emergency Situations, the National Guard, and the Federal Penitentiary Service will be increased through indexation by 6.3 percent.

The size of the military pension after innovations

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

This year, military pensions will be increased by more than 6% in October. This increase includes an indexation of military pay by 4.3% and an increase in the coefficient to 73.68% (versus today's 72.23).

This is important to know: Retirement age for military personnel

The State Duma, by the way, planned to freeze the coefficient. However, payments to former military personnel will be increased by an additional 2% due to an increase in the coefficient. The presidential decree on the abolition of the reduction factor actually increases the pension of WWII participants by 9 thousand rubles. This is the only real increase in pensions in recent years.

Will the reduction factor be cancelled?

Expert opinion

Gusev Igor Yurievich

Lawyer with 6 years of experience. Specializes in the field of civil law. Has experience in developing legal documentation.

The Russian government is short of funds, therefore, cancellation is not expected in the near future. In addition, the deputies planned to implement a “freeze” at the value of 0.7223 for the entire 2021.

(until 01/01/2020). This is precisely what the legislative draft, submitted by deputies to parliament and approved by the State Duma in the 1st reading, was aimed at.

Fortunately for military pensioners, Vladimir Putin has made his own adjustments.

The Communist Party of the Russian Federation tried to introduce a legislative draft to cancel the reduction coefficient, but in the winter of 2021 it was rejected.

After this, the government did not touch upon this issue in any way, since it planned to assign pensions taking into account 100% monetary allowance only from 2035. Now the increase in the reduction coefficient cannot be called stable. Therefore, it will not be canceled for now.

Military pensioners will have their reduction factor reduced by 2%

- For 20 years of service.

- For 12.5 years of service, with the recipient’s total experience of at least 25 years.

- For the loss of a breadwinner for disabled relatives: sons/daughters; mother/father with a disability or retired; a wife who is caring for a child under fourteen years of age.

- Due to disability that occurred during military service or due to illness during this period.

Pensions for military personnel are calculated completely differently than insurance pensions. Their value is based on a person’s salary and is proportional to length of service. Therefore, it is possible to start receiving such a pension much earlier than a regular one. The recipient of such a pension has the opportunity to get a job and accumulate pension points to receive an insurance pension.

The Russian government is short of funds, therefore, cancellation is not expected in the near future. In addition, the deputies planned to implement a “freeze” at the value of 0.7223 for the entire 2021 (until 01/01/2020). This is precisely what the legislative draft, submitted by deputies to parliament and approved by the State Duma in the 1st reading, was aimed at. Fortunately for military pensioners, Vladimir Putin has made his own adjustments.

In addition, on April 30, 2021, Federal Law No. 66 “On Amendments to the Law on Military Pensions” was published, according to which, from May 1, 2021, the use of PC was canceled for military pensioners from among WWII veterans. This change made it possible to increase pensions for veterans by approximately 9,000 rubles.

The indexation of the DDV to the annual inflation rate is carried out in accordance with Law 306-FZ of November 7, 2011 (clause 9 of Article 2), but was not carried out for a long time, which negatively affected the state of the army. Young people were more willing to choose highly paid commercial structures rather than contract military service. A shortage of personnel forced legislators to lift the moratorium on indexation of VAT in January 2021.

Useful video

More details about canceling the reduction factor in the video:

Leap year 2021 brought a lot of troubles to planet Earth. Every day the evening news on TV strives to receive a Nobel Prize for the nature and scale of what happened.

But watching all the events, we forgot about our own well-being. Prices are creeping up, life is becoming more expensive.

What about the salaries and pensions of citizens? In this article we will talk about military pensioners. What will military pensions be like from January 1, 2021? What kind of indexation did legislators plan? Will you have enough money for a summer vacation or will you have to make ends meet again?

We consider in the article:

How is military pension calculated?

The basic amount for calculating a pension is the military personnel's allowance (DV). Its size depends on:

- the title of retiree, which he received upon his retirement;

- position held during service.

The resulting amount is not strictly fixed throughout the entire pension period. Every year, according to the resolutions of the Government of the Russian Federation, the additional income increases by the inflation factor included in the budget. That is, the value of the pensionable income of a retiree every year will be equal to the maximum allowance of an active military man at the level of similar ranks and positions.

Next, according to paragraph 2, the length of service coefficient is determined. If you “work” in the army for 20 years, its value is 50%. For each year there will be an increase in pension by 3%. The maximum value of this coefficient can only reach 85%. This corresponds to a service life of 32 years.

For persons whose service experience is 12.5 years in the army, and the total length of service is 25 years, the increase for length of service beyond will be made at the level of 1% per year.

A formula for calculating a pension for a military retiree (with a service period of, for example, 25 years in the army) is already emerging:

Only point 3 remains (the most interesting). This is a reduction factor. Since the beginning of 2012, it was introduced against the backdrop of a significant increase in military salaries. Its value was 54%. That is, in our case, the pension is reduced by another half.

Russian President V. Putin promised that this reduction factor will increase by 2% annually until it reaches the maximum 100%.

All components of the military pension calculation were received. Now let's see:

- which of these indicators is guaranteed to increase in 2021;

- what indicator is planned to increase in 2021;

- and what possible bonuses (rumors) will be applied next year.

It is worth noting that the budget officially includes indexation of payments to military pensioners for 2021 at the level of 4.3%. But due to the difficult situation in Russia (covid-19, financial burden, something else), parliamentarians reduced this figure to 3%. In 2020, indexation is planned from October 1.

How much is it in 2021?

Calculation of the individual reduction coefficient: for a year of service on top of 20 years of military experience, a former employee of the Ministry of Internal Affairs of the Russian Federation is plus 3% to the coefficient. He himself changed several times:

- For the period from 2012 to 2021 it increased from 54% to 62.12

- By 2021 it has grown to 69.45

- By 2021, its size was 72.23.

This is important to know: Pension for military pensioners upon reaching 60 years of age

Today it is planned to increase it to a maximum of 85%, but the increase is still frozen, at least until 2021. Only the abolition of the reduction coefficient for military pensioners in 2021, which affected WWII veterans, received approval from deputies.

A separate approach is used when calculating mixed length of service. Preferential length of service includes at least 25 years of cumulative work experience, of which 12.5 are in the Ministry of Internal Affairs. The reduction factor increases by only 1% annually for each additional year.

The last increase in this indicator is planned in October - up to 73.68% (approximately 2%). Calculated on a national scale, the figure looks impressive. But for each individual person, given the rise in inflation, this amount means nothing.

Increasing pensions: latest news from the State Duma

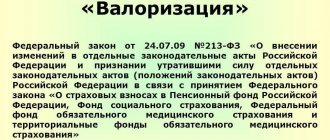

The increase in the pension of a retired military personnel occurs due to an increase in the additional allowance. Every year this indicator is indexed in accordance with the planned inflation rate for the country.

In 2021 in accordance with the procedure, the increase in gross income is planned in October by 3%. Previously, the budget included an indicator of 4.3%. The country's leadership was forced to decline due to the pandemic. Due to the restrictive measures that were in force from the end of March to the beginning of August, the budget did not receive a lot of money.

In 2021, it is planned to index the DDV by 4%, again in October (4th quarter). Accordingly, with an increase in DDV, payments to retirees will also increase.

Rules for calculating military pensions

For a better understanding of the term called “reduction factor” (RC), it is necessary to understand more deeply the multiple nuances of the rules for calculating pension payments for retirees of the Armed Forces of the Russian Federation. This information is legally most fully outlined in the law “On Military Pensions.”

Military personnel have the opportunity to receive a pension upon reaching a certain age, as well as in the event of becoming disabled (due to injury/illness). Our legislation also provides for close relatives and spouses (children, disabled parents or pensioners, widow/widower with a dependent child under 14 years old) of a deceased soldier the right to receive a survivor's pension. The following factors are also used in calculating payments:

- the size of a real military salary with all existing allowances.

- official salary;

- army rank;

- total length of service in the army;

- indexing.

For example, it is necessary to consider the procedure for calculating pensions for actual length of service. It is issued only in two cases:

- when the length of service is more than 20 years inclusive;

- when the work experience exceeds 25 years, of which 12 and a half years are military or alternative service to the people of Russia.

In the first option, the minimum possible length of service in the army presupposes a specific pension amount taken from accounting - 50% of the monthly official salary. In the event that length of service exceeds the minimum length of service, a special bonus of 3% is awarded for each subsequent year of service, but within the limits of: no more than 85% of the total salary.

The second, main case, involves an additional payment of 1% annually after 25 years of service.

PCs are not used for the following exclusive groups of military personnel:

- judges of army tribunals;

- employees of the military prosecutor's office;

- members of the Investigative Committee.

Taking into account the fact that most of the military personnel of the Russian army receive a salary in the amount of 30 thousand rubles, allowances for military personnel in accordance with the legislation “On special payments to military personnel” are established in the following specific cases:

- for continuous service - 10 - 40% of the monthly salary;

- class - 5 - 30% of monthly salary;

- monthly incentive;

- surcharge for secrecy - no more than 65%;

- for service under special conditions, etc. - up to 100% of monthly salary;

- for conscientiousness - up to 300% annually.

Based on the above information, the formula for calculating the amount of payments to pensioners for military service will be as follows:

P = DD x (0.5 + D% x Vd), where

DD – basic salary (allowance);

D% – percentage of additional payment to pensioners for military service (1% - 3% based on the calculation option);

Vd – excess length of service (more than 20 and 25 years).

Important! This formula was used to calculate pension amounts until 2012, until the PC was introduced.

So how did this coefficient change the amount of compensation for military service for pensioners ?

Who is promised more? Increase in pension

If we talk about such categories of citizens as working military pensioners, then things are more optimistic. The fact is that such citizens, in addition to military benefits, also receive civilian benefits.

Upon completion of a certain (established) number of years, provided that the employer has faithfully transferred money to the Pension Fund, the retired military man will be awarded a second pension.

In 2021, the insurance pension is expected to increase by 6.3%. Therefore, working retirees can also count on this increase.

Cancellation of the reduction factor: reality?

Cancellation, or more precisely, achieving a 100% reduction factor in the near future, is unlikely. You can easily verify this by referring to Russian legislation.

Decree number 381 at the end of 2021 froze the annual increase in this coefficient by 2% until the beginning of 2021. In 2021, its figure is 73.68% and will not be increased. But there is good news.

The freeze, in accordance with Decree 381, will last until January 1, 2021. After this date, the law will end. Therefore, in 2021 we should expect an increase in pensions by 2%.

Expert opinion

Gusev Igor Yurievich

Lawyer with 6 years of experience. Specializes in the field of civil law. Has experience in developing legal documentation.

Note that the law provides for an increase in the reduction coefficient by 2% annually. But the standard also states that the government can increase the indicator by more than 2%, based on the inflation index.

Of course, to say that the planned achievement of a 100% reduction in military pensions is an increase in pensions is, to say the least, unconscionable. The government has reduced military pension payments for a number of reasons.

But for people who honestly defended their country for half of their lives, this attitude of parliamentarians is insulting.

They took away what they honestly earned, and now they give it back in parts, calling it an increase. You come across such comments on the Internet all the time. Of course, people can be understood, because this is exactly what this norm with a reduction factor looks like. But, according to the government, this is a forced and temporary measure.

Cancellation of the reduction coefficient for military pensioners, latest news

The pension with a minimum length of service or experience in both cases is 50% of the salary. If the length of service exceeds the minimum, then in the first case 3% is added for each additional year over 20 years (but not more than 85% of the allowance). In the second case, with “mixed” length of service, 1% is added for each year after 25 years (Article 14 of Law No. 4468-1).

- 1 How is a military pension calculated?

- 2 Introduction of a reduction factor and its growth

- 3 When will the reduction factor for military pensioners be cancelled?

- 4 Conclusion

The principles for calculating military pensions differ significantly from the organization of “civilian” pension provision. A number of criteria on the basis of which their size is determined have no analogues in pension legislation for civilians. In this article, we will consider one of these specific factors - the reduction coefficient for military pensioners in 2021 and the prospects for its abolition.

The allowance included in the calculation formula is determined on the basis of Art. 43 of Law No. 4468-1. In 2010-2011, military personnel's salaries were significantly increased. This should have led to a corresponding increase in military pensions. But on January 1, 2012, a change was made to the law, which essentially left military pensions at the same level - a reduction factor. The government explained this by the unstable economic situation and lack of funds in the budget.

The legality of the introduction of this norm was repeatedly verified by the Constitutional Court, which did not see it as a violation of constitutional rights (this is indicated, for example, by the rulings of July 17, 2012 No. 1433-O and of September 24, 2012 No. 1800-O). The court refers, in particular, to the fact that due to the increase in the base (i.e. official salaries), the absolute amount of pensions has not decreased. In addition, the law provides for a mechanism for a gradual increase in the coefficient, and therefore pension payments.

The abolition of the reduction coefficient for military pensioners over 60 years of age (for women - from 55 years of age) deserves a separate discussion. Upon reaching the appropriate age, they become entitled to 2 types of pensions: social old-age pension. However, the reduction rate also applies to her. It has long been planned for them to abolish this obvious injustice.

Most likely, there is no chance of a 100% return of pension payments for this category of pensioners: neither in the near nor in the distant future. According to legislators, an unfair situation will arise when a serviceman of general retirement age of low rank receives a payment that exceeds the pension of a 50-year-old colonel. The fact that this situation is now unfair for many more people is not taken into account.

The answer to the question of when 100% accrual of military pensions will return is unknown. The reduction factor is changed manually every year when drawing up the budget, and they periodically threaten to freeze it for an indefinite period. Many pensioners believe that they will not live to receive their full pension. It is quite possible that it will be canceled only for small groups of pensioners, such as WWII veterans.

Russian President V. Putin signed a law for military pensioners: from May 1, 2021, the reduction coefficient for military pensioners has been abolished. More precisely, it was canceled for WWII participants. As a result of the Decree, their benefits should increase by approximately 9.5 thousand rubles monthly.

Thanks to this law, people who defended their country, sometimes at the cost of their health and immediate risk to their lives, cannot receive their well-deserved pension in full. In 2012, they were entitled to only 54% of its size. The coefficient of 0.54 did not apply to representatives of the judiciary and military investigative bodies, which is strange in itself, and invariably causes discontent among other retired military personnel.

In addition, on April 30, 2021, Federal Law No. 66 “On Amendments to the Law on Military Pensions” was published, according to which, from May 1, 2021, the use of PC was canceled for military pensioners from among WWII veterans. This change made it possible to increase pensions for veterans by approximately 9,000 rubles.

There have been discussions about abolishing this indicator for a long time. However, it only came to a real legislative draft and reading in the State Duma only once. This happened in 2014. A member of the Communist Party of the Russian Federation, Tetetkin, introduced legislative draft number 631118-6 to the lower parliamentary house. The bill proposed to completely abolish the use of this indicator. Consideration of this legislative draft took place only in 2021. Most of the deputies voted against it in the 1st reading .

The bill was approved by only 19 members of the State Duma.

Which categories will have their pensions increased?

The law on payments to military pensioners has several categories for which these same payments are made, namely:

- for service;

- for disability;

- for the loss of a breadwinner.

The last payment is assigned to disabled family members of a deceased serviceman.

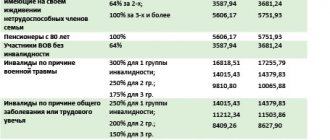

Payments based on length of service were thoroughly discussed in the previous sections of the article. The procedure for calculating disability benefits is also determined by Law No. 4468-1. Without going into details, here are just the main points:

the amount of military disability benefits depends on the monetary allowance (MSA) and is determined as a percentage (the percentage depends on the nature of the injury and the disability group).

The amount of payments for the loss of a breadwinner is also determined. Therefore, an increase in payments in 2021 will also affect these benefits. They will grow.

Letter in an envelope

In the middle of the restrictive period due to the pandemic, the Agency for Strategic Initiatives, led by General Director Chupsheva, proposed organizing an increase in pensions by 5-10%. These measures were supposed to support the Russian population during difficult times associated with loss of income and the pandemic.

A corresponding letter was sent to M. Mishustin. Mrs. Chupsheva proposed raising the salaries and pensions of all civil servants by 5-10%. This would strengthen the economy by supporting both citizens and small and medium-sized businesses.

At the moment there is no official information on this letter. Therefore, this proposal remained within the framework of “initiatives”.

Pensions for military personnel are calculated completely differently than insurance pensions. Their value is based on the person’s monetary allowance,

proportional to length of service. Therefore, it is possible to start receiving such a pension much earlier than a regular one.

The recipient of such a pension has the opportunity to get a job and accumulate pension points to receive an insurance pension.