What is a military pension

Receipt of payments under the “military pension” item is conditional on the presence of full length of service. In addition to direct service in the ranks of the Armed Forces, military experience can be earned in the system of the Ministry of Internal Affairs and the Ministry of Emergency Situations, as well as working in the criminal investigation department and fire brigades.

Along with having the full length of service required for retirement, payments are assigned to people who were injured in the service, as well as workers of the listed industries who have reached the maximum age specified in the charter as permissible for service.

A military serviceman has the right to receive two types of pension benefits, namely:

- According to length of service.

- Social benefits paid by the Pension Fund. To complete it, you must provide information about your length of military service and the length of time you worked at a civilian enterprise.

In 2021, you can apply for benefits for women after 55.5 years, for men - 60.5 years.

There are conditions for granting state benefits ahead of schedule. To do this, experience must include:

- service in the conditions of the CS or areas equivalent to it;

- work in hazardous industries

To receive social benefits, legal acts establish a minimum length of service of 10 years of service. Moreover, only the period of official employment, when the employer made regular contributions to the Pension Fund, will be considered such length of service.

How is military pension calculated?

The basic amount for calculating a pension is the military personnel's allowance (DV). Its size depends on:

- the title of retiree, which he received upon his retirement;

- position held during service.

The resulting amount is not strictly fixed throughout the entire pension period. Every year, according to the resolutions of the Government of the Russian Federation, the additional income increases by the inflation factor included in the budget. That is, the value of the pensionable income of a retiree every year will be equal to the maximum allowance of an active military man at the level of similar ranks and positions.

Next, according to paragraph 2, the length of service coefficient is determined. If you “work” in the army for 20 years, its value is 50%. For each year there will be an increase in pension by 3%. The maximum value of this coefficient can only reach 85%. This corresponds to a service life of 32 years.

For persons whose service experience is 12.5 years in the army, and the total length of service is 25 years, the increase for length of service beyond will be made at the level of 1% per year.

A formula for calculating a pension for a military retiree (with a service period of, for example, 25 years in the army) is already emerging:

DDV*(50% + 15%)*Kpon

Only point 3 remains (the most interesting). This is a reduction factor. Since the beginning of 2012, it was introduced against the backdrop of a significant increase in military salaries. Its value was 54%. That is, in our case, the pension is reduced by another half.

Russian President V. Putin promised that this reduction factor will increase by 2% annually until it reaches the maximum 100%.

All components of the military pension calculation were received. Now let's see:

- which of these indicators is guaranteed to increase in 2021;

- what indicator is planned to increase in 2021;

- and what possible bonuses (rumors) will be applied next year.

It is worth noting that the budget officially includes indexation of payments to military pensioners for 2021 at the level of 4.3%. But due to the difficult situation in Russia (covid-19, financial burden, something else), parliamentarians reduced this figure to 3%. In 2020, indexation is planned from October 1.

Military pensions from April 1, 2021

In 2021, military pensions for citizens discharged from military service or equivalent service (Ministry of Internal Affairs, Ministry of Emergency Situations, Federal Penitentiary Service, etc.) will be increased by 6.3% from October 1 . Pension benefits will first be increased by indexing military salaries by 4.3% , and then will be further increased by 2% . An additional increase of 2% from October 1 will be carried out by increasing the value of the reduction coefficient to the military personnel's pay by 1.45% (from 72.23 to 73.68).

- The rule of law on the annual indexation of monetary allowances was suspended from 01/01/2013 to 01/01/2018 , and indexation by 4% in 2021 practically affected the material support of military personnel, since total inflation for this period was about 46% , and the cost of a minimum set of food products has increased by almost 60% .

- Due to the increase in the VAT rate from 18% to 20%, an increase in prices is predicted in the first half of 2021 , and payments will be indexed from October 1 (i.e. almost at the end of the year). Therefore, rising inflation in the first half of the year will further worsen the financial situation of military personnel and military pensioners.

As Deputy Defense Minister Tatyana Shevtsova reported to a Rossiyskaya Gazeta correspondent, a battalion commander with the rank of lieutenant colonel in 2018 receives a salary of 88,759 rubles, a squad commander - 47,821 rubles, an ordinary contract service shooter - 32,012 rubles. etc. In 2021, these salaries will increase by another 4.3% , in 2021 - by 3.8%, in 2021 - by 4% (all adjustments will occur from October 1).

- The government planned not to carry out an additional increase in military pensions in 2021, since the original draft federal budget for 2019-2021. such expenses were not included . In addition, this bill was adopted in the first reading by the State Duma on October 24, 2021.

- The next day (October 25), President V. Putin announced that he had instructed the Government to prepare an amendment to the project and provide funds for an additional increase in pensions by 2% above the inflation rate. The draft budget with such an amendment has already been adopted in the second reading in the State Duma on November 14, 2021.

It is worth noting that even with an increase of 6.3%, military pensions will not be increased in full , as provided by law. For example, an increase in pensions due to an increase in the reduction factor in 2020 will not be made from the beginning of the year, but only from October 1, 2021. According to the conclusion of the State Duma Committee on Defense, payments to military personnel have already been under-indexed by almost 20% , starting in 2015.

-Who has it easy now? Served for 18 years, left at 5:30 and arrived at 11:00 pm. Vacation in Bre. In 1998, he was dismissed as a major due to organizational staff, by order of the Ministry of Defense in June, money (kopecks) in August. And now you can retire not at 60 but at 65. Rejoice who receives a pension. But how long will it take to receive it? Many classmates and colleagues have already left for another world.

Next, according to paragraph 2, the length of service coefficient is determined. If you “work” in the army for 20 years, its value is 50%. For each year there will be an increase in pension by 3%. The maximum value of this coefficient can only reach 85%. This corresponds to a service life of 32 years.

Background of events

According to current legislation, the level of payments to defenders of the Fatherland should be higher than the amount of civilian ones, since the appointment takes into account:

- current support for a military personnel according to his rank and position;

- length of service in the army;

- a coefficient lowered during difficult years for the state, with a promise to gradually return it to its previous level.

Today, the latest news reports that in 2021, military pensions will be increased in two ways: through indexation of pay in units (those who served under contract in the army for 20 years or more are entitled to 50% of the amount corresponding to their position and rank) and an increase of 1% for mixed length of service (12.5 years of service and a total of at least 25 years of service).

In 2021, a letter was sent to the Prime Minister of the country from the Director of the Agency for Strategic Initiatives S. Chupsheva, in which recommendations were made to increase pensions. We were talking about a measure that would improve the situation of civil servants and optimize the market for wholesale, retail trade and the provision of services to the population.

Attention!

Initially, it was planned to increase pensions for military personnel from 3.8 to 4.3%. However, then the planned indexation rates were reduced to 3% under the pretext that the inflation rate was lower than expected (according to data provided by Rosstat).

Financial analysts noted that such a decision contradicts the legislative requirements for indexation exceeding the official inflation rate by at least 2%. The expected cancellation of the reduction coefficient turned into a freeze in 2020 at the already established level.

When will the reduction factor for military pensioners be cancelled?

Salary is the salary of an army employee, including salary and allowances. According to Art. 2 of the legislative act of November 7, 2011 number 306, military personnel receive bonuses for:

Forecasts

Military pensions are indexed from January 1. This year the increase was 4 percent. As for the indexation of pensions in 2020-2021, its size has not yet been specified. Most likely, it will be within the limits of annual inflation, which is projected to be 4.4 percent.

In September 2021, the Government introduced bill No. 802513-7 to the State Duma to extend the “freeze” of the reduction coefficient (PC) until 2021 at a value of 0.7368. That is, the size of the military pension will continue to be determined as 73.68% of the military pay. The draft law with this content was adopted in the third (final) reading of the State Duma on November 19, 2021. On December 2, Law No. 381-FZ was signed by President V. Putin. The text of the law is presented below:

Incomplete accounting of the amount of allowance when determining the amount of pension payments has been carried out since January 1, 2021, when a reduction factor of 0.54 was introduced (Part 2 of Article 43 of Law No. 4468-1 of February 12, 1993). Further, its value should have increased annually by 2% until it was brought to 100%. But in fact, the scheme for increasing it looked like this (table below):

The procedure for increasing the coefficient in previous years

On behalf of the President of the Russian Federation V. Putin, in 2021 the reduction coefficient for military pensions (military personnel, employees of the Ministry of Internal Affairs, the Federal Penitentiary Service, the Russian Guard, the Ministry of Emergency Situations, etc.) was increased from 0.7223 to 0.7368. This means that when determining the size of the pension, 73.68% of the salary of military personnel will be taken into account instead of 72.23%. This increase in military pensions took place on October 1, 2021.

The amount of support for former soldiers is determined by the amount of salaries of military personnel. Its increase did not occur for a whole five years. However, in 2021, the head of the country indexed compensation by 4%. Which will certainly lead to an increase in pension payments for older former employees.

The reduction coefficient for military pensioners in 2021 was introduced as a forced measure due to pronounced crisis phenomena in the state. In proportion to this standard, the amount of pension provision for such a category of elderly people as former soldiers is reduced.

What is the reduction factor in 2021

The algorithm for calculating compensation for former army employees is strikingly inconsistent with the standard definition of payments for civilian pensioners. The assignment of pension amounts to the defender of the Motherland does not depend at all on his age. According to Art. 43 of Law No. 4468-1, the following factors influence the volume of future pension provision:

The principles for calculating military pensions differ significantly from the organization of “civilian” pension provision. A number of criteria on the basis of which their size is determined have no analogues in pension legislation for civilians. In this article, we will consider one of these specific factors - the reduction coefficient for military pensioners in 2021 and the prospects for its abolition.

Pension reform for military personnel in 2021

The Government has long discussed issues related to increasing seniority. At the same time, for military personnel this threshold was changed from the existing 20 years to the projected 25. Such innovations also apply to employees of the Federal Penitentiary Service and the Ministry of Internal Affairs.

Until 2021, issues of raising the retirement age were considered as speculation, but in June active actions by government commissions began. Projects to reform military pension provisions have been developed over the past several years. And on June 14, 2021, the retirement age was raised for all civilians of the Russian Federation.

In light of these events, the question arose about increasing the length of service for military personnel. The reform itself was announced in 2021 and was implemented in January 2021.

Under previous legislation, pensions for military personnel were provided after 20 years of service. That is, at almost 40 years of age, a military man can become a pensioner, and, having finished his career, calmly retrain for civilian work. The authorities thought this was not entirely fair to other citizens of the country.

Therefore, the main goal of the innovations is to partially equalize some pensioners with others, as well as take into account the interests of the state. The authorities have seriously taken up the issue of increasing seniority.

For reference! It is planned to replace the concept of “length of service” with a personal “social package”. Officially, the draft pension reform in this part has not been fully prepared and, accordingly, has not been put forward for consideration, but its very existence casts doubt on the state’s intention to continue to support the security forces at the proper level.

Such a pension reform for military personnel in 2021 seems unfair to the army men who work for the good of the Motherland and to defend their state and live according to irregular schedules. In connection with assignments, commanders make numerous moves and quite often give up a comfortable life because of their chosen profession.

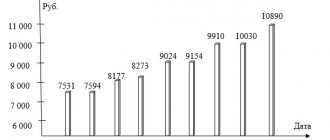

The volume of pension provision itself is not so huge and amounts to about 10,000 rubles for the vast majority of military personnel and a little more for the officer corps. But despite this, pension reform is already in effect.

Should I be afraid of pension cancellation?

The possible abolition of military pensions threatens to reduce the motivation of young people to serve in the army. It’s already difficult to interest them; the military has to provide social support.

It turns out that when a military man retires young, he receives transfers - weekend benefits.

At the moment, a military pension will be granted only when the length of service has exceeded 20 years. Or 25 years (if the military man is over 45 years old).

This means that a military man must live most of his life in the army.

Thus, in the case of replacing a military pension with a social package, if a military man ended his career ahead of schedule (perhaps his health or family circumstances failed him, etc.), he will still be entitled to cash payments.

Proposals of the Ministry of Finance on pension reform for the military and the Ministry of Internal Affairs

The Russian Ministry of Finance proposed optimizing the country's budget and reducing spending on the army and security forces. Part of the proposals of the Ministry of Finance concerns the retirement of military personnel and persons belonging to equal categories, as well as the procedure for calculating pension payments.

These are the following changes:

Increasing length of service to 25 . Currently, military personnel and law enforcement officers who have served at least 20 years are entitled to a long-service pension. It is worth noting that the Ministry of Finance previously announced plans to increase length of service from 20 to 25 years. In particular, such a statement was made in 2021, when raising the retirement age for “civilian” pensioners was discussed.

Exclusion from the length of service of the period of study at a school or military university. Now this period is included in the “experience” of a serviceman. Accordingly, in order to receive a service pension after receiving a diploma, you only need to serve 15 years.

It turns out that due to the implementation of these two proposals (increasing the length of service and excluding the period of training from it), the serviceman will retire 10 years later than envisaged before the reform.

“Freezing” the reduction factor . According to current legislation, when calculating a military pension, not the full amount of monetary allowance is taken into account, but only its part, limited by a reduction factor. Now it is 0.7368, that is, when calculating the pension, 73.68% of the monetary allowance is taken into account. This ratio should increase by 2% annually until it reaches 100%.

However, the Ministry of Finance proposes to limit the maximum value of the reduction factor to no more than 80%.

Cancellation of indexation of military pensions by 2% above inflation . Presidential Decree No. 604 of 05/07/2012 provides for an annual increase in pensions for military personnel in accordance with an index that exceeds the actual inflation rate in the country by 2%.

It is worth noting that it was not always possible to ensure such indexing. For example, there was no such increase in 2021, and the pension increase plan for 2021 does not provide for such an increase. And now the Ministry of Finance proposes to completely eliminate such a norm and increase pensions for the military only according to inflation.

What other changes are envisaged by the reform of the army and the security bloc?

The reform proposed by the Ministry of Finance contains nine key points:

- Reduction of staffing by 10%

. True, the Ministry of Finance itself stipulates that unfilled vacancies must be reduced, and employees who do not directly perform law enforcement functions must be transferred to the civil service. - Transfer of some functions to civilian ministries

. The Ministry of Labor can coordinate the program of resettlement of compatriots. And the Ministry of Health will be responsible for control and licensing functions in the field of legal drug trafficking. - Optimization of the administrative apparatus

. The ratio of the number of bosses and subordinates should follow the “herringbone” principle - the higher the level, the fewer employees. - Creation of a unified settlement center and a unified logistics system

. Thus, the Ministry of Finance expects to decentralize the financial and economic activities of the Ministry of Internal Affairs. - Transform the Ministry of Internal Affairs into a single law enforcement agency

. The police can include the FSIN, State Fiscal Service, FSSP, while simultaneously reducing the total number. - Increase the wear time of clothing items

. - Limit the maximum amount of monetary allowance when assigning a departmental pension

. Currently the coefficient is 0.7368 and should increase to 1.0. The Ministry of Finance proposes to limit the value to 0.8. - Cancel the mandatory indexation of pensions to a level of at least 2% above inflation

. - Increase the length of service for retirement from 20 to 25 years

. In this case, the period of study will not be included in the length of service.

It is worth clarifying that for now these are only proposals from the Ministry of Finance , which have not been formalized in the form of a bill and have not been submitted for consideration to the State Duma. The content of the reform is discussed at the level of ministries and departments. In particular, the MFD has already reported that they are preparing a negative review of the reform project. The department believes that such changes will lead to increased corruption, a decrease in the quality of work and an outflow of personnel.

V. Putin about the proposals of the Ministry of Finance

On October 22, a meeting of the Valdai Discussion Club was held, during which the President was asked to comment on the reform proposed by the Ministry of Finance for the military, employees of the Ministry of Internal Affairs and other departments. Vladimir Putin said that no practical decisions are planned on this issue, and these are only discussions within the Government of the Russian Federation.

At the same time, the President explained that all changes must be made taking into account the real situation in the economy, the real incomes of military personnel and law enforcement officers.

Legislative regulation of military pensions for military personnel

These payments are made not through the Russian Pension Fund (PFR), as for civilians, but from the budget of the Russian Ministry of Defense. The main provisions are determined by Law No. 4468-1 “On pensions for persons who served in military service” dated February 12, 1993.

There are pensions:

- For length of service . The most common type of government support for the military. To be appointed, a citizen must meet legal requirements - serve in the ranks of the Armed Forces of the Russian Federation (AF) for at least 20 years or have established reasons for resigning.

- For disability . It is prescribed to persons who have received limited capabilities due to injury or illness received while serving in the RF Armed Forces.

- For loss of a breadwinner . Recipients of this type of pension are members of the family of a deceased military man.

How are they calculated?

Pension benefits for military personnel are calculated taking into account length of service, rank and the amount of cash allowance (SDS) that the citizen had in the service.

For example, for those transferred to the reserve:

| Length of service | Pension calculation formula | Pension ceiling |

| More than 20 years | 50% of SSD + 1% for each year of service over 20 years | 85% of SSD |

| Less than 20, but more than 12.5 years, with a total experience of 25 years | 50% of SSD + 1% for each year of service over 25 years |

Officers' salaries are indexed to combat inflation - this is also reflected in the amount of pensions.

The law also introduced additional payments to the state support of retired military personnel. For example, if a citizen has dependents, the total payment will be increased by 32–100% (if there are three or more of them).

- Why do COVID-19 patients need rehabilitation?

- Viagra Soft

- Lavash roll with red fish

The remaining two types of pensions have the following features:

- For disability . Depends on the assigned category and the reasons for the disability. For example, persons who became disabled group I during hostilities receive a pension - 85% of the allowance.

- For loss of a breadwinner . The amount of payments is regulated by the cause of death of the serviceman. The maximum amount is due to dependents of those killed in service - 50% of the amount of monetary allowance.

How are they different from civilians?

According to current legislation, a military pension is awarded to persons:

- Those with at least 20 years of service in the Armed Forces or equivalent structures. These are the Federal Penitentiary Service, the Ministry of Internal Affairs of the Russian Federation and other law enforcement agencies.

- Dismissed from the ranks of the RF Armed Forces upon reaching the age limit.

- Those who retired due to health reasons or due to organizational and structural changes, and have reached 45 years of age. In this case, a total of 25 years of experience is required, of which at least half is service in the army, navy or law enforcement agencies.

In addition to the existing military state support, a citizen, having retired, according to the law, can then accumulate insurance experience. Then he becomes entitled to a second pension - according to age.

Changes in 2021

The upcoming reform project considers the following options:

- Replacement of state benefits for length of service with a one-time social package. Its size will be comparable to pension payments for several years. According to the developers of the reform, these funds are considered not as compensation for canceled payments, but as assistance when leaving military service and looking for further work. At the same time, retirees receive the right to free retraining in a new specialty and assistance in finding employment.

- The definition of pension is not based on length of service, but upon reaching a specific age (as for civilians).

- Increasing the length of service to obtain the right to a pension from 20 to 25 years with a change in the payment structure. Their maximum amount will be 95% of the salary (persons with 35 years of service experience can receive it).

These changes are currently under development. The first three proposed options are radical, and the last one acts as a gentle alternative, so it is preferable for future retirees.

In order for the reform of military pensions to take place, it is necessary to prepare a bill, consider it by the Duma and adopt the corresponding normative act. This takes from six months to a year and a half, so the earliest date for introducing new rules for state support for retired military personnel is 2020. It is also possible that the corresponding bill will not be prepared or rejected, and the payment system will remain the same.

- How to remove shellac at home

- Folk remedies for increasing potency in men

- Acute tracheitis

What was proposed as a reform of the military pension system?

Judging by the explanations that Vladimir Nazarov gave in October 2016 to Nezavisimaya Gazeta regarding his previously voiced proposals to abolish military pensions, if such a project (pension reform) had actually been implemented, it would not have affected existing military pensioners - citizens would have continued receive assigned pensions. According to Nazarov, the reform should have been based, first of all, on a gradual adjustment of the rules for the retirement of military personnel .

This implies a change in length of service requirements, the introduction of a progressive “age - length of service” scale, which will allow a citizen who has more work experience and a higher rank to retire earlier. After dismissal, it is planned to provide the citizen with a one-time cash benefit and provide the opportunity to complete a training program and find employment within the framework of the newly acquired profession.

“... Those who are planning to retire from the military should be offered a normal social contract instead of a pension. When a person finishes military service, if he is not disabled and everything is fine, you need to give him money for retraining, give him a large severance pay so that he has enough for a year or two of comfortable life and after that he can work just like a normal member of society at another job."

Forecasts for increase

The latest news from the State Duma on the amount of military pensions in 2021 today is contradictory and suggests two probable scenarios:

- they will be left at the planned level;

- they will be increased.

On a note! Will there be a default in Russia in 2021?

True, there is little chance of the second scenario. There are several reasons:

- Due to the coronavirus pandemic and forced quarantine, the Pension Fund lost a significant amount.

- It is likely that additional tranches from the federal budget or the Reserve Fund will be required.

- Even when planning the budget for a prosperous 2019, the indexation period was postponed to the beginning of the fourth quarter, and the initiative of the Duma Defense Committee to partially cancel the reduction coefficient was frozen.

- When voting, most of the deputies ignored the arguments that the indexation at the end of 2021 would be eaten up by the inflation rate that had increased over 9 months.

Since the payment of indexation of pensions to military pensioners in 2021 is again planned for the fourth quarter, and not at the beginning of the year, the latest news for today does not exclude a possible revision of the planned indicators, and not upward.

It is enough to simply extend the resolution on freezing the reduction coefficient, which is intended to be valid until January 2021. So experts do not expect any additional measures to increase pensions for retired military personnel, other than those announced in the 3-year economic development plan.

Who is promised more? Increase in pension

If we talk about such categories of citizens as working military pensioners, then things are more optimistic. The fact is that such citizens, in addition to military benefits, also receive civilian benefits. Upon completion of a certain (established) number of years, provided that the employer has faithfully transferred money to the Pension Fund, the retired military man will be awarded a second pension.

In 2021, the insurance pension is expected to increase by 6.3%. Therefore, working retirees can also count on this increase.

Cancellation of the reduction factor: reality?

Cancellation, or more precisely, achieving a 100% reduction factor in the near future, is unlikely. You can easily verify this by referring to Russian legislation.

Decree number 381 at the end of 2021 froze the annual increase in this coefficient by 2% until the beginning of 2021. In 2021, its figure is 73.68% and will not be increased. But there is good news.

The freeze, in accordance with Decree 381, will last until January 1, 2021. After this date, the law will end. Therefore, in 2021 we should expect an increase in pensions by 2%.

Note that the law provides for an increase in the reduction coefficient by 2% annually. But the standard also states that the government can increase the indicator by more than 2%, based on the inflation index.

Of course, to say that the planned achievement of a 100% reduction in military pensions is an increase in pensions is, to say the least, unconscionable. The government has reduced military pension payments for a number of reasons. But for people who honestly defended their country for half of their lives, this attitude of parliamentarians is insulting.

They took away what they honestly earned, and now they give it back in parts, calling it an increase. You come across such comments on the Internet all the time. Of course, people can be understood, because this is exactly what this norm with a reduction factor looks like. But, according to the government, this is a forced and temporary measure.

Bill on reduction coefficient in 2021

On September 30, 2021, the Government of the Russian Federation prepared and submitted to the State Duma bill No. 1027752-7 on extending the “freezing” of the reduction coefficient (PC) until 2022 at a value of 0.7368 . This means that the size of the military pension will continue to be calculated taking into account 73.68% of the monetary allowance of military personnel.

The law will come into force on January 1, 2021, and its provisions will apply throughout 2021.

- The explanatory note to the bill states that despite the “freezing” of the coefficient, a planned increase in military pensions will take place in 2021.

- They will be increased by indexing salaries by position and rank, taking into account which military pensions are calculated. Indexation will be 3.7%, which corresponds to the forecast inflation level of the previous year (2020).

Graph of coefficient changes in previous years

Incomplete accounting of the amount of allowance when determining the amount of pension payments has been carried out since January 1, 2012. Then a reduction factor of 0.54 in part 2 of Art. 43 of Law No. 4468-1 of 02/12/1993. Then its value should have increased annually by 2% until it was brought to 100%. However, in fact, the scheme for changing it looked different - the table is presented below:

| Period | from 01/01/2015 | from 01.10.2015 | from 01.02.2016 | from 02/01/2017 | from 01.10.2019 |

| PC value | 0.6212 (62.12%) | 0.6678 (66.78%) | 0.6945 (69.45%) | 0.7223 (72.23%) | 0.7368 (73.68%) |

The table shows that the last time the PC value was adjusted was on October 1, 2021. Then it was “frozen” for the entire 2021, and now they plan to use it in calculations throughout 2021.

Calculation and accrual of military pensions

As with insurance pensions, military pensions are calculated based on the employee's salary, called pay , which includes salary and monthly allowances.

In general, when calculating a military pension, the following indicators are taken into account:

- official salary>;

- salary according to rank>;

- monthly allowances>;

- years of service beyond the minimum length of service>;

- reduction factor>;

- regional coefficient>;

- interest on salary depending on the basis of retirement.

There are 3 reasons for retirement:

- by length of service (from 12 or 20 years of service),

- disability and

- loss of a breadwinner (Article 13-42 of Law No. 4468-I “On Military Pensions”).

In the last two cases, payments are also given to family members of the serviceman.

Depending on the type of pension, the formula includes a percentage of the salary, which is a minimum of 50%, a maximum of 85%. The formula and example of calculation will be given below.

Which categories will have their pensions increased?

The law on payments to military pensioners has several categories for which these same payments are made, namely:

- for service;

- for disability;

- for the loss of a breadwinner.

The last payment is assigned to disabled family members of a deceased serviceman.

Payments based on length of service were thoroughly discussed in the previous sections of the article. The procedure for calculating disability benefits is also determined by Law No. 4468-1. Without going into details, here are just the main points:

the amount of military disability benefits depends on the monetary allowance (MSA) and is determined as a percentage (the percentage depends on the nature of the injury and the disability group).

The amount of payments for the loss of a breadwinner is also determined. Therefore, an increase in payments in 2021 will also affect these benefits. They will grow.

Pension in the Ministry of Emergency Situations: rules for accrual and withdrawal, calculation and payments

According to the standards for calculating seniority, only those days that have been worked in full and in certain positions will be counted. In other words, those working days for which wages were calculated and there were deductions to the Russian Pension Fund are counted.

- First, we identify the total amount of monetary remuneration by adding all components of the salary: 16,000 + 11,000 + 10,800 = 37,800 rubles;

- Then we identify the basic salary, taking into account the coefficient of 69.45%: 37800 * 0.6945 = 26,252 rubles;

- For the period of service under consideration, the pension percentage will be fifty percent plus three for each year of overtime, in the end we calculate: 50+(3*5)=65%;

- We add the regional coefficient for the Kirov region, which is equal to 1.15. We get the final calculation: 26,252 rubles * 0.65 * 1.15 = 19,623 rubles - the amount of the pension.

Payments taking into account mixed experience are made upon reaching 45 years of age, taking into account 25 years of total experience with 12.5 years of experience in the specialty. After the appointment of such payments, you can work in a civilian specialty. Upon reaching retirement age, a corresponding payment is issued. Moreover, the initial appointment is not suspended.

- period of military service;

- the duration of obtaining civilian specialties on the basis of higher or secondary specialized educational institutions, not exceeding 5 years at a rate of 2:1 - for employees who began service before 2012;

- time of obtaining professional (higher or secondary) education at the same rate - for employees who began service in 2013;

- work in remote and high mountain areas (altitude above sea level - more than 2500 m). For some cases, there are preferential terms for accruing length of service (combat operations, special conditions, foreign business trips).

Important! A long-service pension is paid to a citizen only if he does not perform military or equivalent service (continued work in the State Border Guard Service, work in law enforcement agencies and other law enforcement agencies). Otherwise, payments are suspended, but will be resumed upon leaving service. Carrying out other work activities does not deprive a former employee of the State Border Service of the right to receive payments based on length of service.

We recommend reading: Where to draw up a deed of gift for an apartment

I ask you not to redirect my appeal to persons who do not make decisions on this issue, but to resolve it on its merits and send me a response to the email address I provided. In the officer ranks of all law enforcement agencies, among military pensioners, the issue of legal arbitrariness in relation to the reduction coefficient for military pensions has been discussed for 8 years.

- For 20 years of service.

- For 12.5 years of service, with the recipient’s total experience of at least 25 years.

- For the loss of a breadwinner for disabled relatives: sons/daughters; mother/father with a disability or retired; a wife who is caring for a child under fourteen years of age.

- Due to disability that occurred during military service or due to illness during this period.

Given the freeze, military personnel will lose 5% of their monthly pension contributions. Military pensions for privates and sergeants are almost closer to civilian insurance ones. However, there is still a high probability that the reduction factor will increase to 100% before 2035 if the freeze is not extended.

Most likely, there is no chance of a 100% return of pension payments for this category of pensioners: neither in the near nor in the distant future. According to legislators, an unfair situation will arise when a serviceman of general retirement age of low rank receives a payment that exceeds the pension of a 50-year-old colonel.

In accordance with paragraph 6 of Article 8 of the Federal Law “On the procedure for considering appeals from citizens of the Russian Federation” dated 02.05.2006 N 59-FZ, I do not have the right to send my appeal to the Minister of Defense or other officials, since only you alone can resolve an issue related to the lack of rights in relation to military pensioners. However, my letter has already been repeatedly redirected by the adviser to the department of written appeals, A. Itskovich, to the Ministry of Defense, which approach of officials to appeals from Russian citizens is unacceptable and insults the faith of the people in the elected government.

I read somewhere that for the New Year, instead of 2%, each military pension will be given a large Chupa Chups in a bright wrapper and 0.5 “fire water”, and also a new, elongated Doshirak. It moves off the ears more slowly than the previous one and lingers on them longer... And for those who have believed since 2012, they don’t shake it off at all...

In accordance with the retirement age table, in 2021, women born in the first half of 1965 and men born in the first half of 1960 will be able to start receiving the second payment. To do this, they will need to have at least 12 years of work experience in civilian life.

- monetary support for active military personnel (appropriate rank and position);

- length of service - the longer the length of service, the greater the percentage of the monetary security the pensioner receives;

- The reduction factor is the same for everyone, and it is established by federal law. Now the coefficient is 0.7368.

IPC in the prescribed amount

(total number of accumulated points). Starting from 2015, the IPC standards for receiving old-age insurance pensions are also increasing annually. In 2021, this will require at least 21 points.

According to preliminary forecasts, it is clear that in a few years the total amount of pension payments to military personnel for 1 month will be almost equal to what ordinary citizens receive. There are certain concerns that such a situation may cause strong dissatisfaction among citizens who have retired due to long service.

Article 48

Law of the Russian Federation dated 02/12/1993 No. 4468-1 (as amended on 12/28/2013) “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penitentiary system and their families.”

Article 43

Law of the Russian Federation dated 02/12/1993 No. 4468-1 (as amended on 12/28/2013) “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penitentiary system and their families.”

Article 43

Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system and their families" (hereinafter referred to as the Law).

Subparagraph “a” Article 14

Law of the Russian Federation dated 02/12/1993 No. 4468-1 (as amended on 12/28/2013) “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penitentiary system and their families.”

Article 48

Law of the Russian Federation dated 02/12/1993 No. 4468-1 (as amended on 12/28/2013) “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penitentiary system and their families.”

What can military retirees expect?

From January 1, 2021, it is planned to increase military pensions, some of which also apply to combat veterans:

- an increase in the base amount (the starting figure for calculating the pension), that is, the salary according to rank and position (more precisely, 50% of it, which is due for 20 years of service), by 3% annually;

- increase by 1% if military service is 12.5 years;

- planned indexation and postponement of the increased payments due to this;

- cancellation of the reduction factor;

- expansion of the program of benefits provided (for disability and loss of a breadwinner)

Former military personnel and the families of those killed may receive bonuses provided for by new laws recently adopted by the State Duma. For example, a bill on increasing survivors’ pensions passed the first reading; it is possible to postpone the indexation period from October 2021 to an earlier time.

Advice!

You need to carefully monitor the benefits provided - some of them are only available after submitting an application.

The pension of combat veterans is formed on the basis of the type of pension status, disability, length of service, rank, amount of insurance payments made and additional benefits. All benefits are granted only on the basis of an issued certificate, which is an official document confirming status. Federal laws provide for an increase in the pensions of combat veterans when the indicators that determine the composition and size of the assigned pension change. In addition to free housing, discounts on housing and communal services, tax deductions and the provision of allowances and compensation provided for by federal laws, there may be additional benefits provided by regional authorities.

Results

Due to the difficult financial situation in the country in recent years, the size of pensions paid to the military and law enforcement officers has been reduced. In 2021, it is planned to index the pay of active military personnel and pensioners by 4%. It is possible to change the reduction factor by 2%. Benefits will be expanded at the federal and regional levels. To calculate the pension due, it is necessary to take into account individual indicators.

Reduction factor for military pensioners in 2021

The same as in 2021 - 0,7368

. That is, the amount of the pension will be 73.68% of the salary of an active military man who has the same rank and the same position as the pensioner before leaving service.

What will be the reduction factor for military pensions in 2020?

As such, the reduction factor has appeared since 2021. Then, let us remind you, a reform was carried out in the pay of military personnel - due to an increase in salaries and allowances, it increased sharply. And the pensions of former military personnel are tied to the “salaries” of active ones. The budget, even in those relatively fat years, would not have been able to support a simultaneous increase in wages and military pensions.

The law allows a wife to receive her husband's pension after his death if his income was the main component of the family budget

However, it is important to understand that the Pension Fund does not allow you to receive two pensions at the same time. This means that you first need to give up your

To do this, you need to contact a Pension Fund employee and write a corresponding application.

Thus, the reduction factor reduces the amount of pension payments to active military pensioners. Some of them lose about 4 – 7 thousand rubles. However, this is compensated by various benefits that retired military personnel can receive when contacting the employees of the social benefits department at the place of registration.

How to apply for a military pension - step-by-step instructions

Today they often talk about the reduction factor for military pensioners, but few people understand what it means and how it is applied. In fact, this is a measure that is designed to provide former military personnel with an average level of income upon retirement. It is worth considering in more detail what its features are and when it is used.

Let us immediately note that since 2021, monetary allowance has increased in rapid spurts and continues to demonstrate positive dynamics in comparison with the planned plan. Initially, the coefficient was set at 54%, which was supposed to increase by 2% annually - accordingly, by 2021 it was supposed to be 70%. However, the annual indexation reached 7%, which led to 3.68% above the expected in 2021. At the same time, inflation is again taken into account when calculating the cash content.

From October 1, 2021, military pensions will increase by 3%, but the reduction factor will be frozen. The relevant bills have already been approved by the State Duma. The federal law, which has a downward effect, is being approved by the Federation Council and will soon be signed by the President of the Russian Federation.

Calculation of military pensions until the end of the freeze

First, let’s explain why freezing the coefficient has a negative impact on payments. Since the amount of monetary allowance is multiplied by a percentage, the amount of accruals is reduced by a certain proportion. That is why the annual indexation of allowances, which is planned to be increased to 100% by 2035, is so important. It is better to demonstrate this with an example that shows how long-service military pensions will be calculated until the end of the freeze.

For example, in 2021, Deputy Tetekin sent a bill for consideration by members of the State Duma. It stipulated that it was necessary to abolish the PC for citizens undergoing military service. For several years, consideration of the document was postponed. The study of the project took place in 2021.

Consequences of the abolition of military pensions.

After the abolition of military pensions, some of the people who agreed to devote their lives to the army will choose a different path. In addition, the authority of the Russian army will decrease significantly.

Currently, military pension recipients are the following employees:

- FSB,

- Ministry of Emergency Situations,

- Ministry of Internal Affairs,

- other law enforcement officers.

If the innovation is adopted, the military one-time payment will be enough to live for 1 or 2 years without working.

It is planned that this time will be quite enough to adapt to ordinary life, in which there is no military regime. In addition, about 600 billion rubles will remain in the country's budget annually.

Expert opinions.

Experts believe that the state will still continue to pay military pensions. People serving the Motherland are the most important for the country. It is unlikely that any of these people will advocate such innovations.

The state understands perfectly well that it is very difficult to resist so many people who are significant to it. Experts also suggest that a crisis will come in the security sectors, and this cannot be allowed in the conditions of today’s foreign policy.

In this regard, there is reason to assume that there will be an increase in pensions for military pensioners , and not its abolition.

Other experts, analyzing this issue, start from the fact that the bulk of the military pension has been frozen. In this regard, a wave of negativity swept across the country.

If the military is told about the complete abolition of pensions, the freeze will not seem so scary, and all the attention of the population will switch to the risk of cancellation.

The main law of humanity applies here: in order to make a person happy, you must first take everything from him, and then return at least a quarter.

There is reason to assume that if the military pension is cancelled, the entire population, and not just the military, will react to this. After all, if such significant sections of the population are deprived of their pensions, then what can we say about civilians. This means that this could threaten the abolition of pensions in general for everyone.

Experience of other countries.

There are quite a lot of countries that have no pension at all. The population works exactly as long as it is physically able to do so. In some countries there is not even a lump sum benefit paid in connection with old age.

There are no pension payments in:

- Afghanistan,

- Thailand,

- Iraq,

- India,

- China (if the employee does not work with registration).

Reaction of trade unions and the State Duma

Before the adoption of the described law in December 2015, the State Duma and the United Russia party opposed its approval. They noted that consideration of the budget in the lower house affects the preservation of the rights of pensioners who are currently continuing to work. The government believes that former military personnel and civilians do not have enough income to retire. That is why there is a large number of working people of retirement age: in Russia they make up 34% of the total number of people receiving a pension.

Representatives of numerous trade unions also reacted negatively to the adoption of the law on the abolition of indexations for working pensioners in 2021. They believe that in this way the social insurance rights of people of retirement age are violated. The latter are not equal to the rest, that is, unemployed pensioners.

Earlier, representatives of the Ministry of Labor said that the abolition of indexations would not affect all employed elderly people. A detailed discussion of the bill was planned for December 2015. It was stated that the issue would be agreed upon at a meeting of the tripartite commission. All these plans were not implemented, and as a result, the government announced the abolition of indexation of military and civil pensions for working people for 2021.

Cancellation of military pensions in 2021 - latest news for today

The abolition of military pensions does not pose a threat to current retirees. The proposed new law will not affect them, even if the pension is cancelled. After all, if a pensioner, for example, is already 65 years old, then giving him a lump sum benefit and then sending him to work would be stupid. In case of cancellation, the state will deal with the employment of former military personnel, and no one will employ those who have not worked for a long time and receive a pension. No one will be able to engage in professional retraining or send them to receive other education.

At the same time, the period of 20 years of service will remain for disabled people, for employees who have reached the maximum age for service, as well as in connection with organizational and staffing measures. For now, one can only guess what the pension reform of 2021 will consist of. The forecasts for it are quite contradictory.

Current situation

Despite the abolition of indexation of pensions for working citizens, all categories (employed and unemployed) will receive an increase this year, which will be at least 4%. This is the official government statement. Whether this measure will be a one-time thing and whether a larger increase factor can be expected has not yet been announced.

Currently, the average pension for former military personnel is approximately 40% higher than for civilians. Last year, from the beginning of October, a one-time indexation of social benefits for military personnel was carried out; it amounted to 7.5%, or approximately 1,500 rubles.

What's in the latest news about military pensions?

Increasingly, information appears in the news not about the abolition of military pensions, but, on the contrary, about their indexation. Thus, the value of a military pension should only increase depending on the increase in inflation.

The state is guided by the principle that the increase in expenses should not exceed the amount of the pension. In addition, do not forget that there is also a second pension for military pensioners .

Some sources also contained information about the expected increase in length of service to 25 years (versus the current 20).

This is due to the fact that with increasing length of service, the need for new personnel will become less. Thus, the size of payments will increase, and the number of such transfers will decrease.

What does the situation with the military retirement age look like today?

For several years now, pension reform has been going on in Russia, which concerns all citizens who retired due to old age, disability and other reasons. She treats the military as much as anyone else. Former military personnel today can count on receiving an old-age insurance pension, but their pension provision has a number of differences:

The age of military pensioners is lower than that of ordinary pensioners - from 45 years with 20 years of continuous service;

— When leaving the ranks of the military or government agencies for medical reasons, a military man may be under 45 years of age, but to receive a pension, he must maintain a total length of service of 25 years, of which at least 12 must be spent in service.

— The size of “military” pensions directly depends on the salaries of military personnel: when salaries increase, the pension also increases.

Today, those liable for military service are negative about the new decree of the country's president, according to which benefits for former military personnel will be increased in such a way that pensioners will ultimately receive 2% more than the current inflation rate in the country. And this attitude is completely justified - people believe that the amount is too small.