February 23, 2021

It cannot be argued that the work of a doctor, nurse, or paramedic is difficult work. That is why the law establishes preferential conditions for retirement. The main point is that a medical worker has the right to early retirement payment , subject to certain conditions. Rules for registering a pension, requirements and nuances - all this is discussed below.

Preferential long-service pension

The right to early retirement for medical workers is enshrined in Federal Law No. 400 of December 28, 2013, as well as a number of Government Decrees and other regulatory legal acts. The opportunity for early registration is provided after years of service . In other words, a person must first work for the required period of time as a medical employee.

After a medical worker has acquired the necessary experience, he will be able to submit a corresponding application to the Pension Fund office at his place of residence. What is important is that in this case, the age of the citizen will not be important, as well as the presence of an established worked-out period for the general insurance period.

According to the established rules, to apply for a preferential pension, a person must have:

- According to clause 20 of part 1 of article 30 of Federal Law No. 400, medical work experience:

- At least 25 years of age , when working in rural areas or towns equivalent to the urban type.

- At least 30 years , when conducting mixed activities (in villages, cities, etc.), or when working exclusively in the city.

- Have a minimum value for the E-score indicator and the day of registration for receiving payment. It should be remembered that in accordance with Federal Law No. 400, the value of the IPC increases every year. Respectively:

- In 2021 the value should be at least 21.

- In 2022 from 23,4.

- By 2025 the figure will increase to 30.

In calculating the length of service, the position held by the person also plays a significant role. The thing is that only periods of work in positions and institutions provided for by law . The calculation is carried out in accordance with the established procedure, for example, for some categories 1 year is equal to 1.5.

Features of early retirement provision for medical workers

17.04.

2013 This article highlights issues related to the assignment of early retirement pensions to medical workers. An early labor pension in connection with medical activities is established for persons who carried out medical and other activities to protect the health of the population with at least 25 years of work experience in healthcare institutions, if such work throughout their entire career was carried out only in rural areas and urban-type settlements, or at least 30 years, if the work was carried out only in cities or there is “mixed” experience, i.e.

in cities, rural areas and urban settlements. Decree of the Government of the Russian Federation dated October 29, 2002 No. 781 approved the List of positions and institutions in which work gives the right to early retirement, as well as the Rules for calculating special length of service. At the same time, periods of work only in those positions and institutions that are provided for in the List are counted towards the length of service that gives the right to early pension provision.

Is the head nurse of the anesthesiology and intensive care unit entitled to accrual of preferential service for one year and six months?

96 lawyers are currently online Hello. I have been working as a senior nurse in the anesthesiology-reanimation department since 2007.

All this time I thought that my experience was going on for a year and a half. I myself calculated that I should go on a preferential pension this year. I submitted the documents, and they told me that there was a new decree of the Russian Federation from 2012, where my position was not included in the list of positions. Why is that? I was in before, but not now? Have my working conditions changed or what?

May 22, 2021, 21:06, question No. 1644075 Zoya, Baikonur 600 cost of the question question resolved Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (6)

- Lawyer, RodnikiChat

- 50% fee received Lawyer,

SaratovChat- 9.0 rating

expert

- expert

- 9.0 rating

- 9.0 rating

- 50% fee received Lawyer, Saratov Chat

- 9.0 rating

- expert

- expert

- 50% fee received Lawyer,

Nuances of pension reform for medical workers

The pension reform carried out in 2021, of course, affected all working citizens. Doctors are no exception in this regard. The new regulatory act No. 350-FZ was adopted on October 3, 2021. In accordance with these bills, employees entitled to early retirement are granted a special deferment , which begins to be calculated from the moment they work the required years.

It is worth noting that at the moment there is still a transition period . From the moment of its introduction (from 2019), this deferment of execution is being introduced gradually, and by 2023 it will be a full 5 years. This means that those who have completed the required length of service by the age of 23 will be able to begin receiving payments no earlier than 2028.

Thus, the required work experience for a medical worker is 25-30 years, depending on the area. But, pension payments will begin only after 5 years (if the year of service is 2023 or more). The employee has the right not to work for these 5 years, because experience has already been accumulated.

As for the gradual introduction of deferment, it looks like this:

- Starting from 2021, the increase is carried out gradually. In the period 2019-2020, the deferment was only 1.5 years instead of 2.

- For 2021, the deadline is shifted by 3 years, payment is possible only from 2024.

- For 2022, the deferment is 4 years (in 2026), and from 2023 there will be no increase in 5 years or more.

It is worth noting that previously, before the introduction of changes, the period for obtaining a preferential payment was considered to be the year of developing the required length of service. However, despite the established deferments, there was no increase in length of service for years of service. That is, at the moment, a doctor still needs to work for 25-30 years in the relevant position and institution.

Is medical school included in general medical experience?

of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive bodies, state bodies under federal executive bodies or as representatives of these bodies abroad, as well as representative offices of government agencies of the Russian Federation ( state bodies and government institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;9) the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144- Federal Law “On operational investigative activities.” (Clause 9 introduced by Federal Law dated June 29, 2015 N 173-FZ)2.

Is studying at a school, technical school or institute included in the work experience? There are several cases when studying at a vocational school or university can be included in the work experience. This depends on the form of study - full-time or part-time, and is also additionally regulated by legislation in other areas. In full-time education, if a student or listener is busy only with studying, then his insurance experience is not counted.

Medical experience to receive a long-service pension

As already mentioned, a medical worker (doctor, nurse, midwife, paramedic) receives the right to receive a preferential payment only after working in this field for at least 25-30 years , depending on the place of work. Again, these standards have not changed for 2021, and no innovations are planned in the near future.

The main nuances, in this case, are related to the calculation of the period of labor activity. At different times, they are regulated by separate regulations and have their own requirements. The periods are divided as follows:

- The work of a doctor until January 1, 1992 is determined by Resolution of the Council of Ministers of the USSR of December 17, 1992 No. 1397.

- Labor activity in the period from January 1, 1992 to October 31, 99 is regulated by Resolution of the Council of Ministers of the RSFSR dated September 6, 1991 No. 464.

- From November 1, 99 to December 31, 2001 - Decree of the Russian Government of September 22, 99 No. 1066.

- Starting from January 1, 2002 to the present, the calculation of periods of custody is carried out on the basis of Government Decree No. 781 of October 29, 2002.

In order to correctly calculate what is included in the length of service and for what periods, you should be guided by the specified regulations for each year separately. It is important that only those types of activities (name of profession), as well as medical institutions that comply with legal standards . If the entries in the work book do not meet the requirements, the pension fund has the right to exclude a certain period from the calculation.

Private medical practice and special experience are a difficult dispute with the Pension Fund.

M. worked in healthcare institutions for more than 30 years, which gave her the right to an early retirement pension in accordance with subsection. 20 clause 1 art. 27 Federal Law “On Labor Pensions”. According to the minutes of the meeting of the commission to consider the implementation of pension rights of citizens, the applicant was denied a pension. However, the special experience does not include the period of work as a nurse anesthetist in a private clinic.

List of positions and institutions, work in which is counted in the work experience, giving the right to early assignment of an old-age labor pension to persons who carried out medical and other activities to protect public health in health care institutions, approved. Decree of the Government of the Russian Federation of October 29, 2002 N 781 provides for the position of “nurse anesthetist”, the structural unit “department of anesthesiology and intensive care”, and the name of the institutions is “hospitals of all names”, the calculation of experience is 1 year for 1 year and 6 months.

The basis for refusal to grant a pension was the form of the medical organization - a closed joint stock company. There was no such type in the list of names of institutions on the List. The Pension Fund of Russia spoke as follows - since it is not a hospital, not a hospital, etc. “no and no trial.”

But the medical worker thought differently and filed a lawsuit to recognize her right to an early pension.

It must be said that the requirement to include work experience only in state and municipal medical institutions was first introduced by Decree of the Government of the Russian Federation of September 22, 1999 N 1066 and with the advent of the private medical and educational sector caused a lot of controversy.

By Resolution of the Constitutional Court of the Russian Federation dated June 3, 2004 N 11-P, it was recognized that the form of ownership as such cannot serve as a sufficient basis for differentiating the conditions for assigning old-age labor pensions, since such a right is aimed mainly at protecting against the risk of loss of professional ability to work before reaching general retirement age.

In 2009, the Government amended Resolution No. 781 and excluded the reference to “state and municipal” healthcare institutions from the List (Resolution of the Government of the Russian Federation of May 26, 2009 N 449). However, it should be taken into account that the rest of the List has not undergone any changes. Approved in 2002, it fully complied with the Nomenclature of state and municipal healthcare institutions, approved. By Order of the Ministry of Health of the Russian Federation dated November 3, 1999, and then by Order of the Ministry of Health dated June 3, 2003 No. 229.

In Russia there was a Unified Nomenclature of Health Care Institutions and only state and municipal institutions were included in it. This is how healthcare institutions are presented in the List. Therefore, having excluded from the List of Resolution No. 781 the indication “state and municipal” Nomenclature of honey. institutions remained in their original form and no private medical organization could simply be on the List.

Therefore, the application of Government Resolution No. 781 without taking into account the above interpretations of the Constitutional Court of the Russian Federation is impossible.

In this regard, the Moscow City Court, for example, in an appeal ruling dated September 12, 2012 in case No. 11-16710, indicated: “When resolving the issue of classifying a state or municipal institution as a medical institution, one should be guided by the Nomenclature of Medical Institutions approved in accordance with the procedure established by law, and in relation to institutions of other forms of ownership - Federal Law dated November 21, 2011 N 323-FZ (as amended on June 25, 2012) “On the fundamentals of protecting the health of citizens in the Russian Federation.”

In force with clause 11 of Art. 2 of the said Federal Law, a medical organization is a legal entity, regardless of its organizational and legal form, carrying out medical activities as the main (statutory) type of activity on the basis of a license issued in the manner established by the legislation of the Russian Federation.

In judicial practice regarding the consideration of cases related to the exercise of the right to early retirement pensions, there are enough decisions to include in the special length of service a period of work in a private medical organization, existing in a form not provided for by the List of Government Resolution No. 781, including preferential calculation.

Thus, by the decision of the Simonovsky District Court of Moscow dated March 19, 2012 in the case of the claim of Sh. against the State Administration of the Pension Fund of the Russian Federation No. 8 for the city of Moscow and the Moscow Region, the period of work of a nurse in surgery of the clinical department at OJSC was included in the plaintiff’s special experience. Medicine" from September 1, 2005 to June 8, 2008, from June 12, 2008 to February 5, 2009 as a year of work to one year 6 months. By the appeal ruling of the Moscow City Court dated September 12, 2012 in case No. 11-16710, the decision of the first instance court was recognized as legal and justified and left unchanged.

The Solntsevsky District Court of Moscow, by a decision dated April 26, 2011, satisfied S.’s claims against Department No. 4 of the State Pension Fund of the Russian Federation No. 2 for Moscow and the Moscow Region and included in the preferential length of service the period of the plaintiff’s work as a nurse at ZAO Central Polyclinic Literary Fund".

The Pension Fund's objections were of a similar nature - S. did not work in a healthcare institution, but in an organization that had a different organizational and legal form (CJSC).

The court rightfully pointed out that the name of the organization in itself does not predetermine the right to assign a pension, and therefore cannot serve as a sufficient basis for differentiating the conditions for assigning a pension to persons working in positions with identical functional responsibilities.

The Moscow City Court, having considered the cassation appeal of the defendant of Department No. 4 of the State Pension Fund of the Russian Federation No. 2 for the city of Moscow and the Moscow Region, left the decision of the district court unchanged and the complaint without satisfaction (Determination of the Moscow City Court dated June 24, 2011 in case No. 33- 19352).

The appeal ruling of the Krasnodar Regional Court dated September 17, 2013 in case No. 33-20090/2013 upheld the decision of the court of first instance, the plaintiff included in her work experience the period of work at LLC MFO “Clinic “Na Zdorovie”. The court found that the work was directly related to the implementation of medical activities.

In addition, the List of works, professions, positions, specialties and institutions, approved by the Decree of the Government of the Russian Federation of October 29, 2002, provides for the position of obstetrician-gynecologist. Thus, the scope of activity of LLC MFO “Clinic “For Health” is entirely in the field of medicine, and specifically, the provision of medical care to the population.

According to a certificate from plaintiff M.’s place of work, the private clinic is a privately owned medical and preventive institution and operates on the basis of a license issued by the Moscow Department of Health. Nurse anesthetist M. performed all job duties stipulated by Order of the Ministry of Social Development of Russia dated July 23, 2010 No. 541-n “On approval of the Unified Qualification Directory of Positions of Managers, Specialists and Employees, section “Qualification Characteristics of Workers in the Healthcare Sector.”

According to the Charter of the CJSC, the company carries out medical activities, including preventive and curative medical care, including high-tech medical care, and any services in the field of health care.

The nomenclature of positions for medical and pharmaceutical personnel and specialists with higher professional education in healthcare institutions, approved by Order of the Ministry of Health of the Russian Federation dated April 24, 2003 N 160, Order of the Ministry of Health and Social Development of the Russian Federation dated September 8, 2005 N 553, provides for such a position as “nurse anesthetist”, therefore the position applies to healthcare institutions.

The nature of M.’s work was also confirmed by the employment contract, job description, workplace certification card for working conditions, from which it follows that the plaintiff’s position is subject to guarantees and compensation for workers employed in hazardous working conditions: additional leave, a reduced working week of 39 hours. and so on. Under such circumstances, there were no grounds for excluding the specified period of work from the plaintiff’s medical experience.

By the decision of the Lefortovo District Court of Moscow dated December 2, 2013, M.’s claims regarding the inclusion of the period of work as a nurse anesthetist in a private clinic in the length of service for an early retirement pension were satisfied, the length of service was calculated taking into account harmful working conditions of 1 year for 1 year 6 months. The court ordered the institution of the Pension Fund to assign plaintiff M. a labor pension from the date of her application.

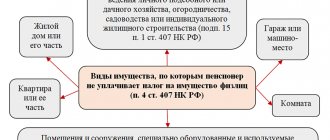

Who is eligible for early retirement?

As already mentioned, only official work activity , in professions and in health care institutions established by law, is counted in medical experience. At different time periods, the names may change, so the data should be correlated with the regulatory act of that particular time.

Currently, Government Decree No. 781 is in force. Accordingly, the list of professions that earn medical experience from January 1, 2002 includes:

- specialist doctors, of all possible names;

- physicians in management positions;

- senior nurses, nurses;

- managers;

- paramedics;

- obstetricians;

- nurses;

- physician assistants and so on.

The full list can be found in regulation No. 781.

How is preferential service calculated?

Calculation rules will also change depending on the period of employment. If we talk about calculations starting from January 1, 2002, the following rules are observed:

- Preferential length of service is counted in calendar order, that is, 1 year worked is equal to 1st year of medical experience. In this case, it does not matter what clinical profile is indicated, and the departmental or territorial affiliation of the institution in which the work is carried out is also not important.

In certain cases, the calculation of length of service is carried out not year by year, but according to individual (special) conditions (In accordance with the Rules for calculating periods of work, giving the right to early assignment of an old-age pension for those who carried out medical and other health protection activities... RF PP dated 29.10 .2002 No. 781) :

- For persons who carried out medical and other activities to protect public health in health care institutions in the city, in rural areas and in an urban-type settlement (working village), a year of work in a rural area or in an urban-type settlement (working village) is counted towards the specified work experience as 1 year and 3 months

- According to the established List, a number of medical specialist positions are calculated according to the scheme 1 year = 1 year 6 months.

- Separate standards are also established for highly specialized specialists. These include: ambulance workers, forensic experts, surgeons, burn department specialists, and so on. In this case, the calculation of length of service is carried out on the basis of “a year and a half”. At the same time, for surgical workers operating in rural areas, a coefficient of 1.9 is established due to combination.

- An additional measure was introduced due to the pandemic. According to Government Decree No. 1191 of August 6, 2021, the length of service for those who work with Covid-19 patients is calculated according to the “one day in two” scheme. The responsibility for transmitting all necessary information to the Pension Fund falls on the direct employer. These measures were established for the period from January 1 to September 30, 2020.

- If the work was carried out before November 1, 1999, then the specified period will be included in the calculation in full. After November 1, only if the employee has worked the required working hours, in accordance with labor legislation.

- If labor activity was carried out in several positions or in different medical institutions during a part-time working day, then the calculation is carried out in full if the total output corresponds to the full rate for one of the positions.

- Experience worked outside the Russian Federation is counted under general conditions.

It should be understood that medical experience is a period of continuous work of a medical employee in healthcare institutions . The calculation includes only the time when work was carried out at full time or at a reduced rate, if this is established by law. When working part-time, the periods are summed up.

Also included in the calculation are periods of temporary disability, maternity leave, advanced training, and passing a probationary period when applying for a job.

Periods of work that count towards length of service

To calculate medical experience, it is important to know what is included in medical experience. Let's look at these points in more detail.

So, medical training for a pension includes:

- direct performance of labor duties in healthcare institutions. When working part-time before 1999, the corresponding periods are included in the length of service. After 1999, it includes periods of full-time work;

- periods of temporary disability;

- time spent on maternity leave, as well as to care for a child up to 1.5 years old;

- the period of testing for employment;

- time of forced absences due to the fault of the employer.

In general, the periods included in the length of service correspond to those taken into account when calculating the length of insurance in the usual manner.

Is residency included?

Studying at a medical university is quite long, which is not surprising, given the specifics of the activities of future doctors, who are responsible for the health and lives of patients.

It should be noted right away that this period is not included in the special training in principle. However, many students and current doctors are concerned about whether clinical residency is included in medical training. After all, it is during this period that students are directly engaged in medical work, albeit under the supervision of their experienced mentors.

It is impossible to answer this question in the affirmative. The fact is that during the residency period there is no labor relationship between the student and the medical institution, and residents are not included in the staff. Accordingly, there are no grounds for including this period of special work experience.

What is continuous nursing

The concept of “continuous medical experience” is of particular importance for health workers. It should be understood as carrying out work activities without significant interruptions in it, associated, for example, with dismissal and changing the type of activity.

The possibility of obtaining a special category depends on continuous medical experience , which, in turn, determines the accrual of additional allowances to the salary of a medical worker.

In what cases is it interrupted?

In cases where a medical worker is not directly engaged in work activities for a valid reason (vacations, temporary disability, etc.), the special length of service is not interrupted. However, this can happen when a doctor quits his job. In this case, the legislator provided for him a period of one month without interruption of service. If a citizen finds employment in his specialty for more than one month, then the continuous length of service begins to flow again.

Important! In cases where the doctor worked in northern areas classified as preferential territories due to their climatic conditions, this period is increased to two months.

Is length of service taken into account if you work in a private clinic?

Government Decree No. 781 of October 29, 2002 defines a list of not only medical positions, but also the types of health care institutions in which labor activity gives the right to the corresponding benefit.

So, among others, these include:

- general hospitals;

- clinics, outpatient clinics;

- MSCh;

- dispensaries;

- FAPs;

- sanatoriums;

- military hospitals and honey. companies;

- psychiatric clinics;

- ambulance and blood transfusion stations;

- antenatal clinics and maternity hospitals.

It is important to note that the benefits apply to health workers working in the medical field. institutions belonging to different departments and at different levels. However, a necessary condition for this is belonging to state or municipal structures in which citizens can undergo treatment under compulsory medical insurance or due to a certain status (for example, military personnel).

Accordingly, the implementation of medical activities in commercial clinics is not included in the preferential length of service for granting a pension.

Positions for which the calculation is carried out annually for 1 year and 6 months

As already mentioned, there is a certain list of medical workers who, when calculating their length of service, follow the “ year for 1 year and six months ” scheme. According to Government Decree No. 781 of October 29, 2002, this is currently:

- Specialists from surgical departments, hospital workers, burn and oncology departments, orthopedic, otolaryngological, microsurgical departments as:

- doctors of any profile, including directors;

- nurses, senior nurses, midwives and so on.

- Departments, mobile ambulance teams, wards and groups, intensive care anesthesiologists:

- doctors;

- nurses;

- nurse anesthetists.

- Employees of forensic bureaus, laboratories, more specifically:

- doctors and heads of the forensic medical examination bureau;

- nursing staff.

- Employees of pathological and anatomical departments:

- doctors and managers;

- nursing staff.

Additional information about department employees and specialists whose length of service is calculated according to the “one and a half year” scheme can be obtained by reading Government Resolution No. 781.

Rules for applying for a preferential pension

It should be remembered that the size of the pension payment, both for special accruals and regular accruals, consists of a fixed amount, as well as compensation based on points. Currently, the cost of one E-point is 81.49 rubles . The determination of the IPC is carried out for each person individually, in accordance with the final value of work experience, as well as the amount of wages.

To receive a pension payment, a medical worker must contact the branch of the Pension Fund of the Russian Federation at his place of residence, with a corresponding application and a package of documents. The most important thing is confirmation of the work experience . The main list of attached documents includes:

- applicant's passport;

- original and copy of work book;

- insurance certificate (SNILS);

- extract, certificates and other documents that would confirm the person’s actual experience;

- personal application to receive early pension payment.

You can submit documents yourself through the Pension Fund branch or through a representative. In the latter case, you will need to present a notarized power of attorney. In addition, the entire package can be sent by registered mail. In this case, copies pre-registered with a notary are sent.

In some cases, Pension Fund employees may request additional documentation. It could be:

- information on the level of average income at the time of obtaining the right to early retirement;

- confirmation of disability or period of long-term incapacity;

- certificate of actual place of registration or residence.

Submitting documents is free, and no state fees are charged. The processing time for applications is 10 working days. Based on the results of the review, the applicant is notified in writing.

All about whether studying at a technical school is included in the length of service for calculating a pension

- service in the army, the Ministry of Internal Affairs and other government agencies;

- looking after a disabled person: a child or an adult, if he is assigned to group 1;

- caring for an elderly person over 80 years of age;

- sick leave;

- child care up to 1.5 years (up to 6 years in total);

- receiving unemployment benefits;

- performing public works on a paid basis;

- stay in places of deprivation of liberty subject to further rehabilitation;

- living in a marriage with a military man in settlements where there were no employment opportunities (up to 5 years);

- living abroad with a spouse who is an employee of diplomatic departments (up to 5 years).

We recommend reading: Sample declaration for tax deduction for the purchase of an apartment 2019

The size of the pension directly depends on how many years a person or his employer has made contributions to the appropriate fund for him. In order for there to be a basis for calculating a pension, a citizen must have a minimum length of service.

Features of early retirement during the Covid-19 pandemic

On April 6, 2021, Decree of the Government of the Russian Federation No. 1191 was published, according to which the period of work of medical employees with patients with the COVID-19 virus is calculated according to length of service as “ two days ”. This rule applies to the following types of work:

- Providing medical care to patients with coronavirus infection.

- Providing emergency care, including specialized care, collecting biological material for laboratory tests. And also for medical evacuation of persons with suspected coronavirus infection.

- Providing primary health care to citizens diagnosed with COVID-19 on an outpatient basis, including patients with symptoms of ARVI and pneumonia.

Is studying at a medical school included in special experience?

According to the current legislation (Part 1 of Article 11 of Federal Law No. 400 “On Insurance Pensions”), labor service, including special service, includes only periods for which insurance payments are made to the Pension Fund . Accordingly, if we talk about completing training at a medical school, then this period can be included in the length of service only if at that time the person held a full-time position, received a salary and made appropriate contributions.

Similar situations are possible if the employee has undergone advanced training courses, internship, residency, and so on. What is important is that in this case, if appropriate circumstances exist, the period can be calculated according to the “year to year and a half” scheme and the like.

Is studying at a vocational school included in the work experience and where is it noted?

According to the norm of Article 10 of the said law, length of service is the sum of all periods of work of a person with an official salary, provided that contributions were transferred from his salary to the Pension Fund. Until 2021, the total length of service included the following periods of training:

We recommend reading: Benefits for paying housing and communal services for veterans of the Moscow region in the Moscow region

Again, training is not taken into account when calculating length of service for payment of veterans , but there is a note : regional laws (regional, regional, Moscow, Leningrad) may change the procedure for assigning ranks. Therefore, you need to look at regional legal acts to find out whether study is included in your work experience.