Types of pension payments in Russia

A pension is usually called a regular cash payment, which is designed to provide financial support for the residents of the country when they reach a certain age, upon receipt of disability, due to the loss of a breadwinner, or due to length of service. At the present stage in Russia there are several types of pension benefits:

Related articles Who receives a social pension in Russia The right to an old-age insurance pension Recalculation of a disability pension

- on compulsory insurance;

- on state support;

- on optional collateral.

Payments under compulsory pension insurance are assigned upon the occurrence of an insured event. These include reaching the age limit, losing a breadwinner and establishing a disability. The purpose of the insurance pension is to compensate a person for the income that he received during his working activity, or to compensate for the payments that disabled family members had before the death of the breadwinner. The amount of subsidies is determined by the state and is subject to periodic indexation.

The most common type of insurance pension is the old-age pension. It is assigned to men when they reach the age of 60, while women retire at the age of 55. A number of persons have the right to receive an insurance pension at an earlier date. In addition to age, the amount of insurance coverage and the presence of a certain number of pension points are taken into account.

If they have any insurance experience, disabled people of groups 1, 2, 3 have the right to receive a disability insurance pension, and the cause (trauma, injury, occupational disease) and the time of onset of disability do not matter. Provided that the citizen was dependent on disabled citizens, after his death they are assigned payments in connection with the loss of a breadwinner.

Lifetime monthly state pension benefits are financed from the federal budget and assigned to citizens who were in public service. These include:

- military personnel;

- civil servants;

- residents of besieged Leningrad;

- participants of the Great Patriotic War;

- test pilots and astronauts;

- victims of radiation or man-made disasters during service;

- disabled citizens.

State pension has several varieties:

- for length of service;

- by old age;

- on disability;

- in case of loss of a breadwinner;

- social.

Pension in the Russian Federation for non-state provision, or as it is also called, funded, is available to all persons who have expressed their desire to receive it. Citizens can form their pension savings in state and non-state pension funds. This is a kind of investment, the payment of which will be made when a person retires as an addition to the state pension.

The average rate on payday loans in Russia fell to 600 percent

Thus, his pension corresponded to the minimum subsistence level. From January 1, pensions were indexed by 7.05%. Under the old scheme, this pensioner began to receive 8,564 rubles. Considering that this amount exceeded the subsistence level, he was no longer entitled to the FSD.

The monthly cash payment received by federal beneficiaries will increase by 3.2% (from February 1). And state security pensions, including social ones, will increase even more - by 4.1% (from April 1).

Supporting socially vulnerable segments of the population is the responsibility of the state and working citizens. Every pensioner receiving a pension below the subsistence level has the right to demand additional payment to the regional level. It varies depending on the climate and living conditions. At the same time, the cost of a grocery package is on average the same throughout the country.

The monthly old-age payment (the main type of pension) is 13.3 thousand rubles. The size of the social pension is 9 thousand rubles. According to the PFR branch, the insurance pension will be recalculated in August due to an increase in contributions. The maximum amount of increase for working pensioners will be 234 rubles.

Today, more than 98 thousand pensioners of the republic continue to work in various fields. The oldest female worker today is 88 years old, the oldest working pensioner is 90. Both live and work in Izhevsk.

The growth of old-age pensions over the past three years (since 2015) ranged from 5% to 12.1%. On average in Russia the figure increased by 10.3%.

According to Art. 25 of Federal Law No. 166-FZ of December 15, 2001 “On State Pension Provision”, when determining the indexation coefficient, it is necessary to rely on the minimum amount required for living. In 2021, the cost of living for pensioners was 8,846 rubles. According to Rosstat, pensions will increase by approximately 554.71 rubles.

In some regions, the authorities have allocated money to support pensioners during the period of self-isolation extended until the beginning of May. For example, in Moscow they will pay 4,000 rubles, in St. Petersburg - 2,000. Funds come without a request, automatically.

According to the PFR Internet portal, citizens born from 1953 to 1967 are subject to a one-time cash payment.

The legislation of the Russian Federation regulates state support for vulnerable segments of the population, which include pensioners. In Russia, the possibility of ending working life has been established for women at 60 years old, for men at 65 years old.

The highest average pensions in the country are in the northern regions (25 thousand rubles), but prices there are also high.

To apply for a pension, a person who has reached a certain age must visit a branch of the Pension Fund.

However, pensioners also receive more than in Tatarstan in nearby regions - for example, in the Kirov region and Udmurtia. Also, pensioners have higher incomes in the Vologda and Tula regions. The regions with the largest pensions were the districts located in the northern part of the country.

Social security of Izhevsk provides pensioners with various subsidies and benefits. They can pay discounted rates for utilities, have free public transportation, and receive additional cash benefits.

The concepts of “minimum pension” and “living wage of a person who has reached retirement age” are identical. In the next 3 years, pensions will be indexed only according to the level of inflation. If we consider 2021, the pension will be indexed by 4.5%. In addition, pensioners received a one-time payment in the amount of 5,000 rubles due to their permanent residence in the Russian Federation.

When calculating the monthly benefit, all constantly received funds are taken as the basis. One-time transfers are not taken into account.

Let's respect each other and the site where you and other readers come to chat and express their thoughts.

Compared to last year, the number of citizens increased by almost 6 thousand people. And this dynamic has been repeated over the past few years. The average size of the old-age insurance pension is 13,760 rubles, for disability – 9,000 rubles, and in case of loss of a breadwinner – 9,340 rubles. Today, more than 98 thousand pensioners of the republic continue to work in various fields.

In 2021, representatives of the Pension Fund announced an upcoming increase in the cost of living of a pensioner and social benefits. payments accordingly. From 01/01/19, the lower limit will increase by 2.5%. For an individual calculation, find out it based on your area of residence and multiply it by the percentage indicated above.

The minimum pension is provided to those persons who have no work experience. In Izhevsk, the minimum pension is within 8,500 rubles. The minimum wage is 7,500 rubles.

The indicator of a rich and prosperous Tatarstan clearly does not correspond to the status of the region: the republic is in the second half of the list - in 50th place.

Average pension in Russia in 2018

Citizens are assigned different allowances. For example, military personnel in the reserve always receive more than employees of budgetary organizations. The minimum that everyone who is entitled to a payment can count on cannot be below the subsistence level. The regional leadership determines its value, which is calculated taking into account various criteria. This includes lifestyle, climatic conditions, consumption of certain types of products due to cultural or national characteristics, and much more.

If the accrued payment turns out to be below the BPM for the region, the citizen is entitled to an additional payment from the budget until this value is reached. As for the maximum that a person can count on, his length of work, age, and salary are taken into account. Having these indicators, it will not be difficult to derive the average value for Russia.

To determine the average pension in the country, annually the Pension Fund publishes information on the average pension in the Russian Federation and for each region separately. Additionally, you can see information about average values by profession. However, there is no data for 2021 yet, but if you turn to the official information provided by the State Statistics Committee, you can see the following financial indicators:

| Period | Nominal value (average figure), rubles | Real value as a percentage of | Percentage ratio of the average assigned pension and average accrued wages, % | ||||

| corresponding period of the previous year | previous period | December of the previous year | |||||

| 2017 | |||||||

| January | 17426 | 137,3 | 139,3 | 139,3 | 49,3 | ||

| February | 12893 | 99,4 | 73,8 | 102,9 | 36,0 | ||

| March | 12905 | 99,7 | 100,0 | 102,8 | 33,5 | ||

| 1st quarter | 14408 | 112,0 | 114,5 | 39,3 | |||

| April | 12929 | 99,9 | 99,9 | 102,7 | 32,5 | ||

| May | 12923 | 100,0 | 99,6 | 102,3 | 32,1 | ||

| June | 12917 | 99,7 | 99,3 | 101,6 | 30,7 | ||

| 2nd quarter | 12923 | 99,9 | 88,93) | 31,7 | |||

| 1st half of the year | 13666 | 105,9 | 35,3 | ||||

| July | 12911 | 100,2 | 99,9 | 101,5 | 33,4 | ||

| August | 12934 | 100,9 | 100,7 | 102,2 | 34,8 | ||

| September | 12956 | 101,3 | 100,3 | 102,5 | 34,5 | ||

| 3rd quarter | 12934 | 100,7 | 99,9 | 34,3 | |||

| January-September | 13422 | 104,2 | 35,1 | ||||

Nominal pension amount

In Russia, some pension benefits, for example social benefits, have a fixed amount. As for labor, it all depends on how long the person worked and what salary he had. The size of the old-age pension is directly related to the amount of insurance payments that the employer transfers to the Pension Fund. Today this figure is 22% of the accrued amount. For this reason, the longer a person works and the higher his “white salary”, the greater the amount of allowance he can count on in old age.

According to the law, all funds transferred to the Pension Fund are converted into points. Every year, the value of points increases by 2.4, so that by 2025 the value becomes equal to 30. The resulting number is multiplied by the individual pension coefficient - this is an amount in rubles, the value of which is indexed annually taking into account the level of price growth. For 2018, the IPC was set at 78.58 rubles, while for 2018 the value should rise to 81.49 rubles.

It should be taken into account that the figures obtained are nominal, i.e. accrued amount of pension benefits.

According to official information from Rosstat, the average size for the country has the following average values:

| Period | Accrued | Growth percentage | |

| 2016 | 2017 | ||

| 1st quarter | 12299 | 14408 | 117,15% |

| 2nd quarter | 12418 | 12923 | 104,07% |

| 1st half of the year | 12359 | 13666 | 110,58% |

| 3rd quarter | 12416 | 12934 (forecast figure) | 104,17% |

As can be seen from the table above, based on the results of the 3rd quarter, accrued pension benefits will increase by only 518 rubles. The difference will be a little over 4 percentage points compared to the same period in 2021.

The real cost of pensions

In order to understand how much the average income of people applying for a permanent pension has increased, it is necessary to take into account the inflation rate for a certain period and apply it to the accrued amount. According to Rosstat, the real amount for the first half of the year was 0.2% lower than for the same period in 2021. According to the baseline budget scenario, the average pension in Russia will continue to fall in 2021 (expected to be minus 0.7%). For the next two years, negative growth will be 0.6% annually.

It should be taken into account that the calculation takes into account the pension accruals of both working and non-working pensioners. The government plans do not include data on a possible increase in benefits for people who continue to work, and according to estimates there are about 10 million of them. For this reason, there is a real decrease in the average value. There are different opinions on how to achieve an increase in the real value of pension accruals, among which they name, for example, indexation of payments to working pensioners, but nothing has been done so far.

Minimum pension in 2021: table with amounts for all regions

It is now at a record low level (less than 2% since the beginning of the year). As a result, the average insurance pension in the country will be 14,075 rubles. As the Pension Fund explains, more than 40 million people now receive insurance pensions. Almost 3.7 million more people receive pensions under the state pension system.

By the way, pensions for working pensioners will also increase (from August 1). The increase will be a maximum of three pension points (in money this is about 245 rubles). Next year, only the size of maternity capital will not increase. It has been frozen at the level of 453 thousand rubles for several years.

Let’s say a pensioner—a combat veteran—has a pension of 7,000 rubles. He received a federal supplement up to the subsistence level of 1,002 rubles, as well as a monthly cash payment of 500 rubles. According to the new scheme, his insurance pension will be indexed by 493.5 rubles, as well as his daily allowance by 21.5 rubles. Thus, he will begin to receive 9,017 rubles in his hands instead of the previous 8,502 rubles.

This site is a non-commercial information project; it does not provide any services and has no relation to the services provided by the Pension Funds. By the way, in terms of the size of the average pension, most regions do not reach the all-Russian figure - 46. If you look at the federal districts, the average pension in the district is lower than the all-Russian figure in four of them.

According to preliminary calculations, the average size of the insurance pension in the region will increase by 390 rubles. and will amount to more than 13,400 rubles. The cost of the individual pension coefficient (pension point), taking into account which insurance pensions are assigned, is 81.49 rubles.

What is this, an apocalypse? No, high alert mode to prevent the spread of coronavirus infection. Hundreds of Glasovka residents are now forced to follow the advice of Joseph Alexandrovich Brodsky not to leave the room. The task seems simple, but terribly boring.

Previously, the process of assigning a social supplement went like this: the pension was indexed. and if she did not reach the PMP, they gave an additional payment.

First Deputy Chairman of the Bank of Russia Sergei Shvetsov, in an interview with RG, told who the new pension savings scheme would be suitable for.

As before, in 2021 there will be no pensioners in Russia with a monthly income below the subsistence level of a pensioner in the region of residence.

From the table you will see how much the cost of living of a pensioner in your region has increased over 1 year (from 2021 to 2020) and over 2 years (from 2018 to 2020).

That is, RSD is paid when the regional PMP is higher than the federal one (living in the region is more expensive than the average in Russia).

According to numerous reviews from pensioners, the indexation of pensions at the beginning of 2020 was not successful. Citizens receiving a pension at the subsistence level saw subsidies with an unchanged amount or a slight increase.

Different combinations of these factors in different proportions, respectively, give rise to differences in average pensions across regions. There is no goal to equalize the size of pensions for all residents of the country, regardless of place of residence, the Pension Fund clarified.

According to data obtained by the analytical service of Realnoe Vremya, the average size of the most common type of pension in Russia - old age - is 14.1 thousand rubles. Moreover, depending on the region, the figure varies quite significantly - from 11.4 to 25.2 thousand rubles per month, according to data for 2018.

The living wage for a pensioner, which is set by the authorities of each region at the end of the year, essentially represents the minimum pension for non-working pensioners (with some reservations).

According to data obtained by the analytical service of Realnoe Vremya, the average size of the most common type of pension in Russia - old age - is 14.1 thousand rubles. Moreover, depending on the region, the figure varies quite significantly - from 11.4 to 25.2 thousand rubles per month, according to data for 2018.

The living wage for a pensioner, which is set by the authorities of each region at the end of the year, essentially represents the minimum pension for non-working pensioners (with some reservations).

No changes are planned regarding pension payments in 2021. Changes will only affect people who apply for a funded pension.

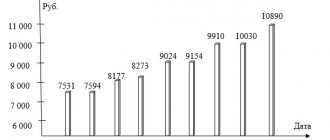

Dynamics by year

At the beginning of the 2000s, Russian pensioners could not boast of large incomes, because the average allowance in the country was only 25 US dollars in equivalent. The loan gradually began to increase in payments, with the largest jump noted in 2010. So over 13 years, the average value increased more than 14 times. Compared to Western European countries, pension accruals remained minimal, but the very fact of growth was obvious. Progress in social security of citizens has been recorded.

The process of increasing pension payments was associated with economic growth and an increase in GDP. However, after 2014 the picture ceased to be rosy. In real terms, the amount of allowance began to decrease, although the nominal value increased. Neither indexation nor one-time additional payments helped. This is due to the systemic crisis and falling oil prices. An additional factor was the increased capital outflow. Real growth was noted in January 2021 by tenths of a percent. In January 2021, the average value increased, but this was due to a one-time payment of 5 thousand rubles.

How will the average pension in Russia change in 2021?

According to the government’s plans and the adopted draft budget for 2018, pensioners can expect a long-awaited increase in payments. This will affect both insurance and social pensions. It was noted that there will be no one-time subsidies, as there were in 2021, but indexation will be applied based on the planned inflation rate in the country. According to the information announced, the average pension in Russia in 2021 will be increased for working pensioners. However, this will happen not by indexing payments, but by increasing the value of the individual pension coefficient to 81.49 rubles.

The government's plans for 2021 do not address the issue of raising the retirement age, which would help reduce the cost of paying benefits. On the other hand, this would make it possible to reduce the burden on the budget due to large contributions to the Pension Fund and lower costs of payments. According to the Russian leadership, there will be enough money in the budget for the planned increase in allowances.

Indexation of insurance pensions by age

Traditionally, the increase in labor pensions in Russia occurs in February. This is due to the fact that by this time there are official data on the growth of inflation in the country for the last year period. This information is extremely important, since this value is used to determine the indexation of pension benefits for the coming year.

An increase is planned for 2021 in January. The people's representatives took this step to increase the total income of the population at the end of 2021. According to preliminary data from Rosstat, inflation for the previous year will not go beyond 3–3.5%, so it was decided to increase pension benefits by 3.7%. Thus, the average value is expected to be 14,075 rubles in 2021.

Increasing the social old-age pension

Old-age social pensions are awarded to people who have reached retirement age but have not accumulated the required length of service. According to the law, in 2021 it was 8 years, and from 2021 it should be 9 years. Unlike the labor pension, it is assigned provided that the man has reached 65 years of age, and the woman has reached 60 years of age. To calculate benefits, you must contact your local branch of the Pension Fund.

The old-age social pension is small and is indexed annually. As a rule, this happens from April 1st. 2021 is no exception, so from now on it is planned to increase social benefits by 4.1% compared to the previous year. According to preliminary calculations, this will help raise the payment to a value equal to 9045 rubles. (national average).

Increase in pensions for disabled people and survivors in 2018

Pension payments in the event of the loss of a breadwinner are assigned to those persons who are classified as dependents - citizens who are fully financially supported by another person. These include:

- minor children, including adopted children;

- persons who are full-time students but have not reached 23 years of age;

- disabled relatives (parents, spouses, grandparents);

- sisters and brothers;

- grandchildren;

- unemployed close relatives who care for the children of the deceased until they turn 14 years old.

The average social pension in Russia in 2021 for the loss of a breadwinner is set at the following level, taking into account an increase of 4.1% from April 1:

| 2017 | 2018 | |

| upon the loss of one parent | 5 034,25 | 5240,65 |

| with the loss of both or a single mother | 10 068,53 | 10481,34 |

Disabled people, depending on the group, will receive the following payments:

| 1 group | 10 068, 53 | 10481,34 |

| 2nd group | 5 034,25 | 5240,65 |

| 3 group | 4 279,14 | 4454,58 |

| Disabled children | 12 082,06 | 125773,42 |

| Disabled people of group 1 (from childhood) | ||

| Disabled people of 2 groups (from childhood) | 10,068.53 rub. | 10481,34 |

The monthly subsidy intended for caring for a disabled child and a person disabled since childhood of group 1 will be 5,500 rubles.

What does the amount of pension depend on?

The average size of pension accruals in Russia, although it has a specific value, does not reflect the real picture in the country. This is due to the fact that the amount of payments to pensioners is influenced by many factors. These include:

- fixed part of the insurance pension - established by the Government of the Russian Federation, valid for a year;

- funded – depends on the insurance premiums paid by the employer;

- indexation to the inflation rate for the previous year;

- the size of the regional subsistence minimum for a pensioner (PMP);

- industry support for individual professions.

The average pension in Russia in 2021 is 14,100 rubles. Each region calculates its own pension payment indicators, which are influenced by the following factors:

- economic indicators;

- the size of the regional budget;

- pensioner's profession;

- position, title;

- length of service;

- work experience;

- territorial coefficient;

- regional surcharges;

- presence of disability.

- Changes in insurance premiums in 2021

- Nail fungus removal

- Julienne in pots - how to cook according to step-by-step recipes with chicken, mushrooms or potatoes

Indexation of pension payments

According to Federal Law No. 400-FZ of December 28, 2013, pension accruals for non-working pensioners are subject to annual indexation. Its value depends on the inflation rate of the previous year. This indicator is taken into account when calculating the average pension in Russia.

Indexation is not available to citizens who continue to work after reaching retirement age.

In 2021, there was an increase in financial support:

| Type of pension | Indexation period | Height, % | |

| Insurance | 01.01.18 | 3,7 | |

| Social | 0.1.04.18 | 4,1 | |

| Social payments of the Pension Fund of the Russian Federation | 01.02.18 | 2,5 | Monthly cash payment A set of social services (travel, medicines) Funeral benefit |

Taking into account the indexations carried out, the average amount of payments to pensioners for 2021 is:

| Type of pension | Accrual | Size, r. |

| Insurance | By old age | 14100 |

| By disability | 8738 | |

| For the loss of a breadwinner | 8869 | |

| Social | 9062 | |

| For disabled children | 13410 |

Distinctive features by region

Pension payments in each region of Russia have different average values, since the amount of the minimum allowance is set by local authorities in accordance with the cost of living in force in a given region. Traditionally, residents of the Far North and Moscow pensioners receive the most. For a more clear example, you can see the numbers in the table below, which identifies the subjects with the largest and smallest monetary allowance:

| Region of Russia | Amount of allowance, rubles | |

| 2017 | 2018 | |

| Chukotka Autonomous Okrug | 20197 | 20 944 |

| Nenets Autonomous Okrug | 17550 | 18 199 |

| Moscow | 12147 | 17 500 |

| The Republic of Sakha (Yakutia) | 16813 (1 zone); 14240 (2 zone) | 17435 (1 zone); 14763 (2 zone) |

| Kamchatka Krai | 16540 | 17 151 |

| Magadan Region | 15700 | 16 280 |

| Yamalo-Nenets Autonomous Okrug | 14270 | 14 797 |

| Sakhalin region | 12754 | 13 225 |

| Murmansk region | 12052 | 12 497 |

| Arhangelsk region | 11876 | 12 315 |

| …………………………………………………… | ||

| Ivanovo region | 7902 | 8 194 |

| Chuvash Republic | 7856 | 8 146 |

| The Republic of Ingushetia | 7815 | 8 104 |

| Ryazan Oblast | 7713 | 7 998 |

| Saratov region | 7687 | 7 971 |

| Orenburg region | 7485 | 7 761 |

| North Ossetia | 7335 | 7 606 |

| Karachay-Cherkessia | 7224 | 7 491 |

| Bryansk region | 7066 | 7 327 |

| Kursk region | 6793 | 7 044 |

How much is the pension based on the subsistence minimum?

According to the law, the minimum pension benefit cannot be less than the subsistence level in a particular region. If less is accrued, an additional payment is due up to the BPM value. The cost of living is determined by the government of the Russian Federation and the regional administration. The established federal value is taken into account by local governments, and it is impossible to pay below this level.

The living wage is the amount of money that is necessary to preserve the health of a citizen and ensure his normal functioning. The basis of the BPM is:

- food basket (vegetables and fruits, potatoes, cereals, fish, meat, eggs, etc.);

- non-food products (medicines, shoes and clothing);

- communal payments;

- using public transport.

Here are just some values by city:

| City | Average accrued payout | Living wage | Ratio |

| Murmansk | 15150 | 8840 | 171,38% |

| Khabarovsk | 13331 | 8012 | 166,39% |

| Moscow | 12400 | 8502 | 145,85% |

| Saint Petersburg | 12400 | 6258 | 198,15% |

| Ekaterinburg | 11400 | 6354 | 179,41% |

| Tyumen | 11181 | 5882 | 190,09% |

| Ufa | 10870 | 6070 | 179,08% |

| Rostov-on-Don | 10610 | 6350 | 167,09% |

| Smolensk | 10489 | 6335 | 165,57% |

| Kaliningrad | 9448 | 6354 | 148,69% |

Other cash bonuses and benefits

Analyzing the data on minimum payment amounts, you can see that not everywhere these figures reach the declared 8,703 rubles. In this case, the citizen is entitled to an additional payment from the state (this applies only to non-working pensioners). In addition, he must permanently reside on the territory of the Russian Federation. Federal benefits also include travel on public transport at special rates. In addition to allowances, older people are offered security provided by the government of the subject. This could be additional cash payments, provision of medicines and food, or sanatorium-resort treatment.

Don't miss: Matkapital: one-time payment

Average pension size in 2021 for certain categories of citizens

Special attention is paid to benefits for length of service. Not all citizens receive it, but only those defined by law. Longevity pay is not awarded upon reaching a certain age, but based on the amount of time worked. The payment is compensation for difficult working conditions over a long period of time, which can lead to deterioration of health and affect the quality of work performed.

Occupations that may qualify for long service accruals include:

- federal state and municipal employees;

- workers in underground or mining operations;

- emergency services workers;

- civil aviation employees and astronauts;

- public sector employees (medics, teachers, cultural workers);

- river and sea fleet employees in the fishing industry;

- military;

- law enforcement officers.

Pension provision for public sector employees

It is still not legally defined who representatives of the public sector are, but it is understood that these are workers in education and health care, social services, culture or science. These categories have the right to early retirement after working a certain amount of time. Additionally, they are entitled to allowances from the federal and regional budgets and certain benefits.

There was no separate information about the possibility of increasing the state pension, so former public sector employees have the right to expect an increase related to insurance or social pensions. If they have the necessary insurance experience and the required number of points, their allowance will increase from the first of January. Otherwise, they have the right to count on increased payments only from April.

Average military pension in 2021

Certain categories of Russian citizens have the right to receive military pensions, which include:

- military personnel through the Ministry of Internal Affairs;

- employees of the state fire service;

- employees of authorities involved in the control of the circulation of psychotropic and narcotic drugs;

- National Guard members;

- employees of the penal system.

Unlike other groups of the population, they have the right to receive two pensions - one from the Ministry of Defense or Internal Affairs, and the other depending on the time worked (social or labor). The last increase dates back to 2021 due to an increase in monetary allowance, which is a reducing factor when calculating allowance and today is 72.23%. According to preliminary data, Russian citizens who have retired or been transferred to the reserve from military service will not receive another increase in 2021.

Civil servants' pension

In 2021, civil servants will face another increase in the retirement age, which will be 61 years for men and 56 for women. The minimum length of service in the position must be at least 16 years with a further increase to 20. The calculation principle will not change and will be tied to the salary of the civil servant at the last place of work. The maximum will be 755, while the minimum is fixed at 45%. For each additional year of service there is a 3% increase.

Pension in the Russian Federation

Average indicators of social payments today do not reflect the real problems of the population's security. Speaking about the average values of pension payments, it should be borne in mind that the minimum and maximum values of these indicators vary greatly. Statistical data for the Russian Federation:

- the size of the social pension in 2021 is 9,062 rubles;

- military personnel with disabilities - 12,688 rubles;

- social assistance for persons who have lost their breadwinner from among military personnel or conscripts is 10,746 rubles;

- veterans and disabled people receive 30,000 rubles.

Average indicators depend on the region, profession, and type of pension payments. In the capital region, this figure is 15,200 rubles. And the statistics on paid pensions are as follows:

- retirement age – 14,075 rubles;

- disabled categories - 8,700 rubles;

- social payments - 9,045 rubles;

- employees of law enforcement and paramilitary structures - 25,400 rubles.

Thanks to indexing, averages also change. Insurance increases, of course, do not fully solve the problems of citizens due to inflation. At the beginning of 2021 and 2021, indexations of 3.7% were carried out.