The procedure for transferring a pension from Kazakhstan to Russia when a pensioner moves

Citizens of Kazakhstan are equal in rights to Russians in terms of pension provision if they reside in the territory of the Russian Federation legally and intend to remain for permanent residence.

| The sequence of actions of a Kazakh when transferring a pension to the Russian Federation (what needs to be done) | Key Points to Pay Attention to |

| Upon arrival on the territory of the Russian Federation, legalize your residence | Legalization of stay includes: · registration through the territorial body of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs; · registration of the appropriate residence status (residence permit, refugee, migrant) In the absence of a residence permit (without confirmation of permanent residence), transfer of a Kazakh pension to Russia is impossible |

| Withdraw from pension registration in Kazakhstan | The migrant must notify the Kazakh pension service about his move and deregister |

| Contact the territorial body of the Pension Fund of the Russian Federation at the place of registration (actual residence) to assign a pension and wait for a response | The general procedure applies, namely: 1. The migrant submits an application in the form and appropriate documents. 2. The registrar issues him a receipt for acceptance of documents. 3. After 10 days of consideration, the applicant is given a response. 4. The assignment of pension payments is carried out from the date of submission of documents. 5. Payments are made using one of the methods chosen by the applicant (options: by bank card, by mail, etc.) |

The amount of pension payments at the new place of residence is revised taking into account the norms of the current legislation of the country of resettlement.

A citizen of Kazakhstan permanently residing on the territory of the Russian Federation has the right to initially apply for a pension at his place of residence in Russia. The circulation scheme is similar. First, an application is written, documents are collected, then everything is sent together to the territorial branch of the Pension Fund for registration.

Important! The Russian pension includes a fixed and insurance component. Details about this norm and the calculation of pension payments are in Article 15 , as well as Art. 16 Federal Law No. 400 dated December 28, 2013 . The amount of payment depends on the length of service, contributions made, and the price of the insurance point.

Agreement between the CIS countries on the provision of guarantees for the right to pay pensions

In 1992, the CIS member countries signed an agreement that still regulates the issue of pension provision for citizens of post-Soviet republics moving for permanent residence to one of the signatory countries.

The document says:

- the provision of pension payments to citizens of the countries participating in the agreement is carried out in accordance with the laws of the state in which they live;

- all payment costs are borne by the country that pays the pension;

- benefits are assigned only at the place of residence;

- the applicant’s work experience includes all years of work recorded in the territory of any of the participating states or in the USSR until the time the agreement came into force;

- When pensioners resettle, the provision of benefits in the country of previous residence is terminated if payment of the same purpose is provided for at the place of new residence.

Thus, how a pension is calculated in Russia for migrants from Kazakhstan depends on the standards in force in the Russian Federation at the time the applicant retires, taking into account the conditions set out in the agreement.

In addition to Kazakhstan, the signatories of the agreement today are Ukraine, Turkmenistan, Armenia, Belarus, Kyrgyzstan, Turkmenistan, Tajikistan, and Uzbekistan.

Is it possible to transfer a pension from Kazakhstan to Russia?

To move and transfer their pension payments to the Russian Federation, a citizen of the Kyrgyz Republic will have to perform several actions:

- It is legal to cross the Russian border.

- Register with the migration service.

- Obtain the status of a migrant, refugee or obtain a residence permit.

- Notify the Pension Fund of Kazakhstan that you have changed your place of residence and withdraw from the pension register in your country.

- Submit documents related to work experience to the Russian Pension Fund.

After a special commission examines the submitted documents and the candidate’s pension file and confirms their accuracy, it will set the amount of the monthly payment. All payments are transferred to a card account, which the pensioner must register by that time.

As an option, the pension can be delivered to the recipient by mail in the manner prescribed by law. Transferring a pension from Kazakhstan to Russia when moving for permanent residence is impossible if the applicant does not have a residence permit.

How to apply for a pension

So, we found out that we can move on to the issue of processing payments only when our stay in the Russian Federation is legalized. That is, it will be clear that the citizen intends to settle in Russia on a permanent basis. To ensure that the process does not drag on, it is very important to know exactly what documents the candidate will need and how much he can expect.

Preparing documents

You can receive pension savings when moving to Russia from Kazakhstan on the basis of the following package of papers:

- Residence permit.

- Passport.

- Work book, which records the existing experience.

- A certificate from the pension fund of the country of citizenship stating that the applicant does not receive payments at the place of previous residence or that they have been discontinued.

- Certificate from the place of new residence.

- A certificate fixing the amount of insurance premiums.

If we are talking about a disability pension, then you will need a medical document and a certificate of family composition, including dependents. To assign a pension in the event of the loss of a breadwinner, you must attach to the package of documents a certificate of death of the breadwinner, documents that can confirm your relationship with him, a certificate of income or lack thereof. IDPs and refugees will definitely need a certificate confirming their status. According to the agreement signed by the CIS countries, legalization of documents for submission to the Pension Fund of the Russian Federation is not necessary.

Payment amount

To be able to withdraw pension savings, you will need a card account. But in order for the funds to go to him, payments will have to be recalculated. It is produced under the following conditions:

- Old age pension benefits are accrued when the applicant reaches the appropriate age and has at least 15 years of experience. In this case, the pension coefficient must be at least 30 points (depending on length of service).

- Disability benefits - to recalculate, you will have to re-pass a medical and social examination (MSEC) already on the territory of the Russian Federation and confirm your disability.

- In the event of the loss of the main breadwinner, it is necessary to confirm the death of this person and provide the documents specified above.

- By length of service - if you have harmful work experience or work in a certain position.

A pension on any of the above grounds includes two components:

- fixed payment (takes into account the norms of Article 16 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”);

- insurance (calculated in accordance with Article 15 of Federal Law No. 400).

The fixed amount of the old-age pension today is 4,558.93 rubles, and for the loss of a breadwinner and disability - 2,279 rubles.

The insurance pension is calculated using the formula: IPC (individual pension coefficient, which depends on contributions made to the Pension Fund) multiplied by the value of the pension point (in 2021 - 74.27 rubles). A fixed amount is added to the result obtained.

Thus, what kind of pension a Kazakhstan pensioner will receive when moving to Russia will depend on previous contributions, length of service and the value of the point, the amount of which increases every year.

If the country paying the pension uses a national currency, payments are calculated based on the official exchange rate at the time the benefit is awarded.

Documents required to assign pension benefits in Russia

A citizen of Kazakhstan can check the final list of documents that must be submitted for assignment (transfer) of a pension directly with the territorial office of the Pension Fund of the Russian Federation. The basic package of documents will be as follows.

| Document's name | Clarifications |

| Identity document | Passport |

| Standard application form for granting a pension | Application form |

| Resident card | For foreigners |

| Passport of a citizen of the Russian Federation | For Russians |

| Document confirming refugee status | Served by refugees |

| Work book, certificate of contributions | Other documents confirming the existing experience, as well as average monthly earnings for the period before 01/01/2002 |

| A document confirming the termination of pension payments in Kazakhstan | Draws up and issues the relevant branch of the Pension Fund of Kazakhstan |

| Disabled person's certificate | Attached when applying for a disability pension |

| Death certificate of the breadwinner | Necessary for granting a pension due to the loss of a breadwinner. Along with it, a document confirming family ties with the breadwinner is submitted. |

The application form for filling out can be downloaded on the website of the Pension Fund of the Russian Federation or taken when submitting documents. The format of the document is presented in Appendix No. 1 to the Administrative Regulations of the Pension Fund of the Russian Federation (Order of the Ministry of Labor of the Russian Federation No. 279n dated June 6, 2016).

The applicant has the right to submit documents in person, send by mail or remotely (via the State Services portal), as well as through an authorized representative. For incapacitated or minor citizens, the application is filled out and submitted by their legal representative. At the same time, he indicates his personal data and signs the application himself.

Social payments

Social benefits from the State Social Insurance Fund increase every year.

Video material about social payments in Kazakhstan:

Survivor's pension

Family members have the right to receive social benefits in the event of the loss of a breadwinner.

The pension is assigned:

- Persons under 18 years of age (children, brothers and sisters - if they do not have parents);

- Persons over 18 years of age if they have a disability that appeared before they turned 18;

- Persons studying full-time at any secondary or higher educational institution (up to 23 years old);

- Relatives of the deceased who are raising his child/children (up to 3 years old);

- Guardians (per child for each lost parent).

The survivor's pension is calculated from the number of disabled citizens living in the family:

| Number of disabled family members | Amount (tenge) |

| 1 | 21 035 |

| 2 | 36 444 |

| 3 | 45 250 |

| 4 | 47 940 |

| 5 | 49 652 |

| 6 or more | 51 609 |

It is important to know! Pension in Uzbekistan

The amounts depend on the subsistence level (subsistence level). For family members of military personnel, the amount of payments increases by 0.25 monthly wages for each member.

Disability pension 1st group

Disabled children (from 16 to 18 years old), disabled since childhood, disabled people with general illness receive a benefit in the amount of 1.78 monthly wages. Military personnel, special services workers:

- 1.78 PM – for disability received outside of working hours;

- 2.74 PM - for disability received in the performance of official duties.

Conscripts - 2.11 PM. In addition, disabled people of group 1 have the right to receive a Special State Benefit:

- 1.49 MCI – disabled people with general illness, disabled children (16-18 years old);

- 0.96 MCI – disabled children (under 16 years old).

The amount directly depends on the PM coefficient, which increases every year.

Errors when applying for pensions for citizens of Kazakhstan in the Russian Federation

Error 1. Usually on the territory of Russia, documents of foreign countries are subject to legalization, since without this they are not accepted. As for documents issued by Kazakhstan and relating to pension provision, the situation is different.

Art. 11 of the Agreement regarding pension provision, signed by the CIS member states, establishes the following. The specified documents, if they were issued by the CIS member states or before December 1, 1991, are recognized in the territories of these states without legalization. The same norm applies to states that were part of the USSR.

Thus, Kazakh documents regarding pension provision can be submitted to the Pension Fund of the Russian Federation without legalization.

Error 2. Pensioners who have registered and received a pension in Kazakhstan, when moving to permanent residence, can begin applying for a pension at their new place of residence, following the general procedure. The opinion that the pension transfer is carried out automatically or is issued immediately upon arrival in the territory of the Russian Federation is erroneous.

First, a Kazakh needs to legalize his stay in Russia and obtain a residence permit. Without this, the Russian Pension Fund will not assign pension benefits, even if a citizen of Kazakhstan has already applied for and received a pension in his homeland.

Example 1. Pension provision for a citizen of Kazakhstan when moving to Russia

A pensioner, a citizen of Kazakhstan, moved to Moscow with her daughter. She is granted Russian citizenship according to a simplified scheme, since she is a participant in the State Program for the Voluntary Resettlement of Compatriots.

The pension issued in Kazakhstan is preserved and will be paid to her on the territory of the Russian Federation. The procedure and right to provide pensions to citizens of Kazakhstan is stipulated by the relevant Agreement of the CIS member states of March 13, 1992.

Example 2. Old-age pension for a citizen of Kazakhstan who has received Russian citizenship

A citizen of Kazakhstan moved to his children in Belgorod, where he received Russian citizenship. The migrant has 5 years of work experience and will soon turn 60 years old.

Upon reaching the specified retirement age, he has the right to apply for an old-age pension. Registration is carried out in the general manner when contacting the territorial branch of the Pension Fund of the Russian Federation at the place of permanent residence. He can confirm the fact of permanent residence by presenting a Russian passport with a mark of valid registration at the place of residence.

Kazakhstanis will be able to receive pensions in Russia, Belarus, Armenia and Kyrgyzstan

A year ago, on December 20, 2021, the countries of the Eurasian Economic Union (EAEU) signed the Agreement on pension provision for workers of the EAEU countries. This document provides for citizens of the association to receive a pension for work not only in their homeland, but also for periods of work in other EAEU countries.

This is not just an agreement - it is a list of pensions, a mechanism for their export. And, of course, protecting the right to pension of migrant workers, who until now could not claim pension benefits if they worked for a long time not in their own country, but in another, as an expat or guest worker.

Initially, it was decided that each state would assign and pay pensions according to its own legislation. And this is the basis. But at the same time, despite the differences in the pension systems of the countries of the Union, work experience acquired in the territories of the EAEU member states both before and after the entry into force of the agreement, as well as experience acquired during the times of the former USSR, will be taken into account.

The bill on ratification of the agreement has already been approved by parliament and sent to the President of the Republic of Kazakhstan for signature. It is expected that it will come into force at the beginning of 2021.

So, what changes await citizens of the EAEU states?

What pension benefits will migrant workers receive?

Aloud about forced vaccination 08/09/2021 15:301179

The agreement encourages migrant workers to work legally, because they will be able to receive pensions from countries where they worked for 12 months or longer. This is the most important innovation.

In accordance with the Agreement, a member state of the EAEU pays a pension to a worker based on his work experience acquired in the territory of this state. At the same time, the formation of a worker’s pension rights and the assignment of a pension to him are carried out on the same conditions as for citizens of this state.

And what is important, if the work experience acquired in the territory of one state is not enough for the worker to have the right to a pension in accordance with the legislation of that state, it is allowed to take into account the work experience acquired by the worker in the territories of other EAEU countries. The only exception is cases when such length of service coincides in time.

The document also establishes that the assignment and payment of a pension in accordance with the legislation of one state that is a member of the union does not affect the right of a worker to the simultaneous assignment and payment of a pension in accordance with the legislation of another state.

What pensions does this agreement apply to?

Rich schoolchildren are 3 years smarter than poor ones 05/31/2021 14:0011832

Those workers who worked legally in Kazakhstan and paid social and pension contributions for at least one year can count on the following pension payments: pension payments from the UAPF at the expense of generated pension contributions; upon reaching retirement age; when establishing disability of the first and second groups, if the disability is established indefinitely; lump sum payment to heirs.

Those citizens who worked in Russia can count on receiving an insurance pension for old age, disability or loss of a breadwinner, as well as a fixed payment to the insurance pension, an increase and (or) increase in the fixed payment to the insurance pension and an additional payment to the insurance pension , unless otherwise provided in this Agreement. In addition, they are entitled to a funded pension and other payments from pension savings, if any.

The shortest list of pension benefits is from Belarus. If you worked there temporarily, or always lived there, and then decided to move to another country in the common space of the EAEU, then you are entitled to an old-age labor pension for length of service (except for pensions of military personnel, persons equivalent to them, members of their families and civil servants), for disability, in case of loss of a breadwinner. Quite a Soviet set.

In Armenia, a mandatory funded pension is added to the Belarusian set in the form of an annuity, a program payment, a lump sum payment or a lump sum payment to heirs.

Kyrgyzstan, and that, unlike Belarus, will add to the pension ration the accumulative part of the pension from the state accumulative pension fund; payments from pension savings from the state accumulative pension fund.

There are few rich people, but their incomes are stable 08/04/2021 12:302473

It should be taken into account that when a worker (family member) is resettled from the territory of one member state to the territory of another, if the right to a pension was exercised before the resettlement, it is reviewed.

What kind of pension should you dream about?

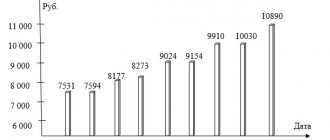

Unfortunately, the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Kazakhstan still does not have data on average pensions in the EAEU countries for 2021. And in 2021 there was the next gradation.

First place goes to Russia. In dollar equivalent – 193. Second place goes to Belarus, with $176. Only then comes Kazakhstan - the average pension in our country in 2021 was $157.8. True, last year, due to the devaluation of the tenge, it dropped to $150.5.

Well, outsiders in pension provision are Kyrgyzstan (the average pension in 2021 was $128) and Armenia (only $84).

Even from this short sample, it is clear where the average pensioner lives best...

***

© ZONAkz, 2021 Reproduction is prohibited. Only a hyperlink to the material is allowed.

Answers to frequently asked questions

Question No. 1: A citizen of Kazakhstan lived in Astana until 2008. Currently she is a citizen of the Russian Federation and is planning to apply for a pension. Is it possible to use the average monthly earnings for the period of work in 2000-2001 to assign it?

Can. The Agreement of the CIS countries in the field of pension provision dated March 13, 1992 obliges to take into account the length of service accumulated by a pensioner in the territory of the CIS member countries. The procedure, rules for calculating and calculating this length of service are determined by Russian pension legislation.

Thus, pension payments for Kazakhs can be calculated in accordance with clause 3 of Art.

30 Federal Law No. 173 of December 17, 2001 “On labor pensions in the Russian Federation.” To do this, you can take the average monthly earnings in 2000-2001, information about which is taken from personalized records. Therefore, a citizen of Kazakhstan needs to provide this information from the individual records of Kazakhstan. Rate the quality of the article. We want to be better for you:

Migration of pensioners from the Republic of Kazakhstan to Russia

Every year, a large number of citizens of the Republic of Kazakhstan decide to live in Russia. Following the youth, representatives of older generations are rushing to apply for a temporary residence permit, and then a residence permit. Many reunite with young members of the family, because in their old age they need help.

Legislative framework of the Russian Federation in relation to moving pensioners

For Kazakh pensioners, a pension in Russia when moving from Kazakhstan has become possible thanks to the Agreement concluded by some CIS countries. It provides guarantees in the field of pension provision. This document, dated March 1992, was a fair step by the Russian government and the governments of other participants towards the citizens who once lived in the Soviet Union.

Citizens of the states that signed the document can receive a pension both at home and when moving to the Russian Federation.

Watch the video: Pension in the Russian Federation for visiting pensioners from Kazakhstan.

Guarantees of the Agreement

Pensioners of each state receive the same guarantees on the territory of any of the participating countries. Just as Kazakhs have the right to apply for a pension in Russia, Russians have the right to apply for pension provision on the territory of Kazakhstan when relocating.

The agreement guarantees the following:

- If those who moved to a new place are entitled to social benefits, the accrual of similar benefits at the old place of residence will be stopped.

- When calculating a pension, the work experience of the applicant will take into account all years of work in any of the states, as well as in the Soviet Union before the entry into force of the Agreement.

- Benefits are assigned exclusively at the place of residence.

- The costs of all payments described are borne by the country making the payments.

- Pensions for retirees are provided in accordance with the laws of the country in which they reside.

So, the payment of pensions to migrants, if they are visitors living in the Russian Federation, is made on the basis of the laws of the Russian Federation. Payments are calculated based on the standards established in the Russian Federation.