Determining close relatives is not difficult in everyday life, since people usually consider all blood and step-relatives from the same generation or from the closest generations to be close.

But from a legal point of view, the concept of kinship has a more complex and ramified interpretation. We will consider further who are close relatives according to the Family Code and other legislative acts.

The concept of “close relatives” in the legislation of the Russian Federation

Constitution

Article 51 of the Constitution of the Russian Federation affirms one of the principles of criminal law - “no one can be obliged to testify against himself, against his spouse and close relatives” - while indicating that the circle of close relatives is determined by federal legislation . First of all, such a legislative act is the Family Code of the Russian Federation, as well as other legislative acts that we will consider below.

Family law

According to Article 14 of the RF IC, close relatives are...

- children and parents;

- grandfathers, grandmothers and grandchildren, granddaughters;

- sisters and brothers (full - having common parents, not full - having a common father or mother).

Administrative legislation

According to Article 25.6 of the Code of Administrative Offenses of the Russian Federation, close relatives include...

- children and parents;

- adopted children and adoptive parents;

- siblings;

- grandfathers, grandmothers and grandchildren, granddaughters.

Criminal procedural law

Article 5 of the Code of Criminal Procedure of the Russian Federation expands the circle of close relatives compared to the administrative law...

- husband and wife;

- children and parents;

- adopted children and adoptive parents;

- siblings;

- grandfathers, grandmothers and grandchildren, granddaughters.

According to the norms of the Constitution and criminal procedural legislation, the listed persons have the right to refuse to testify in the investigative process and in court against close relatives.

Housing legislation

In housing legislation there is no concept of “close relatives” at all.

But according to Article 31 of the Housing Code of the Russian Federation, members of the homeowner’s family are husband and wife, children and parents. In addition, the owner has the right to move into the residential premises any person, even if he is not related to him by family ties. And this person will be recognized as a “family member”.

Tax law

Clause 18.1 of Article 217 of the Tax Code of the Russian Federation, speaking about close relatives, makes reference to the above-mentioned Article 14 of the RF IC. For them, tax legislation provides special privileges - income from transactions made between close relatives is not taxed.

Also, tax is not paid on gifts and inheritances. Even the amount of the state fee that must be paid when entering into an inheritance depends on the degree of family ties.

Close relatives pay only 0.3% (no more than 100 thousand rubles), the rest - 0.6% (no more than 1 million).

rub.).

Is your spouse a close relative or family member?

From the above it is clear that the Civil Code (Article 37), Family Code (Article 14), Administrative Code (Article 25.6) and the Tax Code of the Russian Federation (Article 217) separate the concept of “close relative” and “spouse”.

Since the most complete concept of “close relatives” is given in Article 14 of the Family Code of the Russian Federation and many other branches of law take this concept as a basis, we will proceed from it. It follows from Article 14 of the Family Code that the concept of “close relatives” is based on blood relationship, which the spouses do not possess. According to Article 2 of the Family Code, spouses are recognized only as family members, on an equal basis with parents and children. Consequently, the spouse in family relations is not recognized as a close relative, but only as a family member.

The basis of a family is considered to be a married couple - a man and a woman, and all statistical classifications of family composition are based on the addition of children, relatives, spouses and other relatives and close relatives (in-laws) to this basis. Therefore, the concept of “family member” can be defined as follows: a family member is a person who is in a relationship of marriage, kinship, adoption, property, or actual cohabitation and running a common household with another person.

Modern society knows the following ways of creating a family (family membership): adoption by a single adoptive parent of a minor child; adoption of a child (children) into a foster family by a single caregiver; the birth of a child as a result of the actual cohabitation of his parents; the birth of a child by a single mother; actual cohabitation of a man and a woman; cohabitation of relatives of varying degrees of kinship; union of same-sex persons.

Not all of these family forms are recognized by the Russian legislator.

Is the ex-spouse a close relative or family member?

Kinship relations must be maintained on the date of transfer of property into the ownership of the donee individual. Therefore, if the husband gave his wife a car in 2012, and in 2014 (on the date of filing the return) they were already divorced, then this does not oblige the ex-wife to pay tax on the expensive gift. She will only need to submit a declaration to the tax authority and attach documents confirming the existence of a legal marriage with the donor on the date of receipt of the car.

In a letter dated 10/07/2010 No. 03-04-05/10-606, the Russian Ministry of Finance indicated that the former spouse is not a family member or a close relative; income received under an apartment donation agreement by former spouses is subject to personal income tax.

Are persons in a civil marriage considered close relatives or family members?

Actual marriage relations (the so-called “civil marriage”) currently in Russia do not entail the emergence of family rights and obligations; therefore, the benefits provided for in paragraph 18.1 of Article 217 of the Tax Code do not apply to such relations, since such relations are not legalized between However, only when a gift is made between legal spouses, income tax for an individual is not levied (paragraph 2 of clause 18.1 of Article 217 of the Tax Code).

Are they close relatives...

…husband and wife

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

However, marriage is a special type of relationship, secured by a special document (marriage certificate), a legal union that implies many privileges, including:

- Right of inheritance . In the absence of a will, the widow or widower is the first priority claimant to the inheritance along with the children and parents of the deceased, despite the lack of blood relationship (see “Is the inheritance divided between spouses?”);

- Joint marital property . Everything that is acquired by a husband or wife during their legal marriage belongs to them on equal rights, regardless of who acquired it and with what means. If necessary, joint property can be divided equally.

Adult citizens of different sexes can enter into marital relations, except in cases...

- one of them is legally married;

- presence of blood relationship (mother and son, father and daughter, grandfather and granddaughter, grandmother and grandson, brother and sister);

- the existence of a relationship between an adoptive parent and an adopted child;

- one of them has incapacitated status;

...ex-spouses

Former spouses, that is, husband and wife who have legally dissolved their marriage, lose all relations with each other. They are no longer family members and do not have the special privileges that the law grants to spouses (see “Is the ex-wife an heir”).

…grandmother

The grandmother is a close relative for her grandson and granddaughter in accordance with Article 14 of the RF IC and other legislative acts.

A grandfather, like a grandmother, is a close relative to a grandson and granddaughter.

A grandson and granddaughter are a close relative to the grandparents on the father's or mother's side.

...mother-in-law

The father-in-law and mother-in-law are not relatives - in relation to the daughter-in-law, father-in-law and mother-in-law - in relation to the son-in-law. The law calls such relationships a property. This category also includes the relationship between stepfather, stepmother and stepson, stepdaughter, as well as other relationships. However, relatives can be considered family members.

…brother or sister

Full-born (born from a common father and mother) and not full-born (born only from a common father or only from a common mother) are close relatives.

…cousin or brother

Unlike siblings, the law does not classify cousins as close kinship. For example, if we are talking about inheritance, then they relate only to the third line of heirs, and then only by right of representation instead of the aunt or uncle of the deceased.

...brother's wife or wife's brother

The wife of a brother or sister, the brother or sister of a wife - there are no relations of consanguinity between these persons, but there are relations of property arising from a marriage between relatives.

Social kinship

Kinship through marriage is otherwise called the word “property” (from the word “one’s own”) or “social kinship.”

Such relatives are named as follows:

Spouses

- Spouses - married persons.

Husband (spouse) is a man in relation to the woman married to him.

- Wife (spouse) is a woman in relation to the man married to her.

Parents of spouses

- Father-in-law is the father of the husband.

- Mother-in-law is the husband's mother.

- Father-in-law is the wife's father.

- Mother-in-law is the mother of the wife.

- Matchmaker is the father of one of the spouses in relation to the parents of the other spouse.

- Matchmaker is the mother of one of the spouses in relation to the parents of the other spouse.

Brothers and sisters of spouses

- Brother-in-law is the husband's brother.

- Sister-in-law is the husband's sister.

- Brother-in-law - brother-in-law.

Shurich (obsolete) - son of brother-in-law.

Spouse of a close relative

- Son-in -law is the husband of a sister, daughter, or sister-in-law. In other words, a son-in-law is a man in relation to his wife's family: her parents. (father-in-law), her sister (sister-in-law), her brother (brother-in-law) and the latter’s wife.

- A daughter-in-law is a son's wife in relation to his parents. (father-in-law and mother-in-law). Really a daughter-in-law (due to unpleasant associations in the word “daughter-in-law”)

- Daughter-in-law - wife of a son, brother, brother-in-law. In other words, a daughter-in-law is a woman in relation to her husband’s family: his parents (father-in-law and mother-in-law), his brother (brother-in-law), his sister (sister-in-law) and the latter’s husband. The daughter-in-law for the father and mother of the husband is also the daughter-in-law for his entire family.

Yatrov (yatrovka) (obsolete) - brother’s wife.

Non-family relationships

In people's lives, close, non-family relationships are of great importance, which is also reflected in terminology.

Before marriage

- Groom - a man intending to get married, in relation to his future wife (bride).

- Bride is a woman intending to get married, in relation to her future husband (groom).

Wedding and marriage

- Imprisoned parents - persons replacing the parents of the bride or groom at the wedding.

A planted mother is a woman who replaces the natural mother of the bride or groom at a wedding.

- The planted father is a person who acts in place of the natural father of the bride or groom at a wedding.

Outside of marriage

- A cohabitant is a man who lives together with his partner and is in a close relationship with him/her without official registration.

- A cohabitant is a woman who lives together with her partner and is in a close relationship with him/her without official registration.

- A lover is a man who is in a close relationship with his partner, which is not encouraged by the law or morality of a given society, community, or relatives.

- A mistress is a woman who is in a close relationship with her partner, which is not encouraged by the law or morality of a given society, community, or relatives.

Relationships during the second (and subsequent) marriage

- A half-brother is the son of a stepfather or stepmother from a previous marriage in relation to a child born in another marriage of his parent.

- A half-sister is the daughter of a stepfather or stepmother from a previous marriage.

- Stepfather is a man in relation to his wife’s child born in another marriage = mother’s husband.

- Stepmother is a woman in relation to her husband’s child born in another marriage = father’s wife.

- Stepson - a boy in relation to the partner of his parent in another marriage = step-son of the husband or wife.

- Stepdaughter - a girl in relation to her parent's partner in another marriage = stepdaughter of her husband or wife.

Relationships upon adoption or loss of parents

- Adopted - adopted child.

An adopted daughter (named daughter, adopted) is a female person in relation to the adoptive parents.

- An adopted son (named son, adopted) is a male person in relation to the adoptive parents (adoptive parents).

Religious connections

- A godfather is a man in relation to the one he baptized.

- A godmother is a woman in relation to the one whom she baptized.

- Godson (godson) is a male person in relation to those who baptized him.

- Goddaughter (goddaughter) is a female person in relation to those who baptized her.

- Godfather is the godfather in relation to the godson's parents and godmother.

- Kuma is the godmother to the godson's parents and to the godfather.

- Godfather is the father of the godfather.

- Godbrother is the son of the godfather.

- Cross brother (brother on the cross, named brother, brother) - persons who exchanged crosses.

- Father - priest, as well as an appeal to him.

Father is an Orthodox priest, as well as an appeal to him.

- Matushka is the wife of an Orthodox priest or nun, as well as an address to her.

Biological connections

- Donor is a person who gives his or her blood, tissue, cells or organ for transplantation into other people.

- Recipient - a person who receives a transplant of any organ, tissue or cells of another organism.

Simera is an organism with an established graft.

- A foster brother is a boy/male in relation to a person with whom he was breastfed by the same woman, but who is not a sister or brother.

Alphabetical list of relationships

Grandmother, grandmother - the mother of a father or mother, the wife of a grandfather Brother - a son in relation to other children of the same parents Godbrother - the son of a godfather Cross brother, cross brother, named brother - persons who exchanged pectoral crosses Bro, brother - cousin Bratanich - brother's nephew Bratanikha - cousin's wife Bratanna - brother's daughter, brother's niece Brother - cousin or distant relative Bratova - brother's wife Bratych - brother's son, brother's nephew

Widow - a woman who did not enter into a second marriage after the death of her husband Widower - a man who did not enter into a second marriage after the death of his wife Great Aunt - the sister of a grandfather or grandmother (great aunt) Great Uncle - the brother of a grandfather or grandmother Branch - line of kinship Grandson - a son's son or daughters, sons of a nephew or niece Great-great-cousin - the granddaughter of a cousin Great-niece - the granddaughter of a brother or sister (second cousin) Great-grand-great - being a relative in the third degree, second cousin Great-siblings - second cousins Great-great-cousin - grandson of a cousin Great-nephew - grandson of a brother or sister Great-second cousin - grandson of a second cousin (second cousin) Granddaughter, grandson - daughter of a son or daughter, nephew or niece

Great aunt - the sister of a grandmother or grandfather Great great aunt - the sister of a great-grandmother or great-grandfather Great-great-great aunt - the sister of a great-great-grandmother or great-great-grandfather Great niece - the daughter of a cousin Brother or sister Cousin - the daughter of an uncle or aunt Great aunt - a cousin of a father or mother Great cousin - related to Second Degree Cousin - the son of an uncle or aunt Great Uncle - the brother of a grandfather or grandmother Great Uncle - a cousin of a father or mother Great Nephew - the son of a cousin Brother or Sister Great Great Grandfather - the brother of a great grandfather or great grandmother Great Great Grandfather - the brother of a great great grandfather or great grandmother Brother in law - the brother of a husband Grandfather, grandfather - the father of the father or mother Godfather - the father of the godfather Dedina, grandfather - aunt by uncle Dedich - direct heir by grandfather Daughter - a female person in relation to her parents Named daughter - adopted child, pupil Dsherich - nephew by aunt Dchersha - aunt's niece Uncle - a person caring for a child Uncle - father's or mother's brother, as well as the aunt's husband

Half-blooded children (same-blooded) - children born from the same father (consanguineous father), but different mothers) Half-uterine children (one-uterine) - children born from the same mother, but from different fathers Half-born - born from the same mother, but from a different father

Wife - a woman in relation to the man with whom she is married Groom, wife - unmarried fourth wife Groom - who has arranged a bride for himself

Sister-in-law, sister-in-law, sister-in-law - husband’s sister, sometimes brother’s wife Son-in-law - husband of a daughter, sister

Knee - branching of the clan, generation in the pedigree Godmother - participant in the baptism ceremony in the role of spiritual mother Godson - godson Goddaughter - goddaughter Godfather - participant in the baptism ceremony in the role of spiritual father Consanguinity - descent from the same parents Blood - about kinship within one families Cousin - cousin Cousin - cousin Kum - godfather in relation to the godson's parents and godmother Kuma - godmother in relation to the godson's parents and godfather

Little aunt - the sister of the father or mother (cousin) Little uncle - the brother of the father or mother Mother - a woman in relation to her children Godmother, godmother - successor during the baptismal rite Named mother - mother of the adopted child, pupil Milk mother - mother, nurse Mother planted - a woman who replaces the groom's own mother at a wedding Stepmother - a stepmother, the father's other wife in relation to his children from a previous marriage Foster sister - a child (woman) fed by someone else's mother in relation to her children Foster brother - a child (man) fed another man's mother in relation to her children. Husband is a man in relation to the woman he is married to.

Daughter-in-law - a brother's wife or a son's wife, as well as the wife of one brother in relation to the wife of another brother Illegitimate - born from parents who are not in a church marriage

Homogeneous (consanguineous) - originating from one father Monouterine (one-uterine) - originating from the same mother Father - a man in relation to his children Godfather - the successor during the baptismal rite Named father - the father of the adopted child, the pupil The father of the adopted, planted, mummer - a man who replaces at the wedding of the groom's own father Stepfather - stepfather, the mother's other husband in relation to her children from a previous marriage Father - the eldest in the generation Father, stepfather - son, heir

Stepdaughter - stepdaughter of one of the spouses Nephew - son of a brother or sister Niece - daughter of a brother or sister Nephew - relative, relative, fellow countryman Side (son, daughter) - son or daughter not descended from a legal marriage Generation - relatives of the same degree of kinship in relation to a common ancestor Fullbred - descended from the same parents Descendant - a person descended by birth from some clan, a person in relation to his ancestors Great-grandmother - the mother of a grandfather or grandmother Great-grandmother - the same as a great-grandmother Great-grandson - the son of a grandson or granddaughter Great-great-great-cousin niece - the great-granddaughter of a cousin Great-great-great-niece - the great-granddaughter of a brother or sister Great-great-great-great-great-second cousin - the great-granddaughter of a second cousin Great-great-great-great-great-grandnephew - the great-grandson of a cousin Great-great-nephew - the great-grandson of a brother or sister Great-great-great-great-great-great-great-grandson of a second cousin Great-grandnephew - daughter of a grandson or granddaughter Great-grandfather - the father of a grandfather or grandmother Great-great-grandmother - the mother of a great-grandfather or great-grandmother Great-great-grandson - the son of a great-grandson or great-granddaughter Great-great-great-great-great-great-great-great-great-great-granddaughter of a cousin Great-great-great-great-niece - the great-great-granddaughter of a brother or sister Great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-great-granddaughter - great-great-great-grandson of a cousin Great-great-great-nephew - great-great-great-grandson of a brother or sister Great-great-great-great-great-great-great-great-great-great-great-great-grandson of a second cousin Great-great-granddaughter - daughter of a great-grandson or great-granddaughter Great-great-grandfather - father of a great-grandfather or great-grandmother Grandparents - the first known couple in the pedigree from which the clan originates Grandfather - parent great-great-grandfather, great-great-grandmother Ancestor - an ancient predecessor in the family, as well as a compatriot from previous generations Married - descended from the same parents, but born before marriage, and then recognized in it Adopted daughter - an adopted child of someone else, a girl Adopted son - an adopted child of someone else, a boy Fifth cousin - being a relative in the fifth generation (by great-great-grandfather)

Clan - a number of generations descending from one ancestor, as well as a generation in general Parents - father and mother in relation to children Parent - the same as the father Parent - the same as the mother Native - descended from the same parents See blood, full-blooded Relatives - relatives Ancestor - the first known representative of the clan from which it originates Pedigree - the same as genealogy Pedigree - a list of generations of the same clan, establishing the origin and degree of relationship Relative - one who is related to someone Kinship - a relationship between people created by the presence of common immediate relatives

Matchmaker (m), matchmaker (f) - the parent of one of the spouses in relation to the parents of the other spouse Father-in-law - the father of the husband Mother-in-law - the mother of the husband Step-brothers and sisters descended from different parents Step-children - children who are each other's brothers or sisters stepfather or stepmother In-law - a person who is related to someone Property - a relationship of closeness between people that arises not by kinship, but from a marriage union (relationships between a spouse and blood relatives of the other spouse, as well as between relatives of spouses) Brother-in-law - husband sisters-in-law (sisters of the wife) Brothers-in-law - persons married to two sisters Sister-in-law - sister of the wife Seventh cousin - being a relative in the seventh generation (by great-great-great-great-grandfather) Family - a group of relatives living together Sister - the daughter of the same parents or one of them in relation to their other children Sis, sister, sister - cousin Sister - cousin, daughter of a mother's or father's sister Sister, sister, sister (ancient Russian) - mother's sister's son (sisterly nephew) Orphan - a child or minor who has lost one or both parents Daughter-in-law - a son's wife in relation to his parents, daughter-in-law Consort - a brother-in-law's wife, the wives of two brothers in relation to each other Spouse - husband Spouse - wife Son - a man, a boy in relation to his parents Son godfather (godson) - a male person in relation to the adoptive son named - adopted, pupil

Father-in-law - the father of the wife Aunt, aunt - the sister of the father or mother, as well as the wife of the uncle Mother-in-law - the mother of the wife Second cousin - the cousin of the grandfather or grandmother Second cousin - the daughter of the second cousin or sister Second great-great-grandmother - the cousin of the great-grandfather or great-grandmother Second cousin - great-great-grandmother great-great-grandfather or great-grandmother Second cousin - the daughter of a great-uncle (aunt) Second cousin - a second cousin of a father or mother Second cousin - who is a relative in the third degree (through a great-grandfather) (see great-grandfather) Second cousin - the son of a great uncle (aunt) Second cousin - a cousin grandfather or grandmother Second cousin - a second cousin of a father or mother Second cousin - a son of a second cousin Second cousin - a cousin of a great-grandfather or great-grandmother Second cousin - a cousin of a great-great-grandfather or great-great-grandmother Adopted - a female person in relation to his adoptive parents Adopted - a male person in relation to adoptive parents

Last name is the same as clan, family

Fourth cousin - second cousin of a grandfather or grandmother Fourth cousin - daughter of a fourth cousin Fourth great-grandmother - second cousin of a great-grandfather or great-grandmother Fourth great-great-grandmother - second cousin of a great-great-grandfather or great-grandmother Fourth cousin - daughter of a second cousin Uncle (aunt) Fourth cousin - four father's or mother's cousin - a relative in the fourth generation through a great-grandfather Fourth cousin - the son of a second cousin of an uncle (aunt) Fourth cousin - a second cousin of a grandfather or grandmother Fourth cousin - a fourth cousin of a father or mother Fourth cousin - the son of a fourth cousin Fourth great-grandfather - a second cousin of a great-grandfather or great-grandmother Fourth cousin great-great-grandfather - second cousin of great-great-grandfather

Sixth cousin - being a relative in the sixth generation (by great-great-great-great-grandfather) Brother-in-law - wife's brother Shurich - son of a brother-in-law (wife's brother)

Yatrov (yatrovka) - wife of brother-in-law (husband’s brother)

In preparing the article, materials were used from the sites: ru.wikipedia.org, wikiznanie.ru

The article was written and posted on October 28, 2012. Added -

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Author: lawyer and tax consultant Alexander Shmelev © 2001 — 2020

Rubric “Question/Answer”

Good afternoon Is my stepfather a close relative if he was legally married to my mother for more than 30 years? Now he is dead. I work in a government agency.

Can I receive financial assistance in connection with his death? The organization’s wage regulations state that financial assistance is paid in connection with the death of a close relative. Thank you!

If my brother and I have the same father, but different mothers, can we legally be considered close relatives?

My father, with whom my brother and I did not communicate, died. The mother has been dead for a long time. The father lived with another woman and left a will after his death. He bequeathed all his property to her. Can my brother and I get a share as close relatives?

Detailed answers about who is considered close relatives:

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

Content:

In Russian law, the concept of “close relatives” is found quite often. However, depending on whether it is indicated in the family code, the code of administrative offenses or criminal law, this term has different definitions.

Knowing who a close relative is is important, especially when it comes to inheritance issues. If you encounter difficulties in obtaining an inheritance, it is better to seek help from professionals.

Who are husband and wife to each other?

The wife and husband are the closest people to each other, but the law specifically regulates their relationship .

Here lies the greatest nuance, which is far from obvious to the average person. According to the same Family Code, a husband and wife cannot be considered immediate relatives. The relationship between husband and wife is not considered consanguineous (kinship), but inherent. Since marriage is an agreement between two people, and therefore the relationship between the relatives of both parties is not blood, but inherent. It can be said that a family union in the form of a legal marriage is a relationship by contract, and not a true blood relationship. Which persons are related to:

- Husband and wife;

- Mother and father of the husband or wife (mother-in-law, father-in-law, mother-in-law and father-in-law);

- Son-in-law and daughter-in-law.

This circle of people are each other’s family members, which includes many other persons, such as stepmother and stepfather, children born in a civil marriage, relatives living together, etc.

Don't have time to read the article?

Article 14 of the RF IC states that close relatives are blood relatives in one generation, across a generation and in neighboring generations. In simple terms, in family law, close relatives are parents, children, grandparents, grandchildren, brothers and sisters (full and half-blood).

It is noteworthy that according to the Family Code, a husband and wife are not close relatives , since they are not related by blood. Spouses are recognized as family members in accordance with Article 2 of the same Family Code.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

However, an officially registered marriage, by law, is considered a special type of relationship. Therefore, despite the lack of family ties, husband and wife have some privileges.

For example, if one of the spouses died without leaving a will, then the second is the heir of the first priority, like close relatives.

Is my stepfather a relative in the ascending line or not?

To be recognized as a family member, it is also necessary to prove the fact of living together with the owner (tenant). If we are talking about such categories of relatives as sisters and brothers, grandchildren, grandfathers, grandmothers, uncles and aunts, nephews, then in addition to documents confirming relationship with the employer (owner), they should provide evidence that would indicate that They were moved into the living quarters precisely as family members. Disabled persons who are dependent on the owner (employer), in order to confirm the fact of lack of ability to work, must attach to the claim a pension certificate, a certificate of disability or a birth certificate. Evidence will also be required that such persons receive financial assistance, which constitutes their main source of livelihood, precisely from the owner (tenant). These persons should also be moved in by the owner (tenant) precisely in the role of family members, and not just like that.

Persons who do not fall into any of the categories described above will have to sufficiently substantiate the reason why they consider themselves members of the owner’s (tenant’s) family. The reason must be so serious that the court can recognize the need to move in as an exceptional case, as stipulated in the Housing Code. An example of such an exception would be a situation where a woman and a man are in a so-called civil, that is, not officially registered marriage, and they have a child. You also need to prove the fact of moving in as a family member. To do this, it is necessary to present such arguments so that it is clear to the court that there is a family relationship between the owner (tenant) of the property and the person moving in. Such relationships are based on a common budget, joint housekeeping, and the availability of items for joint use. Within family relationships, people bear common expenses for purchasing food and show care towards each other. In addition, family relationships are based on common responsibilities and rights, common interests. Of course, the conditions listed may not apply to every family. But some of them must be cited as justification for the existence of family relationships, and not those that arise, for example, from a contract.

It should be remembered that if a spouse, parents or children move into the tenant’s residential premises, then other persons who are family members and included in the order or social tenancy agreement must give written consent to such move-in. Such consent must be attached to the application. This rule does not apply to the case when minor children of the tenant move in.

Additionally, in the text of the statement of claim for recognition as a family member, it is necessary to indicate on whose initiative the plaintiff was moved into the residential premises, and whether there was an agreement on this with the owner (tenant). It is also necessary to describe in general terms the established procedure for using the living space and the objects located in it. Indicate existing relationships with other persons who also live in this premises. At the end of the descriptive part of the application, it is indicated for what purposes the plaintiff requests to be recognized as a family member, and how he intends to use the court decision made on such a claim.

Close relatives in other areas of law.

The Family Code is the main legislative act that determines who is a relative. However, in other codes and areas of legislation, the definition of close relatives may include not only those mentioned in the Family Code of the Russian Federation.

For example, according to paragraph 4 of Article 5 of the Code of Criminal Procedure, close relatives of a citizen are his spouse, parents, brothers and sisters, grandparents and grandchildren. Also, close relatives in the Criminal Procedure Code may include adoptive parents and children.

That is, in this case, consanguinity does not have the same meaning as for the Family Code.

Article 25.6 of the Code of Administrative Offenses states that close relatives are all those relatives specified in Article 14 of the Family Code, as well as adoptive parents or adopted children.

As for Tax legislation, in which there is a serious need to determine which relatives are close and which are family members (for example, when determining tax benefits), the Tax Code in this matter refers to the Family Code of the Russian Federation.

Does degree of relationship affect taxation?

This group includes cousins. That is, the descendants of the brothers/sisters of a particular citizen. Also included are great-grandparents and great-grandchildren.

Members of the same family who are related to each other by a direct ascending line (kinship going from a person to his distant ancestors) or descending (coming directly from his ancestors). According to this point of view, the closest relationship is considered to be the blood relationship between parents and their children, grandparents and grandchildren. It’s a pity that people have a small number of such relatives: unfortunately, there aren’t many long-lived people now, but I’d really like to talk to my great-grandmother. Siblings and brothers.

The definition of close relationship is based on the principle of common blood. It follows from this that a husband or wife is not recognized by family law as close relatives, since there is no blood relationship. There is, as already mentioned, an acquired kinship. It arises as a result of some legally significant actions. This may include recognition of paternity/maternity, wedding or adoption.

Are adopted children close relatives?

The Family Code does not recognize adoptive parents and those adopted by close relatives for the same reason of lack of consanguinity. However, there is an exception to this rule.

For example, if a man marries a woman who has a child and adopts him, that is, the name of this man is recorded in the “father” column on the child’s birth certificate, then they will be considered close relatives to each other. If he remains in the status of a stepfather, then there can be no talk of kinship.

Children adopted from an orphanage will not be defined as close relatives.

However, according to Article 137 of the Family Code, despite the lack of kinship with the adoptive parent, adopted children will have all the same personal and property rights and obligations in relation to adoptive parents as natural children.

That is, despite the fact that there is no family connection between the adoptive parents and the children, he will have all the same rights as close relatives.

Recognition as a family member of the owner or tenant of a residential premises

(Granting the status of a family member to a non-relative through a judicial procedure for establishing a legally significant fact)

The list of persons who are family members of the owner or tenant of a home in terms of property relations is enshrined in the Housing Code, and according to this set of laws, this circle includes: the owner’s spouse, parents and children. However, it may be necessary to determine the status of a family member in relation to a citizen living together with the owner or tenant of the apartment, but who is not his closest relative. Such a need may be associated with obtaining a housing certificate, relocating to another place of residence, submitting documents for registration as a person in need of improved housing conditions, and in connection with other circumstances. In this case, the list of categories of persons falling under the definition of family members may be expanded, but this will most likely require a procedure for establishing the relevant legally significant fact in court.

The status of a family member allows a citizen to be recognized as having the right to housing. Thus, any relatives of the owner, along with disabled persons dependent on him, and, as an exception, other citizens can acquire the status of a member of the owner’s family only if they are moved into the residential premises by the owner himself as members of his family. Similar definitions will apply to family members of the tenant of the residential premises, that is, when a social tenancy agreement is in force. But at the same time, the landlord has the right to prohibit the tenant from moving in other persons as members of his family living together with him, if as a result of such moving in, the living space allocated according to established accounting standards for one family member turns out to be less than the permissible value. However, it should be noted that when minor children move in with their parents, the consent of the landlord or other family members is not required.

As noted above, the classification of a citizen as a member of the family of the owner or lessor is carried out in the form of establishing a legal fact and is carried out in the manner of legal proceedings. When drawing up a statement of claim for recognition as a family member of the owner or tenant of a home, the citizen who wishes to gain the status of a family member must be indicated as a plaintiff. If it is necessary to grant such a status to a minor, then the claim must be filed in court by his legal representatives, who can be one of the parents, an adoptive parent, or a guardian. The defendant in such claims is either the owner or the tenant of the residential premises. In addition to the plaintiff and defendant, the application must indicate all third parties who have rights to the disputed housing. If we are talking about an apartment provided under a social tenancy agreement, then the landlord is indicated as a third party - the administration of the municipality within which the disputed housing is located. The claim is filed in court at the location of the disputed home. In this case, the plaintiff must pay the state fee provided for non-property disputes.

In order for the court to satisfy the plaintiff’s demands, he will have to competently substantiate his claim by providing relevant evidence. Certain documents must be attached as such evidence. Thus, the application must include an order for an apartment, a lease agreement or a certificate of registration of property rights. Confirmation of registration at the place of residence in the disputed premises will also be required. Recognition of a person as a family member is based on confirmation of family ties with the owner or tenant of the property. Relationship is confirmed by a birth certificate, and for spouses by a marriage certificate.

Inheritance by close relatives.

One of the main reasons why you may be interested in issues related to family ties is inheritance. When considering this issue, you need to refer to Article 1142 of the Civil Code of Russia.

It says that the heirs of the first priority are the children, spouses and parents of the deceased. The heirs of the second stage are the testator's brothers/sisters, as well as grandparents.

Thus, it turns out that spouses, not being close relatives, fall into the category of first-line heirs, while many relatives who are considered close are not direct heirs.

This definition as “close relatives” according to the Family Code of the Russian Federation is mentioned in Article 14. But there is still no exact interpretation, although this category can be found in various legislative acts.

In addition, there are also family members. To better understand this issue, you should become more familiar with the prescribed wording and find out how the concept of “relatives” is interpreted from the point of view of the Family Code of the Russian Federation and other standards.

What laws govern the concept?

Determining who is considered a close relative under the law, and who in a particular case is not, is determined by the specific law that regulates the relationship.

The absence of an appropriate definition in this law does not mean that all relatives without exception belong to the category of close ones. The most general characteristic of this concept is contained in the legislation regulating marriage and family relations (Family Code of the Russian Federation, we will write in more detail below). It is the persons listed in it who are recognized as close relatives.

However, the peculiarities of legal relations in a particular legal area also leave an imprint on the concept of close kinship, as a result of which the list of such relationships can be changed and presented with a broader list.

First of all, this concerns criminal legislation, as well as certain civil norms, therefore the relevant codes or individual laws in their general provisions contain a definition of relatives recognized as close when applying the special norms of such legislation.

Status of relatives and spouses in family law

It is important to understand who is hidden behind the category of close relatives according to the RF IC, simply because too often one has to deal with this definition when it comes to other federal laws. Direct relatives according to the Family Code are parents and children, grandparents.

Close relatives are also grandchildren and other relatives in the direct and ascending line - full or half brothers and sisters. They are highlighted separately, but nevertheless included in the general circle.

Since this term is spelled out in an article related to certain obstacles that can prevent marriage, adoptive parents and adopted children are also mentioned here, who are not allowed to marry each other. But they are no longer considered close relatives.

Separate attention is paid to the status of spouses. They cannot be related by blood, therefore a relationship arises between them.

They also affect relatives of both spouses. However, husband and wife are only members of the family, which includes parents and children.

Therefore, this unclear status of the father or mother causes some problems when it comes to other branches of law.

The lack of clarity in the wording means it affects so many people in the simplest of situations. For example, a son-in-law cannot send a currency transfer to his mother-in-law as a close relative, since she is not considered such. But other legal documents do not provide a clear answer.

Are stepfather and stepson family members or not?

- Lateral kinship is a connection between citizens who have ancestors from whom they are separated by one or more generations. Brothers and sisters, if they have a different father or mother, are incomplete.

Family law, as well as the Civil Code of the Russian Federation, do not separate full- and half-blood relatives, giving them the same rights and obligations. At the same time, the degree of kinship matters - the number of generations that separate citizens from their common ancestor. This deduction is called the standard personal income tax deduction for children. Child support from an unemployed person In March, I divorced my wife, she filed a lawsuit for child support. The court ordered alimony in the amount of ¼ of all types of income.

Family members and relatives in criminal law

In this matter, the Criminal Code is more focused on the Constitution of the country and therefore there is a clear list. The law interprets that a person may not testify against himself, his spouse or immediate relatives.

Their circle is defined by law and includes spouses, their parents and children, including adopted children. This also includes siblings, as well as grandfathers, grandmothers and grandchildren.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The Civil Code classifies not only parents and children as relatives, but also brothers and sisters. Here, as in criminal law, there are also no half-siblings.

When an arrest or even detention of a suspect occurs, relatives must be notified about this within half a day, which raises a number of questions. After all, the suspect may only have family members nearby, and relatives may live in another region or even country.

After a divorce, it is the closest relatives who have the priority right to communicate with the child. True, this is not prohibited for other relatives and family members, unless the matter is about deprivation of parental rights.

An interesting fact is that they made a relaxation for military personnel and father-in-law, mother-in-law, father-in-law and mother-in-law fell under this category. Therefore, it is possible that some amendments will be made to the Criminal Code.

Criminal and civil law

In the Criminal Procedure Code, an ex-wife is not considered a relative.

Based on the norms of the constitution and legislation, the ex-spouse has the right to refuse to testify in court against close relatives. According to the Criminal Code, an ex-wife is not a relative, but a member of a family that has lost legal force, created by registering the relationship in the registry office. The most pressing issue is the division of property (apartments, houses, cars) by former spouses.

According to civil law, the wife is considered to be the heir of the first priority. However, from the moment the marriage is officially dissolved, she ceases to be a relative and, as a result, loses the right to receive the spouse’s property.

The ex-wife has the right to claim her husband’s property if she has an obligatory share in the inheritance, is indicated in the will, or the marriage is dissolved after the opening of the inheritance. The gift agreement can be drawn up in the name of the ex-wife, and it will be legitimate.

The concept of relatives in tax, housing, labor law

Taxation could not help but touch upon the term, since it also falls under an article of the Tax Code. One of them states that transactions between close relatives cannot be taxed.

In addition, based on the Family Code, tax authorities will not charge an additional fee if the income was received as a gift, but only in the case of close connections. This includes not only siblings, but also family members.

However, you have to pay a notary fee and its amount depends largely on the degree of relationship. For loved ones it will be 0.3 percent if the total amount does not exceed one hundred thousand rubles. For other relatives it will cost twice as much, but the total amount should not exceed a million rubles.

Interestingly, the concept is actually absent from the Housing Code. But the term “family member” occupies a dominant place.

Not only spouses and their children are considered such, but also the owner’s parents, especially if they live together. Moreover, if the owners voluntarily move in a third person, then he too becomes a member of the family, although he will not have family ties.

This partially affects dependents who are unable to work and non-adopted individuals.

This issue is not clearly spelled out in the Labor Code. True, one of the articles allows you to take unpaid leave in connection with the death of close relatives. Therefore, distant relatives or close family members are not mentioned and each employer is inclined to interpret the article as he wants. After all, even spouses are not included in it.

In addition, this circle of people cannot, for example, work together in municipal institutions, especially subordinate to each other. If someone close to you is serving a sentence or has already served it, this leads to the fact that you may not pass the test when the opportunity to get a job arises.

This applies most of all to the banking sector and law enforcement agencies. Such discrepancies in codes can be both useful and harmful if a controversial situation arises and it needs to be resolved legally.

Housing Code

There is no concept of “kinship” in the Housing Code.

Instead, the broader concept of “family members” is used, which includes all persons living in the same apartment or house. In the event of a divorce, the right to use residential premises for a spouse who is not the owner of a specific apartment or house is not retained .

If the property is registered in the name of the husband, the court during a divorce may reserve the ex-wife’s right to live in this premises in the absence of other living space and the possibility of acquiring it.

The court may also oblige one of the spouses to pay alimony and support the other for a certain period of time.

Thus, during a divorce, the owner of the premises has the right to evict and deregister former family members.

Inheritance by law or will

In the matter of inheritance, much will depend on the existing will. If it is missing, then after six months the heirs will be able to receive it, but only in order of priority. There are first, second and subsequent stages and they are clearly stated in the legislative norms.

The testator has the right to dispose of his property or property himself and he is not obliged to leave it to relatives or family members. These can be friends, organizations or legal entities and individuals.

However, there are a number of restrictions when, despite the will, a circle of direct relatives has the right to their obligatory share in the inheritance. This is especially true for minor children or dependents - spouses, parents, etc.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Often these issues have to be resolved in court. Sometimes a situation arises when a complete stranger claims his rights and talks about a family connection and shows the relevant documents to confirm this.

Tax law

The Tax Code treats close relatives as a separate category. Such persons can enter into transactions with each other and still not pay tax on the profits received. If a gift agreement is executed, close relatives and family members (both the donor and the recipient) are exempt from tax.

When paying the state fee for notary services (for drawing up, certifying documents, etc.), close relatives receive additional benefits in the form of a reduction in the amount payable.

Definition of close relationship

But the opposite picture also occurs, when a close person is essentially a relative, but there is no documentary evidence of the degree of kinship in the family according to the law in this regard, and a certain dilemma arises. New innovative methods will allow us to solve it today. True, you will still have to run around and collect a lot of information.

First of all, you will need to find at least some documents confirming the degree of relationship. It is best to contact the registry office.

It may be located in another region or country, but the answer, as a rule, always comes along with copies of documents available there. There is still an opportunity to go to court at your place of residence and try to draw up a competent statement of claim that will help convince the judge.

Only here you can’t do without some supporting documents.

True, now there is an opportunity to do a DNA examination. With its help, it is not difficult to prove your relationship, even if it is not only brothers and sisters, grandparents, but also other first and second cousins.

Summing up some results, I would like to say that there are still a lot of shortcomings in this issue. Many people become close relatives, but are not considered such by law.

Vague formulations such as “family members” are not always satisfactory and often go against the realities of life.

To date, there is no clear definition of close relatives, despite the fact that some amendments have been made to certain articles of various codes regarding this issue. There is hope that we will still be able to resolve it and draw up a clear list so that so many controversial issues do not arise.

Who belongs to relatives according to the law, see in the video:

Summary

Such a concept in legislation as close relatives is used to regulate certain social relations. These persons usually include citizens related by blood to each other.

The list of citizens who are close relatives may vary depending on the area of application of the law, so it is possible to determine who exactly belongs to them from various legal norms. To identify kinship, legislation is mainly guided by the general principles of the family code .

It is generally accepted that spouses are not close relatives, but family members. Therefore, legal norms indicate separately the husband and wife along with other relatives. In another case, the law classifies not only spouses, but also other close relatives as family members.

The degree of kinship plays a big role in the distribution of inheritance in the absence of a will. The legislation establishes a special order of inheritance , depending on which family members or close relatives have the right to claim the property of the deceased.

Also, the degree of relationship is important when receiving an inheritance for citizens who, by law, are entitled a mandatory share in the inheritance or who have the right to count on certain benefits when paying state fees when registering the right to inheritance.

Blood relations

The answer is actually not as simple as it seems. It all depends on the situation and how one understands direct kinship.

From a biological point of view, spouses are not related. They are two separate independent individuals who produce offspring. Are husband and wife related? No. They have no blood relationship.

By the way, marriages between close relatives are prohibited in Russia. Therefore, even from the point of view of legislation, spouses cannot have common relatives. Otherwise, the marriage will not be concluded in the registry office.

Degree of consanguinity

Relationship degree refers to the number of offspring born between two individuals. They find out who is a direct relative, ascending, descending or collateral, for a variety of legal reasons.

For example, for inheriting material assets, the closer a person’s degree of relationship, the greater his opportunity to inherit property. It could also be a simple desire to make contact or ordinary interest.

The procedure for determining the degree of consanguinity is quite simple and is performed in several stages.

- First of all, the specific person with whom the degree of relationship is being considered is taken into account. In this case, who are these relatives in a direct ascending line? These are parents, grandparents, and so on.

- Then the number of offspring between people is taken into account. This is best done in a descending or ascending straight line. For example, three births occurred between a person and his great-grandmother: grandmother or grandfather, mother or father, and himself.

- It is a little more difficult to calculate the degree of collateral relationship. This can be done schematically by drawing the closest relatives. These come first from brothers and sisters, then from aunts and uncles, followed by great-aunts and uncles. It is also calculated along a descending lateral line, starting with nephews and moving to great-nephews.

Who is a close relative under the law?

Close relatives are citizens who have blood ties based on biological descent with a common ancestor. There is no specific norm in the legislation that gives a clear definition of the concept of close relatives , but a list of such persons can be identified when regulating certain social relations.

- parents;

- children;

- grandparents;

- brothers and sisters - including half-brothers, i.e. if only one of the parents is common.

- Adoptive parents or adopted children.

Are husband and wife related?

Based on the rules of civil law, spouses do not belong to close relatives , since their affiliation with such is not described anywhere. If legal relations arise with the participation of spouses, they are indicated separately.

For example, in clause 18.1 of Art.

217 of the Tax Code of the Russian Federation states that family members and close relatives are exempt from income tax when donating property (relatives and spouses are listed below). Based on the norms of this article, we can conclude that family members are not considered close relatives, since there is a distinction and these citizens are listed separately .

Basically, the law contains instructions for both spouses and other relatives. According to Art.

5 of the RF IC, in case of possible gaps in the law and the absence of indications of family members, circumstances are applied based on the general principles of family or civil law by analogy with the law. The principle of reasonableness and fairness also applies.

Those. in some cases, spouses may be recognized as close relatives .

Who is not closely related?

There are categories of citizens who are not close relatives of each other. They can only be so in relation to one of the spouses. This list includes:

- cousins/brothers;

- great-grandparents and great-granddaughters/great-grandchildren;

- aunts/uncles and nieces/nephews;

- daughter-in-law/son-in-law, father-in-law/mother-in-law;

- mother-in-law/father-in-law.

By the way! In a civil marriage, the man and woman are not related. They have no right of inheritance. The only exception can be a will.

Mother and son, being the closest relatives, inherit property after each other. After the son’s marriage, the mother-in-law and daughter-in-law will not be related, so there is no right of inheritance between them.

Often, ignorance of the law leads to serious mistakes. Spouses are family members, but not relatives. After a divorce, all ties are broken. For example, a husband gives his wife an expensive gift at the time of marriage (real estate, shares, a car). According to clause 18.1 of Art. 217 of the Tax Code of the Russian Federation, the recipient does not pay personal income tax in the amount of 13% from close relatives or family members. If at the time the wife files her income tax return they are divorced, then this gift is not taxed. Confirmation - marriage certificate at the time of gift delivery and divorce document. All certificates must be attached to the income tax return.

How are immediate family members different from other family members?

It is possible to determine the differences between family members and close relatives only when certain legal relations arise, since some provisions of the law may indicate different citizens as family members .

Thus, based on the norms of family law, when alimony obligations arise, it becomes obvious that spouses and close relatives are generalized and indicated as family members . In another case, according to the norms of housing legislation, family members include only spouses , parents and children (Art.

31 Housing Code of the Russian Federation). However, this article indicates the possibility of recognizing third parties as in court.

Based on the norms of civil law , we can conclude that not all family members are considered close relatives, since there is no indication of spouses . However, in another case, some relatives may be part of the family.

Is the stepdaughter related to the stepfather?

The Tax Code of the Russian Federation is not subject to personal income tax on income in cash and in kind received from individuals as a gift, with the exception of cases of donation of real estate, vehicles, shares, shares, shares, unless otherwise provided by this paragraph. Income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren , full and half-blood (having a common father or mother) brothers and sisters).

Proof of relationship when inheriting property

When accepting an inheritance, according to the law, it is necessary to confirm to the notary the family relationship with the heir. Depending on the order of inheritance and the distance of relationship, these may be the following documents:

- birth certificate - in case of death of a parent;

- certificate of recognition of paternity - if the child was born outside of an official marriage;

- adoption decision;

- marriage certificate.

Depending on the order of inheritance and the distance of relationship, it will be necessary to provide a more extensive list of documents. If it is not possible to confirm the relationship, the relative can contact the registry office to request the necessary data.

If the registry office for some reason cannot provide such information, then the citizen has the right to go to court to recognize family ties.

Relations in a common-law family

In this case, even after separation, the woman is legally not related to her former common-law spouse. According to the Constitution, the Church is separated from the state. For this reason, the wedding ceremony does not provide a legal basis for recognizing the legality of creating a family.

There are no guarantees or social protection during cohabitation: there is no joint property, and the principle of inheritance does not work.

Thus, even the wife is not a close relative under the current law. Marriage entails the birth of in-law relationships. From the moment of dissolution of the union through the registry office, former spouses are legally no longer members of the same family or relatives.

From the moment the marriage is officially terminated, all rights and obligations of persons who previously formed a unit of society in relation to each other lose force. Knowledge of the law protects a person in emergency circumstances, saves in difficult life situations, and helps prevent them.

+7 , St. Petersburg +7

or via the feedback form below.

Benefits for close relatives according to the law when entering into an inheritance

Property acquired by inheritance is not subject to income tax rules , with the exception of property rights associated with intellectual property. However, there are other costs that must be paid to accept the inheritance.

- children (including adopted children);

- spouse, parents;

- brothers and sisters, only full siblings.

Citizens are exempt from paying the state fee for issuing a certificate if:

- The inheritance included real estate in which the successors were registered on the date of death of the testator and continue to live in the specified housing.

- Inherited property includes cash deposits, wages, and insurance amounts.

- The property of a citizen who died while performing state or other public duties is transferred.

According to Art. 333.38, regardless of the type of inherited property, minor children or citizens over whom guardianship has been established are exempt from paying state taxes due to the presence of mental disorders.

Who are close relatives under the Family Code and why apply this particular law? Each of us has our own idea of the circle of relatives who are close. But the answer to this question is not an empty platitude.

The law grants close relatives the largest volume of personal non-property and mutual property rights.

The peculiarity of the use of the term “close relatives” in Russian legislation is that the laws of the Russian Federation may include a different list of such persons. In the Criminal Procedure Code of the Russian Federation, the legislator expanded it (in comparison with the Family Code of the Russian Federation).

And in some international treaties (for example, the 1951 Convention, Rome) or departmental acts, on the contrary, it is narrowed.

At the same time, if the term “close relatives” is used in legislation (civil, labor, tax, etc.), but its definition is missing, the Family Code is used.

Is the aunt a close relative and how can the relationship be proven?

Paying attention to the wording of the norm, it turns out that other brothers and sisters are not considered close relatives. What the legislator meant when he introduced this norm into legal force is not clear, however, despite this, many scientists agree that sisters and brothers are among relatives who have the status of close ones.

There is no clear answer to this question, so we will try to compare the two types of these transactions. The essence of donation is indicated above. Now, with regard to the will, the following should be noted.

Relatives who are recognized by law as close to each other have rights and obligations in relation to each other. In different branches of law, the lists of who is a close relative under Russian law may differ slightly. Making a gift between relatives consists of the gratuitous transfer of property from one person (aunt, uncle) to another person (nephews). Thus, a mandatory feature inherent in this transaction is gratuitousness, or in other words, only the donor is obliged to transfer the gift; the recipient does not have any reciprocal obligations.

FAQ

Considering the ambiguous approach of the legislator to the definition of this concept, many citizens have natural questions regarding who will be a relative in a given situation.

Who is a close relative when donating an apartment?

According to ch. 32 of the Civil Code of the Russian Federation, the donation of property can occur between different entities, but a fairly common occurrence is the situation when some real estate, for example an apartment, is transferred in this way to a relative.

In this case, it is necessary to take into account one nuance related to taxation. Clause 18.1. Art. 217 of the Tax Code of Russia exempts the donee from paying personal income tax if he is a family member and (or) a close relative of the donor. In turn, the Tax Code of Russia has a link to the RF IC, but expands the list to include spouses, adoptive parents and adopted children.

Who is a close relative in inheritance?

As noted earlier, family ties influence the order in which inheritance is accepted by law. Close relatives are indicated in Art. 1142-1143 of the Civil Code of Russia and they are called up within the 1st and 2nd stages.

In addition, when issuing a certificate of inheritance rights, a lower notary fee is established for these persons compared to other heirs (clause 22 of Article 333.24 of the Tax Code of Russia).

Is a stepfather a close relative under the law?

Taking into account the provisions of Art. 14 of the RF IC, such a person is not considered a close relative. However, if he is an adoptive parent in relation to a child within the framework of other legal relations (as discussed above), he can be considered one.

Is grandma a close relative?

All of the above-mentioned legislation refers to grandparents as immediate family members.

Is the sister a close relative?

Art. 14 IC of Russia includes the sister in the list of subjects falling under this category.

Is the wife a close relative?

Family law does not define a wife as a close relative, due to the lack of a “blood connection” between the spouses.

In conclusion of the issue under consideration about who close relatives are, it should be noted that regulatory acts do not have a unified position on this issue. That is why it is proposed to define these persons as having connections based on marriage, kinship or property.

Dear reader! The article describes the most common legal problems and ways to solve them. If you want to find out how to solve your particular problem, contact a consultant for free help:

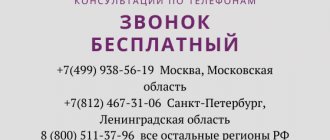

Moscow, Moscow region: +7 (499) 288-72-46

St. Petersburg, Leningrad region: +7 (812) 317-60-18

Regions, Federal number: +8 ext. 859

24/7, FREE, FAST

Is the stepdaughter part of the family?

Now the tax office is demanding a declaration from a minor child (stepson), or more precisely from his representative (wife), citing the fact that the stepfather and stepson are not relatives and that “they wanted to put it on the family code.” Thus, having received the assistance we were entitled to from the state, we paid for the re-registration of the apartment, and now also the tax. In our situation, is it possible to somehow prove to the tax authorities that we are members of the same family, living together under the same roof through thick and thin for more than 5 years, and how to do this? Answers

- payment of tax upon gift from father to stepsonAuthor: lawyer Kuzovokova O.A. 01/18/2012 Hello!

Legal regulation of relations between spouses

A completely reasonable task arises to regulate relations between husband and wife in various areas. Each branch of law provides references and clauses specifically indicating the rights and obligations of spouses. For example, the Criminal Code states that you do not have to testify against yourself, your spouse and close relatives.

When making a will, you need to take into account the fact that

the husband and wife are not close relatives .

If it turns out in the will that all the property is divided by close relatives, then the wife of the deceased may be left with nothing, since she does not belong to this circle of people. The inheritance passes in accordance with the last will of the deceased person under a will, regardless of the procedure for inheritance by relatives, which is specified in the law. Whereas without a will, she would have been the heir of the first priority according to the Civil Code of the Russian Federation, along with her children and parents. For the same reason, the former spouse (and all their relatives) are no longer members of the same family, and therefore cannot claim anything after a divorce. But blood relatives cannot be former , because their relationship is not based on contracts.

Knowing the law releases many benefits that you can take advantage of. You can draw up a deed of gift, correctly draw up a will, and also enjoy other privileges by knowing exactly who are legally close relatives.

Closest relatives according to the Family Code of the Russian Federation

The Family Code provides for a clear circle of persons as close relatives, who are:

- Persons who are in a descending and ascending direct family line (grandchildren, grandparents, parents and children, both relatives and those who became such as a result of the adoption procedure).

- Persons who are in a horizontal direct family line (brothers and sisters, both full and half).

The basis for the classification and inclusion of the above-mentioned relatives among the closest relatives is blood kinship, with the exception of relatives who acquired this status as a result of adoption (due to the identity of the relationships arising between adopted children and adoptive parents, the relationship between parents and children, biological kinship is not required). Such kinship gives rise to certain legal relations with ensuing mutual rights and obligations, as well as certain prohibitions (for example, marriage).

The marriage and family legislation of the neighboring country of the Republic of Belarus has followed the same path.