general information

Federal Law No. 5 of January 21, 1995 clearly regulates the concept of “combat veteran”.

So, this category includes military personnel:

- sent to other states by government bodies of the USSR, government bodies of the Russian Federation and who took part in hostilities in the performance of official duties in these states, as well as those who took part, in accordance with decisions of government bodies of the Russian Federation, in hostilities on the territory of the Russian Federation;

- working on the territory of Afghanistan during the period when hostilities were taking place there;

- working in the Syrian Arab Republic since September 30, 2015;

- those involved in demining the territory of the USSR and adjacent states in the period from 1945 to 1951;

- engaged in combat minesweeping operations from 1945 to 1957;

- engaged in carrying out combat missions on the territory of the Russian Federation, the USSR and a number of other countries.

It is these citizens who have the right to receive monthly cash allowances, the amount of which is strictly regulated by the legislation of the Russian Federation.

Combat veterans can be considered not only military personnel who have fully served their contract, but also those who have been transferred to the reserve.

Article 3, clause 1, clause 1, Federal Law “On Veterans”:

Combat veterans include: military personnel, including those transferred to the reserve (retired), those liable for military service, called up for military training, members of the rank and file and commanding officers of internal affairs bodies and state security bodies, employees of these bodies, employees of the USSR Ministry of Defense and employees of the Ministry of Defense of the Russian Federation, employees of institutions and bodies of the penal system, sent to other states by government bodies of the USSR, government bodies of the Russian Federation and who took part in hostilities while on duty in these states, as well as those who took part in accordance with decisions of government bodies authorities of the Russian Federation in hostilities on the territory of the Russian Federation.

Download Federal Law “On Veterans” No. 5 dated January 12, 1995.

Amount of monthly cash payment in 2021

Monthly payments to combat veterans in 2021 amount to RUB 2,972.82.

The payment of funds is carried out by the Pension Fund of the Russian Federation and its territorial departments.

Set of Social Services (NSS)

The amount that is withheld by the Pension Fund for social services can be received by the citizen in cash equivalent. To do this, he needs to contact the territorial office of the Pension Fund with a package of documents to draw up the appropriate application.

After refusing to receive a set of social services in kind, the amount that was withheld for the NSO is added to the amount of EDV.

Documentation

When applying to the Pension Fund to draw up an application for the transfer of a set of social services in kind to material form, a citizen must have a passport with him.

The legislation does not provide for other documents, therefore they have no right to demand them when applying.

Taxation

Since payments to combat veterans are considered by tax authorities to be the income of an individual, income taxes were withheld from them.

However, on April 13, 2021, the Constitutional Court of the Russian Federation issued a resolution according to which payments received by veterans are not subject to taxation until appropriate changes are made to the Tax Code.

The Pension Fund does not have the right to withhold interest from the EDV, paying the amount in full.

Article 217, Tax Code of the Russian Federation:

The following types of income of individuals are not subject to taxation (exempt from taxation): state benefits, with the exception of temporary disability benefits (including benefits for caring for a sick child), as well as other payments and compensations paid in accordance with current legislation. At the same time, benefits that are not subject to taxation include unemployment benefits, maternity benefits.

According to the ruling of the Constitutional Court of the Russian Federation, payments received by combat veterans are classified as state benefits. And they cannot be taxed.

Indexing

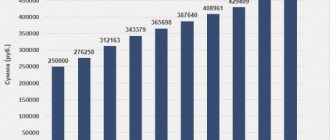

Payments for certain categories of citizens are usually indexed once a year . Until 2021, benefits for combat veterans were subject to indexation twice a year.

Since February 2021, amendments have been made to legislative acts that have reduced indexation periods to once a year.

What is more profitable than NSO in rubles or services?

Many citizens of the appropriate category are faced with the problem of determining what is more profitable for them - to receive a set of social services in cash or in kind.

As the practice of many branches of the Pension Fund of the Russian Federation shows, most of the “beneficiaries” prefer to receive their benefits in rubles.

So, if the cost of medicines does not exceed 700 rubles per month, then veterans prefer to receive funds in cash.

According to the latest changes, the range of social services includes:

- provision of medicines (889.66 rubles);

- vouchers to sanatoriums (137.63 rubles);

- free travel on public transport (127.77 rubles).

Citizens have the right to receive NSO in rubles in whole or in part, choosing for themselves only those items of expenditure that they really need.

What else is required

As of April 2021, the amount for calculating increased monthly allowance for combat veterans is 1,779 rubles. However, the preferential conditions that are prescribed for combat veterans, translated into monetary units, amount to 1,075 Russian rubles. Despite the fact that combatants are generally included in the list of privileged pensioners, their pensions are paid according to a slightly different scheme. Experts also report that after the pension reform, the payment of the UBI UDV may increase 3 times in 2021.

The amount of such payment is usually regulated by changes in the amount of minimum consumption. Minimum consumption for Russia is one of the leading criteria for calculating social benefits, including pensions. That is why the category of beneficiaries, as well as combat veterans, will see an increase in pension payments in 2021. This is officially stated in federal law number 5, which was approved back in 1995. As of April 2021, deputies in the Russian State Duma are confident that the payment of the EDV VDB in 2021 can be raised to 2,850 rubles. This also takes into account the minimum subsistence level, which is 11,280 rubles. It is noted that if there are approximately 1.5 million combatants in Russia, the government will need to allocate more than 37 billion rubles to pay the monthly EDV.

How to apply for a monthly benefit

In order to apply for benefits, a veteran must contact the territorial department of the Pension Fund of the Russian Federation at his place of residence with the following documents:

- identification document;

- combat veteran certificate.

The application is submitted to employees of the Pension Fund in writing in person or through an electronic account on the official website of the Pension Fund of the Russian Federation.

Within 10 calendar days, the applicant must receive a response to the application confirming the right to receive payments or a reasoned refusal.

In this case, a citizen who does not agree with the decision of the Pension Fund has the right to file a claim with a higher pension authority to consider the legality of the refusal.

Can relatives receive EDV?

If a combat veteran is presumed dead or killed, his family members are entitled to receive the monthly payment in his place.

When applying to the Pension Fund, relatives must have with them documents confirming a close relationship with the deceased, a combat veteran’s ID card and an identification document of the applicant.

Receipt procedure

If a combat veteran is a pensioner, then the monthly cash payment is transferred to him simultaneously with pension payments . At the same time, the citizen has the right to choose exactly how to receive savings:

- through the post office;

- through a credit institution (banks);

- through a courier organization.

If a change in the method of receipt is required, the person must submit a corresponding application to the Pension Fund in writing in person or through a representative, or electronically on the official portal of the Pension Fund.

If the recipient of the payments is not a pensioner, then he can receive funds once a month on the date designated by the Pension Fund. A person can choose the method of receipt independently by drawing up an appropriate application.

Monthly cash payment to combat veterans

EDV UBD refers to one of the types of support from the state. But not all citizens can receive such payments. To receive it you must go through the registration procedure. Also, monthly cash payments to combat veterans are periodically indexed.

The payment is received in the month for which it is due. Veterans who are also pensioners receive benefits along with their pension in a way convenient for them.

Who is entitled to

Veterans who, while in service, took part in hostilities on the territory of the country or abroad can receive such a payment. These include military personnel and citizens equivalent to them, including police and state security workers. Also, those who participated in post-war operations carried out mine clearance in the period from 1945 to 1951, and for sea mines this period was extended until 1957.

Military pilots and participants in automobile convoys delivering supplies to Afghanistan.

Those who were sent to work in combat zones are not accrued EDV.

Law

The rights of veterans are enshrined in federal law No. 5-FZ of January 12, 1995. The content indicates which citizens can claim certain benefits and payments. The amount of EDV for combat veterans is reflected in paragraph 3, part 4, article 23.1 of the Law “On Veterans”. The value is not fixed and is regularly indexed.

Decor

Payments begin to be transferred only after they are processed. The veteran is required to fill out an application and provide a number of documents. The procedure is carried out by the Pension Fund. A citizen can apply there in person by visiting the branch at the place of residence, also through an electronic portal or a trusted person can act on his behalf. In the latter case, a power of attorney certified by a notary is required.

Instructions

They start by collecting the required papers. Among them:

- Identity document. A passport with a mark indicating the place of registration will do. You can bring your registration certificate separately;

- Certificate confirming the status of a combat veteran;

- SNILS.

If the citizen is a pensioner, he attaches confirmation of this. Also, if he wants to receive payments to the card, he should provide his account details.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

EDV can be accrued together with a package of social services. The amount is divided into these two areas. But if a veteran wants to receive payments in the maximum amount, he needs to write an application waiving the social package. You can also change its volume and only partially receive the social package. A citizen must submit such an application no later than September 30 of the current year.

Once the veteran's application is registered, a decision will be made within 10 days to confirm his eligibility to receive such benefits. The refusal must be accompanied by a reason. The veteran can correct it or file a complaint with higher authorities.

If the citizen is not a pensioner, the period within which payments will be transferred is determined by the Pension Fund. A citizen can only choose the method of receiving finance.

Housing subsidy

Combat veterans or family members of deceased veterans are entitled to receive cash payments for the purchase of housing in the form of a housing subsidy.

The amount that the state transfers to this category of citizens is a target amount, therefore it can only be spent on the purchase of residential premises.

The size of the payment directly depends on the average market value of 1 square meter of total housing area in the constituent entity of the Russian Federation.

Article 7, paragraph 1, Federal Law of July 19, 2011 N 247-FZ:

The payment amount is calculated based on the average market value of 1 sq.m. housing in the region multiplied by 18 sq.m.

An increase in the UBI is expected from April 1, 2021

From February 1 of this year, the size of the NSO was indexed by the same 4.3 percent. Now the set of social services in monetary terms will be 1,121.42 rubles. We are talking about changing the cost of services that are included in the NSO to:

For example, the inflation rate in 2021 was 4.3 percent, which means that the increase in the monthly wage from 2021 will be the same. The size of one-time payments will differ depending on the features of the set of social services.

We recommend reading: New presidential decree on streamlining citizenship

EDV for combat veterans from July 1, 2021 - what amount is due, will there be an increase

It is worth keeping in mind that it is not necessary to refuse benefits as a “package”. A person can choose for himself which benefits he does not plan to use and which ones he will need. You can only refuse unnecessary benefits, and based on this, the amount of EDV will be assigned.

In cases where a person is entitled to EDV for several reasons at once (for example, a combat veteran also has a disability), payments are not summed up. A person is assigned the largest EDV out of several that he can apply for.

We recommend reading: If I moved to the Chernobul zone, I’m 53 years old when I retire in a new way