What additional payments are there for pensioners for children?

In accordance with federal regulations governing pension provision, the following persons are entitled to bonuses:

- who gave birth to two or more children before 1990

- having minor children

- having dependents

- having children with disabilities

- classified as mothers/fathers of many children

A separate category can include an allowance for pensioners who have the status of “children of war.”

The amount of each bonus is determined separately based on the personal application of the pensioner. The main calculation criterion is a certain number of pension points for a particular factor.

See also: Survivor's pension in 2020.

Legal aspects

Legal support is regulated by Law No. 350-FZ of October 3, 2018, which came into force in 2020. The main innovation is a gradual increase in the pension age limit for women from 55 to 60 years over the next five years. In accordance with the regulatory document, women who have raised four dependents have the opportunity to retire early at the age of 56, and for three dependents at the age of 57, if they have the appropriate time worked.

If a legal act does not make changes to the procedure for assigning payments, then the provisions of Law No. 400-FZ of December 28, 2013 apply. According to Article 12, the general period for pension provision includes the time of caring for each child up to one and a half years of age, with a limit of six years . Technically, the additional payment to the pension for having many children occurs as a result of the transfer of the “non-tenure interval” dedicated to the educational process into the accumulative amounts provided for by law.

Increased interest in recalculation has risen since 2015, since previously the time spent on maternity leave was included only in the total length of service, and after this date it is possible to convert it into specific numerical coefficients. However, according to statistical data, the real bonus was given to 20-30% of people who applied to the fund. This is due to the presence of the conjunction “or” in the selection, since recalculation leads to a decrease in the period of production activities and the exclusion of income in the form of wages.

Important! Recalculation of pensions for maternity leave for pensioners does not guarantee a positive result in the form of an actual increase in cash equivalent. Factors that increase the likelihood are the number of students, average salary and conditions for retirement. Each case requires individual consideration by Pension Fund specialists, but if the result is negative, the accrued amount remains at the same level and is not subject to downward adjustment.

Supplement to pension for children born before 1990

In 2020, a supplement was introduced for children born in the USSR before 1990. The decision to accrue additional pension points was made on the basis of the absence of maternity leave in the work experience. Read more: How to calculate a pension based on points.

The following may apply for additional payments:

- parents with two or more children, provided they were born before 1990

- parents who were on maternity leave for up to 1.5 years

- persons who can confirm all the specified facts with documents

Additionally, the following conditions must be met:

- assignment of pension benefits until 2020

- no early retirement

The amount of the benefit is determined depending on the number of children and the duration of maternity leave.

| Amount of children | Maternity leave for 1 year | Maternity leave for 1.5 years |

| 1 | 1,8 | 2,7 |

| 2 | 3,6 | 5,4 |

| 3 or more | 5,4 | 8,1 |

Special conditions for calculating allowances for children have been developed for the following categories of pensioners:

- persons working in the Far North. The amount of additional payment is determined by regional legislation

- retired military personnel. The amount of additional benefit for one child will be 32% of the pension, for two children - 64%, for three or more - 100%

- pensioners of the Ministry of Internal Affairs and the Ministry of Emergency Situations. The payment amount also varies from 32% to 100% of the pension provision

Documentation

To process a payment to the Pension Fund, you must provide the following package of documents:

- pensioner's passport

- certificate confirming the birth of each child

- pension certificate (pension book)

- SNILS

- certificate of absence of supplement for the second parent

- any document that can confirm that the baby has reached the age of 1.5 years (school certificate, extract from a medical card, diploma, etc.)

- certificate of family composition

How to apply

To carry out recalculation, a written application is submitted to the Pension Fund, which indicates:

- name of government agency

- Full name of the applicant

- SNILS

- citizenship

- registration address

- contact number

- passport details

- floor

- personal data of the legal representative when conducting recalculation by proxy

- type of pension

- type of benefit

- attitude towards the job at the time of application

- number of dependents

- list of attached documents

The application can be submitted:

- personally

- through a legal representative

- through the multifunctional center

- online through the Public Services service

Pension Fund employees are given 10 days to consider the application. If the application is approved, the allowance will be received from the next reporting period.

The most important thing about surcharges

- Who should I contact for a new pension calculation? Persons who retired before 2020 and cared for a child up to one and a half years old. When calculating pensions after 2020, the optimal option was selected, taking into account the period of child care.

- It is important to remember that calculation using the point system reduces the length of service. Therefore, if you have little experience, you won’t get a raise.

- You should not immediately write an application to cancel your existing pension. Contact the customer department for a preliminary estimate. For the fund's employees, this is labor-intensive work, but they do not refuse this service.

- Changing the calculation procedure does not entail a reduction in the current pension. If the result of the recalculation turns out to be negative, the payment amount will remain the same.

- You can submit documents to change your pension in a way convenient for the pensioner: in person to the Pension Fund department, MFC, or remotely via the Internet.

- The amount of the increase is individual. Practice shows that the amount of additional payment can range from 3 to 400 rubles.

Supplement to pension for dependent minor children or students

Additional payments are provided for pensioners with dependents.

Dependents mean:

- minor children

- incompetent relatives

- children aged 18-23 years who are fully supported by a pensioner and undergoing full-time education

The amount of the supplement varies depending on the number of dependents. Every year on February 1, the payment is indexed.

The surcharge amounts are presented in the following table:

Required documents

To apply for an allowance for a dependent or for children under 18 years of age, a working pensioner must prepare the following set of documents:

- passport

- SNILS

- pensioner's ID

- child's birth certificate or other document proving relationship with a dependent person

- certificate of family composition

- certificate of joint residence with a dependent

- certificate from the educational institution (for students)

- checks, bank statements and other documents confirming the costs of caring for a dependent

- certificate of the amount of income received (for working pensioners)

Registration procedure

Registration of benefits is also carried out at the Pension Fund by submitting a written application.

Refusal to pay or accept documents can be appealed in court. Before filing a claim, preparing documents, etc., it is recommended to engage a qualified lawyer. You can get specialist help on our website.

What difficulties may arise

In some situations, pensioners face a number of difficulties when applying for recalculation. Most often, older people complain about the Pension Fund’s refusal to recalculate. They believe that Foundation officials are deceiving them. However, this is not always true.

In Russia, recalculation is not carried out, which will allow a pensioner to be paid less than he receives at the time of contacting the Pension Fund specialists. Consequently, most often those who receive recalculation refusals are those who:

- receives a state pension;

- retired in 2020 and later;

- receives a preferential pension;

- has only 1 child;

- receives maintenance due to the loss of a breadwinner.

The second common complaint of older people is the need to collect additional paperwork.

Anna Pavlovna Ch. turned to a Moscow lawyer for assistance. The woman explained that she tried to submit documents for recalculation, since her pension for 2 children is not currently taken into account. The Fund specialist asked that the documents be supplemented with a certificate stating that her husband, from whom she had been divorced for more than 15 years, did not use the additional payment, and she does not know where he is now. The lawyer explained that she is not obliged to provide such a certificate, and the specialist’s demand can be appealed to the management of the client service.

Additional payment to the pension of the mother of a disabled child, large families

The following can receive a pension benefit when raising a disabled child:

- mother aged 50 with more than 15 years of work experience

- father aged 55 with 20 years of work experience

The pension amount increases:

- for a standard bonus in the amount of 1478-2527 rubles (determined individually)

- for social assistance in the amount of 5,500 rubles

- for benefits provided by regional regulations. For example, the mother of a disabled child living in Moscow receives an additional 5,000 rubles per month

What documents are needed

To apply for benefits you will need:

- passport, SNILS, pension certificate of a person entitled to additional benefits

- birth certificate of a child with disabilities

- medical documents, including a certificate recognizing the child as disabled since childhood

- certificate of family composition

Registration procedure

Registration of benefits begins with the preparation of all medical documents. Next, a written application is submitted to the Pension Fund in the form presented above and the decision of the responsible employees is awaited.

In case of missing documents, errors, etc., the documents are returned to the applicant to eliminate the identified deficiencies.

If the rights of a pensioner are violated

To the credit of PFR specialists, it is worth noting the small number of complaints about infringement of the rights of a pensioner. But if this happens, then unlawful actions can be appealed:

- from the direct management of the territorial branch of the Pension Fund;

- in the higher authority of the Pension Fund of Russia;

- at the prosecutor's office.

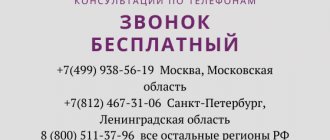

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below

What should be the pension supplement for war children?

A special category includes pensioners who have the status of “children of war.” These include citizens born in the USSR between 1923 and 1945, provided that the child permanently resided on the territory of the state during the period of hostilities.

This category of citizens does not have an official status assigned at the state level. The amount of supplements to the pension benefit in this situation is determined by the regional authorities. For example, in the capital, “children of war” receive 1,000 rubles a month and have the right to receive a 50% discount on government services.

Documentation

Registration of additional benefits is carried out on the basis of the following documents:

- passport, SNILS, pension certificate

- certificates of birth within a specified period

- any documents proving the fact of residence in the country within the specified period

Who will benefit from the recount?

During the recalculation, the individual amount of the surcharge is determined. Having a large number of children does not guarantee a raise. It is important to understand that the work experience at the time of raising children (up to 1.5 years) is replaced by points for the non-insurance period. If during this period the woman had a good salary, there may be no additional payment, and after recalculation it may turn out that the pension amount will become even smaller. You shouldn’t be afraid of this - if this happens, no one will reduce your pension, they will simply refuse the additional payment and leave everything as it is.

An additional payment can be given to a woman for 1, 2, 3 or 4 children. Subsequent children will no longer be counted. At the same time, for some categories of citizens the recalculation will bring an increase, but for others it will be completely unprofitable. Here are classic cases of both options (but in each specific case the situation may be different due to individual factors and circumstances):

| Most likely to get a raise | After recalculation, the pension may be less |

| In case of birth of 2 or more children and being on maternity leave with them for up to one and a half years If several children are born at the same time (points will be counted as 2, 3 or 4, and the insurance period will decrease slightly) If at the time of birth and child care the mother was not employed or undergoing training When retiring with the minimum possible work experience If pension payments are calculated from earnings, below the Russian average In the case when the pension amount turned out to be almost the same as the minimum subsistence level established in the country | If the recalculation is made for an only child If the pensioner has a long work history, which includes the period of childcare If, when calculating pension payments, the average salary turned out to be higher than the national average |

The most significant increase in pension will be for those women who satisfy a number of conditions:

- cared for 2 or more children on maternity leave;

- had little income at that time or were not employed at all;

- have little work experience.

It is highly undesirable for women who have received a pension on preferential terms to apply for additional payment. Because of this, their benefit period is lost, because it is replaced by a non-insurance period. In some cases, this may completely deprive a woman of the right to early retirement.

Assignment of pension

Federal Law No. 400 prescribes the conditions for assigning pension payments to Russians. Article 8 states that the right to the insurance portion arises from:

- men 60 years old;

- women 55 years old.

Key indicators for determining the amount of benefits:

- evaluation of documents confirming work experience,

- a set of deductions from wages.

The introduction of a point system (IPS) by the pension reform combined both parameters.

The individual coefficient is formed based on:

- insurance experience;

- salary level.

Each full calendar year of recorded experience adds coefficients (IPC) to the employee.

Until 2020, Federal Law-173 was in force. Article 10 of this law stated that the insurance period is formed from the stages of labor activity during which the Pension Fund of the Russian Federation received contributions made by employers and the insured person.

From the beginning of 2020 (January 1), Article 12 of Federal Law No. 400 introduced a new rule, according to which the insurance period was supplemented by other periods listed by the provisions of the article.

Clause 1.3 designated the time of caring for children up to one and a half years old as periods counted as “insurance” periods subject to the calculation of the IPC.

Until this moment, such periods were included in the length of service, but did not affect the amount of benefits and were recognized as “non-insurance”.

Calculating the total number of odds is a complex process. The result depends on:

- time of work;

- type of assigned state support;

- moment of applying for a subsidy.

The number of IPCs earned while working reflects:

- the amount of wages;

- the total result of contributions paid;

- duration of the labor stage.

The algorithm for assigning IPC to citizens who completed their working career before January 1, 2020 is given in Article 34 of Federal Law No. 400.

Pension Fund employees:

- raise a personalized case for payments;

- divide the amount of the assigned benefit by the cost of the coefficient (64.10 rubles).

Social pensions and IPC are indexed annually.

Indexation of the insurance part of the state benefit in 2020 will be 3.7% (for non-working pensioners), the price of a point will increase to 81.49 rubles.

Where to contact

Recalculation is not performed automatically. In order for it to be done, you need to contact the territorial client service of the Pension Fund with all the necessary documents.

Applications are also accepted at multifunctional centers during personal visits and on the Unified Portal of Public Services in electronic form.

The pensioner will need to correctly draw up and submit an application for recalculation of the pension, which is registered in the office of the Pension Fund. After which it is sent for review by specialists for recalculation.

If your application is approved, increased payments will be received next month. If the applicant is refused, he will receive an official response within 10 days.

As for the deadline for submitting an application, there are no restrictions on this parameter; you can use the above methods for submitting an application at any convenient time. The main thing is not to delay submitting documents, since the recalculation will be carried out only from the first day of the next month.