The difference between insurance experience and labor experience

It is important not to confuse length of service and insurance.

Work experience is the periods of work of a person under an employment contract, regardless of whether there were transfers of contributions to the Pension Fund. In this case, the type of contract (indefinite, fixed-term, part-time) does not matter.

The insurance period is the period of work during which contributions to the Social Insurance Fund were paid either by the employee himself (who was, for example, an individual entrepreneur) or by his employer.

Some periods included in the length of service are not included in the insurance period. For example, this could be a period of working as self-employed. That is, if yesterday an employee paid tax on professional income, but refused to transfer contributions, in the future this period will not be included in the insurance period. However, the Pension Fund explains that self-employed citizens, if desired, can deposit a certain amount into their pension account during the year. Then the experience will be credited to them .

When calculating the insurance period, only those periods when insurance premiums were paid to extra-budgetary funds are taken into account.

Due to such situations, the employee’s insurance length may be less than the length of service on the same date.

Insurance experience from 2021 in Russia

Discussing changes in the rules for calculating the insurance period for pensions since 2016, experts fear that this system will be quite difficult to understand right away.

Which, naturally, will cause a slight shock among the population. The authorities have already reformed the pension system several times, and it is safe to say that these reforms have not yet been particularly successful, therefore, there is something to be afraid of, but it is worth emphasizing that these similar innovations should make the life of a person who retires better for retirement.

There are ways that will help you find out your personal insurance record, according to the first of which you can do this by asking for help from a representative of the insurance fund, and the second is to do everything yourself. There is no point in talking about the first method for a long time, but in order to use the second, you need to look through all the entries in the work book, add to them those periods that are not displayed in it (child care, service time, entrepreneurial activity and other positions) , and then use a special calculation formula. An online calculator will help you accurately calculate your insurance period starting from 2021 in Russia; you just need to enter your personal information.

We recommend reading: Is it possible to get into kindergarten without registration?

Documents to confirm your experience

A document that confirms the insurance period is a work book or a certificate of employment, generated by the employer in accordance with Art. 66.1 Labor Code of the Russian Federation.

If the work book was not kept, then supporting documents may be:

- written employment contracts;

- certificates issued by employers or relevant government agencies;

- extracts from orders;

- personal accounts or payroll statements.

For example, recently an employee was an individual entrepreneur and worked without an employment contract, but today he is your employee. To calculate the insurance period, the employer needs a certificate from the regional office of the Social Insurance Fund about the contributions paid by the individual entrepreneur.

There are cases when several periods coincide for inclusion in the insurance period . This is possible if the employee works two jobs at the same time. Or when an individual entrepreneur pays social insurance contributions and at the same time works in an organization under an employment contract. In such situations, only one of the periods selected by the employee will be taken into account (Part 2 of Article 16 of Law No. 255-FZ of December 29, 2006). He confirms his choice with a free-form statement.

From what year is the funded pension accrued: payment periods

Otherwise, accrual occurs from the date when the last missing document is submitted to the organization. If any of the documents is missing, then Pension Fund employees must explain what exactly this document is and how it can be obtained.

We recommend reading: Benefit upon death of mother

In 2021, the retirement age will be: for women - 55 years, for men - 60, not counting the exceptions prescribed by law. To assign a pension, you must submit an application to the local branch of the Pension Fund.

Rule for calculating insurance period

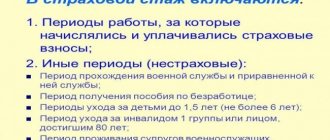

The procedure for calculating the insurance period for sick leave benefits is determined by Order of the Ministry of Labor of Russia dated August 27, 2019 No. 585n (as amended on January 19, 2021) “On approval of the Rules for calculating and confirming the insurance period for determining the amount of benefits for temporary disability, pregnancy and childbirth” and the Federal Law “ On compulsory social insurance in case of temporary disability and in connection with maternity" dated December 29, 2006 No. 255-FZ. When calculating the length of sick leave, the following periods are taken into account:

- work under an employment contract;

- public service (civil or municipal);

- periods of other activities during which a citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

In all of the above situations, the insurance period is considered:

1 full month = 30 days.

1 full year = 12 months.

That is, every 30 days are converted into a full month, and every 12 months - into a full year (clause 23 of section III of the Rules for calculating and confirming the insurance period).

Example:

Vera Pavlovna worked at Horns and Hooves LLC from March 1 to May 25, 2015. Then she quit and did not work anywhere until May 25, 2021. From May 26 to September 3, 2021, she worked at Fangs and Feathers LLC, and then quit again. From January 1, 2021 to the present, Vera Pavlovna has been working at Lobster and Squid LLC.

Using this example, we will calculate Vera Pavlovna’s insurance period:

from 03/01/2015 to 05/25/2015 - 2 months 26 days;

from 05/26/2015 to 05/25/2016 - did not work (not taken into account in the total insurance period)

from 05/26/2016 to 09/03/2016 - 3 months 9 days;

from 09/04/2016 to 12/31/2016 - did not work (not taken into account in the total insurance period);

from 01/01/2017 to 08/03/2021 - 4 years 7 months 4 days.

Vera Pavlovna’s total length of service as of 08/03/2021:

We add up the days: 26 + 9 + 4 = 39, which means 1 month and 9 days.

We add up the months: 2 + 3 + 7 + 1 (the one we counted above) = 13 means 1 year and 1 month.

Add up the years: 4 + 1 (the one you counted above) = 5 years.

Total: 5 years 1 month 9 days.

Insurance experience, several ways to prove it

The most important and general issues regarding the issuance of documents confirming work experience are contained in the Regulations on the procedure for confirming work experience for the assignment of pensions in the RSFSR, approved by order of the Ministry of Social Security of the RSFSR dated October 4, 1991 N 190. In accordance with this Regulation, the length of service is established at on the basis of documents issued at the place of work, service, study or other activity counted towards work experience, or by higher organizations, as well as archival institutions. The main document on the basis of which work experience is established is the work book. The instructions on the procedure for maintaining work books at enterprises, institutions and organizations, approved by the resolution of the USSR State Committee for Labor of June 20, 1974, became invalid due to the adoption of the resolution of the Ministry of Labor of the Russian Federation of October 10, 2021 N 69 “On approval of the Instructions for filling out work books” *(9). Labor books in the USSR were introduced by the resolution of the Council of People's Commissars of the USSR dated December 20, 1938 “On the introduction of labor books” * (10). This normative act was canceled by the resolution of the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions of September 6, 1973 “On work books of workers and employees” * (11), which introduced a new form of work books, which is used to this day. Currently, the Decree of the Government of the Russian Federation of April 16, 2021 N 225 “On work books” * (12) is in force. In the absence of a work book, as well as in the case where the work book contains incorrect and inaccurate information or there are no records about individual periods of work, written employment contracts drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose are accepted to confirm the periods of work, work books of collective farmers, certificates issued by employers or relevant state (municipal) bodies, extracts from orders, personal accounts and statements for the payment of wages. In the event that a work record book is not kept, periods of work under an employment contract are confirmed by a written employment contract drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose. The periods of work under a civil law contract, the subject of which is the performance of work or the provision of services, are confirmed by the specified contract, drawn up in accordance with the civil legislation in force on the day the relevant legal relationship arose, and the employer’s document on the payment of mandatory insurance payments. In this case, the duration of the period of work included in the insurance period is determined according to the validity period of the contract corresponding to the period of payment of mandatory payments. In cases where the validity period of the agreement is not established, the duration of the specified period is determined based on the period for making mandatory payments. The periods of work under copyright and licensing agreements are confirmed by the specified agreements, drawn up in accordance with the civil legislation in force on the day the relevant legal relationship arose, and a document from the territorial body of the Pension Fund of the Russian Federation or the territorial tax authority on the payment of mandatory payments. In this case, the duration of the period of work included in the insurance period is determined according to the validity period of the contract corresponding to the period of payment of mandatory payments. In cases where the validity period of the agreement is not established, the duration of the specified period is determined based on the period for making mandatory payments. Periods of work for individual citizens under contracts (domestic workers, nannies, secretaries, typists) during the time before the conclusion of employment contracts or contracts of a civil law nature, the subject of which is the performance of work or the provision of services, is confirmed by an agreement between the employer and the employee registered with trade union bodies , and a document from the territorial body of the Pension Fund of the Russian Federation or the territorial tax authority on the payment of mandatory payments. The periods of work of members of a peasant (farm) economy and citizens working in a peasant (farm) economy under contracts for the use of their labor are confirmed by a work book and a document from the territorial body of the Pension Fund of the Russian Federation or the territorial tax authority on the payment of mandatory payments. Entries made in the work books of farm members and citizens working in peasant (farm) farms under contracts for the use of their labor are certified by the local government body. Periods of work as a shepherd under an agreement with a collective of citizens - livestock owners, during the time before the conclusion of employment contracts or civil contracts, the subject of which is the performance of work or the provision of services, are confirmed by an agreement between the shepherd and the collective of citizens - livestock owners (with a note on his execution) and a document from the territorial body of the Pension Fund of the Russian Federation or the territorial tax authority on the payment of mandatory payments. It should be borne in mind that periods of work before a citizen’s registration as an insured person can also be confirmed by testimony and are established on the basis of the testimony of two or more witnesses who know the citizen from working together with the same employer, if work documents are lost due to a natural disaster (earthquake, flood, hurricane, fire and similar reasons) and it is impossible to restore them. A citizen's application to establish the period of his work based on testimony must be accompanied by: 1) a document from the state (municipal) body on whose territory the natural disaster occurred, confirming the date, month, year, place and nature of the natural disaster that occurred; 2) a document from the employer or the relevant state (municipal) body confirming the fact of the loss of work documents in connection with the specified natural disaster and the impossibility of their restoration; 3) a certificate from an archival institution or state (municipal) body confirming the absence of archival data on the period of work established by witness testimony. In case of loss of work documents and the impossibility of obtaining them due to careless storage, intentional destruction and other similar reasons through no fault of the employee, periods of work are established on the basis of the testimony of two or more witnesses who know this employee from working together with one employer and have documents about their work for the time in respect of which they confirm the citizen’s work. The employee’s application to establish the period of his work based on witness testimony must be accompanied by an employer’s document or other documents confirming the fact and reason for the loss of work documents and the impossibility of obtaining them. The employee’s application to establish the period of his work based on witness testimony must be accompanied by an employer’s document or other documents confirming the fact and reason for the loss of work documents and the impossibility of obtaining them. The length of service established by testimony cannot in this case exceed half of the insurance period required for the assignment of a labor pension. When establishing the period of work based on testimony, the following is taken into account: the period of work, starting from the employee reaching the age at which it is permissible to conclude an employment contract in accordance with the labor legislation in force on the day the relevant legal relationship arose; witness testimony only for the period of joint work in which the witness reached the age at which it is permissible to conclude an employment contract in accordance with the labor legislation in force on the day the relevant legal relationship arose. The establishment of periods of work based on testimony is made by a decision of the body providing pensions, the form of which is approved by the Pension Fund of the Russian Federation in agreement with the Ministry of Health and Social Development of Russia. This decision is made on the basis of the testimony of witnesses given to the body providing pensions at the place where the pension was established or at the place of residence of the witness. If a witness is unable to testify due to health reasons or other valid reasons, witness testimony certified in the prescribed manner may be presented in writing. The period of receiving state social insurance benefits during a period of temporary disability is confirmed by a document from the employer or the territorial body of the Social Insurance Fund of the Russian Federation on the period of payment of the specified benefit. Based on a citizen’s application, the period of his work, based on witness testimony, can also be established before the onset of conditions giving the right to a labor pension. If one of the witnesses testifies about a citizen’s work for a longer period than the other witness, the period confirmed by both witnesses is considered established.

We recommend reading: What documents are needed for an audit

Let us now move on to the question of that. How and on the basis of what regulatory legal acts is the insurance period currently confirmed? According to paragraph 4 of Art. 13 of the Law “On Labor Pensions”, the rules for calculating and confirming the insurance period, including on the basis of witness testimony, are established in the manner determined by the Government of the Russian Federation. Currently, the Rules for calculating and confirming the insurance period for establishing labor pensions are in force, approved by Decree of the Government of the Russian Federation of July 24, 2021 N 555 * (7) (hereinafter referred to as the Rules of July 24, 2021). In accordance with the specified Rules of July 24, 2021, the insurance period includes (counts): a) periods of work and (or) other activities performed on the territory of the Russian Federation by persons insured in accordance with the legislation of the Russian Federation on compulsory pension insurance; b) periods of work and (or) other activities performed by insured persons outside the Russian Federation, in cases provided for by the legislation of the Russian Federation or international treaties of the Russian Federation. or in case of payment of insurance contributions to the Pension Fund of the Russian Federation upon voluntary entry into legal relations for compulsory pension insurance; c) other periods: the period of military service, as well as other service equivalent to it, provided for by the Law of the Russian Federation of February 12, 2021 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, institutions and bodies the penal system, and their families”*(8); the period of receiving state social insurance benefits during the period of temporary disability; the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than three years in total; the period of receiving unemployment benefits, the period of participation in paid public works and the period of moving in the direction of the state employment service to another area for employment; The rules for confirming insurance experience differ depending on the moment of occurrence of the above periods: after registration or before registration of a citizen as an insured person. the period of detention of persons who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of these persons serving their sentences in places of deprivation of liberty and in exile; the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years. Thus, the Rules of July 24, 2021 distinguish the following periods included in the insurance period: periods of work; periods of other activities; other periods. The rules for confirming insurance experience differ depending on the moment of occurrence of the above periods: after registration or before registration of a citizen as an insured person. As for confirming the insurance period for the period after a citizen’s registration as an insured person, the least number of questions arise here. The rules of July 24, 2021 establish that periods of work and (or) other activities after registration of a citizen as an insured person are confirmed by documents on payment of the relevant mandatory payments, issued in the prescribed manner by the territorial body of the Pension Fund of the Russian Federation on the basis of individual (personalized) accounting information . Much more questions arise when confirming the relevant periods included in the insurance period before registering a citizen as an insured person. Documents confirming the above periods before registration of a citizen as an insured person, included in the insurance period, can be classified as follows. In the event that a work record book is not kept, periods of work under an employment contract are confirmed by a written employment contract drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose.

We recommend reading: What is the retention period for the log of requests for equipment under the control of the dispatcher?

Insurance period for employee sick leave

The insurance period directly affects the amount of temporary disability benefits. If the insurance period:

- from 6 months to 5 years - 60% of average earnings;

- from 5 to 8 years - 80%;

- more than 8 years - 100%.

Important: according to paragraphs. 1 clause 1 art. 9 of Federal Law No. 255-FZ of December 29, 2006, leave without pay is not included in the insurance period . But the current employer does not see these vacations in the work book. In order to correctly calculate the insurance period, the accountant needs a certificate of the amount of earnings for the previous two years in form 182n from the previous place of work. It is usually issued on the day of dismissal or when the employee re-applies to his former employer.

Example:

Accountant Maria Ivanovna issued a certificate of temporary incapacity for work. Sick leave is open for the period from May 10 to May 24, 2021.

Maria Ivanovna’s work book details:

from 01/15/2004 to 07/20/2014 - Romashka LLC;

from 07/21/2014 to 08/25/2018 - Kolokolchik LLC;

from 08/26/2018 to the present - Forget-Me-Not LLC.

The length of service is considered on the day preceding the day of onset of illness, that is, in this case, on May 9, 2021:

01/15/2004 - 07/20/2016 - experience 10 years 6 months 5 days;

07/21/2014 - 08/25/2018 - experience 4 years 1 month 4 days;

08/26/2018 - 05/09/2021 - experience 2 years 8 months 13 days.

Result: total insurance experience: 17 years 3 months. 21 days

This means that Maria Ivanovna’s temporary disability benefit will be 100% of her average earnings.

If the work experience is less than six months, temporary disability benefits for one full calendar month are paid in an amount not exceeding the minimum wage (as of 01/01/2021, the minimum wage is 12,792 rubles). In 2021, the daily benefit amount for employees who work for less than 6 months is equal to:

- for months of 31 days - 412.65 rubles. in a day;

- for months of 30 days - 426.4 rubles. in a day;

- in February - 456.86 rubles.

To calculate the number of sick days, multiply by the daily allowance.

Example:

Tamara Petrovna was self-employed until April 1, 2021 and did not pay contributions to the Social Insurance Fund. Since 04/01/2021, she has been working as a cashier at Horns and Hooves LLC. Tamara Petrovna issued a certificate of temporary incapacity for work from June 1 to June 7, 2021. Tamara Petrovna’s insurance record at the time of the insured event was 1 month 29 days.

The temporary disability benefit for Tamara Petrovna will be:

426.4 * 7 = 2,984.80 rub.

Insurance period for sick leave for individual entrepreneurs

If a certificate of incapacity for work is opened by an employee of an individual entrepreneur , then sick leave is calculated according to the general rules, depending on the length of insurance. Since the individual entrepreneur is obliged to conclude an employment contract with each employee and transfer contributions to the Social Insurance Fund.

But if the certificate of incapacity for work is opened by the individual entrepreneur himself , then he can count on sick leave during illness only if he has entered into a voluntary social insurance agreement and paid insurance premiums for himself to the Social Insurance Fund.

The agreement must be concluded in advance. In order to receive sick leave payments in 2021, the individual entrepreneur had to enter into an agreement and pay contributions in 2020.

Insurance" and "work" experience: differences

The period of parental leave until the child reaches the age of three, receiving payments for certain types of compulsory state social insurance, except for pensions of all types (except for disability pension), is included in the insurance period as the period for which insurance contributions are paid, based on the amount minimum insurance premium.

In accordance with Art. 48 Labor Code of Ukraine, clause 1.1. Instructions on the procedure for maintaining work records of employees, approved by order of the Ministry of Labor and Social Policy, the Ministry of Justice, the Ministry of Social Protection of the Population of Ukraine dated July 29, 1993 No. 58, the work record is the main document on the employee’s labor activity.

We recommend reading: Is an 80-year-old military pensioner entitled to a fixed payment towards his pension?