Last modified: June 2020

The responsibility of parents to financially support their children is determined by the Family Code of the Russian Federation. Child support is paid until the child reaches the age of majority. The law gives spouses the right to independently agree on the transfer of funds to the child by concluding an appropriate voluntary agreement, or to resolve this issue during court proceedings. Alimony from lottery winnings is collected, but there are some restrictions.

Types of income from which alimony is paid

Let's turn to the current legislation.

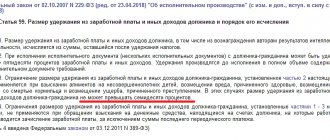

According to Art. 82 of the Family Code of the Russian Federation, the list of incomes that are taken into account when calculating and collecting alimony is determined by the Government of the Russian Federation. And indeed: such a list was approved by Decree of the Government of the Russian Federation No. 841 of July 18, 1996.

The types of income that are taken into account when calculating and collecting alimony can be divided into the following groups:

- Income from work:

- wage;

- remuneration of deputies and civil servants;

- monetary allowances for military personnel;

- fee;

- wage supplement (for harmfulness, for night work, for length of service);

- bonus.

- Income not related to work:

- pension;

- scholarship;

- unemployment benefit;

- temporary disability benefits;

- Income from business activities:

- profit;

- dividends;

- Income from civil contracts (for example, from a work contract);

- Passive income:

- payments from tenants of residential or commercial real estate;

- income from copyright and related rights;

- interest on deposits;

- other.

As we can see, lottery or casino winnings are not included in the list of income from which alimony is paid.

Types of income from which alimony is not paid

But lottery winnings are not included in the list of income from which alimony cannot be collected.

According to Art. 101 Federal Law “On Enforcement Proceedings”, such income is:

- compensation payments for compensation for harm to health;

- survivor benefits;

- financial assistance for the birth of a child, marriage, death of a relative;

- compensation payments to victims of a disaster or natural disaster;

- targeted payments for the purchase of medicines or treatment;

- travel allowances, payments for the purchase of working tools;

- maternal capital;

- alimony.

What is not subject to alimony payments?

The law also establishes a list of incomes on which alimony payments cannot be made. Here's what we're talking about:

- Benefits issued by the state if their recipients are pregnant or postpartum women.

- Business trips.

- Products intended for receiving special therapeutic and preventive nutrition.

- Maternal capital.

- Lifting cards issued to people changing their region of residence due to business needs.

- Pension accrued due to the loss of a breadwinner.

- Compensation for the use of workers' own materials or tools in the production.

In addition, alimony is not allowed to be deducted from the following types of financial assistance:

- Issued to the newlyweds.

- Allocated for funeral services on the occasion of the death of a relative.

- In case of the birth of a newborn.

- If it is issued to victims of natural disasters.

Parent's obligation to pay child support

In our country, financial support for children until they reach the age of 18 is the responsibility of parents by law. This obligation cannot be canceled or transferred to anyone: a parent who does not live with his child either provides for him voluntarily, or part of his income is withheld and transferred to the parent who provides the care and maintenance of the common minor child.

The obligation to pay for the maintenance of children remains until they reach adulthood, and if a child is disabled, alimony is paid for him even after reaching 18 years of age - until his restoration of his working capacity is recognized. If the health status of a disabled child who has reached the age of 18 does not improve, he may remain supported by his parents throughout his life.

The very fact of the birth of a child implies that both parents must bear their parental function without any conditions or coercion. Parents' responsibilities include:

- Parenting.

- Ensuring adaptation and socialization from an early age.

- Teaching useful skills.

- Learning new knowledge - independently or by facilitating children’s visits to preschool institutions and development groups.

- Providing household amenities to the extent necessary for children.

- Providing all material needs - food, clothing and other needs.

- Development of children's inclinations and talents.

Attention! The material component is the only parental responsibility that is measured in specific numbers and has its own required minimum.

If both parents live with the child, neither the court nor the guardianship authorities will inspect how mom and dad cope with their responsibilities, and how much each of them spends their income to provide for the needs of the child. But if one or both parents do not live with the child, the question of paying child support arises.

Moreover, if the parent supports the child voluntarily (and especially if he also records all bank transfers or other methods of paying funds for the child’s support), we are not talking about forced collection.

If there is no voluntary payment by the parent for the needs of the child or the parents cannot peacefully agree among themselves on the amount of alimony (for example, if the father gives money for the child in such meager quantities that this amount cannot provide for any needs), the question of collecting alimony arises through the court.

The judge sets the amount of child support in the amount established by law and based on the real confirmed needs of the child, regardless of how much one party wants to pay and the other party wants to receive.

As a rule, the amount is determined by a share of the payer’s income, is deducted from them once a month and is paid until the child’s eighteenth birthday. If the defendant does not have a stable income, a fixed amount is assigned, based on the cost of living in the region, which he will pay regardless of how much money he receives for his work and how often this happens.

The process of collecting alimony payments and methods of paying them

The law defines two options for collecting alimony: in the form of a voluntary agreement of the parties or through the court. If there is a voluntary agreement, all conditions for paying alimony are specified in it. These include the amount of alimony (which does not have the legal restrictions that are taken into account in court), frequency of payments, form (cash, bank transfer, etc.), sanctions for violating the agreement, and other conditions.

Concluding a voluntary agreement is much simpler and more convenient, and collecting alimony is much faster than in court. There is one minus: the parties are not always able to come to a voluntary agreement. Collecting alimony through the court is much more difficult and longer, but as a result, the court’s decision, in any case, will oblige the negligent parent to provide for his child.

After the court makes a decision to collect alimony payments, a writ of execution is issued. This document is the basis for withholding alimony from the defendant’s salary. The plaintiff submits the writ of execution to the bailiff service - either with his own hand or by entrusting this task to the court by writing a corresponding statement.

The bailiffs open enforcement proceedings and send a notice to both parties. If the alimony payer has an official place of work, the writ of execution is sent to the accounting department of his employer, after which alimony deductions from his salary begin to be calculated monthly.

If the payer is not officially employed, the bailiff service studies and takes control of the sources of his cash receipts. The amount of receipts is calculated, after which that part of the funds that is prescribed in the court decision is withheld - as a percentage or a fixed amount.

There are several ways to transfer alimony funds to a recipient:

- by transfer to a bank account or plastic card specified in the writ of execution;

- by postal transfer (all translation costs are paid at the expense of the payer and are not included in the alimony amount);

- in any other way that suits both parties.

Important! All support payments must be verified, so it is in the best interest of both parties to retain receipts, cashier's checks, or cash receipts.

One of the conditions for paying alimony, fixed by law, is its regularity - parents are obliged to provide for their children constantly, and not from time to time. Therefore, if the alimony payer violates the regularity of payments, then penalties in the amount of 0.5% per day of the unpaid debt are charged on the resulting debt.

If the debt is not repaid, bailiffs have the right to impose other sanctions: seizure of property, ban on leaving the country, deprivation of a driver’s license, assignment to forced labor, etc.

What income is taken into account

It is a mistake to believe that alimony can only be withheld from wages. Alimony deductions, according to the legislation of the Russian Federation, are collected from all types of income, both labor and other.

Labor income includes:

- salary for the main job and any number of part-time jobs;

- income of civil servants, military personnel, employees of the Ministry of Internal Affairs, employees holding state and municipal posts, etc.;

- arts and media staff fees;

- any additional payments to the basic salary: for category, rank, length of service, etc.;

- additional payments for special working conditions;

- one-time and periodic bonuses;

- additional payment for working overtime, at night, on weekends and holidays;

- surcharges paid in certain regions.

Other income from which alimony must also be paid includes:

- pensions (including for disability) and any additional payments to them;

- scholarships for undergraduates, graduate students and any scientific workers;

- unemployment benefits;

- payments based on the liquidation of the employing enterprise;

- compensation for loss of health and victims of man-made disasters;

- income from business activities;

- income from the activities of the miner;

- rent for leasing real estate and other property;

- dividends from securities;

- income received on the basis of the concluded agreement.

Lottery winnings: alimony and taxes

What does it mean? Why are lottery winnings not included in any of the lists? And what should the alimony payer do?

So, according to Art. 81 of the RF IC, alimony is collected from the payer’s income.

But despite the absence of the literal expression “lottery winnings” in the List of types of income from which alimony is withheld, you will still have to pay:

- according to paragraphs. 2 of the List of Income, approved by Decree of the Government of the Russian Federation No. 841 of July 18, 1996, alimony payments are withheld from income under civil contracts;

- according to Art. 2 Federal Law “On Lotteries” and Art. 1063 of the Civil Code of the Russian Federation, games and sweepstakes are conducted on the basis of a civil contract concluded between the draw organizer and the player. In the Russian Federation, games are held in the form of lotteries and drawings, as well as bets on sports in bookmakers.

Under the terms of the agreement, the organizer creates a cash prize fund (or assigns a prize in kind), and the player purchases a lottery ticket, receives a receipt or other document that confirms the conclusion of a civil contract and agreement with the terms of the drawing. If the conditions of the game and/or a certain set of events are met (for example, a combination of numbers matches), the player receives a cash prize fund or a prize in kind.

Thus, a lottery winning is income received as a result of a concluded civil contract. This is already enough to pay alimony from income in the amount established by the alimony agreement or court decision/order.

Lottery winnings and taxes

According to Art. 41 of the Tax Code of the Russian Federation, income is an economic benefit expressed in cash or in kind. Lottery winnings are quite consistent with these signs. In addition, lottery winnings can be considered income, since clause 1.5 of Art. 228 of the Tax Code of the Russian Federation provides for the obligation to pay tax on personal income.

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

Thus, a lottery winning is income because...

- it was obtained as a result of a civil contract

- it is subject to taxation

therefore, it falls under the definition of income mentioned in Government Decree No. 841 of July 18, 1996, and alimony should naturally be deducted from it.

What is withheld first: alimony or personal income tax?

According to the general rule of calculations and deductions, personal income tax is first withheld from income, then alimony.

After tax is withheld, child support is withheld and paid. Moreover, as a matter of priority, even if the payer has other debts or payment obligations.

The amount of tax that must be paid on winnings is:

- 35% - if participation in the drawing does not involve risk (does not require making a bet or buying a ticket);

- 13% (30% for non-residents of the Russian Federation) - if you need to buy a lottery ticket or place a bet to participate in the drawing.

According to paragraphs. 5 p. 1 art. 228 of the Tax Code of the Russian Federation, the winners of the drawings must pay the tax themselves if the winnings do not exceed 15,000 rubles. If it exceeds, the tax is paid by the organizer of the drawing.

For example, Citizen V. Plesnev won 1,000,000 rubles in Russian Lotto. The organizer paid income tax - 130,000 rubles. From the remaining amount, alimony for the maintenance of three children was withheld in the amount of 50% - 435,000 rubles.

Lottery: legal nature

Let’s try to approach the resolution of this situation from the other side – the definition of the concept “lottery”.

The Civil Code of the Russian Federation regulates the procedure for conducting lotteries. Article 1063 indicates that a lottery ticket is an agreement between the organizer and the lottery participant.

That is, by receiving a ticket, the lottery participant agrees to the terms of its holding, and the organizer, accepting money for the ticket, undertakes to pay the participant certain cash or a prize in kind if he wins.

It turns out that lottery winnings are nothing more than income under a civil contract.

IMPORTANT! Income is expressed not only in cash, but also in kind. The same rule applies to lottery winnings - after all, material benefits (a car, a summer cottage, an apartment, etc.) can often act as such.

If you win the lottery, do you have to pay alimony from this amount?

Expert opinion

Egorov Nikita Anatolievich

Practitioner lawyer with 10 years of experience. Specializes in criminal law. Member of the Bar Association.

The obligation to deduct alimony from the amount of winnings depends on how the amount of alimony is established. Depending on the chosen collection method, the procedure for withholding alimony obligations will differ significantly.

Withholding from lottery winnings if alimony is in a fixed amount

In this case, a fixed amount of alimony is established, and a change in the income of the payer in itself does not in any way affect the change in the amount of this amount.

If the recipient of alimony wishes to change the fixed amount established by agreement or by the court, he will need to either enter into a new agreement with the alimony payer or file a claim with the court.

Note: If the lottery winnings amount to a significant amount, for example, several million rubles, then the recipient of alimony has the right to demand an increase in the collected alimony in a fixed amount.

Alimony is collected as a percentage of income

As has already been established, winning the lottery is nothing more than income. Consequently, it will be taken into account along with the other income of the alimony obligee when calculating the amount of alimony.

ATTENTION! The usual one should not be confused, i.e. the so-called “risk” lottery, with incentives.

This is a lottery for which a ticket is not purchased, and no money is paid to the lottery organizer by the participant. Such lotteries are held for the purpose of advertising goods, services, stores, etc.

An example of such a lottery is a drawing of prizes by a retail chain using check and telephone numbers. From the point of view of civil law, no contract is concluded here.

Consequently , the winnings are not taken into account when calculating alimony .

Withholding of alimony from the lottery will be made after deducting the amount of tax from it. And even if the child’s father does not want to pay him, the FSSP service will have to be informed about this, since their competence includes accounting for overpaid or underpaid alimony.

When is alimony not collected from winnings?

Sometimes draws and games are held without the purchase of lottery tickets and the direct consent of the participants. This often happens in shopping and entertainment establishments to increase the loyalty and involvement of potential customers.

For example, in a shopping mall there was a game under the terms of which a cash prize in the amount of 10,000 rubles should be received by the buyer of any product if the last digits in his receipt are ones. The winner of the game was the buyer R. Timofeev. However, since he did not purchase a lottery ticket and did not become a participant in civil legal relations with the administration of the shopping center, his winnings cannot be called income. Therefore, he is not required to pay alimony.

Another case when it is impossible to collect alimony is if the lottery winnings are expressed not in cash, but in kind (an apartment, a car, a tourist package, etc.). According to Decree of the Government of the Russian Federation No. 841, alimony payments are withheld only in cash, and not from income in kind.

But if desired, parents can enter into a written agreement on the transfer by the parent of material assets into the ownership of the child for alimony payments. More information about this possibility can be found in the articles “An apartment instead of alimony” and “Agreement on the payment of alimony by providing property.”

Amount and calculation of alimony from winnings

The amount of child support that will be withheld from lottery winnings depends on the method of collection and the number of children.

Family law allows two ways to collect alimony:

- Shared (according to Article 81 of the RF IC) - involves withholding the parent’s monthly income of a certain share:

- 1/4 - for one child;

- 1/3 – for two children

- 1/2 - for three, four, five children.

- Fixed (according to Article 83 of the RF IC) – applies if the parent does not have a permanent income, or income is expressed in kind or currency, and involves the payment of a fixed amount regardless of the amount of income.

Example of calculating alimony from lottery winnings

If the court (or alimony agreement) has appointed a shared method of payment of alimony, the corresponding share is also withheld from the lottery winnings:

- 25% if the payer supports one child,

- 33% - if there are two children,

- 50% - if there are three, four, five children.

For example, Citizen Trofimov won 50,000 rubles in the lottery. The organizer of the drawing paid 13% income tax for it - 6,500 rubles. The rest of the winnings amounted to 43,500 rubles.

Trofimov’s alimony obligations to his minor son are 25% of income. Calculation of alimony:

43500 x 25% = 10875 rubles - alimony

43500 – 10875 = 32605 rubles – the balance of the winnings after taxation and payment of alimony.

If alimony is assigned in a fixed amount

Alimony is assigned in a fixed amount if the parent receives unstable income or his income is expressed in kind or in foreign currency. The amount of child support does not depend on the parent’s income – the child receives a fixed amount each month.

Therefore, receiving a lottery win will not affect the amount of alimony in any way - the fixed amount will remain the same.

A parent who lives with a child and receives alimony may have a natural question: will the child really not receive any of the big winnings just because the payment of alimony is assigned in a certain way? Moreover, this method - fixed - is most often applied to unscrupulous parents who work irregularly or hide income.

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

What should a parent do in this case?

The first thing that can be recommended is to file a claim in court for the second parent to provide a one-time cash payment for the child.

According to Art. 86 of the RF IC, the court may oblige the parent to bear additional expenses for the special needs of the child. Such needs may be, for example, a child’s illness and his need for treatment, constant care, or the purchase of medications. It is also allowed to collect additional payments for needs that are expected to arise in the future (according to clause 3 of Article 86 of the RF IC)

The claim must be filed in the magistrate's court, and if the amount of the recovery exceeds 50,000 rubles - in the city or district court. The period for consideration of the case is two months, after which the court makes a decision. The amount of the additional payment is determined by the court in a fixed amount - based on the financial situation of the parents and the child, as well as taking into account other circumstances worthy of the court’s attention, one of which can be considered a large lottery win.

The second thing that can be advised to a parent is to file a lawsuit to increase the amount of child support payments. The basis for such a claim may be a significant increase in the welfare of the parent who pays child support.

How to find out about winning the lottery to collect alimony

News about big wins is published in the media and becomes widespread.

But you may not find out about small additional income, especially if the recipient of alimony does not maintain relations with the payer himself, his friends and relatives. All that remains is to rely only on the good faith of the alimony payer and wait for transfers for the child.

If the executive document (voluntary alimony agreement, court order or decision) is in the Bailiff Service, the bailiff should be responsible for tracking income and cash receipts, and collecting alimony from them.

For example, he can submit a request to the Tax Service and receive a notice of income from which income tax was paid. But, of course, only if the alimony payer has declared income and paid taxes.

Arbitrage practice

Since large lottery wins among alimony payers do not happen very often, a unified judicial practice has not yet developed. Some courts refuse to collect child support payments because the List of income from which alimony is subject to withholding does not contain the expression “lottery winnings.” Other courts recognize the winnings as income from a civil transaction and make decisions on the collection of alimony.

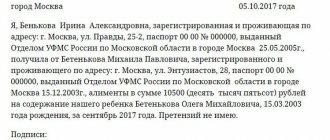

Let's look at a few examples from judicial practice.

Example 1 According to the decision of the magistrate’s court, citizen O. Plesnev is obliged to pay alimony for the maintenance of his minor son in the amount of 25% of all types of income. He made the payments in good faith. In March 2020, O. Plesnev won 100,000 rubles in the lottery. But he did not transfer child support from the amount of money he won.

The bailiff, who was in charge of the case of collecting alimony, sent a request to the Tax Service to obtain data on the income of O. Plesnev. Thus, it was established that income tax was paid, but alimony was not. The bailiff issued a ruling on the calculation and collection of debt in the amount of 25% of the amount won.

Plesnev O. appealed the bailiff's decision. However, the court rejected the complaint, citing O. Plesnev’s obligation to pay child support from all income.

Example 2 Citizen Serenko L. filed a lawsuit to appeal the actions of the bailiff. According to the plaintiff, the collection of alimony from the prize in the amount of 100,000 rubles was unfounded. The bailiff who made the calculation did not recognize the claim and informed the court that information about Serenko L.’s additional income was received from the Tax Service. The 2-NDFL certificate indicated income in the form of winnings. Having considered the case, the court came to the conclusion that the collection of alimony from the winnings was unfounded, since the List of Income approved by the RF PP No. 841 does not indicate income from lotteries or gambling. Despite the bailiff's arguments that the list approved by the Decree of the Government of the Russian Federation allows for an expanded interpretation, the court did not change the decision and declared the decision to collect alimony illegal.

Features of the procedure

The collection of alimony from winnings does not contradict the legislation of the Russian Federation. Parents are required to support minor children, even if earnings are taken from winnings.

For example, a person consistently pays alimony payments in a fixed percentage - 25% of the salary. At some point he decided to buy a lottery ticket. By luck, he wins a car. The citizen decides that he already has a vehicle and decides to take the winnings in cash. They give him 170,000.

If the father does not share the amount received with his child, then the child’s mother has the right to appeal to the bailiffs. They submit an application to the tax office and receive information about the child support provider’s recent income. Due to the fact that the winnings are officially reflected in the database, the father will have to pay 42,500 to the family. The amount will be the percentage established by the court, which is due to be paid to the ex-wife.

There is a certain nuance regarding the collection of child benefits from lottery winnings. You cannot charge a fixed amount of alimony. The method of earning income when playing lotto or other lottery is not the main source of profit. It is impossible to consider this method from the side of additional income, since it cannot be constant. The final amount varies and cannot be predicted, so a percentage is deducted from each win for government tax. Child benefits are paid from the remaining money.