Small children mean small expenses, big children mean big expenses. Parents need to think not only about what to feed and what to dress their children in, but also how to pay for education when they grow up. Financial institutions come to the rescue, offering a product forgotten since the times of the USSR - children's deposits.

What kind of contribution this is and how it works, you will learn from the new article on our portal.

On what basis are accounts opened for a minor?

The rules for opening accounts are regulated by the Civil Code of the Russian Federation, which divides citizens into categories:

- Capable citizens under 14 years of age. Art. 28 of the Civil Code of the Russian Federation, paragraph 1 provides: transactions are available only to parents or guardians.

- Citizens from 14 to 18 years old. They need permission from their elders or guardians to open an account.

- Capable citizens over 18 years of age. If a young person from the age of 16 works with an employment contract, then he is considered fully capable.

It is clear from the resolutions of the Civil Code that up to the age of 14, only parents (grandparents) can open deposits for a child. For a child between 14 and 18 years old, deposits can be opened by parents (guardians) or by the child himself.

When is it better not to open a deposit?

The main thing you need to understand is that the money on the deposit is not actually yours, it belongs to the child. This means that all expenses that do not concern the child are not possible using these savings.

If you (as parents) want to withdraw money before adulthood, this process is as complicated as possible. And here you shouldn’t be indignant, since this is the essence of the contribution to the child - it’s his money, you decided to give it to him (just in advance and so that there are more of them) and you shouldn’t try to take it back for all sorts of little things.

Although, on the Sberbank website there is the following question:

But what is stated in the answer is written only for your peace of mind. Yes, you must understand that in a critical situation you will be able to get money, but you should not console yourself with the thought that you will run to the guardianship authorities every month - you will not have enough strength and patience. Once again, you don’t need a deposit for regular spending, or if you open one, it’s convenient for withdrawal and replenishment, for example, Manage Online.

We get a guideline for expenses for which you do not need to make this deposit:

- household purchases: clothing, electronics, etc.

- payment for tuition or related courses.

- vacation in all its forms.

- buying a car.

In this case, it is better to take a closer look at other options, which we discussed in detail in the article: Profitable deposits in Sberbank for today.

Where to contact

Banks offer various types of deposits for minor children.

“Replenish” program from Sberbank

For parents who do not know how and where to open a deposit for a small child, Sberbank offers several programs. They provide guaranteed financial assistance to the child to pay for education or for other purposes. One of such programs at Sberbank is the “Replenish” deposit:

- To open an account, a contribution is required: 1,000 rubles or 100 US dollars.

- The client can replenish it whenever it is convenient for him, and other relatives can also deposit money into the account.

- Additional income in the form of interest. A minor can withdraw interest from the age of 14.

The bank ensures the protection of savings, preventing the withdrawal of funds without the permission of the guardianship authorities. The “Replenish” deposit is optimal for generating income . The amount of interest depends not only on the investment period and amount, but also on the currency in which deposits are made . Percentages vary within:

- 3,2–3,85 % - for rubles;

- 0,05–0,95 % - for dollars.

Raiffeisen Kinder

Raiffeisen Bank offers good conditions to ensure the future of children. The Raiffeisen Kinder program considers the possibility of opening an account for a child from birth to 25 years of age. Benefits of the program:

- Individual approach when creating target savings.

- Option to index funds taking into account inflation.

- Possibility of opening an account in any currency.

- Payment of 100% + income from investments at the end of the program.

Deposit "Children" from Rosselkhozbank

Rosselkhozbank offers a “Children’s” deposit, which can be opened for the benefit of minors. Features of the deposit:

- Initial deposit - 3,000 rubles/100 dollars/100 euros.

- You can deposit a maximum of 5 million rubles/150 thousand dollars/150 thousand euros into the account.

- You need to top up your account no later than a month before the end of the deposit period.

- The minimum additional contribution is 1 thousand rubles/50 dollars/50 euros.

- If the client has expressed a desire to receive the amount ahead of schedule, interest will be paid to him at the “Demand” rate.

- Deposit extension is not provided.

Deposit calculator

Deposit amount

Interest rate (%)

Deposit term (months)

Monthly interest

Banking products 14+

For 14-year-old teenagers and slightly older children, there is also the opportunity to open a children's deposit “Top up”. Its conditions are similar to the conditions described earlier. Children can replenish an account opened in their name and withdraw interest, and from the age of 18 - manage the entire amount.

For children of this age, a “Youth Card” is also offered. With its help, teenagers can pay in stores, make purchases on the Internet, and receive various bonuses provided by the Security Council of the Russian Federation.

Terms of use of the Molodezhnaya card:

- issued for 3 years;

- the fee for its maintenance is only 150 rubles/year;

- designed for ages up to 25 years;

- participates in the “Thank you” program from the Security Council of the Russian Federation.

Anyone who has permanent or temporary registration in the region where the branch of the Security Council of the Russian Federation to which the applicant is applying is located can receive such a card. You can even order a card with your own unique design. It is issued within 3-14 days, which is communicated by phone or via SMS.

This card allows you to pay for purchases contactlessly, for this you need:

- determine the purchase amount;

- touch the card to the device on which the “wave” icon is applied;

- wait until the “Approved” message appears.

Once approval is received, the goods will be paid for. You can top up your card via an ATM and by transfer from other cards through Sberbank Online. You can receive a scholarship on the card by providing its details to the accounting department of the educational institution.

How to choose the optimal deposit for a child's deposit

When considering the option of saving money in an account for a minor, it should be taken into account that such deposits are opened for a long period, usually up to 5 years, sometimes up to 18 years. Rates vary depending on this period.

If you have to choose from several financial institutions, you need to pay attention to the one that allows you to “replenish” funds throughout the entire accumulation period, and also provides for automatic extension.

Long-term deposit

The most popular way to accumulate funds is a long-term deposit. According to the results of statistical studies of the Central Bank, the volume of money in citizens’ deposits over the past year has increased by 4.2%. When registering it, it is necessary to take into account several requirements that must be met by the conditions and period of storage of money in order for the deposit to bring the greatest benefit:

- Attribution of interest to the principal amount of the deposit (regular capitalization).

- Possibility to replenish the deposit in any amount without restrictions.

- Automatic contract extension.

- Withdrawing money early without loss of interest.

Making a deposit for a minor has several restrictions:

- Only parents or guardians can open an account.

- This can only be done at a bank branch.

- Withdrawal of all funds is carried out only with the permission of the guardianship authorities.

Youth cards

Another way to provide children with money is to issue Youth Cards 14+ . Cards can be issued to citizens from 14 to 25 years old and take into account the needs of young people:

- “Youth tariff” - the cost of service for the year is only 150 rubles;

- individual design;

- contactless payment technology;

- 10% bonuses for every purchase are returned.

Sberbank provides parents with cards with the opportunity to issue a card for a child from 7 years of age. The card is a debit card and can be opened in his name so that he can learn to pay for purchases and services without cash.

Free services for the card serve as a tool for controlling the spending of your son or daughter:

- Parents' access to card expenses.

- Online purchases only via SMS confirmation.

- Setting a monthly limit.

Targeted deposits allow heirs to accumulate a certain amount for the future. To open it, you do not need to go to the bank, just go to your Personal Account in Internet banking, indicate the purpose, the required amount and date. Then you can take money from the card, and the bank will charge interest.

Depositing and withdrawing funds is available at any time and is not subject to commissions or penalties. An important factor of this type of deposit is that it can be opened without depositing money, and replenishment is allowed later.

Features of children's deposit in Sberbank

Children's deposits in banks can be opened for a child of any age. According to Article 28 of the Civil Code of the Russian Federation, parents and guardians of a minor child are responsible for all property and financial transactions. You can open a deposit:

- parents;

- guardians and legal representatives of a minor - they can be orphanages and guardianship authorities.

The main condition for opening a product is to be over 18 years old, Russian citizenship, and permanently registered in the country.

Non-residents also have the right to open a children's deposit, but for this they will need a residence permit in the Russian Federation.

Children over 14 years old, after receiving a passport, can open a deposit in person, replenish and partially withdraw money according to the terms of the agreement.

Current offers of Sberbank:

- Deposit “in the name of the child”. It can be opened for a child of any age by presenting a passport and the child’s birth certificate. The starting amount is 1000 rubles. The deposit can be replenished with any amount. No one can withdraw money from the account until the child reaches adulthood. Exceptions may be in emergency cases, with the permission of the guardianship authorities. The interest rate will be 4.60-5.0% per annum.

- “Replenish Online.” The deposit can be opened for minors. You can withdraw stipends, interest, bonuses and benefits from the deposit.

You can link a debit card to both products to withdraw interest until you reach adulthood.

Children's deposits are fully protected by Russian legislation and are guaranteed to reach the depositor. They are not subject to judicial collection, division during divorce, or taxation during inheritance.

Deposits in Sberbank can be renewed every 3 years, or they can be transferred to another bank at a more favorable interest rate. Like other products, the deposit is insured and is payable first. The maximum payment is 1 million 400 thousand rubles.

Why do you need a children's contribution?

The main task of a child’s contribution is to accumulate a sufficient amount before the child reaches adulthood in order to provide him with a decent future. The purposes of the contribution may include:

- Russian and international education;

- buying a property;

- purchasing a car;

- wedding;

- trips;

- opening a private business or startup.

The common feature is the accumulative part. Even with a minimum starting amount, you can periodically top up your account and reach a large amount.

Calculation No. 1

The starting amount is 10 thousand rubles.

The interest rate is 4.70%.

The placement period is 3 years.

With passive deposit management, the investor will accumulate an income of 13,278.74 rubles.

Calculation No. 2

The starting amount is 10,000 rubles.

Interest rate – 4.70%.

The placement period is 3 years.

Monthly replenishment – 1000 rubles.

The final income will be 319,456.97 kopecks. Deposit money into the account and capitalize the interest - you can accumulate a serious amount.

How to open a children's deposit

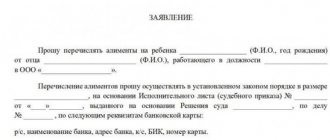

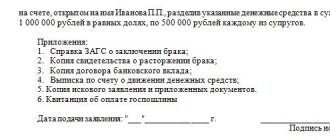

This can only be done at a bank branch. The legal representative brings with him the following documents:

- passport;

- birth certificate or document certifying the right of custody of the child.

The legal representative enters into an agreement and deposits a starting amount into the account - from 1000 rubles.

Alfa Bank has introduced an individual approach to registering children's deposits. The only condition is that the term of the savings account cannot be less than 10 years. The client independently determines the amount of the down payment, the frequency of replenishment and the currency. The percentage is the sum of the total calculation of all parameters.

Replenishment of children's deposit

After concluding an agreement, the deposit can be replenished by parents, relatives and third parties - it is enough to know the account number and full name of the recipient. You must also provide a passport.

You can transfer money manually through bank cash desks, as well as online using bank details.

Starting from the age of 14, the depositor himself can replenish his account. To do this, he must provide a passport. He can also withdraw accumulated interest.

How to withdraw money from a child's deposit

Only legal representatives and guardians can withdraw money from a child’s deposit before the child reaches adulthood under special circumstances. These circumstances must be supported by permission from the territorial guardianship and trusteeship authorities. Their contacts can be found here.

Reasons for which money from the deposit can be used:

- purchase of real estate in the name of a minor;

- purchasing equipment for study - a computer, a specialized laboratory, etc.;

- payment for medical care in case of illness of a child.

To withdraw the amount you will need a passport, birth certificate, initial agreement with the bank and written permission from the guardianship authorities. Only one of the parents can withdraw money by agreement.

From the age of 18, the savings account is completely at the disposal of the child. He can withdraw the money in full or continue saving funds.

Note! In the era of coronavirus, everyone is looking for additional opportunities to earn money. It’s surprising that you can earn much more using alternative methods, up to millions of rubles a month. One of our best authors wrote an excellent article about making money on games with reviews from people.

Interest rates

The profitability of the target deposit depends on the interest rate. It is not a constant value. The rate may vary depending on several factors that determine its size:

- currency;

- term;

- deposit amount.

When the amount of savings reaches a certain amount, the percentage changes and the income increases. How the rate on a deposit in rubles (Sberbank) changes, depending on the specified factors, is shown in the table:

| Term Amount (rub.) | From 3 to 6 months | From 6 months to 1 year | From 1 to 2 years | From 2 to 3 years | 3 years |

| 1,000 or more | 4,15 % | 4,25 % | 4,25 % | 4,2 % | 4,1 % |

| From 100 thousand | 4,3 % | 4,4 % | 4,4 % | 4,35 % | 4,25 % |

| From 400 thousand | 4,45 % | 4,55 % | 4,55 % | 4,5 % | 4,4 % |

Expert opinion

Nadezhda Abrosimova

Leading credit specialist at a TOP-30 bank, expert in lending to individuals

Get a loan

Interest rates at different banks fluctuate depending on the same factors. Rosselkhozbank: for the ruble from 7.6% per year to 7.9% - 5 years, for the dollar from 3.05% per year to 3.35% - 5 years, for the euro from 2.85% per year to 3, 55% - 5 years. Raiffeisen Bank offers opening savings accounts with interest starting from 7% per annum.

Children's deposits - a bright future for a child or parents' money thrown away?

Many loving parents and grandparents have not even heard of it: such investments are not very popular in Russia and are unlikely to be in demand in the near future.

There are several reasons:

- Low rates. For example, Sberbank pays only 3.7–3.8% per annum, provided that the deposit is opened for three years from 1,000 rubles. If you make an investment for 10 years or more, due to inflation there will be nothing left of it.

- The population has lost confidence in banks and is not ready to make long-term investments. They are not even attracted to investment insurance.

- Due to financial instability, banks are not ready to offer consumers long-term products.

The advantage of children's savings deposits is the possibility of early withdrawal and flexibility. When choosing deposits, it is better to give preference to a product for a period of 1 year with automatic renewal. This will allow you to use the money when needed and save interest.

What documents are needed

To draw up an agreement to open an account in the name of a child in any bank, they will definitely require an adult’s passport, his TIN and a son or daughter’s birth certificate.

It’s another matter when the deposit is opened for a child who is already 14 years old or more (up to 18 years old). The ward himself and his parents or guardians can open an account. In such a situation, you will need a document proving the identity of the child himself and the passport of the parent who gives written permission to open an account or opens it himself.

Where are the best rates on children's deposits?

When choosing an organization to make a deposit, you want favorable rates that are not “eaten up” by inflation.

There is plenty to choose from in the Russian financial market:

- The Governor's deposit at Rus Bank is opened in the name of a newborn at 7.79%;

- IC-Bank allows you to make investments for disabled children. By depositing from 1,000 to 10,000 rubles. to the child’s account, in a year he will be able to withdraw this amount + 7.50% per annum;

- Garanti-Invest has slightly reduced the rate and offers only 7.0% with a loan period of 370 days;

- I would like to put Coalmetbank with its product on the fourth step - the “Investment in the Future” deposit. Opened in the name of a child under 18 years of age. There is an automatic extension up to 10 times with quarterly interest rates;

- Pay attention to the Russian Trade Bank. Size - no less than 1,000 rubles. It is possible to replenish the deposit no later than 30 days before the expiration date. The bank provides for payment of interest to a separate account;

- Uralsib Bank has lagged behind its “relatives” and, although it has developed a special program “A Decent Home for Children!”, it offers only 5.7–5.8% per annum. Expenditure transactions for this product are not allowed until the end of the contract.

Whose services to use is up to you.

According to Sovlink IC analyst Olga Belenkaya, banks almost do not offer targeted deposits for children, since these deposits for children are almost no different from ordinary investments. Their only advantage is the ability to save money.

How to profitably open a deposit for a child

A person can hardly imagine what profit he can expect. The Sberbank website has a special calculator that can calculate the return on a deposit. To do this you need:

- On the official page of the bank, select the “Deposit for a child” tab, where you can enter the selected currency.

- The money is transferred to the bank.

- Write down the date the deposit was opened, the child’s details and the date he reached adulthood.

- Indicate the period for which the money is transferred to the bank.

- Enter the invested amount.

- Check the option for withdrawing savings after 14 years.

- Enter the monthly payment amount. If the client will not perform transactions on the deposit, leave the lines empty.

- Click "Calculate".

The system will calculate profitability by providing approximate data. The true size of the profit depends on what interest transactions were performed. If they were removed, the income will be less.

Compensation for targeted deposits for children

Given the long period of depositing money, there is a possibility that the bank in which the deposit is placed will cease to exist. To avoid such a situation, it is recommended to choose reliable banking institutions with a long history.

It may happen that the bank's license has been revoked. Then the client has the right to receive compensation for the amount of deposited funds in a special manner.

If the bank was part of the deposit insurance system, and the amount of money invested was no more than 1,400,000 rubles, you can receive your entire income in full. To do this, you will need to follow the instructions contained on the deposit insurance agency website.

In this case, the applicant for receiving money will be the person who placed the deposit, and not the person who has not reached the age of majority.

If the amount exceeds 1 million 400 thousand, then the client participates in the bankruptcy proceedings of the bankrupt bank on a general basis. As a rule, clients of credit institutions that are not part of the deposit insurance system do not receive income when their license is revoked. However, if you insure your deposit, then if the bank goes bankrupt, you can contact the insurance company for your money.

Place funds in favor of minors only in banks that are part of the insurance system.

How to deposit money

The only way to open a deposit account for a child is at a bank branch, but there are many options for replenishing the account:

- Visit a branch of a financial institution with an agreement and a passport and pay the money to the cashier.

- Use Sberbank online. If you have a debit card in your hands, it must be connected to the system. At the company office, the same must be done with the account. You can put any amount on your card through an ATM, and then transfer this money to your account in your Personal Account.

- Use the mobile application. To replenish your deposit, you only need access to mobile communications.

Terms of deposit

Those who wish to make a deposit with Sberbank for a child are offered the following deposit conditions:

- currency - either rubles or dollars;

- initial investment amount – from 1000 rubles or 100 dollars;

- maximum amount – unlimited;

- replenishment – there are no restrictions on the amount and frequency;

- withdrawal is not provided;

- interest rate – from 3.60% to 4.05% in rubles and from 0.05% to 0.95% in dollars.

Table with interest on the deposit (the rate is indicated in grey, taking into account the capitalization of interest):

Funds deposited in Sberbank for minor children are insured by the DIA up to 1.4 million rubles (or the equivalent in dollars), so there is no need to worry about their safety.

Sberbank does not provide any compensation for deposits for children. This is a commercial product that allows the deposit owner to earn the required amount by a specified date. We can say that this is an analogue of endowment life insurance, but without the insurance payment.

Features of using a deposit registered in the name of a minor

Managing deposit money has its own specifics related to the age of the child at the time of termination. If a decision is made to close the account early, you can do it like this:

- The child is under 14 years of age. The main document of the parent or guardian, the child's passbook and the agreement must be submitted to the bank. If the papers meet all the bank’s requirements, it will pay the required amount.

- The child is under 18 years old. A contract, passbook and passport are provided. Some financial institutions require a power of attorney signed by the parents.

- The child is 18 years old. You need a passport, a contract and a savings book from him. He can carry out transactions with money himself.

When a teenager has already crossed the 14-year-old mark, but has not reached 18 and has made independent deposits into the account, he can withdraw this money without any permission. Other amounts in the account are available to the teenager only with the permission of the parents, and sometimes the guardianship authorities.

Procedure for opening a deposit for a person under 18 years of age

When opening an account for such a person, in order to accumulate finances, it is imperative to choose the right bank and savings program. In this regard, most banks are making a proposal to increase the rate on deposits opened for a minor for a long period (for example, 1-5 years). As you know, these deposits can be replenished, the down payment is minimal, but expense transactions on these accounts are not provided. And so, we can say that “deposits until the child reaches the age of majority” are not popular these days.

About the features of providing compensation

The difficult economic situation in the country in the 90s devalued all citizens’ deposits registered up to that point. Government Resolution No. 1092 dated December 25, 2009 was issued in order to at least somehow restore justice. All citizens who opened deposit accounts before June 20, 1991 received the opportunity to receive compensation. The amount of compensation is determined by the conditions:

- The deposit is open to a person born before 1945 inclusive. The amount is increased three times.

- The deposit is open for a person born from 1946 to 1991. The amount is doubled.

In addition, the amount of compensation is formed depending on the storage period of the deposit and is determined by the coefficients:

- "1" - money was withdrawn before 1996 or is still kept in the bank;

- “0.9” - the deposit was valid in 1992-1994. and closed in 1995;

- “0.8” - opened in 1992-1993, closed in 1994;

- “0.7” - stored in 1992, removed in 1993;

- "06" - closed in 1992

If the deposit was closed from June 20 to December 31, 1991, double and triple amounts are not due. If the person has already received compensation, the payment will be reduced by this amount.

How to withdraw money

There are only two withdrawal options, and they depend on the age of the child for whom the savings were set aside.

After adulthood

Since a deposit is opened in Sberbank in the name of a child, he is the main owner. Parents, even those who open an account, will not be provided with an account statement and a report on the amount of money on deposit. The account owner himself can generate the corresponding request.

As for the possibility of withdrawing funds, they are limited until the child reaches adulthood. Only after reaching 18 years of age will he receive full access to the account and be able to independently manage the money. For example, withdraw to a card from another bank or extend the deposit on favorable terms.

Until adulthood

Until the child reaches 14 years of age, he cannot receive funds from his account. Parents can receive money only with written permission from the guardianship and trusteeship authorities. After the 14th birthday, the owner of the deposit can decide independently what to do with the interest:

- leave them on the account for capitalization and increase profitability;

- display them on the Molodezhnaya card monthly.

Accordingly, the more money in Sberbank on deposit for a child under 18 years of age, the more interest will go to the card. These funds can be spent arbitrarily, for example, to pay for meals at school or to purchase a long-desired item.

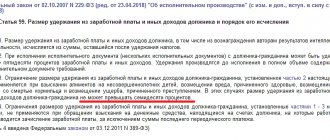

Since for children from 14 to 18 the law establishes restrictions on the disposal of money from a deposit (Article 26 of the Civil Code of the Russian Federation), they will only be able to receive in cash interest, alimony or benefits that were received on deposit and a number of other typical payments. The rest - only by decision of the guardianship and trusteeship authorities:

Issuing money from a deposit to a minor

Advantages of a deposit for a child

Children's deposits are one of the most affordable ways to ensure the future life, education, and work of your child. Rising prices for education, rising housing prices, all this forces parents to turn to a deposit, which has undoubted advantages:

- Parents earn money into the account, and it is registered in the name of a minor citizen. Money can be used not only for study, for large purchases, and business development.

- Possibility of making a deposit for a newborn, up to his 14th birthday.

- A minimum package of documents is required: passport, tax identification number and birth certificate of the baby.

- The “children’s” deposit has a longer term (from one year to 18 years) than a regular one, the term of which is a maximum of 2 years.

- It is less tempting to withdraw money from an account registered in the name of a child for inappropriate expenses than from your own account.

A deposit for a child is a real opportunity to collect money and spend it specifically on his needs, and not on the needs of the family, especially since the registration is simple and transparent, and the first amount for opening a deposit is minimal.

Which bank is better to open an account for a child?

In 2020, the number of financial institutions that offer deposits for children is growing rapidly.

First of all, parents should determine which banks provide the opportunity to open a deposit for their child on the most favorable terms.

Opening an account for a minor has certain legal restrictions; you should be aware of them in advance. Banks open deposits in different currencies.

Income will depend on the amount, term, currency of the deposit and the procedure for calculating interest . When the term ends, the funds are transferred to a current account opened in the name of the deposit owner.

You can open a deposit for a child under 18 years of age only in bank offices; opening online is not allowed. This is due to the need to provide documents for the child.

The deposit agreement is concluded by the legal representative of the child, in some cases by a third party.

The most advantageous offers from banks

Among the many offers from Sberbank, a contribution for a child stands out favorably; it is enough to deposit 1000 rubles . When signing an agreement of 10,000 rubles or more, a mandatory condition is the provision of gifts to children.

This deposit can be replenished . This means that you can deposit additional money during the entire period the money is kept in the bank. You can top up an unlimited number of times.

A deposit for a minor at Rosselkhozbank can be opened in different currencies . The account can be replenished, but without withdrawals. Has five terms, from one to five years.

After this, it is transferred to an account from which money can be withdrawn if necessary. The rate depends on the amount that was invested.

The minimum is 1000 rubles or 50 units for foreign currency deposits. You can make an additional contribution no later than a month before closing.

One of the beneficial ones, according to experts, is children's contribution to KB Garant-Invest. You can open it for a year in one of three currencies. The deposit is replenished and automatically extended until the child turns 14 years old.

There are restrictions on additional contributions; they stop three months before the end of the term. Interest is calculated at the end of the term. Money is issued according to the passport when the child turns 14 years old.

Thus, a deposit and bank account can be opened for a minor child. This service is offered by most credit institutions on favorable terms.

When choosing a bank, first of all you should evaluate its status and reliability . After this, you need to decide on the purpose of registering a deposit for the child.

Depending on your needs, you can open a fixed-term account or a regular current account. It is important to carefully study the terms of registration and what percentage a particular deposit provides.

Up to 14 years of age, parents can manage money in the account, with the permission of special authorities.

At the age of 14, a minor can drive them with permission from parents and guardianship authorities. He receives full control after turning 18 years old.

Similar articles:

- Power of attorney for a child to travel abroad unaccompanied by parents

- What documents are needed to take a child and grandmother abroad?

- Declaration of the Rights of the Child

- What documents are needed to travel abroad with a child?

- Is it possible to take a child abroad without the father’s permission?

- Previous post Is it possible to give an apartment to a minor child?

- Next entry Curfew for minors

Comments on the article “How to open a bank deposit for a minor child?”

Nobody has written anything yet. Be the first!