Pensioners are among the largest category susceptible to public vulnerability. People, despite their advanced age, due to their own life circumstances and health, intend to continue their working activities. The lack of adequate material support is compensated by the state by providing benefits to working pensioners.

Legislative aspect

The area relating to pension provision in the context of the obligation to work is widely covered by regulations.

| Legislative regulation | ||

| Labor Code of the Russian Federation | Federal rulemaking | Tax Code of the Russian Federation |

| Contains provisions governing legal relations in the field of providing additional days for rest, circumstances and conditions for the dismissal of a pensioner. | The adopted laws regulate specific situational issues: 1. Carrying out different types of work by military pensioners. 2. Recalculation of pensions, implementation procedure. 3. Assessment of places of employment for citizens of retirement age. The procedure for paying savings to insured persons. | Regulates the right to receive preferential medications and provides for a tax deduction procedure for a pensioner with a job. |

The above list is not exhaustive. Local legal documents of local self-government bodies also establish privileges for this category of citizens on the territory of a certain subject of the Russian Federation.

List of benefits

The state provides multidirectional support to a pensioner who has decided to continue working. Incentives are characterized by a number of features in contrast to the non-working part of the population.

| Privileges | ||||

| Pension | Labor | Tax | Medical | Social |

Pension

The privilege of this preferential category is the opportunity to submit documents every year to the Pension Fund office at the place of residence to recalculate the amount of financial monthly support. The basis is the desire to work.

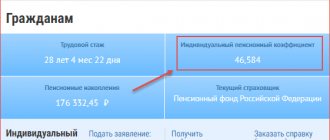

The employer must register an elderly person in accordance with the norms of official employment. For carrying out professional activities, pensioners receive a salary, from which the necessary state taxes and fees are calculated. As a result, auxiliary points are accumulated, which are important in the case of pension indexation. Otherwise, there can be no question of changing the size.

The deadline for applying to government agencies corresponds to the first 7 calendar months of the current year.

Labor

The main advantage of continuing to work for a pensioner is the provision of additional vacation days. There is a small “but”, rest from working days is not compensated.

The duration can be up to 14 days. The Tax Code states that it is possible to increase the period to 2 calendar months.

Persons who intend to start working in the near future have the right to seek help from the nearest Employment Center in order to improve their qualification level or even acquire new skills. Obtaining vocational education is carried out through state coverage of the educational process with the requirement that the citizen undertakes to carry out activities in accordance with the acquired specialty.

It is worth noting that labor benefits guarantee:

- Simultaneous receipt of salary and pension.

- The last priority for layoffs at an enterprise.

- The right to work part-time (reduced) working hours.

- Age discrimination is punishable by law. The case of refusal to exercise the right to work due to old age is not allowed.

Tax

This type of compensation provision has virtually no differences from the total number of tax benefits. Pensioners who continue to officially work are exempt from personal income tax

persons, namely from such payments:

- Cash benefit associated with reaching retirement age.

- Financial additional payments made to employers at their own discretion, provided for by the bonus system at an enterprise, institution, or organization of various forms of ownership.

- The amount of the voucher intended for treatment in a resort sanatorium or boarding house.

The right to a deduction procedure is allowed if a residential area or land plot is acquired for housing construction in an amount calculated in Russian rubles:

- 2,000,000 (includes compensation for major repairs, restoration, finishing work).

- 3,000,000 (loan, mortgage obligations).

- 1,000,000 (for the sale of personal residential property).

The legislator provides an additional benefit for persons who remain to work, despite old age, in the form of exemption from court fees (state fees) in the implementation of certain types of proceedings.

The list of tax privileges with individual characteristics for pensioners is increasing by the municipal authorities at the place of residence.

Social

A citizen who has reached retirement age and continues to work is not endowed with many social benefits. The procedure for determining and using is established at the regional level

authorities. Usually this:

- Free travel by public transport of municipal ownership.

- System of discounts when paying for utility services provided.

- Free travel by intercity trains.

The above list is not exhaustive or mandatory. Some districts define additional conditions for the need to work - the status of a disabled person or a veteran.

Medical

Working pensioners have the right to count on the following number of benefits:

- A full medical examination by qualified personnel once every three years.

- Vaccination against seasonal viral infections.

- Receiving medications as prescribed by the attending physician.

Other benefits

Among other advantages, there are additional ones that arise at a certain expiration

circumstances.

With the consent of the head of the enterprise, pensioners can work under reduced working hours. Application is allowed if:

- An employee provides care and maintenance for a disabled close relative.

- Disability group (1,2) has been issued.

Taking into account legal norms, employers independently express a desire to offer an elderly colleague to work part-time. The benefit is saving wages.

What benefits are missing for working pensioners?

additional social benefit - a benefit that a working pensioner does not have.

The point is that the right to auxiliary monetary compensation is intended for citizens whose pension provision does not exceed the established subsistence level. Receiving a salary corrects this fact.

Specific information must be familiarized with the administrations of local authorities that establish the procedure for the implementation of preferential rights.

Losses on indexation of pension payments will increase

Everyone knows that the main problem associated with the small size of the pension of a working pensioner is the suspension of benefit indexation from 2021.

And now the benefit for such citizens is increased only once a year - in August, when recalculation is carried out due to the receipt of insurance contributions per person. New benefit for working pensioners from the government

And what did this lead to? But the situation is disappointing. Independent statistics show that since 2021, the number of working citizens in retirement has decreased by 40%. It's a lot. However, the actual level of employment remains at the same level. About 30% of “retired” pensioners continue to work, but the relationship with the employer is not formalized.

In other words, an impressive portion of retired people work, receive indexed pensions, and receive wages. And the state treasury, which does not receive taxes, suffers. It would seem that the numbers should speak for themselves, and it’s time to reconsider the issue of returning indexation. But this won't happen.

The Ministry of Finance has officially stated that there are no plans to lift the moratorium on indexation in 2021. At the same time, the minister announced the indexation coefficient for pensioners who do not work. It is 7.05%.

What does this mean for working retirees? It's simple, they will be at an even greater loss than they were before. Thus, as a result of the adjustment, the maximum increase for a working citizen was 244 rubles. If we take as an example the average pension amount (14,144 rubles), then this is an increase of only 1.5%. And non-working pensioners have received an increase of 3.7% since January 2021, taking into account indexation.

Consequently, next year pensioners who work will receive at least twice as much less if the moratorium on indexation is in force. It is quite understandable why a considerable number of pensioners continue to work unofficially.

Features by region

The peculiarities of the existence of a number of advantages are regulated by regional programs, specially developed according to the specifics of the territorial area. The main rule is compliance with federal legislation.

The most common benefits are:

- Travel by public transport.

- Having a special status means a 50% discount when calculating payment for housing and communal services provided.

- Reduced prices for prescription medications.

- Reducing the cost of traveling by rail.

Obtaining privileges requires contacting social authorities.

Additional assistance for different categories of pensioners: military, labor veterans, disabled people, individual entrepreneurs

| State aid | |||

| Military retirees | Veterans of Labor | Disabled people | Individual entrepreneurs |

| Military personnel who continue to work have the right to: — provision of treatment free of charge in departmental health resorts; — priority hiring in the specialty; — extraordinary provision of services from preschool and general educational institutions for their children and grandchildren; — additional material support for pension payments; — obtaining municipal housing; — free travel to the place of sanitary-resort treatment. | — additional days of free vacation; — free medical qualified provision of services; | — approval of job responsibilities in accordance with health status; — unpaid leave up to 2 | — receiving pension benefits. |

| — a 50% discount on the cost of the medicine upon purchase; — no payment for travel on public municipal transport. | — calendar months; — shortened working week; — extraordinary admission to an institute, university, academy, other educational institutions of the system of the Ministry of Education of the Russian Federation; — absence of taxation in the field of transport and land relations; — monthly additional payment if you refuse the standard social set of services; - state standard package of services provided under the federal assistance program. | ||

Mortgage loan for pensioners in all its nuances and bank offers in 2021

Many people are interested in the question of whether it is possible to obtain or issue a mortgage without interest. In fact, interest-free loans do not exist. Even if the bank announces that the interest on the loan is 0%, there are various fees that the client must pay and which affect the cost of this loan product. A special point is the reverse mortgage, about it at the end of the post.

Some special features are provided for military pensioners, i.e. for those citizens who were considered military personnel. A special savings and mortgage system was developed for them. Participants in this system can apply for and receive a mortgage loan under more favorable lending conditions. Moreover, according to the terms of this system, military pensioners receive a certain amount each month from the state budget, which is used to repay the mortgage loan.

We recommend reading: How to get a funded pension born in 1967

How to get a?

Any design is regulated by a special procedure. A pensioner who has not refused to work should perform a number of actions:

- Get information about current preferential benefits.

- Contact the Pension Fund branch at your place of residence.

- Collect the necessary documents (demanding application, passport information, work book, income certificate, etc.)

- Provide a package of papers to the necessary authorities (state social protection authorities, tax office, multifunctional center, others - depends on the type of benefit).

Obtaining additional rights has an inherent declarative nature.

Application for transport tax relief

When is a pensioner considered to be working?

There is no violation of the law here. Since the beginning of 2021, pension legislation has been amended. Now everyone who works and (or) performs other paid activities (the employer makes accruals and pays insurance premiums) and at the same time receives a pension is assessed from the point of view of the law as “working pensioners”.

We recommend reading: A pensioner who did not work in the north and who comes to the north will have an indexed pension

I have been retired for a year and a half now. During this period I did not work. I accidentally found out that I am still considered a working pensioner and cannot apply for indexation. I started to find out why. It turns out that I had previously published two articles (I write scientific articles). Apparently, the editor officially formalized deductions to the Pension Fund of the Russian Federation from the fee due to me. How legal is all this?