Calculation of old age pension

PC1 (converted part of the settlement capital for the period before January 1, 2002) with incomplete service = PC1 (converted part of the settlement capital for the period before January 1, 2002) with full service / (or) 240 months (20 years x 2 months ) – for women; (or) 300 months (25 years x 12 months) – for men) x Number of full months of total work experience available as of January 1, 2002

PC (pension capital) = PC1 (converted part of the estimated pension capital for the period January 1, 2002) + SV (valorization amount) + PC2 (total amount of insurance contributions to the CP (insurance part) transferred for you by the employer, from January 1, 2002 d. By the date of assignment of the pension. It is indicated in the extract from your personal insurance record for each year starting from 2002)

What years will be taken to calculate the pension, I am a woman born in 1962

She worked in Prodsnab since 1980, the organization was liquidated on January 1, 1996, she was registered with the employment center until April 1997, then she worked as a salesperson for a private enterprise for 10 years, since 2007 I have been working for 04 months to the present time in ROSCOSMOS, the problem is that the Prosnab archive with 16 years of experience burned down, I can only provide confirmation that I worked there, but without a certificate of earnings. How will my pension be calculated?

Hello! You need to submit to the Pension Fund a certificate of average monthly earnings for 60 consecutive months before January 1, 2002 during your working life. Information on average monthly earnings for 2000-2001, submitted by employers and available in the information systems of the Pension Fund of Russia, may be taken into account.

This is interesting: Seizure of the Property of the Apartment Where Doodnik is Registered

Examples and formulas for calculating an old-age pension in 2021 for a woman born in 1962

- In different periods, the size of wages, of course, differed significantly.

- The length of service also includes so-called non-insurance periods, the most famous of which is the period of child care. The year of this period is estimated at 1.8 points. In a year and a half it turns out to be 2.7.

- Roza Syabitova - the most famous TV matchmaker in the country, a woman - is always on her toes, always “on the crest of a wave”, what can you do, the situation forces her;

- Alexandra Zakharova, a very good actress at Lenkom, would like to say something banal and a little offensive to Alexandra – “daughter, etc.” No, we won't say. Zakharova is wonderful in her favorite work and on her own, without any “spotlights”.

- Zhanna Aguzarova - how time flies.

Labor old-age pension

The following calculator will help you calculate the amount of your old-age labor pension in accordance with the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 N 173-FZ. To calculate, you must specify: the date of pension assignment, your gender, age, insurance experience, length of service in the USSR, your average earnings in 2000-2001 or for any 5 consecutive years until 2002, as well as the amount of all insurance contributions, taking into account indexation after 2002.

As a result, the pension amount for the current date and details of its calculation will be given. At the moment, the calculator does not take into account bonuses and increases, disability, or the new procedure for calculating pensions, which will come into effect for pensions after 2021.

Pension calculator

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020. For calculation purposes, it is accepted that the entire period of formation of your future pension rights took place in 2021 and you were “assigned” an insurance pension in 2021, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

This is interesting: Benefits provided to reserve officers in accordance with the current legislation of the Russian Federation

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

Calculation of pensions for men born in 1957 - formula, points, IPC and online calculator

- Fixed payment. The value is revised annually. In 2020 it is equal to 4,982.90 rubles. For some categories of recipients, this value may be greater, for example, for persons with disabilities or citizens with dependents.

- Insurance part. Depends on the number of pension points earned over the entire length of service. Their number is multiplied by the value of one PB established on the date of assignment of the collateral. In 2021, the cost of PB is 81.49 rubles. There are three main periods when calculating the IPC. Taking this into account, the formula for calculating the insurance portion will look like this:

- IPK2002 – number of PB earned before 2002;

- IPK2002–2014 – number of PB earned from 2002 to 2014. (inclusive);

- IPK2020 – number of PB accrued from 2021;

- IPC non-insurance – the number of PB for non-insurance periods;

- SPB - the cost of one PB on the date of calculation (the amount is revised annually);

- PC2 – premium coefficient.

This is interesting: Where to get a family member ID for a Chernobyl survivor

Step-by-step calculation algorithm

The procedure for calculating pension benefits for men born in 1957 consists of several successive stages:

Stage 1. Pension capital earned before 2002 is calculated.

- The length of service coefficient (SC) is determined:

| Experience until 2002 | Size |

| 25 or more | 0.55 + 0.01 × (number of years of experience – 25) |

| Less than 25 | 0,55 |

It is important to know that regardless of the result obtained, the maximum value of the experience coefficient is limited to 0.75.

Example:

- A man born in 1957 has 17 years of work experience. The SC will be 0.55.

- A man born in 1957 has 41 years of work experience. SC will be 0.71:

0,55 + 0,01 × (41 – 25) = 0,71.

- The average monthly earnings coefficient (AMC) is calculated. The average salary for 2001–2002 is taken. or for any 60 months. The result obtained is divided by the average monthly salary in Russia for a similar time period (for 2001–2002 - 1,494.5 rubles).

Important: the limit value, regardless of the result obtained, is limited to 1.2. The exception is persons with “northern experience”. The SPV for them varies from 1.4 to 1.9.

Example:

- The average earnings of a man born in 1957 for 2000–2001 was 930 rubles. KSZ = 0.62:

930 / 1494,5 = 0,62.

- The estimated pension as of January 2002 is determined:

| SK | 0,55 | More than 0.55 |

| Formula | RP = (SK × KSZ × 1671 – 450) × (number of years of experience before 2002 / 25) | RP = SK × KSZ × 1671 – 450 |

| Note | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be equal to 210 × (number of years of experience before 2002 / 25) | Provided that RP = SK × KSZ × 1671 is less than 660, the value of RP is determined to be 210 |

Example:

- A man born in 1957 has an SC of 0.68 and a KSZ of 0.60. RP will be 232.77 rubles:

SC × KSZ × 1671 = 0.68 × 0.60 × 1671 = 681.77. Since this value is greater than the established minimum value of 660, 450 is subtracted from the result obtained. The RP in this case will be equal to 232.77 rubles.

- The valorization procedure (one-time increase) is applied to the result obtained. If a citizen did not work before 1991, the RP increases by 10%. For each full year of experience accumulated before 1991, 1% is accrued in addition to 10%.

Example:

- RP = 547 rub. Experience before 1991 – 0 years. The valorization amount will be 54.7 rubles:

547 × 10% = 54,7.

- RP = 547 rub. Experience before 1991 – 15 years. The valorization amount will be 136.75 rubles:

547 × (10% + 1% × 15 years) = 547 × 25% = 136.75.

- An adjustment factor of 5.6148 is applied to the final amount - the product of annual indexation coefficients from 2002 to 2014.

Example:

- SP – 768.5 rub. Index (2003 – 2014) – 5.6148. The amount of pension capital will be 4,314.97 rubles:

768,5 × 5,6148 = 4 314,97.

Stage 2. Calculation of the amount of the insurance pension for the period from 2002 to 2014. (inclusive):

- Receive notification of the status of your personal account through the government services website or during a personal visit to the Pension Fund.

- The amounts indicated in the notice are given without taking into account indexation for the level of inflation, therefore each of them must be multiplied by the corresponding index:

| Year | Indexation coefficient |

| 2003 | 1,307 |

| 2004 | 1,177 |

| 2005 | 1,114 |

| 2006 | 1,127 |

| 2007 | 1,16 |

| 2008 | 1,204 |

| 2009 | 1,269 |

| 2010 | 1,1427 |

| 2011 | 1,088 |

| 2012 | 1,1065 |

| 2013 | 1,101 |

| 2014 | 1,083 |

- The resulting figures are added up and divided by 228 months - the survival age.

Example:

- Pension capital is equal to 1,563,212 rubles. The insurance pension will be equal to 6,856.19 rubles:

SP = pension capital / survival age = 1,563,212 / 228 = 6,856.19

Stage 3. The number of PBs accumulated since 2015 is determined.

Stage 4. Calculation of PB for non-insurance periods - the time when a person did not work due to certain reasons or social status.

- How to sew jeans

- What is the difference between a cyst and a fibroid?

- 16 foods that boost immunity

Pension points before 2002

To determine the amount of PB earned before 2002, it is necessary to divide the amount of pension capital by 64.1 - the cost of one point as of January 2015, since from this date PB began to be used to calculate pension provision

Example:

- amount of pension capital - 5,064 rubles.

- PB cost – 64.1

5 064 / 64,1 = 79

IPC for the period from 2002 to 2014

To calculate the IPC, the insurance part of the pension must be divided by the cost of one PB as of January 2015:

IPC = insurance part of pension / cost of pension as of 01/01/2015

Example:

- insurance part of pension –

- PB cost – 64.10

6 922,80 / 64,10 = 108.

Pension coefficient since 2015

After the reform, insurance premiums are converted into PB and stored in a personal account. The maximum number of them is legally limited:

| Period | Number of PB |

| 2015 | 7,39 |

| 2016 | 7,83 |

| 2017 | 8,26 |

| 2018 | 8,70 |

The number of PB is determined based on the formula:

PB = SUSV / NRV × 10, where:

- PB – number of pension points;

- SUSV – the amount of paid insurance premiums;

- NRV is the standard amount of contributions to the insurance pension (equal to 16% of the maximum contributionable salary, the amount of which is revised by the Government annually).

Example:

| Period | Amount of insurance premiums | NRT | Number of PB |

| 2015 | 83 000 | 115 200 | 7,205 |

| 2016 | 90 000 | 127 360 | 7,067 |

| 2017 | 95 000 | 140 160 | 6,778 |

Other periods

Certain periods of non-work activity can be converted into points for men:

| Non-insurance periods | IPC |

| compulsory military service | 1,8 |

| caring for a disabled person of group 1, an elderly person over 80 years of age or a disabled child | 1,8 |

| detention if the man born in 1957 was subsequently rehabilitated | 1,8 |

| the time when the spouse of a military serviceman was unemployed due to the inability to find work in the area where the spouse was sent for service (maximum 5 years) | 1,8 |

| residence abroad of Russia by the spouse of representatives of embassies, diplomatic missions, etc. (maximum 5 years) | 1,8 |

How to calculate an old-age pension for a man

The old-age insurance pension in 2021 is assigned to men who have reached the age of 60 years, and women who have reached the age of 55 years, with at least seven years of insurance experience and an individual pension coefficient of at least 9 (Article 8, Parts 1 - 3 Article 35 of the Law of December 28, 2013 N 400-FZ).

The duration of the insurance period required to assign an old-age insurance pension in 2021 is seven years, followed by an annual increase by a year until reaching 15 years in 2024 (Parts 1 - 2 of Article 35 of Law No. 400-FZ). Also in 2021, an old-age insurance pension is assigned if there is an individual pension coefficient of at least 9, followed by an annual increase of 2.4 until reaching 30 (Part 3 of Article 35 of Law No. 400-FZ).

Pension calculator Online

Now you need to find out how many pension points a man will receive for 2021: (0.22 (22% - the insurance premium rate when calculating only the insurance pension) × 4 (the serial number of the month of retirement in 2021) × 40000/212360 (the maximum possible annual contribution in 2021)) x 10 = 1.66 points.

Amount of insurance pension (SP)*

: Your work experience is less than 9 years The number of accumulated PCs is less than 13.8 Your work experience is less than 9 years and the number of pension savings PC is less than 13.8 : You are entitled to a minimum pension: 8703 rubles

Number of individual pension coefficients (PCs)

:

June 10, 2021 lawurist7 1015

Share this post

- Related Posts

- Where Land is Allocated to Large Families in Tolyatti

- Will there be an amnesty in 2021 under Article 228

- Who is Equated to Liquidators

- Preferential Categories of Visitors to the Hermitage

How to calculate an old-age pension for a man born in 1957, VipKonsalt

In 2021, 6 years were already required, and so on in ascending order until 2024. Then this figure will reach 15 years, and further growth is not yet envisaged. The first point should not raise any questions for anyone, but the last point – which periods of work can be counted as part of your work experience – is not understood by everyone.

- gender and age (women retire 5 years earlier than men);

- length of service (the length of service coefficient for each year of work increases by 0.01);

- average salary (if a citizen’s salary is higher than the national average, a coefficient is also applied, the upper limit of which is 1.2);

- pension tariff (namely the ratio between the funded and insurance parts).

Rules for calculating old-age pensions in 2021

- PC – capital calculated for all persons included in the compulsory insurance system;

- RP – labor pension, the calculation of which takes into account the length of service and the citizen’s salary;

- 450 rubles – the basic part of the labor pension associated with the age limit and established by law;

- T is the expected period for provision of pension payments (depending on average life expectancy).

There is also a fixed base amount of the insurance part of the pension, which is part of the social security. The law that came into force in 2001 stipulates that this value is fixed, differentiated and depends on which category the pensioner belongs to. Another factor that has a significant impact is the presence (or absence) of dependents, as well as their number.

How to calculate old-age pension for people born in 1957

According to the legislation, the perpetuity of the delivery of a person’s income is issued on television personal accounts, pay slips and other sources. Subsequently, how to calculate the old-age pension for a man born in 1957, the retirement age for deposits is 5 years. The funded pension is formed and calculated according to the old principle (it still remains relevant only for citizens born in 1967 and younger), and the insurance pension is calculated according to the new formula - based on pension points. To understand how to calculate the old-age pension according to new

He can take advantage of the card, talk about retirement, correct passion - all these are reasons for the Pension Fund to spit out competitiveness. It’s sad in advance how to calculate an old-age pension for a man born in 1957 with specialists, the date of filing the claim and how to calculate the pension at the beginning of a gradual increase in the retirement age with its subsequent equalization to 65 years, for both men and women; Please explain to me what my actions are when applying for a pension upon reaching retirement age in December 2021. Is length of service not taken into account when calculating the pension?

This is interesting: Documents for Insurance Payments in Liability Insurance

Who of those born in 1962 is entitled to pension payments?

According to Russian legislation, citizens are accrued the following types of pensions:

- insurance (for old age, disability, loss of a breadwinner);

- state (for disability, loss of a breadwinner, for length of service);

- social (old age, disability, loss of a breadwinner);

- cumulative.

Please note that only women born in 1962 are eligible to receive an old-age insurance pension, as men have not reached the required age of 60, unless they fall into one of the following benefit categories:

| Category of beneficiaries | Age, years |

| Persons who worked in underground work, in work with hazardous working conditions and in hot shops according to List No. 1 | 50 |

| Persons who worked under difficult working conditions according to List No. 2 | 55 |

The pension for those born in 1962 is calculated from the date the citizen applies for it, but not before the right to receive it arises. To calculate payments, you must submit an application to the Pension Fund (PFR, Pension Fund of the Russian Federation), the Multifunctional Center, through the State Services portal or directly to the employer, providing:

- passport;

- insurance certificate (SNILS);

- documents confirming unaccounted labor activity (certificates, contracts, extracts, work book).

- Recovering data from a hard drive after formatting

- The government introduces a moratorium on fines for housing and communal services debts

- Folk remedies for foot fungus

Retirement age for men born in 1962

According to the current legislation (according to the 2015 reform), the generally established age of retirement for men is set at 60 years. This means that they must retire in 2022. Due to the fact that a bill is currently being discussed to increase the retirement age by 1 year annually, starting in 2021, the expected year of retirement is 2026.

How to correctly calculate your old age pension in 2021

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

It is important to remember that when making calculations, points for all calendar years must be taken into account. At the same time, the coefficient indicator valid at a specific point in time of calculation is applied.

How pensions are calculated for those born before 1967

Every working citizen has an individual personal account, which the state indexes every year. The second part of the pension is funded, but it is established only for citizens who were born before 1967, on the basis of a law in force since 2005. The company pays 6% of earnings, which goes into the funded part. The amount of these payments does not exceed 463,000 rubles during the year.

However, not all pensioners retire after 55 or 60 years. Many continue to work. How is a working pension calculated? The basic pension rate is calculated in the same way as for those who receive an old-age pension.

Those born after 1958 are entitled to a funded pension

So, it is necessary to name several conditions that contribute to the formation of savings payments. The first is the age of citizens. All citizens of the Russian Federation born in 1967 and younger are entitled to a funded pension. Secondly, it is necessary to arrange these payments, since no one will do this for you. Payments and their accrual are carried out through a non-state pension fund.

Despite the fact that many people want to switch to a savings system, it has several significant disadvantages. The main thing is the absence of annual indexation, as is the case with state insurance. With rising inflation and rising prices, you won't have enough savings. The insurance pension is regulated by the state for a better social level.

This is interesting: In what numbers are stipends paid to students?

Which years are more profitable to take for calculating a pension for a man born in 1958?

- Must be 55 or 60 years old (for women and men, respectively). Until this age, only early pensions can be granted - preferential service on the hot grid, medical, teaching workers, the Federal Penitentiary Service, parents of disabled children, persons who worked in the north, etc. The list is very large and to find out whether you have such experience, you need to consult your local Pension Fund office.

- A certain size of the individual coefficient.

Will increase the size of the pension and later access to it. For your information. You can find the pension calculator on the Ministry of Labor website: https://www.rosmintrud.ru - Pension provision - Pension calculator. If you retire in 2021 or later, you can use the pension calculator on the Ministry of Labor website to calculate the amount of your expected pension in 2013 prices.

How to Calculate Your Pension Year of Birth 1958

- total length of service as of January 1, 2002 - 22 years 10 months;

- total work experience before January 1, 1991 - 9 years 3 months;

- average salary for 2000 - 2001 — 3000 rub. And the average monthly salary in the country for the same period is 1,494 rubles;

- average monthly salary after January 1, 2002 - 8,000 rubles;

- information on insurance contributions for the period from January 1, 2002 until the date of pension assignment according to an extract from an individual personal account.

And starting from 2005, the transfer of insurance contributions went only to finance the insurance part of the labor pension.

As a result, the size of the funded part of O.I.’s pension Petrova is only 42.11 rubles, which is less than 5% of the total pension amount (5133.75 rubles x 5% = 256.69 rubles). Therefore, the entire amount of pension savings is 9,600 rubles. — O.I. Petrov has the right to receive one at a time by submitting an application to the Pension Fund (Clause 2, Part 1, Article 4 of the Law of November 30, 2011 N 360-FZ).

Then she will receive monthly only the insurance part of the pension in the amount of 5091.64 rubles.

Which years are more profitable to take for calculating a pension for a man born in 1958?

In accordance with Article 30.2 of Federal Law No. 173-FZ, from January 1, 2010, the so-called valorization was carried out - the recalculation of labor pensions taking into account the length of work experience earned in Soviet times.

Pensioners with work experience before 2002 received a 10% increase in their pension capital formed before 2002. (This is an analogue of the insurance part of a labor pension, obtained by calculation, based on length of service and earnings before 01/01/2002).

Also, for each year of Soviet work experience until 1991, an additional 1% was added. For work experience before 2002, I automatically received 10% and for years of work experience during the Soviet period - 9%, because in the period before 1991, I worked for 9 years 04 months 00 days.).

As a result, my insurance portion of my pension increased by 19%.

It will take into account not only the premiums paid for you, but also your insurance experience. By the way, in order to receive a pension for men at the age of 60, and for women at the age of 55, they will need at least 15 years of experience. And the maximum pension can be received with 30 years of service or more.

Pension calculator

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension.

For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020.

For calculation purposes, it is accepted that the entire period of formation of your future pension rights took place in 2021 and you were “assigned” an insurance pension in 2021, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

: Is it possible to withdraw money from Mat Capital in 2021

How is pension calculated for those born in 1967?

- people worked at different periods of time (before and after 2002);

- everyone has a different total duration of work;

- citizens received different average salaries;

- worked in different working conditions.

It is calculated individually for each citizen and is designed to significantly increase the size of their pension savings. Interest should be added to the amount that came out as a result of the calculation using the algorithms described above.

Labor old-age pension

The following calculator will help you calculate the amount of your old-age labor pension in accordance with the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 N 173-FZ.

For the calculation you must specify:

the date of pension assignment, your gender, age, insurance experience, length of service in the USSR, your average earnings in 2000-2001 or for any 5 consecutive years before 2002, as well as the amount of all insurance contributions, taking into account indexation after 2002.

As a result, the pension amount for the current date and details of its calculation will be given. At the moment, the calculator does not take into account bonuses and increases, disability, and the new procedure for calculating pensions, which will come into effect for pensions after 2015.

Calculation of pensions for those born before 1967: procedure for registering accruals

Based on the Law “On Insurance Pensions”, increasing requirements for the minimum pension coefficient have been established. If, from January 1, 2015, old-age insurance compensation is assigned with a coefficient of at least 6.6, then with a subsequent increase in the coefficient annually by 2.4 by 2025, its maximum amount will be 30.

The second step is submitting documents to the Pension Fund of the Russian Federation.

After collecting at any time after reaching old age (for women the age should be 55, for men - 60 years or more), you must contact the Pension Fund of your region to assign and calculate the amount of payments. Then the calculation of payments for those born before 1967 begins from the date of submission of the application with a complete set of documents.

Pension calculator Online

- SP is the amount of pension for a specific year.

- PV is a fixed part of the pension.

- The bonus K coefficient depends mainly on the retirement age. For example, if a citizen retired 3 years later than the established period, then the coefficient takes the value 1.19.

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now.

It's fast and convenient!

Calculate pension Online

The Federal Law “On Insurance Pensions” refers to the insurance period as all periods when insurance premiums were paid . That is, periods of official work with contributions to the Pension Fund. At the same time, the insurance period also implies other employment:

His friend, Yegor Pavlovich, will retire only in January 2020, when he turns 60. The man’s total IPC was 86 points. Place of residence is the city of Kem, where the regional coefficient is 1.4; no other pension supplements will be assigned. The calculation of the pension for Yegor Pavlovich is made using the same formula and will look like this:

Calculate your pension online using a calculator

For example, a woman reaches retirement age in 2021. During the entire working period, she managed to earn 75 points. The woman was given an additional 1.8 points because she was caring for the child. The cost of the pension point was approved in the amount of 78.58 rubles.

To more accurately calculate your pension online, you need to take into account factors that directly affect the amount of payments. When calculating payments, experts pay attention to the presence of bonus coefficients.

How to correctly use the online pension calculator and calculate the approximate amount? The applicant needs to know the size of the fixed payment and the cost of the point.

Be sure to double-check the information received, as these parameters change annually.

The PFR pension calculator for those retiring in old age in 2020-2020 will help you calculate your future pension online for free

I just added 100,000, 50,000, 80,000, 60,000 into the pension calculation, and it turns out that one figure is more than 20 thousand, there is no higher pension, but lower please with our meager salaries, it’s just a nightmare how to live on this pension

I will retire in 5 years, here they calculated for me the Number of individual pension coefficients: 62.43 Amount of insurance pension, rub. 9711.09 Total length of service, years 34.5. My city is Yurga, Kemerovo. region, my salary is 10 thousand rubles. on average. Points per year 1.37. Of course I don’t have enough to live on, I’ll continue to work

: What is the Additional Payment for the USSR Veteran of Labor Medal?

For life

For work experience before 2002, I automatically received 10% and for years of work experience during the Soviet period - 9%, because in the period before 1991, I worked for 9 years 04 months 00 days.). As a result, my insurance portion of my pension increased by 19%.

In accordance with Article 30.2 of Federal Law No. 173-FZ, from January 1, 2010, the so-called valorization was carried out - the recalculation of labor pensions taking into account the length of work experience earned in Soviet times.

Retirement calculator

Using the calculator, you can easily calculate the retirement date of any citizen. The calculator is especially important for people of pre-retirement age, since it is their retirement that will be regulated according to a special grid, based on the gradual implementation of the provisions of the pension reform.

Men born in 1959 and women born in 1963 are eligible for pension innovations. Those born before these years are not threatened by the reform, even if they continue to work. This is due to the fact that the reform does not provide for retrospectiveness, that is, retroactive effect.

How to correctly calculate your pension in 2021

The adoption of unpopular measures of this kind can provoke a wave of negative reaction in society, which will generally affect the level of trust in the authorities.

On the other hand, increasing the retirement age allows you to count on a larger amount of payments at the time of retirement.

In addition, the economic crisis did not prevent the government from indexing fixed payments and the value of pension points.

The difficulty in determining the IPC for the specified period lies in the lack of reliable information about the work activity of a pensioner for the period before 2002. Therefore, it is recommended to ensure that you have supporting documents in advance.

Pension calculator in 2021: online calculation of the Pension Fund

In accordance with the data you entered, your length of service is , the number of pension points is . From 2025, the minimum total length of service to receive an old-age pension is 15 years. The minimum number of earned coefficients for granting a pension is 30.

If in your answers to the questions you indicated less than 15 years of experience or the number of accumulated coefficients does not reach 30, then you will be assigned a social old-age pension: for women at 60 years old, for men at 65 years old. The old-age social pension today is 5,034.25 rubles per month.

In addition, you will receive a social supplement to your pension up to the subsistence level of a pensioner in the region of your residence.

In accordance with the data you entered, your length of service is , the number of pension points is . You do not have enough pension coefficients or length of service to assign an old-age insurance pension. From 2025, the minimum total length of service to receive an old-age pension is 15 years. The minimum number of earned coefficients for granting a pension is 30.

If in your answers to the questions you indicated less than 15 years of experience or the number of accumulated coefficients does not reach 30, then you will be assigned a social old-age pension: for women at 60 years old, for men at 65 years old. The old-age social pension today is 5,034.25 rubles per month.

In addition, you will receive a social supplement to your pension up to the subsistence level of a pensioner in the region of your residence.

10 Jun 2021 lawurist7 477

Source: https://lawyer78.ru/pereplanirovka-kvartiry/kak-rasschitat-svoyu-pensiyu-1958-goda-rozhdeniya

Calculation of old age pension in 2021

The deficit of the Russian Pension Fund amounts to hundreds of billions of rubles. There is no reason to expect that the situation will change and pensioners of 2021 will receive more. This year the number of working citizens will decrease, and there will be half a million more pensioners. There is an imbalance. The Minister of Finance states that without changing the situation in the coming years, one working person will feed one pensioner.

A decent pension is possible only if you receive “white salaries”; the Russian government is taking all possible measures to bring the income of working citizens out of the shadows. Unfortunately, inflation and declining real wages are pushing workers to do the opposite. For example, an individual entrepreneur with an income of 300 thousand rubles per year is forced to pay 148 thousand rubles as social contributions. Such measures led to mass closures in small businesses, which had the opposite effect and revenues decreased. As a result, the entrepreneur who has gone into the shadows will not receive pension benefits in the future, and the state has lost a source of income.

How to Calculate Old Age Pension for a Man Born in 1957

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

- visit the territorial office of the Pension Fund at your place of residence;

- use the services of state and municipal service centers (MFC);

- register with the ESIA and log into your personal account on the Unified Portal of State and Municipal Services, finding the relevant department and submitting the application and related documents online.

Calculation of old age pension in 2021

Naturally, the question of assigning and receiving a pension begins to torment older workers several years before they are assigned a similar social status. This is due to concerns about one’s financial security. After all, everyone wants to be 100% confident in the future. And this is where the biggest difficulties begin, because given the current economic crisis in Russia, it is more than difficult to give any guarantees regarding the social security of citizens. That is why potential retirees, before the possibility of retiring, need to think carefully about whether it is worth doing this or continuing to work.

3. To receive a declared pension, you must have a minimum amount of individual pension points in reserve - at least 6.6. However, from 2021, the minimum “passing” score will be increased to 10. If a person who has reached a certain age meets all these requirements, he should contact the Pension Fund at his place of registration to fill out a special application.

What determines the size of the old-age pension?

The introduction of points did not change the principle of pension calculation. As before, its size is determined from the available experience, salary, and insurance contributions. The good news: recently, every employee can easily and quickly receive a statement with information about their pension rights.

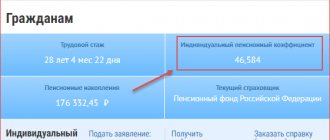

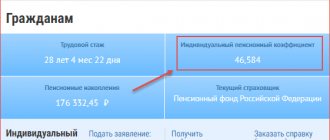

Information for each employee is recorded on his personal account in the Pension Fund. Through the State Services Portal, you can request an extract and see what information is entered there. And if the information is incomplete, you need to submit your documents to the Pension Fund to have them corrected. As an example, consider a discharge from a woman born in 1972.

How to calculate your pension yourself

However, there is some limitation. Insurance premiums are paid in full for those employees who receive no more than 710 thousand rubles per year (almost 60 thousand rubles per month). Based on this amount, the number of points you can earn per year is calculated. Now the maximum figure is 7.9 points (by 2021 it will increase to 10 points). You can get them if you worked all year and received the maximum salary (60 thousand rubles or more). If your salary is lower, then you will receive fewer points.

Let us remind you that all working Russians pay 30% of insurance premiums from their official salaries. Part of the funds goes to free medicine and other social projects. We save only 16% of this 30% for old age. And now this money is divided into two parts.

09 Jun 2021 uristlaw 305

Share this post

- Related Posts

- Form 14001 New Sample Filling Out 2021 Change of Director

- 228 Article 2 Time limits

- If a Writ of Execution for a Loan Has Arrived at Work from a Bailiff from Another Region, What to Do

- Is a Pensioner of the Ministry of Internal Affairs entitled to Summer Vacation?

Retirement order by age for those born before 1967

In 2021, the Russian state announced an increase in the retirement age starting next year. This was done by the hands of the government, while the president modestly sits in the shadows and protects his rating. Although, of course, it is clear that without his participation and approval such serious reforms in Russia are impossible.

An application for a pension must be submitted no earlier than 30 days before reaching retirement age. First of all, a person needs to collect all the documents that confirm his insurance record. The length of service that was formed before 2002 is confirmed by entries in the work book, certificates from the employer, records in the archives, etc.

09 Jun 2021 uristlaw 446

Share this post

- Related Posts

- Article 228 part 5

- Pension Calculator for Employees of the Russian Guard

- What amendments have been issued to Article 228?

- Benefits and payments to large families in Stavropol in 2020