What are pension points

PB are conditional indicators that reflect a citizen’s contribution to his or her security in old age. Pension points are awarded to a citizen during work. The more years a citizen works and the higher his salary, the more PB he will earn. The points are intended to simplify the calculation of pensions.

PB can be obtained not only for contributions made by the employer. They are also enrolled if a citizen serves in the army or is on maternity leave. In other words, PB is accrued not only for official work activity, but also for socially significant periods of life.

Number of points and pension amount

The more PB a Russian has accumulated, the greater his pension provision will be. In addition, the later a person applies for a pension, the higher it will be.

The salary that the employer paid the Russian for the work is of primary importance. All contributions are stored in the Pension Fund database.

For each year of work, a citizen is awarded PB. The salary is multiplied by the percentage of contributions to the Pension Fund. The accrual is carried out according to the pension reports of employers.

Important! If wages are “gray”, then the number of PBs does not increase. For this reason, it is necessary to work officially, according to the Labor Code of the Russian Federation.

How many points are needed to earn a pension?

Since 2015, pension insurance has been calculated taking into account the number of pension benefits and their prices on the date of payment. The calculation of PB is carried out using a special formula. To become a recipient of insurance pension benefits in 2021, a worker must accumulate at least 16.2 PB. Moreover, by 2025 this figure will increase to 30.

Many have heard that it is possible to increase the amount of insurance premiums on your own. To do this, it is necessary to make voluntary transfers of money to the Pension Fund. However, as of 2021, the maximum allowable amount of voluntary contributions has been significantly reduced. If in 2021 it was equal to double the minimum wage multiplied by 26 percent and 12 months, now it is determined differently.

The minimum wage (increased to 11,280 rubles) is multiplied by 22 percent and 12 months. Therefore, to receive 1.618 PB in 2021, you need to make voluntary transfers to the Pension Fund in the amount of at least 29,779 rubles.

The concept of minimum and maximum quantities

A citizen must accumulate a minimum amount of PB in order to start receiving an insurance pension. As mentioned above, in 2021 this figure is 16.2

In addition, the state has established the maximum allowable amount of PB that a Russian can receive in 12 months. In 2019, this figure is 9.13. From 2021 it will increase to 10.

Maximum points per year

The procedure for converting pension rights until 2002

To calculate the old-age pension until 2002, the employee's length of service and salary were used. According to the Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ from 2002 to 2015. Pension rights were determined in accordance with Soviet legislation, indexed, and then transferred to the personal account of the Pension Fund of the Russian Federation in the form of initial capital.

You can calculate the RPC yourself using the following method:

- The length of service coefficient is determined.

- The average monthly earnings coefficient (AMC) is calculated.

- The estimated pension is calculated as of January 2002.

- Valorization is being carried out.

- A correction factor is applied.

How to determine your estimated pension

At the initial stage, you need to determine the experience coefficient. It depends on the gender of the applicant and the duration of employment. Please note that regardless of the calculation results, the maximum value applied is 0.75:

- If a man’s length of service is less than 25 years, and a woman’s is 20 years, the SC value is set to 0.55.

- For each additional year of experience over 25 years for men and 20 for women, 0.01 is added to the SC value of 0.55.

At the next stage, the calculation of the KSZ is carried out. To do this, the average salary for 2001-2002 is calculated. or for another 60 months. The result obtained must be divided by the average monthly salary in Russia for the same time period. Average monthly earnings in Russia from 2001 to 2002. was 1,494.5 rubles.

Regardless of the final result, the marginal KSZ is:

- 1.4-1.9 – for those working at that time in the Far North;

- 1.2 – for all other applicants.

Having all the data, the amount of the estimated pension is determined:

- If the experience coefficient is 0.55:

RP of men = (SC x KSZ x 1,671 - 450) x (annualized experience accumulated before 2002/25)

RP of women = (SC x KSZ x 1,671 - 450) x (annualized experience accumulated before 2002/20)

- 1671 is a constant and corresponds to the average salary in the country in December 2001.

- 450 is the basic pension amount established by Law No. 173-FZ.

Please note that according to Law No. 173-FZ, if RP = SK x KSZ x 1,671 is less than 660, the estimated pension is determined by the formulas:

RP men = 210 x (annualized experience accumulated before 2002/25)

RP of women = 210 x (annualized experience accumulated before 2002/20)

- If SC is greater than 0.55:

RP = SK x KSZ x 1,671 – 450

Please note that according to Law No. 173-FZ, if RP = SK x KSZ x 1,671 is less than 660, the calculated pension is set at 210.

- Online excursions for International Museum Day

- 9 Early Signs of Rheumatoid Arthritis

- 5 Important Things Grandparents Can Teach Their Grandchildren

Valorization

Valorization is applied to the calculated pension amount - a one-time increase:

- If the pensioner does not have work experience before 1990, 10% is added to the result obtained.

- If there is employment for this period, 10% is added plus 1% for each full year of experience. You can confirm your work experience with a work book, statements, orders, contracts.

Determination of the settlement capital of RPK 1

The amount of the insurance pension (SP) as of January 1, 2002 will be:

SP = RP + SV, where:

- SP – insurance pension;

- RP – estimated pension;

- SV – amount of valorization.

Please note that if the obtained result of the joint venture is multiplied by 228 (the number of months of the survival period, which is 19 years), then the result will be the amount of capital that the citizen formed as of January 1, 2002.

Since capital indexation was carried out annually, in order to obtain the ruble expression of the RPC, it is necessary to apply an adjustment factor to the amount of the insurance pension. They will be the product of the annual indexation coefficients for the period from 2002 to 2014. inclusive. It is equal to 5.6148:

RPK1 = SP x 5.6148, where:

- RPK1 – estimated pension capital accumulated as of January 1, 2002;

- SP – the amount of the insurance pension;

- 5.6148 – indexing coefficient.

Cost of points

To convert PB into rubles, you need to multiply only 2 numbers: the number of PB by the price of one PB. Below you can see an example of this procedure.

A college teacher received 20 thousand monthly. During the period of work, he accumulated 100 PB. In 2021, the price of one PB is 87.24 rubles. Consequently, a citizen’s pension insurance will be equal to the product of 100 and 87.24, that is, 8724 rubles. Of course, the fixed payment equal to 4983 rubles is not taken into account here. It must be added to the citizen’s insurance pension; it is also paid every month.

Concept

The transfer of insurance contributions by the employer for each hired employee guarantees that a citizen, after reaching the age of a pensioner, will be able to receive a monthly pension that will ensure an optimal standard of living. All contributions are accumulated in the citizen’s personal account, which leads to the formation of pension capital.

Important! Capital is represented by the total amount of all insurance and other types of contributions transferred to a person’s account.

All funds are managed by PF employees, which allows you to significantly increase savings over time. The resulting value is represented as the basis on which you need to focus when calculating your insurance pension.

It is otherwise called estimated pension capital, which includes :

- initial capital formed by people who officially worked before 2002;

- calculated, obtained by adding up all contributions transferred after 2002;

- capital created as a result of valorization, which is represented by a revaluation of the rights of people with experience before 2002, therefore such citizens receive an additional 10% to the capital that was created before 2002, as well as 1% for each year of work before 1991 .

Valorization appeared only in 2010, and it is also used in relation to all types of insurance pensions.

How to calculate: instructions

Some citizens may be curious about how much PB they have accumulated in their account. To obtain information, you can use one of the following methods:

- government services website;

- official Internet portal of the Pension Fund;

- visit to the Pension Fund institution.

To obtain information on the government services portal, you must perform the following steps:

- Register. Please provide your last name, first name and telephone number. The number you entered will receive a code that you need to enter in the appropriate line in order to log in to the site. In order to fully use the site, you must fill out a form and confirm your identity (uploading a scan of your passport and SNILS).

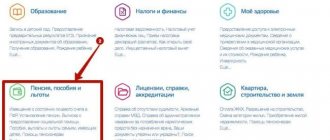

- Go to the catalog of public services . Go to the “Pension, benefits and benefits” subsection, request an extended statement by clicking on the link “Notice on the status of your personal account in the Pension Fund of the Russian Federation”.

- Wait for a response . The request is processed in a few minutes. After this, you will receive a letter that will contain a report with information on the PB. If necessary, you can print it directly in your personal account.

NPF (non-state pension fund) clients can obtain information about PB on the websites of the relevant organizations. The government services website does not store information about the PB of NPF clients.

It is also possible to check the number of PBs via the Pension Fund website:

- Log in to your personal account. To access it, log in to the government services website with proof of your identity.

- Go to the “Pensions” subsection.

- Click on the “Get pension information” button.

- Wait for a response. You will receive a letter indicating the number of accumulated PBs and your existing experience.

A pension calculator is a service that is intended to explain the procedure for forming pension rights and calculating the amount of payments. In order to use the service, you will need to provide the following information:

- gender;

- year of birth;

- duration of military service. Only conscript service needs to be taken into account;

- number of children;

- duration of care for each child, citizen over 80 years of age or person with group 1 disability;

- the number of years that you are not going to apply for payments after becoming eligible for them;

- category of work (military service, civil service, regular work, own business);

- number of years worked. Information about length of service can also be entered here;

- official salary excluding tax.

The information that will be obtained when using the calculator is conditional. It should not be taken as the exact amount of pension benefits. In order to find out the real number of PB, it is advisable to use the previous 2 methods.

A personal visit to the Pension Fund institution, which is located at your registration address, is considered the most time-consuming method. Find out when you can contact it on a question that interests you, and come to it on time. You need to take your passport and SNILS with you. Information about the number of PBs will be indicated in the statement.

Reference! If you are a client of a non-state pension fund, then you need to visit its nearest branch. The institution's staff will provide you with all the required information.

If before 2013, Russians could not think about the number of PB and received data about it in the form of letters from the Pension Fund of the Russian Federation, then today they need to check the number of points on their own. It’s good that this can be done not only by visiting the Pension Fund in person, but also online.