In September 2021, the reorganization of the funds ended: now “SAFMAR” also includes the “European Pension Fund”, the personal account of which still performs its functions in full. Its clients have access to a list of services and can quickly seek help through various sections of the site.

Particular attention is paid to the security of personal data; modern technologies and algorithms are used to protect confidentiality.

Personal account features

In the PFU personal account, the user can:

- Get information about personal and corporate accounts.

- Read the electronic version of the document on non-state pension provision.

- Submit a notification to the insurance company.

- Keep confidential information up to date.

- Receive a pension account statement for any period of time.

- See the history of replenishment of the savings part.

- View your total funds.

The service is available both on the website and in the mobile application.

Credit Europe Bank: login to your personal account

To carry out remote transactions with financial assets placed with the bank, you must log into your personal account. To do this, go to the official website of Credit Europe Bank at https://www.crediteurope.ru/ and in the upper right corner we find the “Internet Banking” button. Click on the link and indicate your username and password on the page that opens. If the details are entered correctly, click the “Login” button.

The personal account of Credit Europe Bank allows you to perform the following operations with your cards and accounts:

- General information about accounts, cards, deposits and loans (account status, details for crediting funds)

- History of recent transactions (previous transactions made in your personal account)

- Payment for services (mobile communications, utilities, Internet, TV, fines and taxes, state duties, etc.)

- Money transfers (between your accounts and cards, as well as to other bank clients)

- Blocking a bank card (if the card is stolen or lost)

- Online loan application (allows you to submit a loan application via the Internet)

- Deposits (opening a deposit to make a profit)

- Loans (management of an existing loan: payment schedule, debt balance, debt repayment)

- Opening an account

- Find the nearest ATMs and branches

- Exchange rates and precious metals

- Feedback from bank technical support

How to register in the system

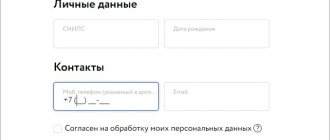

The non-state European Pension Fund offers a fairly simple registration of a personal account for individuals. You will need:

- SNILS number;

- Mobile phone number;

- Email.

Important! At the moment, registration is available for clients under compulsory pension insurance.

Registration in your personal account

The registration process in the personal account of the European Pension Fund has been simplified as much as possible. There is no need to enter a lot of personal data and wait for the organization's employees to approve your application. All you need to do is enter the following information:

- SNILS number;

- Current mobile phone number;

- E-mail address.

client.npfsafmar.ru/register.asp - personal account registration

The information provided will help you register as quickly as possible.

What to do if you have problems logging in

Safmar has detailed instructions on how to log into the European Pension Fund through your personal account if certain problems arise.

Important! If the client does not remember the email, then it is required to fill out an application “On making changes to personal data” and take it to the branches of PFU or the partner bank of JSC Raiffeisenbank with a Russian passport and SNILS. Another way to send: via mail. To do this, you will need “Consent” and photocopies of the pages of the Russian passport, on each page of which a signature and the mark “Copy is correct” are placed.

Important! If you lose your password, you need to click on “Forgot your password?”, and you will receive instructions on how to recover your data by email.

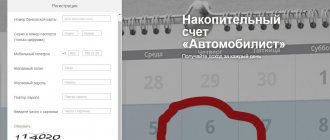

Account registration

To date, the registration parameters in the system have changed slightly due to the reorganization. European Insurance Fund in 2021. The reorganization was carried out with the aim of increasing the efficiency of customer service, protecting personal data and optimizing work with pension savings. For complete registration, go to the inpatient department of the European Pension Fund NPF Safmar in your city and sign a mandatory funded pension insurance agreement, attaching a form.

Further registration takes place on the Foundation’s website at: https://client.npfsafmar.ru/register.asp. In electronic form, enter: SNILS, mobile phone number, email address. Then click on the “Register” option. Instructional instructions will be sent to your email address and your mobile gadget will also receive an SMS notification when the operation is completed. As mentioned earlier, access to the account is provided to clients who signed the Agreement three months before the date of registration of the account.

Personal account mobile application

PF "European" was the first Fund to develop a mobile application for providing pension services.

This includes:

- Information about the nearest branches, addresses and telephone numbers.

- Information on topics of financial support for old age.

- Up-to-date mailbox support.

- The ability to send messages directly from the application to the Contact Center.

- Checking your retirement account.

The developers focus on modern methods of protecting confidential information. The application is available in Play Market and Apple Store.

Mobile application features

Since 2012, the fund’s clients have had access to a mobile application that can be installed on a smartphone. It can be downloaded from Google Play or Apple Store.

With it you can:

- Learn about pension fund news;

- Find the nearest representative offices;

- Track the movement of funds and account status;

- Check the information you are interested in at the NPF contact center;

- Change the email address for sending notifications.

If necessary, fund clients can contact the hotline 7 (495) 777 9989 / or contact NPF employees at

Customer support via account

On the official website in the “Feedback” section, the client can ask any question, including technical problems.

“European Pension Fund” also responds on social networks.

NPF European hotline

The company operates a Hotline for 12 hours from 8 am. Contact numbers and 8 (800) 700 80 20.

Email for letters

Credit Europe Bank: login to your personal account

To increase the level of user convenience, representatives of Bank Europe Credit have developed a personal account system that allows clients to manage their accounts at a distance from the office or ATM.

To log into your account, you must be a client of the Eurobank and go to the official website using the link https://online.crediteurope.ru On the left side of the main page you will find a special form. For authorization you will need a login and password.

When using the Internet banking in question, you don’t have to worry about the risk of fraud and the safety of your funds. The official website uses a special secure connection to maintain confidentiality and important information.

Your personal account is divided into 2 main categories. The first is intended for ordinary citizens, and the second for legal clients. For individuals, there are a number of advantages of using a personal account, which include:

- Detailed details of all recent transactions made with the client’s account;

- Timely informing users about special offers from the bank;

- Monitoring the status of all accounts and bank cards;

- Familiarization with the loan repayment schedule, as well as current debts;

- Creation of templates for frequent transfers;

- Setting up automatic payments option.

In fact, this list includes most of the actions that are required by the client to cooperate with the bank. In this regard, Internet banking is actively used by many bank clients.

- Credit Europe Bank personal account: instructions for registering, changing and restoring your access password

How to disable your personal account

The account is linked to the validity of the contract. If the client refuses to provide services and terminates it, the personal account ceases to be active.

Thus, the “European Pension Fund” provides a wide range of services and supports customer service on mobile devices using an application. The website has a feedback form and a hotline, where Foundation employees will provide answers to questions. PFE ensures that all clients receive quality service.

European Pension Fund: login to your personal account

Only registered users have access to an account with the European Pension Fund. For authentication we will need: login, password and code from the banner. After clicking the “Submit” button, you will be automatically redirected to your personal account.

In the same panel there are hyperlinks “Forgot your password?”. and "Registration". They are necessary for people visiting the site who need to recover their locker password or who have not registered on the site. Registration is open only to clients with compulsory pension insurance. Users who previously did not have a login and password will be able to log in later.

To receive a pension certificate, you can either write a letter to NPF Safmar or call the customer service department. Full contact information is available on the company website. The login and password for your personal account are issued after creating an account. It is also allowed to use the login and password previously issued by the European Pension Fund NPF and REGIONFOND NPF.

The login and password for your personal account are issued by the European Pension Fund in a special access card. This is a plastic carrier that is prepared after the conclusion of the Agreement. The data is saved on the card. However, please note that you will receive access to the locker only three months after concluding a compulsory pension insurance agreement. A notification with this information comes to the client’s mobile phone in the form of an SMS message. After this operation, access to the account becomes open.

European Pension Fund - Capital Pension, video:

How to transfer a pension to the fund

The transfer of the funded part of the pension to NPF SAFMAR from the Pension Fund of the Russian Federation is carried out as follows:

- Before December 1 of the current year, you need to contact the fund - service addresses on the website https://www.npfsafmar.ru/kontakty/.

- You must provide your passport and SNILS and sign the agreement.

- After signing the agreement, take the SAFMAR details and go to the Pension Fund to apply for the transfer.

- Wait for approval.

Funds from the funded part of the pension are not transferred immediately, unlike the formation of an NGO. The Pension Fund will send your money to the fund only at the beginning of the next billing period (from the new year). At that time, the organization will begin to invest money in assets, and the funded part of the pension will begin to generate income.

An application to the Pension Fund for the transition can also be submitted remotely - through the State Services service or the personal account of the Pension Fund of Russia. The 5 year rule should also be followed. If you change funds more frequently than this period, all investment income may be lost.