Home NPF

The VTB Pension Fund belongs to the VTB group of companies, which also includes banking and financial organizations. The fund implements several pension programs designed for individual and corporate clients.

On the website of the non-state pension fund, individuals and legal entities can access the VTB NPF personal account service, which makes it possible to monitor in detail online the accumulation of pension contributions.

vtbnpf.ru - official website of NPF VTB Pension Fund

Personal account features

After registering and gaining access to the personal account of the VTB non-state pension fund, the following options become available to the client:

- Obtaining current information about the status of an account in a pension fund. The client independently chooses what funds, where and when he will invest in the future, and also selects the period for receiving a pension;

- Checking existing and connected services;

- Obtaining information about the amount of maternity capital, part of which was allocated for the accumulation of a future pension;

- Obtaining up-to-date information about ongoing programs;

- Answers to popular questions about the work of a non-state fund;

- Submitting an application for participation in a particular pension program;

- Contact technical support.

Access to a personal account for both individuals and legal entities on the NPF VTB-24 website opens after the registration stage has been completed. Client registration is carried out on the official website of the organization vtbnpf.ru. You can apply for registration at any branch of VTB Bank; all the necessary information about the data to enter your personal account will be sent via SMS message.

Features of the personal account of NPF "VTB"

The personal page of the client of NPF VTB is posted on the official website of the fund and was created so that everyone can track the current state of their pension savings. In order to gain access to your personal account, you must request registration in the online service. After receiving confirmation, you must fill out a form with your data and set a login and password combination for subsequent logins. After authorization you will be provided with the following information:

- about the state of one’s own savings in a non-state pension fund;

- on the amount of maternity capital, which is specially allocated for the funded part of the pension;

- about active pension reserves and investment programs that bring additional savings.

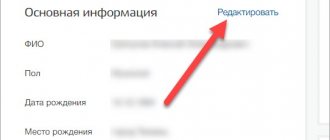

In addition, in your personal account you can change information about yourself, set a financial phone number, email address, etc.

Login window on the site

Official website: https://www.vtbnpf.ru.

Personal account: https://web.vtbnpf.ru.

Hotline phone number: 8.

Registration for legal entities and individuals

The registration process for legal entities is similar to that for individuals: you need to contact a bank branch to apply for access to your personal account. If in the process of using the NPF functionality there have been any changes in personal data, a letter with updated information must be sent to the bank.

The registration process can also be completed on the website. To do this, go to the “Personal Account” tab, click on the “Registration” link and enter:

- Valid email address;

- We come up with a password, which must consist of at least 6 characters;

- The verification characters from the picture are entered into the appropriate window.

After filling out all the fields, click on the “Registration” button.

https://web.vtbnpf.ru — VTB Pension Fund: login to your personal account

Registration of a personal account of NPF VTB for legal entities

Legal entities are registered with a non-state pension fund in the same way as individuals. Changing confidential information requires filling out a new form with new information and sending it to the bank branch.

The first authorization in the system is carried out through:

- login – this is the SNIPS number. The code should be entered as follows: the first three cells are for the first three digits of the number, the fourth cell is for entering the remaining digits;

- password – the passport number confirming Russian citizenship is used as it. After logging in, the login should be replaced by creating an individual password

- maximum complexity;

- captcha is an alphabetic or alphanumeric code that must be entered to confirm that the registration is carried out by a person and not a robot.

You can avoid hacking and other troubles if you do not tell anyone secret information, first of all, the invented code. Also, you should not write the code on any media.

Legal entities can log into their personal account by pressing the “Bank-Client” button, after which a company representative will be taken to a page convenient for making calculations and storing important information.

Login to your personal account

How to log into your personal account

To enter your personal account of the VTB Pension Fund on the website, you must enter your login, password and verification code:

- Login – SNILS number. You must enter the first three digits in each cell, the last two in one;

- Password. When you first log in, the password is your passport number. Immediately after logging in, you need to go to your personal account settings and change your password to a more secure one;

- Captcha is a verification code that protects the system from robots and spam.

To prevent third parties from gaining access to your personal account, be sure to change the standard password to a new one. A strong password should include lowercase and uppercase Latin letters, numbers and special characters.

Login for legal entities is carried out through the “Bank Client” system.

If you have forgotten the password you set, you can recover it on the login page. To do this, click on the “Forgot your password?” button. After this, a new generated password will be sent to the email address specified during registration, which also needs to be changed in your personal account. You can recover your password an unlimited number of times, but it is advisable to remember it.

How to log into the personal account of NPF VTB?

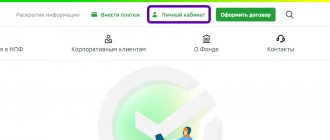

To log into your personal account at VTB Pension Fund, you need to:

- Open the official website of the company.

- Click the “Personal Account” button in the upper right corner.

- Enter your login (SNILS number) and password.

- Enter the characters from the picture.

- Click on the “Login” button.

You can also log into your personal account through the Government Services portal if you have a verified account.

Additional features of your personal account

The personal account of NPF VTB 24 allows you to transfer funds to the funded part of your pension. The choice of a private management company is an individual decision for each client. Basically, non-state funds do not impose special requirements on clients and have high returns.

Funds from the pension reserve can be used to capitalize the account; all you have to do is submit the appropriate application. You can redirect once a year, but do not forget that all investment income will be lost.

Personal account functionality

The main task of the personal section is to provide information to every citizen. An open financial policy is the key to customer trust. Therefore, the LC proposes:

- Receive information about your pension savings;

- Maintain several retirement accounts at the same time for insurance. Unlike the state program, here you can independently choose the amount of contributions in order to increase or decrease the efficiency of the funded part of the pension;

- View information about maternity capital, as well as about accruals on it, if the funds were not used immediately, but were invested;

- View the results of pension investment, control the level of pension increases.

In addition to the fact that deferred savings can be used by a person who is a client of the VTB Fund, after his death the money goes to his heirs. Such conditions are not offered by government programs.

Support

The non-state pension fund uses modern technologies that prevent the leakage of personal information to the network. It is safe to use your personal account.

If you have any questions regarding customer service and registration and logging into your personal account, you can contact technical specialists for help by calling 8.

Official site:

https://www.vtbnpf.ru

Personal Area:

https://web.vtbnpf.ru

Hotline phone number:

Registration in the system

First, you need to log into the NPF VTB Pension Fund official website - web.vtbnpf.ru and leave a request for the provision of Internet services. This can be done by visiting a bank branch in person. After the application from the client is processed, he will be sent all the necessary data to work with his personal account (login and password).

Reviews about the VTB pension fund

Clients have mixed opinions about the insurance company. The level of trust in NPFs is high, as evidenced by a large client base and numerous positive reviews. Clients note:

- high-quality and efficient work of managers in offices;

- quick resolution of issues, lack of paperwork;

- extensive office network;

- stable profit;

- transparency of the information provided regarding the implementation of pension programs and investment projects;

- fast execution of contracts.

There are also negative reviews, in which clients point to:

- interruptions in the work of your personal account;

- inaccurate information regarding the account status;

- months-long delays in pension payments;

- loss of client documents;

- incompetence of the hotline operator;

- Hotline malfunctions.

Like any private company, the VTB fund has pros and cons. But taking into account the large client base, we can say that VTB is a pension fund that enjoys the trust of citizens and successfully implements pension programs. It should be paid attention to by people who do not want to experience a cash deficit in old age, which in modern economic conditions is a very real prospect. Detailed information about the activities of the fund can be found on the official website.

Registration and Login Process

To use the personal account of NPF VTB, preliminary registration is required. It consists of the following steps:

- Come to the branch and write an application for the provision of the relevant service, or send an application online.

- Wait for the information to be verified and registration in the system confirmed.

- Get login details.

After these simple steps, logging into your personal account will be very simple:

- On the official website of NPF VTB, on the right side, find the link “Personal Account for Individuals” and click on it, or follow the link web.vtbnpf.ru.

- A standard form will appear in the window that opens with space for login and password and a captcha.

- Enter the login - SNILS number, and the password - initially this is the passport number, consisting only of numbers (then can be changed by the client at will).

- Enter the code from the picture and click the “Login” button.

- If you need to recover your password, click the “Forgot your password?” button. and follow the instructions in the instructions.

After logging in, access to all capabilities of VTB Non-State Pension Fund becomes open and a person can carry out any manipulations with accounts.

If difficulties arise, each person can receive free advice and assistance in the current circumstances, the hotline number is 8-800-775-25-35.

Login for individuals to NPF VTB on web.vtbnpf.ru

For the first authorization at VTB you will need:

- Login is your SNILS number. The first three digits are entered one in each cell, and the last two - in the fourth cell.

- Password - passport number. Immediately after logging in, you will need to come up with a fairly complex password and remember it.

- Captcha - protection against robots and spam.

Important : to avoid hacking or providing access to unauthorized persons, the client should create a strong password using lowercase and uppercase Latin letters, special characters and numbers.

Additional features

NPF VTB can offer clients such a service as connecting to the “Golden” package, which includes free of charge:

- Connect to online banking.

- Opening of three additional accounts.

- Linking any three cards to mobile banking.

Additionally, if desired, a person can order and issue cards to receive discounts. This could be a travel card for earning miles, an experience card for earning bonuses, a car card for cashback on car expenses, a card for cashback for restaurants, and much more. These bonus cards will already help you save significant amounts, and after viewing the full line of VTB offers, you can even select several types of services for a profitable distribution of finances.

Registration and login to your personal account

In order to start using the personal account service through the official website of the VTB Non-State Pension Fund, the client of the pension program submits a written application to the Fund for the provision of Internet services. After processing the application, the client’s data will be registered in the system, and he will receive the necessary data to log into the personal account of VTB Non-State Pension Fund.

The link to the client’s personal section is located among the group of blocks on the right side of the main page of the site. Clicking on the link “Personal account for individuals” will redirect the client to a page with an electronic “Login” form. Here, a registered user can log in by entering in the empty cells of the form:

- Login - SNILS number, 3 digits in the first 3 cells, the remaining 2 digits in the fourth.

- The password is the default passport number (6 digits without series), but can be changed by the user.

- The code from the picture that protects the system from spam.

Link "Forgot your password?" under the line for the captcha code on the authorization page allows you to recover your password if it becomes inaccessible for some reason. Restoration is carried out via the email associated with the user account.

The client is obliged to inform the Fund about any changes in personal data by sending a completed form with updated information by Russian Post. The application form and the address of the Fund can be found on the VTB NPF website under the block with the authorization form. The client also formalizes a refusal to use his personal account in the form of a written application and delivers it to the Fund himself or by mail.

- Official website: https://www.vtbnpf.ru

- Personal account: https://web.vtbnpf.ru

- Hotline phone number:8

Content

NPF VTB is a pension fund owned by a financial group with the same name. For several years now he has been confidently holding his own in the pension insurance industry, where competition is high. Many citizens trust their money to the insurance company; the client base exceeds 1.5 million people. The official website is located at: www.vtbnpf.ru

The fund's priorities are:

- high-quality and prompt customer service;

- transparency of activities;

- absence of bureaucratic delays;

- stable income from the implementation of investment programs;

- wide distribution of the office network throughout the country's populated areas.

For the convenience and efficiency of working with clients, an official website has been created that provides many online opportunities. The service has a well-designed and understandable interface; information for individuals and legal entities is divided into sections and subsections. The site has a built-in search engine through which you can find the necessary information. At the bottom of the main page there is a news block where you can find out current information about the activities of the insurance company.

To get more opportunities on the site, you need to create a personal account. It allows:

- receive information about the status of a savings or individual account;

- add maternity capital to the funded share of the pension;

- monitor the participation of pension savings in investment projects;

- edit personal information;

- change email address and password.

To make registration on the site possible, you need to submit a paper application for the provision of this service.

Company employees process the application and provide the client with the details necessary to log into the account. On the main page on the right there are two blocks: a personal account for individuals and for legal entities.

By clicking on the link, the user is taken to the authorization page.

When you click on the “Personal Account” link, a window called “Login” opens.

Here you need to enter the following data in the lines:

- login – SNILS number;

- password – passport number (digits only, without series);

- security code – symbols indicated in the picture.

If you have forgotten your password and your passport is not nearby, recovery is available. You need to click on the “Forgot your password” sign.

A window will open in which you need to enter your email address and security code and click on “Submit”.

An email will be sent to you with a link to access your account.

VTB is a pension fund that provides a wide range of services:

- state co-financing of pensions;

- compulsory pension provision;

- non-state insurance;

- corporate schemes.

State co-financing

The operating principle of the program is as follows:

- The client enters into a contract with the fund.

- Every year for 10 years, the client makes contributions to the fund (from 2,000 to 12,000 rubles).

- The state provides support to the citizen: it doubles the contributed amount through the implementation of investment projects.

- A citizen's pension savings increase significantly.

Mandatory pension provision

This program allows a citizen to increase pension savings by participating in profitable investment projects.

The employer monthly transfers 22% of the employee's salary to the Russian Pension Fund. The transferred amount is divided into two parts: 16% remains in the Pension Fund as an insurance share in points, 6% is a cumulative share in rubles, which can be combined with the insurance, left in a state fund, or transferred to any private insurance company. In a non-state pension fund, the accumulative share will work; the increase in money is ensured by participation in investment programs. The accumulated funds can be transferred to heirs.

Non-state insurance

The program is intended for citizens who want to secure substantial capital for themselves in old age. The client will receive not only the state pension, but also the money he has accumulated in an individual account in a private fund. This account is separate from the compulsory pension insurance account. Client:

- independently determines the amount and frequency of deposited money;

- at its discretion, adjusts contributions to change the amount of the expected pension;

- monitors the movement of money accumulated in the account;

- receives investment profit;

- has the right to transfer the accumulated amount to his heirs;

- has the right to terminate the contractual relationship at any time with a return of all money.

Corporate schemes

They allow the employer to reduce production costs, attract young and highly qualified specialists, and provide acceptable social support for retired workers.

There are several options for corporate insurance. The participating enterprise reduces payments to the Pension Fund. As a result, funds are freed up to increase wages and improve production profitability.

The company is constantly improving the principles of its activities, thanks to which the leading rating agency "Expert" changed its rating from A(+) - high reliability, to A(++) - maximum reliability. This means that the fund continues to actively develop, and is not in danger of losing its license or sudden closure.

To terminate the contractual relationship, the client must fill out an application in free form and submit it to the fund. The document must indicate where the money should be transferred (to the Pension Fund of the Russian Federation, to another private company, to a bank account). If you plan to transfer to the Pension Fund, then it is enough to submit an application to the branch of the state fund; in this case, there is no need to notify VTB about your decision. When submitting an application to a NPF or Pension Fund, you must attach SNILS and an identity card.

Fund participants need to take into account that when the contract is terminated, financial losses are inevitable:

- profit is transferred for an incomplete financial year;

- tax is deducted (13%) if the money is transferred to a bank card;

- transaction costs are covered by the client.

The main office of the VTB private fund is located at: Moscow, st. Vorontsovskaya, 43(1).

A toll-free hotline operator is ready to answer any questions you may have - (8-800) 775-25-35.

You can also write an email to: [email protected]

Clients have mixed opinions about the insurance company. The level of trust in NPFs is high, as evidenced by a large client base and numerous positive reviews. Clients note:

- high-quality and efficient work of managers in offices;

- quick resolution of issues, lack of paperwork;

- extensive office network;

- stable profit;

- transparency of the information provided regarding the implementation of pension programs and investment projects;

- fast execution of contracts.

There are also negative reviews, in which clients point to:

- interruptions in the work of your personal account;

- inaccurate information regarding the account status;

- months-long delays in pension payments;

- loss of client documents;

- incompetence of the hotline operator;

- Hotline malfunctions.

Like any private company, the VTB fund has pros and cons. But taking into account the large client base, we can say that VTB is a pension fund that enjoys the trust of citizens and successfully implements pension programs. It should be paid attention to by people who do not want to experience a cash deficit in old age, which in modern economic conditions is a very real prospect. Detailed information about the activities of the fund can be found on the official website.

Recent and future changes in the policy of compulsory pension insurance are forcing an increasing number of citizens of the Russian Federation to turn to non-state funds. The NPF of the country’s “second” bank, VTB, is in the top 10 of the population’s trust rating.

Let's look at the benefits of insurance at the VTB Pension Fund and the possibilities of your personal account on its website.

Content

VTB non-state pension fund

NPF VTB is a pension fund owned by a financial group with the same name. For several years now he has been confidently holding his own in the pension insurance industry, where competition is high. Many citizens trust their money to the insurance company; the client base exceeds 1.5 million people. The official website is located at: www.vtbnpf.ru

The fund's priorities are:

- high-quality and prompt customer service;

- transparency of activities;

- absence of bureaucratic delays;

- stable income from the implementation of investment programs;

- wide distribution of the office network throughout the country's populated areas.

For the convenience and efficiency of working with clients, an official website has been created that provides many online opportunities. The service has a well-designed and understandable interface; information for individuals and legal entities is divided into sections and subsections. The site has a built-in search engine through which you can find the necessary information. At the bottom of the main page there is a news block where you can find out current information about the activities of the insurance company.

To get more opportunities on the site, you need to create a personal account. It allows:

- receive information about the status of a savings or individual account;

- add maternity capital to the funded share of the pension;

- monitor the participation of pension savings in investment projects;

- edit personal information;

- change email address and password.

VTB pension fund personal account - login

When you click on the “Personal Account” link, a window called “Login” opens.

Here you need to enter the following data in the lines:

- login – SNILS number;

- password – passport number (digits only, without series);

- security code – symbols indicated in the picture.

If you have forgotten your password and your passport is not nearby, recovery is available. You need to click on the “Forgot your password” sign.

A window will open in which you need to enter your email address and security code and click on “Submit”.

An email will be sent to you with a link to access your account.

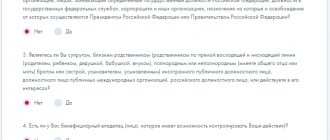

Registration of a personal account for the VTB Pension Fund

An interesting feature that will delight many potential clients is the fact that the system does not provide for standard registration on the website of the non-state pension fund VTB24 and in your personal account. You will be able to log into your personal account without going through this procedure. This is due to the fact that the virtual service is the most important part of the institution’s services and is provided by default.

We can say that the role of registration is performed by concluding an agreement with the establishment. In this case, the signing of an agreement can occur in two formats:

- upon personal visit to the nearest office;

- online, using a special questionnaire.

The final decision depends only on the wishes of the registrant, since the result with each approach will be the same.