Create a prosperous future for yourself and your loved ones

Treatment in foreign clinics in case of critical illness

Your own financial advisory business

For 15 years, Renaissance Life has been a reliable partner for millions of clients

Compensation for financial losses in case of loss of life or health

Capital creation regardless of circumstances

Investment management with return on investment guarantees

- all possibilities

- investing

- accumulative insurance

- risk insurance

To choose the best insurance coverage, you need to take these 3 steps

Investment life insurance is the “golden mean” between deposits and mutual funds.

Under life insurance contracts with a period of 5 years or more.

“Unfortunately, there are many examples that can be given between treatments here and there.” But it is the attitude towards the patient that first catches your eye.”

One of the main Russian experts in financial consulting talks about the state of affairs with financial education in Russia.

What career opportunities are there in ?

One of the company's best financial consultants shared his secrets of success.

Outside of work, we may simply not pay attention to our image, to how we are perceived. But in the workplace, your image is a tool, a way of influencing people around you.

Become part of a team of professionals!

The VI All-Russian Savings Week has started

Director of the IT Department at the Yandex Scale conference

Financial advisor Lidiya Lavrova on NTV

Processing and registration of documents, receiving correspondence

Russia, 115114, Moscow, Derbenevskaya embankment, 7, building 22, floor 4, room. 13, room eleven

Payment of insurance premiums by bank card

Full control

Do you want to feel yourself at the forefront of financial markets without leaving your easy chair? You have this opportunity. Turn on your personal Internet account and full speed ahead - the value of personal assets, growth forecast, history of changes in key indicators and the latest statistics. Everything's under control.

Control on the move

Do you want to feel yourself at the forefront of financial markets without leaving your easy chair? You have this opportunity. Turn on your personal Internet account and full speed ahead - the value of personal assets, growth forecast, history of changes in key indicators and the latest statistics. Everything's under control.

Growth straight ahead

Do you want to feel yourself at the forefront of financial markets without leaving your easy chair? You have this opportunity. Turn on your personal Internet account and full speed ahead - the value of personal assets, growth forecast, history of changes in key indicators and the latest statistics. Everything's under control.

Capital preservation

Do you want to feel yourself at the forefront of financial markets without leaving your easy chair? You have this opportunity. Turn on your personal Internet account and full speed ahead - the value of personal assets, growth forecast, history of changes in key indicators and the latest statistics. Everything's under control.

The request has not been created.

Try sending your request again or contact us by phone 8 (495) 981 2 981

The personal account “Renaissance Life” is available around the clock and works every day of the week. This is very convenient, since having access to the network, all insurance contracts, important documents and all the latest information related to the Renaissance Life Personal Account are available at any time, which in turn significantly saves time.

Using the Renaissance Life Personal Account, users have the following opportunities:

- Ability to search for information related to all previously concluded insurance contracts;

- It becomes available to view detailed information about specific risks, amounts, deadlines, etc.;

- View payment status information;

- Find out contact information about the Agent you are interested in;

- Familiarize yourself with the structure of assets under the “Investor” program;

- The ability to view and analyze the dynamics of the return on assets under the “Investor” program for various periods of time.

Professional and prompt consultation provided by online support operators will allow the client to get an answer to any question regarding the insurance service.

Features of your personal account

Thanks to access to Renaissance Life, the client gets the opportunity to:

- Search for information on contracts and their terms.

- Changing data in your personal account.

- Payment of insurance premiums and monitoring of payment status.

- Search for contacts of an insurance agent.

- Request tax deductions.

Thanks to round-the-clock online user support, it is possible to quickly receive answers regarding insurance (CASCO, OSAGO, corn cards, pensions, etc.).

How does the Renaissance Life Personal Account work?

After authorization, the user is immediately taken to a page containing information about insurance contracts. On the left side the client’s name and the menu available to him are displayed. You can always return to the Contract Information tab using the menu on the left side of the page.

If you click on the policy number, the screen will display all the information on the insurance agreement, as well as the possibility of paying premiums.

Clicking through the contract will show:

1. Full information about the selected cost of the insurance policy, its term and insurance risk.

2. Details of your agent and the name of the agency (partner) through which the contract was concluded.

3. Information about the dates of contributions and their status.

4. Payments to the insurance company under the concluded insurance contract.

Tax deduction due to insurance

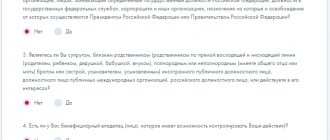

After concluding a long-term contract with an insurance company for five or more years, the client has the right to receive a fixed tax deduction according to the amount of the contribution. Registration of this service is also available in the Renaissance Life Personal Account, which allows you to issue a tax deduction (the service is integrated together with the Nalogiya.ru company).

There are two main ways to submit documents to the Federal Tax Service (tax office) to receive a bonus tax deduction:

- Online, using the taxpayer’s personal account on the official website;

- And also an offline method, carried out through personal contact with tax officials and submission of all necessary documents.

Depending on the chosen method of submitting documents to the tax service, you will be provided with originals of the necessary documents sent to the address of the partner (company), or to your postal address, or scanned copies of documents will be uploaded to your Personal Account in the section “Documents Requested from the Insurance Company” "

After you have indicated in your Personal Account the necessary documents that you need to receive from Renaissance Life Insurance Company, click on the inscription “Proceed to filling out the 3-NDFL declaration”, you will be taken to the official website nalogia.ru and will be automatically registered.

Perhaps, to complete registration on the site, you will need to indicate your email address (for example) and confirm it by clicking on the link in the letter that will be sent to your email. If the email does not arrive for a long time, check your Spam folder.

Follow the instructions and tips from the Nalogia.ru service to obtain the documents required by your tax office.

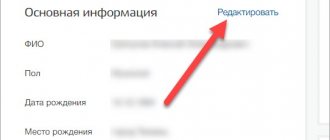

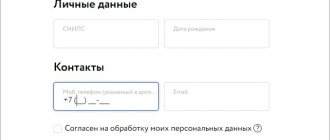

Personal data of the Policyholder

Viewing and changing data is carried out in the “Personal Data” section. To go to the tab, you need to select the corresponding section in the left menu.

In the section you can:

- Find out information about VIP cards and a valid email address.

- Change your existing online email address, phone number and password.

- Edit information on an identity document (passport), addresses, status of a foreign public official and a Russian public official.

The system allows you to view and edit client data. If the information entered during registration has not been updated for more than a year, the user will receive a corresponding notification.

It is not necessary to provide new information: if there are no changes, you should confirm the operation, and in other cases, click “Update” and do everything according to the instructions provided.

To correct, change or update personal data, you must click on the “Change” button next to the item that is subject to editing.

When you click on the above button, special fields will appear in which updated personal data is entered. After completing the entry, the new data must be saved. This is done by clicking on the button of the same name - “Save”.

For example: you need to update your Russian passport data. To do this, click on the “Change” button, the following window opens:

After the passport information has been entered, you must click on the “Save” button.

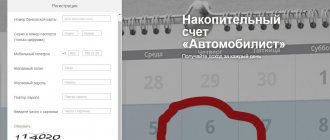

Payment of insurance premiums (premiums)

The insurance contract can be paid in two ways: through the website renlife.com and through the Renaissance Life Personal Account. Payment for insurance through your Personal Account:

Making insurance contributions

Thanks to working with the official website of Renaissance Life, the user can pay their fees independently. It is done like this:

- select the contract number to make a payment;

- in the payment section, click the “pay” button;

- in the window that appears, check the correctness of the data entered and edit it if necessary, click the “confirm” button;

- a window will open with payment of the fee through the bank, in which you also need to check the correctness of the entered data;

- Click the “pay” button.

Attention! The clause with periodic write-off is only available if there is no debt under the contract. If a client has a write-off enabled through mPos, and he wants to pay for insurance through a personal account, he needs to fill out a corresponding application at one of the company’s branches.

form for making an insurance premium.

Registration

By signing an agreement with an insurance company, citizens have the right to a personal Renaissance insurance account. Technically this happens automatically. The contract itself provides for the indication of login and password positions. In fact, the cabinet contains all the information about the policyholder and data useful for the client:

- personal insurance tracking;

- editing information about yourself;

- clarification of everything related to policies, etc.

Registration is carried out by activating the button of the same name. In the window that opens, you need to fill in the fields with your passport data, full name, phone number, email address, password and its confirmation. Then, in a special field, repeat the alphanumeric image and check the box that allows the use of personal data. The account activation code will be sent to your phone. All that remains is to enter the number and code in the appropriate fields and enter your personal account.

Registration in the system

You can register a Renaissance Life personal account only at a branch of this insurance company. To do this, the user needs to do the following:

- Go to the nearest branch of the organization. If you don’t know where to go, you can use the map available on the official website www.renlife.com in the “Contacts” section.

- Ask an employee of the organization to register you in your personal account.

- Fill out the appropriate application.

- Submit your application for review.

The submitted application will be reviewed for some time. After this, the organization’s employees will register a personal user account for you, in which you can log in.

Attention! In the application to create an account, you must indicate your passport information. So, don't forget to take your passport with you.

Varieties

https://www.renins.com/ – at this address on the Internet you can find the official portal of IC renessans. Online access to the site is possible from any communication devices (including push-button phones). In the section on individuals there are categories:

Renlife

lifecabinet is available 24 hours any day and all information about important documents is always at hand for the client:

- everything related to contracts concluded with an insurance company by a citizen;

- detailed information regarding risks, amount, duration;

- payment status;

- structure of assets under the “Investor” program;

- Agent contacts;

- return on assets and its dynamics;

- opportunities to choose a loan on favorable terms.

lifecabinet.renlife.com/user/login – address that allows you to log into your personal account of the life program.

OSAGO and Casco

If difficult situations arise with registering a personal account for Renaissance insurance, you must contact the insurance company branches in St. Petersburg or any other city in the country. This can also be done using telephone hotlines. In addition to concluding contracts, here you can change your name and passwords online, add new drivers, view information about insurance cases of interest (data for the last three years), as well as policies, and book a date for visiting the insurance company office.

The b2b product allows remote users (Volgograd, for example), using the Renaissance insurance personal account, to independently fill out and print auto policies and carry out all operations within their competence.

Renlife ru

Here, 24 hours a day, 7 days a week, you can download important documents and receive information via lk:

- about everything related to the Life client agreement or driver’s insurance;

- details of risks and payment amounts, timing of receipt of funds;

- status of the completed payment;

- structuring of assets under the investment program;

- contacts of your agent;

- level of profitability of acquired assets, dynamics;

- lending options on convenient terms.

In the office, the client can buy a new policy, enter into contracts, change personal data, add a new driver by proxy, view information about insurance cases as an example, and make an appointment at the office.

Login to your personal account

There are several ways to log into your personal Renaissance account.

The email address must be current. When registering, you will receive an activation and login link via email. You can also change the password via email if the client has forgotten it.

By phone number

A request automatically generated by the system will be sent to your mobile number. Login by phone number is carried out using an activation code, which must be entered into the appropriate field in the account.

By passport

When registering to enter your account, you can specify the series of your passport as login and use it in the future.

Via gosuslugi.ru

If you have an account on the gosuslugi.ru portal, you can log into your Renaissance Insurance personal account using your phone number or email address as login and specifying your password.