Login to your personal account Vnesheconombank

For legal entities, Vnesheconombank Leasing provides the opportunity to receive remote banking services through the Internet banking system. To do this, you will need confirmed registration on the site and a personal computer with an Internet connection. The main features of Internet banking include:

- Downloading primary financial statements;

- Receiving information about the due date of the next lease payment and CASCO prolongation;

- Receiving statements of mutual settlements;

- Search for information on penalties.

Login to your personal account is available from the main page of the Vnesheconombank Leasing website https://veb-leasing.ru/. On the central banner, select “Login to your personal account”, on the new page, enter your user login information: email and password, click “Login”.

Housing and communal services personal account

- receive individual information;

- control utility bills;

- upload/download meter readings;

- monitor tariff changes;

- pay bills for gas, water, electricity, telephone, garbage collection, heating, etc.;

- order the services of masters;

- print receipts for payment of bills;

- maintain interactive communication with all participants in the housing and communal services system.

The housing and communal services virtual portal is a utility payment service that allows you to make payments remotely. Here you don’t need to endlessly stand in queues and fill out a lot of receipts, since you can pay for gas, water, electricity, heat and other housing and communal services using templates created in your Personal Account.

Where can I form a funded pension?

Unlike the insurance payment, which is taken into account in pension points (IPK) and only on the personal account of the Pension Fund of the Russian Federation, the funded pension is formed in monetary terms in the account of the insurer, which the citizen has the right to choose himself:

- state (PFR);

- non-state (NPF).

Both state and non-state foundations cannot manage funds. For this purpose, there are management companies (MCs) . The NPF independently, without taking into account the opinions of the insured persons, selects the management company with which it enters into an agreement. The Russian Pension Fund reserves the right for citizens to choose their own management company. It could be:

- GUK (state management company);

- CHUK (private management companies).

Both State Management Companies and private management companies are legal entities that have the appropriate license to manage funds in the financial market. There are many of them, but not all of them can carry out this activity.

According to the legislation of the Russian Federation, an insured person can transfer his savings to the management only of those management companies that are annually selected based on the results of competitions held by the Federal Service for Financial Markets, and with which the Pension Fund of the Russian Federation has concluded a trust management agreement.

VEB RF extended: what is it

VEB or in other words Vnesheconombank of Russia is an investment, completely state-owned bank whose main task is the development of the country’s economy.

In modern Russia, citizens’ pensions are divided into two types:

- The accumulative part is accumulated in the employee’s personal account by depositing funds from the employer.

- Insurance pension – accumulation of points that will be taken into account when receiving a pension.

Previously, absolutely all accounts with savings were formed in the pension fund of the Russian Federation.

Now every worker has the opportunity to transfer his funds to other authorized organizations, such as NPFs; there are 34 such organizations in Russia. Why is this necessary? The fund invests the funded part of the pension so that the funds multiply, otherwise they will burn out due to inflation. Non-state funds distribute funds at their own discretion and can make very profitable deposits, but the state does not control their actions; they are only certified by the Pension Fund.

Vnesheconombank plays the role of a company managing funds for the funded part of citizens' pensions from the state.

The bank's insurer is the Pension Fund of the Russian Federation. To place your savings in a state bank, you must fill out an application, provide a passport and SNILS. Documents are submitted to the pension fund at the place of registration.

The company provides citizens with two packages of services:

- Securities portfolio.

- Expanded portfolio.

A portfolio of government securities was received by citizens who themselves made a choice in favor of a bank manager on a state basis. We wrote a statement and contacted the Pension Fund.

The expanded package is received by all citizens who have not been active in this issue, the default package. Most of the citizens and savings are concentrated here.

Both are under the reliable protection of competent specialists, whose task is to protect savings from inflation.

The difference is that the Government Securities portfolio is safer and more conservative, less risky investments, but the interest may be lower.

Funds are invested in government securities of large companies. Part of the workers' savings is sent to the deposits of reliable banks.

It is worth noting that based on the results of the past two years, VEB RF, as a management company of citizens’ pension savings, managed to increase the amount of savings of citizens with an expanded portfolio by 6.5%, which is higher than the average inflation rate for this period.

While the largest non-state funds were unable to increase funds sufficiently to overcome the level of inflation.

Registration of a personal account Vnesheconombank

Registering a new account in your Vnesheconombank personal account does not take long, and all information for the user is displayed 15-20 minutes after confirming the procedure.

Vnesheconombank personal account registration page

Registration occurs in 5 main steps:

- NPF web uk extended personal account

- Conclude a leasing agreement in the regional division of Vnesheconombank (address of the central office and customer service points https://veb-leasing.ru/contacts/headquarters/);

- When concluding an agreement, indicate the full details of the organization, incl. INN and OGRN (OGRNIP) and email address;

- Submit the completed agreement to the responsible employee of the company. Its verification takes 2 business days. After the specified time has expired, the user can register;

- In the browser line, indicate the address https://cabinet.veb-leasing.ru/register and type the INN and OGRN (OGRNIP) in the special field, click the “Register” button;

- The system will automatically send a letter to the specified email address describing further actions.

Registration is completed. To simplify logging into your Vnesheconombank personal account, when logging in, the user can save the account in the browser settings.

Profitability of VEB pension savings

The return on investment of savings funds is calculated in accordance with Order of the Ministry of Finance of the Russian Federation No. 107n dated August 22, 2005 and is a relative indicator of the growth of funds. There are four profitability indicators:

- year to date;

- for the previous 12 months;

- for the previous 3 years;

- average (for the entire period of validity of the trust management agreement).

Information on the profitability of savings of the state management company is not classified and is publicly available on the official website of Vnesheconombank.

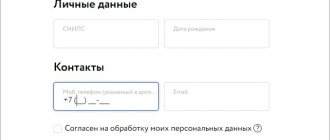

How to place a funded pension in Vnesheconombank?

It is necessary to take into account the fact that the Pension Fund is Vnesheconombank’s insurer. Therefore, the application for the placement of benefits must be submitted accordingly to the last option. To submit, you must go to this branch in person. But this can be done without leaving home (then you will have to “tinker” with the papers so that the notary can sign).

In addition to the application to the Pension Fund, you must provide:

- a document identifying the person (in most cases this is a passport of a citizen of the Russian Federation);

- SNILS.

It is possible to deliver documents by a trusted person (official representative). Then he will need the following:

- passport of this person;

- a power of attorney certifying the right to dispose of the insured persons.

How to calculate the profitability of pension savings?

The funded part of pension funds consists of an employer insurance contribution of 6% (of the deducted 22%) from the payroll.

Elena Smirnova, a pension lawyer, is ready to answer your questions. Thanks to this, those who are given wages “in an envelope” will not receive NP.

It may include:

- Pension Fund - citizen’s personal account: registration and login on the Pension Fund website pfrf.ru

- contributions at your own request, which, if anything happens, are easily transferred to non-state pension funds, management companies (state and commercial). The right to choose remains with the citizen;

- co-financing program (where money is provided by the state). It came into force in 2008, when the government wanted to increase people's voluntary contributions. But at the moment the program has lost its power and is no longer valid.

Vnesheconombank: login to your personal account

Vnesheconombank (State Corporation Bank for Development and Foreign Economic Affairs) is a Russian specialized institute, in the literal sense of the word it is not a bank and does not have a Central Bank license. The activities of the organization are regulated by the law “On the Development Bank”. Vnesheconombank was founded in 1922 under the name “Russian Commercial Bank”.

The main directions of the bank's work are:

- 1. Development Bank - credit and investment support for large government projects created to strengthen economic development in various business areas and eliminate infrastructure restrictions;

- 2. Agent of the Government of the Russian Federation - provides state guarantees, carries out work with external debt;

- 3. Support for the financial system of the Russian Federation - refinances the debt of companies in Russia on the foreign market during a crisis period; provides a special type of lending for banks and companies, a subordinated loan.

Vnesheconombank owns several banks, incl. received by him during the crisis in 2008-2009, the Vnesheconombank group also includes the companies VEB Engineering, VEB Capital, VEB Leasing, VEB Innovations, Russian Direct Investment Fund, etc.

Login to your personal account Vnesheconombank

For legal entities, Vnesheconombank Leasing provides the opportunity to receive remote banking services through the Internet banking system. To do this, you will need confirmed registration on the site and a personal computer with an Internet connection. The main features of Internet banking include:

- Downloading primary financial statements;

- Receiving information about the due date of the next lease payment and CASCO prolongation;

- Receiving statements of mutual settlements;

- Search for information on penalties.

Login to your personal account is available from the main page of the Vnesheconombank Leasing website https://veb-leasing.ru/. On the central banner, select “Login to your personal account”, on the new page, enter your user login information: email and password, click “Login”.

Registration of a personal account Vnesheconombank

Registering a new account in your Vnesheconombank personal account does not take long, and all information for the user is displayed 15-20 minutes after confirming the procedure.

Vnesheconombank personal account registration page

Registration occurs in 5 main steps:

- How to enter the personal account of the PFRF of an individual or legal entity

- Conclude a leasing agreement in the regional division of Vnesheconombank (address of the central office and customer service points https://veb-leasing.ru/contacts/headquarters/);

- When concluding an agreement, indicate the full details of the organization, incl. INN and OGRN (OGRNIP) and email address;

- Submit the completed agreement to the responsible employee of the company. Its verification takes 2 business days. After the specified time has expired, the user can register;

- In the browser line, indicate the address https://cabinet.veb-leasing.ru/register and type the INN and OGRN (OGRNIP) in the special field, click the “Register” button;

- The system will automatically send a letter to the specified email address describing further actions.

Registration is completed. To simplify logging into your Vnesheconombank personal account, when logging in, the user can save the account in the browser settings.

Recovering your Vnesheconombank personal account password

To recover your password, you must click on the “Forgot your password?” button. on the login page. In the new window, enter your email address and select “Recover.” The Vnesheconombank Internet banking system will automatically send a letter describing further steps to recover your password.

Recovering the password from your Vnesheconombank personal account

Download the Vnesheconombank mobile application

An official application for logging into your Vnesheconombank Leasing personal account has not been developed. At the same time, most tablet devices and smartphones support a mobile version of your personal account.

Free hotline number of Vnesheconombank

Vnesheconombank is ready to promptly advise on various issues regarding the organization’s work and resolve emerging customer problems. To get in touch, just call the hotline:

- 8-800-200-42-83 – For calls within Russia;

- +7-495-981-42-83 - Moscow.

It should be noted that calls to the second telephone number are paid in accordance with the tariff plans of the city telecom operator in the region.

If it is not possible to contact the bank yourself, Vnesheconombank offers to fill out a feedback form.

This can be done from any page of the site, the “Send us a message” dialog box will automatically appear on the left side, fill in the required fields with o, click “Submit” and re-confirm the operation.

User support specialists will contact you at the specified contact details as soon as possible.

Source: https://banks-cabinet.ru/vneshekonombank.html

Web uk extended personal account

Hi all. Be careful, there is a wild long post ahead that may bring you money. Read at your own risk: I decided to write it partly for the sake of justice, because I burn with it like a burning fart of equality: First, a little prelude. On September 16, I decided to transfer my pension savings to Sber NPF, which I successfully did by writing an application at the nearest branch. There I received an answer that wait until March 17 and go to your personal account and you will see everything and everything will be chocolate. Having set myself a reminder for March 17, I conveniently forgot about it. In March, when I saw the notification and went into the personal account of the NPF, I was extremely surprised that I was refused to credit funds to the Sberbank NPF. Full of confusion, I dialed the Sber hotline and received an answer that after October I wrote a new application to another NPF. I don’t remember this and I certainly haven’t done this, unless, of course, I have a split personality. Next, I called NPF Soglasie and described the situation.

How to find out the size of your pension and the amount of pension savings

To find out the amount of pension savings, you need to obtain a complete extract from the citizen’s personal account. To do this, in the Personal Account of the Pension Fund of the Russian Federation, in the “Individual Personal Account” section, select the item “Order a certificate (extract) on the status of the ILS.” In the window that opens, click on the “Request” button. The generated document in pdf format can be opened in the “Request history” section.

The document consists of several pages and contains data on length of service, savings and the pension assigned to the citizen. Information about pension savings is presented in section No. 3. An example of such a statement is in the picture below:

How to transfer funds to another portfolio?

If you decide to transfer your funded portion of your pension savings from one VEB.RF portfolio to another, this can be done in two ways. In the first case, you will need to come to the Pension Fund office and personally submit an application for transfer, and in the second, you do not need to go anywhere, everything can be done from home. To do this, you will need to go to your “Personal Account” on “Gosuslugi” or on the Pension Fund website and submit an application online.

In addition to VEB.RF, the Russian Pension Fund has concluded trust agreements with other private management companies. If you wish, you can choose one of the portfolios of such companies. In this case, the Pension Fund will still remain your insurer and will pay you your pension when the time comes.

The situation is different with non-state pension funds. If you transfer your savings to one of the NPFs, the selected fund will become your insurer and will pay your pension.

IMPORTANT

According to the law, savings can be transferred from one fund to another without loss of accumulated funds no more than once every five years. If you apply for a transfer early, you could lose quite a large sum. Thus, VEB.RF clients lost 11.4 billion rubles in 2021 due to early transfer to non-state pension funds. You can find out when the five-year period begins for you on the websites of State Services or the Pension Fund of Russia. For more information on how to transfer funds from one fund to another without loss, read the article.

Cumulative part of pension

Since I am quite young, I do not pay much attention to the topic of pension savings and have not followed the NPF for a long time, but today I decided to clarify the name of my NPF and see its results, however, when I went to the government service website, I was somewhat surprised: I asked the Pension Fund for Information about the status of the individual personal account of the insured person, and in paragraph 3.1. It is indicated that the Insurer with whom the insured person is currently forming pension savings is the Pension Fund of the Russian Federation. The funds are invested in VEB Management Company ADVANCED

Vnesheconombank personal account

We tell you how best to do this. The returns of different investment portfolios tend to vary. This is the only way to change funds without losses if you switch early. The procedure should be as follows:. If you have forgotten your password, enter your email, a control line for changing your password, as well as your registration data, will be sent to it.

Benefits of registration. After checking the information provided, you will have access to discussions and the ability to communicate with colleagues without restrictions. We recommend that you register on the Fincult website. Home Securing the future Pension system. How can I find out where my pension savings are? Was this material useful to you? Your vote has been counted. What information were you missing? I already have an account. Login via. Enter the site.

Remember me. Forgot your password? Login as user:. Password request If you have forgotten your password, enter your email, a control line for changing your password, as well as your registration data, will be sent to it. Send control string. Benefits of registration We recommend that you register on the Fincult website.

Personal account of NPF VTB

Link "Forgot your password?" under the line for the captcha code on the authorization page allows you to recover your password if it becomes inaccessible for some reason. Restoration is carried out via the email associated with the user account.

- Login - SNILS number, 3 digits in the first 3 cells, the remaining 2 digits in the fourth.

- The password is the default passport number (6 digits without series), but can be changed by the user.

- The code from the picture that protects the system from spam.

Does VEB Management Company “Advanced” have an official website and “Personal Account”

VEB Management Company “Advanced” does not have an official website or “Personal Account”. For information about your savings, you must contact the Pension Fund or Gosuslugi. But GUK VEB.RF has an official website, and even two. The first one, where you are now, was created to give people as much knowledge as possible about savings, to talk about important things that will help everyone understand the issues of forming a pension. And the second site is dedicated to the activities of VEB.RF as a state corporation: in addition to the function of a state management company in the field of pension savings, VEB.RF solves many problems for the development of the Russian economy. This general website has a section of the State Administration of the Russian Federation VEB.RF, where reports on income and profitability from the placement of citizens' pension savings are regularly published.

You saw the “Extended” Management Company in VEB’s pension statement – what is it?

Since 2002, citizens of the Russian Federation, in addition to the state (insurance) pension, also have a funded pension. Only the Pension Fund of Russia (PFR) works with the insurance part, and the funded part can be formed either in the Pension Fund or in a non-state pension fund (NPF), if you transfer it there.

Read more about the difference between funds in the article “PFR or NPF: what is the difference, pros and cons.”

If you have not submitted any applications to transfer your savings, you are “silent”. In order for your savings to be preserved and increased, they need to be invested. The Pension Fund of Russia, under a trust management agreement, entrusts this task to the state management company (GMC) VEB.RF.

Read more about VEB.RF in the article “About the state management company VEB.RF.”

For this purpose, VEB.RF has two investment portfolios of funds for future pensioners - an expanded one (it contains funds from the vast majority of clients) and government securities.

Thus, the mark “VEB Management Company “Extended”” in your pension statement indicates that your funds are invested as part of the largest savings portfolio on the market.

BY THE WAY

At the end of 2021, VEB.RF increased the savings of “silent people” by 146.8 billion rubles.

About the state management company Vnesheconombank

The Russian compulsory pension system reform divided the unified pension into insurance and funded. Contributions to the second are voluntary. This money is accumulated in bank accounts and invested by professional market players. For example, State Management Company Vnesheconombank (VEB) - citizens have been placing pension savings in the state management company since 2003.

Options for forming a funded pension

Within 5 years from the start of your working life, you need to decide: to contribute 16% of your income to the insurance portion or 10% to the insurance portion and 6% to the funded portion. In the second case, the citizen chooses a Pension Fund (PFR or non-state).

In 2021, those who started paying to the Pension Fund under compulsory insurance after January 2014 have the right to choose the “Insurance + Savings” option. Regardless of the citizen’s decision, a moratorium on savings contributions has been introduced until 2021: all contributions go to the insurance part. This was done to optimize the pension budget of the Russian Federation. Previously received funds are invested as before.

The pension fund entrusts funds to professional market players - management companies. Management companies invest them, thus increasing savings and forming a future pension. Every year, companies confirm their status by participating in an auction. In 2003 there were 56 of them, in 2021 - 38. Some of them cooperate with the Pension Fund of Russia.

One management company, Vnesheconombank, was appointed by the Government of the Russian Federation . Citizens who have chosen the Pension Fund as their insurer can independently entrust their money to the State Management Company by submitting an application to the local branch of the Fund. VEB also receives funds from “silent people” - those who have not expressed written wishes about their future pension.

About web activities

The state-owned management company Vnesheconombank was created as a special separate division of VEB in 2003. Its activities are regulated by several provisions, in particular:

VEB invests money in low-risk assets, while receiving returns that are comparable to the inflation rate. Thanks to this conservatism, during the crisis of 2014–2015, VEB increased the savings of future retirees by 12.5–15.8%, which exceeded the figures of most other management companies.

GUK VEB is a completely state-owned company. Its directorate and top management are appointed by the Government, and the supervisory board includes the main leaders of the country (ministers, assistants to the President of the Russian Federation).

To place their pension savings in VEB, a citizen writes an application to the local branch of the Pension Fund of the Russian Federation. Its form was approved by Government Decree No. 9P of January 21, 2015. In the text of the document, the submitter indicates which portfolio the GUK should use.

statements on the selection of an investment portfolio.

The following must be attached to the application:

- passport (residence permit);

- SNILS;

- power of attorney for the representative and his identification card, if he is acting on behalf of the insured.

Documents can be submitted:

- in person at the Pension Fund;

- through the MFC - a center employee takes copies of the passport and SNILS, certifies them, sends the documents to the Pension Fund;

- by mail - copies must be notarized.

The application can be submitted online through your Personal Account on the official Internet resource of the Pension Fund of Russia or the State Services portal. To access the services, registration with the “Confirmed” status is required.

An investment portfolio is the total volume of savings and a financial program for their management, directions of investments. GUK offers 2 portfolios for the future pensioner to choose from:

- Basic (GS).

- Extended . This package is installed for “silent people”.

| Base | Advanced |

Investment areas:

| Investment areas:

|

| Has the highest degree of reliability | Has the maximum degree of profitability |

The investment portfolios of the State Management Company are separated from each other and from other assets of the company. For both, accounts have been opened with the Central Bank of the Russian Federation, specially selected banks and depositories. The safety of money is controlled by the Trust Management Committee, which includes representatives of the Government and the Pension Fund.

filling out an application for choosing a Standard (Basic) portfolio.

filling out an application for choosing an Extended Portfolio.

Conclusion of a trust management agreement

By transferring the money of future pensioners to the management company for investment, the Pension Fund of the Russian Federation signs trust management agreements with them. The Fund has 2 agreements with Vnesheconombank:

- About the expanded portfolio No. 22-03G065 dated December 31, 2003.

Source: https://pensiapro24.ru/vyplaty-dlja-naselenija/budushhim-pensioneram/vneshjekonombank-pensionnye-nakoplenija-v-gosudarstvennoj-uk/

What is this

A portfolio is understood as the total volume of pension savings that citizens have entrusted to a management company or non-state pension fund. This is also a financial investment program: areas of investment, measures designed to mitigate possible risks.

GUK Vnesheconombank (Development Bank) offers its clients 2 portfolios to choose from: government securities and extended.

In accordance with the investment declaration of the second, the company invests:

- in Russian securities (federal and regional);

- bonds of Russian business companies;

- securities of foreign financial organizations;

- mortgage-backed bonds;

- accounts and deposits in rubles and currencies (US dollars, euros, British pounds, Japanese yen). Several times a year, the State Management Company holds auctions among financial organizations to place pension savings;

- from 2021, the Development Bank participates in repurchase agreements as a buyer of Russian securities with their subsequent sale.

The maximum profit on the portfolio of VEB Management Company “Extended” comes from federal securities, bonds of Russian companies and interest on deposits and accounts. The smallest ones are shares of international companies and mortgage securities.

For the safety and security of citizens’ savings, each portfolio opens its own deposits and accounts. The money of future pensioners is kept separately from other assets of the Development Bank.

Each investment object is selected by the Trust Management Committee based on the degree of probable risk and return. All transactions and operations are checked by the Internal Control Service for compliance with legal requirements.

According to the investment declaration of “Extended”, the GUK has the right to work with securities that are either backed by a state guarantee or have a high reliability rating (from “A-(RU)”) according to the ACRA agency.

Thus, by investing only in low-risk assets, Vnesheconombank achieves maximum profit while maintaining a high degree of security for the funds of future retirees.

Activities of Vnesheconombank in relation to pension savings

The state management company from 2003 to this day is the Bank for Development and Foreign Economic Affairs - Vnesheconombank . The main task of a state company, like any other management company, is to invest pension savings, which are transferred to it by the Russian Pension Fund.

Despite the fact that Vnesheconombank is a state management company, it cannot guarantee a pension increase. The income of the State Management Company (like any management company) is the result of investing savings, and there can be both profit and loss. In the event of a loss, a citizen will be able to receive only the amount that was contributed by him and his employer.

In accordance with Article 26 of Federal Law No. 111-FZ of July 24, 2002, it is allowed to place funds only in low-risk assets (government securities of the Russian Federation, shares and bonds of Russian issuers, etc.).

The funds of savings are under the management of the State Management Company:

- citizens who consciously entrusted the formation of their pension to the State Administration of Ukraine;

- “silent people” (those who have pension savings, but have never entered into an agreement with anyone).

Vnesheconombank is a 100% state corporation , that is, it does not have membership of a non-profit organization.

Selection of the investment portfolio of a state management company

- government securities of the Russian Federation;

- bonds of Russian issuers;

- bank deposits in rubles and foreign currency;

- mortgage-backed securities;

- bonds of international financial organizations.

On July 18, 2021, Federal Law No. 182-FZ “On Amendments to the Federal Law “On Non-State Pension Funds” and the Federal Law “On Investing Funds to Finance the Funded Part of Labor Pensions in the Russian Federation” came into force. In accordance with it, the State Management Company, whose functions are currently performed by the State Development Corporation "VEB.RF" (VEB.RF), invests citizens' pension savings in two investment portfolios.

Activities of Vnesheconombank

For 16 years now (as of 2021), Vnesheconombank has been fulfilling its obligations as a state company. Its main function is the work of money (investing). The bank receives these funds from the Russian Pension Fund.

Although Vnesheconombank is in “reliable” hands, this still does not guarantee the constant stability of pension increases. After all, the company's constant profit will sooner or later be replaced by a deficit. In this case, the money can be returned, but only if the amount was paid together with your employer.

Profitability of pension savings

The results of investments and audits of the state management company VEB, in accordance with Order of the Ministry of Finance No. 107 of August 22, 2005, are published in the public domain.

The company has shown such profitability over the past years.:

| Period | Profitability, % per annum | Official inflation rate (Central Bank of the Russian Federation), % |

| I quarter 2020 | 1,95 | 0,8 |

| 2017 | 8,59 | 2,5 |

| 2016 | 10,53 | 5,4 |

| 2015 | 13,15 | 12,9 |

| 2014 | 2,68 | 11,4 |

| 2013 | 6,71 | 6,5 |

| 2012 | 9,21 | 6,6 |

| 2011 | 5,47 | 6,1 |

| 2010 | 7,62 | 8,8 |

From the quarterly reports you can find out what percentage of profits were received for the current year, the last 12 and 36 months and for the entire period of validity of the trust management agreement between the Development Bank and the Pension Fund.

Thanks to the conservative investment policy of the State Management Company, the portfolio's return annually exceeds the official inflation rate. The exception was the crisis year of 2014. But even then, Vnesheconombank made a greater profit than other private management companies.

Difference between an extended portfolio and a government securities portfolio

Extended Portfolio

. This portfolio contains funds from the majority of VEB.RF clients. They are invested in Russian government and mortgage-backed securities, as well as corporate bonds and bonds of international organizations, placed in deposits and trust accounts in rubles and foreign currency.

Government securities portfolio

. These funds are invested more conservatively. They are invested only in government securities, bonds of Russian issuers, secured by government guarantees, and are also placed in trust accounts in credit institutions in rubles and foreign currency.

VEB Management extended investment portfolio – the facts speak for themselves

The investment declaration of this portfolio was supplemented with new instruments, in which the State Management Company was able to invest in them from November 2021. The share of these instruments in the portfolio structure has increased since 2021, for example, bonds of Russian issuers amounted to 1.6% (7.79 billion rubles) in 2021 and 31.8% (602.3 billion rubles) in 2021 .

However, it is worth noting that the investment program (investment declaration) declared on VEB’s website itself requires more detailed consideration before choosing this fund as a pension manager.

Web uk official website personal account

This amount includes funds from insurance premiums for funded pensions for the second half of the year and incoming amounts of insured debt; contributions from citizens within the framework of the Co-financing Program for the second half and year and state co-financing funds for the year; maternity capital funds that certificate holders allocated during the year to form their funded pension, as well as investment income from the temporary placement of these pension savings funds by the Pension Fund. Today, the Russian Pension Fund completed the transfer of pension savings to management companies. However, its final size will depend on numerous factors, namely the situation in the state and its budget. The funded part is organized only by professional market participants and is a mandatory part of the citizen’s future pension, if he chooses this option. Composition of Vnesheconombank's investment portfolios for placing funds of future pensioners Expanded investment portfolio: government securities of the Russian Federation; bonds of Russian companies, including those backed by government guarantees; mortgage-backed securities; bonds of international financial organizations; deposits in rubles and foreign currency.

Sources used:

- https://banks-cabinet.ru/vneshekonombank.html

- https://pensiology.ru/ops/budushhim-pensioneram/formirovanie-nakopitelnoj-pensii/doveritelnoe-upravlenie/guk/

- https://pfrf-kabinet.ru/grazhdanam/pensioneram/veb-uk-rashirnnyj.html

- https://pravonazakon.ru/npf-veb-uk-rashirennyj-lichnyj-kabinet.html

- https://veterinar-rso-a.ru/bankovskoe-pravo/veb-uk-lichniy-kabinet.php

- https://pensiya.veb.ru/kak-uvelichit-budushhuju-pensiju/chto-takoe-veb-uk-rashirnnyi/

- https://posobie03.ru/vjeb-uk-rashirnnyj/

Web uk state management company personal account

- bonds of international financial organizations;

- deposits in rubles and foreign currency.

- bonds of Russian companies, including those backed by government guarantees

- government securities of the Russian Federation;

- mortgage-backed securities;

The Russian Pension Fund reserves the right for citizens to choose their own management company. This could be: Both state management companies and private management companies are legal entities that have the appropriate license to manage funds in the financial market.