Profitability and reliability

Based on information obtained from special portals, profitability for 2011 was 6.5% per annum, in 2012 – 7.3%. The overall profitability for 2016-2017 has not been published at this time. As of September 30, 2016, it is known that this figure does not exceed 12.01%.

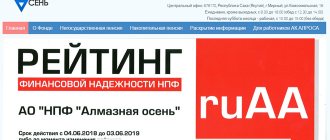

IMPORTANT! Rating agency specialists rated the reliability of NPF Alliance at A++ - the maximum mark.

Personal account of NPF Alliance

At NPF Alliance Rostelecom, your personal account is located on the official website. Once you log in, you can check the status of your personal account, print out a statement for all periods, or consult with a specialist. How to open a personal account in NPF Alliance:

- Registration.

On the website npfalliance.ru you can register and log into your personal account of the Alliance pension fund, find out detailed information about the services provided, get advice, and so on.

- Login to your personal account.

To do this, you need to visit the NPF Alliance Rostelecom official website, create a personal account and log in with your details.

Contact Information

The main office is located at: Moscow, Ozerkovskaya embankment, building 30. Working hours are from 9:00 to 18:00.

Contact phone: 8-800-707-0357

Official website: www.npfallianz.ru

Free help from a Pension Lawyer Legal advice

on deprivation of rights, road accidents, insurance compensation, driving into the oncoming lane, and other automotive issues.

Daily from 9.00 to 21.00

Moscow and Moscow region +7 (499) 653-60-72 ext. 945 St. Petersburg and LO+7 ext. 644 Free call within Russia8-800-511-20-36 —> HomeNPF

"Alliance" is a non-state pension fund of Russia, which is a structural division of the German holding Allianz, founded in 1890. The company offers its clients services for individual compulsory insurance, and also allows you to create an additional pension account by concluding an individual or corporate service agreement.

In Russia, the company began providing services to clients in 2010. In 2021, the main shares of the company were purchased by the telecommunications holding Rostelecom . In 2017, NPF Alliance began issuing pensions to former employees of Rostelecom.

npfalliance.ru - official website of NPF Alliance

Advantages and disadvantages

Private clients can independently determine the time and amount of contributions, use a fixed-term or lifetime pension.

If the contract is terminated early, the money is returned to the owner. The size of pension accruals for corporate clients directly depends on wages. Employees become interested in earning money and effectively performing work tasks. A legal entity can reduce the base income tax rate and pay to the Pension Fund not 30%, but 12%.

Disadvantages include the unstable economic situation. Citizens who have invested money in investments may lose due to a jump in the stock or securities market.

The non-state pension fund "Alliance" offers comprehensive support in the field of pension insurance and payment of benefits to legal entities and individuals. The company's programs and schemes are aimed at providing clients with a decent life in old age.

"Alliance" is a non-state pension fund of Russia, which is a structural division of the German holding Allianz, founded in 1890. The company offers its clients services for individual compulsory insurance, and also allows you to create an additional pension account by concluding an individual or corporate service agreement.

In Russia, the company began providing services to clients in 2010. In 2021, the main shares of the company were purchased by the telecommunications holding Rostelecom

. In 2021, NPF Alliance began issuing pensions to former employees of Rostelecom.

npfalliance.ru - official website of NPF Alliance

Personal account: opportunities and registration

The personal account of the Alliance non-state pension fund allows you to control the status of your pension account directly on the company’s website without leaving your home. The client also gets the opportunity to print statements for the required period and consult with a specialist on issues of interest online.

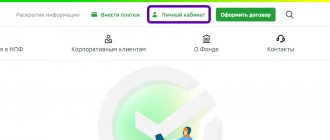

Access to your personal account opens after registration. To start registering, you need to go to the main page of the NPF website at www.npfalliance.ru and click on the “Log in to your personal account” link, which is located in a separate block in the upper right part of the site. Next, next to the inscription “No personal account?” Click on the “Registration” item.

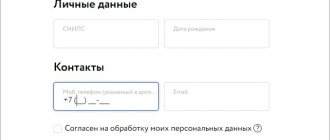

To gain access to your Alliance personal account, you must go through the registration process. The user is required to provide the following information:

- Number of the insurance certificate of compulsory pension insurance;

- Date of Birth;

- Cell phone number;

- Valid email address.

We check that the information entered is correct, check the box next to “I agree to the processing of my personal data,” and then click on the “Register” button.

The system will automatically send an email with further steps to the specified email address.

NPF Alliance Rostelecom: personal account

Personal Area

The personal account becomes available to a private member of the Fund when he completes registration. To register, a client of an organization must go to the portal www.npfalliance.ru and go to the Personal Account tab at the top right and click on the registration button.

You must enter the following data in the form that opens:

- SNILS number;

- birthday;

- phone number;

- electronic mailbox.

Next, you must agree with the processing of personal information and click on the registration button. After this, the user must log into the email account and follow further registration instructions.

The fund’s clients also have access to a mobile application that provides the following features:

- viewing the status of agreements;

- viewing the balance of an individual account;

- contacting support with questions;

- locating the nearest divisions of the organization on the map;

- request information about account balances by email.

Possibilities

In the Personal Account, the client of the organization can receive information about the funded part of his pension. You can also receive a printout for the required period and get advice from an NPF employee directly on the portal.

How to find out your savings?

You can find out your own savings by logging into your Personal Account using the link https://lk.npfalliance.ru/

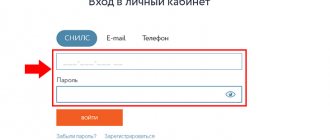

How to log into your personal account

To gain access to the main features of your personal account, you must log in. To do this, go to the main page of NPF “Alliance”, click on the “Login to your personal account” button. On the page that opens, fill in the “SNILS” and password fields, and then click on the “Login” button.

To recover a forgotten password, you need to click on the “Forgot password” link in the authorization block next to the “Login” button. Next, enter the number of the compulsory pension insurance insurance certificate (SNILS) and the mobile number that matches what was specified during registration.

NPF Alliance: login to your personal account

To view information and manage pension accruals, you need to log in to your account.

Open the main page of the non-state pension fund, click the “Login” button, indicate your personal identifiers. Here you will need to enter a password with your SNILS number. After checking the information, the system will provide access to your personal account. If you cannot log in to your Alliance account, check the identifiers. You may have selected the wrong keyboard layout or accidentally switched the character case. You can also click the “Forgot your password” link if authorization attempts are unsuccessful. Indicate SNILS with your mobile phone number. The service will send a confirmation code to your phone.

- NPF Heritage (Norilsk Nickel) - profitability rating and customer reviews

Mobile app

To improve the ease of use of the service and to make the Alliance personal account accessible to a wider audience, the company has released a special mobile application. It allows you to access the main functions of your personal account even when away from your computer.

The mobile application allows:

- View the status of accounts under agreements concluded with the pension fund;

- Ask questions to support staff;

- View information about the location of the nearest branches of the Alliance pension fund on the map;

- Request the generation of reports on the status of the pension account (with subsequent automatic sending by email).

The application is available for download in the official AppStore and GooglePlay stores. The application is distributed free of charge; login is also carried out using your SNILS number and password. If you have not yet registered an account on the site, you can do so directly in the application.

Contact information and support

The main office is located in Moscow at the address: Ozerkovaya embankment, 30. Clients are received on weekdays from 9 am to 6 pm.

The company's support service strongly does not recommend sharing the login and password from the personal account of the non-state pension fund to third parties. If for some reason you cannot access your personal account due to the entered data, immediately contact the company's employees at the toll-free number 8 800 707 0357 or send a letter with a detailed description of the problem to the email address [email protected ]

Official site:

https://npfalliance.ru

Personal Area:

https://lk.npfalliance.ru

Hotline phone number:

8 800 707-0357

You can share or save the article for yourself:3 962

Discussion of the article:

Non-state pension funds are an alternative to the Pension Fund and offer citizens to transfer their savings under more favorable conditions. One of such companies is NPF Alliance, which has been working in this area since 2010.

General information about the fund

JSC NPF Alliance is a company engaged in the storage and payment of pensions to citizens of the Russian Federation. Clients are both legal entities that create savings for their employees, and individuals who decide to transfer their pension capital to a non-state company.

Reliability rating of NPF "Alliance"

Rating agencies gave NPF Alliance an A+ rating. It confirms the high level of reliability of the company. The company took 12th place in the overall rating of non-state pension funds.

Fund returns by year

The company's profitability in the period until 2015 fluctuated between 5-7% per annum. After the purchase of NPF by Rostelecom, the profitability increased sharply, and by the beginning of 2021 it was almost 10%.

Statistics of NPF Alliance

Every year the Foundation's clientele increases by an average of 2,000 people. In 2021, NPF Alliance crossed the bar of 50,000 participants. In the same year, the market value of pension savings deposited in the Fund was estimated at 490,000 rubles.

Alliance Foundation programs

There are different offers for individuals and legal entities.

To sign an agreement with the Fund, legal entities must submit:

- certificate of entry into the Unified State Register of Legal Entities;

- an extract confirming registration with the Federal Tax Service;

- protocol indicating the company's management;

- passport details of the head of the organization and the chief accountant;

- account details;

- information about the person who entered into the transaction on behalf of the company (power of attorney, passport details, position, etc.).

To open a personal account, a citizen must provide:

- SNILS;

- personal account details;

- copy of passport.

For private clients

Ordinary citizens will be able to increase their pension by:

- transfer of the funded part of the pension according to compulsory pension insurance;

- accumulation of an additional part of the pension under NPO.

The first program assumes that:

- income comes from investing funds and depends on the person’s investment portfolio;

- contributions under compulsory pension agreements concluded before the beginning of 2021 can be made by the employer;

- the client can pass on his savings by inheritance.

The second program has the following advantages;

- the client can choose exactly when to deposit funds;

- it is possible to request urgent and unlimited payments;

- the accumulated amount can be transferred to the heirs, assigning each a share;

- You can terminate the agreement with the fund before the pension is assigned.

to corporative clients

Legal entities will be able to take advantage of corporate pension programs, with the help of which they can form pension savings for employees.

To participate in the program, the client must open a joint account (an individual entrepreneur registers a personal account). The contract period ranges from 1 year to 25 years. After retirement, employees can transfer money for life.

You can replenish the savings of each employee from the accrued wages and various remunerations. The idea is that staff will have a stake in the outcome of their work as it directly impacts future pensions.

Stages of inheritance

First of all, you need to approach the notary with a document containing information about the place of last registration of the deceased. The lawyer will issue a list of papers that need to be collected in order to enter into inheritance rights. After that, contact him again.

The procedure for receiving an inheritance includes 3 stages:

- Write an application requesting a certificate.

- Pay the state fee.

- After 6 months, obtain from a notary a ready-made certificate of the right to inheritance according to the law. If it does not contain a complete list of property, you need to draw up an additional act. If the notary refuses to draw up a document, the heir has the right to go to court.

More on the topic Old-age insurance pension, what is it, who receives it, amount in 2021

Official website of NPF "Alliance"

You can open the NPF portal by going to https://npfalliance.ru/.

Personal Area

To authorize the account, the client needs to follow the link https://lk.npfalliance.ru/ and fill out the form by entering the login (SNILS) and password.

Using an account on the website, the client will be able to:

- track the growth of your savings;

- obtain the necessary documents for a certain period;

- request a consultation with a Foundation employee.

Termination of an agreement

The agreement is considered terminated if:

- the fund has fulfilled the obligations assumed in the agreement with the client;

- the citizen died (the company was liquidated), and the heirs received his pension capital;

- the client transferred his savings to another non-state pension fund.

Advantages and disadvantages

To increase the return on savings, the Fund invests available funds in:

- bonds of business companies;

- government securities;

- shares of enterprises and other assets.

It is more profitable for legal entities to cooperate with non-state pension funds, since this allows them to reduce the income tax rate and reduce the amount of payments to the Pension Fund from 30% to 12%.

One of the disadvantages is that the Fund is seriously affected by the general economic situation in the country. Most of the investments go to the purchase of assets owned by the state, which is why profitability directly depends on the stock and securities market.

Registration cost

The legislation of the Russian Federation does not provide for the introduction of an inheritance tax. To enter into inheritance rights, you need to pay for the services of a notary before completing the documentation. The amount differs by region. The size is determined by the notary chamber of the subject.

When preparing documents, heirs must pay a state fee.

The amount depends on the degree of relationship and the health status of the legal successors. If they lived and continue to live in the same living space as the deceased citizen, then there is no need to pay. Minor heirs receive exemption from state duty.

More on the topic Pension Fund of Evpatoria, official website, address and telephone number on the map

For other citizens, the amount is a percentage of the value of the property; the heirs pay:

- Spouses, parents, children, brothers and sisters – 0.3%.

- All other citizens – 0.6%.