The payment of alimony is a mandatory procedure, which is based on the common participation of both parents in caring for the child.

The need to pay benefits is obvious, but how should they be paid? During the course of the article, we will consider all the basic rules, taking into account the many employment options.

And so, before you figure out how to pay, you should decide on the method of agreement. You should know that there are 3 types:

- based on a court decision;

- written contract;

- verbal agreement.

The last type of payment is the most flexible, as it allows you to agree on the method and frequency of payments verbally between parents.

Even if the payment occurs by oral agreement, it is still necessary to form an evidence base. It can be a receipt from terminals (payment), a printout of a bank transfer or a receipt for receipt of funds . This is necessary if you have to prove in court that benefits were paid.

Reference: The basis for the requirement for alimony is the Federal Law “On Enforcement Proceedings” No. 229-FZ of October 2, 2007, Article 102.

The document contains the procedure for payment and regulates the amount of payments, as follows: With an increase in the cost of living, the bailiff changes the amount of accrued alimony, which is collected in cash according to the increase in the minimum income for the corresponding socio-demographic group of the population.

The second key document is the “Family Code of the Russian Federation” dated December 29, 1995 N 223-FZ, Article 113.

Average earnings and its role in this procedure

Any earnings may be subject to alimony, regardless of its level. In general, the average salary in Russia is not taken into account if there is a main, official job.

Step 1. The monthly payment amount is calculated based on the income statement of a particular parent. In general, information about average earnings and state deductions for 2017 is useful with written and oral agreement of both parents.

Average earnings fluctuate greatly depending on the region of residence, so the calculation is based on the statistical average for all regions. Today this amount is 36,200 rubles.

Step 2. Calculation of alimony, which occurs according to the principle:

- for one child is 1/4 of earnings, that is, 9,050 rubles;

- for two children the proportion is 1/3 of the amount, that is, 12,066 rubles;

- for 3 or more children, 1/2 of the average salary is paid, that is, 18,100 rubles

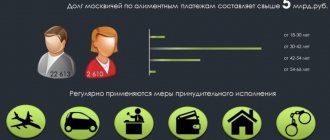

Step 3. The amount of debt is calculated if the parent for some reason did not pay child support (for example, because he was temporarily unemployed). As a standard, the court assigns debt for the previous 3 years from the date of application.

Next, we will consider in detail the payment procedure for minor children in different cases.

We will tell you more about how and on what basis the amount of alimony is determined in a separate article.

Alimony in a fixed amount

Alimony in a fixed amount can be determined both by an agreement on the payment of alimony, and collected by the court in the procedure of claim proceedings. In the latter case, the court will have to provide grounds that do not allow the collection of alimony as a percentage of earnings.

For example, paying parent:

- has irregular, fluctuating earnings and (or) other income;

- earns in foreign currency or receives income in kind;

- has no earnings and (or) other income;

- in other cases, if the collection of alimony in proportion to earnings and (or) other income is impossible, difficult or significantly violates the interests of one of the parties (clause 1 of Article 83 of the RF IC).

A special case is provided for in paragraph 3 of Art. 83 RF IC. If there are children with each of the parents, the amount of alimony in favor of the less wealthy parent is determined not as a share of earnings, but as a fixed sum of money collected monthly.

The amount of a fixed sum of money is determined by the court based on the maximum possible preservation of the child’s previous level of support, taking into account the financial and marital status of the parties and other noteworthy circumstances. The courts take into account the size of the subsistence level in the region, the property status of the family until the parents of the child stop living together or until one of the parents stops paying funds for the maintenance of the child on a voluntary basis (by agreement of the parties) when the parents live separately (Review of judicial practice of the Armed Forces of the Russian Federation dated 13.05 .2015).

In addition, alimony in a fixed amount is also collected in favor of other persons entitled to alimony (Articles 85, 87, Chapter 14.15 of the RF IC).

The advantages of this type of alimony are that in case of a decrease or loss of the debtor’s earnings, the amount of alimony is stable. The downside is that indexation is required, control over the work of the bailiff regarding its implementation and the correctness of calculations (Article 117 of the RF IC).

What happens if you don't pay child support?

If you work unofficially

Due to fewer jobs and higher taxes, employers are increasingly moving into the shadows. Thus, official employment is not always available, which raises the issue of paying money for child care.

There are several legal ways that will help you pay, even while working informally or without working at all.

The basic method is to provide the relevant documents to the court. So, having learned that the parent does not have official employment, the court will review the alimony in such a way that the calculation will take place according to the scheme described above, based on the average salary.

In this case, you need to keep receipts or other documents confirming the payment.

ATTENTION! If you previously had official work or have recently completed your studies, there is an opportunity to join the labor exchange. Then the amount that is paid to the person will be his source of income. Child support is calculated based on this earnings.

If there is such an opportunity, then you can withdraw your earnings in pure form. So, having concluded a civil contract with a person who buys services or goods, for example, making repairs in an apartment, it is actually possible to pay alimony from this amount.

To do this, you should bring documents to the court and they will recalculate the amount of payments , but then you will have to worry about paying taxes.

We remind you that you can get a quick free consultation by phone: +7 just click to call

Ways to reduce the amount of alimony

The amount of monthly payments can be reduced only by applying in court. To successfully consider the case, the plaintiff must provide documentation confirming the basis of the claims.

You can request a reduction in alimony if:

- The child is 16 years old, he works and receives an income that is enough to meet his needs.

- The child owns property that gives him a lot of money.

- A citizen obligated to pay alimony is a disabled person of group 1 or 2.

- The child is in a boarding school and is being supported by the state.

According to Art. 119 of the Family Code, the amount of payments can be reduced by a court decision, subject to a change in the family or financial situation of the payer. There are legal ways to do this.

Low or unverified income

If the payer receives a gray salary, then the salary amount in the 2-NDFL certificate will be indicated lower than it actually is. The court assigns alimony obligations as a share of the official, confirmed income. The recipient of alimony has the right to demand payments in a fixed amount, proving that the payer’s income is greater than indicated in the certificate.

The payer has other children

You can demand a reduction in alimony if a citizen has another family that also needs to be supported. According to the law, alimony obligations cannot infringe on the interests of the payer and his children.

If the alimony pays 25% of earnings for one of his children, and at the same time the children from another marriage are left with an amount less than the established subsistence level, a claim should be filed in court to reduce alimony. The court orders payments in accordance with the evidence provided by the plaintiff.

It is important to know! The court may reduce alimony payments to 0.1 of the minimum subsistence level established in the region or country.

Alimony for children from a second marriage

The new spouse has the right to apply to the court for the assignment of alimony obligations for a common child. If the court obliges a citizen to pay child support for a second child, then part of the funds will remain in the payer’s family.

The court divides the amount of child support proportionally among all children. If for one child 25% of income is charged, then for two – 33%. Consequently, each child accounts for 16%, which saves the family budget.

Exceeding the child's needs

The payer's high income implies large alimony payments. You can pay less child support if you can prove that the amount of payments exceeds the needs of the minor. To do this, the payer needs to collect evidence and apply to the court for a reduction in the amount of alimony.

The child’s mother, in turn, will have to provide documents confirming expenses for the child in order to maintain the amount of payments. As evidence, the court considers receipts and checks for payment of the child’s needs and needs.

How to pay correctly through Sberbank?

Sberbank is a convenient tool for paying benefits; its main advantages are: accessibility, simplicity, absence of taxes and storage of complete information on each payment. This approach is the most convenient, as it has all the necessary functions for correct payment.

There are several ways to quickly pay child support:

- using terminals and ATMs;

- through the bank's website;

- mobile application or the nearest branch.

IMPORTANT! If payment is made through the website, then you must write the purpose of the payment, the name of the recipient and the child. Additionally, you can indicate the date of transfer of funds, this is important if there are delays in the transfer due to the fault of the bank.

It is best to automate the payment and it will be executed monthly on the same day, if there are funds in the account. It is better to print out receipts from time to time. Now that we have figured out how to transfer alimony through Sberbank, it’s time to move on to the next equally important section of our article.

We tell you in a separate article how to write an application at work so that alimony is immediately transferred to a Sberbank card.

How to pay child support voluntarily?

It is rare, but it happens when a parent voluntarily pays alimony without any coercion or pressure from his spouse, the court, or bailiffs. There is no alimony agreement or court decision, and the duty of the father or mother to support their child is fulfilled voluntarily and in good faith.

In this case, the payer himself determines the payment method. In practice, the most common options are:

- cash transfer;

- money transfer by mail (with mandatory notification of delivery);

- money transfer Western Union or other money transfer systems;

- money transfer to a bank account or bank card.

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Those who make voluntary payments should pay attention to the mandatory documentary recording of each cash payment . Some may find this inappropriate or undignified, but in the event of an unexpected trial, evidence of alimony payments (receipts, receipts, checks, account statements) can be very useful.

In the payment order for the transfer of funds or in the receipt for receipt of funds, it is necessary to indicate the intended purpose of the payment - alimony, as well as the payer and recipient of the alimony payment. The absence of documents confirming the voluntary payment of alimony may become a reason for unscrupulous statements and demands on the part of the recipient of funds.

In this regard, we recommend reading our article “How to prove that you paid alimony?”

Procedure for payment to the orphanage

If there are parents, children who are in an orphanage may receive alimony payments. In this case, a trial always takes place and the amount of payment is established.

Payment of benefits for a child living in an orphanage does not differ from a standard transfer, only the money goes to the organization’s account.

They use them according to the following principle: 50% for maintenance, food and care, and the remaining 50% goes to an account opened in the name of the child. Subsequently, interest is charged on them.

To pay such alimony, it is enough to know the payment details, which will be provided by the institution where the child is staying. It is imperative to indicate the purpose of the money.

We talked about whether a parent who has been deprived of parental rights should pay here.

Alimony in kind

This type of alimony is applied on the basis of an agreement on the payment of alimony (Article 104 of the RF IC). The court may order alimony to be paid in this way only if there are grounds under Art. 118 of the RF IC, when a person obligated to pay alimony leaves for permanent residence in a foreign state and has not entered into an agreement on the payment of alimony with family members to whom he is legally obliged to provide maintenance.

The type of property that will be provided as alimony is determined by the parties in the agreement. Alimony in kind may be periodic.

How to increase the amount of child support?

Payment if you move to another job

Article 111 of the RF IC, paragraph 1, indicates the obligation of the former employer to inform the bailiffs within 3 days about the termination of cooperation with the person and indicate his new place of work, if such information is known.

Article 111 of the RF IC, paragraph 2, obliges the payer himself to notify within three days of a change of place of work.

After receiving the notification, the executive service must recalculate child support and notify both parents about it.

The procedure for increasing the amount of alimony payments through the court

If the bailiff or the applicant discovers that the debtor has other sources of income other than wages, or establishes that the payer is deliberately hiding part of the income, the recipient of the alimony must provide all collected evidence to the court along with an application to increase the amount of monthly mandatory payments.

An application can also be filed if a settlement agreement was concluded between the parties, but the claimant does not comply with its terms.

The mother can submit an application to the magistrate at the place of residence of the defendant or at her place of residence if she provides evidence that the minor children live with her.

The application must indicate the following information:

- name and location of the court;

- first name, last name, patronymic of the applicant, place of residence, contact telephone number;

- circumstances of the case: when and in what amount was alimony awarded, how the payer fulfills his financial obligations, why the applicant asks to increase monthly payments;

- norms of legislation referred to by the applicant;

- the petition part indicating the specific amount of increase in alimony or transfer of the debtor to another form of collection;

- date and signature of the claimant;

- an application indicating the evidence provided by the plaintiff.

Read more about increasing the amount of alimony in the article

Your rating of the article

How to pay according to a writ of execution

A writ of execution is a document that contains information about a court decision, in particular regarding the payment of alimony. It must be transferred to the bailiff to monitor the fulfillment of obligations on the part of the other parent and to the defendant’s place of work.

Often, at the place of work, an amount is immediately deducted to pay off the monthly share of the payment , with the consent of the employee or a court order for forced collection.

The document can be obtained immediately after the court decision is made, even if the decision is subsequently appealed.

Find out how alimony is collected under a writ of execution here.

From what earnings is alimony calculated?

The list of income from which alimony can be calculated is established in the legislation of the Russian Federation.

Such income includes:

- official salary (including bonuses, advances and additional payments);

- state provision (pensions, unemployment benefits, scholarships);

- other income (from renting an apartment, from entrepreneurship, from a prisoner, from shares);

- monetary awards (payments for achievements in culture, teaching staff, doctors)

There is also a list of those payments from which it is prohibited to withdraw alimony funds:

- sick leave for a pregnant woman;

- payments for transfer to another place of residence;

- for medical nutrition;

- for worn-out equipment;

- for sanatorium-resort treatment;

- alimony payments provided to the payer himself;

- maternal capital;

- survivor's pension

When calculating alimony funds, the following must be calculated from them:

- state duties and other taxes;

- alimony to another person;

- insurance funds;

- union dues;

- contributions to the pension fund.

The final payment amount depends on the income level of the parent paying child support.

Recently, compensation for the use of personal vehicles for production purposes has been removed from the list of income from which alimony is deducted.

The reason is that the nature of these payments is essentially not income, but only reimbursement of costs associated with using a personal car not for one’s own needs. The Constitutional Court of the Russian Federation came to this conclusion in early February in Resolution No. 7-P. This position is now enshrined in law.

Compensation is established by law. Is it possible to collect alimony?

Situation: An employee of the Arkhangelsk seaport filed a claim against his employer with a request to recover money from him as compensation for moral damage. The reason for this statement was that the employer withheld alimony from the amount of compensation for travel expenses to the vacation spot and back. The petition was granted by the court decision.

The plaintiff believed that these actions violated his rights, since these payments do not fall into the category of those from which alimony can be legally withheld.

The port itself responded with a reverse appeal against the court ruling, but this lawsuit did not change anything. The court justified its decision as follows:

- deduction of alimony from payments that are not subject to collection by law is prohibited (Part 4 of Article 138 of the Labor Code of the Russian Federation);

- the list of income from which alimony for the maintenance of minor children can be collected is established by the Government of the Russian Federation;

- this compensation is not indicated in the general list, but is present in the Law of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas.” Such compensation acts as state support for citizens living in difficult climatic conditions.

Moreover, citizens living and working in the Far North have the right to receive money twice a year for travel and baggage in Russia (Article 325 of the Labor Code of the Russian Federation), as well as annual paid leave.

Withholding alimony from this type of compensation is prohibited by law and violates the rights of a citizen of the Russian Federation.

Payment from salary

To ensure timely payment, a forced system is often used. So, alimony can be transferred to the plaintiff’s account on a monthly basis without human intervention.

Otherwise, you will have to transfer the finances yourself, in a way convenient for both parents.

The amount of wages itself is determined on the basis of a court decision or mutual agreement.

In general, you can choose the payment method yourself, if this is not specified by the court, but the main condition is the availability of complete information about the transfer.

Since all terminals and ATMs issue checks, online banking always provides the opportunity to print receipts and specify the role of the payment in more detail.

You will find more information about who and how to withhold wages in a separate article.

One-time payment of alimony

Like alimony in kind, this type of alimony is possible only on the basis of an agreement (Article 104 of the RF IC, Appeal ruling of the Vologda Regional Court dated May 13, 2015 N 33-2352/2015) or can be determined by the court if there are grounds under Art. 118 RF IC. Alimony can be paid in one lump sum either in cash or in property.

In judicial practice, there are cases of challenging such agreements as imaginary transactions, when they were concluded not for the purpose of paying alimony, but for the purpose of avoiding paying debts. (Appeal ruling of the Perm Regional Court dated November 11, 2015 in case No. 33-12120/2015, Appeal ruling of the Sverdlovsk Regional Court dated September 22, 2015 in case No. 33-13199/2015).

Alimony from an unemployed person - how is it calculated and collected?

Payment by checks

Checks are quite significant evidence of payment of the monthly part for child care and can be used if the court requires evidence of payment of the corresponding amount.

Since from the moment you go to court you can demand payment of alimony from 3 years ago , you must carefully save receipts during this period. It is recommended to copy receipts onto thicker, office paper, which is easy to preserve.

From separate publications by our experts, you can learn about how to send alimony by postal order, where to get it and why you need a certificate of payment of alimony.

The procedure for reducing the amount of alimony

First of all, the payer needs to collect evidence confirming a change in financial or marital status. Then you will need to draw up a statement of claim and pay the state fee.

The amount of state duty is calculated based on the value of the claim and can reach large amounts. The cost of the claim is the amount by which the alimony is reduced. But it is better to first pay a fixed state fee of 300 rubles, and pay an additional fee in accordance with the price of the claim, if the court requires it.

A statement of claim to reduce the amount of payments is submitted to the judicial body that made the court decision on the assignment of obligations. If such an appeal is impossible, the plaintiff has the right to appeal to the court at his place of residence.

A claim that complies with the norms and requirements of the law is accepted and considered by the court. Then the court will make a decision and issue the plaintiff a writ of execution, which is presented to the bailiff service for execution.

The court decision comes into effect from the moment it enters into legal force. If the claim is refused, the payer has the right to appeal the decision by filing an appeal.

Information for individual entrepreneurs

It is somewhat more difficult to calculate alimony for an individual entrepreneur than for an ordinary worker, since not everything he receives is pure profit. Every business involves expenses and costs of various goods or materials to provide services.

Thus, an entrepreneur must pay alimony only from net earnings that he can dispose of. From the entire amount that passed through the hands of the entrepreneur during the month, real income is calculated.

That is, the cost of doing business is taken away and the part that is allocated to pay taxes.

Watch a video on this topic:

We consider the question of whether alimony is subject to income tax here.

How to achieve a reduction in payments?

How to make sure you pay minimum child support. The action plan is as follows:

- It is necessary to collect evidence confirming that changes have occurred in a financial matter or in the family. What was mentioned above.

- Next, you should prepare a claim and pay the state fee. It is calculated based on the annual amount of alimony.

- You need to file a claim.

If the application meets the requirements of procedural legislation, then it will be accepted and considered by the court at the hearing. After which a decision will be made. If it is in favor of the plaintiff, then you will need to obtain a writ of execution and present it to the bailiffs so that they are aware that the amount of alimony has been reduced.

Procedure for changes under a global notarial agreement

The procedure for increasing the amount of alimony depends on in accordance with what document and in what order (voluntary or forced) their payment is made. So, if alimony legal relations are regulated by a settlement notarial agreement, then at any time the parties can sit down at the negotiating table and draw up a new document, which will spell out a different, increased amount of deductions. However, this is only possible if both parties are ready to recalculate – both the mother and the father. If the alimony payer disagrees, it will not be possible to make adjustments to the agreement, so the woman will only have to initiate legal proceedings.

When concluding a new notarial settlement agreement, a mandatory condition will need to be met, namely, to establish the amount of alimony payments that, under similar circumstances, would be assigned by the court. Because This executive document has full legal force; it must be drawn up according to the principles of objectivity and rationality, and, therefore, not infringe on the interests of any of the parties.