The Rosgosstrakh client’s Personal Account provides access to a list of existing MTPL agreements and makes it possible to issue new policies.

Login to your personal account

Rosgosstrakh is one of the leading insurance companies in the country. Now, using its services has become much easier and faster. You can do this even without leaving home.

To do this, you need to spend only 5 minutes registering your personal account. A modern and well-thought-out service allows you to solve a number of different issues, saving your time. A simple and understandable menu will not cause problems in working with the service and will allow you to get quick service when you need it 24 hours a day.

Personal account of Rosgosstrakh Bank for individuals

At Rosgosstrakh Bank, Internet banking for private clients has sufficient functionality to use the bank’s services and products remotely - without visiting the office of a credit institution. This significantly saves customers time and also helps relieve the technical support team. In your personal account you can perform the following operations:

- Processing loans, bank cards, deposits, investment accounts.

- Making payments and paying for services - taxes, housing and communal services, Internet, telephony.

- Transfers between your accounts and cards, as well as sending money to other banks.

- Replenishment of deposits, bank cards, investment accounts, electronic wallets.

- Control and management of bank cards.

At RGS Bank, Internet banking for individuals is available to bank clients. Users who are not clients of the bank can use remote services posted on the official website.

Your options

As soon as you enter your personal account, almost all of the company’s services immediately become available to you:

- you can enter into an agreement for any company services;

- all information about the company’s current offers becomes available;

- enter into a contract;

- get information about what stage your application is at. Has it been considered, etc.;

- notify the company if you have an insured event.

An additional plus is that all this can be done not only through an Internet browser, but also through a mobile application, since it includes all the functionality of the service. In addition, the application has an emergency button. By using it in the event of an accident, you quickly receive all the necessary information about the actions that you need to take in this situation.

Registration

Individuals who are not clients of the bank will not be able to access the bank's online banking. To access you need to have a bank card or open a bank account. There are no other options for individuals.

- On the official website of the bank you need to follow the Internet banking link.

- On the next page, the system offers the client two options: login or registration - you should select the second option.

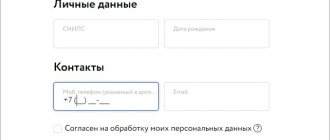

- Next, fill out a form with bank card details and other client registration data.

- You will need to indicate the series and number of your passport, mobile phone, and also come up with a username and password.

After completing these steps, the client can start working in Internet banking. Access to the system is 24/7. This is the advantage of the service: operations can be performed at any convenient time.

How to log into your OSAGO personal account?

There are two ways to enter your MTPL personal account. In the first case, you need to log into your Rosgosstrakh personal account by entering your email address and password. Next, at the bottom of the site, click on the “MTPL” tab.

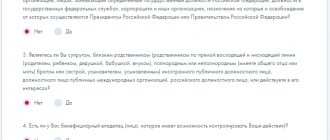

If you have not logged into your personal account, then when you click on the “OSAGO” tab, a window will appear where it will be written “You need to log in.” In this window you select the desired option from the two offered:

- You have a password. Enter your username and password to log into your account.

- You don't have a password. In this case, you need to complete full registration, indicating all the necessary data.

Important! You can enter your Rosgosstrakh personal account in another way. It is suitable for those who have linked their account to an account on the State Services portal. Then you will not need to enter your contact information and password. You just need to click on the “Log in via ESIA (Government Services)” button. After that, you log in to the company’s website, and log in to your MTPL personal account according to the scheme described above.

Internet bank of Rosgosstrakh Bank for legal entities

RGS clients include business representatives of all levels. They, just like private individuals, can use the bank’s services remotely.

To log into Internet banking, you will need to open a link on the bank’s official website, then indicate the client’s category - legal entity. The client receives login data from the bank upon concluding the agreement.

Personal Account "Rosgosstrakh" - Profile, Policies and Documents

“Personal Account” is a multifunctional service. It allows you not only to control already issued policies, but also to buy new insurance, extend the validity period of concluded contracts, and get acquainted with the company’s lucrative offers. The functionality of this system should be considered in more detail.

"Home"

The first tab that opens for the user after registering in the system and each time he logs in. This section presents the company's profitable offers that its customers can take advantage of.

The user has the opportunity to familiarize himself with the products offered, learn more about them, or immediately issue an insurance policy by clicking on the “Buy” link.

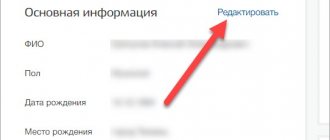

"My profile"

This section is dedicated to the client's personal data. It displays information about the person for whom the account is registered, as well as information used to log in to the system.

It consists of two subsections:

- Policyholder. This subsection displays the personal data of the person acting as the policyholder. In addition to the information entered during registration, the user can also indicate the current city of registration.

- Change password. This part of the resource is used to change the password, mainly after using a temporary access code. To change, you must enter the new value twice.

If the policyholder's passport details or place of residence have changed, it is recommended to make changes as soon as possible.

"My insurance"

Almost the main tab of the service. Policies issued by the company's clients are displayed here. If the user has an insurance contract, its parameters will be shown in the form of a special table consisting of the following columns:

- Product name.

- Duration of insurance.

- Insurance policy parameters.

- Actions available to the user.

Although after issuing an MTPL or CASCO policy, information about it should be entered into the database automatically, in some cases failures are observed. If the insurance contract issued by the user is not displayed in the table, you can add it manually.

To do this you need to do the following:

- Click on the “Add OSAGO”/ “Add CASCO” button (depending on the product purchased).

- Enter your policy and passport details in the fields that open.

- Click on the “Find Policy” button.

If a document is found in the database, it will appear in the table. If other types of policies are not shown to the user, you will have to contact the employees

As the name suggests, this section is dedicated to purchasing an insurance policy. It displays two types of products:

- Policies purchased online.

- Products issued exclusively in offices.

When selecting an insurance product to be purchased online, the user will be redirected to a section of the site that allows them to make a purchase. More details about the insurance registration process can be found below.

"My orders"

The “My Orders” section displays all of the user’s orders. The latter can find out when and for what product the application was submitted, look at its status, and get acquainted with the calculation data. Data is displayed for all orders, including policies that have expired at the time of viewing the information.

"Insurance case"

This section is entirely devoted to problems associated with the occurrence of insured events. With it, the user can do the following:

- Notify company employees about the occurrence of an insured event.

- Check the status of the payment case.

- Check exactly what documents need to be submitted to receive monetary compensation.

- Familiarize yourself with the correct procedure in the event of an insured event.

In addition, the user is provided with toll-free telephone numbers, using which one can obtain comprehensive information on all issues related to insurance claims.

Mobile app

You can download official mobile applications using the following links: https://apps.apple.com/ru/app/rosgosstrakh - for iPhones and https://play.google.com/store/apps/details/ru.rgs - for Androids.

Attention: at the moment the application on iPhones is temporarily suspended. Technical support specialists are making efforts to restore stable operation.

Recovering your personal account password

Restoring access to your personal section is carried out entirely in electronic format. To do this, you need to go to the authorization page my.rgs.ru and enter your email address. Next, click the “Recover Password” button, and a secret code will be sent to the specified e-mail, through which you can enter your Rosgosstrakh personal account. Then, on his account, the user will be able to change the password to a more convenient one.

How to recover your password if you forgot it

If the user is unable to log in to his Personal Account, he must first check the correctness of the login and password entered in the form. If this does not help in the process, then Rosgosstrakh has provided an option to restore details.

The client needs to meet several conditions before starting the procedure:

- You need to remember the data entered during registration.

- Details of contracts and agreements, if they have been drawn up, may be useful.

If all the conditions are met, then you need to open the login page to your Personal Account and click on the “Forgot your login or password” button. It is located under the details entry form. The access recovery page will open. There you need to provide the same information as during registration. Additionally, the system may request some data. Next, the user must click on “Continue”.

An SMS with a confirmation code will be sent to your phone, which you will have to enter into a special window in the system. At this stage, the procedure is almost complete. The user must call the service center using one of the hotlines and provide the operator with the recovery data.

Related article: Features of accident insurance at Rosgosstrakh

Information may be required:

- policy number (if available);

- FULL NAME;

- a codeword.

After interacting with the operator, access to your Personal Account can be restored again. After this, the client is able to log into the system using the new data.

Download the Rosgosstrakh Bank mobile application

For those clients who are constantly busy, but at the same time actively use all the banking services of this financial institution, a special mobile application has been developed that makes it possible to carry out banking transactions anywhere and at any time of the day using their mobile phone.

The mobile application has all the same functions as a personal account on the website of a financial institution. It is available for customers with Android or iOS devices. Moreover, you can download and install it on your mobile application completely free of charge. To enter the application, the client must enter his username and password.

When you launch it for the first time, it is recommended to create a short password for easier use of the application. However, if the device supports login using a fingerprint, it can also be used.

To install a mobile application, you need to go to the application store and type “Rosgosstrakh” in the search. After this, you need to select the first application returned by the search and click on the button to install it. After this process is completed, a new icon will appear on the phone.

The application of this financial institution can also be downloaded from the following links: