Supplement to military pension for children

According to paragraphs. “b” of part one of Art. 17 of this Law, to the long-service pension, including the one calculated in the minimum amount, non-working pensioners are accrued a supplement if they have three or more disabled “dependents” (in your case, minor children) in the amount of 100 percent of the calculated pension amount specified in part one Article 46 of the said Law.

According to Part 1 of Art. 46 of the Law, this estimated pension amount is established in the amount of the social pension provided for in subparagraph 1 of paragraph 1 of Article 18 of the Federal Law “On State Pension Provision in the Russian Federation”, and is revised simultaneously with the change (indexation) of the amount of the specified social pension.

Allowance for minor children for military pensioners 2021

In total, according to Article 12 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ (came into force on January 1, 2015), a total of no more than 6 years of periods of child care lasting 1.5 years can be taken into account in the length of service, so points are not for more than four children in the amount established by part 12 of article 15 of the same law.

We recommend reading: Sample donation agreement for a share to a minor

In 2021, the pensioner is entitled to an increase for both dependents. The amount of the bonus is 64% of the conditional indicator. It is equal to the size of old-age social benefits. From April 2021 – RUB 5,034.25 .

Additional payment to pensioners for minor children

not allowed. his This is an inheritance. Inheritance is not any part of income. You would not be entitled to part of the inheritance even if you were still married. Your husband's property is not also an element from which.

Yes, in full Hold. the amount of alimony is made: -with all types taking into account pensions, monthly increases, allowances, raises, etc.

to additional payments established for certain categories

of pensioners

. Your wife has the right to file a claim for alimony collection on the basis of Article 81 of the RF IC for one

child

, 25% of or other income earned.

Alimony is only not pensions; it is withheld for the loss of a breadwinner. in Ukraine, yes, 25% per child for

sure.

This video is unavailable

In 2021, leaders revised the reforms for additional payments to pensions for children for non-working pensioners. Each point has its own clarifications. Financial assistance is paid only until the child reaches the age of majority or for the period of his education, but until he reaches 23 years of age.

As a rule, pension fund employees are responsible for calculating all payments. The first, main group of payments includes: - for an insurance pension; - to receive social benefits; - for retirees from military units and those involved in professional sports. Additional payments to pensions for children born in the USSR in 2021: system based on the number of children

Supplement to Military Pension for Minor Children in 2021

Allowances for combat veterans UBD are a support measure provided for citizens with a special status. Privileges become available to those who have received a veteran's certificate and have ceased their activities. However, there are nuances associated with the peculiarities of providing funds in individual constituent entities of the Russian Federation.

Those pensioners who receive a monthly disability benefit, or live in the Far North of the KS and equivalent areas of the PKS and who are supporting minors, are entitled to an addition to the pension for children in the amount of: Number of dependent persons Amount of additional support for a pensioner Amount of additional collateral Amount of additional collateral. Supplements for disability pensions are calculated in similar amounts and in the same manner; increases are calculated only for long-service pensions for the corresponding categories of pensioners on the basis of Art.

Supplements for minor children for recipients of insurance pensions depend on the amount of the fixed payment (FP). Its size is reviewed annually on February 1 and is established by decree of the Government of the Russian Federation. From April 1, additional indexation may be carried out taking into account the growth in income of the Pension Fund (PFR). In recent years, due to the budget deficit of the Pension Fund of Russia, this practice has been absent.

For residents who are over 80 years old, there is a different payment table. It is also divided into 3 intervals. One ward - 5970 rubles, two - 6832 rubles, three - 7680 rubles. The amount can vary from 6 to 20 thousand rubles. Additional payments to pensions for children born in the USSR in 2021: a special category

The amount of the pension is determined based on the social minimum, which in 2021 is more than 5 thousand rubles. In the case where these are regions equivalent to it, the service life should be 20 years or more. Length of service gives citizens the right to purchase an increase.

What additional payment for children is due for a military pensioner?

All of the above documents must be provided every year. Moreover, they must be dated at least a month earlier than the moment the application was submitted. Copies of certificates do not have to be certified by a notary - this can also be done in the military unit in which the serviceman served.

We recommend reading: Penalties and fines for posting budget 2021

Along with active military personnel, they have the right to receive medical care free of charge in military hospitals and clinics (this only applies to family members of retired officers); once a year they are entitled to a free voucher or a voucher to a boarding house at a discount. It can be given to a sanatorium or children's camp. A military pensioner has the right to an annual compensation of 300 rubles for each child under the age of 18, and free travel to and from the vacation destination.

What benefits and allowances are available to military pensioners: review

According to Article 45 of Federal Law No. 4468-I, combat veterans are provided with a pension supplement of 32% of the calculated pension amount. The amount of this pension supplement increases simultaneously with the indexation of social benefits, that is, on April 1.

In the case of moving to an area with normal climatic conditions, the regional coefficient is applied only if there is sufficient northern experience, that is, 15 years of service in the Far North or 20 years in an equivalent area.

We recommend reading: Free consultation with a notary on inheritance

Additional payment to pensions for military pensioners for minor children in 2021

In this article we will tell you how the military pension is calculated and accrued. Registration and determination of the size of a military pension occurs according to a special algorithm and differs from the calculation of an insurance or social pension. There are three categories of pensions for military personnel or their families:. As the name implies, payments are assigned as a result of certain conditions.

According to the law, pensioners who have minor citizens as dependents are awarded an increase according to the following scheme: Pension increases differ between groups of pensioners. However, many older people do not know what they can qualify for. Therefore, the main goal of the article is to simply and concisely talk about bonuses in the new and outgoing years. Due to the fact that the profession of a police officer is associated with danger and risk to life, representatives of this category of the population have the right to count on a decent pension.

Additional payments to military pensioners for minor children in 2021

For residents who are over 80 years old, there is a different payment table. It is also divided into 3 intervals. One ward - 5970 rubles, two - 6832 rubles, three - 7680 rubles. The amount can vary from 6 to 20 thousand rubles. Additional payments to pensions for children born in the USSR in 2021: a special category

A one-time compensation social payment to orphans and children left without parental care, persons from among orphans and children left without parental care, at the end of their stay in government organizations of the city of Moscow for orphans and children left without parental care, and non-governmental organizations for orphans and children left behind

Persons who have reached retirement age are entitled to a supplement to the insurance part of pension benefits if they have dependents. Elderly Russians receive an increase for the following categories of minor or incapacitated daughters, sons, brothers, sisters, grandchildren;

In parallel with the application, all necessary supporting documents are prepared, the review period of which is no more than 10 working days. In other words, submit on Friday the 10th, it is more reasonable to expect a response no earlier than Monday the 27th. Those who submitted documents 3 days later, on Monday 13th, may also come with you.

Citizens who are disabled people of group I and persons who have reached the age of 80 are entitled to receive a supplement to their long-service pension in the amount of 100% of the calculated pension amount. At the same time, non-working pensioners who have dependents in their care who do not receive social and insurance pensions are given a premium of 32% for one disabled relative, 64% for two, 100% for three or more.

Depending on the disability group, the amount of payment changes. For example, if disability increases due to a general illness, work injury, or occupational disease, the payment will be recalculated in accordance with the new disability group and the previous cause will remain the same. The status of the recipient also matters.

In the absence of a disability group, WWII participants receive an additional 32% of such pension, and upon reaching the 80-year mark - 64% of the calculated amount of payments. If the benefit has already been assigned using an increase, then this additional payment will not be established.

- pension provision;

- tax benefits;

- provision of medical care;

- obtaining and maintaining housing;

- discount on payment of part of utilities;

- preferential supply of medicines and medical products;

- prosthetic and orthopedic services;

- funeral services.

The main issues and procedure for calculating cash benefits for old age are enshrined in Federal Law No. 309. It also states that the indexation coefficient, which as of 2021 is 72.23%, has a great influence on the size of a military pension.

Even working pensioners are entitled to raises. It is important that the citizen has accumulated work experience in one of the departments that are eligible for preferential conditions. The presence of wages and other sources of income is not an obstacle to the calculation of benefits. If a serviceman has experience in the civilian sphere, he may also qualify for a regular labor pension.

The amount of payment for dependents is determined as a third of the amount of the fixed payment to the insurance pension (that is, its basic part). This norm is enshrined in law in Part 3 of Art. 17 of Law No. 400-FZ of December 28, 2013. Let us recall that from January 1, 2019, the cost of the PV was indexed by 7.05%, so its size was 5334.20 rubles.

There are a number of professions that allow you to retire much earlier: based on length of service. These include employees of the Ministry of Internal Affairs, teachers, medical workers, citizens working in hazardous facilities and a number of other professions listed in the pension legislation of the Russian Federation.

For example, the minimum and maximum monthly allowance for child care up to one and a half years has increased. Both unemployed parents and those with little work experience can receive it. The amount of the benefit depends on several factors. These are the minimum wage, the income limit for calculating insurance premiums and the average daily earnings. If a parent does not work, then he receives a minimum amount.

- The pensioner officially went to work or became an entrepreneur;

- The dependent was expelled from the university and went to military service;

- The dependent went to study at a military university;

- The dependent was assigned a pension (social, disability, etc.);

- The dependent has married;

- The dependent lost the opportunity to study full-time and switched to correspondence;

- If a dependent began to care for a pensioner over 80 years of age or a disabled person of group 1;

- The dependent has died.

Every year, the amount of additional payment for minor children, students and other dependents increases from February 1. This is due to the indexation of the fixed payment amount in accordance with the price growth index. But starting from 2021, this increase procedure has been changed - now the payment amount is indexed from January 1 , and the indexation coefficient is set above the inflation rate. For example, in 2021, indexation was carried out at 7.05%, although according to Rosstat, inflation in 2021 was 4.3%. As a result, the value of the FI became equal to 5334.19 rubles, and for each dependent they began to pay an additional 1778.06 rubles. (i.e. 117 rubles more than in 2018).

Supplement to pension for minor children in 2021

- availability of documentary evidence of family ties;

- confirmation that the minor is a dependent;

- the child is not paid insurance or social security;

- parents are recipients of pensions regardless of whether they are employed or not.

Please note that the above categories of applicants have the right to claim monthly increases not only for their own children, but also for other minor citizens in their care:

Supplement to pension for minor children in 2021

- availability of documentary evidence of family ties;

- confirmation that the minor is a dependent;

- the child is not paid insurance or social security;

- parents are recipients of pensions regardless of whether they are employed or not.

- Citizens who have reached retirement age and receive insurance coverage for old age or disability. Both pensioner parents can apply for the supplement for each dependent.

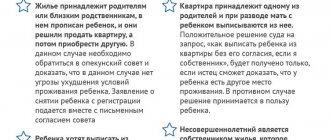

- Persons from among former military personnel receiving a pension for long service or disability. If there are several non-working pensioners in a family who are dependent on the same child, the bonus is accrued to only one parent.

Additional payment to a military personnel pension for a minor child

“On pension provision for persons who served in military service in internal affairs bodies, the State Fire Service, agencies for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families”

It is known that there are circumstances in connection with which a pensioner receives an increased pension. At the same time, pensioners receiving such increases must remember that as soon as the conditions in connection with which these increases are made change, the Pension Fund authorities must be informed about this. For example, a recipient of an old-age insurance pension whose dependent child is a full-time student has the right to receive an increased amount of a fixed payment (about 1.5 thousand rubles)

Features of additional payments to pensions for children

Such pensioners also have the right to receive a pension supplement, provided that they themselves do not work anywhere, and their wards have either not reached the age of majority or are studying at universities that are not related to the Ministry of Internal Affairs.

Which categories of the population can receive such a bonus and how to get it is a question that interests a large number of people. Let us immediately note that today the pension supplement is calculated and paid automatically. The payments themselves are made in accordance with submitted applications, and not everyone’s pension increases.

Additional payment to a military personnel pension for a minor child

On a general basis. Details are in the social security office at your place of residence. To

long

pension assigned to dismissed military personnel, a supplement is accrued to non-working pensioners who are dependent on disabled members.

He will be the breadwinner - alive, healthy... What a pension

?

This pension

is paid

to minors

who have lost their parents.

If a minor

gets married, such

a pension

is still paid until he reaches 18 years of age. unless...

We recommend reading: Low-income family 2021 average per capita family income

Supplement to pension for dependents in 2020

A cash increase can be received for each disabled family member , but no more than three. Both pensioners have the right to such additional payments; dependent family members (children, grandchildren, brothers or sisters) belonging to the following categories (clause 3 of Article 17 of Law No. 400-FZ of December 28, 2013):

Confirmation of the fact that a minor is a dependent can even occur as a result of interviewing witnesses (relatives, neighbors, etc.). As a last resort, it is possible to confirm this fact in court.

Supplement to pension for dependents

To assign an increase to the pension for a dependent who has reached 18 years of age and who is undergoing full-time training in an educational organization of any organizational and legal form (except for institutions of further education), the following documents must be sent to the Pension Fund of the Russian Federation:

The additional payment is assigned from the 1st day of the month following the month of filing the application with the Pension Fund. Therefore, in order to start receiving an increased pension from September 1, you will need to submit documents in August.

Supplement to pension for minor children and dependents in 2021

In order to receive an increased pension, you must contact the Pension Fund with an application for recalculation. If a positive decision is made, the pension will be increased from the 1st of the next month . If the increase is refused, a written notification will be received from the Pension Fund (we remind you that not all pensioners are entitled to such an increase).

The cost of a fixed payment increases annually, therefore the amount of additional payment for disabled family members will increase every year. During the discussion of pension reform in 2021, a law was adopted that fixed the size of the pension fund for subsequent years. Therefore, it is already known how much the additional payment for dependents will be from 2020 to 2024.

Additional payment to the pension for a minor child for a working pensioner

- conditions presented by regional programs of a specific constituent entity of the Russian Federation;

- when taking into account pension coefficients;

- according to the amount of funds received by the pensioner, defined as his income.

- cannot be less than the current living wage in Russia;

- is subject to annual indexation, after which its size will be increased;

- subject to regulation by legislative acts in force in the required area in the territory of a specific region of the country;

- is calculated according to the specific category to which the pensioners applying for payment belong.

Payments to pensioners of the Ministry of Internal Affairs for minor children in 2021

Important! Additional payments to pensioners of the Ministry of Internal Affairs for minor children are paid throughout the year (or as long as there is a basis for payment), after which it must be re-registered. To extend payments, you need to have a certificate of the status of your personal account from the UPFR, a certificate of family composition and a work record book.

Experts from the Pension Services Department of the Central Federal District of the Ministry of Internal Affairs of the Russian Federation provide the following list of reasons for stopping the accrual of bonuses to pensioners of the Ministry of Internal Affairs to their pensions for the maintenance of children under 18 years of age:

Payments to pensioners of the Ministry of Internal Affairs for minor children in 2021

- an application from the mother or father of the child (second parent) indicating the fact that the minor is a dependent of a former employee of the Ministry of Internal Affairs (issued in cases where the pensioner and the child live separately);

- court decision/decree on the maintenance obligation of a pensioner of the Ministry of Internal Affairs (if the child and the pensioner live separately).

- a former employee of the Ministry of Internal Affairs decided to find a job after leaving the Ministry of Internal Affairs or become an entrepreneur;

- the child entered into an official marriage;

- the child began to receive his own social pension;

- parents allowed the child to care for a person over 80 years old or a disabled person of group 1;

- the child died.

Additional payment to military pensioners for children

- free medical care in military hospitals;

- free trip (once a year) to a children's camp;

- free travel to the holiday destination with an accompanying person;

- 50% payment once a year if the child is sent to a boarding house or sanatorium;

- in some regions, such children are provided with preferential (free) travel on municipal transport.

In 2021, some changes were adopted not only to the Federal Law of December 3, 2021 N 319-FZ “On Amendments to the Law of the Russian Federation “On Pensions for Persons Who Served in Military Service, Service in Internal Affairs Bodies, the State Fire Service, authorities for control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families" on pensions for the military, employees of the Ministry of Internal Affairs, the Ministry of Emergency Situations and other law enforcement agencies, but also in regional laws. Based on them, the procedure for calculating pensions for people from among the former military who were urgently called up for service, employees of law enforcement agencies and equivalent departments has changed.

New benefits for teachers, pensioners, and military personnel in a review of legal news for June 2021

Review of bills affecting the rights and obligations of citizens.

Legal news for June 2021

You can watch analysis of individual news on YouTube, YandexZen.

Consumer rights

List of unacceptable conditions in contracts with consumers – Draft Law No. 1184356-7 ( more details )

The State Duma of the Russian Federation is considering a bill that approves a list of unacceptable contract terms that infringe on consumer rights. Such conditions include, in particular: the seller’s right to unilateral refusal, limitation of the seller’s liability, limit the method of payment, and the establishment of a mandatory pre-trial procedure for resolving disputes. The Explanatory Note states that the adoption, publication and wide dissemination of information about unfair contractual terms will not only help prevent one of the most widespread offenses, but will also significantly reduce the level of abuse of rights by an economically strong subject of consumer legal relations.

Prohibition on the collection of personal data of consumers – Bill No. 1184356-7, 1184517-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which the seller (performer, owner of the aggregator) does not have the right to refuse to conclude, perform, change or terminate a contract due to the consumer’s refusal to provide his personal data, except in cases where the obligation to provide such data is provided for by the legislation of the Russian Federation. Federation or is directly related to the execution of the contract with the consumer. Violation of this prohibition will entail administrative liability and 200 thousand rubles.

Tax news review for June 2021

Rights of pensioners

Guarantees of the rights of pensioners in the event of bankruptcy of a pension fund - Bill No. 1185065-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which, in case of revocation of a license from a non-state pension fund or its bankruptcy, compensation for losses to NPF participants who have not been assigned a pension is provided in the amount of up to 1,400,000 rubles. Participants who are paid a pension are guaranteed their payment in the amount paid on the date of the guarantee event (bankruptcy, revocation of a license), but not more than two sizes of the old-age social pension. The Explanatory Note states that as of April 1, 2021, 6.2 million citizens entrusted NPFs with the formation of their pension savings under NGO programs; the total volume of pension reserves as of this date amounted to 1.5 trillion rubles. Payments of non-state pensions for 2021 amounted to 74 billion rubles, and the number of recipients of such pensions reaches 1.6 million citizens. In this regard, the activities of NPFs on non-state pension funds (taking into account its goals, functions and scale) are of particular social significance and require ensuring a high level of protection of the rights of citizens-clients of the NPF and their pension savings.

Changing the procedure for compensating travel expenses for pensioners in the Far North - Bill No. 1185101-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which pensioners in the Far North should receive compensation for travel expenses by any type of transport (with the exception of taxis), including personal ones, to their vacation spot and back. The Explanatory Note states that the current rules for compensation of travel expenses for pensioners do not imply that pensioners will receive the specified compensation if they travel to a vacation spot on the territory of the Russian Federation by personal transport.

It is proposed to expand pension guarantees for parents with many children - Bill No. 1190292-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which it is proposed to exclude from the Federal Law “On Insurance Pensions” the limitation of the total insurance period associated with the period of child care to six years, and also to establish an individual pension coefficient of 5.4 for the fifth and subsequent children. The Explanatory Note states that if the bill is adopted, a parent caring for five children could receive an increase in pension in the amount of 3,203 rubles in 2021, and a parent caring for six children could receive 4,003 rubles, etc.

Additional pension for miners and other coal industry workers - Bill No. 1193473-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which additional pension benefits are provided for former employees of liquidated coal industry organizations who have worked for at least ten years in coal (oil shale) mining (processing) organizations, but have reached retirement age after their dismissal from these organizations. provision (non-state pensions). The Explanatory Note states that at the moment the right to an additional pension does not apply to those coal industry workers who have worked for at least 10 years in coal industry organizations, but retired after the liquidation of the enterprise.

Early retirement of representatives of the peoples of the North - Bill No. 1195263-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which the right to early retirement is given to citizens from among the indigenous peoples of the North who have reached the age of 55 and 50 years (men and women, respectively), permanently residing in areas inhabited by indigenous peoples of the North, as well as in places of traditional residence and traditional economic activities of indigenous peoples of the Russian Federation, on the day of pension. The Explanatory Note states that the condition for assigning a social pension to disabled citizens from among the indigenous peoples of the North is permanent residence in the areas inhabited by the indigenous peoples of the North on the day the pension is assigned, which is, in fact, unfair in relation to representatives of the indigenous peoples of the North living in neighboring municipal areas, places of traditional residence and traditional economic activity of indigenous peoples of the Russian Federation.

Increasing pensions in the Far North - Bill No. 1195367-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at applying, when increasing the fixed payment to the insurance pension, a general (total) coefficient for the entire period of residence of persons who have worked, respectively, for at least 15 and 20 calendar years in the regions of the Far North and equivalent areas with unfavorable natural conditions. climatic living conditions. The Explanatory Note states that the purpose of the developed draft law is to preserve the residence of people who have retired.

Changing the procedure for calculating social supplements to pensions - Bill No. 1195404-7 ( more details )

The State Duma of the Russian Federation is considering a bill that proposes, when calculating the total amount of material support for a non-working pensioner, taken into account when establishing a social supplement to his pension up to the subsistence level of a pensioner in a constituent entity of the Russian Federation, to exclude from the specified total amount the cash equivalents of social support measures provided in accordance with with the legislation of the Russian Federation and the legislation of the constituent entities of the Russian Federation, for payment for telephone use, for payment for residential premises and utilities, for payment for travel on all types of passenger transport (urban, suburban and intercity), as well as monetary compensation for the costs of paying for these services. The Explanatory Note states that the mechanism established by the current version of the law for calculating the total amount of material support for a pensioner for assigning a social supplement to a pension so far takes into account a number of insignificant cash payments for preferential categories of citizens. As a result, material support for the most urgently needing groups of citizens in certain regions becomes lower than that for the average pensioner.

Commentary on tax disputes for May 2021

Prohibitions for foreigners

Sanctions for foreign citizens violating the rights of Russians – Bill No. 1185348-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which the following sanctions will be applied to foreign citizens and stateless persons involved in violating the rights of Russian citizens:

• ban on entry into the Russian Federation;

• seizure of financial and other assets, as well as a ban on any transactions with property and investments;

• suspension of activities on the territory of the Russian Federation of legal entities under their control.

Previously, such measures could only apply to US citizens.

Prohibition of providing surrogacy services to foreigners – Bill No. 1191971-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at establishing a ban for foreign citizens and stateless persons to use the institution of surrogacy on the territory of the Russian Federation. The Explanatory Note states that during the period of restrictions on movement between states related to the COVID-19 pandemic, investigative authorities again received a number of reports of infants born by surrogate mothers being on the territory of the Russian Federation without parents and without proper supervision and care, including including their deaths, and signs of human trafficking in relation to these children.

Tax news digest for June 2021

Rights and responsibilities of gun owners

Cancellation of experience for owning small cars - Bill No. 1195415-7 ( more details )

The State Duma of the Russian Federation is considering a bill that will allow hunters who have been issued hunting tickets or hunting membership cards to purchase long-barreled hunting firearms with a rifled barrel with a muzzle energy of no more than 150 J and a caliber up to 5.6 mm inclusive (“small ones”), without a five-year experience in owning smooth-bore long-barreled firearms. The Explanatory Note states that the adoption of the amendments will make the Federal Law “On Weapons” more logical and meet the modern needs of society in hunting, and will also reduce the number of unnecessary weapons “in the hands” of citizens.

Raising the gun ownership age - Bill No. 1196104-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which the right to purchase civilian firearms of limited destruction, gas weapons, smooth-bore long-barreled self-defense weapons, sports weapons, hunting weapons, signal weapons, bladed weapons intended for wearing with the national costumes of the peoples of the Russian Federation or Cossack uniform is available to citizens of the Russian Federation who have reached the age of 21. The Explanatory Note states that the tragic events that occurred on May 11, 2021 in the city of Kazan, and earlier in 2021 in the city of Kerch, showed what a public danger smooth-bore long-barreled weapons can pose. In both cases, both shooters were under 21 years of age. In addition to the very fact of committing a crime, these acts have acquired a high public resonance and replicate patterns of aggressive behavior in society, primarily among teenagers.

Blocking on social media networks of information on the manufacture of explosives – Bill No. 1195680-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at extrajudicial blocking of Internet sites that restrict information on methods and methods of homemade explosives, explosive devices, and firearms on social networks. It is also proposed to block comments that justify illegal actions directed against the life, health, and freedom of citizens. The Explanatory Note states that the distribution of such material on the Internet has a detrimental effect on the psyche and moral and ethical views of unformed individuals and, above all, minors.

Tax disputes for 2020

Car owners' rights

Garage associations – Bill No. 1192708-7 ( more details )

The State Duma of the Russian Federation proposes to adopt a Law on Garage Associations. The law will regulate relations arising in connection with the activities of garage owners' associations and garage cooperatives, and parking space owner's associations. It determines the goals, the procedure for the formation and use of their property, the basis of management, and also determines the features of the exercise of ownership of places intended for storing vehicles. The bill establishes provisions on the share of each owner of a garage or parking space in the right of ownership of common property, determines the list of common property of garage owners and the basis for its use. The Explanatory Note states that the adoption of this bill will have a positive impact on the development of civil turnover in general and will serve as an incentive for the development of garage construction.

Cancellation of mandatory inspection – Bill No. 1193342-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which mandatory technical inspection does not apply to personal vehicles owned by individuals and used by them exclusively for personal purposes. The Explanatory Note states that according to the Scientific Center for Road Safety of the Ministry of Internal Affairs of the Russian Federation, in the first nine months of 2021, among road accidents, the share of accidents due to technical malfunctions of vehicles was only 7.1%. At the same time, violation of traffic rules by drivers is 88.7%, and the unsatisfactory condition of streets and roads is 35.5%. In addition, the indicated 7.1% also includes accidents involving all vehicles used for commercial, personal and other purposes. Thus, the share of road accidents due to technical malfunctions of vehicles is insignificant.

Fine for exceeding the speed limit by 10 km/h – Bill No. 1195490-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which exceeding the established speed of a vehicle in populated areas in which the requirements of the Road Traffic Rules of the Russian Federation are in force, establishing the procedure for traffic in populated areas, by an amount of more than 10, but not more than 20 kilometers per hour - entails imposition of an administrative fine in the amount of five hundred rubles. The Explanatory Note states that the lack of liability for violation of the speed limit by up to 20 km/h allows vehicle drivers to violate the Rules and drive vehicles in populated areas at a speed of up to 80 km/h, with a limit of 60 km/h, and in residential areas and courtyards at a speed of up to 40 km/h, with a limit of 20 km/h.

TOP 10 Tax disputes for 2020

Military law

Prisoners of concentration camps will receive benefits for veterans of the Great Patriotic War - Bill No. 1195145-7 ( more details )

The State Duma of the Russian Federation is considering a bill that provides for the classification of former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War as veterans of the Great Patriotic War. The Explanatory Note states that the proposed changes are consistent with the concept of Russian legislation, which recognizes as veterans of the Great Patriotic War those disabled from childhood due to injury, concussion or injury associated with combat operations during the Great Patriotic War of 1941 - 1945; persons awarded the badges “Resident of besieged Leningrad” and “Resident of besieged Sevastopol”.

Social support for UBD – Bill No. 1192860-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at improving the implementation of measures of social support for combat veterans. Thus, it is proposed to provide children of veterans with priority places in preschool educational organizations. It is also proposed to exempt veterans from transport tax. The Explanatory Note states that the adoption of the federal law will provide combat veterans with a decent life and once again confirm their services to the Fatherland.

Military innovative technopolis “Era” – Bill No. 1202726-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at regulating relations arising during the functioning of the Military Innovation Technopolis “Era” of the Ministry of Defense of the Russian Federation. The bill was developed in order to provide participants in the Military Innovation Technopolis “Era” of the Ministry of Defense of the Russian Federation (hereinafter referred to as Technopolis) with measures of state support and defines the goals, objectives and main areas of activity of Technopolis. The Explanatory Note states that the difference between Technopolis and innovative scientific and technological centers (hereinafter referred to as INTC) and innovation centers lies in the purposes of creation. Thus, the purpose of creating INTC and Skolkovo is to commercialize the results of research and development, and Technopolis is intended to create and improve weapons, military and special equipment.

Practice of the Constitutional Court on taxes for 2020

Rights of children and parents

Maintaining pension supplements for working disabled children – Bill No. 1184271-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which disabled children and minor citizens, during their temporary employment in their free time from school, in the direction of the state employment service, will receive a social supplement to their survivor's pension. The Explanatory Note states that the adoption of the bill will contribute to the integration of these categories of minors into work, including vocational guidance, the development of work skills in adolescents, and the prevention of neglect and delinquency.

Legal status of large families – Bill No. 1194379-7 ( more details )

The State Duma of the Russian Federation is considering a bill on the legal status of large families. In particular, it provides for monthly payments for each child in the amount of the subsistence minimum, an annual compensation for the purchase of clothing in the amount of 20% of the average salary, and a monthly monetary compensation for housing and utilities. The Explanatory Note states that a large family is not just a unit of society, but a support for the state in its further development. At the same time, a large family is extremely vulnerable. The adversities and sorrows that happen in the life of every person can quickly turn into a disaster for a large family.

They propose to provide land for free twice - Bill No. 1195270-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which minors who have become participants in the family's common shared (joint) ownership of a land plot upon free provision, as well as those who have acquired rights to a share of such a land plot by way of succession, retain the right to a one-time free provision of land plots located in state or municipal property after they reach the age of majority. The Explanatory Note states that minor citizens, children who are members of both large and young families, having reached adulthood, by law cannot exercise their right to receive a land plot free of charge due to the fact that they have already received a share of such a plot earlier, as members of a large or young family, or by inheritance.

Commentary on the practice of the Supreme Court of the Russian Federation for 2020

Animal rights

Mandatory registration of animals – Bill No. 1196076-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at establishing mandatory registration of animals. Also, in order to ensure the safety of the population, the bill proposes to prevent dogs from being without a muzzle and a leash outside the places permitted by the decision of the local government for walking animals.

Ban on keeping animals – Bill No. 1195130-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which, for committing a crime, the court may impose a ban on keeping any animal or an animal belonging to a certain type of animal for a period of up to five years. The Explanatory Note states that the legislation of some states, along with punishment by the court for the person who committed cruelty to animals, decides to impose a ban on keeping an animal.

Labor rights

Minimum wages for teachers – Bill No. 1183927-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which the base salary (basic official salary) of teaching staff of state and municipal educational organizations implementing general education programs is set at no lower than 4 times the minimum wage. At the same time, the minimum wage of teaching staff of state and municipal educational organizations implementing general education programs cannot be lower than the level corresponding to the average wage in the corresponding constituent entity of the Russian Federation. The Explanatory Note states that the results of various monitoring, research and surveys show that the level of remuneration of many school teachers actually does not reach the regional average and differs significantly depending on the subject of the Russian Federation.

Increasing payment during downtime - Bill No. 1195240-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which downtime for reasons beyond the control of the employer and employee is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to downtime, but not lower than the minimum amount established by federal law wages. In the Explanatory Note, the proposed innovation, which increases the amount of payments during the period of forced downtime for reasons beyond the control of the employee and the employer, should become a new incentive measure to support the coronavirus pandemic and prevent a decline in the standard of living of the population.

Monthly financial support for coaches – Bill No. 1189332-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which the coaches of the champions of the Olympic and Paralympic Games are invited to provide additional monthly financial support. The Explanatory Note states that it is the coach who plays an important role in the preparation of a high-class athlete, the so-called sports elite. The champion's success is largely due to the intellectual development and training strategy proposed by the coach.

Other

Repatriation of compatriots to Russia – Bill No. 1191989-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which a foreign citizen or stateless person recognized as a compatriot, who speaks Russian and freely uses it in the family, everyday and cultural spheres has the right to apply for repatriation to the Russian Federation. The Explanatory Note states that the bill fills the lack of a repatriation component as a key gap in the State program to assist the voluntary resettlement of compatriots living abroad to the Russian Federation.

Insurance of accounts and deposits of lawyers, notaries and other persons – Bill No. 1192126-7 ( more details )

The State Duma of the Russian Federation is considering a bill aimed at extending the deposit insurance system to medium-sized enterprises, socially oriented NPOs, educational and medical organizations, lawyers, and notaries.

Replacement of monetary compensation with social services – Bill No. 1193483-7 ( more details )

The State Duma of the Russian Federation is considering a bill that establishes the possibility of filing an application for the resumption of the provision of social services provided both before and after October 1, in the event that these persons develop diseases that require the provision of necessary prescription drugs in accordance with the standards of medical care. The Explanatory Note states that numerous requests are received from citizens who previously exercised the right to refuse to receive social services in exchange for a monthly cash payment, and at the moment, due to force majeure circumstances related to their life and health, are in dire need of provision necessary medications as part of a set of social services, but cannot exercise their right to renew these services, since force majeure circumstances for these individuals occurred after October 1, that is, after the deadline for submitting the relevant application. Thus, these persons, finding themselves in a critical situation related to their life and health, are deprived of the physical opportunity to renew their right to the provision of necessary medications for the next year.

Officials will be required to declare jewelry - Bill No. 1196129-7 ( more details )

The State Duma of the Russian Federation is considering a bill according to which it is proposed to include in the anti-corruption legislation of the Russian Federation the obligation to provide information on each transaction for the acquisition of a luxury item, including those made using precious metals and (or) precious stones, works of art, antiques, if the total amount such transactions exceed the declared income.

Other

How is the military pension supplement calculated?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

Disabled people of the first and third groups, as well as those who received injuries during the work process that led to them receiving a disabled group, can qualify for an increase in pension by 300% of the original amount of pension payments.

We recommend reading: How to reflect the withholding of vacation pay upon dismissal in 6NDFL

Allowance for minor children for military pensioners 2021

- Visit the territorial office of the Pension Fund.

- Compile and submit the appropriate application (you can view and download it here: [ Sample application for additional payment for a dependent ]), attaching supporting documentation to it.

- If the application is approved, payments in an increased amount will begin next month. In case of refusal, an official notification will be received within 10 days.

If there are disabled children in a family dependent on able-bodied parents, in addition to additional payments to pensions, adding non-insurance periods of activity to the insurance period and increasing the number of individual industrial complexes, the right to early registration of pension payments .

Supplement to pension for minor children

An increased fixed payment is due to citizens who receive an insurance (labor) pension for old age or disability and have disabled family members (children, grandchildren, brothers, sisters) in their care. At the same time, a pensioner can receive an additional payment to the pension for brothers, sisters or grandchildren only if they do not have able-bodied parents .

It is quite common for pensioners to have disabled dependents in their care. For such cases, the legislation provides for additional payments to the insurance pension , which are carried out by increasing the fixed payment included in it by one third for each dependent (but not more than three in total).

How to apply for a pension supplement for pensioners for children in 2021

- region of residence of the citizen (regional surcharges are regulated by local legislation);

- seniority;

- number of dependents under guardianship;

- presence or absence of disability;

- age of the pensioner;

- capacity of a person.

With constant changes in legislation, pensioners often cannot understand what certain payments are. Funds transferred for children born before 1990 are sent along with the rest of the pension. At the same time, the procedure for calculating the basic benefit changes. This occurs due to the fact that experience is replaced by additional points.

We recommend reading: About job quotas

Additional payment to a military personnel pension for a minor child

b) father, mother and spouse, if they have reached the age of: men - 60 years, women - 55 years, or are disabled; c) a spouse or one of the parents or a grandfather, grandmother, brother or sister, regardless of age and ability to work, if he (she) is engaged in caring for children, brothers, sisters or grandchildren of the deceased breadwinner who have not reached the age of 14, and does not work; d) grandfather and grandmother - in the absence of persons who are legally obliged to support them.

if there is one such family member - in the amount of 32 percent of the calculated pension amount specified in part one of Article 46 of this Law; if there are two such family members - in the amount of 64 percent of the calculated pension amount specified in part one of Article 46 of this Law; if there are three or more such family members - in the amount of 100 percent of the calculated pension amount specified in part one of Article 46 of this Law. The specified supplement is accrued only to those family members who do not receive an insurance or social pension; c) pensioners - participants of the Great Patriotic War from among the persons specified in subparagraphs “a” - “g” and “i” of subparagraph 1 of paragraph 1 of Article 2 of the Federal Law “On Non-Disabled Veterans” - in the amount of 32 percent, and persons from among them who have reached the age of 80 - in the amount of 64 percent of the calculated pension amount specified in part one of Article 46 of this Law. The bonus provided for in paragraph “c” of part one of this article is not accrued to the pension calculated with the increase provided for in Article 16 of this Law.

Amount of additional payment to military pensioners for minor children in 2021

b) father, mother and spouse, if they have reached the age of: men - 60 years, women - 55 years, or are disabled; c) a spouse or one of the parents or a grandfather, grandmother, brother or sister, regardless of age and ability to work, if he (she) is engaged in caring for children, brothers, sisters or grandchildren of the deceased breadwinner who have not reached the age of 14, and does not work; d) grandfather and grandmother - in the absence of persons who are legally obliged to support them.

if there is one such family member - in the amount of 32 percent of the calculated pension amount specified in part one of Article 46 of this Law; if there are two such family members - in the amount of 64 percent of the calculated pension amount specified in part one of Article 46 of this Law; if there are three or more such family members - in the amount of 100 percent of the calculated pension amount specified in part one of Article 46 of this Law. The specified supplement is accrued only to those family members who do not receive an insurance or social pension; c) pensioners - participants of the Great Patriotic War from among the persons specified in subparagraphs “a” - “g” and “i” of subparagraph 1 of paragraph 1 of Article 2 of the Federal Law “On Non-Disabled Veterans” - in the amount of 32 percent, and persons from among them who have reached the age of 80 - in the amount of 64 percent of the calculated pension amount specified in part one of Article 46 of this Law. The bonus provided for in paragraph “c” of part one of this article is not accrued to the pension calculated with the increase provided for in Article 16 of this Law.