How are payments calculated?

The pension for citizens of the Russian Federation born before 1967 is composed of a guaranteed fixed rate, as well as an insurance part. In addition, the calculation procedure and the number of payments vary depending on the fulfillment of certain conditions.

In the case where citizens were born after the above-mentioned date of the year, the benefit is made up of two components: a funded share and an insurance share. The estimated amounts are much higher; the length of service, the level of the citizen’s official salary and the availability of additional benefits are also taken into account.

How to calculate your pension in 2021

The amount of payment calculated using formulas may be lower than the pensioner’s subsistence level (PLS) in the region of his residence. Then he will be assigned a social supplement in such an amount that the pension provision together with this supplement will amount to the amount of PMP.

How to calculate your pension

All of the above allowances are added to the pension amount calculated using the formula. That is, in fact, the formula will look like this: SP = SPK × IPC + FV + D , where D are various additional payments.

The state regularly improves the pension system. Now the year of birth is one of the key factors according to which old-age cash benefits will be paid: those born before 1967 receive a pension in three components, and after this year - in two.

Until 2021, pension provision for working citizens and members of their families was regulated by Federal Law dated December 17, 2021 N 173-FZ. The old-age labor pension (this is the most common type of pension) consisted of two parts - funded and insurance.

How is pension calculated for persons born before 1966?

- Must be 55 or 60 years old (for women and men, respectively). Until this age, only early pensions can be granted - preferential service on the hot grid, medical, teaching workers, the Federal Penitentiary Service, parents of disabled children, persons who worked in the north, etc. The list is very large and to find out whether you have such experience, you need to consult your local Pension Fund office.

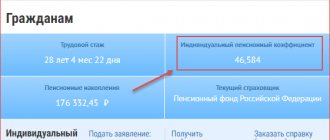

- A certain size of the individual coefficient. It denotes the ratio of a person’s entire pension capital (earnings + insurance contributions + periods of activity) to the current value of the point in the country. The value of the IPC for 2021 is 11.4, and for each subsequent year it increases by 2.4, and so on until its value reaches the maximum possible - 30. Further increase is not provided for by law. The value of the pension point is determined at the beginning of each year by the Government of the Russian Federation. This year it is 78.28 kopecks.

- Work experience. From 2021, the length of service required for calculating a pension increases by 1 year, starting from a value of 5 in 2021. In 2021, 6 years were already required, and so on in ascending order until 2024. Then this figure will reach 15 years, and further growth is not yet envisaged.

It is worth noting that a man retires 2 years later than the established period, so he is entitled to bonus coefficients for a fixed payment and for an insurance pension - 1.19 and 1.24, respectively.

Now you need to find out how many pension points a woman will receive for 2021: (0.22 (22% - the rate of insurance contribution when calculating an insurance pension) × 4 (the serial number of the month of retirement in 2021) × 25000/212360 (the maximum possible annual contribution in 2021))x10=1.04 points.

Calculating your pension using the pension fund calculator

- The results of pension calculations are purely conditional and are intended only to familiarize yourself with the amount of your future pension. For a more accurate calculation, we recommend contacting the pension fund.

- All calculation data: coefficients, point value, fixed payment amount, which are used in the calculator, are given as of January 1, 2021 . This means that for the entire period of work experience that you indicate in the calculations, the values of the coefficients, fixed payments, your salary, etc. will apply. taking into account 2021 indexation.

- The calculator will be more useful to those users who are just starting their work experience.

- When calculating, it is conditionally assumed that in 2021 you have the right to receive a pension with the data you entered.

- If you need to pre-calculate the GIPC, you can do so on this page.

The legislative framework

The concepts of the process and all regulatory frameworks are given in Federal Law No. 400, which contains the concept of the insurance share of pension payments, the procedure for their calculation and its types.

According to this bill, in order to receive benefits in old age, you must meet the following criteria:

- Age category: men - from sixty years old, women - from fifty-five. Early retirement is permitted only in situations specified in current legislation;

- At the time of registration of payments, the period of payment of insurance fees to the Pension Fund of the Russian Federation must be no less than fifteen years;

- The total number of pension points accrued for a citizen’s work experience must be at least thirty at the time of retirement.

It is important to understand that recent changes in legislation applied to pension benefits have affected both the procedure for their calculation and payment.

The official work experience, calculated before the first of January two thousand and two, can be approved by conclusions from the place of employment, recording in the work book, conclusions on the payment of taxation for those engaged in entrepreneurial activities, etc.

However, already in the period after the above-mentioned date, the length of service is recorded only if payments were made to the Pension Fund of the Russian Federation from each employee’s salary.

Accordingly, the more payments were made, the larger the pension the citizen is entitled to.

In addition, the length of service includes periods of time when work was not carried out in full or not at all:

- Duration of illegal detention;

- The period of full-time study in educational institutions;

- Period of service in the RF Armed Forces;

- Leave due to child care (but not more than six years in total), for citizens over eighty years of age, disabled people of the first group, or children with disabilities;

- The period of residence of the wife in a military garrison, during the period of the husband’s service, if it is not possible to get a job;

- The period of time during which unemployment benefits were paid.

All of the above periods of time, for official registration in the length of service, will require appropriate documents confirming their validity.

Formula for determining the insurance part

Taking into account the above criteria and relying on the provisions of Law No. 400-FZ (December 28, 2013), the insurance pension formula for women born in 1964 can be expressed as follows:

RSP = FV + SPB × KPIK, where:

- RSP – amount of insurance pension;

- FV is a fixed (basic) component, the size of which for 2019 is set at 4,982.90 rubles;

- SPB - the cost of a pension point (in 2021 - 81.49 rubles)

Please note that in addition to the insurance pension, women born in 1964 can also receive a funded pension, but only if it is formed. The size of the payment depends on several factors:

- the amount of contributions to be deducted;

- the number of years during which contributions were made;

- in which fund the savings were placed (each company has its own interest rates).

- VTB Pension Fund - how to transfer savings and their profitability, conditions of participation and description of programs

- How to quit smoking on your own at home

- 3 signs to recognize a psychopath

What factors influence the value of the IPC?

During their working career, women receive a salary, based on the amount of which the employer pays insurance contributions to the Pension Fund. Subsequently, they are converted into pension points, the number of which directly affects the size of the pension payment. For different periods of employment, the IPC is determined taking into account a number of features:

| Calculation time periods | Criteria taken into account when calculating | Peculiarities |

| Until 2002 |

| Due to the fact that the Pension Fund does not have enough information about the length of service and accruals made, the IPC may be reflected erroneously in each individual case. To avoid this, it is recommended to provide all possible evidence of employment at this time and confirm the amount of salary received. |

| 2002–2014 | Funds accumulated in accounts are converted into IPC using a special formula | You can calculate the number of IPCs yourself by using the calculator on the Pension Fund website |

| Since 2015 | Determined by the amount of insurance premiums | Calculation is carried out for each year worked |

| Other periods | The IPC is stipulated by law depending on the reason for lack of employment | The periods during which the woman did not work are taken into account. This includes:

|

The number of pension points can be calculated on the Pension Fund website, using a special calculator, or using the following formula:

IPC = Amount of insurance contributions of a citizen for a specific year / Standard amount of contributions for an insurance pension × 10

Rules for making payments

Federal benefits expected for citizens born before nineteen sixty-seven consist of three components:

- Fixed rate;

- Insurance share;

- Accumulation part.

A fixed rate is material benefits paid to each person who has reached the age of a pensioner, regardless of work experience. The number of payments is primarily influenced by the age category of people of retirement age.

The state has established a minimum fixed rate for the current year of 4,805 rubles.

However, it may vary depending on the territorial location, type of professional activity, assigned disability group and availability of employees.

The insurance share is made up of material contributions made by the employer to the Pension Fund every month.

Accordingly, the higher the official salary (official), the larger the pension. In addition, the federal authorities make an annual recalculation of the payment with its increase, depending on the growth in the cost of goods and progressing inflation.

The funded part is a material share for those who were born before 01/01/1967. According to the legislation that was in force until two thousand and five, all employers undertake to transfer to the Pension Fund six percent of the official salary each month.

It was from these funds that this part of the pension was calculated.

It depends on the size of the citizen’s profit from two thousand two to two thousand four.

How to receive lump sum payments

The accumulated funds can be received one-time or no more than once every 5 years. Payments are available subject to the following conditions:

- The insured person born in 1967 and later did not refuse the opportunity to form a funded pension, and the employer made contributions.

- The pensioner continued to independently pay insurance premiums for the funded portion of his income.

Conditions of receipt

Based on Art. 4 of Law No. 360-FZ, the following insured persons can apply for security:

- receiving pensions for old age (age, including those assigned early), disability, and loss of a breadwinner;

- those receiving a social pension provided due to insufficient insurance coverage or pension points;

- who have accumulated contributions of 5 percent or less of the amount of the old-age insurance pension component.

- How to make a call forward on a megaphone

- 6 secrets to a long life from the oldest people on the planet

- Regions of Russia in which there are many vacancies for people with disabilities

How is it processed and who pays?

To receive payments, you will need to contact the Pension Fund thirty days before the age specified in the legislation.

You can apply for a benefit only by providing a certain package of documentation:

- Passport or residence permit;

- SNILS;

- Documents confirming official work experience (including in the USSR);

- Conclusions that confirm the inclusion of work experience for periods of no contributions to the Pension Fund.

An employee of the Pension Fund will check the correctness of the completed application and accompanying documentation, and also make photocopies of them, returning the originals. If the submission rules meet all the required standards, the application is considered within ten days.

After this, a notification comes from the Pension Fund of the Russian Federation, which states that pension payments have been assigned or denied.

Calculation of pensions for those born before 1966

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

Experience under List 1 for men and women

Various types of pension calculators are very common on the Internet, which is explained by the increased interest of citizens in the issues of calculating pensions. However, it should be remembered that there is no calculator that could even approximately reliably calculate the size of your future pension payments. This is due to many reasons, the main one of which is the extreme opacity of the system for calculating pension savings practiced by the Pension Fund.

the maximum contribution base of the amount of insurance contributions to the pension) consisted of + 2,308.27 rubles for the same period black salary. And for retirement. If 202100 rub. / / (16% ×having the required work experience it will be necessary to receive a 20 thousand pension without withdrawing from a funded pension or Example

Calculation of accrual for a pensioner - formulas

To preliminary calculate the expected pension payment for an individual citizen, it can be calculated using a certain formula approved at the federal level.

The complete manual consists of three components and can be represented by the following formula:

PP = FS + SD + LF

Where:

- PP – pension benefit in full;

- FS – fixed rate;

- SD – insurance share;

- LF – accumulative part.

FS are a fundamental part of the payment, which is provided at the state level.

NP is the individual savings of citizens.

For the calculation, you only need to determine the SD, which can be found using the following formula:

Where:

- SD – insurance share;

- PC – pension capital;

- T – time of deductions, calculated in months.

To carry out calculations using the above formula, you will need to determine the size of the PC, which is calculated by the following equation:

PC = UPC + RP

Where:

- UPC – conditional pension capital;

- RP – estimated pension.

To calculate the RP the following will be used:

Where:

- RP – estimated pension;

- SC – coefficient accrued for length of service. For men with twenty-five years of work experience and women with twenty years of work experience, the coefficient is 0.55. After this, for all years worked beyond this number, it increases by 0.01, but cannot exceed the figure of 0.75;

- ZR/ZP – the ratio of the candidate’s salary to the average salary in the state. The limit value can be no more than two;

- SWP is the size of the average salary in the country for the year two thousand and one, which was 1,671 rubles.

In order to determine the size of the insurance share, you will need to find out how much money has accumulated from contributions in the period after two thousand and two. You can find out this figure by contacting your local FIU.

After calculating all the components, you can get the expected amount of pension payments.

Calculation of pensions for those born before 1967 - example

Let's consider a practical example of calculating benefits for Artemov A.A., born in 1958, who wants to end his official work experience with retirement in 2021.

To obtain a pension, Artemov A.A. came to the local Pension Fund with a completed application and a package of documentation a month before retirement.

The benefit amount is determined using the following formula:

- The documents provided confirm the work experience of Artemov A.A. at 30 years old. For men, the coefficient for twenty-five years of experience is 0.55, since a citizen’s work experience exceeds this figure by five years, another 0.05 points are added. The final calculation gives a figure of 0.60 points;

Artemov did not provide a certificate of income. Also, Pension Fund employees took into account average earnings. The average citizen's salary was 1,530 rubles. Divide by the average salary for 2002: 1530/1671 = 0.92;- The figure is substituted into the formula to determine PC: 0.92 x 1671 x 0.60 – 450 (fixed rate for 2002) x 228 (approximate number of months of benefit payment) = 104,200;

- Next, the coefficient is multiplied by the total indexation coefficient: 104,200x 5.6148 = 585063.77 – the amount of pension capital of Artemov A.A. by 2021;

- In addition, a slight increase of 0.1 points is added for work activity in post-Soviet times, 585,063 rubles;

- To these calculations are added payments made by the employer to the Pension Fund since 2002, which amounted to 1,234,567.89 rubles;

- Let's sum it up: 1234567,89 + 2390338,27 + 2390400,12 = 6015306,26;

- This amount is divided by the approximate payment period (228 months):

6015306,26/228 = 26382,92.

- Next, the pension coefficient (which amounted to 120.1 for contributions) is multiplied by the cost of the point (81.49 for 2021), and we obtain the amount of insurance payment: 9786.9 rubles;

- We add a fixed rate to the insurance share, the minimum amount of which is 4983 rubles: 9786.9 + 4983 = 14770 rubles.

To calculate pension benefits, citizens can use the pension calculator, which is located on the official website of the Pension Fund. Also, to make calculations, you can contact the nearest Pension Fund.

Formula for calculating pension payments

The monthly payment of Russians is divided into 3 types of payments: basic (fixed), insurance and savings. According to Federal Law No. 424-FZ of December 28, 2013, any citizen of the Russian Federation has the right to choose where and how to transfer contributions towards a future pension:

- For the formation of only the insurance part. 22% of the employee’s salary, mandatory for transfer to the Pension Fund, is distributed as follows:

- 16% – for the insurance part of the pension;

- 6% – joint tariff for a fixed payment.

- For the formation of both parts – insurance and savings:

- 6% – joint tariff;

- 10% – to the Pension Fund for the insurance part of the benefit;

- 6% - to the account of the management company according to the choice of the future pensioner, for example, a non-state pension fund (hereinafter - NPF) for a funded pension.

Basic part

Fixed payment (hereinafter - FV) - the basic part of the pension - the amount guaranteed to be accrued by the state to a citizen who has retired. As of 02/01/2018, its amount was 4982.9 rubles. The FV is subject to annual recalculation in accordance with the growth of the inflation rate. Its value is multiplied by the indexation coefficient (hereinafter referred to as K):

| Recalculation date | TO | FV size (r.) |

| 02/01/2015 | 1,114 | 4 383,59 |

| 02/01/2016 | 1,040 | 4 558,93 |

| 02/01/2017 | 1,054 | 4 805,11 |

| 02/01/2018 | 1,037 | 4 982,90 |

- Is it possible to be a carrier of coronavirus?

- 7 reasons for low energy and how to increase it

- Roll with nuts - how to cook at home from yeast, puff pastry, biscuit or stretch dough

Cumulative

This is a cash benefit, partly dependent on salary and consisting of pension savings formed through contributions from the insured person's employer and/or voluntary financial contributions. This type of benefit is not subject to annual indexation. The funded pension (hereinafter referred to as N) is calculated using the formula N = NCHLS / P, where:

- NCHSL - the sum of all savings voluntarily made towards future pension payments to a special part of the personal account of the insured citizen.

- P – the period during which the owner of the deferred funds plans to receive monthly benefits. For 2021 it is equal to 246 months.